WA Chief Scientist says it would be ‘tragic’ if Lithium Valley opportunity slips

Many advocates believe developing a Lithium Valley in WA will substantially increase Australia’s exposure to the trillion-dollar new era battery value chain.

Australia has a “once in a life-time” narrow window of opportunity to carve out a decent slice of the new-era battery pie and evolve from a mere “dig and grow” country to a globally competitive downstream battery manufacturer, according to Western Australia’s Chief Scientist Professor Peter Klinken.

Regional Development Australia (RDA) released a report in May establishing a case for a WA-based “Lithium Valley”, which would involve processing the state’s energy metals and increasing Australia’s exposure to the A$213 billion battery chain.

At the moment, Australia is primarily a “dig and grow” economy – focused on shipping its ore overseas for further processing, Prof Klinken told Small Caps.

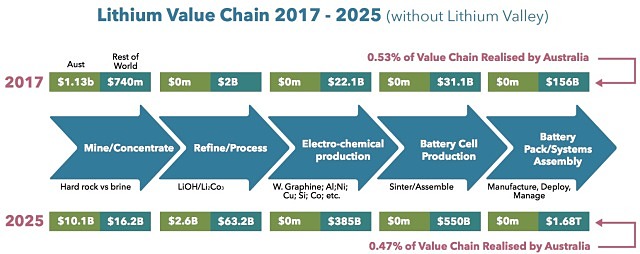

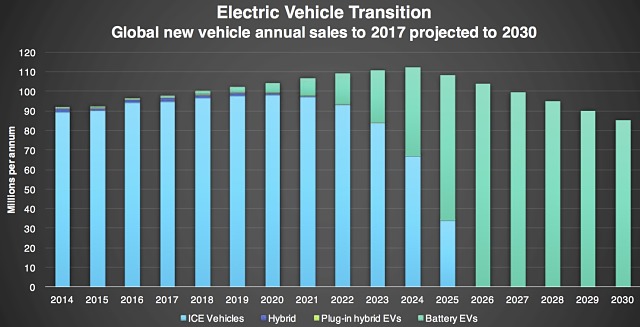

The “dig and grow” resources industry has certainly bolstered Australia’s economy throughout the years, but the RDA and other industry stakeholders have begun a push to secure a substantial portion of the downstream value chain which is projected to soar to around A$2 trillion by 2025.

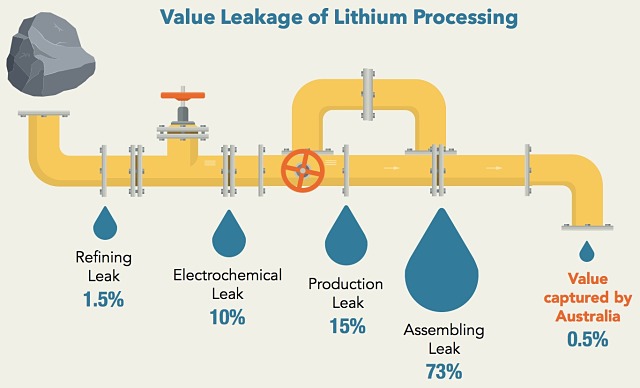

Australia currently captures only 0.5% of the lithium value chain.

RDA estimates that WA currently recovers a little more than A$1 billion of that A$213 billion battery chain from mining the metals. However, the economic value of goods increases “sharply” the further up the value chain they go.

By boosting secondary processing capacity alone, WA could capture up to 27% of the chain’s trillion-dollar value, or A$57 billion, the RDA estimates. This number would be even larger if entire batteries were manufactured onshore.

A Lithium Valley would have numerous positive flow-on effects for Australia’s economy including jobs, prosperity and strategic advantages as a trading partner.

However, unless the Federal Government comes to the party, Australia’s portion will remain a meagre 0.5%, despite the fact it possesses all the raw materials, capability and experience to carve a bigger slice of the pie.

RDA has likened Australia’s current opportunity in the surging battery chain to the rise of Silicon Valley in the US, which now has an estimated value of US$2.8 trillion.

The lithium value chain is set to grow tenfold within the coming decade.

Commenting on the narrow window of opportunity to partake in this new technology era, Prof Klinken said it would be “bordering on tragic” not to take advantage.

“We’re missing out on something like 99.5% of the value of batteries. We have all the elements and we only get 0.5% of the value out of all of this.”

“That doesn’t seem to make a lot of economic sense to me,” he said.

He cautioned that there were many more countries in the world that want to play in this rapidly surging space.

