Australian Federal Government finally breaks silence on trillion-dollar lithium-ion opportunity, action needed

Australian Government Minister for Resources and Northern Australia Matthew Canavan said “it was time” for Australia to seize the opportunity to expand its presence across the lithium-ion battery value chain.

The Australian Federal Government has broken its silence after releasing a much-awaited report into a “once in a lifetime opportunity” that the $213 billion lithium-ion battery value chain presents to the country with its abundant resources and expertise.

For months, industry groups have been calling on the federal government to take action with Western Australian chief scientist Peter Klinken telling Small Caps earlier this year it would be “tragic” if the nation let this chance slip to boost Australia’s exposure to the value-chain, with the lithium-ion value chain forecast to be worth around $2 trillion by 2025.

Despite Australia hosting most of the resources needed to make the lithium-ion battery, Australia’s mining sector remains a “dig and grow” industry – with the country’s rich battery mineral resources exported overseas for downstream processing and converting into lithium-ion batteries.

Australia vs Rest of the world in the lithium value chain from 2017-2025.

As a result, the country captures a meagre 0.53% of the current $213 billion value chain and if action isn’t taken urgently enough, it will lose out on this narrow window of opportunity to secure a substantial slice as the new energy era continues to grow.

The Australian Trade and Investment Commission (Austrade) has now released The Lithium-Ion Battery Value Chain – New Economy Opportunities for Australia.

Much of the report draws on similar findings published earlier this year by the Region Development Australia (RDA) and Association of Mining and Exploration Companies (AMEC), which urge the federal and state governments to act now so that Australia can capture a slice of the trillion-dollar lithium battery pie in years to come.

Commenting on the report’s debut, the Australian Government’s Minister for Trade, Tourism and Investment Simon Birmingham said the government recognises the “one in a generation opportunity” lithium-ion value chain poses for the country.

“At the moment, Australia produces about half of the world’s lithium, but once it’s mined out of the ground, it’s shipped offshore, with all of the value-creation activities such as processing and battery manufacturing occurring overseas,” Mr Birmingham said.

“Australia is uniquely blessed with numerous rare earths, that are increasingly important both economically and strategically across the globe. Our ambition is to drive enhanced investment across the value chain of commodities like lithium,” he added.

Time for action

Lithium Australia (ASX: LIT) managing director Adrian Griffin was cited as a major contributor to the report offering up his views and insights.

However, Mr Griffin told Small Caps although the federal government now recognises the opportunity greater exposure to the lithium-ion value chain will offer, it needs to act “urgently”, or the opportunity will slip through Australia’s fingers.

He added the government had even “damaged” the opportunity by changing the research and development rebate policy.

The government’s new policy proposes a research and development rebate cap where, before, none was present.

In the 2018 budget, the government stated the R&D rebate would be stunted at $4 million for companies that generate less than $20 million a year in revenue.

“Lithium Australia would like to see the government reverse its decision on that policy or provide the battery industry with a carve out,” Mr Griffin said.

“We are looking at research and development programs that are very significant in terms of capital requirements to get this off the ground in the required time,” he explained.

As a result, Mr Griffin said the company was reviewing other countries to establish its processing plant due to better research and development financial incentives available in those regions.

In addition to attracting foreign investment, which the government recognises as a priority, Mr Griffin said the approval procedures needed to be streamlined and expedited across the board – noting that all permitting, and approvals need to be in place before a company can secure finance or investment.

He said one way of expediting permitting processes would be to have pre-approvals in place at various sites throughout the country where land can be used for a designated application.

“That would speed the process up enormously.”

“We are facing a situation where there’s an exceptionally small time-frame to get this in place – if it can indeed be done.”

“We can’t afford to waste time.”

He added implementing free trade zones would enable manufacturing goods to be brought into Australia.

“Effectively, import and export without duty and if you did that, you can streamline the manufacturing processes and a lot of the administration.”

“We’ve got to get it moving and have plants under construction and people committed to an investment within the next two years,” Mr Griffin added.

Abundant resources

With a booming lithium mining sector, Australia has an abundance of almost all the minerals required to generate the lithium-ion battery and its components for domestic and world markets.

The country is currently the world’s largest hard rock lithium spodumene producer and Talison Lithium’s Greenbushes mine in WA hosts the world’s greatest known lithium spodumene reserves.

