Lithium stocks on the ASX: The Ultimate Guide

Experts predict the lithium-ion battery value chain will be worth $2 trillion by 2025.

The rapidly evolving lithium scene is a different place than 12 months ago and barely recognisable from the fledgling sector it was a decade ago, with a flurry of lithium stocks joining the ASX in recent years.

As the sector continues to grow and change, lithium investors can be certain about one thing – it is here to stay.

Less than 10 years ago, not many people would have predicted the boom that was about to occur with experts suggesting the lithium-battery value chain will be worth trillions in the not-too-distant future.

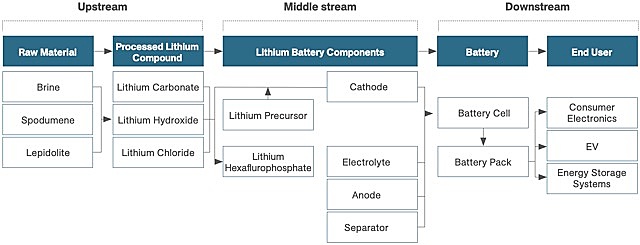

The lithium-ion battery industry chain.

By 2025, the lithium-ion battery value chain is expected to reach $2 trillion and this number is only predicted to continue rising as the sector expands on the back of the electric vehicle and renewable energy revolutions.

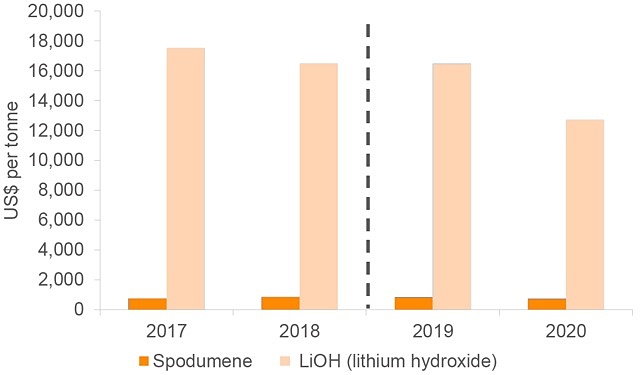

Lithium price performance

Despite the sector’s exceptionally bright future, 2018 heralded a step change in the lithium market, which had enjoyed an uninterrupted upward ride in previous years.

Mid-2018 kicked-off the start of lithium’s price decline, with the price for all major lithium products falling between June and December.

Australia’s primary lithium export spodumene dropped from about US$900 per tonne to less than US$600/t in November last year.

Comparative lithium price of spodumene ore and lithium hydroxide.

The fall in spodumene prices was attributed to the decline in lithium carbonate prices, which is spodumene that has been processed to a 99.5% battery grade lithium material.

Since mid-2018, the price for high-end 99.5% battery grade lithium carbonate has dipped from US$22/kg to below US$14/kg.

Triggering the collapse in 2018 was the wave of new hard rock mines arising out of Western Australia, including Altura Mining (ASX: AJM) and Pilbara Minerals’ (ASX: PLS) new mines and Galaxy Resources’ (ASX: GXY) expanded operations.

Despite the current slump, analysts continue to advocate for the metal’s longer-term outlook.

According to the Australian Government Office of Chief Economist’s report Resources and Energy Quarterly (December edition), the new mines and expanded operations have now tipped the lithium market into oversupply, with spodumene production soaring 70% to 366,000t in 2017 and this is expected to climb to more than 411,000t by 2020.

Meanwhile, refined lithium is also increasing, with output from China alone expected to have risen 23% between 2017 and 2018.

The report predicts the largest refined lithium growth will come from Tianqi’s Chinese facilities which are scheduled to undergo extensive bottlenecking this year.

Although the market will likely remain in oversupply in the near-term, the report forecasts demand will outpace supply after 2020 primarily due to the accelerated uptake in electric vehicles across the globe.

It’s expected the lithium market will come under “significant pressure” from 2022.

With lithium fundamentals expected to tighten for the majority of the next decade, it helps to understand more about the commodity and its uses.

About lithium

Lithium is a “comparatively rare element” and, in nature, it is usually found in ionic compounds such as granite pegmatites (hard rock deposits) or in brines.

Also, as the world’s lightest and least densest metal, lithium is so soft it can be cut with a knife.

In its pure form, lithium is silvery-white, but because it is highly reactive, it is not found in nature in its metal form.

Trace amounts of lithium are found in the human body and lithium salts have been used to stabilise mood in bi-polar sufferers.

The main global uses of lithium.

In addition to the human body, the mineral has multiple and varied applications, with the element sought for use in the nuclear sector as well as in heat-resistant glass and ceramics, greases and polymers, air treatments, industrial powders, steel and aluminium.

However, what the mineral has become renowned for in recent years is its critical inclusion in the lithium-ion battery, which now accounts for almost half of global consumption.

History of lithium

Modern cosmological theory believes lithium was one of the three elements synthesised in the Big Bang.

Fast forward to the 1800s and the lithium mineral petalite is believed to have been discovered by Brazilian chemist Jose Bonifacio de Andrada e Silva in a Swedish mine.

While examining the petalite ore in 1817, Johan Arfwedson and Jons Jakob Berzelius identified a new material by isolating it as a salt and named it lithium.

Arfwedson then noticed the element was also present in spodumene and lepidolite.

Lithium is the 3rd element on the periodic table, it bears the symbol Li, has an atomic number 3 and atomic weight of 6.94.

It was first extracted from its salt when William Thomas Brande used electrolysis on lithium oxide in 1821. Lithium was then generated in larger quantities by 1855.

The metal’s first primary use was in greases for aircraft engines, due to its heat resistant properties. Lithium-based soaps were found to have a higher melting point than other alkali soaps.

They were also noted to be less corrosive than calcium soaps.

Lithium demand picked up during the Cold War where it was used in manufacturing nuclear fusion weapons.

The metal was then used to lower the melting pressure of glass and enhance the liquefying behaviour of aluminium oxide during the Hall-Heroult process.

Until the mid-1990s, these applications swallowed up most lithium demand.

However, this changed with the advent of lithium-ion batteries, with the battery accounting for the majority of lithium consumption by 2007.

Lithium-ion batteries

Driving lithium-ion battery growth are energy storage and electric vehicle markets, which are on the rise as the global population moves away from fossil-fuel power.

Benchmark Mineral Intelligence managing director Simon Moores told the US senate the world was currently “in the midst of a global battery arms race”.

“The advent of electric vehicles and energy storage has sparked a wave of battery mega-factories that are being built around the world,” he said.

“Since my last testimony only 14 months ago, we have gone from only 17 lithium-ion battery mega-factories to 70.”

Li-ion batteries are being increasingly used to meet energy storage needs.

He said in gigawatt hour terms, battery mega-factories have surged from 289GWh to 1,549GWh – the equivalent of 22 million pure electric vehicles worth of battery capacity in the pipeline.

“The scale and speed of this growth is unprecedented, and it will have a profound impact on the raw materials that fuel these battery plants.”

Mr Moores added he expects the investment scope will also drive the cost of lithium-ion battery production below $100 per kilowatt hour this year.

“For example, in the next decade, the demand for lithium is set to go up nine times – this is lithium used in the battery industry.”

“Cobalt is set to go up six times, nickel is set to go up five times, and graphite anodes is set to go up nine times.”

Slightly less bullish on how much lithium consumption will increase is Australia’s Chief Economist, which forecasts lithium demand will grow “six fold” over the next decade.

China leads the charge

As with most other supply chains, China is leading the charge in the lithium-ion battery space, with Mr Moores pointing out China was on track to control 65% of the world’s battery capacity by 2028.

“It already has 51% of lithium chemical capacity, 80% of cobalt chemical capacity, 100% of graphite anode capacity and a third of nickel chemical capacity,” Mr Moores added.

Powering China’s growing lithium-ion battery capacity is the country’s electric vehicle uptake – with the nation accounting for nearly half of global electric car sales in 2017.

China accounted for nearly half of all global electric vehicle sales in 2017.

The China Association of Automobile Manufacturers (CAAM) reported sales of new energy vehicles in China hit 607,000 units in the first eight months of 2018 – up almost 90% on 2017 levels.

This was despite a fall in overall automobile sales.

Why lithium-ion batteries?

What makes the lithium-ion battery appealing to electric vehicle and consumer electronics manufacturers is the combination of the battery’s lighter-weight and high electrochemical properties.

Although the lithium-ion battery dominates the renewable energy market, substitutes and alternatives do exist.

Calcium, magnesium, mercury and zinc can be used as anode material in batteries.

Meanwhile, the redox flow battery market is also on the rise, with more common choices being the vanadium and the zinc batteries.

However, these batteries tend to be used in much larger applications, leaving the lithium-ion battery as the preferred chargeable source in the rapidly growing electric vehicle sector, for now.

