Cannabis stocks on the ASX: The Ultimate Guide

The global legal cannabis market is expected to be worth US$146.4 billion by the end of 2025.

Cannabis has recently become one of the hottest investment sectors on world markets and despite Australia’s legal restrictions, the ASX has seen a flurry of pot stocks float in the last couple of years.

Although, it was not that long ago that the very idea of investing in the flowering herb meant dropping your money into an illegal “stash”.

The very fact that recreational cannabis use has been illegal in most Western countries since the 1930s has meant it has been significantly under-researched by modern pharmacology.

As clinical research on its medical benefits ramp up and its commercial uses are explored, this could mean an opportune time to invest – or will it just be a flash in a pan?

What is cannabis?

For those a little out of the loop, cannabis has been more commonly referred to as ‘marijuana’ and informally named ‘weed or pot’.

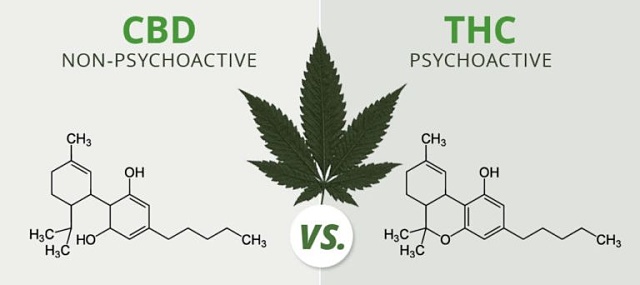

The two main properties of the cannabis plant species are delta-9 tetrahydrocannabinol (THC) and cannabidiol (CBD).

Both compounds interact with your body’s endocannabinoid system to impact the release of neurotransmitters in your brain. These neurotransmitters relay messages between cells about pain, stress, sleep and many other functions.

Each compound interacts differently to produce different effects on the body.

CBD vs THC

Reports vary on how many other compounds are present in the plant, with some only detected at very low levels, but the figure has been up around the 500 mark.

THC

THC is the main psychoactive ingredient, notorious for its ability to generate a euphoric ‘high’.

Alongside its recreational purposes, it has been used medically for its relaxing and pain-relieving effects.

It is also considered to help with conditions including insomnia, low appetite, nausea, anxiety and as a muscle relaxant.

CBD

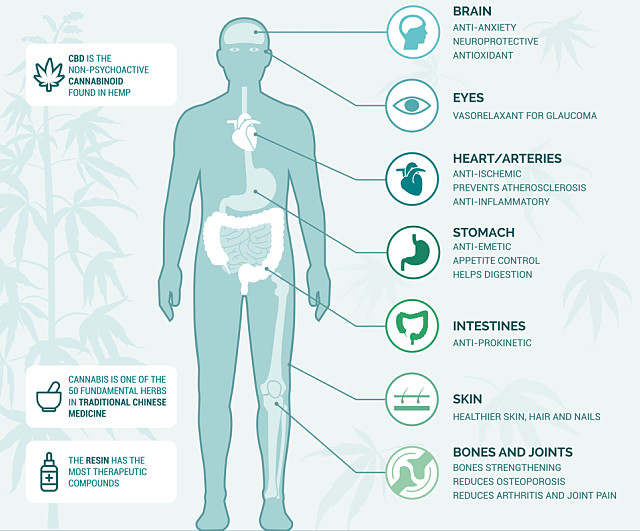

CBD is a non-intoxicating compound that can serve to balance or dampen the effects of THC.

It is considered preferable as a medicine because it lacks the psychoactive side effect and has many other medical benefits.

In addition to pain and nausea management, it is mainly used to treat seizures, inflammation, migraines, depression, psychosis or mental disorders.

Hemp

Hemp is a cannabis variety that is primarily grown for its fibre. It can be refined into paper, textiles, clothing, biodegradable plastics, building materials and insulation, paint, biofuel and animal feed.

It contains a higher concentration of CBD and relatively lower levels of THC, making it the ideal source for CBD oil.

Hemp seeds have recently been touted as a ‘superfood’, containing high levels of protein, dietary fibre and amino acids. They are also a rich source of magnesium, zinc and iron.

Hemp seeds can be eaten raw, ground into hemp meal or made into a liquid such as hemp ‘milk’. They can also be cold-pressed into oil.

The leaves of the hemp plant do not contain as much nutritional value as the seeds but can still be eaten as leafy vegetables or pressed into juice.

Terpenes

Some lesser known compounds are terpenes, which are fragrant oils that provide each plant strain with its distinct aroma. These oils are said to offer medicinal properties without containing CBD or THC.

Researchers have identified more than 100 different terpenes in the cannabis plant. Some common ones include limonene, which has a citrus aroma and is considered effective at relieving stress and anxiety, and carophyllene, which is believed to alleviate chronic pain and treat insomnia.

Another common flavour is pinene, which smells like pine needles and has shown potential medical value as an anti-inflammatory, a topical antiseptic and even a bronchodilator for asthma sufferers.

Uses of cannabis

Cannabis is showing tremendous promise in treating a range of diseases and conditions ranging from appetite enhancement and anti-nausea for patients going through chemotherapy or suffering from HIV/AIDS all the way through to suppressing or eliminating convulsive or muscle spasm sessions in diseases such as epilepsy, Multiple Sclerosis, strokes and Parkinson’s disease.

Cannabis also shows some promise as a treatment for insomnia, eczema, pain relief, melanoma and even for autism, although many of these claims will obviously need to be backed up with medical trials in which standardised doses of various cannabinoids are compared with current treatments to ensure they are effective.

In addition to hemp’s use as a food or textile product, it has been used as a building material, combined with lime to make concrete-like bricks called ‘hempcrete’. Being both durable and a ‘breathable’ material, it has also been used for thermal insulation.

As a paper product, hemp is both light and strong with a higher tear resistance so has been used for specialty items such as cigarette paper, filter papers and even bank notes.

Both hemp and CBD have also shown promise as an ingredient in cosmetics and skincare products with their antioxidant and anti-inflammatory properties considered helpful in treating acne, dry skin and the potential prevention of wrinkles.

Of course, you can’t forget the plant’s more controversial purpose as a recreational drug with psychoactive properties.

Medical history

Cannabis has an extremely long history with the first documented case of its use dating back to the time of Chinese Emperor Shen Nung, who was regarded as the “father of Chinese medicine”, circa 2800 BC.

The therapeutic use of cannabis is also mentioned in ancient texts of the Greeks, Romans, Indian Hindus and Assyrians.

