With gold currently in what analysts are calling a decade long bull run, now is the time to look at its trailing sister metal, silver, and the ASX stocks that have exposure.

According to renowned economist and author Jim Rickards, we are in the fourth year of the current gold bull market.

While gold and silver traditionally move together in price, silver tends to lag behind but then rises or falls more rapidly.

As a result, silver is a much more volatile commodity and has been described by market experts as “gold on steroids”.

For more than four months, gold has remained above the A$2,000 per ounce mark and even almost hit A$2,300/oz in late August on the pressured Australian dollar.

Silver has followed a similar path, with its price surging from around A$21.50/oz in July to almost A$29/oz in early September.

Currently at 1/83 of the gold price, silver – also referred to as “poor man’s gold” – is certainly a more attainable investment.

History of silver

Silver was one of the first five metals discovered and used by humans, along with gold, copper, lead and iron.

The first evidence of silver mining dates back to 3000 BC in Turkey and Greece.

Its chemical symbol ‘Ag’ comes from the Latin word for silver, ‘argentum’, which is derived from a word meaning ‘shining’.

The metal’s association with money and wealth dates back to ancient times, with the Romans using the word ‘argentarius’ for banker (or silver trader). Today, the French word for money is ‘argent’.

Silver has been used alongside gold as a form of currency for thousands of years. Since it is not as rare and therefore not as valuable as gold, silver represented smaller denominations of money.

In the 700s AD, the Saxons used one pound of silver to make 240 ‘sterling’ coins. This can be compared to today, where one British pound sterling comprises 100 pence.

Silver mining ramped up in the 15th century when Spanish conquerors discovered rich veins of the metal in South America.

According to industry trade group the Silver Institute, about 85% of silver produced between 1500-1800 AD came from Mexico, Peru and Bolivia. These three countries are still major silver producers today.

In addition to its role as a store of wealth, silver has a long history as a multipurpose metal with antibacterial properties making it useful for controlling spoilage, infections and illness.

It has been used in medicines and bandages, and American pioneers were said to have placed a silver coin in a jar of milk to keep it fresh (long before refrigeration).

Russian armies during both world wars, and even dating as far back as the Napoleonic wars, reportedly used silver-lined water casks to clean drinking water from rivers and streams.

In 1835, the German chemist Justus von Liebig acknowledged silver’s great ability to reflect visible light and discovered a way to coat glass with a thin layer of metallic silver.

This made mirrors, which were previously luxuries only afforded by the rich, less expensive and able to be manufactured on a larger scale.

Silver was also used in the first photographic cameras of the 19th century. Silver-based film continued to be used in the 20th and early 21st century until digital technology recently all but eliminated the use of film.

A well-known flaw of silver is how easily it tarnishes; however, it actually only tarnishes when it comes in contact with sulphur.

For most of human history, the metal was able to maintain its lustre over time but since the industrial revolution, small amounts of sulphur are now present in the atmosphere. Hence, this has caused silver to tarnish when exposed to the air.

Uses of silver

As well as being used in coins as currency, the precious metal’s attractive colour and shine make it desirable in jewellery and silverware such as cutlery, serving platters and candelabras.

However, pure silver is malleable and soft, so in order to make it into hardened products, an alloy comprising 92.5% silver and 7.5% copper or other metals is used. This is known as ‘sterling silver’.

Silver has a higher electrical and thermal conductance, and a higher reflectivity at most temperatures, than any other metal, making it perfect for solar panels.

It has also been used in the medical field for centuries for its antimicrobial properties. Common uses include wound dressings, creams and as an antibiotic coating on medical devices such as breathing tubes and catheters.

Silver compounds have also been used in external preparations as antiseptics, diluted in eyedrop solution and sometimes used in dermatology as a caustic to treat skin conditions like corns and warts.

More recently, silver has been shown to be effective against bacteria that is becoming resistant because of the overuse of chemical antibiotics. Another interesting purpose involves weaving nanoparticles of the metal into clothing to prevent bacteria from building up on sweat and oil deposits.

