Few minerals in recent history have generated as much global discussion as uranium, but this hasn’t curbed the eagerness of several ASX stocks in firming up uranium operations both in Australia and internationally.

From the days of activists waving the flag on uranium mining’s perceived imposition on indigenous land rights and environmental protection, through to debates around whether nuclear energy is part of the solution to climate change, views have been divided.

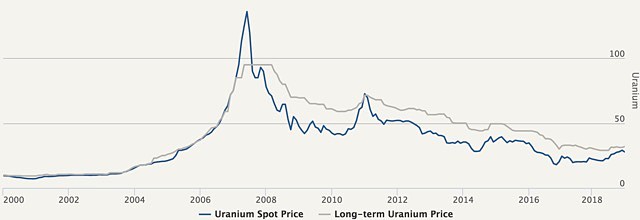

Several global events, including the Fukushima nuclear disaster and Kazakhstan ramping up uranium production, tipped the uranium market into oversupply in 2011.

A gruelling seven-year bear market ensued, dragging the commodity’s price down 85%. The bear market also killed off many industry participants, with the number dropping from more than 500 to around 50.

Larger producers such as Cameco and Kazatomprom opted to shut-in parts of their production, refusing to continue mining during the bear market, despite some moving closer to the end of their long-term supply contracts.

However, green shoots are emerging signalling the long bear market is over, with the uranium spot price soaring almost 40% between April and November 2018.

While nuclear power’s future in OECD countries remains a question mark, experts believe there will be significant growth in non-OECD nations due to current nuclear commitments.

So, what is uranium, what role does it play in today’s economy, and why has its very existence created such heated debate?

Raw uranium

Uranium is one of the heaviest of all naturally-occurring chemical elements, almost 19 times denser than water.

Comprising 92 protons and 92 electrons in its atomic structure, it was discovered in 1789 by German chemist Martin Klaproth in a mineral called pitchblende (or uraninite).

Uranium was first isolated as a metal in 1841 by French chemist Eugene-Melchior Péligot when he showed the black metallic substance obtained by Klaproth was really the compound uranium dioxide.

Péligot made actual uranium metal by reducing uranium tetrachloride with potassium metal.

In 1896, French physicist Henri Becquerel discovered uranium to have radioactive properties and in 1938, German physicists Otto Hahn and Fritz Strassmann showed that under certain conditions, the metal could be split into parts to yield energy in the form of heat.

The active part of this energy process is the uranium-235 isotope which raw uranium contains in small amounts (0.71%), along with isotopes U-238 (99.28%) and traces of U-234 (0.0054%).

Of these, only U-235 (143 neutrons + 92 protons) is fissile, meaning it can start a nuclear reaction and sustain it. U-238 (145 neutrons + 92 protons), by comparison, has no current nuclear use although many Generation IV designs are envisaged to use this (which makes up 95% of spent fuel) as fuel.

Uranium occurs as a significant component of more than 150 minerals and as a minor component of another 50, and is commonly found at low levels (measured in parts per million) in soil, water, plants, and animals (including humans).

Additionally, the earth’s oceans are estimated to contain some 4 billion tonnes of uranium.

According to the World Nuclear Association, while the bulk of the world’s uranium supply is used for making electricity, a small proportion is used to produce medical isotopes.

Uranium mining

Uranium can be extracted using open pit, underground or in-situ processes.

Open pits are most viable when the uranium ore body is near the surface (up to a 150m depth) and while they generally involve less capital expenditure than underground operations, this mining method can leave a massive footprint and environmental remediation can be costly in terms of time and money.

These operations often require a larger ore resource to be commercially viable.

Underground mining is most commonly used to exploit ore bodies with higher grades of uranium that are too deep to access using open pit methods and, while it requires the construction of access tunnels and declines, the long-term environmental impact is not usually as great.

The rate of excavation underground is also slower than in an open pit operation, and the process can sometimes be more hazardous for miners.

Uranium ores recovered from open pits and underground mines are milled in a process which (in its simplest form) involves crushing and chemical separation of the uranium mineral from the remainder of the ore.

Chemical separation of the ore continues until all that is left is the desired amount of uranium, with the objective being to isolate the uranium oxide concentrate to sell to companies for further enrichment.

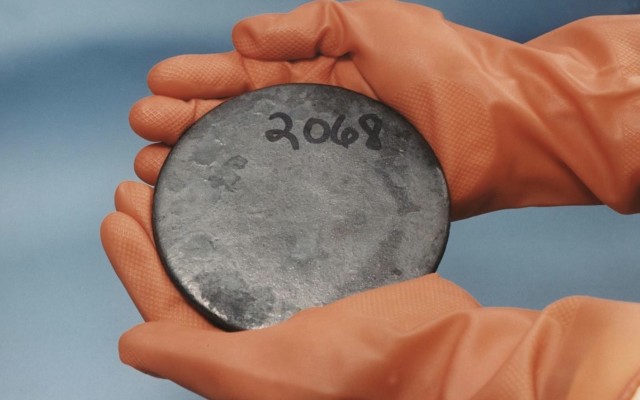

Milled uranium is also known as U308 or yellowcake, due to its yellowish colour. Pure U308 contains about 84.8% uranium metal.

The final method of mining uranium is in-situ recovery (also known as in-situ leaching or solution mining). This method can often require a lower capital expenditure to get the operation off the ground.

Most suited to deposits sandwiched between impermeable layers porous enough to allow water to flow through, in-situ recovery involves keeping the uranium ore in the ground, where it is introduced to an acidic mix of groundwater and gaseous oxygen via a series of injection wells.

The pregnant ore-containing solution is then pumped to the surface before recovering the minerals.

Unlike open pit and underground mines, in-situ recovery creates little disturbance at the surface and does not produce tailings, eliminating the need for tailings dams.

Mill tailings and slurry ponds can pose an environmental risk if not managed properly, due to the chemistry of their waste.

However, mining companies are governed by strict laws regarding care of tailings to avoid potential contaminated spills.

Energy Resources of Australia (ASX: ERA) knows all too well the social and financial burden of accidental tailing leaks, after a radioactive spill occurred at its Ranger uranium mine in the Northern Territory in 2013.

The spill led to a forced shutdown until authorities completed an audit of the entire site and were satisfied it was compliant with regulations.

The operation – currently processing stockpiled ore and due to cease production by January 2021 – has generated over 30 million tonnes of liquid waste over the past three decades.

Uranium uses

In the early days, uranium had very little practical use, mostly limited to the colouring of ceramics and as a catalyst in certain specialised applications.

But, by World War 2, pure uranium for the manufacture of atomic bombs was produced using the Ames process, developed by chemists at Iowa State University in the town of Ames to demonstrate that a fissile (or nuclear) chain reaction could be self-sustained and controlled.

The process – which discovered new methods for melting and casting uranium, and made it possible to cast large ingots of the metal, thereby dramatically reducing production costs – resulted in increased global demand for pure uranium, all produced by the Ames project until large industry took over in 1945.

According to Iowa State University records, Ames produced more than 2 million pounds (or 1,000t) of uranium for the US-led Manhattan Project, advancing wartime efforts to uncover the secrets of atomic power and protect national security.

Today, uranium is highly valued for nuclear applications, both military and commercial, and even low-grade uranium ores are considered to have great economic worth.

The market for uranium is currently centred around enriched fuel for power generation, however the U-235 in naturally-occurring uranium is low and usually needs to first be bumped up to between 3% and 5% before it can be considered reactor-grade.

This is different to the highly-enriched uranium (greater than 90% U-235) used in nuclear bombs and weapons manufacturing (above 20%), which is difficult and expensive to create.

Australia’s uranium production is exported for exclusively peaceful purposes, and only to countries and parties with which Australia has a bilateral nuclear co-operation (safeguards) agreement.

