High Purity Alumina stocks on the ASX: The Ultimate Guide

Collerina Cobalt plans to become a HPA producer using its disruptive proprietary technology.

As with other battery minerals, new markets are rapidly opening up for materials such as high purity alumina (HPA), propelled by the influx of high-tech industries emerging on the world stage – resulting in numerous ASX stocks turning their attention to HPA and the “huge growth story” it represents.

The prolonged downturn in global markets has attracted a silver lining. Cyclical slumps have historically sparked huge technological leaps and the last decade has been no different with the advent of the new era global battery market.

Only five years ago, the fledgling lithium-ion battery technology that has powered the electric vehicle and renewable energy revolution was barely known.

Now, the new era battery sector has driven growth in several energy minerals with lithium the first to go for a run, followed by graphite, cobalt and copper. Another mineral nickel is now finally having its time in the limelight.

However, one critical battery element – HPA is lesser well-known.

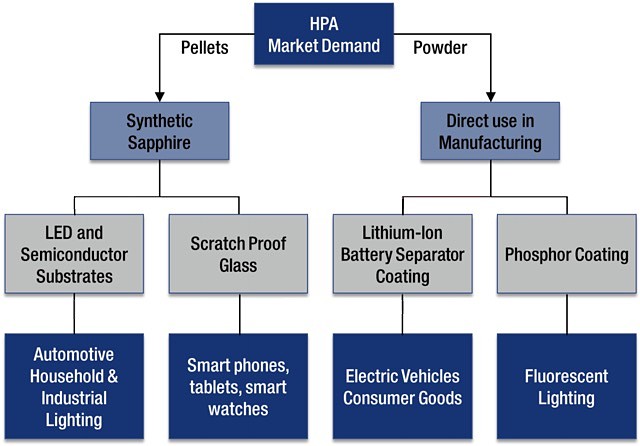

The material is now coming to the fore as a result of its use in LEDs and coating cathode and anode electrode separator sheets in the lithium-ion battery.

The rising global uptake of LED lighting has triggered increased demand for HPA.

As CRU International senior consultant Toby Green said at a recent conference, “HPA is a huge growth story”.

He pointed out that the lithium-ion battery story was not about lithium, cobalt or even nickel sulphate.

“It’s high purity alumina,” he told conference delegates.

What is HPA?

HPA is a high-grade form of non-metallurgical alumina, with a purity level of 99.99% or above.

The material is chemically inert in most environments, has a very high melting point, and does not conduct electricity.

Traditionally, bauxite has been used as feedstock for creating a refined aluminium metal, which is then processed further to create HPA.

However, this costly and energy intensive method of manufacturing HPA has restricted its production.

“The current way that HPA is produced is using aluminium metal as a feedstock,” Altech Chemicals managing director Iggy Tan told Small Caps.

“The metal is basically dissolved in alcohol and then converted back to alumina,” he explained.

Traditionally high purity alumina is produced from aluminium metal; however, new technologies have produced it from aluminous clay (kaolin).

“If you think about where aluminium metal comes from – it comes from the bauxite process where they’ve already made an alumina. But, they can’t use it because there is so much sodium locked into the crystal structure. HPA producers have to use the next stage which is the aluminium metal.”

Mr Tan pointed out how expensive the process can be due to the energy required to make the aluminium metal, alone, prior to processing it into an HPA.

However, technological advancements have spawned several disruptive processes for producing HPA directly from other sources including kaolin or its purer, less common derivative halloysite, and industrial feedstock.

Most of these newer processes bypass the aluminium metal stage or use an alternative feedstock.

Benefits of HPA in lithium-ion batteries

HPA is also incorporated in the lithium-ion battery, which is a market forging rapidly ahead.

Lithium batteries generate a lot of heat, which, if left unmanaged can result in thermal runaway like what notoriously happened to Samsung with its Galaxy Note 7 smartphone.

Additionally, the larger the battery, the bigger the risk. It has been found that using HPA coated separators in lithium batteries can boost safety and efficiency.

HPA-coated separators increase the battery’s thermal stability, as well as enhancing impedance which allows for high power capability. The material can also improve battery life cycle and decrease self-discharge.

Synthetic sapphire and HPA

HPA is critical in creating synthetic sapphire, which is used in developing substrates for LED lights, semiconductor wafers used in electronics, scratch resistant glass used in wristwatch faces, optical windows and smartphones.

In this field, HPA is sought for its extreme hardness. It transmits in UV, visible and IR wavelengths. It has high heat resistance and thermal conductivity.

HPA is used in both the lithium-ion battery and screen that make up electronic devices including smartphones.

Similar to the battery sector, HPA is also consumed due to its chemical inertness and high electrical resistance.