In addition, almost all electrical connections in modern vehicles are outfitted with silver-coated contacts. For example, silver membrane switches are used for basic functions such as starting the engine, opening power windows and adjusting power seats.

Silver is also crucial for window defogging, heated seats and luminescent displays.

According to the Silver Institute, about 51.8Moz of silver was used in automotives in 2018, up 4% from 2017.

Global demand

In today’s world, demand for silver comes equally from investment (as a precious metal asset) and non-investment avenues such as industrial and technological purposes.

According to the Silver Institute’s World Silver Survey 2019, physical demand for silver totalled more than 1.03 billion ounces in 2018.

This 4% increase on 2017 was attributed to a 20% jump in coin and bar demand, mainly driven by strong consumer sentiment in India, as well as a modest rise in jewellery and silverware fabrication.

Industrial fabrication currently makes up about 56% of the silver market with more than 40% of this demand coming from the electrical and electronics sector and almost 14%, or 80.5Moz of total physical demand, deriving from photovoltaic (ie solar panels) applications.

According to the Silver Institute, silver demand from the solar industry “took a breather in 2018” with silver powder production falling due to “continued thrifting and a glut of inventory that firstly needs to find its way through the system”.

However, this drop was countered by a rise of silver demand from the electronics and brazing alloys and solder sectors.

Heraues senior precious metals analyst David Holmes claims the industrial and technological use of silver is expected to grow significantly over the next decade.

He said silver’s “long-term fundamentals as industrial demand within the electronics’ sector is expected to double over the next 15 years”.

Silver mining

South America tops the chart as the biggest silver-producing region, with Mexico ranking as the number one producer, followed by Peru.

These countries are joined by Bolivia, Chile, China, Russia and Poland, with Australia and the US rounding out the top 10 list.

Silver is rarely found as a native element mineral and is typically mined as a by-product in polymetallic deposits alongside lead, zinc, copper and gold.

According to the Silver Institute, only about one-quarter of silver’s total output in 2018 came from mines where silver was the primary metal.

This means its global supply is greatly affected by the market trends of these other metals.

Global silver mine output declined 2% in 2018 to total 855.7Moz, driven primarily by the lead and zinc sectors, the Silver Institute reported.

In particular, Guatemala saw the largest decrease in production in any single country, after its High Court revoked the mining licence of its biggest silver operation, the Escobal mine owned by Pan American Silver (TSE: PAAS).

In addition, Canada’s top producer Teck Resources (TSE: TECK.B) suffered a fire at its Trail lead-zinc smelting facilities and ongoing maintenance problems that negatively affected its output (including silver) in 2018.

In Australia, silver production fell in the by-product sector, but this was countered by strong performance in the primary sector, mainly due to higher grades and higher utilisation at South32’s (ASX: S32) Cannington silver and lead mine in Queensland.

According to the Silver Institute’s report, ramping up of operations in Argentina, India and Mexico are expected to boost global production in 2019.

Top silver producers

Mexican mines dominate the production of silver, particularly in the primary sector.

Mexico-based precious metals miner Fresnillo is the world’s leading silver producer and operates the world’s top producing silver mine, Saucito, as well as other leading mines, Fresnillo and San Julian.

Polymetal International operates the Dukat mine in Russia, where silver output falls just under Saucito’s production levels.

According to Geoscience Australia, Australia has the largest share of global economic silver resources, even outstripping Mexico, Canada and the US.

While almost all of Australia’s silver is produced as a by-product of underground lead-zinc or copper mines, South 32’s Cannington mine in Queensland is one of the few mines in which silver is a principal extracted commodity (along with lead).

Other major silver-producing mines in Australia include Mount Isa in Queensland and McArthur River in the Northern Territory, both owned by Swiss mining giant Glencore and which also produce zinc and lead.

Silver as an investment

Like its precious metal relative, gold, silver has a role as a store of value. It can act as a safe haven and an effective hedge against an uncertain dollar.