As more nations discover the advantages of nuclear energy, such as its low operating costs, fewer greenhouse emissions and relative reliability compared to conventional forms of electricity, global demand for the product is expected to rise.

In fact, the prospect of increased demand to fuel a growing industry has become the driver for some Australian mineral exploration companies.

Other applications

However, the mineral’s applications are more widespread than just power plants.

Treated uranium is also used in the production of radioactive isotopes (or radioisotopes, radionuclide), which play vital roles in the medical and food processing industries.

In 2016, the global radioisotope market was valued at US$9.6 billion – with medical radioisotopes accounting for about 80% – and the global radioisotope market is poised to reach around US$17 billion by 2021.

North America is the dominant market for diagnostic radioisotopes, holding close to half of the market share, while Europe accounts for about 20%.

In the nuclear medicine space, a small number of radioisotopes are employed in the detection, diagnosis and treatment of diseases including many types of cancers, heart conditions, and gastrointestinal, endocrine, and neurological disorders.

In the food industry, they are used to destroy harmful bacteria, which may be inadvertently present in some food matter, thereby extending a product’s shelf life.

Known as food irradiation and employing gamma rays occurring naturally from the radioactive decay of cobalt-60, the process has been proven by bodies such as the World Health Organisation and the United Nations Food and Agriculture Organisation to be a safe and effective alternative to chemical and heat treatments.

Odd uses for uranium in the past have included lamp filaments for stage lighting, stains and dyes for wood and leather, and in mordants for fixing dyes in wool and silk, as well as in smoke detectors

Uranium enrichment

Weapons-grade uranium utilises a highly-enriched (more than 90%) version of fissile isotope U-235, which makes up less than 1% of all natural uranium.

Enriched, or concentrated, U-235 provides the fuel for nuclear reactors and atomic bombs.

To separate the tiny quantity of uranium-235, which is present in every natural sample of uranium ore, engineers use a chemical reaction to turn the uranium into a gas, before placing the gas into large cylindrical centrifuge tubes, each spinning on its axis at incredibly high speeds.

It is at these speeds that the molecules are separated – the heavier U-238 gas molecules move to the edges of the tube and can be sucked out, while the lighter U-235 ones remain in the middle.

Once the U-235 is removed, the remaining gas is converted back to a solid metal for use in various applications.

According to World Nuclear Organisation statistics, while 13 countries presently have enrichment production capability or near-capability, about 90% of the world’s enrichment capacity is in the five nuclear weapons states, namely, the US, Russian Federation (formerly part of the Soviet Union), United Kingdom, France and China.

These countries, plus Germany, Netherlands and Japan, also provide toll enrichment services to the commercial market.

Cleaner than coal?

For supporters, uranium has always been the clean, reliable, renewable and preferred option over fossil fuels such as coal.

There is now growing recognition that, rather than exacerbating the problem, nuclear power positively contributes to the mitigation of global greenhouse gas emissions.

Research has shown nuclear power plants emit zero emissions at point of generation and very small quantities over the entire nuclear fuel cycle from uranium mining through to waste disposal.

By comparison, the World Nuclear Association in 2011 assessed the greenhouse gas emissions produced by different forms of electricity generation and found that fossil fuels create greater amounts of greenhouse gas emissions than nuclear or renewable energies.

According to the Massachusetts Institute of Technology, 90% of carbon emissions from electricity generation in the US are produced by coal-fired power plants and include sulphur dioxide, nitrogen oxides, toxic metals, arsenic, cadmium and mercury.

And in an Australian Government document titled Australia’s Emissions Projections 2017, the Department of Environment and Energy revealed the nation released 554Mt of carbon dioxide and other greenhouse gases in 2016 – a figure which is set to rise by 2030, with the single biggest contributor being coal-fired electricity generation.

Advocates and activists

Australia’s uranium industry has had a chequered past with pro-mining groups and the anti-nuclear movement each lobbying to have their issues heard.

The discovery of large deposits of uranium at Ranger, Jabiluka, Koongarra and Narbarlek in the Alligator Rivers area of the Northern Territory during the late 1960s demonstrated the divide, when activist groups for Aboriginal land rights, environmental protection and the safety of nuclear power went head to head with the government and the mining industry over proposed new developments.

The clash of interests over an area with historical and cultural significance led to the Ranger Uranium Environmental Inquiry in 1975 involving intensive public hearings with the mining industry, government agencies and community groups and resulted in the production of two weighty reports – the first, of which, supported the premise of new uranium mines within Australia.

Gaps in the understanding of uranium’s role in the production of greenhouse emissions and the related impact on climate change have also stalled the industry’s progress, with anti-mining groups targeting the generation and disposal of radioactive waste from the milling process and general perceived health risks from mining and nuclear power stations.

On the flipside, the Australian Nuclear Association has said that if the country has any chance of reaching its targets under the 2016 Paris Agreement – in which United Nations member countries ratified a treaty to strengthen the global response to climate change – it needs to think seriously about introducing nuclear to its energy mix.

This is given added pressure with more environmentalists and conservationists now calling for nuclear.

The association believes that without the resilience and reliability provided by nuclear energy, Australia will struggle to achieve a decarbonisation of the grid by the 2030 target date using just wind, solar and pumped hydro.

Fukushima destroys an industry

Unlike Australia, Japan has few natural energy resources and embraced nuclear energy as a national strategic priority since the 1970s.

The country’s reliance on nuclear is so great that when a magnitude 9.0 earthquake and 15m tsunami caused major damage to the nation’s Fukushima Daiichi nuclear power station in March 2011, it had a myriad of impacts on the local economy and on a larger scale, decimated the country’s industry and eroded the world’s confidence in uranium.

Ranked as the world’s second worst nuclear event after the 1986 Chernobyl disaster in the Ukraine, the Fukushima accident kicked off what has become a prolonged bear market for uranium prices worldwide.

Fukushima was among the world’s 15 largest nuclear plants and the chain of events which caused radiation leaks and a triple core meltdown crippled not just operator Tokyo Electric Power Company Holdings – which posted a US$15 billion loss that year, making it the largest ever reported by a Japanese company outside of the banking sector – but also Japan’s domestic industry, which had been pursuing nuclear energy since the 1960s.

When disaster struck in 2011, Japan had 54 active reactors generating a combined one-third of the country’s power requirements.

After turning all the reactors off in the period following the Fukushima accident, reactors have commenced coming back on line and today, there are nine active reactors with more expected to recommence generation in coming years albeit potentially slower than the government envisaged.

Eleven are being decommissioned – six of them at the Fukushima site – and there are question marks over the future of the rest.

Earlier this year, Japan’s former prime minister Junichiro Koizumi (in office from 2001 to 2006) urged the country to completely eliminate the use of nuclear energy.

In February, current prime minister Shinzo Abe blasted Koizumi’s suggestion, saying he “cannot recognise it as a responsible energy policy”.

Mr Abe has been vocal about bringing more of Japan’s idle reactors back online despite furore surrounding the prefecture’s ongoing safety amid concerns about the management of tonnes of radioactive waste water as the country approaches preparations to host the 2020 summer Olympics.

Uranium prices

Five years after the accident, prices hit an 11-year low as the market struggled with an oversupply of uranium after consumers such as Germany, Italy and Switzerland moved to decommission active plants, and other energy alternatives such as renewables and cheaper gas entered the market.

After Fukushima, uranium prices entered a period of steady decline until the price fell below US$18/lb in late 2016.

The price then hovered between US$20/lb and US$25/lb for about 18 months, before rising steadily in the last six months of 2018 to end the year at US$28.50/lb.

The uranium price creeping back up in 2018 is believed a result of production cutbacks including Cameco’s decision to suspend production at its McArthur River mine and Key Lake mill operations, both in Canada, commencing January 2018.