Elon Musk powers lithium’s future

At the forefront of the electric vehicle scene is notorious entrepreneur and Tesla co-founder and chief executive officer Elon Musk.

South African-born Mr Musk is renowned for a variety of business ventures including co-founding and selling PayPal.

He went on to establish Tesla in 2003 where the company’s first Roadster sports car was unveiled to the market in 2008, followed by the Model S sedan in 2012.

Elon Musk with the Tesla Powerpack energy storage unit.

By 2017, Tesla had begun delivering the Model 3 mass-market electric car comprising over 215 miles of range.

Other auto manufacturers began to follow Tesla’s example with most majors having either built or announced plans to manufacture electric vehicles.

BMW and Porsche have also unveiled charging station infrastructure that can power a vehicle to travel 100km in less than three minutes.

Electric vehicles

In a speech at the AMPLA Annual Conference in October last year, Office of the Chief Economist general manager of the economic advice service Melissa Bray said demand for lithium-ion batteries “is expected to be particularly strong” as a result of their use in electric vehicles.

“The outlook for lithium seems particularly bright,” Ms Bray added.

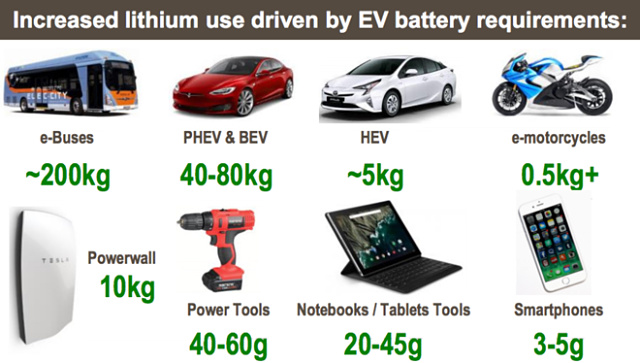

Lithium-ion batteries used in modern electric powered products.

By 2025, analyst JP Morgan predicts electric vehicles and hybrid electric vehicles will make up a third of all global vehicles sales – up from a meagre 1% in 2015.

Meanwhile, Ms Bray’s team forecasts global electric vehicle sales will tip 50 million by 2030, up from other estimates including Bloomberg New Energy Finance’s prediction of 30 million by 2030.

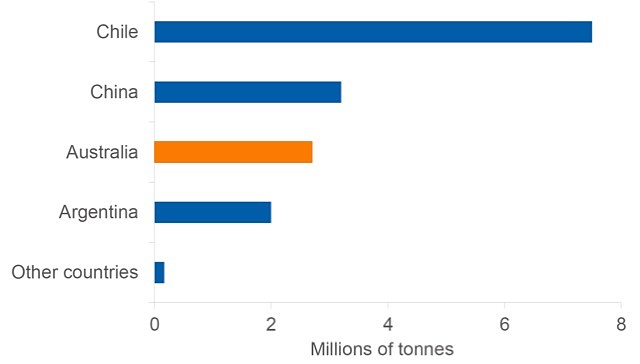

Lithium reserves world-wide

As the lithium-ion battery space heats up, it is critical to know if there are enough lithium reserves to meet demand.

The US Geological Survey estimates global lithium reserves totalled 16Mt in 2018.

Australia is the world’s largest lithium exporter and hosts around 17% of known global reserves.

Global lithium reserves by country.

Other top lithium producing regions include Chile and Argentina – with Chile, Bolivia and Argentina collectively known as the Lithium Triangle due to the prospective lithium brine salt flats.

Brine versus hard rock deposits

To feed the growing lithium-ion battery sector, most lithium is sourced from closed-basin brines (58%) or hard rock deposits such as pegmatites and related granites (26%).

Other rarer lithium sources include lithium clays (7%), oilfield brines (3%), geothermal brines (3%) and zeolites (3%).

In a brine operation, lithium is found dissolved in concentrations up to 2,222 parts per million. It is extracted from the saline groundwater beneath playas and salt lakes, with primary brine producing regions comprising Argentina and Chile, the US and China.

Lithium brine in Salinas Grandes, Andes, Argentina.

These operations usually require less capital outlay than hard rock mines, and work by pumping the brine to the surface using wells.

The solution is then concentrated in nearby solar ponds, and processed further to create a battery ready lithium carbonate or lithium hydroxide product.

Hard rock pegmatites are generally exploited for their spodumene content with the biggest spodumene operations existing in Australia, Zimbabwe, Brazil, China and Portugal.

The Democratic Republic of Congo is also an emerging region for hard rock spodumene deposits, with AVZ Minerals firming up the world’s largest lithium resource at its Manono project during 2018.

Diamond drill cores of spodumene-bearing pegmatite.

Pegmatite deposits can be mined via open pit or underground.

In addition to brines and spodumene deposits, petalite ore, on a lesser scale, is also exploited for lithium.

Also on the future radar are lepidolite deposits, with several companies having developed proprietary processes that can economically extract lithium from lepidolite, which has been, until now, overlooked in favour of the other lithium minerals.

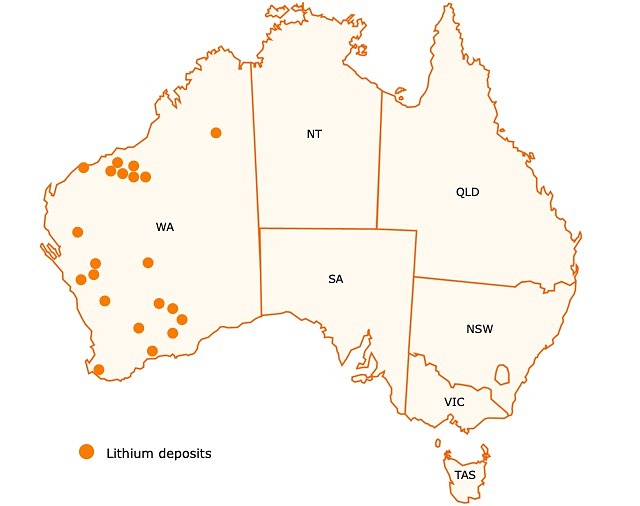

Australia to dominate global hard rock supply

Known for its plentiful resources, Australia is set to dominate the lithium carbonate market with its hard rock operations estimated to account for 80% of global supply.

Prior to the rush to bring lithium operations off the ground world-wide, the market was spearheaded by just four large mines.

China’s Tianqi Lithium and US company Albemarle own the world’s biggest mine – Greenbushes in WA, while SQM (Sociedad Quimica y Minera) in Chile and Livent (formerly FMC Lithium) in the US made up the rest of world supply.

The Greenbushes mine in Western Australia.

Greenbushes was Australia’s first hard rock lithium mine and the joint venture has approved a $516 million expansion to the mine, which will triple production capacity with annual spodumene production to grow to 1.95 million tonnes per annum over two stages. A concentration plant is also expected to be added to the operations.

Since Greenbushes was established, Australia has seen the rise of other lithium mines including Mt Marion, Mt Cattlin, Wodgina, Bald Hill, Altura, Pilgangoora and the advancement of the Northern Territory’s first lithium operation Core Exploration’s Finniss project.

Major lithium deposits in Australia.

Due to new supply coming online, spodumene exports were estimated at $900 million in the 2017-2018 financial year and Australia’s Chief Economist anticipates this will grow to $1.2 billion in 2019-2020.

As well as the advent of new mines, there is an industry push in Australia to capture more of the trillion-dollar value chain, with experts and stakeholders, alike, calling on the Australian Government to encourage further investment into downstream processing and battery manufacturing – rather than digging the valuables out of the ground and shipping them to other countries for treatment.

Lithium stocks on the ASX

With lithium set to play a vital role in the world’s and Australia’s energy future, Small Caps has compiled a list of ASX-listed companies with lithium projects:

Alliance Mineral Assets (ASX: A40)

In December, Alliance Mineral Assets formalised the 100% acquisition of Tawana Resources under a scheme of arrangement between Tawana and its shareholders.

The two companies have been joint venture partners in the Bald Hill lithium-tantalum mine in WA’s eastern goldfields.

During January, Alliance achieved record monthly production of 13,160t of lithium concentrate grading 6.15%.

The company shipped around 23,000t of concentrate in February which was expected to bring in about $26 million revenue.

A further 30,000t of lithium concentrate is expected or ready to be shipped before the end of the March quarter.

For the 2019 calendar year, Alliance is targeting lithium concentrate production of 180,000t with this expected to rise to 240,000t in 2020.

Alliance is pursuing additional offtake partners for projected increases in stage one and stage two lithium concentrate production at Bald Hill.

The company said offtake interest to date has been strong as there is “limited uncommitted, high quality, spodumene available from producers” in 2019.