Hindu legend has described the onset of fever as “hot breath of the gods” with cannabis used in religious rituals to appease the gods and reduce the fever. Modern science has now shown that THC can be effective at reducing body temperature.

Some of the documented medical indications of cannabis included treatment for rheumatic pain, constipation, malaria and female reproductive disorders.

Medicinal cannabis and hemp health benefits.

The founder of Chinese surgery, Hua T’o, was believed to have combined wine with a compound of the plant to make a ‘boil powder’ to anesthetise patients during surgical operations around 200 AD.

In 1841, the Irish physician William Brooke O’Shaughnessy helped to introduce cannabis into modern Western medicine after living in India. His research papers detailed many medical benefits of cannabis including a case where it stopped convulsions in a child.

Industrial history

Hemp is one of the fastest growing plants and was one of the first plants to be spun into usable fibre some 10,000 years ago.

It has a similar texture to linen and was commonly used for fabric, rope and sail canvas, with the word ‘canvas’ interestingly being derived from the word ‘cannabis’.

In 1454, the world’s first book to be printed on a moveable type printing press, the Gutenberg Bible, was printed on hemp paper. The few remaining original copies of this bible are considered to be the most valuable books in the world, with a complete copy valued at around $25 million.

During 1690, the first American paper mill made paper from hemp and in 1853, Levi Strauss & Co used hemp to make the world’s first pair of jeans.

In 1897, Rudolph Diesel invented the world’s first diesel engine which was designed to run on clean burning vegetable oils including hemp oil. For about three decades, hemp oil was the fuel of choice for automobiles.

But in the 1930s, anti-cannabis propaganda changed everything.

Why was it made illegal?

Cannabis was a key ingredient in many mass-produced legal drugs in the early 1900s before restrictions increased and it began being labelled as a poison.

Two American men have been marked as the culprits for the modern prohibition of marijuana: Harry Anslinger and William Randolph Hearst.

Anslinger became the Director of the Federal Bureau of Narcotics in 1930 and Hearst, a publishing and timber mogul, was considered his co-conspirator.

In 1936, the US propaganda film Reefer Madness was released, telling the cautionary tale of teenagers who were enticed by drug dealers to smoke “reefer” (cannabis) cigarettes and consequently, lead a life of horrendous crime.

It demonised marijuana as a dangerous drug and played on the racist attitudes of white Americans at the time, mirroring Anslinger’s campaigns depicting African-Americans as being more disposed to the drug and pushing it on innocent white people, along with their “Satanic” jazz music.

Meanwhile, Hearst lost 800,000 acres of timberland to Pancho Villa during the Mexican Revolution, plus his paper mills were increasingly being replaced by hemp.

So, he took advantage of his publishing empire to taint public perception of marijuana by linking it to the Mexicans.

In fact, the Mexican Spanish word ‘marihuana’ was used instead of cannabis in propaganda, further elevating the discomfort levels of Americans who feared the influx of Mexican immigrants in the southern states, particularly Texas and Louisiana.

Another reason cannabis was disliked was because people could grow it themselves, which impacted pharmaceutical and petrochemical companies.

The DuPont chemical company had a financial interest in stamping out hemp production as it began selling rayon, and then nylon, fibre in the 1920s and 1930s.

As Anslinger and Hearst’s smear campaign continued, cannabis was regulated in every state of the US by the mid-1930s.

William Randolph Hearst is largely to blame for the criminalisation of cannabis by using his media empire as a propaganda tool of influence.

Then the Marijuana Tax Act of 1937 was enacted, which effectively banned the use and sale of marijuana. Anslinger was the author of this legislation.

This act was later replaced by the Controlled Substances Act of 1970, which placed cannabis on the most restricted drug use, Schedule 1, making it very hard to legally obtain for drug manufacturers and even researchers.

This restrictive drug status spread to most modern Western countries so there was little or no modern pharmacological research into the hundreds of natural compounds, including 104 cannabinoids, that are found in the cannabis plant.

It is only now that we are finding out in greater detail how these various cannabinoid compounds interact and trigger receptors in the central nervous and immune system to produce effects that may be highly beneficial to human health.

Legal changes in recent times

Interestingly, it was the use of cannabis as an illegal recreational drug that eventually led to significant political pressure around the world from parents of sick children who were forced to effectively become criminals to arrange the supply of cannabis oil to alleviate the symptoms of their children.

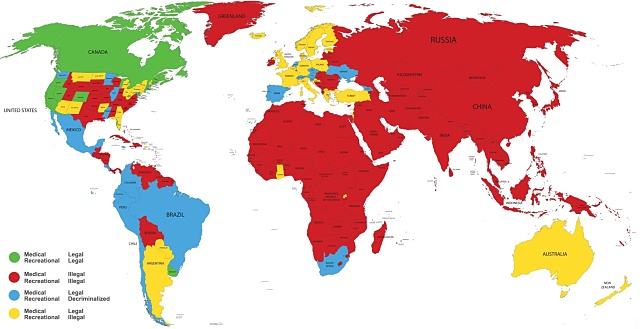

That has led to a significant easing of restrictions in researching and supplying medicinal cannabis, with 51 countries now legalising or decriminalising the herb in some form, including 31 that have fully legalised it for medical and/or recreational use.

The current legal status of cannabis around the world.

Australia received legislative approval in October 2016 and was legally permitted to import cannabis for medicinal use only in 2017.

Hemp food products were also approved for human consumption that year. Prior to this, all species of cannabis had been banned from being added or sold as food.

Australian politicians are divided on the idea of legalising the plant for recreational purposes. While the Labor Party and Liberal-National coalition are against it, the Greens and Liberal Democrats support it, even claiming it could generate close to $2 billion for the economy each year including $300 million in GST revenue alone.

Medicinal cannabis has been legal in Canada since 2001 and last October, it became the second country after Uruguay to legalise possession and use for recreational purposes.

Other countries that have lifted restrictions in recent years include the US, South Africa, Peru, Costa Rica, Chile, Colombia, Mexico, Spain, Portugal, Germany and the Czech Republic.

The United Kingdom also legalised medicinal cannabis as a controlled drug in November and only just received its first legal bulk shipment in February.

Interestingly, the drug is still technically illegal in the Netherlands, despite the nation and particularly its capital Amsterdam being world-renowned for its relaxed and widespread cannabis use.

Laws surrounding cannabis use and access are being loosened around the world in recent times.

It is traditionally sold in local “coffee shops” and possession of less than 30 grams is generally considered a minor misdemeanour. Authorities have been known to turn a blind eye to even smaller quantities for personal use, although it is still technically able to be confiscated by police.

