Rare earth stocks on the ASX: The Ultimate Guide

中国控制着全球80%左右的稀土产量。

As the use of rare earth elements in emerging technologies becomes increasingly significant in today’s modern world, investors are being drawn to ASX stocks involved in the minerals.

At present, China controls the bulk of its production capacity and is dangling it like a carrot in a trade war with the United States.

However, the US isn’t keen to play along and is, instead, looking to other nations to help maintain its supply of these critical minerals.

As the second top producer of rare earth element, Australia is in a prime position to take advantage of the situation, with ambitions to become an international “powerhouse” via its Critical Minerals Strategy.

Federal defence minister Linda Reynolds also recently called rare earth element’s continuity and guarantee of supply an issue of “national importance”.

So, do these minerals really give China the bargaining power? Or, will this be the push Australia needs to up its game and take a larger share of the market?

What are rare earth elements?

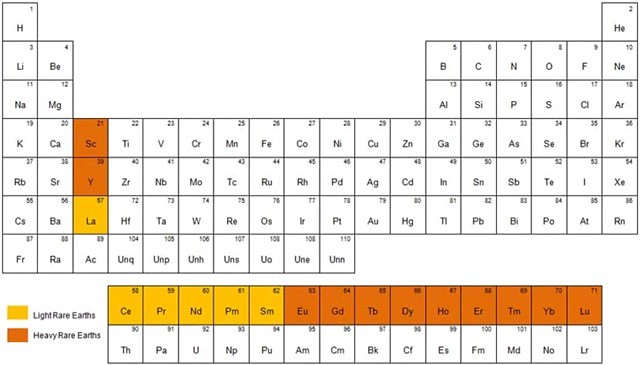

Rare earth element, also referred to as rare earth minerals, are a group of 17 metals made up of 15 lanthanides, plus scandium and yttrium.

Lanthanides are the chemical elements with atomic numbers 57 to 71 on the periodic table and include (in table order): lanthanum, cerium, praseodymium, neodymium, promethium, samarium, europium, gadolinium, terbium, dysprosium, holmium, erbium, thulium, ytterbium and lutetium.

Rare earth minerals consist of 17 elements from the periodic table.

Scandium and yttrium fall under the same umbrella because they tend to occur in the same ore deposits and have similar chemical properties.

The elements are also often found in minerals with thorium and, sometimes, uranium.

The name itself is deceiving as these minerals are not “rare”, but just rather hard to find in economic quantities and complex to extract, making mineable concentrations less common than most other ores.

According to Geoscience Australia, they have “unique catalytic, metallurgical, nuclear, electrical, magnetic and luminescent properties”.

The group can be divided into three classifications – light, medium and heavy elements.

With resources typically reported as rare earth oxides (REO).

History

The first rare earth elements were discovered in a heavy, black rock found at a quarry in Sweden in the late 18th century.

This rock, first referred to as ‘ytterbite’ and later renamed ‘gadolinite’, was found to contain the first two known rare earths: yttrium and cerium.

It took another three decades for researchers to identify other elements in these ores because the similarity of rare earths’ chemical properties makes them difficult to distinguish.

Rare earth elements, excluding scandium, are heavier than iron and are theorised to have been produced in supernova explosions.

Further discoveries were made over the 1800s and the first half of the 1900s, but demand for rare earths didn’t gain much momentum until the launch of the first colour televisions in the mid-1960s.

Before then, most of the world’s supply of REOs came from South Africa, India and Brazil.

But, when the Mountain Pass mine in California began generating europium – an important material for producing the TV’s colour images – the US took over as the leading producer.

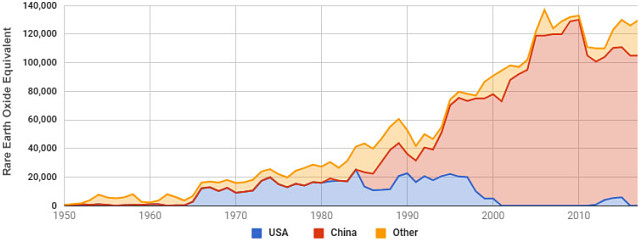

China then began mining significant amounts of rare earth elements in the 1980s and quickly surpassed the US as the top producer.

The country strengthened its hold on the market over the 1990s and 2000s by producing and selling rare earth elements at such low prices that other suppliers were unable to compete and subsequently ceased operations.

To this day, China’s dominance in the market continues to be a key inhibitor of output from other areas of the world.

Rare earth element applications

The global demand for rare earth element has increased drastically over the past two decades, in line with the minerals’ expansion into high-end technologies and environmental and economic applications.

According to Geoscience Australia, uses range from routine technologies such as lighter flints, glass polishing mediums and car alternators, to high-end technology like lasers, magnets, batteries or fibre-optic telecommunication cables.

Rare earth elements are used throughout modern vehicles.

Other applications may have futuristic functions, such as high-temperature superconductivity, safe storage and transport of hydrogen for a post-hydrocarbon economy, and as a solution for environmental global warming and energy efficiency issues.

Rare earth element are also used in the automotive, oil refining and aerospace industries, the military and even in healthcare.

One of the fastest growing and high-value markets for rare earths is magnets, with rare earth element permanent magnets considered to be three times stronger than conventional magnets and only one-tenth of the size.

This is one of the reasons why items such as consumer electronics have become smaller, lighter, more efficient and affordable.

Global demand

According to Geoscience Australia, the rare earth element market was worth US$415 million (A$595 million) in 2017.

The most in-demand of the 17 minerals are neodymium and dysprosium, which are the ones used in the production of these super magnets.

However, the less valuable elements continue to be mined and produced as by-products of the more marketable types.

In its Rare Earths: Global Industry, Markets & Outlook 2018 report, market research firm Roskill said global demand has been largely driven by developments in the use of rare earth permanent magnets in automotive and renewable energy generation, with these magnets forecast to show strong growth in the years leading up to 2028.

