Hydrogen stocks on the ASX: The Ultimate Guide

Australia has the resources, economic capacity and trade links to become a regional hydrogen superpower but it faces higher production costs than other energy sources.

The list of ASX hydrogen stocks is expanding as companies get on board due to the increasing conviction the fuel is vital to achieving a clean and secure energy future.

Hydrogen’s global outlook continues to grow in scale as countries around the world strive to achieve net zero carbon emissions or substantial reductions in shortened timelines.

The number of countries with policies that directly support investment in hydrogen technologies is rising, along with the number of sectors they target.

Australia, with its plentiful resources, economic capacity and established trade connections, is in an ideal position to become a regional hydrogen superpower, provided it can resolve the commodity’s high production costs compared to other energy sources.

What is hydrogen?

Hydrogen is the most abundant chemical in the universe and can be produced as a gas, liquid or made part of other materials.

It is present in almost all molecules in living things and can be generated from a variety of resources, such as natural gas, nuclear power, biogas and renewable power sources including solar and wind.

When produced using renewable sources or processes, hydrogen can become a way of storing renewable energy for use at a later time as required.

Hydrogen is the most abundant element in the universe, accounting for around 70% of all matter.

In gas form, hydrogen can be delivered through existing natural gas pipelines. When converted to a liquid or other material, it can be transported on trucks or ships, making it a tradable commodity to export overseas.

In Australia, hydrogen is mainly used as a raw material for industrial processes.

According to the Australian Renewable Energy Agency (ARENA), hydrogen can help to reduce carbon emissions in those high-temperature industries, as well as some transport sectors.

The growing interest in the use of hydrogen for clean energy systems comes down to two main attributes: it can be produced without direct emissions of air pollutants or greenhouse gases; and it can be made from a range of different low-carbon energy sources, thus contributing to a resilient, sustainable energy future.

It is also hailed for its use in a wide range of new applications as an alternative to current fuels and imports or to complement the greater use of electricity.

The hydrogen colour spectrum

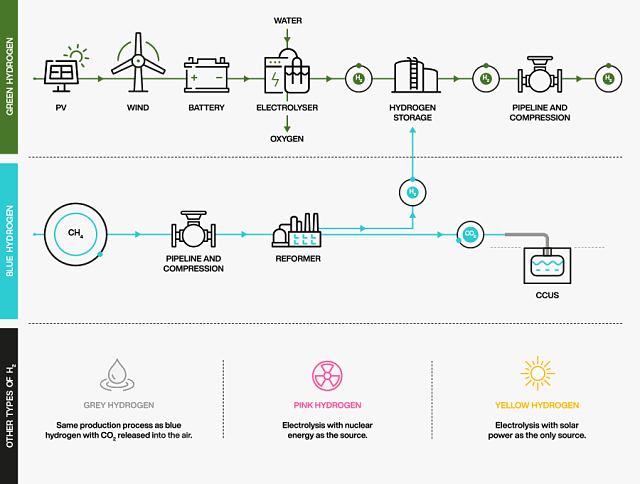

While hydrogen itself is a colourless gas, a rainbow of colours represents the many ways it is produced and not all types are as ‘clean’ as you may presume.

‘Green’ hydrogen is the type receiving the most attention of recent times (and a main focus of this guide) as it refers to hydrogen produced with no harmful greenhouse gas emissions.

It is made using clean electricity from surplus renewable energy sources, such as solar and wind power, to electrolyse water. Without emitting any carbon dioxide in the process, electrolysers use an electrochemical reaction to split water into its two components of hydrogen and oxygen.

Green hydrogen currently only makes up a small percentage of global hydrogen production (about 0.1% according to the International Energy Agency) because production is expensive. However, there is mounting interest in green hydrogen technology and its proportion in the global energy mix is expected to grow as governments execute their various carbon reduction schemes.

‘Blue’ hydrogen is produced by splitting natural gas into hydrogen and carbon dioxide using a process called ‘steam reforming’ or ‘auto thermal reforming’. The carbon dioxide produced as a by-product is then captured and stored to mitigate environmental impacts, known as carbon capture and storage or sequestration (CCS).

The various types of hydrogen.

Other colours in the spectrum include the most common ‘grey’ hydrogen, which is produced from natural gas or methane using steam reformation but without capturing emissions in the process.

Natural gas is currently the primary source of hydrogen production and accounts for around 70 million tonnes per year or 75% of global dedicated hydrogen production.

‘Pink’ hydrogen (also sometimes classified as ‘red’ or ‘purple’) is generated through electrolysis powered by nuclear energy, and ‘yellow’ through electrolysis using solar.

New entries in the colour charts are ‘white’ hydrogen, a naturally-occurring geological hydrogen found in underground deposits or created through fracking, and ‘turquoise’ which denotes the process of methane pyrolysis to produce hydrogen and solid carbon.