Other lithium operations in Australia include Galaxy Resources’ (ASX: GXY) Mount Cattlin, Mineral Resources (ASX: MIN) and NeoMetals’ (ASX: NMT) Mount Marion, Kidman Resources’ (ASX: KDR) Earl Grey joint venture, Alliance Mineral Assets’ (ASX: A40) Bald Hill, Pilbara Minerals’ (ASX: PLS) Pilgangoora, and Altura Mining’s (ASX: AJM) Altura Lithium.

In addition to the operating mines, there are many ASX-listed lithium explorers scattered through Australia and the world.

It’s not just about lithium, though, Australia hosts plentiful amounts of most other essential battery metals including graphite, nickel, manganese, cobalt, copper and zinc.

Australia is abundant in mineral resource reserves relevant to manufacturing lithium-ion batteries.

There is also the potential to for Australia expand into other energy storage technologies including the vanadium and zinc redox flow batteries that require vanadium and zinc as critical ingredients.

Lithium-ion battery consumption

Driving the lithium-ion battery growth are the electric vehicle and renewable energy spaces.

Deutsche Bank predicts global battery consumption will surge five-fold in the next decade.

As a result, demand for lithium carbonate equivalent, a key ingredient in the battery, is predicted to soar from 214,000t in 2017 up to around 587,000t in 2025.

Options emerging for battery recycling

In addition to providing the requisite minerals, Australia has to potential to “lead the world” in recycling and reusing lithium-ion batteries.

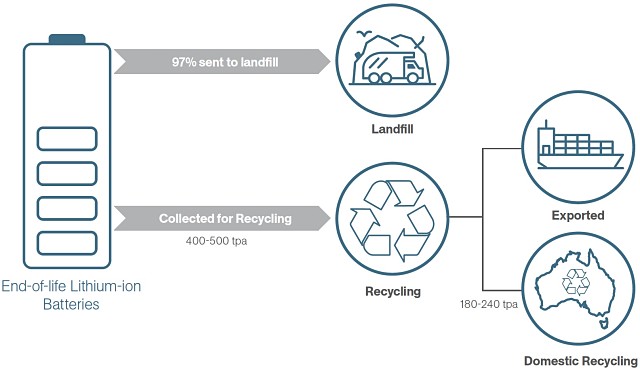

According to the CSIRO, currently of the 3,300t of lithium-ion batteries that are thrown away annually, only 2% of the waste is recycled.

Battery recycling flow diagram.

The CSIRO suggests up to 95% of the waste can be reused in new batteries or moved to other sectors.

Lithium Australia is looking to capture this market through its subsidiary RCARC, which is developing technology to recycle end-of-life lithium-ion batteries.

WA, Queensland and NT lead the way

In response to earlier calls to take advantage of the burgeoning lithium-ion battery value chain, the WA State Government installed the Lithium and Energy Materials Industry Taskforce to capitalise on the state’s unique position.

As part of this, the world’s largest lithium producer Albemarle will build a $1 billion lithium hydroxide plant in WA’s south west.

This is the state’s second lithium hydroxide facility, with Tianqi constructing a $700 million plant in Kwinana.

Additionally, Kidman Resources and its joint venture partner propose to build either a lithium carbonate or lithium hydroxide operation.

Meanwhile, the Queensland Government has committed $3.1 million into a feasibility study for a 15GWh Gigafactory in Townsville.

And, in the Northern Territory, a 1GWh lithium-ion battery manufacturing facility is in the planning stages.

Ducks line up in a row for Australia’s new energy era

While Australia has the expertise and skills necessary to lock-in more of the lithium value chain, with a highly educated workforce, and one of the world’s safest, cleanest and most productive mining sectors, the report has identified it doesn’t yet have domestic manufacturing capability for some elements.

At the stage, Australia does not possess the ability to refine and manufacture coated spherical graphite for the battery anode.

Other capabilities needed include manufacturing polymer separators, cell enclosure material, and copper and aluminium foils for electrodes and electrolyte.

However, the Australian Government Minister for Resources and Northern Australia Matthew Canavan said “it was time” to seize this unique opportunity – pointing out that, with the right government policies in place, Australia could very well become a leading supplier of lithium-ion batteries and its components.

Though, Mr Griffin and Prof Klinken have both cautioned, this opportunity has a very narrow window.

“We’ve got a window, and we have to make sure we act and grasp the opportunities before the window closes,” Prof Klinken said.

“We’re missing out on something like 99.5% of the value of batteries. We have all the elements and we only get 0.5% of the value out of all of this.”

“That doesn’t seem to make a lot of economic sense to me,” he said.