Currently, there is no substitute for HPA in manufacturing synthetic sapphire.

HPA market dynamics

Andromeda Metals managing director James Marsh told Small Caps the HPA market was “growing dramatically” as a result of the rise in LED lighting, smartphones and lithium-ion batteries.

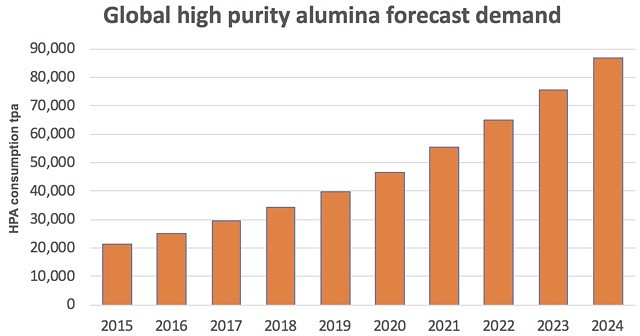

Analysts predict the HPA market will increase by around 16% to 20% annually over the next few years.

According to Altech’s Mr Tan the current HPA market is about 30,000tpa.

Mr Tan anticipates about 38,000tpa of HPA, alone, will be required to coat separators in lithium-ion batteries by 2025.

“If you include the LED industry and separator forecasts, an average of around 92,000tpa of HPA will be used in total by 2025,” Mr Tan told Small Caps.

“If you think about the growth to 92,000tpa by 2025, it is something like a 60,000tpa increase over that period.”

“The growth is very similar to the lithium sector a decade ago,” Mr Tan pointed out.

Demand for high purity alumina is forecast to grow over the coming years.

Mr Tan was one of the driving forces behind one of the first major lithium carbonate producers – Galaxy Resources (ASX: GXY) and the Mt Cattlin spodumene project in WA.

During the last decade, Galaxy grew from a fledgling lithium explorer at a time when lithium attracted little attention to a company with a $1.1 billion market cap.

Mr Tan believes the HPA market is heading in a similar direction. “It was the same strategy preparing production capacity before the demand arrives. At the time we had a vision the demand for lithium was going to be there – driven by the electric vehicle market – more particular around China, because of the pollution and the regulations.”

“We could see the demand coming in. That’s why we built the plants and acquired companies to be ready for that,” Mr Tan explained.

Are we driving to a HPA supply crunch?

The HPA market is fragmented and opaque, with the largest producer Sumitomo Chemicals arising out of Japan.

Other major global HPA producers are located in China, Japan, South Africa and France.

Mr Tan pointed out new HPA entrants will take at least a few years to bring their operations online, leading to a likely scenario where demand will outstrip supply.

“The thematic is very similar to the lithium industry 10 years ago,” Mr Tan said.

“Penetration rate is very fast. We entered HPA for the LED industry and we knew the separator industry was emerging.”

HPA is sourced for use in lithium-ion batteries as well as LED and numerous other applications.

He added it now looked like the separator sector is going to be another big market for HPA.

“So, you have two sectors that are driving demand.”

In line with these expectations, Tokyo-listed W-Scope manufactures HPA coated battery sheets, and in its first quarter results of 2018, it posted a 350% increase in sales for this product compared to the same period in 2017.

Meanwhile, global LED light demand is predicted to surge to 4.1 billion by 2024 – up from 864 million in 2015.

HPA prices

HPA pricing is based purely on buyer and seller negotiations with factors like physical characteristics and chemical composition impacting the final value.

“It is not a commodity where you can look on LME [London Metals Exchange] and get a price. It is very specific to different customers and it is all very confidential and so on,” Mr Tan said.

HPA prices vary based on their purity and physical characteristics.

According to Andromeda’s Mr Marsh, 99.99% (four nine or 4N) purity HPA is the most widely used product in the HPA market and commands between US$20,000/t and US$30,000/t, while the less common extremely high purity or 99.999% (5N) HPA attracts US$50,000/t, and the even scarcer 99.999% (6N) will draw an even larger premium.

HPA stocks on the ASX

Currently, minimal, if any, HPA is produced in Australia or by Australian-listed companies.

However, that is all about to change with several companies attempting to lock-in exposure to the next battery material that’s forecast to boom.

These companies include:

Alchemy Resources (ASX: ALY)

Alchemy Resources plans to look at the potential of producing HPA from its West Lynn nickel and cobalt project in NSW after phase one drilling revealed broad, high-grade alumina from the clay zone above the nickel and cobalt mineralisation.

Better drill results from the initial drilling campaign produced 39m at 20.3% alumina from 16m, 30m at 20.5% alumina from 21m, and 21m at 22% alumina from 15m.