‘Black’ and ‘brown’ hydrogen signify the use of black or brown coal (lignite) in the hydrogen-making process, or hydrogen made from fossil fuels through the process of ‘gasification’. These types are the total opposite to green hydrogen and are the most environmentally damaging. For the purposes of this guide, most information does not relate to this hydrogen category.

History of hydrogen

Hydrogen was first recognised as an element more than 250 years ago by the English physicist Henry Cavendish. Some of its initial uses included an internal combustion engine powered by hydrogen and oxygen, the hydrogen gas blowpipe, hydrogen gas lamps and limelight (stage lighting).

The first hydrogen-filled balloon was invented in the late 1700s and in 1852, Henri Giffard invented the first hydrogen-lifted airship. In the 1900s, regular scheduled flights began on rigid airships lifted by hydrogen known as ‘zeppelins’, which were also used as observation platforms and bombers during World War I.

After the German zeppelin Hindenburg famously exploded mid-air in New Jersey in 1937, killing 36 people, hydrogen’s reputation as a lifting gas was ruined despite later investigations blaming the ignition of the aluminised coating. However, hydrogen is still often used instead of expensive helium for weather balloons.

Liquid hydrogen fuel, together with oxygen oxidiser, was used to power the main engine of NASA’s Space Shuttle from 1981 to 2011. The components were contained within an external tank that was jettisoned about 10 seconds after the main engine cut off and re-entered the Earth’s atmosphere, designed to break up before impact in the ocean.

Current end uses

Nowadays, hydrogen is mainly used as a raw material for industrial processes. It is used in oil refining (removing sulphur from fuels), metal treatment, fertiliser (ammonia) production and food processing (to hydrogenate oils from fats to make products like margarine, for example).

It can replace or supplement natural gas in heating and cooking.

It also has the potential for use in heavy haulage and other large transport solutions with hydrogen-powered fuel cells able to power large vehicles including buses and trucks, maritime vessels and aviation.

Hydrogen fuel cells produce electricity and can power devices as small as laptops and mobile phones, or as large as backup or emergency power in buildings and for military applications.

There is also growing interest in the development of hydrogen-fuelled cars, which usually have an electric motor powered by a hydrogen fuel cell and are believed to be two to three times more efficient than an internal combustion engine running on petrol.

Global demand

According to the International Energy Agency (IEA) 2019 report titled The Future of Hydrogen, demand for hydrogen has grown more than threefold since 1975, but it is almost entirely supplied from fossil fuels with 6% of global natural gas and 2% of global coal going to hydrogen production.

This means hydrogen production is still responsible for around 830Mt of carbon dioxide each year – the equivalent of the United Kingdom and Indonesia’s carbon emissions combined.

Total global hydrogen demand is currently around 330Mt of oil equivalent per year, which is larger than the primary energy supply of Germany.

According to a March 2021 report by Grand View Research, the global hydrogen generation market size was worth US$120.77 billion (A$162 billion) in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 5.7% from 2021 to 2028.

“An exponential increase in the demand for clean and green fuel with the rising pollution levels, coupled with the growing government regulations to control and curb the sulphur content in fuels, is expected to drive the market for hydrogen generation,” the report reads.

Grand View has pointed to its increasing application in various industries as the major driving force for the hydrogen industry globally.

Also fuelling demand for green hydrogen is the growing focus on environmental, social and governance (ESG) principles by companies and investors alike.

Governments around the world are pushing to achieve ‘net zero’ emissions, meaning as much greenhouse gas is taken out of the atmosphere as is put out.

As society continues to place higher value in social responsibility and sustainability, green hydrogen shows promise as a future fuel source and its use can improve companies’ ESG rating.

According to Deloitte energy transition and decarbonisation partner John O’Brien, hydrogen could potentially be “the only way” some niches in Western Australia’s mining sector could decarbonise.

“If all the red dirt that happens to exist in Western Australia is going to continue having value, hydrogen has to work,” he said at a mining industry panel earlier this year, referring particularly to iron ore, steel, ammonia, and chemicals production.

Speaking at the same panel discussion, Hydrogen Energy Pty Ltd director Richard Beazley said hydrogen would be the way to “get away from fossil fuels … unless you can get renewables to work 90% of the day on an average day”.

Global production

According to Statistica, the global production of hydrogen reached 60Mt and is forecast to increase to about 300Mt by 2030.

The European Union (EU) leads the world in clean energy policy. In its 2020 hydrogen strategy, the European Commission set out plans to drive the region into a burgeoning hydrogen hub.

“Hydrogen is essential to support the EU’s commitment to reach carbon neutrality by 2050 and for the global effort to implement the Paris Agreement while working towards zero pollution,” the commission stated in the report.

By 2030, the EU intends to have 40 gigawatts of its own green hydrogen production capacity and will potentially import another 40GW to meet its 2050 net zero deadline.