It can also offer some financial security in the case of needing a substitute currency if monetary systems collapse or in the event of a natural disaster or war, where access to cash may be difficult.

A convenient benefit of silver, compared to gold, is its representation of smaller denominations. If all you needed was a carton of milk and all you had was a 1oz gold nugget, that’s some expensive milk, indeed.

Another advantage to investing in silver is its volatile pricing – this means it has the potential to offer a greater return on investment than gold.

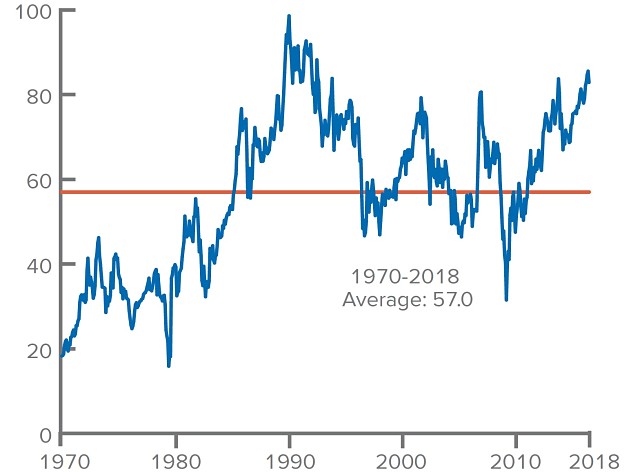

Gold-silver ratio

Many metal enthusiasts consider the gold-silver ratio as one of the most reliable gauges for trading their assets.

The gold-silver ratio represents how many ounces of silver is required to purchase a single ounce of gold.

For example, if gold is US$1,500/oz and silver is priced at US$17.64/oz, it would take 85oz of silver to buy 1oz gold, making the gold-silver ratio 85:1.

The concept of trading the gold-silver ratio involves switching holdings of the two metals when the ratio swings to statistically extreme levels.

For example, if the ratio rises to 100:1, a trader might sell 1oz gold for 100oz of silver. Then, when the ratio contracts to 50:1, the trader could buy 2oz gold with their 100oz silver.

This manner of trading is based on accumulating greater quantities of metal rather than increasing dollar-value profits. In times of currency devaluation and deflation from economic recessions and even war, precious metals have been known to maintain their value.

But, while silver has tended to echo gold’s price curve, the ratio has been affected by additional factors, with silver’s volatility stemming from its dual role as an industrial metal.

The gold-silver ratio has been tracked for thousands of years. During the Roman Empire, the ratio was set at 12:1.

Meanwhile, in the 20th century, the average gold-silver ratio was 47:1, with spikes tending to occur during times of economic instability or recession.

At the start of World War II in 1939, the ratio hit 98:1, and when silver plunged to record lows during the Gulf War in 1991, the ratio widened to a record of 100:1.

In the 21st century, the ratio reached about 84:1 during the 2008 Global Financial Crisis and has been widening again since 2011 to recently hit new highs in 2019 of 90:1 and above.

Silver price trends

Silver has traditionally followed gold, rising and falling in a similar pattern but usually more rapidly, hence its reference to being “gold on steroids”.

While gold has been soaring over the past year, silver was actually on a downward trend from its February 2019 high until late May.

Almost always, it has outperformed gold in a rising gold price scenario. Therefore, historically, a higher gold price has meant silver rising at an even faster pace in percentage terms and leading to a low gold-silver ratio.

But what we have been seeing in recent months is a rising gold price, coupled with a widening ratio.

Some analysts have suggested now would be the time to invest in silver mining stocks before the gold-silver ratio falls back to normal levels, while others are suspicious of the higher ratio and its correlation to an economic recession.

However, silver’s price has been quickly catching up since August. If you compare the percentage increase of both metals’ prices in the last 12 months, there is only a 1% difference between gold and silver’s pace.