Altura Mining (ASX: AJM)

Altura Mining was one of last year’s newest lithium miners after commissioning its namesake project in WA’s Pilbara in the first half of 2018, with a maiden concentrate produced in July and trucking to customers starting soon after.

In early February 2019, Altura announced it was securing a $28 million financing package to fund production ramp up at the project.

The funds are expected to offer a working capital buffer as Altura increases production to nameplate capacity of 220,000tpa annum grading 6% spodumene.

By mid-January, Altura had shipped 24,000t of product to its Chinese customers.

Once it achieves nameplate capacity, Altura will begin stage two construction which will boost the plant’s capacity to 440,000tpa.

American Pacific Borate & Lithium (ASX: ABR)

During the December quarter, American Pacific Borate & Lithium completed a definitive feasibility study for its flagship Fort Cady project in the US.

The project has a resource of 120.4Mt at 6.5% boric oxide and 340ppm lithium, with mineralisation remaining open to the south-east.

Although the project hosts lithium, the company’s focus is on unlocking the boric acid and sulphate of potash potential.

Anson Resources (ASX: ASN)

One of the better-known lithium brine explorers on the ASX is Anson Resources which is exploring its Paradox project in Utah, US.

The company has started the design of its proposed lithium pilot plant which will be near the Cane Creek 32-1 well.

In October last year, Anson generated its first lithium hydroxide from Paradox. The first lithium hydroxide product was the result of research and development precipitation test work carried out on Cane Creek brine.

Test work on the brine is ongoing using Lilac Solutions’ proprietary process. Recent testing on a Cane Creek sample using the process generated a concentrate lithium sulphate solution between 10,000 milligrams per litre lithium to 15,000mg/l lithium.

The project comprises 1,317 placer claims and a further 334 claims under application.

Ardiden (ASX: ADV)

Canadian-focused Ardiden owns the Seymour Lake project in Ontario, Canada where resource expansion drilling in the December quarter returned thick lithium intersections.

Notable results from the program were 23.98m at 1.54% lithium from 212m, including 0.55m at 5.67% lithium from 214.75m; and 37.61m at 1.95% lithium from 224.92m.

Ardiden released a maiden resource for the project in October 2017 of 1.23Mt at 1.43% lithium for 8,200t of the metal.

With the latest round of drilling completed, Ardiden is focused on updating the maiden estimate.

Metallurgical work has generated a battery-grade lithium carbonate at 99.52% purity from Seymour spodumene.

In addition to Seymour, Ardiden owns the Root Lake, Root Bay and Wisa Lake lithium projects in Ontario.

However, no recent exploration has been reported, with Ardiden focused on Seymour Lake.

Argosy Minerals (ASX: AGY)

Argosy Minerals’ flagship Rincon lithium project in Argentina lies within the Lithium Triangle – host to the world’s largest lithium resources.

The company is focused on the fast-track development of its 77.5%-owned project, where it recently announced an upgraded indicated mineral resource of 245,120t of lithium carbonate.

Argosy currently has about 38ha of lithium brine evaporation ponds in operation at Rincon, which provide concentrated lithium brine for use in its stage one industrial scale pilot plant.

It also recently completed a preliminary economic assessment, which confirmed the potential for a long-life, sustainable commercial-scale operation at Rincon and has enabled the company to move directly to a stage three development phase, bypassing its stage two strategy.

Base case scenario key metrics include a 16.5-year mine life producing about 10,000tpa of high value lithium carbonate product, a pre-tax net present value of US$399 million and internal rate of return of 53%.

Project development costs are estimated at US$141 million with a calculated payback period of 2.1 years.

Late last year, Argosy also acquired three additional tenements, boosting its holding at Rincon by 209.5ha to 2,794.4ha.

Arrow Minerals (ASX: AMD)

In addition to gold and nickel projects, Arrow Minerals has a 100% interest in the Malinda lithium-tantalum project in WA’s Gascoyne region.

Over the past two years, exploration at Malinda has comprised rock chip and soil sampling programs and a maiden reverse circulation drilling program in 2017, which intersected up to 2% lithium.

In early 2018, Arrow undertook a large rock chip sampling program following the acquisition of aerial drone imagery and digital mapping. While the samples returned significant tantalum grades, no notable lithium results were reported.

The company is now planning to conduct a project-wide geophysical survey in the first half of 2019 to fingerprint the known mineralised intrusions at Malinda and to evaluate the remaining 580sq km tenement area to identify additional mineralised pegmatite swarms for follow-up.

Arrow is also farming into Zeus’ Camel Hill prospect within its Gascoyne project.

Australian Vanadium (ASX: AVL)

While its main focus is the Gabanintha vanadium project in WA, Australian Vanadium is also earning about a quarter-stake in the Blesberg lithium-tantalum project in South Africa.

Under agreed terms, the company can complete the acquisition of a 26% equity position in the holding company of Blesberg, South African Lithium and Tantalum Pty Ltd, by spending $50,000 in on metallurgical test work and the completion of a mineral resource estimate.

According to Australian Vanadium, the Blesberg deposit is one of the largest known economically mineralised and exploited pegmatite deposits in the Northern Cape pegmatite belt. The area has previously been mined for beryl, bismuth, tantalite-columbite, spodumene, feldspar and mica.

At the end of January, the company said this work required to achieve its equity acquisition was “nearing completion”.

AVZ Minerals (ASX: AVZ)

In August 2018, mineral explorer AVZ Minerals announced a maiden resource for its flagship Manono lithium project in the Democratic Republic of Congo, confirming it as the largest hard rock spodumene deposit in the world.

The resource, which is based on the Roche Dure pegmatite, was upgraded following the completion of additional drilling in November to now total 400.4Mt at 1.66% lithium for 6.64Mt of contained lithium oxide.

An initial scoping study was reported in October, which indicated a possible 20-year mine life for a 2Mtpa operation.

Scoping studies are now underway to evaluate the viability of a 5Mtpa and a 10Mtpa operation. The studies are expected to be completed within the 2019 first quarter.

A definitive feasibility study for Manono is expected to be delivered in the first half of 2019.

In February 2019, the company announced remarkable drill results from its Carriere de l’Este prospect, which lies within the larger Manono project but about 5km north-east of Roche Dure.

According to AVZ, initial results indicated the possibility of another significant lithium deposit with shallow high-grade zones greater than 2% lithium present within wider zones of well mineralised spodumene pegmatite.

AVZ managing director Nigel Ferguson said this new discovery at Carriere de l’Este could “potentially exceed the Roche Dure deposit”.

Bass Metals (ASX: BSM)

In addition to operating its flagship Graphmada large flake graphite mine in eastern Madagascar, Bass Metals holds the Millie’s Reward lithium-in-spodumene exploration project in the central region of the island nation.

In September 2018, the industrial mineral concentrates producer commenced a phase two diamond drilling program at Millie’s Reward following a channel sampling program, which yielded encouraging results including a weighted average intersection of 3.72% lithium oxide over 31m at the Millie’s West prospect.

At the end of January 2019, Bass Metals said drilling had been completed with the company now completing ASX/JORC requirements before releasing results.

Birimian (ASX: BGS)

Lithium explorer Birimian is focused on advancing its world-class Goulamina lithium project in southern Mali to production.

Goulamina is considered the world’s sixth largest spodumene mineral resource, totalling 103.2Mt at 1.34% lithium.

In July 2018, Birimian announced a maiden reserve for the project of 31.2Mt at 1.56% lithium.

The company is looking to develop a 2Mtpa operation to produce 362,000tpa of spodumene concentrate.

A pre-feasibility study announced in July estimated a capital expenditure of US$199 million would be needed to build a 16-year mine that would generate annual EBITDA of US$128 million.

Birimian is now progressing work on a feasibility study with the aim to complete this in 2019.

In addition, the company inked an offtake deal in December 2018 for more than half of the project’s planned lithium production with Chinese chemical convertor General Lithium Corporation.

Under the agreement, the latter will purchase up to 200,000tpa of 6% spodumene concentrate, which equates to 55% of Goulamina’s planned capacity.

Birimian is targeting first production from Goulamina in 2020.

BMG Resources (ASX: BMG)

Last August, battery minerals explorer BMG Resources inked a deal with lithium explorer Lithium Chile to explore and develop three lithium brine projects in northern Chile’s Atacama district, home to the highest grade, lowest cost lithium operations in the world.

The projects cover more than 20,000 hectares and are known as Salar West, Pajonales and Natalie.

Under the terms of the joint venture agreement, BMG can earn up to a 50% interest in the projects for a total consideration of US$3.5 million, to be paid over three years on the completion of milestones.

BMG’s immediate priority is the Salar West project, where a recent geophysics program identified a strong conductive horizon which could be a possible lithium brine target in the southern zone.

In February, the company announced an additional geophysics program aimed at testing the extension of this horizon. The survey is expected to take up to six weeks to be completed and processed.