Hydrogen will play a significant role in the future energy mix.

It also predicts that hydrogen’s share of the EU’s energy mix will grow from 2% to 13-14% by 2050.

However, Asia Pacific is the fastest growing region and accounted for the largest revenue share of the global hydrogen generation market at over 35% in 2020. According to Grand View Research, this trend is expected to continue until 2028 with key countries including China, Japan, South Korea, India and Australia driving this growth.

In terms of clean energy policy, China also appears to be only a few short years behind the EU and its closest competitor in the establishment of a hydrogen economy.

According to a report by Australian Energy Market Commission (AEMC) senior economist Russell Pendlebury, ammonia is the biggest driver of hydrogen demand in Australia, hence many projects entering the feasibility stages of development are planned as integrated hydrogen/ammonia projects.

Although, Australia does have the potential to become a leading global supplier thanks to its large expanses of prospective land, its economic capacity and its existing trade relationships.

Hydrogen production costs

The cost to produce hydrogen is driven by several technical and economic factors including fuel costs – which can make up about 45-75% of production costs – as well as gas prices and capital expenditure on infrastructure such as electrolysers and storage capability.

Countries that have to import gas such as Japan, Korea, China and India, have to contend with higher gas prices which gives rise to higher hydrogen production costs in these regions compared to regions like North America, Russia and the Middle East.

In Australia, hydrogen production costs vary across different technologies, but data has indicated it costs about A$6-9 per kilogram to produce green (renewable) hydrogen compared to $3.5/kg for blue (CCS) and $2/kg for brown/grey hydrogen (fossil fuels).

In late 2020, Energy and Emissions Reduction minister Angus Taylor released the Australian Government’s first Low Emissions Technology Statement as part of the nation’s Technology Investment Roadmap. The statement included a priority to adopt cost-effective technologies to achieve renewable hydrogen production for less than $2/kg.

ARENA chief executive officer Darren Miller said to achieve this price target, electrolyser costs will need to fall from between $2-3 million per megawatt to $500,000/MW and the cost of electricity from solar and wind will need to “nearly halve from today’s levels”.

In May 2021, the Clean Energy Finance Corporation estimated green hydrogen can be produced for under $3.90/kg at the “farm gate” but adding delivery costs for moving electrons and about 20km of pipeline, the delivered cost blows out to $5.82/kg.

Australian government-funded initiatives

In the last couple of years, Australian federal and state governments have announced several strategies to develop a domestic hydrogen production industry that incorporates the vision of Australia becoming a major export player.

The Federal Government’s National Hydrogen Strategy sets a goal for commercial renewable hydrogen exports by 2030.

Both governments and industry have since funded near-term pilot projects, as well as medium and long-term projects spanning the nation.

In April 2021, Prime Minister Scott Morrison pledged $275.5 million to accelerate the development of four clean hydrogen hubs in the country over the next five years, plus $263.7 million for CCS projects over the next 10 years.

The funding builds on investments promised in 2020 of $70.2 million over five years for one hydrogen hub and $50 million for CCS.

Meanwhile, ARENA has invested $55 million in 28 hydrogen projects, from early-stage research and development to early-stage trials and deployments.

The Australian Government also committed $1.62 billion to continue ARENA’s work over the next 12 years and announced expanded responsibilities.

In a landmark deal announced in early October, the Queensland Government has partnered with mining giant Fortescue Metals Group (ASX: FMG) to build the “world’s largest” green hydrogen equipment manufacturing facility in Gladstone. The $1 billion-plus project is designed in six stages with construction of an initial 2GW per annum electrolyser factory expected to begin in February 2022.

The state government has also established the Hydrogen Industry Development Fund which has provided almost $13 million under a first round of funding to build four hydrogen plants. It has committed a further $10 million to industry development activities and a second round of grant applications closed this June.

A few days after announcing the Gladstone facility, Fortescue boss Andrew Forrest unveiled a hydrogen strategy for New South Wales alongside state premier Dominic Perrottet that will provide $3 billion in incentives (including tax exemptions) for green hydrogen production and includes plans for a “hydrogen refuelling highway” between Melbourne and Brisbane.

The plan is expected to help the state halve its emissions by 2030 and get to net zero by 2050, as well as create new opportunities for its heavy industry and “an economic bonanza of investment and jobs”, according to treasurer and energy minister Matt Kean.

Over in Western Australia, the state government declared it will inject $61.5 million into the state’s renewable hydrogen industry with a view to transform into a key exporter.

Premier Mark McGowan announced the initiative in the lead-up to the state budget, describing WA as “ideally placed” to supply countries such as Korea, Japan and China with this carbon-free fuel source.