According to Roskill, neodymium demand compared to total rare earth element demand increased from 19% in 2013 to more than 23% in 2017.

Neodymium oxide and praseodymium oxide are used for magnets, catalysts and pigments.

Over the next decade, the firm anticipates neodymium, praseodymium and dysprosium will form a greater proportion of total demand.

Meanwhile, lanthanum and cerium form the majority of rare earth element demand by volume, making up about 84,700,000t of REO consumption compared to about 53,000t REO for the remaining elements.

Global resources

As the biggest producer of rare earth elements, China accounted for around 80% of global mine production in 2018 and hosts more than a third of the world’s reserves (44 million tonnes).

There is a significant gap between China and the next top producers, which 2018 data from the US Geological Survey shows are Australia at 11% (22Mt) and the US at 8.8% of global production (15Mt).

This means Chinese exports are heavily relied upon throughout the world, even in the countries that host their own resources.

China in recent decades has dominated global rare earth production.

In addition, rare earth element unearthed elsewhere in the world is often processed in China or is linked to the country via Chinese investment, with only a few projects operating independent of the Asian nation.

This disparity has made rare earth element a valuable pawn for China, which has been leveraging its position as a dominant producer in its ongoing trade dispute with the US, threatening to impose an embargo on exports of the minerals.

A big reason why rare earth element projects outside of China have not advanced is because they cannot compete with China’s vast production and cheap labour costs.

But, if China goes ahead with its threatened embargo, this could provide the perfect opportunity for Australia to step up as a major rare earth element supplier to the US.

Location map of rare earth projects in China by region.

Australia currently accounts for more than half of the new rare earth element projects in the global pipeline, despite the country only containing about 2.8% of the world’s reserves, according to the US Geological Survey.

REO resources have been found in the Northern Territory, and all states except Tasmania.

Lynas Corp’s Mount Weld mine in Western Australia hosts one of the world’s highest-grade rare earth element deposits.

Interestingly, it is also one of the few rare earth mines that are totally independent of China, with its material refined at a Malaysian plant.

South Australia’s Olympic Dam has an inferred REO resource in excess of 47Mt – more than five times greater than Mount Weld’s 8.98Mt REO resource. Although, unfortunately, the resources here are not considered currently economic.

Other significant rare earth element deposits around Australia include Toongi in New South Wales, Nolans Bore in the NT and the Wim deposits in Victoria.

Australia only began producing rare earth element in 2013 (from Mt Weld), but in the past it has exported large amounts of monzanite from heavy minerals sands to extract rare earths and thorium.

Elsewhere in the world, rare earth element resources have been identified in Brazil, Vietnam, Russia, India and Malaysia.

Critical minerals strategies

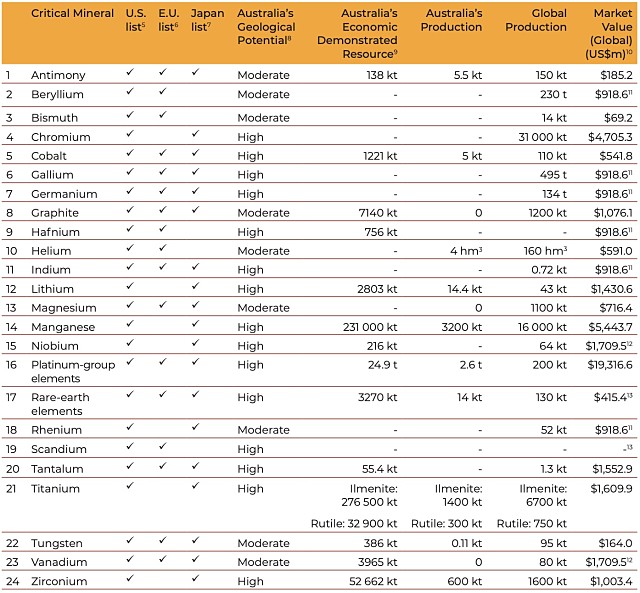

Rare earth elements have been deemed ‘critical minerals’ by Australia, the US Geological Survey and the European Commission.

This means they are considered essential for the economy, but their supply may be at risk due to geological scarcity, geopolitical issues, trade policy or other factors.

While rare earths have been on the US and Europe’s lists for some time, Australia only launched its own Critical Minerals Strategy in March.

This new strategy outlines a policy framework with a vision for Australia to become a “world powerhouse” in the exploration, extraction, production and processing of critical minerals.

It lists a total of 24 critical minerals present in Australia, although rare earth elements have been listed together as a group, with scandium noted separately.

Table of the 24 critical minerals in Australia.

“Australia is ranked sixth in the world for rare earth elements and second for production, yet many of these deposits remain untapped,” the strategy stated.

The report noted while Australia has been moving up the lithium value chain as producers invest in lithium processing, investment in minerals with “high geological potential” such as rare earth elements and cobalt, have been slower.

“With the right supporting framework, the government expects cobalt and other critical mineral markets could develop in response to increasing global demand,” the report noted.

Speaking at the Indo-Pacific conference in Perth in mid-August, defence minister Ms Reynolds said continuity and guarantee of supply of rare earth element tech metals is “an issue of national importance”.

“What we want to do is make sure we have a guaranteed supply. So, it’s not just the IBMs and the Apples and modern companies who produce leading-edge technology who need access to this, but it’s also our defence firms,” she said.

“A lot of our defence equipment and capability actually uses rare earths in its production,” Ms Reynolds added.

Meanwhile, the US list notes the rare earth element group as one of 35 critical minerals, while Europe has specified both heavy rare earth elements and light rare earth elements in its list of 27 critical minerals.

Earlier this year, the Chinese Government implied it might halt exports of rare earth element to the US as its next move in the countries’ ongoing trade war.

The US has since been trying to ink deals with friendly nations such as Australia and Canada to reduce global reliance on China for these crucial materials.

According to a US Government fact sheet, the “reliance on any one source increases the risk of supply disruptions”.

“Demand for critical energy minerals could increase almost 1,000% by 2050,” it stated.