Following this, a phase one exploration program, including geophysics across the other project areas, is planned to define initial drilling targets.

A drilling program is then anticipated to follow immediately once the joint venture has been formal established, expected by the end of March 2019.

BMG’s goal for the next 12 months is to complete initial drilling programs and establish lithium JORC resources within the project areas in an effort to fast-track the development of a lithium production asset.

Boadicea Resources (ASX: BOA)

In addition to interests in nickel, copper and gold, mineral explorer Boadicea Resources has three lithium projects in WA: Horseshoe, Wildara and Hyde Soak.

The 95%-owned Horseshoe lithium project, 75km south-southwest of Coolgardie in the eastern goldfields region, is located in an area where pegmatites have been noted in historical gold and nickel exploration reports, although the area has not been previously explored for lithium pegmatites, specifically.

During the December 2018 quarter, a first pass 595 sample auger soil geochemical program designed to test three initial pegmatite targets produced disappointing results with only low-level lithium and associated multi-elements.

The company said it would consider additional geochemical programs to test other targets within the tenement.

At the Wildara project, 30km southwest of Leinster, Boadicea completed a surface geochemical program during the December quarter to test the lithium and gold potential, with results expected within the 2019 first quarter.

No recent activities have been reported at Boadicea’s Hyde Soak project.

Boadicea is considering options for its Hyde Soak project, 115km north-east of Geraldton, where initial fieldwork in 2017 had confirmed an “extensive, coherent albeit modest tenor, lithium anomalism”.

No significant activity has been reported on this project since.

Caeneus Minerals (ASX: CAD)

Caeneus Minerals holds two lithium projects in Nevada, US, as well as gold and nickel projects in WA.

During the September 2018 quarter, exploration drilling at its 100%-owned Columbus Marsh lithium brine project identified a second lithium-enriched brine zone and allowed the company to develop a full profile of lithium brines within shallow aquifers at the property.

Drilling, sampling and laboratory analysis has identified upper, middle and lower lithium-bearing zones, all of which are reported to contain lithium concentrations.

In December, Caeneus announced it had raised $450,000 by way of a convertible note raising and plans to partially use the funds towards exploration at Columbus Marsh.

The company’s other lithium brine project, Rhodes Marsh, lies about 15km north of Columbus Marsh. In its 2018 annual report, Caeneus said a drilling program is planned to be completed in conjunction with follow-up drilling at Columbus Marsh.

No further field activities were reported during the December quarter at either project.

China Magnesium Corporation (ASX: CMC)

In September 2018, Queensland-based China Magnesium Corporation achieved first production of magnesium lithium from its 108tpa plant one at its Pingyao operations in the Shaxi Province of northern China.

The company is planning to build capacity at Pingyao with the delivery of a second plant, anticipated by the 2019 second quarter.

China Magnesium Corporation has retained a 40% interest in granted exploration licences in the Greenbushes area of WA after selling 60% of its equity in subsidiary CMC Lithium a year ago.

These tenements are close to the world-class Greenbushes lithium-caesium-tantalum pegmatite, which is a major source of spodumene concentrate for the expanding lithium battery market.

In November 2018, the company said first pass exploration at Greenbushes was progressing.

Core Lithium (ASX: CXO)

Formerly Core Exploration, Core Lithium is looking to become the Northern Territory’s first lithium producer from its Finniss project.

Finniss covers more than 500sq km of tenements and hosts 100 historic pegmatites.

A pre-feasibility study showed the potential for a $53.5 million capital expenditure, with rapid payback within 12 months.

Finniss also has a $140 million pre-tax NPV and is predicted to generate $168 million in cash flow over the first 26 months of operations.

Global resources at Finniss total 8.5Mt at 1.35% lithium for 115,700t lithium.

The pre-feasibility study was solely based on the Grants deposit with the definitive feasibility study to include Grants, BP33 and Carlton deposits.

Finniss is located near requisite infrastructure and Core has offtake agreements in place for its proposed production and a heads of agreement locked-in with the Darwin Port to ship 250,000tpa of spodumene concentrate.

Cougar Metals (ASX: CGM)

In addition to nickel and cobalt projects in WA and Chile, Perth-based Cougar Metals holds a 40% interest in the Ceara lithium project in north-eastern Brazil.

Ceara comprises 19 tenements and contains 10 historically-producing lithium workings.

According to Cougar, recent surface samples in the area have returned up to 9.4% lithium oxide.

During the December 2018 quarter, a soil sampling program was completed for a total of 965 samples which are currently being analysed by a laboratory in Brazil.

Following receipt of the results, the company said an additional 1,500 soil samples will be collected over anomalous areas to identify drill-ready targets.

Crusader Resources (ASX: CAS)

While Crusader Resources is mainly focused on gold exploration in Brazil, the company also holds the Manga lithium and tin project in the country’s Goias state.

Crusader had previously explored the ground for gold and indium, with earlier rock chip samples returning up to 1.8% lithium oxide within a zinnwaldite-rich greisen zone.

In February 2018, the company announced its intentions to exit its lithium business in order to focus its efforts on its gold projects.

No further news has been reported in relation to the divestment, with the project still listed in Crusader’s Annual General Meeting presentation in mid-2018.

Cullen Resources (ASX: CUL)

Cullen Resources has retained a 20% free carried interest in the Killaloe lithium joint venture with Liontown in WA’s eastern goldfields.

In August, Matsa Resources announced the sale of its 80% interest in the joint venture to Liontown Resources, expanding Liontown’s footprint beyond its Buldania lithium pegmatite discovery south-east of Killaloe.

Dark Horse Resources (ASX: DHR)

In January, Dark Horse Resources announced that field exploration at the San Luis lithium spodumene project in Argentina had temporarily ceased as it was awaiting the San Luis Mining Authority to issue permits for drilling.

Drilling at the nearby Las Tapias lithium-spodumene project was not as positive as predicted, with a large portion of the pegmatite showing low lithium grades, and Dark Horse has delayed the terms of an option-to-purchase with the project owner.

An agreement announced in September for Dark Horse to acquire the San Jorge lithium brine project in Catamarca province progressed during the quarter, with the company carrying out legal due diligence and finalising terms with the vendor.

Dark Horse is also undertaking a staged acquisition of the Pampa Litio lithium projects in Argentina, in which it currently owns a 25% interest with a right to acquire 100%.

Dart Mining (ASX: DTM)

Dart Mining is continuing with geological interpretation of assay results from 2018 activities at the Dorchap lithium project in north-east Victoria, with the large data set providing a comprehensive picture of the regional dyke geochemistry and distribution of lithium mineral phases along the length of the dyke swarm.

The company said results continue to support the interpretation of a “core zone of fractionation” within the northern Dorchap area, representing the most prospective zone along the northern portion of the dyke swarm.

Dart geologists consider this highly fractionated dyke zone to be the most prospective for high-grade lithium mineralisation, with high-grade lithium oxide results occurring within the 20km zone across several dyke centres.

Lithium distribution has also been defined with coarse petalite found in the Boones D1 target and the Hollow Way target area, representing the outer ends of the fractionation target.

Reverse circulation drilling of the Boones Dyke 1 and Eagle pegmatite targets is pencilled in for March.

De Grey Mining (ASX: DEG)

During the December quarter, drilling and geological logging at De Grey Mining’s King Col pegmatite south of Port Hedland identified lithium-bearing minerals including petalite, spodumene and lepidolite.

De Grey said it is concentrating its efforts on gold exploration and is in early-stage discussions with several parties regarding future exploration of this and other lithium targets.

DevEx Resources (ASX: DEV)

Exploration licences for the Dundas lithium-gold project near Norseman in WA were granted to DevEx Resources in early 2018.

In October 2017, DevEx said a review of more than 9,000 auger samples had identified a 2km long coincident lithium and beryllium anomaly at the project.

The company is assessing its requirements in relation to Aboriginal heritage, with a view to begin drilling.

European Lithium (ASX: EUR)

Austrian explorer European Lithium is fast-tracking a definitive feasibility study at its Wolfsberg lithium project and has secured a $10 million finance facility to complete the study.

Wolfsberg has resources of 10.98Mt at 1% lithium, and a pre-feasibility study revealed an accelerated production case of 800,000tpa to generate 668,120tpa of spodumene concentrate, which will be refined to produce 10,129tpa of lithium hydroxide.

At the accelerated case, Wolfsberg has a pre-tax NPV of $441.9 million.

Drilling is planned to update the resource and underpin the accelerated pre-feasibility study scenario.

Wolfsberg is 20km east of the town it is named after, with a hydrometallurgical plant also nearby.

European Metals (ASX: EMH)

European Metals controls the Cinovec lithium-tin project in the Czech Republic, which the company claims is Europe’s largest lithium deposit.