“We’ve got a window, and we have to make sure we act and grasp the opportunities before the window closes,” he explained.

“Otherwise, in my view, future generations will look back on this and go: ‘how did you guys let such an opportunity slip when you had so many of the cards necessary to go down this pathway?'”

Powerless in an emerging battery world

Despite calls from the Association of Mining and Exploration Companies (AMEC), RDA, major universities and other prominent stakeholders including WA Governor and former Deputy Prime Minister of Australia Kim Beazley, the Australian Federal Government has had little to say on the opportunity.

“I haven’t heard a lot from Federal Government. Australia, and WA, in particular, is the world’s largest producer of lithium, and I haven’t seen a strong statement from the Commonwealth in this area,” Prof Klinken noted.

“We can’t take these remarkable resources for granted. We need some sort of a strategic plan on how we are going to manage these incredibly valuable resources,” Prof Klinken added.

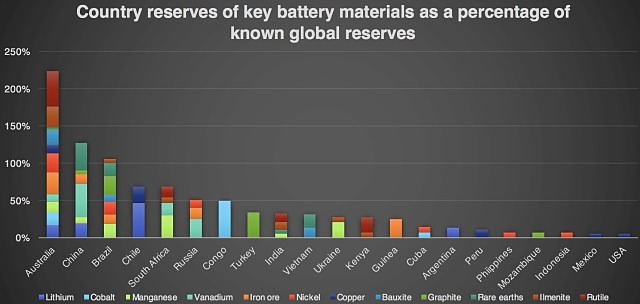

Australia has all the raw materials necessary to create lithium-ion batteries.

“A lot of other countries and jurisdictions in general, like the EU and the US have a list of critical elements – the elements that are absolutely essential for their future.”

“And, I don’t think Australia has such a list,” he said.

According to Lithium Australia’s (ASX: LIT) managing director Adrian Griffin, the Federal Government has gone beyond mere inaction to “jeopardising” the opportunity, with the research and development (R&D) rebate ceiling that was announced in its latest budget.

Mr Griffin told Small Caps that the R&D cap would “destroy any hope” of establishing a locally based Lithium Valley, with more incentives available to battery technology developers in other regions including Europe.

“Australia’s lithium industry risks being consigned to international backwaters if such an opportunity to become a global front-runner in the emerging battery technology race is allowed to slip,” Mr Griffin added.

R&D rebate cap

Until this year, the Federal Government’s R&D rebate did not have a ceiling. However, the 2018 Federal budget has now stunted the R&D rebate at A$4 million for companies that generate less than A$20 million a year in revenue.

Mr Griffin argued the capped rebate made Australia uncompetitive compared to other jurisdictions that offer far more R&D incentives.

“Clearly, if we are to pursue the Lithium Valley concept with passion, as we all wish to, the Federal Government needs to recognise the innovative status of the industry, as it does with biotech, and retain an R&D environment competitive with other jurisdictions and this developing industry,” Mr Griffin said.

Lithium valley

Signs of a fledgling Lithium Valley are emerging with lithium processing plants under construction at two Kwinana sites.

Tianqi Lithium is constructing a two-stage lithium hydroxide processing plant in Kwinana, which is expected to cost the company A$700 million all up.

Additionally, Kidman Resources (ASX: KDR) and joint venture partner Chilean-based SQM have proposed a lithium carbonate or lithium hydroxide refinery in Kwinana.

However, RDA points out these plants were based on business decisions made months-to-years ago.

Should Lithium Valley eventuate, the anode, cathode, chemical and battery manufacturing hub would enable Australia to transition to a “new energy” economy, drawing on all the available raw materials and experience the country has to hand.

However capital investment in these downstream refining and battery manufacturing facilities of A$34.1 billion is essential.

It’s not all about lithium

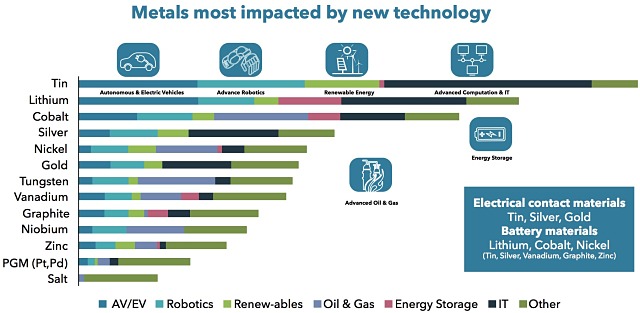

The burgeoning new energy era isn’t just about lithium.