McArthur River was previously the world’s largest uranium mine, estimated to account for 11% of global supply.

“With the continued state of oversupply in the uranium market and no expectation of change on the immediate horizon, it does not make economic sense for us to continue producing at McArthur River and Key Lake when we are holding a large inventory,” Cameco president and chief executive officer Tim Gitzel said of the decision in late 2017.

By July 2018, Cameco had decided to extend the initial 10-month suspension indefinitely in light of continued market oversupply and a commodity price too low to justify restarting idled production.

“We have not seen the improvement needed in the uranium market to restart McArthur River… we will not produce from our tier-one assets to deliver into an oversupplied spot market,” Mr Gitzel said in the company’s 2018 half-yearly report.

“Until we are able to commit our production under long-term contracts that provide an acceptable rate of return for our owners, we do not plan to restart.”

In December 2017, Kazakhstan’s state-owned Kazatomprom also announced it would slash its planned output by 20% (11,000t) for three years from January 2018, to better align supply with demand.

The company currently accounts for one-third of global uranium production and the cutback during 2018 alone will be to the tune of 4,000t – or 7% of forecast output for the period.

A price rebound?

Meanwhile, many uranium experts believe the uranium price will be able to fully recover from the consequences of Fukushima and the negative perceptions it perpetuated about uranium.

Interestingly, the United Nations Scientific Committee on the Effects of Atomic Radiation (UNSCEAR) reported that, by 2015, “no radiation-related acute illness or deaths had been observed as a consequence of radiation exposure in the Fukushima prefecture, and no discernible increased incidence of radiation-related health effects are expected”.

That hasn’t alleviated the metal’s reputation though, and leaves the market wondering if uranium will ever repeat its peak performance of 2007 when prices surged to around US$137/lb.

The Australian Government Office of Chief Economist’s Resources and Energy Quarterly December 2018 – Uranium report clearly states “uranium spot prices appear to be on a sustained recovery”.

According to the report, the uranium spot price will average US$28/lb by 2020 and hover around US$26.2/lb in 2019.

Meanwhile, hedge fund analyst Mike Alkin is more bullish, claiming the current price of uranium “simply has to go up”.

Mr Alkin is so confident that the current bear market is sowing seeds for a bull market to come, that he founded uranium-focused investment company Sachem Cove Partners – a recently created vehicle to exploit what he believes is “the best investment opportunity” in his 20-year career.

“If you’re a global uranium miner right now, it costs you on average US$50/lb to pull it out of the ground and you’re selling it for US$20/lb on the spot market – those economics don’t work,” he told delegates at the 2017 International Metal Writers Conference in Canada.

“It’s an industry in absolute crisis right now but I also think it presents the best risk-reward of any investment I’ve seen in .”

His rebound theory relates to the coming need for global power utilities to restock their uranium supplies.

“Utilities buy on seven to 10-year cycles and during the last peak, they were out contracting, but those contracts are nearing their expiry date and the utilities need time to secure their next source of supply,” he said.

“When those Requests for Proposals come across a mining company’s desk, if they bid on them it won’t be at the US$25/lb uranium price – the incentive price needs to be meaningfully higher.”

“The price will go up.”

Cameco’s shutdown at McArthur River is proof of Mr Alkin’s summary – killing the operation will indefinitely remove 11% of global supply while simultaneously requiring Cameco to source that amount of material to fill contracted sales positions, thereby putting a tremendous strain on a market which already appears in deficit.

If Cameco’s intended effect comes to fruition, this could potentially prompt a significant rise in the commodity’s spot price, especially with growth in the gap between supply and demand.

Capitalising on a bear market

Uranium might be the fallen commodity, but the price has been spot on for newly-listed investment house Yellow Cake, founded on the premise that what goes down must eventually come up.

Yellow Cake listed on London’s AIM exchange in July after raising US$200 million through a share placing and has used the funds to secure 8.81Mlb of uranium oxide from Kazatomprom at a contract price of US$21.01/lb over the next 10 years.

The company plans to be a long-term holder of the commodity and to increase its level of ownership over time.

“A decade of declining uranium prices has resulted in significantly declining investment in exploration for uranium, impacting the development of new uranium mines and resulting in projected supply deficits as global production falls below demand,” said Yellow Cake chief executive officer Andre Liebenberg.

“The supply gap that has been created is currently being covered by secondary sources – largely from enrichment providers underfeeding – however, those sources are also declining and due to the length of time required to develop new uranium mines, new production may not be sufficient to fill the supply deficit.”

Mr Liebenberg said Yellow Cake was established to offer exposure to investors looking to capitalise on the expected resurgence in the uranium price, while avoiding direct exposure to exploration, development, mining and processing risk.

He said his team intends to exploit a “range of expected opportunities connected with owning uranium oxide”, such as uranium trading and optimisation of logistics, revenue generation from uranium lending, and uranium-based financing initiatives such as commodity streaming and royalties.

Kazatomprom said it was pleased to sign the supply agreement for a “substantial proportion” of its product, with Yellow Cake’s successful listing indicating “confidence in the long-term prospects of the uranium market”.

“Due to an exceptional set of circumstances, uranium is one of the few commodities yet to recover from the recent bear market and we believe it is currently fundamentally and structurally mispriced,” Mr Liebenberg added.

World supply and demand

The Resources and Energy Quarterly December 2018 – Uranium report reveals about 11% of electricity used worldwide is generated from uranium, with more than 450 nuclear power reactors operating across 30 countries.

The world’s key uranium consuming nations in 2018 were the US, France, Russia, China, South Korea and Japan.

Global consumption levels in 2017 were about 80,900t and this is expected to have risen to 84,300t in 2018.

Boosting the positive outlook, the Resources and Energy Quarterly December 2018 – Uranium report forecasts global consumption will tip 94,300t by 2020.

Sixteen countries depend on nuclear power for at least 25% of their energy needs, including: Belgium, Bulgaria, Czech Republic, Finland, Hungary, South Korea, Slovakia, Slovenia, Sweden, Switzerland and Ukraine.

Meanwhile, the world’s largest uranium end user, the US, has around 100 operating reactors, which supply 20% of its electricity, while France sources 75% of its power from uranium.

In the last 12 months, global nuclear electricity generation has surpassed pre-Fukushima levels to sit at a little over 2.6 million gigawatt hours per year.

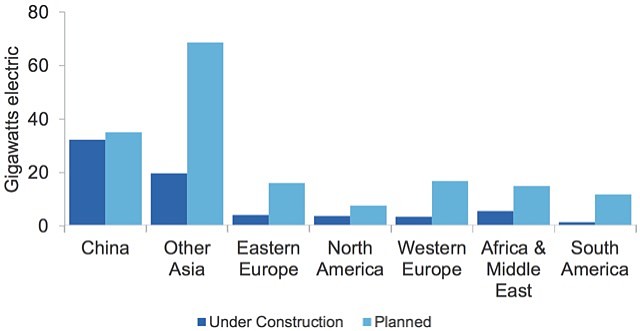

The World Nuclear Association claims 50 new reactors are under construction and about another 150 are planned across the globe.

Nuclear industry research organisation SightlineU3O8 said countries with high population growth and high electricity demands are driving record high nuclear reactor construction, which will likely continue to fuel nuclear demand for at least the next 10-15 years.

“Countries with high projected growth are already taking steps to make emission-friendly nuclear energy a bigger portion of their future energy delivery mix,” SightlineU3O8 said.

Although consumption of uranium is rising and predicted to continue doing so, for some time now, production has not kept up with demand.

Some uranium demand has been met by converting highly-enriched uranium from obsolete military warheads.

However, as the proposed new reactors come online, the supply will need to increase to keep up with global requirements.

In 2017, world uranium production was 69,000t, but this is expected to have dropped more than 10% to about 61,700t in 2018, due to the aforementioned mining cutbacks.