Metallurgical analysis will be carried out after the phase two drilling program, with a JORC resource scheduled to be published in the December quarter.

Alchemy claims the alumina results compare favourably with other deposits that are under current evaluation for generating HPA.

“The potential for HPA and metallurgical work on the nickel-cobalt mineralisation will be further investigated over the coming months,” the company stated.

Alchemy is earning an 80% interest in the West Lynn, along with several other projects from Heron Resources (ASX: HRR).

The projects are on eight NSW licences and to earn the majority stake, Alchemy must spend $1.5 million over three years.

Altech Chemicals (ASX: ATC)

Altech Chemicals recently held an official ground-breaking ceremony, which marks the company beginning construction of its stage one HPA plant in Malaysia.

Once operational, the plant will produce 4,500tpa of 99.99% HPA.

The plant will use kaolin feedstock from Altech’s WA-based deposit which hosts 12.7Mt, which Altech says is enough to underpin its HPA plant for 250 years.

The Meckering-based deposit will be exploited via campaign mining, with two months of simple free dig mining anticipated to provide the HPA plant three-years’ worth of feed.

A final investment decision study projected the HPA operation will have a capital expenditure of US$298 million and generate EBITDA of US$76 million a year, based on a selling price of US$26.90/kg.

Altech has also locked-in an offtake agreement with Mitsubishi for the first 10 years of operation.

The company has also lodged two patents for its HPA processing technology.

Andromeda Metals (ASX: ADN)

Andromeda Metals is earning up to 75% in the Poochera kaolin-halloysite project under a joint venture agreement with Minotaur Exploration (ASX: MEP).

Through the deal with Minotaur, Andromeda will spend $6 million on advancing the project over the next five years.

Andromeda published an updated JORC 2012 resource for Poochera’s primary Carey’s Well deposit of 12.7 million tonnes of bright white kaolinised granite. This resource is expected to yield 12.7Mt of minus 45-micron quality kaolin.

The company is looking to initially fast-track the project to provide high-purity Poochera kaolin-halloysite feedstock for the ceramics, paper, paint, plastics, rubber, environment and pharmaceutical sectors.

Andromeda is also collaborating on researching new technologies with the University of Newcastle including generating HPA for the LED and lithium battery markets.

Meanwhile, a second round of HPA testing on the Poochera kaolin-halloysite ore produced 99.9946% aluminium oxide via a single purification stage which involved a standard hydrochloric acid two-stage dissolution/precipitation purification method.

According to the company, the result confirmed the potential to provide “world class” feed material to produce HPA.

Andromeda is evaluating whether it can create a 99.999% pure HPA via standard multiple purification stages.

Australian Bauxite (ASX: ABX)

Australian Bauxite recently announced its wholly-owned subsidiary ALCORE Ltd has secured global licence rights to refine bauxite using ALCORE technology to produce aluminium fluoride and other co-products including HPA.

The company’s chief executive officer Ian Levy said the potential exists for HPA to be generated using ALCORE technology.

A stage one pilot plant based on ALCORE technology is under construction in New South Wales.

Meanwhile, Australian Bauxite holds 100% of 14 bauxite prospective tenements across Queensland, NSW and Tasmania.

The tenements total 914sq km and the company began bauxite mining at Bald Hill in Tasmania in late 2014. It was the first new bauxite mine in Australia in 35 years.

In addition to processing specialty materials from the bauxite, Australian Bauxite claims its projects are favourably located for direct shipping of the material both locally and overseas.

Collerina Cobalt (ASX: CLL)

Belying its name, Collerina Cobalt is focused on fast-tracking to HPA production using its proprietary solvent extraction and refining process using readily available industrial products as its feedstock.

Unlike the other disruptive technology developers that are looking to use kaolin as the feedstock source, Collerina believes by using industrial feedstock that it is reducing the capital required to begin producing HPA, as well as eliminating the mining and associated acid plant, leach vessels, filtration, naturalisation circuits or tailings facilities.

Collerina carried out its first HPA batch process run in July after a solvent extraction mini run a month earlier.

Assay results on the HPA generated during Collerina’s first solvent extraction test run confirmed it was 99.99% pure on an elemental basis.

Additionally, x-ray diffraction analysis determined the HPA was a desired crystal form.

A prefeasibility study on producing HPA via its proprietary technology is due to wind up in October.

Collerina has also identified secure premises to complete its second mini-rig run, as well as hosting the pilot plant for the upcoming definitive feasibility study.

Additionally, Collerina has ordered long lead items for its pilot plant, with the definitive feasibility study using the pilot plant scheduled to begin as soon as the prefeasibility study has concluded.