Under its plan, the US would share mining expertise with other countries to help discover and develop resources and advise on management and governance frameworks to ensure the industries attract international investors.

In late June, US President Donald Trump and Canadian Minister Justin Trudeau announced plans to collaborate on a US-Canada critical minerals plan.

Obstacles for non-Chinese developments

Roskill analyst David Merriman said in a video interview earlier this year that there were a number of bottlenecks holding back the development of a non-Chinese rare earth element industry.

He said problems arise in the separation/refinement stage “largely because the technical knowledge that is required is very concentrated within the Chinese market, so it’s difficult to get personnel in with the knowledge”.

Mr Merriman added that the capital expenditure required to construct these separation facilities is relatively large.

“We’re talking US$500 million for a number of projects on any scale, so quite significant investments being looked at for an industry that had a lot of risk associated with it in the past and some investors have been burnt previously.”

Another factor inhibiting development around the world is the social and environmental risks associated with rare earth element mining.

According to Perth USAsia Centre research director Dr Jeffrey Wilson, the extraction of these minerals is a highly toxic process.

Speaking at the recent Indo-Pacific conference, he noted one mine in Baotou, Inner Mongolia, has produced “in the last 20 years, about half of the rare earths ever mined; so, there’s a 50% chance you have some of that product on your body right now”.

“It unfortunately has an extremely toxic tailings dam that’s actually known as the Baotou toxic lake, which is full of radioactive and heavy chemicals and unfortunately, sits about 200 miles from the upstream head waters of the Yellow River, an agriculture basin which 300 million people depend on,” Dr Wilson said.

“If there was some kind of natural disaster or earthquake and that tailings dam was to spill into the Yellow River, the human consequences of that would be catastrophic.”

However, Dr Wilson said Australia has proven it can produce these minerals on a cost-effective basis, but more environmentally and socially sustainably than China, which is likely to attract investment.

“If Australia provides a very secure supply chain – from mineral, to intermediate product, to magnet, to application – that would be a very attractive proposition for a well-contained, integrated, secure and controlled supply chain for componentry that goes into very complex defence technology such as fighter aircraft, cyber warfare and naval assets,” he said.

Australian projects in the spotlight

Lynas Corp (ASX: LYC) is the most significant producer of rare earths outside of China, operating the Mt Weld mine in WA.

However, there are a number of other Australian companies looking to take on the challenge of stepping up Australia’s rare earth game.

The Lynas Corp-operated Mt Weld mine in Western Australia is one of the only rare earth operations that is independent of China.

Northern Minerals (ASX: NTU) is developing the Browns Range heavy rare earths pilot project in northern WA with ambitions of becoming the first significant producer of dysprosium outside of China.

In August, the company scrapped a previous offtake agreement with China’s Lianyugang Zeyu New Materials Sales Co Ltd and six days later, announced it had inked an exclusive deal with Germany’s thyssenkrupp Materials Trading gmbh for 100% of the project’s offtake.

Ms Reynolds told media at the time that she was “pleased” by the switch to a non-Chinese company, calling it a “very important development”.

Earlier this year, Arafura Resources (ASX: ARU) released a definitive feasibility study for its 100%-owned Nolans neodymium-praseodymium project in the NT, with project commissioning targeted for 2022.

Meanwhile, Alkane Resources (ASX: ALK) is seeking funding and offtake partners for its wholly-owned “construction-ready” Dubbo rare earth element project in NSW.

Another Australian company Peak Resources (ASX: PEK) looked to Africa for the opportunity to be a low-cost producer of neodymium and praseodymium, recently completing a bankable feasibility study at its Ngualla rare earth element project in Tanzania.

Recycling rare earth materials

There has recently been a big change in the recycling of rare earth materials, particularly magnets.

In August, Birmingham University in the United Kingdom announced it has been awarded €5 million (A$8.3 million) by the European Union’s Horizon 2020 research and innovation program to pilot a new technology for recycling rare earth metals from magnets.

The new scheme involves the extraction of neodymium, as well as boron and iron, from magnets commonly found in hard disk drives, household appliances, electric vehicles and wine turbine generators.

According to Roskill’s Mr Merriman, it has typically been difficult to collect large volumes of rare earth materials given its use in very small equipment such as smartphones.

“It’s very costly to dismantle that and the quality of those magnets is not necessarily brilliant,” he said.

Although, larger magnets being brought back in for secondary supply from wind turbines is a different story.

“We’re talking on the scale of tonnes of magnets, rather than grams of magnets in those smartphones. Also, the standard of those magnet materials is much greater,” he added.

Meanwhile, scientists at Deakin University in Victoria and Spain’s Tecnalia Research and Innovation have recently been working together to improve the process for recovering rare earth metals, which currently generates huge amounts of toxic and radioactive waste.

According to Deakin Institute for Frontier Materials researcher Dr Cristina Pozo-Gonzalo, only about 3-7% of rare earth metals are currently recovered from end-products due to technological difficulties.

Her team’s process involves separating the metals from their end-of-life product then using advanced electrolytes called ‘ionic liquids’ to recover the rare earth metals from the resulting solution using electrodeposition – that is, using a low electric current to cause metals to reform and deposit onto a surface.

If any of this research determines an effective and more sustainable way to recycle rare earth materials, this could be an important step in alleviating the current pressures on the critical minerals.

Rare earth element pricing

It is no surprise that rare earth element prices rely heavily on China due to its dominant position in the supply chain.

So, when the country threatened to impose an embargo on the minerals in May, prices surged.

According to research and price reporting agency Asian Metal, the price of neodymium metal (used in the production of motor and turbine magnets) rose about 30% in just two weeks to reach US$63.25 per kg in early June – its highest price since July 2018.

At the same time, dysprosium (also used in magnets, as well as high-powered lamps and nuclear control rods) hit its highest price since June 2015 at CNY2,025 per kg (US$293/kg).

