Zinc stocks on the ASX: The Ultimate Guide

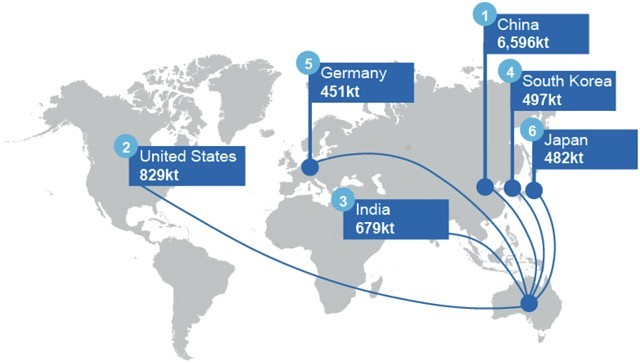

Australia is the world’s third largest zinc producer, while China consumes around half of global zinc output.

Numerous ASX companies have identified an opportunity in the zinc sector, which is predicted to remain in deficit this year due to minimal funds being invested into finding new reserves since the GFC and current zinc mine reserves rapidly depleting.

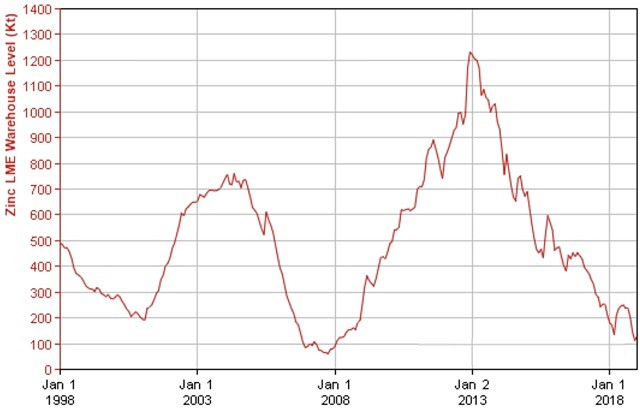

As a result of the ongoing deficit, zinc stocks on the London Metals Exchange plunged to 10-year lows in the December 2018 quarter.

By mid-December 2018, LME zinc inventories had lurched below 120,000 tonnes – down a whopping 90% on the 1.2 million tonnes in inventory recorded in December 2012.

London Metal Exchange (LME) warehouse levels of zinc in Kt.

Adding to the situation is China’s stricter environmental regulations, which have led to a curtailment of zinc mining and processing throughout the country and pressured zinc inventories.

Similar to LME stockpiles, zinc levels on the Shanghai Futures Exchange sunk to 10-year lows in the September quarter and remained there until the end of the year.

Due to a combination of the above and the increasing uptake of zinc in new technologies, most analysts claim underlying tight fundamentals will continue driving the market well in to the next decade.

This is despite the languishing price in recent months, which has been attributed to ongoing trade war tensions between the US and China.

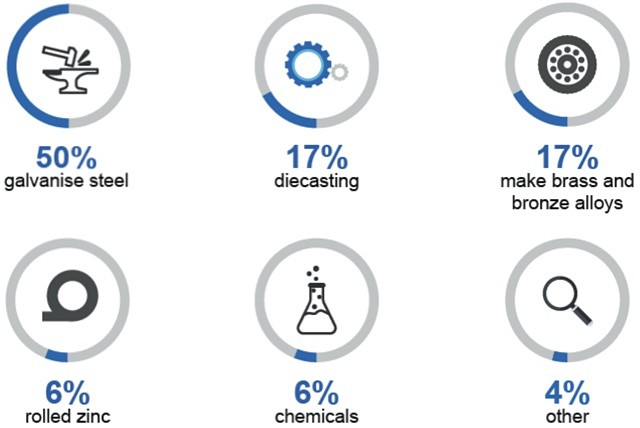

As the world’s fourth most commonly consumed metal, zinc is a critical ingredient in many applications and industries, with the global galvanised steel sector devouring half of global output in 2018.

What is zinc?

Chemically similar to magnesium, zinc consumption only lags behind iron, aluminium and copper.

Around 70% of the world’s zinc comes from mining, while the other 30% arises from recycling secondary zinc sources.

Zinc deposits are primarily sulphidic ore and the mineral is frequently found with lead, silver, copper and iron.

Coating galvanised steel in zinc can prolong its life up to 150 years.

Physically, zinc is a bluish-white and lustrous metal that is hard and brittle at most temperatures. However, it becomes malleable between 100° Celsius and 150°C.

Historical use

Zinc use can be traced back as far as 1400 BC where an impure zinc ore was alloyed with copper to create brass.

A Swiss-born German alchemist known as Paracelsus is believed the first person to document the metal’s name – calling it zincum or zinken in the 16th Century.

Isolation of metallic zinc is expected to have occurred in India before 1300 AD, and German chemist Andreas Marggraf was credited with generating pure metallic zinc in 1746.

William Champion then established a zinc industry in England soon after. He followed this up by building plants in Belgium and Silesia.

Centuries later, in 1940, zinc’s importance in biochemistry and nutrition was identified.

Zinc end uses

In addition to galvanised steel, zinc is used in a variety of everyday applications including human health, sunscreen, cars, cosmetics, aerospace, medicine and fertiliser.

When combined with other metals, zinc can increase the life span by protecting the alloy against corrosion.

Global uses of zinc.

The American Galvanizers Association claims coating galvanised steel in zinc can prolong the unit’s life up to 150 years.

In batteries, zinc can store six times more power than traditional battery systems. It also increases the range of electrical vehicles. And, unlike some other battery metals, zinc is used in other parts of the car including the frame.

Bullish zinc market fundamentals

One of the world’s largest zinc miners, Teck Resources revealed it anticipated 5Mt per annum of new zinc production would be needed to meet demand by 2027.

This is in addition to existing and fully committed supply, with even the pipeline of uncommitted projects believed insufficient to fill the gap.

Zinc mine production expected to peak in 2021.

Teck expects Chinese zinc demand, alone, to grow between 2% and 3% to about 8Mt annually by 2020.

In comparison, environmental and work safety inspections across China have cut production, with several operating mines depleted and affected by low grades.

According to Teck, new zinc projects across China have also been increasingly delayed.

Meanwhile, zinc inventories in Chinese warehouses are at record lows due to smelter cut backs and inventory drawdown.

On a global scale, the International Lead and Zinc Study Group revealed its zinc predictions for 2018 and 2019.

The group’s preliminary data indicates the global market for refined zinc metal was in a 305,000t deficit during the first nine months of 2018.

Additionally, the International Lead and Zinc Study Group expects global demand for refined zinc metal increased by 0.4% to 13.74Mt in 2018 and this will rise 1.1% to hit 13.88Mt in 2019.

On the production side of the coin, world zinc mine output is anticipated to have expanded 2% to 13.03Mt in 2018 and surge a further 6.4% to 13.87Mt in 2019 – just shy of the 2019 consumption forecasts.

Price of zinc

Tight supply and increased consumption pushed the zinc price to 10-year highs in early 2018 where it reached more than US$3,500 per tonne (US$1.60 per pound) – the highest price the metal has commanded since the global financial crisis (GFC) struck.

The GFC caused a depressed commodity market and prompted the zinc price to crash in early 2009 to around US$1,000/t (US$0.50/lb).

Historical zinc price chart.

Although down on its 2018 high, and currently trading under US$2,500/t, the zinc price is far from its pre-GFC spike where it exceeded US$4,500/t.

With zinc inventories reaching critical levels in 2018, Teck anticipates the market will become “very tight” – driving the price back up.

However, the Australian Government’s Resources and Energy Quarterly isn’t as bullish with the report predicting the zinc price will average US$2,775/t in 2019 and dip to a US$2,625/t average in 2020.

Zinc production and consumption

Australia possesses almost 30% of the world’s known zinc reserves and is currently the third largest zinc producer.

Australia holds 28% of the world’s known zinc resources.

Boosting Australia’s exports are MMG’s (ASX: MMG) Dugald River mine which opened in late 2017, New Century Resources’ (ASX: NCZ) newly operating Century asset and Heron Resources’ (ASX: HRR) recently commissioned Woodlawn operation.

However, China is both the largest zinc producing and consuming nation – swallowing up around 50% of global output.

Key zinc consumer markets.

Other large zinc consuming countries include the US, India, South Korea and Germany.

Emerging zinc battery technologies

As the energy storage revolution unfolds, one lesser known battery option is the zinc-bromine redox flow battery, which has a minimum 10-year life with deep daily discharging.

Advantages of the zinc-bromine battery is that it is scalable and can provide power in warm climates without the need for external cooling – withstanding temperatures up to 50 degrees Celsius.

The batteries are also less prone to thermal runaway events like other batteries such as lithium-ion and lead-acid formulas.

Additional advantages include manufacturing the battery from recycled and reused materials, with the zinc-bromine electrolyte material capable of being cleaned and re-used.

Redflow (ASX: RFX) is a small cap that manufactures and deploys zinc-bromine flow batteries. The company has installed numerous zinc-bromine battery for organisations in Australia and overseas including clients such as Optus.

Redflow’s chief executive officer Tim Harris said it is expected the global energy storage market will have attracted $620 billion in investment by 2040.

He added the redox flow battery market is forecast to be worth US$4.5 billion by 2028, with flow batteries coming “increasingly recognised” for their role in the space.

ASX-listed zinc stocks:

The underlying fundamentals of the zinc market remain strong for the next decade, with at least 5Mtpa of new zinc production required to meet demand.