FYI Resources (ASX: FYI)

FYI Resources is another upcoming HPA producer hoping to bypass the traditional manufacturing method with its 100%-owned Cadoux kaolin deposit in WA.

Independent testing on Cadoux feedstock has produced HPA ranging from 99.996% to 99.997% – exceeding the company’s target of 99.99% purity.

This testing has confirmed FYI can generate consistent grades of HPA using the Cadoux ore, with FYI planning to transport the ore to Kwinana for refining into HPA before exporting to global markets.

“These excellent results clearly and independently demonstrate that we are on the right path to proving a proprietary HPA flowsheet that supports realisation of a world class commercial strategic commodity refinery,” FYI managing director Roland Hill said.

The metallurgical results are part of a prefeasibility study into the potential operation.

A mining study update released in late August indicated an operation where 240,000tpa of waste and ore was mined. The study revealed campaign mining with continual processing was a viable avenue.

The current resource of 16.1Mt at 11.76 aluminium is capable of supporting a 50-year mine.

Back in July, FYI met with 15 industry participants during a trip to China to get a gauge on the region’s requirements, pricing and demand.

Nova Minerals (ASX: NVA)

During the 2018 financial year, Nova Minerals looked to acquire 100% of private entity Halcyon Resources, which is advancing the Tambellup kaolin project in Western Australia in order to develop an HPA operation.

However, after due diligence, Nova’s board felt the financial input required to advance the project was not in the company’s best interests.

Instead, Nova agreed to maintain a 26.3% interest in Halcyon and pay the company $55,000.

As a result, Nova was given the right to appoint a director to Halcyon’s board.

Historic drilling at the kaolin project identified a shallow, flat lying ore body, which Nova anticipates is easily upgradeable to a JORC resource with minimal additional exploration.

Halcyon has also developed a proprietary technique for producing HPA, which it has called the Griffin Process.

Nova believes the project has “real merit” and its stake in Halcyon allows it to retain “significant exposure” to the project.

Platina Resources (ASX: PGM)

Platina Resources is evaluating the potential of producing HPA as a by-product from its Owendale scandium, cobalt and nickel project in NSW.

The company produced a small sample of HPA during a metallurgical test work program. Aluminium was first generated from clarified leach solutions following the recovery of scandium in the high-pressure acid leach plant.

Platina then went on to refine the aluminium extracted from the solution to create HPA.

In the first refining attempt, Platina produced a 99.989% pure HPA.

The company plans to carry out further testing to determine the economic viability of generating HPA at Owendale.

“The results demonstrate that Platina has the ability to produce a very high quality by-product, adding another potential revenue stream for the project,” Platina managing director Corey Nolan said.

Pure Alumina (ASX: PUA)

Formerly known as Hill End Gold (ASX: HEG), the company transformed to Pure Alumina in early November 2018.

The transformation reflects the company’s pursuit of producing 99.99% HPA using its Yendon kaolin project in Victoria, and its gold asset disposal.

In mid-November, Pure Alumina shipped its first HPA samples to synthetic sapphire manufacturers, lithium-ion battery separator producers and a phosphate producer.

Pure Alumina anticipates it will despatch more HPA samples to other potential customers shortly.

The company plans to generate 8,000tpa of HPA and is looking to establish a commercial demonstration-scale plant to generate larger HPA quantities to send to customers.

By following this strategy, Pure Alumina anticipates an early cash flow. The company also expects this will help it secure financing to construct the 8,000tpa HPA plant.

A pre-feasibility study was published in June that estimated capital costs of US$271 million to generate EBITDA of US$133 million.

Pure Alumina anticipates the Yendon kaolin resource of 3.7Mt is enough to underpin 39 years at the 8,000tpa HPA production.

A definitive feasibility study is underway, with the company hoping to commission the pilot plant in the first quarter of 2019 and move to making a final investment decision by the September quarter of that year.

Syrah Resources’ (ASX: SYR) founding director Tolga Kumova is one of Hill End’s top five shareholders with a 6% stake.

High Purity Alumina stock tracker

SEE ALSO:

– Gold stocks on the ASX

– Silver stocks on the ASX

– Lithium stocks on the ASX

– Cobalt stocks on the ASX

– Graphite stocks on the ASX

– Nickel stocks on the ASX

– Rare earth stocks on the ASX

– Zinc stocks on the ASX

– Mineral sands stocks on the ASX

– Vanadium stocks on the ASX

– Uranium stocks on the ASX

– Tin stocks on the ASX

– Tungsten stocks on the ASX

– Hydrogen stocks on the ASX

– Oil and gas stocks on the ASX

– Cannabis stocks on the ASX