Gadolinium oxide (used in medical imaging devices and fuel cells) also reached a five-year high at CNY192,500/t (US$27,933/t).

Argonaut Securities analyst Helen Lau told Reuters the big movement in rare earth element prices stemmed from China’s “possible weaponising of rare earths”.

“If China indeed weaponises rare earths, the US will not have enough supply because it needs some lead time to build their own processing capacity, which currently is zero,” she said.

On the Shanghai Metal Market (SMM), neodymium oxide is currently averaging at about CNY304,500/t (US$43,397/t), which would be CNY304.50/kg (US$43.40/kg).

Dysprosium oxide has also eased back to about CNY1,940/kg ($276.49/kg).

In late July, SMM attributed recent price drops to a seasonal lull, with downstream consumers and magnet producers holding back from purchasing rare earth products.

Due to this low consumption season, SMM said rare earths prices were unlikely to pick up in the short-term.

Though despite this weakened demand, August is already starting to see some growth, with prices of dysprosium, terbium, gadolinium and holmium oxides all gaining recently on escalating trade tensions and suspected stockpiling.

Prices of medium, heavy rare earths are likely to climb in the longer term,” SMM stated.

Potential risks

As with investing in any commodity, there is some degree of unpredictability and risk.

First and foremost, China may not go through with its export ban, a black market may emerge, or the World Trade Organisation might rule that China can’t put limits on rare earth element exports, as they did in 2014.

Meanwhile, EV manufacturers could opt for cheaper, lower performance induction electric motors which don’t require rare earths.

Plus, technology is constantly changing and developing. The high price of rare earth elements could drive the development of new magnets with less or no rare earth element materials.

The Chinese government reduced export quotas by 40% in 2010, sending rare earths prices in markets outside the country soaring.

According to Mr Merriman, the biggest thing investors should look out for is changes in Chinese policy.

“We’ve seen some recent reports from the Ministry of Industry and Information Technology out of China about their crackdown on illegal production in China, which is a big problem out there,” he said.

“So, any changes in that, or any localised provincial crackdowns could represent some changes in rare earth pricing,” Mr Merriman said.

Rare earth stocks on the ASX

Let’s take a closer look at the ASX-listed companies with projects that are prospective for rare earth elements.

Alpha HPA (ASX: A4N)

Formerly Collerina Cobalt, Alpha HPA’s Collerina project in NSW hosts aluminium, nickel cobalt and scandium.

The company’s focus is on producing a high purity alumina product using its proprietary technology.

No further work to unlock the scandium value at Collerina has been progressed to-date.

Alkane Resources (ASX: ALK)

Australian explorer Alkane Resources is mainly focused on gold, however it also holds the Dubbo critical minerals project, located 400km northwest of Sydney, NSW.

This project has a large in-ground resource of zirconium, niobium and REEs including yttrium that supports a potential open pit mine life of more than 75 years.

In its June quarterly report, Alkane described the project as “construction-ready, with the mineral deposit and surrounding land wholly-owned, all material state and federal approvals in place, an established flowsheet and a solid business case”.

The company’s key focus is on inking offtake contracts for its products and potentially securing a strategic investor in the project.

Alchemy Resources (ASX: ALY)

Although Alchemy Resources’ West Lynn project in NSW lies in a region that is prospective for scandium, the company is focused on creating HPA from the project’s alumina resource.

No recent work towards unlocking the asset’s scandium value has been undertaken.

Arafura Resources (ASX: ARU)

Aspiring to be Australia’s next fully integrated neodymium-praseodymium producer, Arafura Resources completed a definitive feasibility study of its 100%-owned Nolan project in the Northern Territory in February and is targeting project commissioning in 2022.

The DFS supports an “ultra-low-cost” operation producing 4,357tpa of neodymium-praseodymium oxide over a 23-year mine life.

Arafura said this mine life is based on ore reserves only (which total 19.2Mt at 3% TREO of proved and probable reserves), with potential to extend production.

In June, the company raised $23.2 million in a fully underwritten entitlement offer with the new funding expected to accelerate development of the project.

According to Arafura, this includes project execution readiness to allow the award of key design and project management contracts, the commencement of front-end engineering and design, the completion of the early contractor involvement phase and the delivery and tender of long lead procurement items and early works construction contracts.

In addition, the company is planning to undertake a drilling and metallurgical variability program aimed at potentially increasing the project’s mine life.

In late July, Arafura released an indicative project timeline that points to early works construction starting in October 2020, with plant commissioning anticipated around March-April 2022 and operations to start around August-September 2022.

The company said it is currently pursuing offtake agreements to underpin project funding, targeting magnet manufacturers in Japan and China, as well as automotive manufacturers and wind turbine makers in Europe and Korea.

In addition to Nolans, Arafura holds the Aileron-Reynolds exploration project north-west of Alice Springs in the NT. This project is considered to be highly prospective for apatite-hosted neodymium-praseodymium mineralisation.

The primary focus of exploration at this project is to potentially deliver additional mill feed for the Nolans operation. However, no recent exploration work has been reported.

Australian Mines (ASX: AUZ)

Both Australian Mines’ Sconi and Flemington projects contain scandium, but the company is unlocking the assets’ nickel and cobalt content.

An updated study for Queensland-based Sconi was released in June and estimated the project could produce 1.405Mt of nickel sulphate, 209,000t of cobalt sulphate and 1,441t of scandium over its proposed 30-year life.

Sconi has a reserve of 57.3Mt at 0.58% nickel, 0.08% cobalt and 35ppm scandium.

Australian Mines’ less advanced Flemington project is located in NSW.

Drilling during the June quarter unearthed 15m at 576ppm scandium from 12m, 12m at 500ppm scandium from surface, and 12m at 402ppm from 9m.

Australia United Mining (ASX: AYM)

Australia United Mining’s Honeybugle exploration project in central west NSW is considered prospective for scandium, in addition to platinum, nickel and cobalt.

The junior explorer completed a high resolution aeromagnetic and radiometric survey over the tenement and followed up with ground magnetic surveying.