As the uranium market falls further into deficit, existing mines will be brought back online, with the Chief Economist predicting production will rebound to 72,500t by 2020.

India to host world’s largest nuclear power plant

India is one of the countries targeting the construction of nuclear power plants, under the Indian Government’s commitment to growing the nation’s nuclear power capacity.

Despite not taking part in the 1968 international Treaty on the Non-Proliferation of Nuclear Weapons, India was granted a waiver from the Nuclear Suppliers Group to trade nuclear products with other countries.

India has maintained its vision of becoming a world leader in nuclear power technology, and firmed up its relations with France in 2018 via an Industrial Way Forward agreement to accelerate development of the proposed plant Jaitapur, which will be capable of generating 9,900MW of electric power from six 1,650MW reactors.

Once operational, it is expected Jaitapur will be the world’s largest nuclear power plant.

Ambitions from the east

China’s lofty nuclear ambition – targeting a boost to its nuclear power capacity by 2020 – will see the world’s second largest economy simultaneously increase its demand for uranium.

The country is in the middle of a nuclear reactor building program and aims to have 58 gigawatts of capacity in full commercial operation by the end of the decade.

Beijing has been stockpiling uranium since 2007 from Australia, Canada, Namibia, Uzbekistan and Kazakhstan, in a bid to protect itself from supply disruptions or price fluctuations.

Kazakhstan exports all of its extracted uranium mainly under long-term contracts, as the country does not own its own nuclear power plants.

China remains the main importer of Kazakh uranium, the share of which is usually at least around 55% from the total Kazakh export. In 2017, Kazakhstan exported more than 12,000t to China.

The World Nuclear Association estimated China had 74,000t of stockpiled uranium in 2016 – accounting for around a decade’s worth of supply.

The Shanghai Nuclear Power Office expects China’s natural uranium demand is likely to reach 11,000tpa by 2020, and rise to 24,000tpa in 2030, outstripping production from domestic mines and China-owned mines overseas.

Taiwan nuclear power sentiments shift

Meanwhile, sentiment in Taiwan has shifted after voters in the country recently elected to reject the government’s nuclear power phase-out policy, which was implemented in 2016.

Prior to the policy, nuclear power had contributed 20% of the country’s generated electricity between 2010 and 2015.

Uranium in Australia: is it time?

Back in Australia, “the time has come” to reconsider the role uranium could play in our energy supply, according to Australian Institute of Management chief executive officer Stephen Durkin.

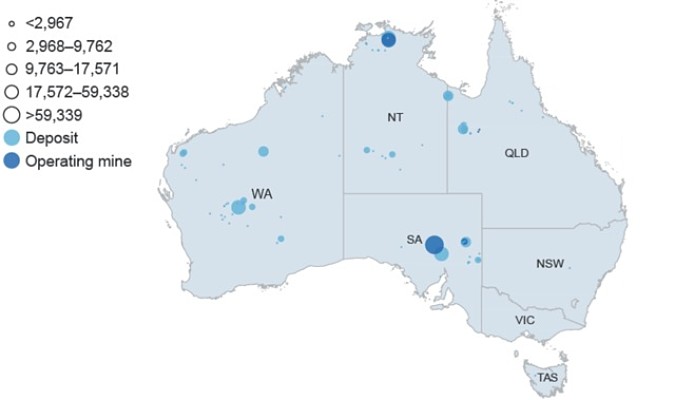

Despite divided views on nuclear power and uranium mining across the country, the fact remains that Australia is the world’s third largest uranium producer.

The country also hosts almost a third of the world’s proven uranium resources.

Although uranium mining is banned in Queensland and WA, Australia produces and exports more than 7,000t of uranium to global markets each year.

Speaking after the AusIMM International Uranium Conference in June 2018, Mr Durkin said rising power costs, lower energy security and the need to reduce greenhouse emissions creates an opportune moment for Australia to move closer to the nuclear option.

“The stigma that shapes discussion around uranium and nuclear energy is holding back from progressing towards a cleaner, more secure energy future,” he told delegates.

“Countries like France, China and India are leading the way on this and Australia has the resources and the professional capabilities to follow suit.”

Speakers at the AusIMM conference expressed bewilderment at the reinstated bans on uranium mining by governments in WA and Queensland, despite soaring electricity prices as well as exploration potential and development opportunities in these states.

The strong role uranium plays in supporting first world medical practices in Australia was also explored, with Charles Sturt University Associate Professor Geoff Currie addressing delegates on the nation’s vital nuclear medicine industry, which is dependent on continued operation of the 20 megawatt, state-of-the-art Open Pool Australian Lightwater (OPAL) reactor at Lucas Heights in NSW.

Opened in 2007 by the Australian Nuclear Science and Technology Organisation (ANSTO) as the centrepiece of its research facilities, OPAL is one of a small number of reactors worldwide known as “neutron factories”, with the capacity to produce commercial quantities of radioisotopes for cancer detection and treatment as well as neutron beams for materials research.

OPAL is used by the scientific, medical, environmental and industrial communities as well as Australian universities, and uses low-enriched uranium as its fuel.

Away from the conference, others have said the nuclear debate has had its day.

“With the possible exception of carbon capture and storage, nuclear power would be the most expensive and least effective way of reducing emissions in Australia,” Friends of the Earth campaigner Dr Jim Green told media earlier this year.

Nuclear physicist and Australian businessman Ziggy Switkowski said what was once a cost-effective option is now less economically-viable and, while nuclear has zero emissions, this was offset by “community concerns about waste and safety”.

The man who once said 50 new reactors would solve Australia’s emissions woes, now believes “the window for gigawatt-scale nuclear has closed” citing rising construction costs, lengthy development timelines and strong performance from the solar-with-battery-storage sector.

However, he noted smaller, modular nuclear reactors could play a role in Australia’s energy future including supporting regional centres.

Uranium stocks on the ASX

While the fate of Australia’s uranium industry hangs in the balance, the fact remains that uranium demand is predicted to rise in several countries worldwide including China and India.

For investors seeking exposure to the uranium market, Small Caps has compiled a list of uranium stocks on the ASX:

A-Cap Energy (ASX: ACB)

The Letlhakane uranium project in Botswana continues to be a core strategy for A-Cap Energy (formerly A-Cap Resources), with a view to supplying uranium oxide to nuclear facilities as a prime fuel for base load power generation and battery markets.

In 2018, the company said it was investigating ways of “materially-improving the project economics” at Letlhakane by reducing operating expenditure, particularly with regards to acid consumption.

The company is planning the next phase of project optimisation work to further de-risk Letlhakane prior to commencing a feasibility study.

Adavale Resources (ASX: ADD)

Through its subsidiary Adavale Minerals, Adavale Resources holds three exploration licences in a highly-prospective sedimentary uranium province within the northern part of the Lake Frome Embayment in South Australia.

The licences, referred to as the Lake Surprise project, contain the Jubilee and Mookwarinna prospects, which could both be mined by shallow open-cut methods. The uranium is amenable to simple heap-leach extraction processes if ongoing exploration identifies economic resources.

Approvals have been received for the tenure on all three tenements to be extended to mid-2020 and Adavale is continuing discussions with potential joint venture parties to explore and develop the deposits.

While there have been no reported field activities conducted prior to the release of the company’s 2018 third quarter report, Adavale has previously stated its plans to extend exploration activities into undrilled areas of the tenements, which appear to contain similar geological environments to Jubilee and Mookwarinna.

In October, Adavale said it was continuing to seek additional mining and energy assets to complement its growth outlook.

Alligator Energy (ASX: AGE)

Continued low uranium prices and a subdued market has seen Alligator Energy broaden its strategy of exploring exclusively for deposits within the Alligator River uranium province (ARUP) in the Northern Territory’s Arnhem Land region.