With such strong fundamentals, Small Caps has compiled a list of the more notable zinc plays on the ASX:

3D Resources (ASX: DDD)

During the 2018 financial year, 3D Resources relinquished exploration licences in the east Kimberly area. However, it retained the mining licence over the Mt Angelo North deposit, which is part of the joint venture between 3D (80%) and Cazaly Resources (20%).

The parties are in discussions about how to extract value from the project, which has a resource of 1.78Mt at 1.21% copper, 1.99% zinc and 11.6g/t silver.

Adriatic Metals (ASX: ADT)

Adriatic Metals’ polymetallic Rupice deposit in Bosnia Herzegovina has revealed numerous high-grade mineralised intersections.

Assays returned in November included a 46m intersection grading 12.7% zinc, 9.6% lead, 309g/t silver, and 4.1g/t gold.

The deposit is part of Adriatic’s 100%-owned Vares project, which hosts historic zinc, lead, barite and silver mine workings.

A maiden resource for Rupice is due to be released by June 2019.

Adriatic is also advancing the nearby Veovaca deposit which has a JORC resource of 4.4Mt at 1.96% zinc and 1.11% lead.

Aeon Metals (ASX: AML)

Via its flagship polymetallic Walford Creek project in Queensland, Aeon Metals is exploring for zinc.

Although focused on the copper content, ongoing drilling at Walford Creek has returned zinc in numerous intersections with grades up to 12.12% zinc reported in 2018.

Within the 15.7Mt resource are several minerals including 129,000t of zinc.

Alacer Gold Corp (ASX: AQG)

Miner Alacer Gold Corp owns 50% of the Gediktepe project in Turkey.

The project’s polymetallic deposit comprises economic values of gold, silver, copper and zinc.

A definitive feasibility study (DFS) at Gediktepe is scheduled for completion in 2019.

The study builds on a September 2016 pre-feasibility study and reserve estimate that includes 779.2Mlb of zinc.

Alara Resources (ASX: AUQ)

Middle East-focused Alara Resources owns a majority stake in the Khnaiguiyah zinc and copper project in Saudi Arabia.

Alara has invested $30 million into developing the project including $23 million on a DFS.

Work on the project had stalled between 2014 and 2018 due to legal proceedings which were finalised in October 2018, paving the way for the company to apply for a mining licence to be reissued and evaluate development pathways.

A DFS was published in April 2013 and revealed reserves of 26.08Mt at 3.3% zinc and 0.24% copper.

The study estimated US$257 million of capital expenditure would be needed to create a 13-year operation that produced 80,000tpa zinc concentrate and 5,800tpa copper to attract more than $2 billion in revenue over the mine’s life.

Revenue projections were based on a zinc price of US$1.05/lb.

Alt Resources (ASX: ARS)

Up to 1% zinc has been uncovered in rock chip samples at Alt Resources’ Paupong gold project.

Drilling at the Windy Hill prospect at the project unveiled 0.8m at 1% zinc, 184g/t silver and 4.1% lead.

During 2019, the company plans to review data it’s collected in previous exploration and continue its regional reconnaissance work.

Alta Zinc (ASX: AZI)

Formerly known as Energia Minerals, Alta Zinc has several assets prospective for zinc including its flagship Gorno project in northern Italy.

The project was mined in the early 1980s before being shut down. Historic production yielded 55-60% zinc sulphide concentrates and 30-40% zinc oxide concentrates with minimal contaminants.

A pre-feasibility study is ongoing into re-commissioning and upgrading existing workings of the underground mine via a phased development strategy which will involve exploiting the Zorzone mineral resource which contains 3.3Mt at 4.9% zinc for 163,000t of contained zinc.

Alta also has additional exploration licences in northern Italy, WA and the NT that are believed prospective for zinc.

Anglo Australian Resources (ASX: AAR)

Anglo Australian Resources’ Koongie Park project in WA is prospective for base metals including zinc.

At the Sadiego deposit, 115,000t of contained zinc has been calculated, while 140,000t of zinc has been estimated at the Onedin deposit – both part of Koongie Park.

Airborne magnetic surveys have noted several more targets to be drilled across the project.

The company’s Leonora project is also believed prospective for zinc and other base metals.

Anson Resources (ASX: ASN)

Although initially exploring the Ajana project for graphite, Anson Resources has identified the potential for zinc at the project in addition to lead, copper and silver.

Previous drilling unveiled up to 3.04% zinc and Anson plans to carry out further exploration to include zinc and other minerals in the resource which is 390,000t at 6.5% lead.

Ardea Resources (ASX: ARL)

Ardea Resources owns the Lewis Ponds zinc, silver and gold project in NSW, which has multiple historic workings.

The company is looking at a bulk tonnage, low grade, open pit operation at the project which has a resource of 6.62Mt at 2.4% zinc.

Metallurgical test work on ore from Lewis Ponds indicates a 66% zinc concentrate can be produced using “off the shelf” processes.

However, Ardea has decided to spin out the Lewis Ponds project within the next 12 months.

Argent Minerals (ASX: ARD)

At its flagship Kempfield project, Argent Minerals has generated a commercial grade zinc concentrate while undertaking metallurgical test work.

The NSW-based project has a mineral resource of 520,000t zinc equivalent at 2% zinc equivalent. Argent has calculated an exploration target of 1Mt zinc equivalent grading up to 2.1% zinc equivalent.

Argent plans to firm up the resource through a 4,100m drilling program, which is due to be completed before the end of June 2019.

In addition to Kempfield, Argent secured tenements in Tasmania which are situated in the Mount Read Volcanics Belt which is prospective for zinc and other metals.

Argonaut Resources (ASX: ARE)

Argonaut Resources hasn’t completed any recent field work on its wholly-owned Kroombit project in Queensland.

However, the project has a 2009 resource of 5.2Mt at 1.9% zinc and 0.15% copper for 98,800t of zinc and 7,800t of copper.

The company has devised an exploration target of up to 1.5Mt at 2% zinc. Metallurgic test work has produced a 54% zinc concentrate.

Artemis Resources (ASX: ARV)

Multi-commodity explorer Artemis Resources has intersected zinc while drilling at the Whundo project in WA’s Pilbara.

Close to Artemis’ Radio Hill processing plant, drilling during the 2018 financial year unveiled up to 7.17% zinc as well as copper and cobalt.

Notable intersections were 12m at 7.17% zinc from 46m, 12m at 4.46% zinc from 34m and 5m at 4.24% zinc from 18m.

In October 2018, Artemis published an indicated resource for the project of 2.67Mt at 1.12% zinc and 1.14% copper for 29,992t of zinc and 30,419t copper.

Asaplus Resources (ASX: AJY)

Singapore-based Asaplus Resources has been developing the Beikeng mine in China’s Fujian Province, which is prospective for iron, zinc, lead and tungsten.

Asaplus owns 80% of the project, which has a resource of 1.058Mt grading 1.22% zinc, 1.53% lead. 27.52% iron and 0.58% tungsten.

The company aims to be in production during 2019 and has already stockpiled 25,000t at the site.

Aura Energy (ASX: AEE)

Aura Energy’s Haggan battery metals project in Sweden is under evaluation due to the rise in vanadium prices.

The project contains several minerals including low levels of zinc. However, Aura is focused on unlocking the vanadium content with the project set to be spun out on either the AIM or TSX in early 2019.

The new entity will be named Vanadis Battery Metals and Aura plans to retain 80% equity.

Aurelia Metals (ASX: AMI)

Located within the Cobar Basin in NSW, Aurelia Metals’ Peak Mine is undergoing an upgrade to include a zinc and lead processing circuit.

Peak has total reserves of 532,000t grading 6.15% zinc and resources of 10.8Mt at 1.04% zinc.

The company’s Hera and Nymagee projects also contain zinc, with Hera’s resource sitting at 2.5Mt grading 3.93% zinc and Nymagee’s totalling 3.78Mt at 1.63% zinc.

During the September 2018 quarter, Aurelia produced 2,249t of zinc.

Auroch Minerals (ASX: AOU)

Auroch Minerals recently completed a maiden drilling program at its Arden project in South Australia, with base metal mineralisation struck in all 10 holes.

A noteworthy intersection was 8.15m at 7.52% zinc and 0.02% lead from 57.65m, including 3.65m at 15.47% zinc and 0.02% lead from 62.15m.

Once targets have been identified, Auroch will carry out the next drilling phase at Arden in 2019.

The company is also exploring the Bonaventura project also in South Australia where recent assays were 6m at 1.53% zinc and 0.21% lead from 28.3m, including 1m at 4.5% zinc and 0.34% lead from 33.33m; and 7m at 1.65% zinc and 0.26% lead from 64.2m, including 1m at 4.14% zinc and 0.66% lead from 70.2m.

Aurora Minerals (ASX: ARM)

Aurora Minerals has a 25% interest in Peninsula Mines, which owns the Ubeong zinc, lead and silver project in South Korea.

For further information on Peninsula’s zinc project, please refer to the Peninsula entry in the guide.

Aurora surrendered its Glenburgh project, which was prospective for zinc, in May 2018.

Ausmon Resources (ASX: AOA)

Junior explorer Ausmon Resources has 100% stake in the Koonenberry project, which is prospective for copper, zinc, silver and cobalt.

A historic 2004 resource exists for the project of 5.75Mt at 1.03% copper, 0.35% zinc, 2.3g/t silver and 0.5g/t gold.

During 2018, Ausmon assayed a historic diamond hole from the project for its cobalt value and identified a 35.2m interval grading 460ppm zinc.