Three “intense” magnetic anomalies were defined as drilling targets.

However, no recent activity has been reported at the project, with the company focusing on the gold potential of its Sofala and Forsayth projects in NSW and north Queensland, respectively.

Broken Hill Prospecting (ASX: BPL)

Broken Hill Prospecting is an Australian explorer focused on industrial, base and precious metals in New South Wales’ Broken Hill region and heavy minerals sands in the state’s Murray Basin.

In July, Broken Hill chief executive officer Trangie Johnston revealed in a letter to shareholders that the company had been reviewing its assets to enhance the value of its heavy mineral sands portfolio by potentially adding a REE focus.

Historically, heavy minerals sands have been a valuable source of REEs via the separation of monazite.

According to Broken Hill, its previous metallurgical test work in the Murray Basin has demonstrated “excellent extraction characteristics of monazite”.

The company is now assessing new processing and leaching technologies that could be suitably deployed.

In addition, Broken Hill recently announced it has formed a wholly-owned US-based subsidiary to acquire and develop the La Paz REE project in Arizona.

According to the company, La Paz is a large tonnage, bulk deposit containing high value, light REE assemblage.

Broken Hill said it has the potential to be the largest REE project in North America, with initial metallurgical test work demonstrating favourable separation of high value, light REE-rich allanite.

Mr Johnston said “on-ground work is expected to commence within months”.

Clean TeQ Holdings (ASX: CLQ)

Clean Teq’s flagship Sunrise battery materials complex is an advanced nickel, cobalt and scandium mining and processing project in NSW.

According to the company, the “construction-ready” asset is one of the largest and highest-grade accumulations of scandium ever discovered, with a total measured, indicated and inferred resource of 28.2Mt at 419ppm scandium for 11,819t scandium (with a 300ppm cut-off).

An ore reserve (proven plus probable) was estimated for the Sunrise project in June 2018, totalling 147.4Mt at 0.56% nickel, 0.09% cobalt and 53ppm scandium.

The company has also developed a proprietary technology to be used in metals recovery and industrial water treatment.

Applying this technology at Sunrise, Clean Teq aims to be a leading global supplier of nickel and cobalt sulphates to the lithium-ion battery industry and plans to produce low-cost scandium for use in next-generation lightweight aluminium alloys for key transportation markets.

A DFS completed in June 2018 demonstrated robust economics and a long mine life in excess of 40 years for the project.

In its annual report, released in August, the company said pre-development activities focused on project engineering and design. Work is also ongoing to secure financing and offtake agreements prior to a final investment decision.

Crossland Strategic Metals (ASX: CUX)

Another company directly exploring for REE is Crossland Strategic Metals, which is actively updating the Charley Creek scoping study.

The company completed an infill drilling program at the NT project in March to establish a JORC-compliant REE resource.

In its latest quarterly update, Crossland was awaiting assays from the program and noted it plans to carry out mineralogical tests.

Crossland’s strategy is to develop a REE supply outside of China, with a traceable origin and low-carbon footprint.

Rare earths Crossland is looking for include dysprosium, erbium, europium, gadolinium, holmium, lutetium, neodymium, praseodymium, samarium, terbium, thulium, ytterbium, yttrium, lanthanum, and cerium.

Greenland Minerals (ASX: GGG)

The Kvanefjeld project, near the southern tip of Greenland, is considered to be one of the most significant emerging REE operations globally, with a large projected output of neodymium, praseodymium, dysprosium and terbium.

The project sits on a resource in excess of 1Bt and an ore reserve estimate of 108Mt to sustain an initial 37‐year mine life.

In July, Greenland Minerals completed a $7 million capital raising which will see funds utilised to advance Kvanefjeld’s technical development and progress the mining licence application through public consultation.

The company is working closely with major shareholder and strategic partner Shenghe Resources Holding Co Ltd to develop Kvanefjeld as a cornerstone of future REE supply.

Greenpower Energy (ASX: GPP)

Greenpower Energy is exploring for multiple minerals across its portfolio including REE and lithium at its Morabisi project in South America’s Guyana.

In March, Greenpower revealed it had identified widespread REE targets at Morabisi, including a 1.2km long anomaly at the Banakuru prospect.

Ionic soil sampling revealed elevated cerium, lanthanum, yttrium and other REE.

At the Robello Creek prospect, Greenpower identified 7% TREO in a sample from the Robello Creek mining workings.

Hastings Technology Metals (ASX: HAS)

Hastings Technology Metals recently secured environmental approval for its advanced Yangibana REE project in WA’s Upper Gascoyne.

The project will include developing five open pits to produce a mixed REE carbonate, which will be exported for further refining into individual REOs.

Hastings owns 100% of the most significant deposits within the project and 70% in other deposits that will be developed at a later date.

Yangibana hosts reserves of 10.35Mt at 1.22% TREO, and a high 41% neodymium and praseodymium content.

The reserve supports an 11-year 1Mtpa operation that will produce 15,000tpa MREC and 8,500tpa TREO, including 3,400tpa neodymium and praseodymium.

Other REEs include lanthanum, cerium, samarium, europium, gadolinium, terbium, dysprosium and yttrium.

Hastings has scheduled production at Yangibana to begin in the second quarter of 2021.

In addition to Yangibana, Hastings owns the Brockman REE project near Halls Creek in WA. The company is advancing a mining lease application for the asset.

Iluka Resources (ASX: ILU)

Mineral sands producer Iluka Resources has commenced a pre-feasibility study at its Wimmera zircon project in western Victoria, which will also investigate the potential to extract REE as a secondary product.

The company is proposing a conventional open pit mine focusing on the WIM100 deposit with an estimated mine life of 20 years.

The REEs contained within the WIM100 deposit include neodymium, dysprosium, praseodymium and terbium.

During the June 2019 quarter, pilot plant test work of the REE refinery process successfully produced a mixture for customer assessment.

The pre-feasibility study is scheduled for completion by the end of the year.