The funding will comprise a $50 million pool to stimulate demand in transport and industrial settings, and $11.5 million for the development of a renewable energy hub on a 64-square-kilometre site at Oakajee, north of Geraldton.

A further $1 million in grants will also be deposited into the Renewable Hydrogen Fund, designed to support capital works projects and feasibility studies across the state. Since 2019, the fund has made more than $10 million available for these industry-led studies.

On a national level, Australia has been working to reach agreements with other countries in a bid to become a major exporter. Some of these partnerships include: investing in new hydrogen initiatives in Germany; working with Singapore to advance low emissions technologies including in maritime and port operations; partnering with Japan to export clean liquefied hydrogen as part of the world-first Hydrogen Energy Supply Chain (HESC) pilot project; collaborating with the United Kingdom on low emissions technology research and development; and promoting hydrogen safety best practice as a member of the US Centre for Hydrogen Safety.

Hydrogen stocks on the ASX

There are some pure play green hydrogen stocks on the ASX while others are generally oil and gas players looking to capitalise on the growing sector using their existing projects to explore carbon capture and storage (CCS).

ADX Energy (ASX: ADX)

Oil and gas producer ADX Energy operates energy projects in Austria, Romania and Italy. In January it announced it will investigate the use of its depleted oilfields in Austria for green hydrogen production and storage.

Known as the Vienna Basin H2 project, ADX plans to repurpose its Gaiselberg and Zistersdorf oilfields and commence a pilot operation utilising a 1MW electrolyser to produce, store and on-sell green hydrogen in the local gas network.

The company hopes to benefit from the rapidly increasing and large energy storage required by intermittent green solar and wind energy, which is forecast to increase by a factor of six in Austria alone in the next 10 years.

In October, ADX announced it had signed a memorandum of agreement with Windkraft Simonsfeld for the supply of green electricity (wind and solar) and to jointly develop the H2 project.

AGL Energy (ASX: AGL)

Australian energy giant AGL Energy is part of a consortium of industry partners in Australia and Japan that formed the Hydrogen Energy Supply Chain (HESC) project, which aims to produce and ship clean liquid hydrogen from the Latrobe Valley in Victoria to Japan. The pilot project aims to demonstrate an end-to-end supply chain between the countries.

Together with AGL, the consortium is comprised of Kawasaki Heavy Industries, Electric Power Development Co (J-POWER), Iwatani Corporation, Marubeni Corporation and Sumitomo Corporation. The project is supported by the Victorian, Australian and Japanese governments, and oil and gas supermajor Royal Dutch Shell is also involved in the Japanese portion.

The decision to progress to a commercialisation phase, which will produce clean hydrogen from coal with CCS, will be made after the pilot project is completed.

Environmental Clean Technologies (ASX: ECT)

Environmental Clean Technologies is focused on advancing green technologies for the energy and resource sectors. Its two hydrogen-related technologies currently under development are HydroMOR and COHgen.

HydroMOR is a low-cost, low emission, lignite-based, hydrogen-driven technology that enables low-value feedstocks to produce primary iron.

COHgen is a process that delivers a lower cost, lower emission method for hydrogen production from lignite (brown coal). The technology is advancing through fundamental lab development intended to form the basis for a patent application ahead of scale-up and commercialisation.

The company’s lignite drying process Coldry is also considered suitable to improve outcomes for downstream applications including hydrogen production and fertiliser manufacture.

In August, Environmental Clean Technologies announced it had become an advisory committee member of the Gippsland Region Hydrogen Cluster, which was formed to build a competitive clean hydrogen industry in the southeastern region of Victoria.

Then in October, chairman Jason Marinko said in a corporate update that technologies like COHgen and HydroMOR place the company in a position to take advantage of the emerging hydrogen industry.

“Our strategic review aims to leverage off the development work undertaken to date and target commercialisation opportunities for our unique technology in a market with increasing government and industry focus on net zero emissions,” he said.

Eden Innovations (ASX: EDE)

Australian clean technology developer Eden Innovations owns the technology to produce Hythane, which is a blend of hydrogen and natural gas (methane) that it claims is a “cost-effective gaseous fuel option that yields significant emission reductions”.

In an October market update, the company said it has been receiving ongoing enquiries from companies in India and New Zealand about accessing the technologies related to Hythane’s production, storage and use. Eden believes this could open significant market opportunities for the Hythane technologies that will also assist in the reduction of greenhouse gas emissions in these countries.

Eden also revealed it has been approached by several companies in regard to its patented methane pyrolysis technology, which produces carbon nanotube, carbon nanofibre, and hydrogen from methane without producing carbon dioxide.

The companies have proposed only using renewable power to drive the production process, generating only hydrogen and carbon nanotubes from the natural gas feedstock – this is known as ‘blue hydrogen’.

Eden did not disclose any specific deals but noted the interest and level of enquiries has stepped up significantly over the last 12 months. It said some have already resulted in sales of Eden products, or ongoing trials and/or discussions which have the potential to develop into future market opportunities.