In 2019, Ausmon plans to accelerate exploration at the project’s main targets.

Austpac Resources (ASX: APG)

Mineral technology company Austpac Resources has discovered zinc and gold mineralisation at its Nhill exploration licence.

Austpac is in joint venture discussions regarding advancing the licence.

In addition to exploring at Nhill, Austpac has created a zinc and iron recovery process which can produce high purity zinc and pig iron from furnace dusts and spent pickle liquor, which are created during steel manufacturing.

Australian Mines (ASX: AUZ)

In 2018, Australian Mines spun off its Bali copper, lead, zinc project through Norwest Minerals, which officially listed on the ASX in late November 2018.

Australian Mines holds almost 30% of its spin out. For further information, please see the Norwest entry in this guide.

AusQuest (ASX: AQD)

Under a strategic alliance, AusQuest and South32 completed a 13-hole 2,860m drilling program at the Blue Billy zinc project during the 2018 September quarter.

The campaign was the second round of drilling for the joint venture. However, in early January, AusQuest said the program had “failed to provide significant improvement in zinc grade and/or thickness” compared to the results from the first drilling round.

Due to the lack lustre results, the strategic alliance was terminated and AusQuest said exploration at Blue Billy would not be progressing in 2019.

Azure Minerals (ASX: AZS)

After acquiring the Oposura zinc, lead and silver project in Sonora, Mexico in August 2017, Azure Minerals completed a scoping study on the project in October 2018.

The study revealed a capital expenditure of $69.9 million to develop an initial 5.3-year operation that would produce on average 19,000t of zinc, 10,000t of lead and 145,000oz silver annually.

With a 16-month payback period, the study predicts life of mine EBITDA up to $239 million and annual average net cash flow of $46 million.

Oposura has a resource of 2.9Mt at 5% zinc, 2.8% lead and 17g/t silver.

Azure has scheduled the pre-feasibility study for completion by mid-2019, with production pencilled in for the first quarter of 2021.

BHP Group (ASX: BHP)

Mining major BHP has a 33.75% stake in the Antamina zinc mine in Peru, with its share of zinc production reaching 120,000t in the 2018 financial year.

BHP’s portion of zinc output from the mine is expected to drop to 85,000t in 2019 – in line with the mine plan.

Meanwhile, BHP’s Minerals Americas assets includes projects in Brazil, Canada, Chile, Colombia, Peru and the US which are prospective for zinc and other minerals.

Carawine Resources (ASX: CWX)

During the latter half of 2018, Carawine Resources was actively exploring its Jamieson asset in Victoria and the Paterson project in WA’s Pilbara.

Previous drilling at the new Paterson tenement Red Dog unearthed 10m at 2,292ppm zinc and 653ppm lead from 92m, and 2m at 1,750ppm zinc, 203ppm lead, 776ppm cobalt and 377ppm copper from 56m.

During 2019, Carawine will be carrying out drilling for zinc and other minerals across both projects.

Cassini Resources (ASX: CZI)

Cassini Resources is targeting large scale zinc and lead mineralisation at its West Arunta project near Lake McKay in WA.

The company completed a 10-hole drilling campaign in the 2018 September quarter.

By early January 2019, assays from the program were pending.

Castillo Copper (ASX: CCZ)

The September 2018 quarter was described as a “transformational” period for Castillo Copper at its Cangai project in NSW.

Assays were published in August showing up to 6.04% zinc, 10.25% copper and 32.5g/t silver.

One intersection was 11m at 5.94% copper, 2.45% zinc and 19.13g/t silver from 40m, with several higher-grade intervals including 1m at 7.53% copper, 6.04% zinc and 30.60g/t silver.

Castillo plans to advance the project in 2019.

The company’s Broken Hill project is also prospective for zinc, with historic assays revealing up to 17.7% zinc in addition to elevated copper, lead and cobalt minerals.

Cazaly Resources (ASX: CAZ)

Cazaly Resources owns 20% of the Mt Angelo North joint venture with 3D Resources. The project is prospective for zinc and the joint venture is discussing how best to unlock the project’s value.

Meanwhile, Cazaly has an exploration licence for the Kurabuka Creek project in WA where BHP carried out previous exploration and uncovered up to 26.1% zinc from rock chip samples.

Once it receives the permit, Cazaly plans to begin actively exploring the project.

Celsius Resources (ASX: CLA)

Cobalt focused Celsius Resources is advancing its Opuwo cobalt, copper and zinc project in Namibia, which encompasses 1,470sq km and is close to power and other infrastructure.

In addition to cobalt, the project is prospective for zinc and has a resource of 112.4Mt grading 0.43% zinc.

Celsius has generated an exploration target up to 51Mt grading 0.82% zinc.

Metallurgical studies have revealed a 46% zinc recovery rate, and Celsius is progressing exploration across the project with a pre-feasibility study due to be completed in the September quarter of 2019.

Centrex Metals (ASX: CXM)

Centrex Metals owns the Goulburn zinc project tin NSW. Although no on-ground exploration was carried out at the project in 2018, Centrex said it planned to drill targets in 2019.

Assays from preliminary drilling in 2017 were 2m at 1.37% zinc and 0.31% copper, and 1m at 1.1% zinc.

Consolidated Tin Mines (ASX: CSD)

Next off the rank is Consolidated Tin Mines, which is already producing from its Mount Garnet underground mine in Queensland’s north.

During the September 2018 quarter, the company processed 36,299t of zinc, lead and copper ore with an average zinc grade of 6.16%.

This generated 1,817t of zinc concentrate during the period.

The company is also exploring for zinc and other commodities at its Einasleigh project, which is also in Queensland.

Consolidated Zinc (ASX: CZL)

Consolidated Zinc recently acquired 90% of the Plomosas project in Mexico.

The Plomosas mine was recommissioned in September 2018, with production ramping up.

Consolidated Zinc expects production will stabilise in 2019 and begin delivering free cash flow from the June quarter.

Historical mining at the project produced 2Mt of ore grading 22% zinc and lead. According to Consolidated Zinc, the project’s mineralised zones remain open at depth and along strike.

Core Lithium (ASX: CXO)

Core Lithium (formerly Core Exploration) owns the Yerelina zinc project in South Australia, which covers 1,000sq km in the state’s north.

During 2016, Core was actively drilling the project and pulled up a 17m intersection grading 1.4% zinc and lead, as well as 19g/t silver.

Higher grade zones were identified including 4m at 3% zinc, 1% lead, and 59g/t silver. Meanwhile, sampling over a 1km strike produced up to 14.7% zinc, 12.7% lead and 567g/t silver.

Dateline Resources (ASX: DTR)

Dateline Resources is looking for a joint venture partner for its Udu project in Fiji.

The deposit was uncovered in 1957 and mined for one year in the 1960s. Records indicate the 32,435t of material was extracted containing copper, zinc, gold and silver. Average zinc grades were 6.7%.

Dateline has firmed up a JORC resource of 4.5Mt at 3.9% zinc and 1.2% copper and identified prospects for follow up exploration.

De Grey Mining (ASX: DEG)

Gold focused De Grey Mining is evaluating base metal targets across its wholly owned Turner River project in WA, which has a resource of 3.47Mt at 3.2% zinc for 111,000t of contained zinc, in addition to lead, copper, gold and silver.

However, the company is actively exploring Turner River and the adjacent Indee project for gold.

Encounter Resources (ASX: ENR)

Encounter Resources owns the Yeneena zinc, lead, copper and cobalt project in WA’s Paterson Province and is seeking a partner to advance exploration.

The company also has a 75% interest in the nearby Millennium zinc project, which is to Yeneena’s north-east.

Encounter has identified a 3km zinc anomaly at Millennium and previous drilling identified 38.7m at 0.9% zinc, 91.8m at 1.6% zinc, 7m at 4.8% zinc, and 0.7m at 36.7% zinc.

Enterprise Metals (ASX: ENT)

In October 2017, Enterprise Metals acquired the Murchison project, which is prospective for gold, copper and zinc.

The company added to its 700sq km landholding in the region by applying for a further 80sq km in tenements in late December 2018.

In 2019, Enterprise plans to test the new tenements with modern airborne geophysics.

Relevant data will be collated to pinpoint drill targets.

Europa Metals Ltd (ASX: EUZ)

Formerly known as Ferrum Crescent, Europa Metals is focused on advancing its Toral project in northern Spain, which is prospective for lead, silver and zinc.

Toral has a resource of 16Mt at 7.5% zinc equivalent, equating to about 640,000t of contained zinc.

In December 2018, Europa released a scoping study on Toral which evaluated three underground development and production scenarios.

During 2019, Europa plans to carry out further exploration to upgrade the resource and progress the project towards a feasibility study.

First Cobalt Corp (ASX: FCC)

Zinc mineralisation has been identified at First Cobalt Corp’s Kerr target, with up to 0.68% zinc returned, along with cobalt, silver, nickel, copper and lead.

Drilling was ongoing at Kerr during 2018. Although low levels of zinc are present in drill results, First Cobalt Corp is focused on the cobalt content within Kerr.

Force Commodities (ASX: 4CE)

Previously known as Sovereign Gold, lithium-focused Force Commodities agreed to sell its wholly-owned Halls Peak zinc project in June 2018 for $665,800 in cash and shares.

The project is located in NSW and the sale is subject to the purchaser XS Resources listing on the ASX.

Halls Peak comprises two exploration licences and previous drilling has unearthed multiple broad intersections with zinc, lead, copper, silver and gold mineralisation.