Krakatoa Resources (ASX: KTA)

In June, Australian mineral explorer Krakatoa Resources announced it acquired a 100% interest in an exploration licence application over an area of WA’s Gascoyne region considered prospective for REE.

The company anticipates it will be granted the licence within five to nine months.

Monazite, which is an important ore for thorium, lanthanum and cerium, is one of three primary exploration targets of the project.

Previous exploration by companies including mining giant BHP (ASX: BHP) have returned samples containing up to 50% monazite.

Laboratory analysis of samples collected by All Star Minerals in 2006 also returned up to 1.4% zircon, 44% ilmenite, 9.9% titanium, 0.46% cerium, 0.25% lanthanum and 0.12% thorium.

Krakatoa has been compiling historical data and undertaking non-invasive groundwork including mapping and sampling while awaiting the grant of the licence.

Legacy Iron Ore (ASX: LCY)

Detailed review and interpretation of available geophysical, remote sensing and geochemical data sets for Legacy Iron Ore’s Taylor Lookout, Sophie Downs and Ruby Plains leases in WA’s east Kimberley region has identified numerous early stage targets for REE and other metals.

Legacy said it would conduct field checks and reconnaissance exploration across these targets in the September quarter.

Lindian Resources (ASX: LIN)

Africa-focused Lindian Resources is currently in a legal battle in Malawi over the Kangankunde REE project, in which it had entered into an option agreement to earn up to a 75% stake.

The company had entered into the exclusive deal with Michael Saner and Rift Valley Resource Developments (RVR) and in November 2018, Lindian obtained an injunction to prevent Mr Saner or RVR from dealing with the project or RVR shares.

According to the company, the project is considered one of the world’s largest REE assets outside of China.

Lindian managing director Shannon Green said in August that the company was in a “strong legal position” in regard to its rights to the Kangankunde rare earths project.

“The legal proceedings are relatively inexpensive whilst the potential upside to Lindian in the event of a successful case is extremely significant given the previously published geological parameters of the project,” Mr Green added.

The High Court of Malawi has set a hearing date in early November 2019.

Lynas Corporation (ASX: LYC)

Lynas Corporation is currently the most significant REE producer outside of China.

The company operates the Mt Weld mine, located 25km south of Laverton in WA, where it initially processes REO at its own concentration plant before shipping the materials to Malaysia to be further refined.

During 2018, Lynas announced a 70% increase in the Mt Weld mineral resource contained REO and a 60% lift in ore reserves, with the ore reserve supporting a more than 25-year life at Mt Weld at rates of around 7,000t of neodymium and praseodymium per annum.

Under the company’s NEXT project, which is aimed at enhancing the capacity at Mt Weld to meet current and future demand, a third tailings storage facility was commissioned and the mining and stockpiling of ore from its mining campaign three is currently underway.

The miner posted a 50% jump in full-year profit for the 2019 financial year of $80 million, as well as record annual rare earth oxide production of 19,737t.

In July 2019, Malaysia renewed Lynas’ operating licence for its processing plant for six months. However, it gave the company four years to relocate its cracking and leaching operations to WA, in order to remove low-level radioactivity from the material prior to shipping it the country.

Meanwhile, Australian heavyweight Wesfarmers (ASX: WES) has been trying to get in on some REE action through Lynas since March, lobbing a $1.5 million bid for the company, which was quickly turned down.

In August, Wesfarmers decided to scrap its offer entirely, partly due to Lynas’ renewed operating licence in Malaysia, which had been publicly opposed by environmental activists due to concerns about radioactive waste.

In early September, Lynas announced the signing of a memorandum of understanding with the City of Kalgoorlie-Boulder for the review and due diligence of potential sites for its new cracking and leaching plant. This is part of Lynas’ plan to move the operations from Malaysia to WA under its “Lynas 2025” growth plan.

Following preliminary site assessment studies, Kalgoorlie and the Mt Weld mine site have been shortlisted as the preferred locations for the facility.

Lynas said due diligence will continue before a final decision is made.

Minbos Resources (ASX: MNB)

Africa-focused explorer Minbos Resources has entered into an option with Tana Minerals Ltd to acquire 90% of the shares in MRE Mining, which owns two exploration permits in Madagascar making up the Ambato REE project.

Surface sampling at the project has returned high-grade REEs contained predominantly in bastnaesite, which is typically low in uranium and thorium and one of only three REE minerals to have been commercially beneficiated.

Rock chip sampling at the Ankazohambo prospect has recovered samples of up to 41% TREO.

In August, Minbos commenced a 118-hole auger drilling program at Ambato to target a 2km long zone of REE soil anomalies at the prospect, after recent soil sampling returning grades of up to 11.7% TREO with 22% of all samples greater than 1% TREO.

Mount Ridley Mines (ASX: MRD)

Aircore drilling at Mount Ridley Mines’ namesake project in WA’s Albany-Fraser Range last year returned anomalous concentrations of 500ppm cerium and 449ppm lanthanum.

The company is actively looking for nickel, copper and gold across the project.

Northern Cobalt (ASX: N27)

Although Northern Cobalt originally secured the Arunta lithium project in the NT for its lithium prospectivity, the company noted it is also prospective for REE including lanthanum, yttrium and cerium.

During 2018, Northern Cobalt carried out mapping, soil and rock chip sampling to work up drill targets.

In the June quarter, Northern Cobalt relinquished four of the project’s eight tenements while it focusses on its Snettisham magnetite, vanadium and gold asset in Alaska.

Northern Minerals (ASX: NTU)

Northern Minerals is currently producing heavy REE carbonate from its Browns Range pilot plant, located 160km southeast of Halls Creek in northern WA.

It is considered the first producer of dysprosium outside of China, launching the plant in July 2018 with a targeted production of 573,000kg of TREO in the first stage of a three-year pilot project.

A total of 45,660kg of REE carbonate was produced by the plant from the start of 2019 until the end of the June quarter.