In October 2018, Alligator completed a seven-hole 2,138m drilling program at the TCC4 prospect within its ARUP project. The program targeted concealed uranium deposits under sandstone cover using Alligator’s proprietary geochemical sampling and geophysical methods.

Significant alteration of host rocks, similar to that of known uranium deposits in the province, was observed in five holes.

In November, the company announced a uranium geologist is conducting a review of the TCC4 drilling results, which will be used to identify priority targets for follow-up drilling.

Based on the review, Alligator said it also hoped to engage with potential strategic partners looking to farm into and pursue uranium targets.

Aura Energy (ASX: AEE)

In December 2018, Aura Energy was granted an exploitation licence for its flagship Tiris uranium project in Mauritania, an important precursor to the East African project’s full development.

Uranium occurs in nine separate deposits within the company’s wholly-owned exploration permits, with the total resource estimated at 52Mlb.

This includes 17.1Mlb uranium oxide in the measured and indicated categories at a 100ppm cut-off and 10.5Mlb measured and indicated at 342ppm uranium oxide at a 200ppm cut-off.

Definitive feasibility study work for Tiris has been ongoing with a key focus on the definition of processing domains and recovery of bulk samples for detailed test work and final process design and engineering. Production is anticipated in 2020.

Tiris remains Aura’s “best near-term cash flow project”, with low capital and operating costs with the promise of strong financial returns under long-term uranium pricing scenarios.

Australian Vanadium (ASX: AVL)

Although focused on vanadium from its flagship Gabanintha deposit, Australian Vanadium’s Nowthanna Hill project, 47km south east of Meekatharra in WA is prospective for uranium.

The company also secured an exploration licence to the south of the Gabanintha deposit, which is prospective for several minerals including uranium.

Toro Energy holds a portion of the Nowthanna Hill uranium deposit adjacent to Australian Vanadium’s tenements and Toro has developed a mineral resource of 13.5Mt at 399ppm uranium oxide.

Australian Vanadium is working on a resource estimate for its Nowthanna Hill project.

Bannerman Resources (ASX: BMN)

Bannerman Resources owns 95% of the Etango project, which is one of the world’s largest undeveloped uranium deposits, located in the Erongo uranium mining region of Namibia which also hosts the Rössing (Rio Tinto), Langer Heinrich (Paladin Energy) and Husab (China General Nuclear) uranium mines.

In 2017, Bannerman commenced a process optimisation study with the objective of incorporating favourable results from a two-year heap leach demonstration plant program and evaluating the application of processing technology advances since the 2012 definitive feasibility study.

In November 2018, the company announced a nine-hole reconnaissance drilling program on its prospecting licence immediately north of the Etango project.

The program is testing two targets within 10km of the proposed Etango processing plant, Ombepo and Rossingberg, with results expected in the 2019 first quarter.

Bannerman said results from the program would help decide whether potential value could be gained from defining further resources within trucking distance of the processing plant.

The Etango definitive feasibility study update is expected to continue in 2019.

Berkeley Energia (ASX: BKY)

Berkeley Energia is one of the largest investors in the Castilla y León region of Spain, with its $100m Salamanca uranium mine still in the planning stages.

The company has 2.75Mlb of uranium oxide under contract for the first six years of operation, with a further 1.25Mlb of optional volume at an average price above US$42/lb compared with a spot price of $22/lb.

Berkeley is currently awaiting an urbanism licence and construction works authorisation for the treatment plant as a radioactive facility.

Following Spanish media reports that the government was intending to deny the permits for the mine, the company said in late October 2018 it was continuing to work with the Nuclear Safety Council in progressing the necessary approvals.

Berkeley is hoping the Salamanca mine will reach production as the uranium market enters the long-awaited supply/demand deficit, which industry experts have called “both fundamental and unavoidable”.

It believes it has the potential to be Europe’s only major uranium mine and one of the biggest producers in the world once operating.

In 2016, an independent study reported that Salamanca will have a net present value of over US$530 million and will produce 4.4Mlb of uranium per annum at a cash costs of US$15.39/lb, putting it among the world’s top 10 lowest cost uranium producers.

BHP Group (ASX: BHP)

Mining giant BHP Group (formerly known as BHP Billiton) is producing copper, gold and uranium from its Olympic Dam project, 560km north of Adelaide in South Australia.

During the 2018 financial year, BHP had produced 3,364t of uranium in concentrate from Olympic Dam – up marginally on 2017’s output. In the September 2018 quarter, BHP sold 765t of uranium oxide concentrate, which is more than the 559t it mined during that period.

In late November, the company announced a diamond drilling program had confirmed a potential new iron oxide-copper-gold mineralised system about 65km south-east of Olympic Dam.

Laboratory assay results showed the mineralisation also contained associated metals including uranium.

A follow-up drilling program is planned for early 2019.

Boss Resources (ASX: BOE)

Boss Resources is continuing its re-start strategy for the Honeymoon uranium project in South Australia. The strategy comprises three key phases, with the first phase including an infill drilling program completed in October.

This program is expected to deliver a measured and indicated resource, which is required for the completion of a definitive feasibility study.

Phase two is expected to commence in early 2019 with an updated mineral resource estimate and followed by wellfield design activities.

An important component will be a re-start of the existing solvent extraction processing plant which, together with the Honeymoon mine, was placed on care and maintenance in 2015.

The plant will process the majority of Honeymoon’s uranium production for the first 18 months of operation.

Previous drill intercepts have confirmed the continuity of uranium mineralisation throughout the target area with suggestions that the mineralisation remains open to the east and northeast of the mining lease, indicating strong potential for future growth of the existing resource.

Cape Lambert Resources (ASX: CFE)

Cap Lambert Resources holds a 15.93% interest in exploration company Cauldron Energy, which operates the Yanrey uranium project in WA.

For more detailed information on the Yanrey project, please refer to the Cauldron Energy entry.

Cazaly Resources (ASX: CAZ)

Cazaly Resources has applied for an 80% interest in two uranium projects Brzkov and Horni Venice in the Czech Republic.

State enterprise Diamo is closing the country’s only operating uranium mine and has indicated interest in mining at Brzkov.

Cauldron Energy (ASX: CXU)

Cauldron Energy operates the 1,548sq km Yanrey uranium exploration project in WA’s Carnarvon Basin, which hosts the shallow accumulation Bennet Well uranium deposit.

At 2015, the deposit had a total JORC indicated and inferred mineral resource of 21.51Mlb at 270ppm uranium oxide equivalent and remains unchanged as no further work has been conducted at the site.

In 2008, Cauldron entered into a joint venture with Atomic (now Intra Energy Corporation) to explore its Uaroo tenements for uranium and went on to earn a 70% interest in the uranium mineral rights within E08/1494 and E08/1495.

Cauldron is now the manager and operator of the Uaroo tenements.

During the September period, Cauldron continued dialogue with the WA Government regarding the status of uranium exploration, with uranium mining currently prohibited in the area.

Cohiba Minerals (ASX: CHK)

In January 2018, Cohiba Minerals entered into a binding terms sheet with Olympic Domain Pty Ltd to earn up to an 80% interest in seven exploration tenements in South Australia over a total portfolio licence area of 1,094sq km.

The tenements are in the Stuart Shelf province, which hosts major IOCG and uranium deposits containing large quantities of hematite and magnetite, as well as significant amounts of copper, gold, uranium, silver and rare earth elements.

In late November, Cohiba announced it was accelerating its exploration plans on the tenements following BHP’s recent Oak Dam IOCG discovery just 2km east of Cohiba’s Horse Well target.

According to the company, a desktop review has confirmed the Horse Well tenements lie within the same regional geological setting as Oak Dam, which also has similar regional settings to BHP’s large Olympic Dam deposit.

In December, Cohiba received commitments from investors to raise $1.6 million to fast-track exploration at the Olympic Domain tenements including a drilling program at Horse Well.