Better results include 102.3m from surface grading 4.4% zinc and lead, 0.39% copper, 88.94g/t silver and 0.26g/t gold; and 43.3m at 5.06% zinc and lead, 0.98% copper, 23.79g/t silver and 0.14g/t gold.

The multiple thick intersections comprise numerous higher-grade intervals with up to 16.78% zinc.

XS Resources is attempting to raise $4.5 million via the issue of 22.5 million shares at $0.20 each. However, by mid-December 2018, the company had only received applications amounting to $17,000 and extended its timetable to list on the ASX to early March 2019.

Frontier Resources (ASX: FNT)

Frontier Resources is exploring the Muller Range and Bulago projects, which encompass 260sq km in Papua New Guinea.

The company is in discussions regarding advancing the projects, with planning for field work underway.

Historic exploration at Muller found lead-zinc soil anomalies including 390m of 0.17% lead and 0.33% zinc.

Galena Mining (ASX: G1A)

Although drilling has encountered zinc at Galena Mining’s wholly-owned Abra project, it has not been included in the resource and reserve estimates.

Drilling in December 2017 returned 55.57m at 7.8% lead, 1.6% zinc and 20ppm silver.

Galena stated zinc, along with copper, and gold were present but of a “lower tenor”. This is despite high-grade zinc sulphide mineralisation within central parts of the deposit’s core zone.

Gateway Mining (ASX: GML)

While advancing its Gidgee gold project in WA, Gateway Mining identified copper and zinc potential at the asset after reviewing historical data.

The zinc zone was 80m at 0.23% zinc from 150m, 48m at 0.16% zinc from 165m, and 30m at 0.23% zinc from 25m.

According to Gateway, the mineralised trend extends along 16km of strike.

The company will consider evaluating the project’s copper and zinc potential further as part of its gold focused exploration program.

Golden Cross Resources (ASX: GCR)

Golden Cross Resources is exploring for zinc at its Cobar Region and Quidong projects in NSW.

Previous exploration at Quidong uncovered up to 22.87% zinc.

Intersections were 4.7m at 1.2% zinc, 0.1% lead and 0.1% copper, 15.2m at 0.9% zinc and 0.32% lead, and 16m at 4.9% zinc, 2.15% lead and 0.1% copper.

Golden Cross plans to test the mineralisation at Quidong further once it has secured regulatory approvals.

Golden Deeps (ASX: GED)

At Golden Deeps’ Abenab vanadium project in Namibia’s north-east, the company is looking at generating zinc and lead as by-products under a stage two development.

The project has a resource of 1.12Mt at 1.28% vanadium pentoxide, 3.05% lead and 1.25% zinc.

Historic production at the project comprised 102,000t of concentrate grading 18% vanadium pentoxide, 13% zinc and 42% lead.

Metallurgical test work on stockpiled low-grade Abenab ore achieved a concentrate with 21% vanadium pentoxide, 14% zinc and 53% lead.

Golden Deeps owns 80% of the project, which was formerly called Grootfontein. The company has engaged consultants to carry out metallurgical studies and firm up drill targets.

Golden Rim Resources (ASX: GMR)

Golden Rim Resources is looking to divest its 73%-owned Paguanta zinc, silver and lead project in Chile.

The project has a measured, indicated and inferred resource of 2.4Mt at 5% zinc, 1.4% lead, 88g/t silver and 0.3% gold (8% zinc equivalent) for 190,000t of contained zinc equivalent metal.

According to Golden Rim, the resource remains open at depth and to south with multiple high-grade shoots identified grading up to 20% zinc and 1,765g/t silver.

To-date, $47 million has been spent on advancing the project including completing the bulk of a feasibility study.

The project is in proximity to those owned by majors including BHP, Vale, Glencore, Codelco and Anglo American.

Golden Rim plans to dispose of the asset during 2019.

Greenland Minerals (ASX: GGG)

The advanced Kvanefjeld project in southern Greenland is Greenland Minerals’ flagship asset – hosting a resource of 1.1Bt grading 11,000ppm total rare earth oxide (TREO), 266ppm uranium oxide, 9,700ppm light rare earth oxides (LREO), 399ppm heavy rare earth oxides (HREO), 10,100ppm rare earth oxides (REO), 893ppm yttrium oxide and 2,397ppm zinc.

Although looking at primarily exploiting the deposit for its rare earth elements, Greenland Minerals expects to produce zinc and uranium as by-products.

In August 2018, Greenland Minerals secured a MoU with Shenghe Resources Holding to advance plans for commercialising the project including financing and offtake strategies for the project which has a projected 37-year mine life.

Hampton Hill Mining (ASX: HHM)

Hampton Hill Mining is earning a 25% interest in the Millennium zinc project from Encounter Resources.

For further information on Millennium, please see the Encounter entry in the guide.

Hampton also owns a 4.73% stake in Peel Mining, which is actively exploring for zinc at its Wagga Tank project in NSW. See the Peel entry for more information on its activities.

Helix Resources (ASX: HLX)

Helix Resources has a 60% interest in the Mundarlo project in NSW, where copper, gold and zinc anomalies have been noted.

A maiden drilling program started in February 2018 and in May assays revealed up to 0.06% zinc. Assays from drilling in the second half of 2018 remain pending.

Helix can earn up to 80% in the project by spending $150,000 on exploration by February 2019.

Heron Resources (ASX: HRR)

Heron Resources owns the Woodlawn zinc-copper project in NSW after acquiring it through a merger in 2014.

Mining at the project began in September 2018, with commissioning starting in December 2018 and first production targeted before the end of the March 2019 quarter.

Total underground indicated and measured resources at Woodlawn are 4.6Mt at 6.7% zinc, 1.9% copper, 2.4% lead, 0.5g/t gold and 52g/t silver (16.7% zinc equivalent).

In addition, inferred resources amount to 2.6Mt at 5.6% zinc, 1.8% copper, 2.2% lead, 0.6g/t gold and 48g/t silver (14.9% zinc equivalent).

Once fully operational, Heron expects to produce 40,000tpa of zinc, 10,000tpa copper and 12,000tpa lead over nine years.

Hexagon Resources (ASX: HXG)

Graphite focused Hexagon Resources has the early stage Halls Creek exploration project which is believed prospective for base and precious metals.

The company has uncovered four drill-ready gold and base metals targets at the project.

Anglo Australia previously owned nearby deposits Onedin and Sandiego, which have historic resources of 2.3Mt at 4.9% zinc, 1.1% copper, 1% lead, and 32.8g/t silver; and 2.4Mt at 5.3% zinc, 1.3% copper, 0.5% lead and 26.2g/t silver, respectively.

Horizon Gold (ASX: HRN)

As its name suggests Horizon Gold is focused on unlocking the gold potential across its assets, but the company is also firming up the zinc potential at its Gum Creek project, with the Altair zinc and copper prospect returning numerous zinc and copper assays.

An eight hole drilling program was carried out at the prospect in 2018 with notable intersections including 38m at 1.89% zinc and 0.64% copper from 97m; 18m at 2.41% zinc and 0.52% copper from 97m, with an 8m higher grade interval of 3% zinc and 0.88% copper from 107m.

Other highlights were a 55m intersection grading 3.32% zinc and 0.52% copper from 184m, including 9m at 6.69% zinc and 1% copper from 213m.

Horizon plans to continue testing the zinc potential at Altair in 2019, along with other nearby targets.

Impact Minerals (ASX: IPT)

Rock chips taken from Impact Minerals’ Little Broken Hill Gabbro target at its Broken Hill project in NSW returned elevated levels of multiple minerals including 1,140ppm zinc.

Meanwhile, assays from diamond drilling at the company’s wholly-owned Commonwealth project, also in NSW, were returned by the end of November 2018 and revealed up to 30.2% zinc.

The project has an inferred resource of 720,000t at 2.8g/t gold, 48g/t silver, 1.5% zinc, 0.6% lead and 0.1% copper. Included within this resource is the higher grade Main Shaft estimate which totals 145,000t at 4.3g/t gold, 142g/t silver, 4.8% zinc, 1.7% lead and 0.2% copper.

Impact plans to undertake further drilling in 2019 and will release a resource upgrade.

Inca Minerals (ASX: ICG)

Peru-focused Inca Minerals is advancing the Greater Riqueza and Cerro Rayas projects in the country.

Anglo-American and BHP have taken up positions in the area which hosts numerous mines and treatment plants.

BHP’s spin-off South32 is earning a 60% interest in Greater Riqueza by spending up to US$10 million on exploration.

At Inca’s Cerro Rayas project, exploration has uncovered up to 30.96% zinc, 161g/t silver and 24.31% lead.

Inca is planning geophysics and drilling at Cerro Rayas in 2019.

Ironbark Zinc (ASX: IBG)

Ironbark Zinc is aiming to develop its 100%-owned Citronen zinc and lead project in Greenland, which has a giant resource of 132Mt at 4.4% zinc and lead – equating to about 12.8Blb of zinc.

The deposit is open, with mining and processing test work revealing the ore is amenable to standard processing methods.

A feasibility study estimated capital costs of US$514 million to generate US$270 in annual EBITDA.

Financial discussions were underway in 2018 to lift the project off the ground.

Kidman Resources (ASX: KDR)

Kidman Resources owns the Barrow Creek project, which is more than 280km north of Alice Springs.

No recent exploration has been reported, but the project has a JORC resource of 2.5Mt at 1.8% copper, 2% zinc, 36g/t silver, 1.2% lead, 0.14g/t gold.