Other critical metals in this emerging energy boom include nickel, manganese, graphite, cobalt, vanadium, tin, tantalum, manganese, and rare earths.

Other metals used in battery technology often overlooked.

Additionally, with numerous innovative battery formulas under development, novel demand may emerge for other plentiful WA minerals including titanium dioxide, which disruptive technology developer UltraCharge (ASX: UTR) has harnessed to generate a cost-effective alternate material for the lithium-ion battery anode.

Speaking with Small Caps UltraCharge chief executive officer Kobi Ben-Shabat pointed out the company had installed a pilot plant in Israel to generate its titanium dioxide anode material, but the company hoped to base its full-scale operation in Lithium Valley.

However, this is not yet possible and may never be if smaller companies are offered little support to develop their technology and plants onshore.

Mr Ben-Shabat said the Federal Government needs to do much more to enable companies to pursue a desired pathway of downstream processing and manufacturing in Australia.

In the vanadium battery space, Australian Vanadium (ASX: AVL) managing director Vince Algar told Small Caps the Federal Government’s rebate cap would “absolutely” impact any new technology a smaller company was attempting to get off the ground including those advancing vanadium redox flow batteries.

Mr Algar noted the “woefully low” R&D rebate cap would place a “massive restriction” on companies that wanted to add value here in Australia.

On the flip side of the coin, Australian heavy rare earths producer Northern Minerals (ASX: NTU) is an example of what government support and the R&D rebate can achieve.

The company just officially opened its Browns Range heavy rare earths pilot plant in WA, making it the world’s first heavy rare earths producer outside of China.

“I note that the government’s proposed changes to the R&D rebates would make it very hard to build this project had we been starting this financial year and ask the government to preserve the current R&D rebate arrangements,” Mr Baku said at the plant’s official opening.

Silicon Valley – when it’s done right

The famed US-based Silicon Valley in California is an example of what can happen when innovation and investment in new technology are encouraged and facilitated.

Silicon Valley became renowned around the world in the 1980s as the birthplace of the silicon chip and all IT technological innovations.

The valley has weathered various economic cycles since its inception and has continued to evolve and is now estimated to be worth US$2.8 trillion.

Government leadership urgently required

AMEC has joined RDA and directed the strong industry chorus calling the Federal Government to step up and provide leadership and assistance in getting this fortuitous opportunity off the ground.

Similar to other stakeholders, AMEC’s recommendations to the Federal Government include another request to retain the uncapped R&D rebate.

“This is critically important in the context of an extremely competitive international investment market,” the organisation stated.

The body says collaboration is also critical, with governments, industry and research sectors needing to work together to capitalise on the “once-in-a-generation” chance.

Mr Griffin added the Federal Government needs to review its policies and provide a “carve out for the battery sector”, similar to what it has done for the biotech scene on the basis it is an “innovative” industry.

The shift to electric vehicles has begun.

He pointed out that although biotech is innovative, it is “hardly new” and new era batteries are a fledgling industry that has only been around in a large way for five years.

“It’s not going to happen without Federal Government help. We need the policies. We need the areas to put these in operation and we also need Federal Government assistance to get there,” Mr Griffin said.

“Providing Australia’s battery industry with preferred status under the R&D rebate scheme is a small price to pay for achieving first-mover status, worldwide industry upside and leadership via WA’s Lithium Valley,” he added.

WA State Government on board

Speaking with Small Caps earlier this year, WA Minister for Mines and Petroleum Bill Johnston said the lithium battery technology was “a real opportunity” for Australia, not just in mining but downstream processing.

“We’ve got good technology companies here that are able to support mining, but also processing, and the further value adding in the battery metals space,” he said.

The WA State Government has backed the mounting call to action and committed A$5.5 million towards installing a New Energy Industry Cooperative Research Centre to advance Lithium Valley and other renewable energy technologies.

However, this research body is also dependent on Federal Government funding and collaboration to be effective.

“The reason that WA’s mining sector is so successful is because it’s about the applied application of technology, it’s about being at the forefront of innovation. The future success of the industry will be about continuing to apply technology,” Minister Johnston said.

Opportunity vanishing

As pressure intensifies on the Federal Government to urgently act, Prof Klinken cautions the narrow window of opportunity is vanishing.

“I see it as such an important moment – certainly for this state, and the whole country. It will give a big boost to the nation, psychologically.”

“We can’t afford to sleep walk into the future,” Prof Klinken said.

“I can’t think of another occasion in my lifetime where everything is lined up. You have all the elements. You’ve got everything in its place,” he added.