Cinovec’s combined resource contains 7.18Mt of lithium carbonate equivalent and 263,000t of tin.

Additionally, the asset has a probable ore reserve of 34.5Mt at 0.65% lithium and 0.09% tin. The reserve is estimated to cover the project’s first 20-years of production with project output of 22,800tpa of lithium carbonate.

A preliminary feasibility study was completed on the project and indicated it has a post tax NPV of US$540 million with a 21% IRR.

Cinovec is also located to infrastructure with a sealed road adjacent to the deposit, and rail lines within 10km of the deposit as well as power lines.

Drilling and metallurgical work are ongoing to advance the project.

Exore Resources (ASX: ERX)

The Sepeda lithium project in Portugal has been subject to an ownership dispute since mid-2017.

Exore Resources is pursuing its legal claim to ownership rights over the project and continues to work towards a legal resolution.

The company also has three projects in central Sweden which are highly prospective for spodumene lithium mineralisation.

Previous field work at the Spodumenberget asset returned up to 2.77% lithium.

However, no fieldwork was conducted during the December quarter while Exore considers how best to extract value from its Swedish projects.

Force Commodities (ASX: 4CE)

The Perth-based lithium-focused explorer Force Commodities has joint venture interests in the highly-prospective Kitotolo-Katamba (70%) and Kanuka (51%) projects within the Democratic Republic of Congo.

In addition, Force has an option to acquire the nearby Kitotolo West project, also considered highly prospective for lithium mineralisation with known areas of artisanal mining activities and exposed lithium-bearing pegmatites.

The projects lie in proximity to AVZ Minerals’ Manono project, which was confirmed last year as the largest hard rock spodumene deposit in the world.

During the December 2018 quarter, phase one reverse circulation drilling commenced at Kitotolo-Katamba and Kanuka, with early Kanuka assays confirming the potential of the area’s Kibaran stratigraphy to have high-grade pegmatite-hosted lithium mineralisation at depth.

Force said it planned to follow up on the Kanuka results with a 1,000m phase two diamond drilling program.

At Kitotolo-Katamba, Force applied for the transformation of an exploration licence into a mining lease. This is an administrative process after which mining licenses in the DRC are granted for a 30-year period.

The decision to proceed with a second phase diamond drilling program at Kitolo-Katamba will be based on a review of the assay results from its phase one drilling program.

Galan Lithium (ASX: GLN)

Galan Lithium received drilling approvals and permits during the December quarter for the Candelas lithium brine project, located along the Hombre Muerto salt flats in the Argentina’s Catamarca province.

A maiden drill hole early this year encountered a substantial intercept of brine with low impurities and confirmed the presence of high-grade, lithium-bearing mineralisation.

In January, Galan was granted a licence for the Pata Pila project along the western margin of the Hombre Muerto which is highly prospective for lithium-bearing brines.

The company also holds an exploration licence at Greenbushes South in WA, which is prospective for lithium, tin and tantalum – mineralisation similar to that at the nearby producing Greenbushes mine.

Galaxy Resources (ASX: GXY)

Miner Galaxy Resources operates the Mt Cattlin project in WA, and the James Bay project in Canada after selling the northern tenements of its Sal de Vida brine asset in Argentina to POSCO.

During 2018 throughput capacity at Mt Cattlin was boosted to 1.6Mtpa, with about 156,689t of spodumene concentrate produced for the year.

During the December quarter, Galaxy generated 33,780t of spodumene concentrate and sold 39,682t of concentrate for a cash margin of US$288/t. However, the cash margin for 2018 averaged US$424/t.

Production in 2019 for Mt Cattlin is projected to reach as high as 210,000t of spodumene concentrate.

In addition to Mt Cattlin, Galaxy is advancing James Bay which has a resource of 40.3Mt at 1.4% lithium.

A feasibility study in underway at the Canadian asset to evaluate the potential of an integrated upstream and downstream operation.

Greenpower Energy (ASX: GPP)

In October, Greenpower Energy carried out a phase three drilling campaign at the Guyana-Morabisi project in South America, but it failed to find conventionally-economic levels of lithium.

Greenpower elected not to proceed to phase four exploration under a previously-signed heads of agreement with Guyana Strategic Minerals.

However, Greenpower said it would maintain its 51% interest but would not expend further on the project at this time.

During the December quarter, Greenpower also surrendered all nine exploration licences forming the Pretoria lithium-potassium project in the NT.

Hannans Reward (ASX: HNR)

Hannans Reward’s exploration goal at its wholly-owned Mt Holland lithium project has been the discovery of a lithium deposit comparable to the adjacent world-class hard rock lithium deposit at Earl Grey, owned by Kidman Resources.

During the December 2018 quarter, Hannans received assays and completed interpretation of first phase exploration drilling at the Mt Holland East target and achieved the same for the fifth phase at Mt Holland West.

The company has since completed an independent technical review of all geochemical data collected to date and lodged work plans for the next phase of exploration drilling, where it hopes reconnaissance field work will confirm geology and check the potential for any pegmatites at surface.

Hawkstone Mining (ASX: HWK)

Hawkstone Mining recently received results of a maiden drill program at the Big Sandy project in Arizona, which successfully identified a clay-hosted lithium mineralised zone in the northern part of the landholding.

A phase two drill program commenced in February to define the extent of the lithium mineralised clays within that zone.

Hawkstone Mining said preliminary metallurgical tests on Big Sandy fresh material have demonstrated high lithium extractions using a sulphuric acid leach, with ongoing test work aiming to optimise the results.

Hipo Resources (ASX: HIP)

Hipo Resources entered into a 60:40 joint venture arrangement with Crown Mining Sarl over the Kamola lithium project in the Democratic Republic of Congo, in the December quarter.

The joint venture is focusing on licences located in the prolific Manono and Kitolo lithium pegmatite belt.

Hipo also has a 25% interest in Next Battery which is developing a state-of-the-art battery prototype based around a much higher performance quality than the best commercial lithium-ion batteries currently on the market.

Infinity Lithium Corporation (ASX: INF)

Perth-based Infinity Lithium Corporation is developing the San Jose lithium project in Spain to produce battery-grade lithium hydroxide for the European renewables market.

The company completed a lithium carbonate scoping study in 2017 before deciding to investigate the potential viability of lithium hydroxide production, delivering a positive scoping study on this in November 2018.

San Jose’s current JORC mineral resource estimate totals 111.3Mt grading at 0.61% lithium oxide.

Infinity is proposing an open pit operation with the ore to be treated and refined onsite over 24-years.

In its December quarterly report, the company said it was advancing discussions with potential strategic partners including global offtake companies, as work progressed towards the delivery of either a pre-feasibility study in 2019 for lithium hydroxide or a feasibility study for lithium carbonate.

Ioneer (ASX: INR)

A pre-feasibility study for Ioneer’s flagship Rhyolite Ridge lithium-boron project in Nevada demonstrated the project’s scale, long life and potential to become the lowest cost lithium producer in the world and the largest producer in the US.

In November, Ioneer appointed Fluor Corporation to provide engineering, procurement and construction management services for the project’s definitive feasibility study currently underway.

A drilling program is being conducted to upgrade the current lithium-boron mineral resource at Rhyolite Ridge to the measured category and extend high-grade, shallow mineralisation to the south of the proposed starter pit.

Jadar Lithium (ASX: JDR)

Europe-focused explorer Jadar Lithium holds five exploration licences in Serbia, with two of these (Cer and Bukulja) situated close to mining giant Rio Tinto’s Jadarite discovery, one of the world’s largest lithium deposits.

During the December 2018 quarter, the company completed a phase two soil sampling program on its Vranje-South project, confirming a number of areas with elevated lithium values, peaking at 220ppm.

Jadar is planning to commence follow-up field activities “as soon as weather conditions improve”. These may include follow-up sampling, 3D geological modelling and possibly drill testing of target areas.

In early February, the company also completed the acquisition of an 80% stake in two lithium exploration licences in Austria.

The licences are considered prospective for lithium and other pegmatite-hosted minerals, although no recent geological exploration for these minerals have been undertaken within the project areas.

However, the assets surround European Lithium’s Wolfsberg lithium deposit, which has been estimated to hold a JORC resource of 10.98Mt at 1% lithium oxide.

Jindalee Resources (ASX: JRL)

Since the middle of last year, multi-commodity explorer Jindalee Resources has been scooping up lithium-prospective acreage in the US.

The company initially acquired the Clayton North lithium project in Nevada before obtaining its current primary focus, the McDermitt lithium clay project, located close to the Nevada-Oregon border.

An initial diamond drilling program completed in September 2018 supported an estimated exploration target at McDermitt in the range of 160-780Mt with an average grade of 1300-1600ppm lithium.

Permitting and approvals for follow-up drilling in 2019 have been progressing, and samples have been submitted for initial metallurgical test work, Jindalee stated in its December quarterly report.