In addition, only citizens are technically allowed to buy cannabis with the exception of some Amsterdam coffee shops that are permitted to sell to tourists.

Meanwhile, the United Nations Commission on Narcotic Drugs was expected to vote on the World Health Organisation’s cannabis recommendations at a meeting in Vienna in early March. However, this was delayed as several member states including the US, Russia and Japan requested additional time to consider the recommendations.

These recommendations, released in January, include changing the classification of CBD to recognise its medical benefits.

Licencing in Australia

In Australia, licences and permits are required in order to grow, manufacture or even research cannabis.

In October 2018, the government’s Office of Drug Control hired more staff to manage an influx of licence applications from companies wanting to grow cannabis commercially or manufacture cannabis-based products.

Growers also require a permit, which involves a facility inspection and specifies the types of cannabis plants a licence holder can cultivate, the number and weight of the plants, as well as the next party in the supply chain (that is, the specific manufacturer or researcher).

Access in Australia

Despite Australia having legislative approval for medicinal use, it’s not as easy as popping in to your local doctor for a prescription. The practitioner must first get authorisation to give it to you.

The Therapeutic Goods Administration (TGA) controls who can use medical cannabis under two Special Access Schemes: SAS A is for palliative care patients, while SAS B is for ‘unapproved’ products.

So far, there are only two registered cannabis medicines in the world – Epidiolex for epilepsy and the Sativex nasal spray, both owned by UK company GW Pharma.

However, the TGA has also permitted the import of unregistered products (that is, ones that haven’t been clinically tested) for medical purposes only.

Cannabis Access Clinics operates numerous premises in Australia.

Access can also be quite pricey, with medicinal cannabis not currently covered by the Pharmaceutical Benefits Scheme, meaning costs are paid by patients out of pocket.

According to recent market research by Cannabis Access Clinics, Australian patients spend an average of $370 per month for treatment.

Epilepsy patients are paying even more, estimated at about $1,000 a month, the clinic reported.

However, a new product and pricing analysis released this week by FreshLeaf Analytics has shown pricing for medicinal cannabis products, especially cannabis oil, in Australia has started to fall.

Despite this, monthly expenditure by patients is up 11.5% for the first quarter of 2019, driven by increased dosages.

In addition, CBD products appear to have hit a floor price, remaining unchanged in the last six months at $0.10 per mg compared to other list prices falling by as much as 26% over the same period.

Market size potential

The gradual legalisation of cannabis has led to an amazing flurry of activity in recent years – much of it on share markets including Canada and Australia – as companies move to address the potentially massive markets for cannabis products.

Last year, a report by Global View Research estimated the worldwide legal marijuana market would reach a whopping US$146.4 billion by 2025, with the US and Canada as the market front runners.

Although, other market research firms have offered different industry values, with New Frontier Data estimating a future market worth US$25 billion.

Late last year, the firm released an in-depth analysis estimating the total current cannabis market in Australia (including the illegal market) could be valued at up to A$6.3 billion.

Meanwhile, Europe-based firm Prohibition Partners suggested the Oceanic cannabis industry (comprising Australasia, Melanesia, Micronesia and Polynesia) could be worth at least A$12.3 billion to the economy by 2028.

Prohibition Partners also predicted Australia’s recreational market could grow up to A$8.8 billion per annum in a decade if it is legalised soon.

And while there is currently over 1,000 registered Australian patients receiving cannabis as a prescription medicine, this figure could swell to 400,000 by 2028, the firm reported.

Unlike many offshore markets which rely on greenhouse growth, Australia has the potential for outdoor cannabis crops and conceivably two crops a year in high sunlight areas.

Industrial hemp being grown in a field.

Growing cannabis crops here is still in the early stages, although as with most agricultural exports Australia shows enormous promise.

According to investment bank Cannacord Genuity Group’s senior analyst Matthjs Smith, Australia is well placed to capitalise on both global and local interest with 2019 expected to be a big year for the industry.

“We are the leading exporters of medical opioids, and I think we can translate that experience into the medical cannabis scene,” he said.

Cannabis grower Cann Group’s chief executive officer Peter Crock said access to export markets is important while Australian regulations are still being developed.

“We don’t have enough demand and it would be too difficult to set up a new industry with such a low patient base,” he said.

Market forecasts for 2019

More cannabis stocks are expected to emerge on the ASX in 2019, with existing stocks forecasting a growth in patient numbers as more locally produced medical cannabis products hit the market.

Ecofibre, which grows industrial hemp in the US state of Kentucky, is one company with a proposed ASX listing date at the end of March 2019.

Melbourne-based Cannvalate, which has plans to become Australia’s largest cannabis cultivation hub, completed a Series A $4 million raise in October 2018 and has plans to IPO later this year.

According to FreshLeaf Analytics’ research, the patient market in Australia is expected to grow at a rate of about 9% per month to result in 15,000-20,000 new patients in 2019.

Based on its current market forecast models (which assume no major regulatory change during the year), the firm is expecting annual product revenue in the Australian legal medicinal cannabis market to reach about $43 million by 2020.

Big companies getting involved

Cannabis is going mainstream too – Constellation Brands, the parent company behind the Corona and Modelo beer brands and Svedka vodka, recently became the largest shareholder of leading Canadian cannabis company Canopy Growth Corp and has plans to experiment with cannabis-infused drinks.

This move has been shadowed by beer brewer Molson Coors, which teamed up with Canadian cultivator The Hydrothecary Corporation in August 2018 to develop their own line of non-alcoholic cannabis-infused beverages, and in December, Budweiser brewer AB InBev SA entered a joint venture to develop non-alcoholic CBD drinks with medical cannabis company Tilray.

Even former heavyweight boxing champion Mike Tyson has entered the sector, launching his own cannabis venture Tyson Ranch on 40 acres in California, which he envisions will be a marijuana “resort” hosting not only growers and researchers but also an “edibles factory”, amphitheatre and areas for “glamping” (the new trend of luxurious camping).

There have also been rumours that Coca Cola would enter the market, reportedly discussing an investment or partnership with Aurora Cannabis Inc late last year, but the Coke company has so far shut down this idea.

On the medical side, cannabis trials are aiming to address diseases in which treatments are measured in the many billions of dollars each year.

While you wouldn’t expect cannabis-based medications to dominate any of those markets, even small percentages could be worth big money.