Northern expects to ramp up to 3Mkg per annum by full-scale operation.

In mid-August, the company announced it had terminated an offtake agreement with China’s Lianyugang Zeyu New Materials Sales Co Ltd due to the latter being “in breach of the agreement and not rectifying the breach within the required timeframe”.

Less than a week later, Northern replaced this agreement with a new deal signed with Germany’s thyssenkrupp Materials Trading gmbh for 100% of the project’s offtake.

The new agreement enables thyssenkrupp to purchase all of the heavy rare earth carbonate from the pilot project, with flexibility for Northern to supply heavy REE as separated products in the future.

The new deal was welcomed by Australia’s government, with defence minister Linda Reynolds describing the switch to a non-Chinese offtake partner as a “very important development”.

Following the offtake announcements, the company revealed it has commenced a scoping study to investigate downstream processing of mixed REE into separated REOs.

It also recently completed a diamond drilling campaign at the Dazzler and Iceman prospects.

In early September, the company reported final assays from a recent infill drilling campaign, announcing the Dazzler prospect returned the “best ever” drill result from the project to-date, with some holes being up to “10 times the average at Browns Range”.

The most notable high-grade intersection was 52m at 4.15% TREO from a depth of 20m, including 18m at 11.48% TREO from 22m.

A week later, Northern announced the recommencement of exploration drilling at Browns Range. This latest program will comprise 3,000m of reverse circulation infill and exploration drilling at the Dazzler and Iceman prospects, to be immediately followed by an additional 1,500m exploration program on regional targets.

Northern said assays are expected to be received from October.

Nova Minerals (ASX: NVA)

Gold and lithium focused Nova Minerals has engaged KPG Capital & Co to advise on selling or executing a joint venture for its Windy Fork REE project.

The asset is part of Nova’s Alaskan joint venture portfolio where Nova is earning up to 85% of Windy Fork and other projects.

No recent exploration has been carried out at Windy Fork, while Nova focuses on other minerals including gold.

Orion Metals (ASX: ORM)

Orion Metals is exploring for REEs at its Mt Surprise project in Queensland’s Mareeba district and at the Mt Ramsay project within the Rockhampton mining district, also in Queensland.

In its 2018-2019 annual report, Orion stated budget restrictions had prevented on field exploration at both projects during the period.

Oro Verde (ASX: OVL)

In July, Perth-based explorer Oro Verde announced it had reached agreement to acquire up to a 60% stake in Rwenzori Metals, which 100% owns and operates the Makuutu rare earth elements project in Uganda, east Africa.

The acquisition is the company’s first step into rare earths, having previously focused on gold exploration in the Central American nation of Nicaragua.

According to Oro, the Makuutu project comprises three licences covering about 132sq km and bears “appreciable quantities” of critical REEs, particularly neodymium and praseodymium.

The project area was previously explored and tested by Rwenzori, with extensive drilling confirming the widespread presence of REO clays through an area with a strike length of 15km x 1.5km.

In addition, ground surveys and preliminary metallurgical testing of an 8.5t sample have been undertaken and a non-JORC compliant mineral resource has been estimated.

In September, Oro released a significant exploration target for Makuutu of 270-530 million tonnes grading 0.04-0.1% TREO.

It also announced it had completed the acquisition of an initial 20% interest in Rwenzori.

Oro is expected to increase its interest in Makuutu to 31% by contributing US$650,000 to initiate an aggressive exploration campaign.

In mid-September, the company said diamond drilling was due to commence at the project “shortly” with the primary objectives of collecting samples for metallurgical test work and to enhance geological data.

Peak Resources (ASX: PEK)

Aspiring to be a low-cost producer of neodymium and praseodymium, Peak Resources has completed a BFS at its Ngualla REE project in Tanzania and is currently at funding stage.

The project has an estimated ore reserve of 18.5Mt at 4.8% TREO for 887,000t of contained REO, which Peak believes is sufficient to support a 26-year mine life.

The company is planning to export about 32,700tpa of REE concentrate grading 45% REO from Tanzania to its Teesside refinery in the UK, which would make it one of the few producers not reliant on China as part of its production process.

In late July, the company entered into a conditional agreement to increase its 75% stake in Ngualla to 100%.

The deal involved reaching a binding heads of agreement with Appian Pinnacle HoldCo to roll up its ownership interest in Mauritian-registered company Peak African Minerals (PAM) into Peak.

PAM is the parent company of Tanzanian-registered PR NG Minerals, which holds project’s exploration licence and special mining licence application.

Platina Resources (ASX: PGM)

Platina Resources’ namesake scandium project (formerly known as Owendale) in central NSW is one of the world’s largest and highest-grade scandium deposits and has potential to become Australia’s first scandium mine with cobalt, nickel and platinum credits.

A DFS was completed in late 2018 demonstrating the technical and economic viability of constructing a simple, low-strip ratio, open-cut mining operation and processing plant to produce high-purity (99.99%) scandium oxide.

Platina is now focused on completing the environmental impact assessment, mining licence and development applications (for the mine and process plant) and securing offtake and project financing.

The company is actively working on a scandium offtake marketing program targeting potential customers in the US, Europe, Asia and Australia.

In September, Platina managing director Corey Nolan said in an interview that the company planned to undertake further metallurgical testing aimed at developing the project at a smaller scale and lower capital cost.

“Today… the scandium market is small with most of the production used for the solid oxide fuel cell market. The great growth market opportunity for scandium is as an alloy with aluminium targeting aerospace, marine, military and automobile industries, but this market is still immature,” he said.

Pensana Metals (ASX: PM8)

Pensana Metals is developing its Longonjo neodymium-praseodymium project in Angola, Africa.

According to the company, it ranks as one of the world’s largest and highest grade neodymium-praseodymium deposits, with high-grade mineralisation extending over 1.5km and an inferred mineral resource estimate of 240Mt at 1.6% REO including 0.35% neodymium-praseodymium, for 3.85Mt of REO including 840,000t of neodymium-praseodymium.