Fortescue Metals Group (ASX: FMG)

Multibillion-dollar mining giant Fortescue Metals Group is behind an initiative to build the world’s largest hydrogen equipment manufacturing hub at Gladstone in Queensland.

The major producer’s wholly-owned green energy subsidiary Fortescue Future Industries (FFI) has partnered with the Queensland government to construct the electrolyser, renewable industry and equipment manufacturing facility, which is expected to be the first in a series of regional Australian centres.

It has been designed as a six-stage project with stage one expected to establish Australia’s first multi-gigawatt-scale electrolyser factory with an initial capacity of 2GW per annum – more than double current production globally.

Along with electrolysers, the facility is planned to manufacture of wind turbines, solar photovoltaic cells, long-range electric cabling, electrification systems and associated infrastructure.

Following final approvals, construction is planned for February 2022 with first production of electrolysers anticipated in early 2023.

Fortescue has projected the investment could be worth up to US$650 million (A$888 million), subject to customer demand, with the initial electrolyser investment expected to be US$83 million (A$114 million).

Mining billionaire and company founder Andrew ‘Twiggy’ Forrest said the initiative is a critical step in Fortescue’s transition from a pure play iron ore producer to a “significant and successful integrated renewables and green resources powerhouse”.

FFI also recently reached an agreement with Incitec Pivot to study the feasibility of constructing a green hydrogen and ammonia production and export facility on Gibson Island, Queensland.

Global Energy Ventures (ASX: GEV)

Perth-based Global Energy Ventures has unveiled plans to develop a 2.8GW green hydrogen export project on Tiwi Islands, NT to produce and export up to 100,000tpa green hydrogen into the Asia Pacific region.

The company is proposing a staged construction with an initial development phase of around 0.5GW and building up to 2.8GW as the regional hydrogen market grows.

The project will incorporate a fleet of its 430t compressed hydrogen ships, which received approval in principle (AIP) from the American Bureau of Shipping in early October.

These ships are a pilot-scale version of the company’s 2,000t ship, which has been designed to transport 2,000t of compressed hydrogen across distances from 2,000-4,500 nautical miles. The full-scale design achieved AIP status earlier this year.

Global Energy Ventures is anticipating receiving full class approvals for the 430t pilot ship in late 2022 with construction expected to commence early in 2023. It aims to start first operations of its 2,000t vessel by 2030.

Financial close for the initial phase of the Tiwi hydrogen project is targeted for 2023 with hydrogen export slated to begin in 2026.

In addition, the company has a memorandum of understanding with the partners of the HyEnergy project, fellow ASX company Province Resources and French independent power producer Total Eren, to undertake a feasibility study on the export of green hydrogen.

The study commenced in October with completion anticipated in the June quarter of 2022. Its scope includes transport from an onshore hydrogen gas production facility in Western Australia’s Gascoyne region to an offshore ship-loading buoy and then on to nominated markets in the Asia Pacific region.

The study, which is due for completion in the first half of 2022, is being supported by a $300,000 grant approved under the WA government’s Renewable Hydrogen Fund, designed to encourage hydrogen-related capital works projects and feasibility studies across the state.

Hazer Group (ASX: HZR)

Technology pioneer Hazer Group is undertaking the commercialisation of the Hazer Process, a low-emission process that converts natural gas into ‘clean and economically competitive’ hydrogen and high-quality graphite, using iron ore as a catalyst.

The process is said to produce at least 50% less emissions than fossil fuel-based hydrogen production such as steam methane reforming.

Hazer has a pilot plant in Kwinana, WA and has begun work towards the construction of a commercial demonstration plant at Water Corporation’s Woodman Point water recovery facility in the south of Perth.

In September, Hazer reported the continued progress of engineering, procurement, fabrication and construction activities at the site, anticipating a commissioning date in the first quarter of 2022.

The company also recently raised $7 million via a share placement and announced an additional $7 million share purchase plan. Funds will be used to support and expand Hazer’s business development activities, enhance ongoing research and development programs and for general working capital.

Hexagon Energy Materials (ASX: HXG)

Hexagon Energy Materials’ Perdika blue hydrogen project, located 200km southeast of Alice Springs in the Northern Territory, aims to use a conventional surface gasification plant to produce blue hydrogen for export and domestic markets.

The project is currently at pre-feasibility study stage with delivery anticipated in December 2021. A drilling program aimed at establishing a maiden JORC compliant mineral resource was also expected to commence late in the 2021 third quarter.

Hexagon believes its blue hydrogen project could be a solution to support the conversion to clean energy economics over the coming decades “using established technology at costs that are economically viable” while green hydrogen remains a “more distant” goal.