The project is in proximity to the Stuart Highway, a gas pipeline and the Darwin to Adelaide railway.

Kidman also holds the Browns Reef project in NSW, where previous drilling has intersected zinc and other minerals including 6m at 11.36% zinc, 4.8% lead, 1.23% copper and 74.17g/t silver.

An exploration target of up to 37Mt at 1.4% zinc, 0.7% lead, 10g/t silver and 0.3% copper has been calculated for the project.

KGL Resources (ASX: KGL)

Although exploring for copper, drilling at KGL Resources’ Jervois project in the NT produced zinc grading up to 1.66% during the September quarter 2018.

In addition to a copper resource, Jervois has a lead and zinc resource estimate of 3.8Mt at 3.7% lead and 1.2% zinc for 143,400t of lead and 46,500t of zinc.

In 2019, KGL plans to continue advancing the copper part of the project, in addition to upgrading the silver, lead, and zinc mineralisation.

Kopore Metals (ASX: KMT)

Africa focused Kopore Metals is exploring the North Korong and Kara domes in Botswana.

At North Korong, two regional scale copper, lead and zinc soil anomalies have been noted across 12sq km.

Meanwhile, three copper, zinc and lead anomalies have been identified at Kara.

Kopore will continue advancing the assets during 2019 with drilling underway at North Korong and ground geophysical programs planned for the March 2019 period.

Koppar Resources (ASX: KRX)

During August 2018, Koppar Resources pegged up more than 500sq km of tenements prospective for zinc and copper.

Koppar spent the remainder of 2018 firming up drill targets across its land holding, which covers 737sq km in Norway.

Several of the tenements host historic mines including the Tverrfjellet workings that produced 15Mt at 1% copper, 1.2% zinc, 0.2% lead, 10g/t silver and 0.1g/t gold.

Zinc grades from historic production ranged from 1.2% up to 5.5%.

During 2019, Koppar will focus on the Tverfjellet and Undal projects.

Korab Resources (ASX: KOR)

Although prospective for zinc, Korab Resources has more recently focused on other minerals at its Batchelor project near Darwin in the NT, including cobalt, scandium, manganese, copper and gold.

The project covers 240sq km and is within the Rum Jungle mineral field, which hosts the nearby Woodcutters deposit which historically produced 4.65Mt at 12.28% zinc, 5.65% lead and 87g/t silver.

Drilling in late 2016 at Batchelor returned 13m at 4.71% zinc, 0.38% lead and 4ppm silver, including 1m at 20.60% zinc, 0.32% lead and 15ppm silver.

Another notable drill intersection was 23m at 4.98% zinc, 1.60% lead and 15ppm silver including 1m at 14.60% zinc, 5.60% lead and 50ppm silver.

Zinc grades unearthed from drilling ranged between 0.10% to 24.30%.

Legacy Iron Ore (ASX: LCY)

Legacy Iron Ore is exploring the Koongie Park project, near Anglo Australian Resources’ Koongie Park deposit which has a resource of 8Mt at 3.3% zinc, 1.2% copper, 0.3g/t gold and 23g/t silver.

The project is close to Halls Creek in WA and soil sampling in the latter half of 2018 uncovered zinc values ranging from 50ppm to 2,000ppm.

Legacy Iron Ore plans to continue advancing the project with geophysics surveys, mapping and data evaluation.

Lincoln Minerals (ASX: LML)

Graphite focused Lincoln Minerals has several projects in South Australia’s Eyre Peninsula prospective for base metals including zinc.

At Uno, outcrop sampling noted 0.1% zinc in 2011. Meanwhile, a drill intersection at the Minbrie project returned 29.5m at 1.88% zinc, 7.37% lead and 0.76% copper.

However, no recent exploration has been reported at the projects.

MacPhersons Resources (ASX: MRP)

MacPhersons Resources has a 100% interest in the Nimbus project just east of Kalgoorlie in WA.

The project has a mineral resource of 104,000t of zinc, in addition to 78,000oz gold and 20Moz silver.

In December 2018, MacPhersons and Intermin Resources agreed to a merger, with the resultant entity to be renamed Horizon Minerals.

The merged entity will be focused on gold production.

Marindi Metals (ASX: MZN)

Multi-commodity explorer Marindi Metals just finished the first year of exploration at its Caranbirini project in the NT.

Exploration focused on the Emu Fault area with the strategy of firming up a world class zinc deposit, close to Glencore’s McArthur River zinc and lead mine.

Marindi claims the McArthur River deposit, which is 10km from Caranbirini, is the world’s second largest zinc deposit with a resource of 237Mt of zinc.

The Japanese Government is earning 70% in Caranbirini by spending $4 million on exploration over three years.

Marindi is in discussions regarding advancing its Yalco zinc project in the region. The company also owns the Newman project which is prospective for zinc and vanadium.

Metalicity (ASX: MCT)

During late 2018, Metalicity completed the sale of its zinc assets including the Admiral Bay zinc project to Kimberley Mining.

As part of the sale, Metalicity will receive C$12.5 million (A$13.23 million) in total cash payments and 25 million shares in Kimberley, which is targeting and IPO on the TSX-V in March 2019.

Metalicity anticipates it will retain exposure to the zinc assets through its stake in Kimberley, which will be worth C$20 million (A$21.17 million) once it is listed.

Metals Australia (ASX: MLS)

Metals Australia owns the Manindi zinc project in WA’s mid west, which comprises three mining leases.

Drilling at the project in mid-2017 returned zinc grading between 4.65% and 16.46%. A JORC resource was released in 2015, which totals 1.08Mt at 6.52% zinc, 0.26% copper and 3.19g/t silver.

During 2018, Metals Australia focused on exploring the lithium pegmatites it had identified at the project.

Metals X (ASX: MLX)

Tin miner Metals X owns 3,000sq km of tenements in WA’s Yeneena Basin. At the Dromedary prospect previous drilling intersected 5m at 9.56% zinc from 124m, 5m at 15.35% zinc from 136m and 12m at 1.93% zinc from 175m.

At the Warrabarty asset, drilling had uncovered 200m at 0.81% zinc from 114m, and 140m at 1.46% zinc and 0.32% lead from 500m.

The mineralisation at Warrabarty extends for 2.5km and is open in all directions.

Metals X plans to drill to test extensions to the known mineralisation.

Metminco (ASX: MNC)

Metminco is actively advancing the Quinchia gold project in Colombia, which is also prospective for other minerals including zinc.

Drilling at the Tesorito gold prospect in mid-2018 uncovered 2m at 17.95g/t silver, 1.99g/t tungsten and 1% zinc.

Metminco will evaluate the prospect further to gain a better understand of the polymetallic mineralisation it has found.

Minotaur Exploration (ASX: MEP)

Queensland explorer Minotaur Exploration is advancing the Windsor project which is close to Red River Resources’ Thalanga operation which achieved record production in the September 2018 quarter.

Minotaur farmed-in to the Windsor project in mid-October 2018 and can earn up to 80% by spending $4 million on exploration over five years.

The tenements span 629sq km and have not had much modern exploration.

Mithril Resources (ASX: MTH)

In the west Kimberley region, Mithril Resources wholly-owns the Billy Hills project which is prospective for zinc and is adjacent to the previous Pilara zinc mine, which produced 10.3Mt at 6.9% zinc and 2.3% lead between 1997 and 2003.

Mithril is targeting several large scale deposits along strike from Pilara. In the first half of 2019, Mithril will carry out induced polarisation geophysics surveys and kick-off diamond drilling at the project.

Previous rock chip samples returned up to 14.24% zinc and lead at the project.

Mithril is also exploring for zinc and other minerals at the Nanadie Well and Bangemall projects.

MMG Ltd (ASX: MMG)

Hong Kong incorporated MMG operates two zinc mines in Australia: Rosebery in Tasmania, and Dugald River in Queensland.

During the September quarter, Rosebery and Dugald River produced 57, 595t of zinc concentrate, in addition to 11,827t of lead concentrate.

In the nine months ending September 2018, the projects generated a combined 162,956t of zinc concentrate and 34,034t lead concentrate.

For the 2018 full year, MMG expects to have produced up to 150,000t of zinc concentrate from Dugald River and up to 80,000t from Rosebery.

At the end of June 2018, resources for Rosebery sat at 18.1Mt at 7.9% zinc, 2.7% lead, 0.24% copper, 98g/t silver and 1.3g/t gold, while Dugald River resources were 63.3Mt at 12.4% zinc, 1.8% lead, 1.5% copper, 27g/t silver and 0.2g/t gold.

Moreton Resources (ASX: MRV)

Pre-production activities are underway at Moreton Resources’ Granite Belt silver project in Texas, Queensland, with silver recovery to begin in early 2019.

The project is believed prospective for other minerals including zinc and in 2017, Moreton committed $9 million towards exploration at the project and unlocking the value of other minerals.

Mount Burgess Mining (ASX: MTB)

Although reviewing its Kihabe project in Botswana for vanadium potential, initial exploration at Mount Burgess Mining’s asset focused on zinc, lead and silver mineralisation.

The Nxuu deposit hosts intersections of 23.08m at 2.56% zinc equivalent, 23m at 1.47% zinc equivalent and 21m at 2.21% zinc equivalent.

Within the numerous intersections are multiple higher-grade intervals with zinc equivalent ranging up to 5.4%.

The project has a 2004 resource of 25Mt at 3% zinc equivalent for 455,000t of contained zinc and 268,000t of lead.