In its June quarterly report, Pensana said a PFS on the project was scheduled for completion in September.

The company’s strategy is focused on fast-tracking Longonjo into production as quickly as possible, based on the high-grade, near-surface weathered zone mineralisation.

Development is proposed to take advantage of nearby infrastructure including the adjacent Chinese-built $1.8 billion Benguela rail line, which links the project with the Atlantic port of Lobito and onto customers in China.

In July, Pensana reported “spectacular” results from an infill diamond drilling program in the area of mineralisation that is the focus of the PFS.

High-grade intersections from surface included: 12m at 11.6% REO including 1.82% neodymium-praseodymium oxide from surface; 10m at 9.13% REO including 1.53% neodymium-praseodymium oxide from surface; and 22m at 5.4% REO including 1.09% neodymium-praseodymium oxide from surface.

Work is also in progress to update Longonjo’s mineral resource estimate, which will include an indicated category mineralisation to support the PFS.

In early September, Pensana updated the market with an anticipated release date for the PFS of mid-to-late October.

Prospect Resources (ASX: PSC)

In February 2018, Prospect Resources announced plans to commence exploration at its Chishanya carbonatite project in the southeast of Zimbabwe with a focus on determining the REE potential.

However, no further activity at this project has been reported since April 2018.

Petratherm (ASX: PTR)

During the July quarter, Petratherm increased its landholding over the Mabel Creek Inlier in South Australia, which is prospective for Olympic Dam-style copper and gold and related REE mineralisation.

The acquisition expanded the company’s total holding over the Mabel Creek Ridge to 2,852sq km.

Past drilling of magnetic targets in the area has located rocks with possible carbonatite affinities.

Carbonatites are a distinctive class of igneous rock which are the source of the most of the world’s supply of high value light and heavy REE.

As the newly-acquired areas had no previous history of detailed ground exploration, Petratherm last month completed an infill gravity survey to define initial drill targets.

Silver City Minerals (ASX: SCI)

Base and precious metals explorer Silver City Minerals has a 75% operating stake in a joint venture with CBH Resources at the Copper Blow copper-gold project, south of Broken Hill in NSW.

While exploration is focused on copper, gold and more recently cobalt, some rare earth elements have been identified at the project.

In particular, a 1.6km geochemical anomaly has been recognised with the soils characterised by elevated copper, gold, molybdenum, nickel and copper, plus “enriched” cerium, lanthanum and yttrium.

Soil geochemistry has also indicated anomalous cerium and lanthanum at a 1.1km northern zone and elevated cerium and lanthanum in a southern induced polarisation target.

Silver City has drilled about 8,500m at the Copper Blow prospect to-date, however, no exploration activity was reported during the June 2019 quarter.

Stavely Minerals (ASX: SVY)

Stavely Minerals’ Ravenswood exploration project in north Queensland is considered prospective for carbonatite-related rare earth mineralisation, in addition to coppe, molybdenum and gold.

Stream sediment samples taken in the tributaries of the Barrabas and Elphinstone Creeks within the project returned highly anomalous REE results. Assay highlights included a sample returning 0.19 grams per tonne gold, 0.91% cerium, 0.43% lanthanum, 0.31% neodymium, 926ppm praseodymium and 514ppm samarium.

During the June 2019 quarter, diamond drilling was conducted at the Connolly North gold prospect but no significant intercepts were returned. No further mention of REEs have been reported.

Tempus Resources (ASX: TMR)

Tempus Resources has a 90% share of the Claypan Dam project in South Australia’s Gawler Craton, which has the potential to host REE and other minerals.

In July, the company said it was progressing with the planning of field programs and reviews of existing data for initial on-ground exploration.

Geological consultants had been contracted to carry out the program.

Todd River Resources (ASX: TRT)

Todd River Resources holds 100% interest in the Sandover project in the NT’s Irindina province, which is believed to be prospective for REE and other metals.

No exploration activity had been logged at Sandover in the company’s July quarterly report.

It also wholly owns the Soldiers Creek project, where it conducted rock chip sampling in late 2017 focusing on three historical tin fields: Muldiva, Buldiva and Collia.

Most of the Collia pan concentrate samples returned highly anomalous REE values, with up to 1.22% cerium, 5,390ppm yttrium, 6,070ppm lanthanum and 4,870ppm neodymium.

A 2018 work program was intended for the project. However, no further activity has been reported.

Victory Mines (ASX: VIC)

Explorer Victory Mines holds 100% interests in the Husky and Malamute tenements in NSW.

In April, the company finalised planning for a maiden drilling program at Husky and Malamute, designed to confirm the tenements’ prospectivity for laterite-hosted cobalt, scandium, nickel and platinum group elements mineralisation in the mafic/ultramafic source rock.

The initial campaign comprised 100 holes for 5,000m at a budgeted cost of $250,000. It was expected to commence in late May, subject to raising sufficient capital via a rights issue.

However, the company closed its rights issue offer in mid-May, only raising $211,949 of its intended $1.2 million.

In August, Victory launched another rights issue to raise $1.48 million.

It also announced that due to cobalt and scandium demand being “relatively weak globally”, the drilling program would be sharply scaled back.

The revised campaign has now been reduced by 60% to 40 holes (2,000m) and at a lower projected cost of between $100,000-120,000.

Victory said it anticipates the drilling program can be conducted during the September quarter, but again, this is subject to raising sufficient capital.

SEE ALSO:

– Gold stocks on the ASX

– Silver stocks on the ASX

– Lithium stocks on the ASX

– Cobalt stocks on the ASX

– Graphite stocks on the ASX

– Zinc stocks on the ASX

– Nickel stocks on the ASX

– Vanadium stocks on the ASX

– Uranium stocks on the ASX

– High Purity Alumina stocks on the ASX

– Tin stocks on the ASX

– Tungsten stocks on the ASX

– Hydrogen stocks on the ASX

– Oil and gas stocks on the ASX

– Cannabis stocks on the ASX