In February 2019, Jindalee announced it had further expanded its acreage at McDermitt by 45% to 28.6sq km. According to the company, these additional claims cover the along strike continuation of lithium mineralised sediments already identified in soil sampling and drilling.

Kidman Resources (ASX: KDR)

Kidman Resources holds the Mt Holland lithium project in Western Australia in a 50:50 joint venture with Chilean chemical company Sociedad Quimica Minera de Chile, one of the world’s largest lithium producers.

The proposed project comprises a mine and concentrator at Mt Holland in the state’s goldfields region and a refinery to be located in Kwinana (Perth).

The mine site includes the Earl Grey lithium deposit, where a maiden ore reserve of 94.2Mt at 1.5% lithium oxide was declared late last year.

The results of an integrated pre-feasibility study for the Mt Holland project was announced in December 2018, outlining a long-life (47 years), low-cost operation with an estimated average production of 45,254t of lithium hydroxide.

The joint venture is on track to deliver a definitive feasibility study on the project in the first half of 2019.

According to Kidman, it is now funded for initial stages of Mt Holland’s capital expenditure (forecast to total US$737 million), with offtake arrangements in place that, once finalised, are expected to cover about 75% of production in the project’s initial years.

Korab Resources (ASX: KOR)

Mineral explorer Korab Resources recently renewed an exploration licence covering its Batchelor/Green Alligator polymetallic project in the NT for a further two years.

The project covers 172sq km in the Rum Jungle mineral field, about 70km south of Darwin.

During the December 2018 quarter, Korab reportedly carried out exploration and evaluation of the project area, focusing on lithium-bearing pegmatites along with gold, cobalt and base metals. To date, no exploration results have been announced.

The company also said it is continuing talks with potential joint venture partners to explore the project for “various commodities”.

Krakatoa Resources (ASX: KTA)

Krakatoa Resources holds the Dalgaranga and Mac Well projects near Mount Magnet in WA.

Dalgaranga is considered prospective for lithium, tantalum, niobium and rubidium.

According to Krakatoa, previous drilling results have supported the presence of a lithium-caesium-tantalum pegmatite within the project area.

The company’s most recent work has comprised the collation of historical exploration data at Dalgaranga.

A field exploration program at Mac Well in 2016 confirmed the occurrence of lithium-bearing micas; however, the company has more recently been targeting gold mineralisation in the area.

Lake Resources (ASX: LKE)

Lake Resources is undertaking a vigorous Argentinian exploration program looking for lithium brine basins and lithium pegmatites in the Lithium Triangle.

It has a very large tenement package of more than 200,000ha, comprising three lithium brine projects and one hard rock project.

In November 2018, the company announced a maiden JORC resource at the Kachi lithium brine project of 4.4Mt of contained lithium carbonate equivalent, and an exploration target ranging between 8-17Mt lithium carbonate equivalent.

At the end of last year, Lake Resources also revealed findings from a phase one engineering study conducted by technology partner Lilac Solutions, which showed a US$2,600/t lithium carbonate equivalent operating cost utilising Lilac’s direct lithium extraction process for the Kachi lithium brine.

Lilac is now in the process of providing a detailed proposal for an onsite pilot plant in 2019 as part of a pre-feasibility study, with the plant anticipated to be a precursor to a full-scale commercial project.

As at the end of January 2019, Lake’s Olaroz-Cauchari and Paso projects in Argentina’s Jujuy province were being drilled for the first time.

Its Catamarca pegmatite lithium project is still at an early exploration stage with field-based XRF analysis planned to identify potential targets for trenching and auger sampling.

Latin Resources (ASX: LRS)

Latin Resources is focused on mineral exploration in Latin America and has secured more than 173,000ha of exploration concessions in the lithium pegmatite districts of the Catamarca and San Luis provinces in Argentina.

At its 100%-owned San Luis lithium project, the company recently reached a social and environmental agreement with local communities and is now awaiting the necessary permits to commence its planned drilling program.

Exploration is focused on the Geminis and Don Gregorio tenements within the project, which contain numerous large and under-explored pegmatites with known spodumene mineralisation.

Drill targets have already been identified to ascertain the size and grade of the San Luis project’s lithium resource.

During the December 2018 quarter, rock chipping, soil sampling and mapping was conducted at Latin’s wholly-owned Catamarca lithium project with the primary focus being on the NW Alto region. This work has resulted in the identification of several drill targets.

The company said it planned to complete rock chipping and mapping over Catamarca’s N Ancasti-Ancasti region during the 2019 first quarter, hoping to also delineate suitable drilling targets here.

Latitude Consolidated (ASX: LCD)

Latitude Consolidated is focused on establishing a portfolio of projects in South Africa, with its flagship project being the Mbeta in Zimbabwe.

The company only just completed its acquisition for a 70% stake in the lithium project during the December 2018 quarter.

The 18sq km of minerals claims are expected to be transferred during the 2019 first quarter, following which Latitude plans to conduct a mapping and sampling program in preparation for a drilling campaign.

The company is also currently performing due diligence on several potential investment opportunities in Zimbabwe and Zambia.

Lepidico (ASX: LPD)

Perth-based Lepidico is a lithium chemical company that has developed clean-tech process technologies to collectively extract lithium and recover valuable by-products from the less contested lithium-mica and lithium-phosphate minerals.

The company is currently constructing a pilot plant in Perth, WA, with commissioning anticipated in April and operations to begin in May.

In February, Lepidico announced it has produced high-purity lithium hydroxide using a new process, LOH-Max, which avoids the production of sodium sulphate as a by-product.

The Perth plant, which was designed to produce lithium carbonate utilising the company’s proprietary L-Max technology, will now be subject to a rework under phase one of its development to include LOH-Max in the circuit.

The company has an ore access agreement with Portuguese company Grupo Mota over its operating Alvarroes lepidolite mine in Portugal.

In January 2019, Lepidico reported a 20t sample of lepidolite was being shipped from the mine to Perth with delivery anticipated in late February. The material will be further concentrated at a metallurgical facility to a grade of about 4% lithium oxide before being fed to the Perth pilot plant.

Lepidico is also currently undertaking a full feasibility study for a phase one L-Max plant to be located in Sudbury, Canada, with results expected in the 2019 second quarter.

In addition, the company is earning an 80% stake in the lithium rights of Venus Metals’ Youanmi project in WA.

A 38-hole reverse circulation drilling program was undertaken during the last quarter, confirming multiple lepidolite-bearing pegmatites with average grades over mineralised intercepts in the Central Zone ranging from 0.4-0.7% lithium oxide and often exceeding 1% lithium oxide.

Lepidico said further work at the project will depend on a full review and interpretation of the drilling results, which is currently underway.

Liontown Resources (ASX: LTR)

Liontown Resources has two 100%-owned hard rock lithium assets at Kathleen Valley and Buldania in WA, as well as the Toolebuc vanadium project in Queensland.

In September 2018, the company announced a maiden resource at Kathleen Valley, estimating 21.2Mt at 1.4% lithium oxide and 170ppm tantalum pentoxide, at a 0.5% lithium oxide cut-off grade.

At the start of the year, Liontown revealed the results of a scoping study that confirmed the viability of a proposed standalone mining and processing operation at Kathleen Valley.

A 16,000m reverse circulation drilling program commenced in February targeting mineral resource growth with the aim to increase the proposed mine life of the project.

A feasibility study is planned to commence, with completion anticipated in early 2020.

At the Buldania lithium project, recent drilling has confirmed a large lithium-mineralised system at the Anna pegmatite with intersections including 29m at 1.3% lithium oxide from 66m, including 9m at 1.7% lithium oxide from 74m.

Liontown is planning additional drilling at Buldania ahead of a maiden mineral resource estimate.

Lithium Australia (ASX: LIT)

Unlike most other lithium explorers, Lithium Australia’s overarching strategy is to build an integrated lithium operation using feedstock typically deemed as waste such as lepidolite or lithium mica material.

The company owns the Youanmi project in WA where lepidolite is the main lithium mineral.

Over the oceans in Germany, Lithium Australia secured the full rights to the Sadisdorf lithium project in 2018, which has a resource 25Mt at 0.45% lithium. The primary mineralisation at Sadisdorf is also lepidolite.

Lithium Australia has developed the proprietary SiLeach process which can make battery-grade material using lepidolite as a feedstock.

In November last year, Lithium Australia announced its wholly-owned subsidiary VSPC had used the SiLeach process to produce tri-lithium phosphate from lepidolite. The tri-lithium phosphate was then converted to a lithium-iron-phosphate cathode material at the VSPC’s Queensland lab.

VSPC was able to manufacture coin cell lithium-ion batteries, which, when tested, achieved equivalent performance to VSPC’s advanced traditional cathode powders.