MRG Metals (ASX: MRQ)

MRG Metals is progressing the Norrliden project, which has a global resource of 5.2Mt at 2.1% zinc, 0.4% copper, 0.2% lead, 0.3g/t gold, and 29g/t silver.

In May 2017, MRG agreed to farm in to the project which is in northern Sweden.

During the September 2018 quarter, MRG completed stage one of the farm-in and secured 10% by spending US$500,000 on exploration.

MRG plans to carry out stage two of the agreement, which will see the company lock-in 25% after it has spent US$1 million on exploration (cumulative) within 27 months.

The company can earn up to 50% by spending US$3 million on the project in total over 39 months.

Musgrave Minerals (ASX: MGV)

Gold focused Musgrave Minerals has identified zinc potential within its Cue project in WA’s mid west.

Drilling at Mt Eelya revealed 4m at 8.1% zinc, 1.5% copper and 0.6g/t gold.

Meanwhile, Petratherm is earning up to 75% in Musgrave’s Corunna project in South Australia, which is prospective for zinc, lead and silver.

Please refer to the Petratherm entry for further information.

Myanmar Metals (ASX: MYL)

Myanmar Metals owns 51% and manages the flagship Bawdwin project, which is scheduled to begin production in 2021.

Situated in Myanmar, the project has a resource of 81.8Mt at 4.8% lead, 2.4% zinc, 0.24% copper and 119g/t silver.

Myanmar is looking to build an initial open pit mine, with the site already hosting hydro-electric power plants, a mine camp, potable water, rail and underground infrastructure.

A pre-feasibility study is underway and will build on the scoping study that was published in September 2018.

The scoping study estimated a 13-year open pit operation to process 1.8Mtpa of ore to recover 517,000t of zinc, as well as 1.01Mt lead, 80.2Moz silver and 30,000t copper.

Capital expenditure was calculated at US$191 million, with Myanmar’s share of the net present value ranging between US$260 million and US$620 million. The payback period was deemed around two years.

New Century Resources (ASX: NCZ)

November 2018 heralded New Century Resources first zinc shipment from its flagship Century operations in Queensland.

The maiden shipment to China comprised 11,000t of zinc concentrate, with New Century focused on ramping up the mine to become one of the world’s top 10 zinc producers.

New Century Resources made its first zinc shipment from its flagship Century mine in Queensland in November 2018.

Century’s reserves of 2.3Mt zinc and 29.7Moz silver shore up an initial 6.3-year mine life. However, the project’s insitu resources of 9.3Mt at 10.8% zinc and lead, in combination with ongoing exploration, are expected to extend the operation’s life span.

Once production reaches fully capacity by the end of 2019, New Century anticipates output of 264,000tpa zinc and 3Mozpa silver.

Based on a zinc price of US$1.25/lb, Century is predicted to generate free cash flow of $1.8 billion over its initial life.

Norwest Minerals (ASX: NWM)

ASX debutant, Norwest Minerals listed in late November 2018 as an Australian Mines spin-off.

Located about 250km from Newman in WA’s Pilbara, the’s company’s Bali copper, lead and zinc project covers 41sq km.

Norwest completed a ground electromagnetic survey in the December 2018 quarter and has planned 2,500m of drilling at the project in 2020.

Nova Minerals (ASX: NVA)

Formerly Quantum Resources, Nova Minerals can earn up to 85% of Alaskan project Bowser Creek, which is prospective for silver, zinc and lead.

According to Nova, the US Government historically forked out $7 million on advancing the 12.95sq km project.

The project hosts multiple walk up drill targets.

Nova plans to carry out detailed sampling for metallurgical and technical work.

Orion Minerals (ASX: ORN)

Africa focused Orion Minerals is fast-tracking the Prieska zinc and copper project in South Africa’s Northern Cape Province.

A scoping study was published in December and indicated up to $390 million would be needed to develop the project, which would have a 10-year life and generate 1.4Mt of 50% zinc concentrate and 900,000t of 24% copper concentrate.

The study estimates life of mine net revenue of $3.457 billion.

A bankable feasibility study is underway and pencilled in for completion by the end of June 2019.

Studies are based on a resource of 28.7Mt at 3.77% zinc and 1.16% copper for 1.084Mt of contained zinc and 334,000t of copper.

Oz Minerals (ASX: OZL)

Although not a priority, miner Oz Minerals is exploring for zinc and other minerals at its Eloise project in Queensland and its Oaxaca Riqueza Marina asset in Mexico.

Drilling has been ongoing at Eloise with 28 holes completed on the Jericho prospect. However, mostly copper and gold mineralisation has been unveiled.

Meanwhile, Oz has firmed up magnetic and gravity anomalies at Oaxaca and will focus on securing permits to drill the targets.

Pacifico Minerals (ASX: PMY)

Pacifico Minerals has earned a 75% stake in the Sorby Hills lead, silver and zinc project near Kununurra in WA.

Drilling has recently been completed and a pre-feasibility study is due to wind up before the end of June 2019.

A resource was published in August 2018 that totalled 16.5Mt at 4.7% lead, 0.7% zinc and 54g/t silver. Pacifico expects to publish an updated resource before the end of the March 2019 quarter.

In the second half of 2019, the company plans to complete a DFS.

Peel Mining (ASX: PEX)

Peel Mining is actively advancing its wholly-owned Wagga Tank project in NSW’s Cobar Basin.

Recent drilling at the Southern Nights prospect has revealed numerous high grade intersections at the project, with one drill hole revealing 18.2m at 40.3% zinc, 15.21% lead, 0.97% copper, 356g/t silver and 2.77g/t gold.

A 20,000m drilling campaign is underway, with Peel targeting a maiden JORC resource by the end of June 2019.

Preliminary metallurgical test work has been carried out on the ore and produced a 47% zinc concentrate, and a 50% lead concentrate.

The mineralised system remains open along strike and at depth.

Peninsula Mines (ASX: PSM)

Graphite explorer Peninsula Mines owns the Ubeong zinc, lead and silver project in South Korea.

Peninsula has reviewed historic drill records which indicate zinc grading up to 18.66% had been unearthed at the project.

Previous drilling at Ubeong produced 7m at 14.6% zinc, and 2.1% copper.

The company plans to follow up on the previous drill intersections.

Petratherm (ASX: PTR)

Petratherm is actively progressing the Corunna and Walparuta projects in South Australia.

The company is earning a 75% interest in Corunna from Musgrave Minerals. During the September quarter 2018, Petratherm completed 42 air core drill holes at the Area 1 prospect.

Assays from the program included 20m at 0.2% zinc, 0.3% lead and 12g/t silver, 8m at 0.3% zinc, 0.07% lead and 16.5g/t silver.

The Walparuta project is prospective for copper, zinc, cobalt, silver and gold.

PNX Metals (ASX: PNX)

A DFS is underway at PNX Metals’ Hayes Creek zinc and precious metals project in the NT.

Located about 170km south of Darwin in the Pine Creek region, PNX anticipates the DFS will boost confidence in the project.

A previous pre-feasibility study indicated Hayes Creek had an NPV of $133 million. The study estimated annual production of 18,200t of zinc, 14,700oz gold and 1.4Moz silver over 6.5 years would bring in revenue of about $628 million.

Capital expenditure is calculated at $58 million with a 15-month pay back period.

PNX hopes to begin developing Hayes Creek in 2020.

Pursuit Minerals (ASX: PUR)

Pursuit Minerals’ Paperbark project is 25km south of New Century Resources’ renowned Century zinc mine in Queensland.

The project covers 70sq km and hosts a JORC resource of 10.4Mt at 2.7% zinc, 0.2% lead and 1g/t silver.

Drilling in 2017 and 2018 has focused on better understanding the zinc system across the tenement, with one intersection revealing 91m at 5.05% zinc and lead.

Pursuit also owns the Bluebush project which encompasses 214sq km and is 72km north of the Century mine.

Red Metal (ASX: RDM)

Red Metal is exposed to zinc’s upside through several assets across Australia including Emu Creek, Cannington South, Punt Hill, Pernatty Lagoon, Three Ways, Lawn Hill and Yarrie.

Lawn Hill is another exploration project close to the Century zinc, lead and silver mine. Red Metal is using high resolution gravity and ground electromagnetic surveys to pinpoint zinc targets for drilling.

The company is also exploring the Three Ways project in Queensland, which is 150km from MMG’s Dugald River zinc, lead and silver operation. Red Metal plans to use magneto-telluric survey techniques to map out drill targets.

Red River also has a joint venture with Oz Minerals at the Punt Hill and Pernatty Lagoon assets in South Australia’s Gawler Craton.

Oz Minerals initiated a maiden drill program in the September 2018 quarter to test six targets totalling more than 6,000m in drilling.

Red River Resources (ASX: RVR)

During the September 2018 quarter, Red River Resources achieved record production from its Thalanga operations in Queensland.

Production from the West 45 deposit was 90,000t grading 0.3% copper, 2.2% lead, 5% zinc, 0.2g/t gold and 31g/t silver – equating to 8.8% zinc equivalent.

This resulted in a dry zinc concentrate of 6,800t – up 24% of the June quarter. Zinc concentrate was sold for between US$1.14/lb and US$1.17/lb during the period.

In the 2018 financial year, Red River processed 228,000t of ore at 10% zinc equivalent. Of that, 17,110t was zinc concentrate grading 56.6% zinc.

To extend mine life at Thalanga, Red River is actively exploring other targets within its portfolio.

Renegade Exploration (ASX: RNX)

Formerly known as Overland Resources, gold-focused Renegade Exploration has a 90% interest in the Yukon base metal project in Canada’s Selwyn Basin.