Incitec Pivot (ASX: IPL)

In October, industrial chemicals manufacturer Incitec Pivot was announced by the Queensland Government as having reached an agreement with Fortescue to study the feasibility of producing and exporting green hydrogen and ammonia at Gibson Island.

The study will investigate building a new water electrolysis facility on the existing brownfield site to produce about 50,000t of renewable hydrogen per year, which would then be converted into green ammonia for Australian and export markets. The Gibson Island plant currently produces more than 300,000tpa of ammonia.

In 2020, Incitec completed a $2.7 million solar hydrogen feasibility study for renewable ammonia production at Moranbah, Queensland.

The maximum purchase price of renewable hydrogen was calculated by the company’s wholly-owned subsidiary Dyno Nobel Moranbah based on next-best alternative comparison with imported ammonia and the study found that investment in additional ammonia manufacturing capacity could be justified if the cost of hydrogen supplied to Dyno was below $2/kg.

In Incitec’s half year report released in May 2021, the company said solar hydrogen would not be commercially viable at industrial scale until around 2040 but it endeavoured to continue identifying new technologies as part of Incitec’s aspiration to achieve net zero emissions “as soon as practicable”.

Lion Energy (ASX: LIO)

Conventional oil and gas player Lion Energy announced a $2.8 million capital raising to pursue a green hydrogen strategy in April.

The company currently holds oil and gas production sharing contracts in Indonesia including Seram, containing the 1.5 trillion cubic feet Lofin gas and condensate discovery.

The strategy includes the establishment of a hydrogen advisory board, the undertaking of a feasibility study as well as potential joint ventures to build large-scale solar/wind farms and relevant energy storage facilities to produce green hydrogen at the lowest cost for domestic and export markets.

In October, Lion said it is close to completing the second stage of work outlined in its hydrogen strategy and is focusing its initial efforts on the production and delivery of green hydrogen for the domestic heavy mobility market.

The company appointed Australian hydrogen engineering firm GPA to carry out a high-level techno-commercial assessment of a 2,000kg per day generic hydrogen production plant in Australia and now the modular hydrogen compression, storage and dispenser offers received from various vendors are under review.

Lion executive chairman Tom Soulsby said the heavy mobility sector is “ripe for adopting hydrogen as a solution for zero emission targets”.

“For the bus industry in particular, some states have ambitious targets, with a requirement for all new public transport bus purchases to be zero emission by 2025.”

“Hydrogen buses are already commercially available, but the refuelling infrastructure is still missing. Lion is focussed on the potential for filling the gap, initially in Queensland and eventually across Australia,” Mr Soulsby said.

“Our production concepts and market approaches are well advanced. We have already identified a handful of potential locations, and we are focussing on the selection of the first site,” he added.

Montem Resources (ASX: MR1)

Canada-focused Montem Resources is the most recent ASX company to delve into the hydrogen market. It had been working on restarting its Tent Mountain hard coking coal mine in Alberta, targeting first coal shipments in 2023, and had already received the final reference terms for its environment impact assessment (EIA) submission as well as secured rail and port access.

But in late June, it received notification from the Canadian Government that it must undergo a federal impact assessment, which would likely delay permitting for the project. As a result, Montem announced new plans in October to develop Tent Mountain as a renewable energy complex to potentially become Canada’s first large-scale green hydrogen producer.

Independent expert studies have shown the project could produce up to 13,000tpa of green hydrogen through combined pumped hydro energy storage (PHES) and renewable offsite wind power.

The company has applied to Canada’s Clean Fuels Program for a grant to assist with funding the project through a feasibility study, which is expected to take 12-18 months.

Montem managing director Peter Doyle said the company started looking at an end of mine life pump hydro project for Tent Mountain in 2019, undertaking a site assessment and economic analysis, which returned “promising” results.

“With the current uncertainty surrounding the timeline of the mine restart, we have brought forward the planning for developing Tent Mountain into a renewable energy complex,” he said.

Mr Doyle noted the site’s inherent advantages including a 300m drop between two reservoirs that were formed during previous mining operations and its 10km distance to Alberta’s high voltage electricity grid, as well as proximity to rail and gas pipelines and “plenty of space” to construct a green hydrogen plant.

“The various technical, economic and social studies we have completed over the past six months show technical viability and strong returns over a 50-plus year project life,” he added.

Later in the month, the company announced the creation of a steering committee to drive the transition from coal to green hydrogen production and appointed power industry expert Will Bridge as chairman.

Origin Energy (ASX: ORG)

Australian energy retailer Origin Energy is conducting a $3.2 million feasibility study into building an export-scale renewable energy plant in Tasmania’s Bell Bay. The study is being partially funded by a $1.6 million grant from the Tasmanian Government.

Under the proposal, the 500-plus megawatt plant would produce more than 420,000tpa of emission-free ammonia through the combination of hydrogen and nitrogen extracted from the air. Potential uses for the hydrogen and ammonia include electricity generation and as transportation fuel.