Core Lithium (ASX: CXO)

Emerging lithium developer Core Lithium (previously Core Exploration) has received expressions of interest from multiple parties regarding a sale or partial sale of the Napperby advanced uranium project in the Northern Territory, which has an inferred resource of 9.54Mt at 382ppm uranium oxide for 8.03Mlb of contained uranium oxide at a 200ppm uranium oxide cut-off.

Core said it would consider offers so it could remain focused on developing its flagship Finniss lithium project, also in the Northern Territory.

The company also owns the Fitton high-grade uranium project in South Australia, adjacent to the Four Mile uranium mine.

Deep Yellow (ASX: DYL)

Uranium-focused advanced explorer Deep Yellow holds an interest in three Namibian assets: Reptile (an active project, containing the Tumas 1 and 2, Tumas 3 and Tubas Sand and Tubas Calcrete deposits, and Tumas east mineralised zones); the Nova joint venture (active); and the Yellow Dune joint venture (non-active).

In November, Deep Yellow had identified a new region of extensive uranium mineralisation in the Tumas 1 East paleochannel area at Reptile, which it followed up with resource definition drilling. Drilling then moved to Tumas 3 West, where “encouraging” results were announced in December.

Testing was paused on the Tumas Central paleochannel over the Christmas break, however, drilling is expected to resume in February. The results of these drilling campaigns are expected to be included in a new mineral resource estimate scheduled to be completed in early 2019.

While drilling at the main target Namaqua had not identified any economic uranium mineralisation so far, the company said further drilling is planned in 2019 to explore previously untested paleochannels in the Nova project area.

The company considers Yellow Dune (EPL3498) to be fully explored with no further potential for additional discovery to add to existing defined resources.

Deep Yellow has applied for a retention licence to secure the area containing the resource as economic studies have shown a mining operation at prevailing low uranium prices, combined with a depressed uranium outlook, would not be viable.

DevEx Resources (ASX: DEV)

DevEx Resources is exploring the West Arnhem-Nabarlek project, which comprises a 5,963sq km tenement package in the NT’s ARUP region – a Proterozoic mineral province known for its world-class uranium deposits.

At the heart of the project lies the historic Nabarlek mine, considered Australia’s highest-grade uranium mine with a previous production of 24Mlb grading 1.84% uranium oxide.

New assessment of historical data has revealed potential for commodities including high-grade copper-gold previously overlooked by uranium-focused explorers.

Eclipse Metals (ASX: EPM)

Manganese-focused Eclipse Metals has numerous uranium tenements under application in the Northern Territory.

The Northern Territory Government has granted Eclipse consent to negotiate with traditional owners regarding the Liverpool project.

Meanwhile, on its granted Bigrlyi licence, Eclipse has evaluated historical data and plans to carry out a geophysical gravity survey of the Ngalia Basin.

Energy Metals (ASX: EME)

Another uranium explorer in the Northern Territory is Energy Metals, with its wholly-owned Ngalia Regional project and its 72.39% stake in the Bigrlyi joint venture.

The Ngalia Regional project encompasses 3,100sq km in the Ngalia Basin and encloses the Bigrlyi joint venture.

Energy Metals has identified several high priority targets for evaluation, with some of the prospects originally discovered in the 1970s.

The company also has a 41.9% interest in the Walbiri joint venture, a 52.1% holding in the Malawiri deposit, and wholly-owns the Macallan licence application in the region.

In addition to the Northern Territory project, Energy Metals has an interest in several other uranium projects throughout WA.

Energy Metals is one of only five companies to currently hold all the required permits and authorisation to export uranium oxide concentrates from Australia.

It is also one of two companies authorised by the Chinese Government to import and export uranium.

The company is negotiating with Australian uranium producers to enable shipments, primarily to major Chinese utility China General Nuclear Power Group, which is the parent of Energy Metals’ largest shareholder, China Uranium Development Company.

In its September 2018 quarterly, Energy said it is “well placed to take advantage of the favourable outlook for uranium as nuclear power continues to play an increasing role in reducing global carbon emissions”.

Energy Resources of Australia (ASX: ERA)

One of Australia’s largest uranium producers and owner of the nation’s longest continually-operating uranium mine is Energy Resources of Australia.

Its Ranger mine is located near Jabiru in the Northern Territory and produced 544t of uranium oxide in the September 2018 quarter, compared with 400t in the previous period, and is currently undergoing progressive rehabilitation activities with a view to final operations in 2021 and complete decommissioning by 2026.

In December, the company reported a project closure feasibility study on Ranger was nearing completion, with preliminary findings highlighting an increase in the estimated cost of the rehabilitation program by $296 million to $808 million. The feasibility study is expected to be finalised in the 2019 first quarter.

Energy Resources of Australia’s world-class Jabiluka deposit, 22km north of Ranger, is under long term care and maintenance and will not be developed without consent from the Mirarr traditional owners.

The company’s Ranger 3 Deeps exploration decline also remains under care and maintenance.

Greenland Minerals (ASX: GGG)

Greenland Minerals’ primary area of interest is the northern Ilimaussaq Intrusive Complex in southern Greenland, which includes several large scale multi‐element deposits including Kvanefjeld, Sørensen and Zone 3, underpinned by a global mineral resource of more than 1.01Bt, including 593Ml uranium oxide.

With an ore reserve estimate of 108Mt and an initial 37‐year mine life, Kvanefjeld is projected to be one of the largest global producers of rare earth elements, with uranium, zinc and fluorspar as by-products.

Havilah Resources (ASX: HAV)

Multi-commodity explorer Havilah Resources wholly-owns tenements prospective for roll-front style uranium in tertiary paleochannels and blanket sands.

The Paleochannel uranium project tenements are located 420km north-east of Adelaide and host the Oban deposit which has an inferred resource of 8Mt at 260ppm uranium oxide equivalent for 2,100t of contained uranium oxide equivalent.

According to Havilah, previous drilling has uncovered many uranium targets to evaluate outside of Oban.

At present, Havilah is looking at joint venture opportunities to advance the project.

Hylea Metals (ASX: HCO)

Cobalt explorer Hylea Metals is acquiring a 65% interest in the Malawi-based Kayelekera uranium project from Paladin Energy.

The Malawi Government owns 15% of the asset, with Chichewa holding the remaining 20%.

In a separate deal, Hylea has the option to acquire Chichewa’s stake in Kayelekera – potentially giving it 85% of the project.

Kayelekera covers 152sq km and hosts a historic open pit mine which produced 10.9Mlb of uranium between 2009 and 2014.

In FY2013, the mine produced 1.07t of ore at 1,350ppm uranium.

The mine has been on care and maintenance due to prevailing low uranium prices.

Jindalee Resources (ASX: JRL)

Jindalee Resources currently holds a 6.7% stake in Energy Metals, giving shareholders continued exposure to development of the Bigrlyi uranium deposit and the potential of Energy Metals’ other uranium projects.

For more detailed information on these projects, see the Energy Metals entry.

Kalia Limited (ASX: KLH)

Formerly known as GB Energy, Kalia owns the Stuart Shelf copper-gold-uranium project which lies within the Olympic copper-gold province in South Australia, host to Olympic Dam, Prominent Hill, Carrapateena, Hillside and other recent discoveries.

The company is focused on exploring for copper and gold on the island of Bougainville, but has exploration licences and licence applications in the Northern Territory, with two licences in the Ngalia Basin area, where other companies are actively searching for uranium.

Laramide Resources (ASX: LAM)

Laramide Resources’ advanced uranium suite includes the recently-acquired, near-term Churchrock and Crownpoint in-situ recovery projects and the La Jara Mesa property in New Mexico, the La Sal project in Utah, and the flagship advanced stage Westmoreland project in Queensland.