It is not hard to envisage several blockbuster cannabis-based drugs reaching massive global sales in markets such as pain, nausea, appetite and convulsion or muscle spasm reduction – with the caveat that it will take many years of clinical trials to ensure uniform dosing, identify the right mix of compounds and prove drug efficacy.

The market for more peripheral cannabis products such as cosmetics, food supplements, edible, oil and smoking recreational drug use and to provide fibre and biofuel may become a more immediate market than as a medicinal drug, given the shorter path to commercialisation.

Cannabis stocks on the ASX

With cannabis here to stay, it will play an increasing role in the future of various industries.

So, let’s take a closer look at the numerous cannabis listed stocks on the ASX:

Affinity Energy and Health (ASX: AEB)

Diversified plant-based health and well-being company Algae. Tec changed its name to Affinity Energy and Health in August 2018, keeping its original ASX ticker code AEB.

In addition to producing commercial quantities of algae for nutraceuticals, animal feed and aquaculture markets, Affinity has a 25% interest in cannabis producer Auberna SA, which is growing a 10-acre crop in Uruguay.

In December 2018, Affinity was approved to establish a medicinal cannabis cultivation and manufacturing facility in the Republic of Malta, making it one in only eight companies to have been granted such a licence.

It has also secured agreements to research medical cannabis in Australia with St John of God Health Care Inc, and to pursue the application of its cannabis oils and algae biomass and oils for use in Skin Element’s (ASX: SKN) range of natural skincare products.

The company has also applied for cultivation and manufacturing licences in Australia. At the time of submission over a year ago, Affinity expected the application to take less than three months. But at the latest update in December 2018, these applications were still under evaluation.

Althea Group Holdings (ASX: AGH)

Victoria-based Althea Group Holdings is a licenced importer and distributor of medical cannabis in Australia.

The company has progressed at a rapid pace since listing last September, having been granted both an export licence and a manufacturing licence, which has allowed it to the start work on a medicinal cannabis production facility in Victoria.

Althea also recently expanded into the UK market, announcing the acquisition of its subsidiary Althea UK in February.

Through this new venture, the company expects to soon start supplying eligible UK-based patients with medicinal cannabis products, making it one of the first companies to do so since the UK’s legislative change in November 2018.

Also, in February, it inked a product supply and distribution deal with Cannvalate, Australia’s largest network of medicinal cannabis-prescribing clinics.

In the first half of 2019, Althea is planning to launch two new products in Australia – soft gel medicinal cannabis oil capsules and a 15ml mouth spray. The company is also hoping to launch these products in the UK as part of its market entry in April.

AusCann Group Holdings (ASX: AC8)

Cannabinoid pharmaceutical company AusCann Group is focused on developing and producing capsule-based pharmaceutical products for the management of chronic pain including neuropathic pain.

In January 2019, the company finalised the purchase of a research and development facility in Perth, Western Australia, which it said completed its previously announced long-term development strategy.

The facility, which will undergo a planned upgrade, will be used to progress AusCann’s pharmaceutical product pipeline. This includes the impending production of hard-shell cannabinoid capsules, which are set to be released for clinical trials towards mid-2019.

AusCann has multiple divisions under its umbrella and has secured several partnerships across the supply chain from raw materials, product development to manufacturing and sales.

It is partnered with Canada’s largest medicinal cannabis group Canopy Growth Corporation and European cannabis breeding company Phytoplant.

AusCann also has an agreement with MediPharm Labs to supply cannabis resin to use in AusCann’s hard shell capsules and is jointly establishing cannabis cultivation, manufacturing and distribution operations in Tasmania with opium poppy exporter Tasmanian Alkaloids.

In addition, AusCann’s Chilean joint venture company DayaCann inked a non-binding memorandum of understanding late last year with Canadian company Khiron Life Sciences (TSXV: KHRN) to supply medical cannabis products for patients in Chile.

The company also has a distribution agreement in place with Australian Pharmaceutical Industries (ASX: API), Australia’s largest pharmaceutical distributor with brands including Priceline and Soul Pattinson Chemist.

Bod Australia (ASX: BDA)

Skincare and natural medicines developer Bod Australia’s medicinal cannabis oil called Medicabilis is currently being prescribed to patients through Australia’s SAS B scheme.

The company has also developed a cannabis-based sub-lingual (dissolved under the tongue) wafer product, which it evaluated in a “world-first” blind clinical trial last July. Blinded conditions refer to both the patient and clinician not knowing if they are using an active drug or placebo.

Bod claims its wafer system is an easily administered, pharmaceutical-grade product with higher absorption than many existing products.

The next phase of the clinical trial will test the absorption rate of the wafer compared to Bod’s Medicabilis oil.

In November 2018, the company obtained an export licence allowing it to export Australian-made cannabis products to international markets including Belgium, Switzerland and the UK.

Bod’s business is underpinned by two exclusive global partnerships – a supply and collaboration agreement with Swiss Botanicals extracts manufacturer Linnea SA and a licencing deal with Singapore-listed iX Biopharma (SGC: 42C) to use its wafer technology.

At the start of March, Bod announced it will begin supplying a pharmaceutical-grade cannabis extract to Australian medicinal cannabis research group Lambert Initiative for use in a clinical trial for Tourette’s Syndrome.

It also has a commercial relationship with the Australia’s largest pharmacy retailer, Chemist Warehouse Group, to dispense its Medicabilis oil.

Bod’s other products include herbal and pregnancy supplements and the True Earth skincare range, made using hemp seed oil.

Formulations for a nutraceutical range using CBD extract is also currently being developed for Europe and the UK.

Botanix Pharmaceuticals (ASX: BOT)

Medical dermatology company Botanix Pharmaceuticals is focused on developing cannabinoid-based topical treatments for acne, psoriasis, atopic dermatitis and other skin conditions.

The company is preparing for the first human trials utilising synthetic cannabidiol in a proprietary drug delivery system known as Permetrex, a topical cream to be absorbed through the skin.

Botanix’s BTX 1503 drug is thought to be excellent at treating acne in teenagers including acne that has become resistant to antibiotics.

The first acne patient studies for this product were completed in January 2018 and a second phase clinical study commenced in June, with completion of enrolment expected in mid-2019.

A phase two patient study is also underway for Botanix’s BTX 1204, said to treat atopic dermatitis, with enrolment expected for completion in the 2019 third quarter.

In addition, data is anticipated from a phase 1b BTX 1308 study involving psoriasis patients in the 2019 second quarter.

BPH Energy (ASX: BPH)

BPH Energy is a diversified company with investments in both biotechnology and resources, including a 26% stake in unlisted oil and gas explorer Advent Energy.