To commercialise its technology, Lithium Australia is looking at establishing a SiLeach plant at Sadisdorf in Germany to take advantage of the advanced European markets.

Lithium Consolidated (ASX: LI3)

Lithium Consolidated is focused on expanding its hard rock lithium assets in Africa, particularly in Zimbabwe and Mozambique.

It also currently holds 16 hard rock lithium licences making up the Yilgarn project in WA and the Tonopah lithium project in Nevada, US.

The latest addition to the company’s portfolio is the Odzi West lithium project, made up of seven lithium exploration prospects in the Mutare greenstone belt in eastern Zimbabwe.

Lithium Consolidated has planned an initial phase of field mapping and rock chip sampling of the outcrops and historical workings within the Odzi West project, to be followed by a surface geochemical sampling program.

Based on the results of the geochemical program, a phase one drilling program could potentially ensue.

The company is currently performing due diligence on the potential 100% acquisition of the Bepe and Kondo mines in Zimbabwe. It is hoping to target early small-scale development of tantalite concentrate production, while it explores the larger-scale potential of a lithium resource.

The company has not reported any recent significant exploration activity at its Yilgarn or Tonopah projects.

Lithium Power International (ASX: LPI)

Lithium Power International’s main focus is on developing its 51%-owned Maricunga lithium brine project into Chile’s next high-grade lithium mine.

A definitive feasibility study released in January 2019 supports a forecast production at Maricunga of 20,000 tonnes-per-annum of lithium carbonate equivalent over 20 years.

Total capital expenditure is estimated at US$563 million, with project operating costs estimated at US$3,772/t lithium carbonate equivalent, without offset income from sales of the potassium chloride by-product.

The company also announced a maiden ore estimate for the project of 742,000t lithium carbonate equivalent, which exceeds the projected 20-year mine life production requirements.

The Chilean government is now carrying out an exhaustive review of the Maricunga project, following the submission of its environmental impact assessment.

Lithium Power also holds a 70% stake in the Centenario lithium project in Argentina, where a drilling program is currently being considered to target a large conductive zone identified in a geophysical survey.

It also holds exploration licences in Pilgangoora, Tabba Tabba, Strelley and Greenbushes in WA.

In late January, the company said it planned to announce a full development program for the Tabba Tabba and Strelley projects by the end of the 2019 first quarter, with exploration drilling anticipated to commence in the second quarter.

Marindi Metals (ASX: MZN)

Marindi Metals acquired the Great Southern project in December as a strategic addition to its Southern Forrestania Greenstone Belt gold-lithium project in WA.

The company moved quickly to commence low-cost exploration activities, with gold the mineral of focus.

Successful geophysical programs over the area identified numerous walk-up drill targets and parallel structures awaiting further investigation.

Marquee Resources (ASX: MQR)

Battery metal company Marquee Resources owns the Clayton Valley project in Nevada, US. The project is near Albemarle’s Silver Peak lithium mine which has been producing since the 1940s.

Clayton Valley is prospective for lithium brines and clays and Marquee is in discussions with a consultant geologist regarding the best course of action for the project.

Marquee has also pointed out the project is only 3.5 hours’ drive from Tesla’s Gigafactory 1.

Metals Australia (ASX: MLS)

Another Canadian mineral explorer is Metals Australia, which holds 100% interest in the early-stage Lac La Motte, Lac La Corne and Lacourciere-Darveau lithium projects in Quebec.

During the December quarter, Metals Australia continued its evaluation of the Manindi lithium project, 500km north-east of Perth, with previous drilling in the September quarter testing three pegmatites which hosted lepidolite mineralisation with assays returning up to 1.96% lithium within a 1m interval.

The company is also looking at carrying out a follow up drilling program at the project in conjunction with ongoing geological evaluation.

Additionally, Metals Australia is in discussions with third parties in relation to the next stage of exploration at Manindi, which may include a joint venture farm-in or acquisition.

MetalsTech (ASX: MTC)

MetalsTech Cancet lithium project is within Canada’s James Bay region and encompasses more than 20,000ha.

The project is the most advanced within MetalsTech’s lithium portfolio and previous drilling has returned 18m at 3.14% lithium and 284ppm tantalum, including 5m at 4.12% lithium and 118ppm tantalum.

MetalsTech has identified 6km of strike at the project which it anticipates is prospective for spodumene-bearing pegmatites.

During the December quarter, MetalsTech continued discussions with prospective investors and potential development partners in relation to a selldown of its hard rock lithium assets as part of its cost and risk reduction strategy.

Mineral Resources (ASX: MIN)

During the December 2018 quarter, Mineral Resources entered into two sales agreements: the first was with Albemarle Corporation, whereby Albemarle would purchase a 50% interest in Mineral Resources’ Wodgina lithium project; the second agreement was with Jiangxi Ganfeng Lithium Co to jointly acquire Neometals’ 13.8% share of the Mount Marion lithium project, operated by Mineral Resources.

Once Mineral Resources secures its share of Neometals’ Mount Marion interest, it will bring its ownership to 50%.

At Mt Marion, 115,000t of spodumene concentrate was produced during the December period, while at Wodgina, production of direct shipping ore was downscaled in the same period to 40,000t from 358,000t in the September quarter.

Shipments from Wodgina were suspended in line with Mineral Resources’ plans to maximise future value from the ore body by retaining the ore for use in spodumene concentrate production.

Meanwhile, construction of a 750,000tpa spodumene processing plant for Wodgina in ongoing with commissioning of the first-stage 250,000t module underway and first spodumene concentrate expected before the end of February.

During the first half of 2019, Mineral Resources generated $21.6 million in operating cash flow and report a net after tax profit of $13.1 million.

Neometals (ASX: NMT)

Neometals executed a sale agreement to divest its interest in the Mt Marion lithium project to the Jiangxi Ganfeng Lithium Co and Mineral Resources joint venture for a combined $103.8 million, including a life-of-mine offtake option agreement for 57,000tpa of 6% spodumene concentrate at market-linked prices.

The company commenced a front-end engineering and design study of the Kalgoorlie lithium refinery project which aims to increase the value of concentrates purchased under the offtake option.

Exploration work comprised grid mapping and soil sampling and continued during the December quarter at the Mt Edwards lithium project, 40km south of Mt Marion.

Neometals is also progressing its lithium-ion battery recycling project to recover more than 90% of all metals from lithium-nickel-manganese-cobalt and cobalt-rich (lithium cobalt oxide) battery chemistries.

Northern Cobalt (ASX: N27)

Cobalt, copper and vanadium explorer Northern Cobalt owns the Arunta lithium project in the NT’s south-east and about 180km north of Alice Springs.

Soil sampling was carried out at Arunta in 2018, which is also prospective for rare earth elements.

Nova Minerals (ASX: NVA)

Initial reconnaissance prospecting at the Sherritt Gordon pegmatites within Nova Minerals’ Thompson Bros lithium project in Canada recorded multiple occurrences of high-grade lithium mineralisation above 1.5% lithium oxide over an extensive area.

The company has an option to earn up to 80% of the project which is 20km from Manitoba’s Snow Lake mining community.

Follow-up drilling will evaluate the SG-1, 2 and Grass River pegmatites within Sherritt Gordon and may contribute to an increase in the project’s overall resource inventory, with both pegmatites remaining open along strike and at depth.

Historical drilling at SG-1 yielded spodumene grading from 7.22% and 31.9% in widths ranging between 1.52m and 5.79m.

Orocobre (ASX: ORE)

A final investment decision was approved for Orocobre and its joint venture parties’ proposed stage two expansion of the Olaroz lithium brine facility in Argentina.

The expansion will increase lithium carbonate production capacity by 25,000tpa to 42,500tpa.

Stage two will produce technical grade lithium carbonate of 99% purity and above, part, of which, will be used as feedstock for the proposed Naraha lithium hydroxide plant in Japan.

During the December quarter, Orocobre generated 3,782t of lithium carbonate from Olaroz and sold 3,019t to achieves sales revenue of US$32 million.

Over at the Cauchari joint venture, also in Argentina, results from a phase three infill drilling program during the December quarter will be used to upgrade the project’s resource estimate and provide the basis for a feasibility study.

Peninsula Mines (ASX: PSM)

Graphite explorer Peninsula Mines has uncovered “highly anomalous” lithium after carrying out soil sampling at the Tonggo project in Korea.

Peninsula has identified 1.2km of pegmatite at Tonggo and plans to pinpoint lithium targets through further field work.

PepinNini Lithium (ASX: PNN)

A geophysical time domain electromagnetic survey at the Incahuasi Salar within PepinNini Lithium’s Salta lithium brine project in north-west Argentina indicated two distinct conductive zones, both of which are potentially lithium brine bearing to more than 200m depth.