The project has a resource of 12.6Mt at 5.3% zinc and 0.9% lead (6% zinc equivalent). The resource is made up of three deposits, which all remain open at depth.

A study was completed in 2012 that indicates Yukon would have an initial seven-year life and produce around 90,000tpa of 58% zinc concentrate and 20,000tpa of 62% lead concentrate.

Renegade is assessing strategies to “achieve the best outcome” for Yukon and has remained in discussions with interested parties.

Rio Tinto (ASX: RIO)

Mining major Rio Tinto is farming-in to Sipa Resources’ Kitgum-Pader base metals project in Uganda’s north.

In August 2018, Rio and Sipa executed an agreement where Rio can earn up to 75% of the project by spending US$57 million on exploration.

Kitgum-Pader hosts the Pamwa lead, silver and zinc deposit, which Sipa uncovered in 2015.

Better intersections from drilling in early 2015 were 1.1m at 5.76% zinc and 1.58% lead, 2.2m at 3.9% zinc and 0.86% lead, and 0.4m at 0.96% zinc.

Rumble Resources (ASX: RTR)

West Australian explorer Rumble Resources is actively exploring several zinc projects across the Pilbara and the state’s mid west.

The company has firmed up targets at the Braeside and Barramine projects in the Pilbara where zinc has been uncovered along with other minerals.

Rumble is also exploring for zinc at Earaheedy in the mid west where historical drilling revealed up to 18.6% zinc within a 3.3m intersection.

Braeside covers 1,000sq km and hosts multiple small scale mines that produced zinc, lead and silver between 1901 and 1959.

Rumble plans to fast-track the next round of drilling at Braeside in 2019.

S2 Resources (ASX: S2R)

In addition to the Skellefte project in Sweden, S2 Resources has boosted its exposure to zinc after it scooped up a 19.99% stake in Todd River Resources in late 2018.

Todd River owns the Mt Hardy zinc, copper, lead and silver discovery in the NT.

Drilling at Skellefte in the 2017 financial year returned 14.71m at 2.2% zinc, 1% copper and 5.4g/t silver. Other intervals were 1.74m at 3.05% zinc, 0.68% copper and 3.7g/t silver, and 2.13m at 8.2% zinc, 1.7% copper and 9g/t silver.

S2 is currently focused on advancing its other projects.

SABRE Resources (ASX: SBR)

During the September 2018 quarter, SABRE Resources lodged renewal applications for tenements comprising its Otavi Mountain Land project in Namibia’s north.

The project is prospective for zinc and lead mineralisation and covers 347sq km.

According to SABRE, the region hosts many historic mines including the Tsumeb copper, lead and zinc mine and smelter complex.

The project’s Border deposit has a resource of 16Mt at 1.53% zinc, 0.59% lead and 4.76g/t silver. Meanwhile, up to 2.9% zinc and lead has been found over 2.8km of strike at the Toggenburg deposit.

Sandfire Resources (ASX: SFR)

Copper and gold producer Sandfire Resources has a number of Broken Hill-type lead, zinc and silver deposits in Queensland.

Drilling was completed at the Breena North, Landsborough, Blackrock and Cannington West projects during the September 2018 period, with results under review.

Sandfire also has a joint venture with Pacifico and MMG over the Borroloola project in the NT.

In July 2018, Sandfire acquired a 14.2% interest in White Rock Minerals, which owns the Red Mountain zinc project in Alaska. Then, in late December 2018, Sandfire and White Rock agreed to enter a joint venture over the project.

Under the joint venture, Sandfire will fund $20 million on exploration over four years to secure 51% of Red Mountain.

Additionally, Sandfire has a 7.7% stake in Adriatic Metals and will collaborate on the company’s polymetallic projects in Bosnia-Herzegovina.

Scorpion Minerals (ASX: SCN)

Formerly Pegasus Metals, Scorpion Minerals is advancing the Mt Mulcahy copper, zinc, cobalt, gold and silver deposit in WA.

Scorpion has identified at least 12km of strike and firmed up an initial resource of 647,000t at 2.4% copper, 1.8% zinc, 0.1% cobalt, and 0.2g/t gold for 11,800t of contained zinc.

Drilling at the project generated zinc grades between 0.95% and 4.54%.

Silver City Minerals (ASX: SCI)

Silver City Minerals is exploring the Razorback West project near the renowned Broken Hill zinc, lead silver deposit in NSW.

Drilling during 2017 returned 17m at 0.16% zinc and 0.19% lead, including 1m at 2.44% lead, 0.34% zinc and 15.3g/t silver.

Although the project hosts multiple zinc anomalies, in 2019, the company will be focusing on its lead targets.

Silver Mines (ASX: SVL)

Silver Mines’ Barabola project in NSW comprises 2,007sq km of tenements with multiple targets identified that are prospective for silver, lead and zinc.

Rock chip samples at the Kia Ora West anomaly returned up to 2.5% zinc, while samples from a historic mine at the Bara North prospect yielded up to 10.3% zinc.

Drilling at the project began in October 2018, with assays due during the March 2019 quarter.

Sipa Resources (ASX: SRI)

Sipa Resources is farming out its Kitgum-Pader project in Uganda to Rio Tinto. The project is prospective for several minerals and hosts the Pamwa zinc deposit.

For more information on Pamwa, please see the Rio Tinto entry in the guide.

Sipa also owns the Barbwire Terrace project in WA’s Canning Basin, which it acquired in late October 2018.

The project is in the Lennard Shelf, which hosts numerous zinc and lead deposits including Admiral Bay which has a resource of 170Mt at 4.1% zinc and 2.7% lead.

South32 (ASX: S32)

BHP spin-off South32 is producing zinc at its wholly-owned Cannington operation in Queensland.

During the September quarter, the company produced 13,200t of zinc, 25,800t lead and 3.18Moz silver from the mine.

From the operation, South32 anticipates it will generate 51,000t of zinc for the 2019 financial year, in addition to 98,000t lead and 11.75Moz silver.

In August 2018, South32 acquired Arizona Mining for US$1.3 billion, giving South32 ownership of the advanced Hermosa zinc, lead and silver project in Mexico.

Hermosa hosts the Taylor deposit, which has a resource of 144.6Mt at 4.1% zinc, 4.4% lead, 2.5g/t silver for 10.8% zinc equivalent.

Stavely Minerals (ASX: SVY)

Stavely Minerals owns the Ararat project in Victoria, which has a resource of 1.3Mt at 2% copper, 0.5g/t gold, 0.4% zinc and 6g/t silver.

Contained zinc within the resource is estimated at 5,300t.

Over at the company’s other Victorian project, Stavely, drilling during the 2018 financial year revealed 31m at 0.46% zinc from 483m, 2m at 2.06% zinc from 653m, and 3m at 2.45% zinc from 190m.

Gold, silver, lead and copper were also unearthed during the drilling program.

Rock chip sampling at Stavely’s Ravenswood project in Queensland returned up to 0.8% zinc.

Although zinc is present at Stavely and Ravenswood, it is not the mineral of focus.

During 2019, Stavely plans to carry out further drilling and target generation activities.

Superior Lake Resources (ASX: SUP)

Superior Lake Resources intersected a new footwall zone grading 25.2% zinc, while drilling at its namesake project in Canada in late 2018.

A restart study was published in October 2018 for the Superior Lake project and estimated a 6.5-year operation that would produce 46,000tpa zinc.

The project has a resource of 2.15Mt at 17.7% zinc, 0.9% copper, 0.4g/t gold and 33.5g/t silver.

Start up costs are forecast at US$75 million and the restart study gave the project an NPV at 10% post-tax of $158.5 million.

A DFS will is expected to be published by mid-2019.

Superior Resources (ASX: SPQ)

Multi-commodity explorer Superior Resources owns the Victor and Nicholson lead, zinc and silver projects in Queensland’s north west.

According to Superior, Nicholson and Victor are within the Carpentaria zinc province, which accounts for 20% of the world’s zinc inventory.

Nicholson covers 332sq km and Superior has noted five Century-sized targets for drilling, while Victor encompasses 1,135sq km and hosts numerous drill targets.

At the end of 2018, Superior said it was in advanced discussions over Nicholson with a “well-funded party”.

Symbol Mining (ASX: SL1)

In late 2018, Symbol Mining (formerly Swala Energy) announced its maiden shipment was underway from its 60%-owned Macy mine in Nigeria, which has a resource of 132,700t at 18.3% zinc and 2.1% lead.

The maiden shipment comprised 250t of DSO zinc and was achieved five months after mining started.

Symbol anticipates production will ramp up to reach 4,500t per month of DSO zinc and separate lead products.

Including the Macy deposit, Symbol has an interest in 510sq km worth of tenements in Nigeria.

Revenue generated from Macy will be funnelled into exploration across the tenements.

Talisman Mining (ASX: TLM)

Talisman Mining has active drilling programs planned throughout 2019 at its Lachlan copper and gold project in NSW, where a strong copper, zinc and lead anomaly extending for a strike length of more than 1km was identified through a geochemical sampling program at the Noisy Ned prospect.

According to the company, first pass reverse circulation drilling completed at the prospect in October 2018 encountered broad zones of zinc, lead and copper mineralisation on all drill sections.

In November, Talisman said results from an upcoming down-hole electromagnetic survey would be “critical to inform geological interpretation and guide potential future drill testing at Noisy Ned”.