The feasibility study is expected to be completed by December 2021 and first production of green ammonia is targeted for the mid-2020s.

Origin is also collaborating with Japan’s Kawasaki Heavy Industries on a 300MW early export project in Townsville, north Queensland, which would produce 36,500tpa of green liquid hydrogen using renewable energy and sustainable water. First export from this project is also targeted from the mid-2020s.

In April, Origin announced it had signed a memorandum of understanding with the Port of Townsville to collaborate on the potential expansion of the port and the development of a liquefaction facility, new berth, and associated infrastructure.

The company described it as “one of the most advanced commercial-scale green liquid hydrogen projects in the world” and said it planned to commence front end engineering and design (FEED) studies this year.

Pilot Energy (ASX: PGY)

Junior explorer Pilot Energy has recently raised $8 million to fund the commencement of studies on the feasibility of CCS and blue hydrogen production in WA’s Mid West, leveraging its existing oil and gas assets in the region.

The company has engaged Technip subsidiary Genesis, along with RISC Advisory and 8 Rivers Capital, to assist with the studies, which will assess the CCS potential of the offshore Cliff Head oil project and additional reservoirs across the broader Perth Basin, the production of blue hydrogen and commercialisation via the provision of carbon management services, and the sale of hydrogen.

Pilot will also assess the feasibility of deploying clean power generation and 8 Rivers hydrogen autothermal reforming technology for clean hydrogen production.

An additional feasibility study is planned for tenure in southwest WA, but Pilot has not revealed any details as yet.

In late October, the company announced the signing of a binding farm-in agreement for private company Advanced Energy Transition to earn up to 50% in the southwest WA Leschenault gas prospect by fully funding the drilling of an exploration well.

Pilot called the exploration well a “key step” in assessing the feasibility of developing its proposed South West carbon management and blue hydrogen project. Subject to regulatory approvals and land access, drilling is scheduled to commence by December 2022.

Pure Hydrogen Corporation (ASX: PH2)

In March 2021, Australian gas players Real Energy and Strata-X Energy completed a merger to form Pure Hydrogen Corporation which, as its name may suggest, aims to become a leader in the development of hydrogen and fuel cell technology in Australia.

Most recently, the company announced it had acquired an initial 24% stake in hydrogen fuel cell vehicle company H2X Global Limited with share options to increase its shareholding to 48%. The pair have also signed a deal where Pure Hydrogen will be the preferred supplier of hydrogen to H2X.

In parallel, Pure Hydrogen has established a new company, Pure X Mobility Pty Limited, that plans to develop and sell hydrogen fuel cell trucks and buses including waste disposal trucks and concrete agitator trucks. It also has a 60% stake in a joint venture with private company Liberty Hydrogen to develop four hydrogen manufacturing and distribution hubs – Project Jupiter and Project Mars in Queensland, Liberty North in NSW and Liberty South in Victoria.

Pure Hydrogen reported making “solid progress” during the June quarter with major partners to secure solutions for hydrogen fuel substitution for diesel, including submitting proposals to “well-known companies with transport fleets” that offered solutions to deliver fuel savings for a hydrogen-fuelled truck versus a diesel truck.

The company also recently announced the acquisition of a 19.99% stake in Botala Energy, which is pursing a $7 million IPO to list on the ASX later this year.

Botala, formerly known as BotsGas, is Pure Hydrogen’s existing joint venture partner on the Serowe coalbed methane project in Botswana.

In September, the companies revealed a hydrogen strategy for Botswana and southern Africa that highlights the potential to convert Serowe’s 2.4 trillion cubic feet of gas resources to hydrogen through pyrolysis.

Province Resources (ASX: PRL)

Province Resources operates the HyEnergy project which focuses on the development of an 8GW renewable power facility and downstream hydrogen plant in WA’s Gascoyne region.

Province has partnered with French independent Total Eren on the project and recently inked a deal with Global Energy Ventures to evaluate exporting green hydrogen using the latter’s compressed hydrogen shipping and supply chain technology. This study commenced in early October and is due for completion in the June quarter of 2022.

Province also recently secured its first licence for the project, a 98.6sq km site north of Carnarvon planned to be the production site and home to some upstream generation assets.

QEM Limited (ASX: QEM)

Junior explorer QEM Limited holds the Julia Creek vanadium and oil shale project in Queensland where it announced earlier this year it would pursue green hydrogen opportunities.

The company is seeking to construct a hybrid renewable energy project capable of feeding power to the grid via the CopperString 2.0 network (a $1.5 billion, 1,000km high voltage transmission project servicing Townsville and Queensland’s Northwest Minerals Province) and to supply power for an on-site green hydrogen electrolyser.