The project comprises nine mining licences totalling 20,840 hectares and all properties are considered prospective for lithium brine aquifers associated with salares (or salt lakes).

PepinNini also announced during the December quarter that it would not proceed with an exploration purchase option covering Patilla Mina within the neighbouring Salar de Pular project.

The company has targeted lithium carbonate production from its three primary targets Pular, Incahuasi and Rincon by mid-2021.

Piedmont Lithium (ASX: PLL)

During the December quarter, Piedmont Lithium commenced a 25,000m drilling program at the Piedmont lithium project, along the world-class Carolina tin-spodumene belt in the US.

The drilling campaign aims to increase the project’s mineral resource and extend its proposed life.

Piedmont also submitted key project permit applications to US agencies, and completed the first tranche of a capital raising exercise for drilling and upgrade of the resource base, pilot-scale metallurgical testwork, engineering studies and ongoing land consolidation.

By late February, Piedmont had increased its land position to 1,824 acres, giving it the largest lithium position in the Carolina tin-spodumene belt.

Pilbara Minerals (ASX: PLS)

Pilbara Minerals is widely acknowledged to be sitting on one of the world’s biggest new spodumene deposits about 120km from Port Hedland in the Pilbara region of northern WA.

The company is aiming to become among the top three lithium raw material producers globally by 2020, with a stage two 5Mtpa plant to be commissioned at its wholly-owned Pilgangoora lithium-tantalum project by the end of 2019.

The plant is forecast to produce up to 850,000tpa of spodumene concentrate over 17 years. In September last year, the company upgraded the total measured, indicated and inferred resource of Pilgangoora to 226Mt grading 1.27% lithium oxide. The resource also contains other valuable minerals including tantalite.

In January 2019, Pilbara said stage two early project works were progressing with detailed engineering underway and long-lead orders being placed for major equipment.

Offtake commitments already cover 100% of the stage two expanded spodumene concentrate production and according to the company, there is strong support from its customer base regarding funding and the desire to expand production.

Pilbara is now evaluating opportunities for a potential stage three expansion to increase throughput to 6.2Mtpa or possibly even 7.5Mtpa, which would deliver up to 1.2Mtpa of around 6% spodumene concentrate.

A reverse circulation drilling program is also ongoing in the Eastern pit exploration area, ahead of scheduled mining activity, with the campaign expected to continue through to the end of March 2019. Pilbara revised its exploration target in late 2018 to 50-90 million tonnes grading 1-1.5% lithia.

Pioneer Resources (ASX: PIO)

Perth-based explorer Pioneer Resources holds several projects prospective for lithium in WA, as well as the Mavis Lake lithium project in Ontario, Canada.

Pioneer’s flagship project is Pioneer Dome in WA, which is prospective for lithium, caesium, tantalum and nickel sulphide. The project also includes the Sinclair caesium mine which began production in late 2018.

At the start of February, Pioneer reported the first shipments of pollucite ore to offtake partner CabotSF and said it was continuing to offtake talks with potential customers for other saleable minerals from the Sinclair mine, including lithium minerals (petalite and lepidolite), which were stockpiled during mining.

Pioneer also owns a 90% stake in the Bogardi project in WA’s Gascoyne region, where five drill holes were completed last quarter on an unconventional lithium clay prospect. However, no significant results were returned.

In August last year, the company announced its intention to move to 51% ownership of the Mavis Lake lithium project in Canada to fast-track exploration following two successful drilling programs carried out over the 2017 and 2018 winters.

Another drilling program has been proposed at Mavis Lake for late 2019.

Poseidon Nickel (ASX: POS)

Poseidon Nickel is a nickel developer that began exploring the lithium potential of its existing projects in WA during nickel market downturn.

In early 2018, it began exploring the lithium potential of its 100%-owned Lake Johnston tenement area, kicking off a reverse circulation drilling program in an area it referred to as the Medusa lithium project.

However, the company did not encounter any encouraging lithium-bearing pegmatites and subsequently decided to shelve the project as it turns its focus back to nickel.

Prospect Resources (ASX: PSC)

Prospect Resources’ main focus is on advancing its flagship 87%-owned Arcadia lithium project in Zimbabwe.

In November 2018, the company completed a definitive feasibility study for the 2.4Mtpa base case development of the project.

Key outcomes included a forecast life-of-mine project revenue of US$2.93 billion over a 12-years and an average annual concentrate production of about 212,000t of 6% spodumene, 216,000t of 4% petalite and 188,000lb of tantalum.

The study also forecast a 2.5-year payback period from first production and an average life-of-mine cash operating cost of US$285/t of concentrate.

Prospect managing director Sam Hosack said the completion of the successful definitive feasibility study validated his belief that “Arcadia is Africa’s leading lithium development project with respect to its scale, grade, economics and team”.

In December, Prospect exported 100kg of lithium carbonate (with a battery grade of more than 99.5%) to Australia to distribute to potential offtake partners for evaluation.

The company’s plans for early 2019 include updating regulatory approvals and securing project financing in anticipation of construction at Arcadia.

Construction and mine development are scheduled for completion in the third quarter of calendar year 2020, with commissioning planned in November 2020.

Pure Minerals (ASX: PM1)

Pure Minerals holds an 80% stake in the Morrissey Hill project in WA’s Gascoyne region, where a recent soil sampling program identified a lithium and tantalum pegmatite target next to the Reid Well lithium-tantalum discovery (with surface values of up to 3.77% lithium oxide).

In the 2018 third quarter, Pure submitted an exploration program of work to the WA Department of Mines seeking approval to begin a reverse circulation drilling program.

More than 12 RC holes are planned over 1,000m to test the 5km long, 1.5km wide anomaly.

No further updates on the Morrissey Hill project have been reported.

Reedy Lagoon Corporation (ASX: RLC)

Reedy Lagoon is actively exploring for lithium in brine at four projects in Nevada, US: Alkali Lake North, Big Smoky South, Columbus Salt Marsh and Clayton Valley.

The project areas are in closed geological basins which share similar geology with Clayton Valley, the location of North America’s only operating lithium brine mine, Silver Peak.

Over the last year, the company conducted an exploration program including drilling at the Columbus Salt Marsh and Big Smoky South projects.

Drilling at Columbus Salt Marsh reportedly intersected multiple brines but while lithium and boron were detected, their concentration was not considered high enough to be significant.

Meanwhile, drilling at Big Smoky South led to the company pegging additional ground which is now referred to as Clayton Valley.

No field exploration was reported during the December 2018 quarter with only rehabilitation earthworks completed at the previous drilling sites.

In January 2019, the company said it was investigating joint venture opportunities for its Nevada projects in order to provide the funding required for its planned drilling programs.

Rio Tinto (ASX: RIO)

You may not expect to see the name of a mining giant like Rio Tinto here but it has taken notice of increasing lithium demand and is now undertaking a pre-feasibility study on its Jadar lithium-borate deposit in Serbia.

In a field update late last year, the company said an exploration drilling program commenced in August with plans for this work to be supplemented by aero-magnetic geophysical surveys in the “near future”.

Of course, even if you believe the most bullish forecasts for lithium, they are unlikely to cause much of a blip on Rio Tinto’s overall profitability.

Rolek Resources (ASX: RLK)

Formerly named Shaw River Manganese, Rolek Resources is currently suspended but is hoping to be readmitted to the ASX following the proposed acquisition of Rolhold Pty Ltd.

Upon the completed acquisition, Rolek will hold lithium, tantalum, beryllium, nickel and cobalt exploration projects in Western Australia, in addition to its flagship Barramine manganese project.

The lithium projects include Mount Dockrell/Lamboo in the Kimberley region and the Red Hill Well project in WA’s Murchison.

The large Mount Dockrell/Lamboo project comprises 89 blocks and neighbours a tin-tantalum mining field where alluvial tin was mined in the 1920s and 1930s. Pegmatite targets have been interpreted within this project area.

According to Rolek, the Red Hill Well project area shows evidence of pegmatite development and an obvious granite source.

Sayona Mining (ASX: SYA)

Sayona Mining is developing the advanced-stage Authier hard rock lithium project in Quebec, Canada.

In September 2018, it completed a definitive feasibility study, confirming the potential for a profitable and sustainable new lithium mine. The study was based on a simple open-cut mining and processing operation.

Key outcomes of the study include an estimated initial capital expenditure of C$89.9 million (A$95.3 million) to deliver a forecast average annual revenue of C$80 million (A$84.8 million) over an 18-year mine life.

Annual average concentrate production is estimated to be 87,400t at 6% lithium oxide.

Sayona also expanded Authier’s total ore reserves to 12.1Mt at 1% lithium oxide for 121,590t of contained lithium oxide.

In addition, total mineral resources (including measured, indicated and inferred categories) were upgraded from 17.4Mt to 20.94Mt at 1.01% lithium oxide.