In 2018, the company added to its Australian portfolio by acquiring the Murphy uranium tenements from Rio Tinto, and taking up the full 100% interest in the Lagoon Creek project, which it previously held in a 50:50 joint venture with Verdant Minerals (ASX: VRM).

Both projects are in the Northern Territory, contiguous to and along strike from Westmoreland, and located in the highly-prospective and underexplored Murphy uranium province.

In the US, Laramide has confirmed an inferred resource estimate at Churchrock of 33.9Mt at 0.075% uranium oxide equivalent for a contained resource of 50.8Mlb.

Crownpoint, located 48km east of Churchrock, is covered by a licence from the US Nuclear Regulatory Commission for uranium production, including the construction of a central processing plant with an approved production capacity of 3Mlb uranium oxide per year.

In December 2018, Laramide announced a maiden mineral resource estimate for Crownpoint of 2.5Mt at 0.102% uranium oxide equivalent for a contained resource of 5.1Mlb.

Manhattan Corporation (ASX: MHC)

Manhattan Corporation’s flagship Ponton uranium project, 200km northeast of Kalgoorlie in WA, comprises over 460sq km of exploration tenements, underlain by tertiary paleochannels within the Gunbarrel Basin, which are known to host a number of uranium deposits and drilled uranium prospects.

In 2017, Manhattan announced an inferred resource for the Double 8 uranium deposit within the Ponton project of 26Mt for 17.2Mlb grading 300ppm uranium oxide.

In September, the company said it was reviewing the importance of Ponton and had “pragmatically decided” to write-off all exploration expenditure at the Ponton, Double 8, Stallion South and Highway South tenements.

Marenica Energy (ASX: MEY)

Marenica Energy holds a retention licence over the Marenica uranium project in Namibia’s highly-prospective Erongo uranium province and, in May 2018, acquired 100% of the advanced Mile 72 exploration project in the same region.

During the September 2018 quarter, the company requested to reduce the area of its Mile 72 licence to exclude environmentally-sensitive zones. It is planning to commence an exploration program at the project once environmental clearance has been received.

Marenica also has five tenement applications in Namibia, which it believes to be prospective for calcrete-hosted uranium mineralisation. One of these applications adjoins Deep Yellow’s Tumas tenement, where successful drilling results in October 2018 confirmed extensions to the Tumas East channel.

In addition, Marenica is progressing with development of its patented U-pgrade beneficiation process technology, applying it to third party projects such as Langer Heinrich (owned by Paladin Energy) and Tumas (Deep Yellow), as well as focusing on commercialisation opportunities.

Marmota (ASX: MEU)

While also now exploring for gold, Marmota started life as a uranium explorer and currently holds a JORC inferred resource at the Junction Dam tenement, near Broken Hill in NSW, of 5.4Mlb uranium with average grade of 557ppm uranium oxide and an exploration target of 22-33Mlb uranium oxide.

The company considers itself “particularly well-placed” for any upturn in the uranium sector, with Junction Dam being adjacent to one of only four permitted uranium mines in Australia.

“It provides our shareholders with effectively a ‘free bonus’ option on the uranium price,” Marmota stated.

Myanmar Metals (ASX: MYL)

After allowing several tenements in the Northern Territory to lapse, in October 2018, Myanmar Metals still held the non-diamond rights to one exploration licence in Arnhem Land near the East Alligator River uranium deposits.

Myanmar Metals has not reported any recent exploration activity over the licence and allowed several to lapse in 2018, as well as relinquishing primary licences EL 30051, and EL 26206.

Paladin Energy (ASX: PDN)

In May 2018, Paladin Energy put its massive 75%-owned Langer Heinrich uranium mine, in Namibia, into care and maintenance due to the sustained low uranium spot price.

In December, the company commenced a concept study, which will be followed by a pre-feasibility study, in preparation for a restart decision.

Collectively, the studies will examine opportunities for improvements to mining and processing at Langer Heinrich including ways to decrease costs and increase throughput and productivity, as well as assess the potential for the recovery of a vanadium bi-product.

According to Paladin, the pre-feasibility study is expected to be completed in 2019, with the restart decision depending on a “sustained uranium price recovery”.

Paladin’s 85%-owned Kayelekera mine, in northern Malawi has been on care and maintenance since 2014. Work continues on ways to reduce costs and maintain a stable “ready to start” site.

The company also has a suite of uranium exploration projects, including the ones it secured when it acquired Summit Resources in late October 2018.

Peninsula Energy (ASX: PEN)

Peninsula Energy has been producing uranium from its Lance projects’ in-situ recovery development on the north-east flank of the Powder River basin in Wyoming since 2015.

During 2018, the company continued its focus on improving operational performance including using lower pH solutions to increase peak uranium solution grades and recoveries.

In late December, it announced the start of field demonstration activities for low pH in-situ recovery at the Lance projects.

Also that month, the company signed a new uranium toll milling agreement with its existing toll milling service provider Uranium One Americas. The deal has an initial five-year term with an option for an additional five years.

According to Peninsula managing director Wayne Heili, the new agreement “delivers a more favourable commercial outcome than the previous agreement”.

Peninsula sold 257,934lb of uranium oxide pursuant to long-term contracts during the 2018 financial year, at an average realised cash price of US$46.73/pound.

The company has up to 6.5Mlb of uranium oxide remaining under contract for delivery to major utilities in the US and Europe through to 2030, at a weighted average delivery price of approximately US$53/pound.

In April, Peninsula decided to divest its 74% interest in the Karoo uranium project in South Africa primarily due to prevailing uranium market conditions which it believes “do not support the ongoing development of this hard-rock mining opportunity”.

The divestment allowed the company to focus all its attention on the Lance projects.

Protean Energy (ASX: POW)

Formerly known as Stonehenge Metals, Protean Energy owns the Daejon vanadium-uranium project, which contains a mineralised strike length of 8.3km and a mineral resource estimate of 76Mt at 0.3% vanadium pentoxide and 110ppm uranium oxide, for a total of 490Mlb contained vanadium pentoxide and 18Mlb of contained uranium oxide.

Protean expects to commence a scoping study for the Daejon development in early 2019.

Red Metal (ASX: RDM)

Red Metal owns tenements in the Olympic Domain portion of the Gawler Craton in South Australia.

The area is believed prospective for IOCG and uranium-type deposits and hosts BHP’s Olympic Dam mine as well as the Prominent Hill mine.

Red Metal also has the Frome joint venture, which includes tenements along the northern margin of the Curnamona Province.

Although uranium is present in the region, Red Metal is focused on the copper and gold potential across its licences.

Reedy Lagoon Corporation (ASX: RLC)

While Reedy Lagoon’s Edward Creek project has uranium on the north-eastern margin of the Gawler Craton in South Australia, no recent field work has been carried out at the tenements.

The licences are considered secondary to Reedy’s US-based Columbus Salt Marsh lithium-in-brine project.

Rio Tinto (ASX: RIO)

Rio Tinto has a suite of uranium projects operated by subsidiaries Energy Resources of Australia (at the Ranger mine in the NT) and Rio Tinto Canada Uranium (at the Roughrider uranium project at Saskatchewan).

In November 2018, the mining giant sold its entire 68.82% stake in Rossing Uranium, which owns the Rossing mine in Namibia, to China National Uranium Corporation for $106.5 million.

Rio’s global uranium production was 2% lower in the first half of 2018 compared to the previous corresponding period, reflecting lower production at Ranger as mining operations continued to process existing low-grade stockpiles, which was partially offset by higher production at Rössing due to higher mill grades.

Ranger’s third quarter production was 15% lower than the same period of 2017 due to declining grades and completion of laterite processing.

As at October 2018, Rio’s expected share of 2018 production from uranium operations was 6.2Mlb to 7.2Mlb. However, this projection was made prior to the sale of Rossing Uranium.