QEM engaged DNV Australia to commence a pre-feasibility study into the project’s solar and wind farm potential in April. By July, the completed first stage of the study had indicated wind power as a viable option.

In August, the company announced a $2 million share placement to accelerate development at Julia Creek including funds for the next round of project studies.

An investor presentation released in October said a bench-scale pilot plant is currently under construction to optimise oil and vanadium recovery, conduct petrology evaluation and gain a better understanding of the company’s internal hydrogen requirements. The plant will validate QEM’s proprietary extraction process ahead of a commercial demonstration plant.

Operational activity is on track to commence at the pilot plant in the first half of the 2022 financial year.

Sparc Technologies (ASX: SPN)

In late October, emerging graphene-based product developer Sparc Technologies announced it is partnering with the University of Adelaide to develop next generation hydrogen technology to deliver “ultra-green hydrogen”.

Under a non-binding term sheet, the pair have agreed to form a joint venture company called Sparc Hydrogen to advance the cutting-edge process which employs the sun’s ultraviolet light and thermal properties to convert water into hydrogen and oxygen without the use of an electrolyser, nor wind or solar farms.

Sparc will hold 72% equity and will develop graphene coatings to be used in conjunction with a catalyst. The University of Adelaide will hold the remaining 28%.

Sparc will also issue the university 3 million new shares and will commit to a joint venture expenditure of $4.75 million over 4.5 years.

Sparc is confident the process will deliver ultra-green hydrogen at the low end of the cost curve.

“Green hydrogen energy has often been touted as being able to provide baseload electricity, however it has struggled to compete economically against conventional fossil fuel baseload electricity,” Sparc executive chairman Stephen Hunt said.

“This globally significant project offers a realistic pathway to achieving economically feasible green hydrogen energy and to advancing industry to net zero.”

“Developing additional graphene applications in the ultra-green hydrogen energy space is also a very important growth opportunity for Sparc,” Mr Hunt added.

SRJ Technologies (ASX: SRJ)

Specialised engineering firm SRJ Technologies has announced a new partnership with Curtin University and precision machining firm SixDe to develop hydrogen-compatible pipe technology.

The project will start in the fourth quarter of 2021 and is expected to be completed in the first quarter of 2023.

SRJ’s coupling technology enables weld-free spool replacement that it says can save up to 90% of the time taken to perform traditional valve changeouts.

The company’s new collaboration will focus on the proof of concept and manufacturing commercialisation of a new weld-free coupling technology for pipelines to meet the requirements of the hydrogen industry. The project will also explore the further enhancement of manufacturing materials and processes with specific application to hydrogen.

SRJ said the intellectual property generated from the project could extend to further applications in the hydrogen industry and it aimed to patent the new technologies and associated manufacturing processes for such applications.

SRJ’s technology is expected to eliminate the need for welding of pipeline joins, thereby mitigating the occurrence of hydrogen embrittlement or weld cracking.

TNG Limited (ASX: TNG)

In September, resource and mineral processing technology company TNG Limited announced it had inked a project development agreement with Malaysia-based green energy company AGV Energy & Technology to jointly and exclusively develop green hydrogen production projects in Australia using the HySustain technology developed by AGV and its partners.

HySustain, which produces green hydrogen using the electrolysis of demineralised water and renewable energy, is at an advanced stage of development based on a test plant in Europe.

The companies plan to jointly scope, evaluate, plan and execute HySustain projects via an incorporated joint venture company on the basis of an agreed staged development framework.

Later that month, TNG said it was progressing talks with the Northern Territory government to utilise the existing land reserved for the company at Middle Arm Precinct for the potential development of a hydrogen production facility under the joint venture.

Wesfarmers (ASX: WES)

One of many wholly-owned subsidiaries of Australian conglomerate Wesfarmers is gas supplier Coregas, which is currently involved in Australia’s largest hydrogen project – the Hydrogen Energy Supply Chain (HESC) gasification plant in Latrobe Valley, Victoria. Through its role in this project, Coregas is aiming to load the world’s first liquefied hydrogen ship in Victoria for transport to Japan.

Coregas is also focused on commissioning the first Australian hydrogen refuelling station for fuel cell electric vehicles, to complement the first two hydrogen-powered trucks expected to operate in the company’s fleet from early 2022.

SEE ALSO:

– Gold stocks on the ASX

– Silver stocks on the ASX

– Lithium stocks on the ASX

– Cobalt stocks on the ASX

– Graphite stocks on the ASX

– Zinc stocks on the ASX

– Nickel stocks on the ASX

– Rare earth stocks on the ASX

– Mineral sands stocks on the ASX

– Vanadium stocks on the ASX

– Uranium stocks on the ASX

– High Purity Alumina stocks on the ASX

– Tin stocks on the ASX

– Tungsten stocks on the ASX

– Oil and gas stocks on the ASX

– Cannabis stocks on the ASX