Tando Resources (ASX: TNO)

Although primarily focused on vanadium, Tando Resources holds 100% interests in the Quartz Bore, Mt Vernon and Mt Sydney (currently under application) projects in the Pilbara region of WA.

The company completed diamond drilling programs at Quartz Bore in late 2017, encountering high-grade zinc mineralisation including a 15m intersection grading at 5.92% zinc.

At Mt Vernon, surface geochemical surveys across the project area have identified discrete copper and zinc targets separated by the Mt Vernon Fault. Four airborne electromagnetic anomalies have also been identified from a historical survey, which the company believes are worthy of further inspection.

Tanga Resources (ASX: TRL)

In June 2018, Tanga Resources completed its acquisition of Coldstone Investments Pty Ltd, which has majority earn-in rights to the Joumbira zinc project, located on the Damaran Belt in Namibia.

During the year, the company completed a seven-hole diamond drilling program at the project, confirming high-grade zones of zinc, lead and silver associated with semi-massive sulphide replacement bodies within a much larger mineralised zone.

Drilling highlights included a 23m intersection grading at 4.1% zinc, including 2m at 15.43% zinc and 2m at 10.38% zinc. The mineralisation was also shown to remain open in all directions, providing significant resource potential.

During the September quarter, up to 15 priority targets were identified from recent magnetic interpretation and 3D inversion modelling work, including several new targets located outside the historical and recent areas of drilling.

In November, Tanga said continued soil sampling and mapping would focus on refining the targets in order to define priority areas for drill testing.

Tao Commodities (ASX: TAO)

Tao Commodities staked six drill sites in November 2018 for its wholly owned Milford zinc and copper project in Utah’s Beaver County.

The drill sites are within the Silver Bear prospect at the US project where dump samples returned between 9.99% zinc and 26.4% zinc, as well as up to 10.65% lead and 3.93% copper.

Tao expects to begin its maiden 1,000m program in early 2019.

Tempus Resources (ASX: TMR)

Recent ASX newcomer Tempus Resources owns the Montejinni project in the NT where it is focused on the copper and zinc potential.

Stream sediment samples have produced anomalous zinc ranging between 50ppm to 50,000ppm.

Tempus plans to carry out gravity and surface geochemical surveys to delineate drill targets.

Terramin Australia (ASX: TZN)

Terramin Australia has a 65% stake in the Tala Hamza project in Algeria.

A DFS on the project indicated an NPV of $260 million (net to Terramin). The asset has a projected 21-year life and is close to requisite infrastructure.

Start-up costs have been estimated at $449 million to produce up to $2.8 billion in post-tax free cash flow.

The project has reserves of 25.9Mt at 6.3% zinc and 1.8 lead for 1.6Mt of contained zinc and 500,000t lead.

Resources at the project total 53Mt at 5.3% zinc, 1.3% lead for 2.8Mt zinc and 700,000t lead.

Terramin is in negotiations regarding different funding solutions and expects to advance the project in 2019.

Thomson Resources (ASX: TMZ)

Thomson Resources currently holds 100% interests in exploration licences making up the Achilles and Browns Reef projects, which surround (but do not include) the Browns Reef zinc-lead-copper-silver-gold deposit in NSW.

This deposit recently became relinquished “open ground” and in November 2018, the company announced its exploration licence application covering the area had been accepted by the NSW Department of Planning and Environment.

The Browns Reef deposit has been explored by several companies dating as far back as the 1970s. The most recent previous explorer, Kidman Resources released an exploration target for the deposit in 2015, consisting of 27-37Mt grading at 1.3-1.4% zinc, 0.6-0.7% lead, 9-10g/t silver and 0.2-0.3% copper.

A drilling program in 2015 highlighted the potential for high grade zones within the overall mineralisation, returning an 8.4m intersection grading at 4.7% zinc from a 299.8m depth.

In November 2018, Thomson said it intended to carry out deep-looking, high precision geophysical testing over the strike length of the mineralisation to search for higher grade lenses.

The company also holds the Lachlan Downs zinc and copper project in joint venture with Silver City Minerals. Under the agreement, the latter can earn an 80% interest by spending $800,000 before July 2020.

Thundelarra Exploration (ASX: THX)

Thundelarra Exploration believes geophysical targets identified at its Sophie Downs project in the east Kimberley region of WA could be graphitic horizons or possibly massive sulphides.

According to the company, these were not drill tested satisfactorily in the last drilling program, but they remain valid targets that warrant follow-up.

Although no recent field work has been conducted at the project, Thundelarra said in its September 2018 quarterly that as the graphite and zinc markets continue to strengthen, these targets “will be revisited when ground access conditions permit a new drilling program”.

Todd River Resources (ASX: TRT)

Northern Territory explorer Todd River Resources is actively exploring for zinc and other minerals at its wholly-owned Mount Hardy, McArthur River and Tomkins projects.

Drilling at an anomaly identified at Mount Hardy unearthed 21m at 4.4% zinc; 25.15m at 2.4% copper, 4% zinc, and 3.1% lead; and 13.45m at 15.9% zinc, 5.75% lead and 0.9% copper.

During 2019, Todd River plans to continue drilling other targets it has noted across the project.

A phase one campaign was completed at McArthur River in September; however, only minor base metal sulphides were intersected.

Initial field work has been completed at Tomkinson.

Traka Resources (ASX: TKL)

Traka Resources is earning a 51% interest in the Gorge Creek project, located on the border of Queensland and the NT and prospective for zinc as well as copper, cobalt, lead and silver mineralisation.

During 2018, the company was cleared to undertake a drilling program on five targets in the project area, but the onset of the wet season has postponed the program until the start of the next field season, anticipated in April 2019.

In October, Traka said an additional six targets, not originally scheduled for drilling, will now be evaluated for inclusion in an expanded program.

Trek Metals (ASX: TKM)

West Africa-focused Trek Metals is currently investigating the potential for open pit mining at its Niambokamba and Dikaki prospects, part of the Kroussou project in Gabon, which covers 1,500sq km.

Recent drilling has uncovered up to 15.2% zinc and lead at Dikaki, with Trek planning to release an exploration target for Kroussou in 2019.

To-date, more than 2,250m of diamond drilling across 45 holes has been undertaken at the project.

The company also has an option to purchase 100% of the Lawn Hill project in the NT.

Valor Resources (ASX: VAL)

A scoping study was completed in August 2018 on Valor Resources’ 100%-owned Berenguela project in Peru.

Although primarily interested in the silver, copper and manganese potential at the project, a 25.8Mt resource exists with zinc grading 0.35%.

The scoping study indicated a zinc powder by-product could be produced in addition to copper, silver and manganese products.

A pre-feasibility study is due to be released in the September quarter of 2019.

Variscan Mines (ASX: VAR)

Variscan Mines secured several projects in France in 2011 including the Merleac zinc project.

However, the company has not undertaken field work at the asset for 18-months do to legal issues regarding exploration activities.

In April 2018, Variscan agreed to sell its French subsidiary to Apollo Minerals for $4.25 million.

However, due to some legalities with the French Government, this had not been concluded by early 2019.

Venturex Resources (ASX: VXR)

During 2018 Venturex Resources maintained development momentum at its Sulphur Springs zinc-copper project in WA.

A DFS envisages a 1.25Mtpa operation to generate cash flow of $80 million per annum by selling 34,000tpa of zinc and 14,000tpa copper.

The Sulphur Springs reserve totals 8.5Mt at 1.4% copper and 3.1% zinc and resources are 17.4Mt at 1.3% copper, 4.2% zinc and 17g/t silver.

Venturex is in negotiations with contractors, financiers and potential offtake parties.

Venus Metals (ASX: VMC)

Venus Metals holds significant acreage in WA with many exploration tenements along the Youanmi greenstone belt and surrounding the historical Youanmi gold mine.

One such project is the 100%-owned Youanmi Pincher Well copper-zinc project, which has an exploration target of 15-25Mt at 2-5% zinc.

To date, there has been insufficient exploration to estimate a mineral resource for this project.

Vital Metals (ASX: VML)

Exploration at Vital Metals’ Aue project in Germany is mainly focused on cobalt, although the area it is also prospective for zinc, tungsten, tin, silver, indium, gold and uranium mineralisation.

The permit is located in one of the most renowned historical mining districts in Germany with an 800-year long history of base metal exploration. In particular, the Jachymov Group of sediments to the south of the permit area is known for skarn mineralisation containing zinc, as well as tungsten, indium and iron.

Vital’s asset portfolio also includes the Nahouri gold project in Burkina Faso, where recent diamond drilling at the Kollo South prospect intersected potential ore-grade zinc mineralisation.

While the drilling program had been targeting gold, zinc was seen to be the most dominant mineralisation present. Drilling at the Kollo Hill prospect also reported zinc mineralisation present in broad anomalous zones over a strike length of 450m.

The company also holds over zinc prospects in Burkina Faso, namely Nabenia, Loubel and Koubongo East. Notable intersections from previous drilling on the prospects include 10m at 2.7% zinc from 59m at Nabenia and 5m at 3.8% zinc from 66m at Loubel.

White Cliff Minerals (ASX: WCN)

White Cliff Minerals holds a 90% interest in the Aucu gold project in the Kyrgyz Republic, where soil geochemistry and rock sampling programs were undertaken in recent months.

In January 2019, the company announced the identification of new outcropping gold and copper zones, with zinc mineralisation also present in the assay results. Sample highlights include yields of up to 6,551ppm zinc.

White Cliff Minerals also holds 100% interests in the Bremer Range and Merolia nickel projects in Western Australia.