RMA Energy (ASX: RMT)

During previous exploration, including regional mapping, at the Cliffdale Creek uranium tenement near Mt Isa in Queensland, RMA Energy reported uranium and copper mineralisation occurring with hematite-stained and hydrothermally-altered breccia, implying that the prospect could be an IOCG-uranium opportunity.

Following a review of its tenement schedule, the company relinquished 48 sub-blocks in July 2018, but renewed and retained the 47 sub-blocks making up the Cliffdale Creek prospect.

No recent field activities have been reported.

Strategic Minerals Corporation (ASX: SMC)

Strategic Minerals Corporation, through its subsidiary company Alpha Uranium, has identified uranium targets within its flagship Woolgar project.

However, due to the Queensland Government’s prohibition on uranium mining, the company is not actively exploring for uranium.

Instead, Strategic Minerals is firming up the gold prospectivity across the tenements.

If uranium legislation changes in the state, Strategic stated it would look at resuming uranium exploration, with the company claiming Woolgar has the potential for “discovery of significant uranium deposits”.

Superior Resources (ASX: SPQ)

Another multi-commodity explorer is Superior Resources, which owns the Nicholson zinc-lead project in Queensland’s north-west. The project is also prospective for uranium and Superior has firmed up the Hedleys uranium prospect.

Superior also maintains an exposure to uranium through a holding of 350,000 shares in uranium-focused company Deep Yellow.

Tasman Resources (ASX: TAS)

Tasman Resources’ Lake Torrens project in South Australia, containing the large Vulcan and Titan deposits, is believed to host IOCG-uranium mineralisation and is near BHP’s Olympic Dam mine.

Tasman has defined a number of potential drill targets at Vulcan West, and is in talks with companies regarding joint venture opportunities relating to the Vulcan and Vulcan West prospects.

In early 2018, Tasman was granted a new 193sq km exploration licence at Pernatty on the southern Stuart Shelf with the purpose of defining additional drill targets.

In January 2019, the company announced several new IOCG target areas defined by recent gravity surveys and subsequent geophysical modelling.

Tasman said it would now consider potential options for drill testing including undertaking its own drilling program or seeking a joint venture partner.

There has been no recent progress at the company’s Lucas Hill prospect, also on the Stuart Shelf.

Toro Energy (ASX: TOE)

While the Wiluna uranium discovery in WA’s northern goldfields has been advanced to beneficiation and process design studies, current uranium market conditions continue to guide Toro Energy’s technical and development programs for the project.

Toro said the focus remains on pursuing studies which have the potential to significantly advance the technical and financial feasibility of Wiluna and support an updated scoping study.

The company plans to advance Wiluna to the point that it is capable of being financed and brought into production as soon as economic conditions justify development.

In its latest annual report, Toro said it is continuing to “evaluate and reduce its exploration holdings at the Theseus uranium project”, near Lake Mackay on the Western Australia and Northern Territory border.

Verdant Minerals (ASX: VRM)

Formerly a uranium producer, the company changed its name from Rum Jungle Resources to Verdant Minerals in late 2016 to reflect its focus on developing fertiliser minerals.

The company has applied for licences covering Dneiper and Old South Road silica projects in the Northern Territory, which were historically explored for uranium.

Verdant has exploration licences for other projects in the Northern Territory, however, the company will not be actively firming up uranium resources even though the area is known to be prospective for the mineral.

In September 2018, it sold its 50% stake in the Lagoon Creek uranium project to former joint venture partner Laramide Resources.

Vimy Resources (ASX: VMY)

Vimy Resources’ flagship Mulga Rock project, located 290km from Kalgoorlie, is one of Australia’s largest undeveloped uranium resources, with a mineral resource 71.2Mt at 570ppm uranium oxide for 90.1Mlb uranium oxide.

A definitive feasibility study released in January 2018 confirmed Mulga Rock as a world-class uranium development with robust financials and simple, low-cost mining and metallurgical processes.

In June 2018, Vimy added to its portfolio with the $6.5 million acquisition of the largest granted uranium exploration package in the NT’s world-class Alligator River uranium district.

The Angularli deposit within the Alligator River project contains a maiden mineral resource of approximately 26Mlb uranium oxide from 0.91Mt grading 1.3% uranium oxide. Vimy owns 75% of the project, with Rio holding the other 25%.

The company commenced a maiden drilling campaign at Alligator River in August 2018, starting with the Angularli deposit before drilling Such Wow.

In December, Vimy reported the identification of a highly prospective, large hydrothermal system at the previously undrilled Such Wow prospect, describing it as a “stand-out exploration target due to the overall size of the structural corridor – more than five times the size of the Angularli prospect”.

Later that month, the company announced it would progress the Angularli deposit to the next stage of development following the positive outcomes of a completed scoping study.

Vital Metals (ASX: VML)

Vital Metals’ wholly-owned Aue project in the western Erzgebirge area of Saxony, Germany, comprises 78sq km in the heart of one of Europe’s most famous mining regions surrounded by several world-class mineral fields.

Historical mining and intensive exploration work carried out between the 1940s and 1980s showed high prospectivity of the Aue permit area for cobalt, tungsten, tin, uranium and silver mineralisation.

A small geochemical program in early 2018 confirmed the presence of cobalt, nickel, bismuth and silver concentrations, with cobalt the current mineral of focus.

Woomera Mining (ASX: WML)

South Australian and WA mineral explorer Woomera Mining has an extensive minerals tenement portfolio prospective for uranium, lithium and other metals in both states.

In South Australia, the tenements are in the Gawler Craton and generally host IOCG-uranium-typed minerals.

In WA, the Lakes Tay and Sharpe project near Mt Cattlin is believed prospective for uranium with a strong anomaly identified in the project’s north.

Woomera is currently carrying out preliminary exploration across its licences although uranium is not a key focus

Zeus Resources (ASX: ZEU)

Zeus Resources holds six active uranium licences in three project areas within WA: three of these make up the Wiluna project, 15km from the township, and were renewed for another five-year term during 2018.

Wiluna houses the Lake Way project (comprising the Kukabubba, Lake Gregory and Hinkler Well discoveries) which stretches over five contiguous tenement applications and a separate single granted tenement covering a combined area of 835sq km in the north-east Yilgarn Craton.

The northern group of tenements extends 90km northwest from the northern edge of Lake Way, which hosts an inferred resource of 10.53Mlb at 543ppm uranium oxide for 11.64Mlb contained uranium oxide.

The southern tenement covers a 4.5km section of the paleochannel which hosts the Dawson-Hinkler uranium deposit immediately to the west, and the Abercromby Well and Millipede uranium deposits immediately to the east.

At the Narnoo South project, exploration drilling during 2015 intersected low-grade uranium mineralisation within a narrow tributary paleochannel, steeply incised into underlying Permian clays.

During 2018, Zeus proceeded with plans for a 12-hole follow-up drilling program with a view to confirming the uranium grade and thicknesses identified during the original campaign.

“The market for low-grade uranium oxide continues to be persistently below US$25 per pound,” the company told shareholders in its 2018 annual report.

“We have continued with the expenditure commitment for retained tenements and have relinquished areas with no foreseeable potential during the financial year,” the company added.

SEE ALSO:

– Gold stocks on the ASX

– Silver stocks on the ASX

– Lithium stocks on the ASX

– Cobalt stocks on the ASX

– Graphite stocks on the ASX

– Nickel stocks on the ASX

– Rare earth stocks on the ASX

– Zinc stocks on the ASX

– Vanadium stocks on the ASX

– Tin stocks on the ASX

– Mineral sands stocks on the ASX

– High Purity Alumina stocks on the ASX

– Tungsten stocks on the ASX

– Hydrogen stocks on the ASX

– Oil and gas stocks on the ASX

– Cannabis stocks on the ASX