It is also commercialising a brain monitoring device used to indicate a patient’s response to drugs administered during surgery.

Late last year, the company revealed its intentions to pursue a “complimentary” strategy of investing in the medical cannabis sector.

While it so far hasn’t announced any finalised investments, it reiterated its intentions in its half yearly report released in March 2019, although noting it may be required to re-comply with some ASX listing rules.

Cannindah Resources (ASX: CAE)

Another odd company looking to take advantage of the burgeoning cannabis market is Cannindah Resources, which holds gold and copper exploration projects in Queensland.

In November 2018, it signed an exclusive business and marketing partnership deal with Annabis Hemp through its wholly-owned subsidiary Cannindah Bioceutical Distribution, which has been aptly abbreviated to CBD.

Annabis is a natural cosmetics company based in the Czech Republic that has developed hemp products and food supplements.

Under the agreement, Cannindah has been granted the exclusive right to market and sell Annabis Hemp products in Australia. These include a 100% organic hemp oil, a hemp massage gel for painful joints and muscles, a face cream for acne-prone skin and an organic hemp ointment for dry skin, eczema and sensitive babies.

In early February 2019, the company said it was continuing to conduct its due diligence and has engaged a consultant to see whether the products are compliant for the Australian market. Any required changes are expected to be minor and likely to be regarding packaging.

Cannindah said surplus cash flow from this business would be used for other operations within the company including exploration activity at its mineral projects.

Cann Global (ASX: CGB)

Formerly Queensland Bauxite, the company officially changed its name to Cann Global at the start of this year to reflect the altered nature and scale of its activities in the medical cannabis and hemp industries.

Although it still currently retains an interest in two bauxite projects in Queensland and New South Wales, the company transformed from a mineral exploration company with a minor interest in medical cannabis to an international medical cannabis and all-natural foods company in the short space of six months.

It is legally licenced to grow and cultivate hemp, running hemp seed farms in four Australian states from which it produces premium hemp seed oil, oil capsules, smoothie blends and hemp milk under the label VitaHemp.

It has a large network of wholesale and retail clients in Australia and, more recently, in China and Vietnam.

In addition, the company signed an MoU with Israeli company PharmoCann to manufacture its cannabis products and collaborate on clinical trials.

Cann Global also recently entered into a strategic collaboration and supply agreement with Canadian company Bonify.

In February 2019, Cann Global announced a signed MoU with Australian pharmaceutical company Biohealth Pharmaceuticals, which is expected to move its production schedule of medical cannabis formulations and nutraceutical hemp food consumables forward to the first half of 2019.

As well as Australia, the partners are planning to target established markets in Hong Kong, Japan and Korea.

Cann Group (ASX: CAN)

Cann Group was the first company in Australia to secure its necessary licences and permits to cultivate and research cannabis for human medicinal purposes.

Subsequently, it was the country’s first company to harvest a medicinal cannabis crop. It has now successfully completed 24 harvests to date.

It is also an authorised supplier, owning the Medicinal Cannabis Medicines Portal.

Cann currently has two cultivation facilities in Victoria and just this week, it announced a non-binding heads of agreement to purchase land in the state’s Mildura region, where it plans to construct a new greenhouse to produce about 50,000kg of dry cannabis flower per annum.

This proposed facility replaces the company’s previous strategy to develop stage three expansion facilities at Melbourne’s Tullamarine Airport, although Cann said it had not ruled out Tullamarine as a potential future site.

During 2018, the company supplied Australian patients with imported cannabis oil from its major shareholder, Canadian producer Aurora Cannabis.

It also executed an agreement for IDT Australia (ASX: IDT) to manufacture its medicinal cannabis-based product formulations and secured a contract with the Victorian government to supply cannabis resin to be used to treat children with severe epilepsy.

Additionally, Cann extended a research and development collaboration with the CSIRO and signed a MoU with Agriculture Victoria to pursue further medicinal cannabis research projects.

CannPal Animal Therapeutics (ASX: CP1)

Animal health company CannPal Animal Therapeutics is an interesting addition to this list with a focus on researching and developing cannabis-based therapies for veterinary use.

Its aim is to produce a drug to ease cancer-related pain in animals, particularly dogs.

Animal health drugs have a faster route to market and with dogs and cats now living longer, more of them are dying of cancer.

Pet owners are eager to help their animals and existing pain treatments come with a range of unwanted side effects.

According to CannPal, old human drugs are being repurposed for animal use but there is still a lack of naturally-derived therapies specifically designed to safely and ethically treat pets. This creates plenty of potential for an animal cannabis treatment if it is found to be effective.

In recent months, CannPal successfully completed the live segment of its phase 1B study for CPAT-01, a drug developed for pain and inflammation control in dogs.

It also received two key ethics approvals to progress to the phase 2A clinical study, which will involve 60 dogs with osteoarthritis.

Additionally, CannPal is about to commence a clinical trial for DermaCann, a CBD-derived oral skin supplement for dogs with dermatological conditions.

The company also has a research collaboration with the CSIRO to evaluate the feasibility of using food production technologies to convert CannPal’s oil formulations into a powdered format.

Creso Pharma (ASX: CPH)

In February 2019, Creso Pharma became the first ASX-listed company to wholly-own a licenced Canadian cannabis producer, after its subsidiary was granted a cultivation permit.

Creso is also one of only five licenced producers in the province of Nova Scotia, where its purpose-built indoor growing facility is located. The facility has a two-tier grow room structure with the capacity to yield 4,000kg of cannabis annually.

A month before it was granted the cultivation licence, Creso’s subsidiary signed a three-year supply deal with TerrAscend Canada, committing a large portion of the facility’s capacity and securing committed revenue before planting had even begun.

This deal followed a strategic collaboration with Sri Lankan pharmaceutical distributor Ceyoka Health and the expansion of an existing distribution agreement with Medleaf in New Zealand.

Creso is developing cannabis and hemp-based products across five categories: therapeutics, nutraceuticals, animal health, topicals and recreation, which includes cannabis terpenes beverages and chocolates.

The company’s medicinal cannaQIX CBD-based pain lozenge is currently sold in New Zealand and is about to be introduced in Brazil, Australia and Sri Lanka.

Its animal health products under the brand name anibidiol are complementary feed products for dogs and cats that are said to support the immune system and behavioural balance, such as reducing stress.

In late 2018, Creso’s distribution partner Virbac Inc (NASDAQ: VBAC) inked a deal to expand distribution of these products to an additional 15 countries across Europe and Latin America.

Creso has also recently developed new products including a nutraceutical product to aid sleep and a topical application to provide relief for athletes.

Elixinol Global (ASX: EXL)

Elixinol Global is a major US hemp grower and one of the largest hemp companies in the world.

Its businesses include: Elixinol LLC, which manufactures and distributes hemp dietary supplements and skincare products out of Colorado, US; Hemp Foods Australia, a hemp food wholesaler, retailer and exporter; and Nunyara Pharma, which currently has pending applications to cultivate and manufacture medicinal cannabis products in Australia.

Elixinol listed on the ASX in January 2018 and reported a maiden profit within the first six months of trading.

In the last year, Elixinol has been expanding its Colorado production facility, which is due to be commissioned in the first half of 2019. The expansion is expected to double production capacity to 24,000 bottles of hemp CBD per day.

Following New Zealand’s softened legislation in late 2018, Elixinol launched its branded CBD capsules, topicals and tinctures (alcohol-based cannabis extracts) into the market.

It also recently expanded into Europe, establishing sales hubs in the Netherlands, Spain and the UK.

In February 2019, the company’s Nunyara business purchased 60 acres of land in the Northern Rivers district of New South Wales, intended as the future site for an Australian medical cannabis cultivation and manufacturing facility.

eSense-Lab (ASX: ESE)

Israel-based life science company eSense-Lab makes synthetic cannabis terpenes for use in plant-based medical and consumer products.

According to the company, it reconstructs the chemical profile of a plant and uses this profile as a reference for the formulation of a plant recipe, essentially creating ‘virtual plants’.

It also adds alternate natural products and produces a new formulation as a terpenes (liquid) with the aroma, flavour and medicinal properties of the original plant.

The different synthetic strains are said to have varying benefits but without containing CBD or THC. For example, the Jack Herer strain is used for patients with mental or neurological problems such as bipolar disorder, post-traumatic stress disorder and migraines. Meanwhile, the Gorilla Glue strain is used to treat pain, stress, depression, insomnia and lack of appetite.

The company is currently working on a cannabis-based e-cigarette liquid called e-Juice infused with terpenes and flavours including pineapple express and mango kush terpene blends.

It also recently signed a two-year commercial supply agreement with UK-based E-Quits Group, which purchased its Super Lemon Haze formulation for integration in a variety of products including terpenes for the food additive market.

EVE Investments (ASX: EVE)

Health and nutrition investment company EVE Investments entered the medicinal cannabis space through its interest in wellness company Meluka Health, which produced Australia’s first organic hemp seed honey in November 2017.

In February 2019, EVE announced it had increased its equity from 50% to 100% in Meluka, which produces honey products under four brands: Meluka Honey, Meluka Essentials, Meluka Family and ecoBotanicals.

EVE also has an agreement with THC Global Group (ASX: THC) under which it leases a portion of its Robyndale organic tea tree plantation in New South Wales (operated by EVE’s wholly-owned subsidiary Jenbrook) for THC to grow medicinal cannabis.

Under the deal, THC provides exclusive access to this cannabis for use by Meluka Health in future products including its hemp seed honey.

In March 2019, EVE announced a few moves to boost its market presence in China and the US.

Firstly, it struck a deal with artificial intelligence and e-commerce marketing company OpenDNA (ASX: OPN) to gather intelligence about Meluka Honey’s Chinese customers’ preferences and buying habits in order to improve marketing and sales support.

A week later, EVE announced it had received the first orders for Meluka Honey products from stockists in Los Angeles, California.

Meluka has also soft launched a US customer focused website and recently reached agreement with Amazon to supply its US online store with its honey products.

IDT Australia (ASX: IDT)

Pharmaceutical manufacturer IDT Australia has been contracted by cannabis grower Cann Group (ASX: CAN) to manufacturer its medicinal cannabis products for domestic and export markets.

In its latest update in February 2019, IDT said it was “standing by” for a final determination from Australia’s Office of Drug Control regarding a medical cannabis manufacturing licence.

Impression Health (ASX: IHL)

Australia’s largest dental impression company Impression Health branched into the medical cannabis field in the second half of last year, announcing a collaboration with US company AXIM Biotechnologies Inc in September to develop cannabinoid therapeutic products.

These products include a CBD-infused chewing gum with various strengths for the treatment of a range of indications, such as pain relating to Multiple Sclerosis.

In December, the company signed an exclusive licencing deal with Resolution Chemicals to produce, register and commercialise the cannabis medicine dronabinol in the US, Canada, Australia and New Zealand.

Dronabinol comes in the form of capsules made of pure THC and is targeted to treat nausea and vomiting caused by chemotherapy, as well as appetite loss in HIV/AIDS patients.

Impression also recently made a manufacturing deal with a Canadian pharmaceutical company to supply cannabis oils, and potentially soft gel capsules for the manufacture of dronabinol, for distribution throughout Australia.

In January 2019, Impression received relevant licences from Australia’s Department of Health in Victoria to sell or supply scheduled cannabinoid substances on a wholesale basis.

The licences also allow the company to import and export cannabinoid medicines to and from Australia, paving the way for it to access wider markets.

In February, Impression announced a signed MoU and exclusivity agreement with US-based RespireRx Pharmaceuticals to licence, partner or complete a joint venture over proprietary information associated with completed clinical trials using dronabinol to treat obstructive sleep apnoea.

RespireRx had completed phase 2B trials for the condition and is now progressing towards phase 3 clinical trials.

According to Impression, the trials have demonstrated that dronabinol “significantly improves” patient outcomes. Should sleep apnoea be added to dronabinol’s list of indications, it is expected to increase the market for the drug over time.

Jayex Healthcare (ASX: JHL)

Jayex Healthcare develops technologies and delivery platforms for the healthcare industry, including leading Australian appointment booking app Jayex Connect.

Last July, the company signed a binding licence agreement with private company MediCann NZ for the medical cannabis grower to use Jayex’s technology in New Zealand’s emerging cannabis market.

The deal was expected to commercialise Jayex’s P2U script processing and Bluepoint remote dispensing technologies. However, the licence agreement was terminated a few months later.

MediCann claims the termination was due to a conflict of interest and failure to disclose solvency issues, but Jayex denies this.

In its 2018 preliminary final report released at the end of February 2019, Jayex said it was continuing to pursue opportunities to commercialise its P2U and Bluepoint technologies “in respect to the prescribing, sale and distribution of legally approved medical cannabis products”.

According to the company, it has invested about $350,000 in the development of its technologies to support the growing global medical cannabis market and would continue to look at future investments in 2019 and beyond.

Lifespot Health (ASX: LSH)

Digital health provider Lifespot Health owns smart vaporiser technology for cannabis oils or herbs through its wholly-owned business Seng Vital.

In December 2018, the company completed the first production of its integrated medihale smart vaporiser and associated app and commenced demonstrations of the production models to medical and recreational cannabis companies in the US, Canada and Australia.

Medihale is reportedly the first Bluetooth-enabled medical regulatory approved vaporiser and health platform designed for the use of medical cannabis.

Together, the devices (the vaporiser and associated app) allow for individually controlled treatment.

The vaporiser uses fingerprint activation and a ceramic heating system to vape cannabis oil or flower, while the app tracks and measures progress such as pain levels.

In late February, Lifespot said it was actively negotiating supply contracts in the medical and recreational cannabis segments and was assessing options to further secure the manufacturing supply chain of vaporisers to meet key clients’ long-term needs for innovative and exclusive products.

According to the company, the international recreational and medicinal vapor market is forecast to grow to more than $86 billion by 2025.

In addition, vaping is the main driver of cannabis concrete sales in the US with 58% of current concentrate spending coming from prefilled vaporisers, Lifespot said.

Inhalation of vaporised cannabis products is seen as having far fewer health risks than combustion or smoking of the drug.

Medlab Clinical (ASX: MDC)

Australian medical life science company Medlab Clinical is focused on developing therapeutic pathways for diagnosed chronic diseases such as chronic kidney disease or pre-diabetes/obesity.

It is also researching new medicines for pain management and the treatment of depression and anti-aging, specifically musculoskeletal loss.

In September 2018, the company was granted a licence to export cannabis relating to the development of its NanaBis and NanaBidial cancer pain management medications, which are delivered in the form of an oral spray.

NanaBis is used to improve symptoms relating to intractable pain in cancer patients, while NanaBidial is used for chemotherapy-induced nausea and vomiting. NanaBidial has a secondary indication for patients suffering seizures.

In March 2019, the company announced it had teamed up with Canadian pharmaceutical company Pharmascience Inc for the further development and global distribution of NanaBis.

The announcement was followed by encouraging data from a stage 1 advanced cancer pain clinical trial, as well as case studies from Special Access Scheme use.

The clinical trial showed a faster absorption rate using the NanaBis spray compared to a tablet version. Meanwhile, the SAS case studies showed significant improvements in sleep and pain scores.

MGC Pharmaceuticals (ASX: MXC)

Biopharma developer MGC Pharmaceuticals creates cannabinoid-based pharmaceutical products for medical markets in North America, Europe and Australasia.

During 2018, the company was granted a formal manufacturing licence to produce medical cannabis at its production facility in Slovenia.

This achievement was followed by TGA approval to market its CanniEpil product, used to treat patients suffering from drug-resistant epilepsy, through specialist prescribers in Australia.

In the first half of 2019, the company is planning to conduct a phase 2 clinical trial into the effects of its CogniCann cannabis product on patients with mild dementia and Alzheimer’s disease.

It is also planning to commence construction of a manufacturing and production facility in Malta, where it has already inked a major distribution agreement with Maltese-based pharmaceutical distributor AM Mangion. Under the three-year deal, AM Mangion will distribute MGC’s medicinal cannabis products to key markets in Europe, the Middle East and North Africa.

In addition, MGC is collaborating with universities to build and launch an international library called CannaHub, a shared database of research and information focused on innovation within the medicinal cannabis industry.

MMJ Group Holdings (ASX: MMJ)

MMJ Group Holdings switched from being a medical cannabis company to a pure-play investor, with investments across a range of cannabis-related sectors including healthcare, technology, infrastructure, logistics, processing, cultivation, equipment and retail.

Its investment portfolio includes Sydney-based medical clinic and online portal Cannabis Access Clinics, Australian start-up Martha Jane Medical, and Canadian companies such as cannabis oil producer MediPharm Labs, licenced grower and pharmaceutical company Harvest One, cannabis-infused beverage company BevCanna and retail chain Fire & Flower.

In January 2019, Harvest One announced the launch of its Satipharm reformulated CBD capsules in Europe. In a recently completed phase 2 clinical trial, the product demonstrated it could significantly reduce seizures in children suffering severe, uncontrolled and treatment-resistant epilepsy.

In March, it became a medical cannabis supplier to Canada’s leading pharmaceutical retailer, Shoppers Drug Mart, supplying its Satipharm branded products.

Meanwhile, MediLabs announced in February it had signed a C$35 million (A$36.94 million) private label cannabis oil sale agreement with an option for an additional C$13.5 million.

The cannabis oil producer also has an agreement with AusCann (ASX: AC8) to provide cannabis resin for the Australian pharmaceutical company’s hard shell capsules.

Rhinomed (ASX: RNO)

Medical technology company Rhinomed has developed nasal and respiratory sprays designed to improve sleep quality and assist breathing during aerobic exercise.

In October 2018, the company signed an exclusive 12-year deal with large US-based medical cannabis operator, Columbia Care LLC, to licence its nasal technology platform to deliver medical cannabis and cannabinoid compounds in a dose-controlled format to the US market.

Columbia Care currently holds licences in 12 of the most populous US states and territories, reaching more than half of the country’s population.

In its reports, Rhinomed has referenced a recently published clinical trial result that showed a cannabinoid formulation could be an effective treatment for sleep apnoea. It said this indication provided the company with “enough strategic reasons to progress this relationship”.

Roots Sustainable Agriculture Technologies (ASX: ROO)

Israel-based Roots Sustainable Agriculture Technologies is developing and commercialising disruptive technologies to address critical agricultural problems such as plant climate management and the shortage of water for irrigation.

The company’s proprietary Root Zone Temperature Optimisation (RZTO) system is based on the concept that soil maintains a relatively stable temperature at a depth of a few metres, with the underground temperature being colder during the summer and hotter during the winter than the top soil temperature.

Roots’ system involves heating the root zone during winter and cooling it in summer to maintain a stable and favourable range all year round.

In mid-2018, Roots signed a deal with American Farms Consulting LLC to install its licenced technology to assist cannabis growers for the legal industry in Washington State.

According to Roots, the open-field pilot program resulted in a 40-272% increase in average plant wet weight of eight strains of heated medical cannabis.

Further results published in February 2019 showed the heating technology more than doubled the cannabis yield, with the average dried untrimmed bud and leaf weight of heated plants being more than 200% higher than the unheated control crop.

During the December 2018 quarter, the company also saw the first commercial sale of its RZTO technology for medical cannabis in Israel, which is a fully legal medical jurisdiction.

Roto-Gro International (ASX: RGI)

Cannabis technology company Roto-Gro International is focused on the cultivation of legal cannabis and perishable food, taking advantage of its proprietary technology in the stackable rotary hydroponic garden space.

It has also entered into a share purchase agreement to acquire Supra THC Services, which holds a Health Canada approved dealer’s licence for legal cannabis.

The company is currently undertaking trials for both perishable foods and cannabis at its grow rooms in Ontario, Canada.

In January 2019, Roto-Gro said the growing trials were expected to be expanded and replicated at a showroom and research facility currently being sourced in New South Wales, Australia, although this appears to just be for leafy green food produce.

StemCell United (ASX: SCU)

In December 2018, biotechnology company StemCell United received ASX approval to acquire a 51% interest in its partner Yunnan Hua Fang Industrial Hemp, which has an industrial hemp licence in China.

Yunnan is involved in the research, development, cultivation and processing of industrial hemp products including fibre, seeds, oil, hemp ‘hearts’ (hulled seed), and hemp ‘hurds’ (wood chips).

The hemp producer is also looking into developing cannabis-based beauty products.

Suda Pharmaceuticals (ASX: SUD)

Western Australia-based Suda Pharmaceuticals is a drug delivery company focused on administering drugs through the oral mucosa, that is, the cheeks, tongue, gums and palate.

In December 2018, the company entered into a fully funded feasibility and option agreement with Zelda Therapeutics (ASX: ZLD) to develop an oral spray of pharmaceutical-grade cannabinoid derivatives to treat conditions including Multiple Sclerosis, epilepsy and nausea.

Above the initial 12-month work plan, there is a 24-month option for Zelda to extend the deal and enter into an exclusive global development and licencing agreement for Suda’s oral spray formulations.

THC Global Group (ASX: THC)

Formerly The Hydroponics Company, THC Global Group changed its name in November 2018 to better reflect the strategic developments in the business, particularly its mission to establish global operations and international partnerships.

With the highly appropriate name and ticker code THC, the company operates growing and manufacturing facilities under its Farm to Pharma pharmaceutical model to deliver medical cannabis to Australian patients through the existing access schemes.

These facilities have a growing capacity of 51,000kg of dried cannabis flower per year.

The company has key commercial partnerships with BOL Pharma and Endoca so, while it awaited permitting to start full-scale domestic operations, THC imported Endoca’s medical cannabis from Europe for Australian patients to access for the first time through its medicines portal in July 2018.

In December, THC received two permits to cultivate and produce high CBD sativa strains at its Queensland facility for research purposes.

Two separate manufacturing licence applications are still under review but in early 2019, the company said these were expected to be approved shortly.

It also expanded into the New Zealand market following its legislative change late last year, now importing CBD products to New Zealand patients under exclusive distribution agreements.

In January, the company said it was also exploring strategic opportunities in Asia and expected to announce further details of negotiations and early-stage partnerships in the coming months.

In addition, THC owns two Canadian companies – Crystal Mountain Products, a global hydroponics retailer and distributor of equipment and material to cannabis producers, and cannabis investment vehicle Vertical Canna Inc.

TPI Enterprises (ASX: TPE)

Australian poppy processing company TPI Enterprises works with poppy growers in Victoria, New South Wales and Tasmania.

In late 2017, the company was granted a licence to grow and manufacture medical cannabis, as well as a separate licence to research the plant.

At the time, TPI said it planned to add medicinal cannabis to its suite of controlled drugs. But so far, it has not reported anything further in relation to this.

YPB Group (ASX: YPB)

Anti-counterfeit company YPB Group entered the international cannabis industry in mid-2018, inking a three-year master supply agreement with Canadian emergent cannabis producer Namaste Technologies.

Namaste has built an e-commerce hub accessible in Canada where medical cannabis users connect to doctors and a range of cannabis products, cultivators, cannabis brands and consumption systems.

Under the deal, the partners are working towards a shared strategy to leverage Namaste’s market position to ensure all its vendors and suppliers along the cannabis supply chain mark every product with a TPB ProtectCode (a unique serialised QR code) aligned to YPB’s Connect platform. This is expected to enhance trust in the legitimacy and integrity of the products via a “certainty of authenticity”.

The partners’ joint initiative to stamp out cannabis fakes by confirming authenticity of an online product is now referred to as ‘Cannabis Confirmed’.

By the end of 2018, four cannabis equipment vendors were signed up under the initiative, including Canadian vaporiser manufacturer Totem Vaporizers.

In early February 2019, YPB said in a market update that it expected new clients as well as new revenues in the coming months from the cannabis sector.

Zelda Therapeutics (ASX: ZLD)

Biopharma company Zelda Therapeutics is focused on researching the use of medical cannabis to treat a variety of ailments, from insomnia to autism, cancer and in reducing opioid use.

In September 2018, it commenced a “pioneering” insomnia trial in Western Australia and a few weeks later, announced an observational trial was underway in Philadelphia, US involving children with autism.

Later in the year, it partnered with St Vincent’s Hospital in Melbourne on an opioid reduction study, then inked a deal with Suda Pharmaceuticals (ASX: SUD) to develop an oral spray containing cannabinoid derivatives to treat Multiple Sclerosis, epilepsy and nausea.

Things haven’t quietened in 2019 either, with the company recently announcing a new Australian patent covering a model prognostic biomarker for breast cancer, complementing Zelda’s ongoing programs to develop cannabis-based cancer therapies.

It also recently announced a binding heads of agreement with US-based cannabis grower and processer Ilera Healthcare to explore collaborative and commercialisation opportunities including licencing of Zelda’s clinically-validated formulations, co-development and data sharing.

SEE ALSO:

– Gold stocks on the ASX

– Silver stocks on the ASX

– Lithium stocks on the ASX

– Cobalt stocks on the ASX

– Graphite stocks on the ASX

– Zinc stocks on the ASX

– Nickel stocks on the ASX

– Rare earth stocks on the ASX

– Vanadium stocks on the ASX

– Uranium stocks on the ASX

– Mineral sands stocks on the ASX

– High Purity Alumina stocks on the ASX

– Tin stocks on the ASX

– Tungsten stocks on the ASX

– Hydrogen stocks on the ASX

– Oil and gas stocks on the ASX