Currently, the gold-silver ratio has pared back to around 83:1 – still historically high but a reduction from this year’s peak of 93:1 in July.

Some market experts are confident that silver is approaching a breakout and is likely to outperform gold in the near future.

This includes Martin Place Securities executive chairman Barry Dawes who believes silver is likely to climb above US$20/oz (A$28.5/oz) over the next 12 months and could possibly reach highs of around US$50/oz (A$71.25/oz) in “probably the next three to four years”.

“It’s pretty close to turning and when it does, it will run for at least two or three years, maybe longer,” he explained.

Mr Dawes compared gold and silver to other precious metals, palladium and platinum, which have flipped in price in the last five years.

In 2015, platinum was priced at around US$1,450/oz while palladium was in the US$800s. Now, the situation is reversed – platinum is currently US$838/oz while palladium is almost double the price at US$1530/oz.

“Palladium’s just gone gang busters and when I think of palladium, I think of silver,” Mr Dawes said.

“What this means is that the possibility exists that there will be a major re-evaluation of silver against gold, purely on a supply/demand availability basis,” he added.

From a precious to an industrial metal

The recent widening in the gold-silver ratio might not necessarily hint at a looming recession. Although this could well be the case, it also shows that silver is no longer a monetary metal that trends with gold to the same degree as it has traditionally.

These days, demand for silver comes from both industrial and investment streams. This means the economic outlook for the global economy can directly affect the price.

Since silver is commonly mined as a by-product along with other industrial metals. Its production and supply may still be maintained if demand for these other metals, such as copper, lead or zinc, is strong.

Likewise, if global manufacturing demand increases for commodities in general, silver has the potential to spike in price.

On the other hand, if demand for the primary mined metals fall, these mines could be shelved, thus cutting supply of silver.

“When the price of lead and zinc is low, we’ll find that production will decline and hence, the availability of silver will decline. And vice versa, when you get new mines coming on stream for lead and zinc, they increase the amount of silver into the market,” Mr Dawes said.

According to fund manager Hedley Widdup, silver’s price also tends to also be capped by industrial demand.

“If silver were to double, I think you would see a very real industrial demand drop and for that reason, you would probably see a price effect as well,” he said.

Meanwhile, gold’s industrial purposes are not as significant as silver for supply/demand issues to greatly affect its price.

“With things like electronics, gold is such a small value input to the final cost of the product that if you double the gold price, it doesn’t go anywhere near changing the price of the product to make it unaffordable,” Mr Widdup said.

He said this means, for instance, a drop in industrial demand could see silver’s price fall while gold continues to rise, thus widening the gap further.

Cornering the silver market

Another interesting aspect of silver’s recent price trend is the speculation that investment bank JP Morgan Chase may be trying to corner the silver market in a similar fashion as the Hunt brothers in 1980.

The Hunt brothers were three sons of Texas oil billionaire Haroldson Lafayette Hunt Jr who attempted to gain the biggest market share of silver in order to manipulate the price.

According to reports, the Hunt brothers accumulated about 77% of the world’s silver, either in physical form or futures contracts, driving the price of silver up by more than 700% from January 1979 to January 1980.

In response, the COMEX changed rules that restricted the purchase of commodities on margin and on 27 March 1980, a day now known as Silver Thursday, the silver’s price plummeted by more than half from around US$20/oz to US$10/oz.

Failing to meet their financial obligations, the Hunt brothers had to be bailed out by several US banks with a $1.1 billion line of credit.

In 1988, the brothers were convicted of conspiring to corner the silver market and were forced to declare bankruptcy.

Nowadays, data from the CME Group shows JP Morgan Chase by far holds the largest position in silver, with a total of 153.7 million troy ounces.

Well-known silver analyst Theodore Butler pointed out JP Morgan’s position two years ago, saying the bank had amassed a huge physical stockpile of silver “all while continuing to make hundreds of millions of dollars in manipulative COMEX short selling”.

Mr Butler was “convinced that silver will soon explode in price in a manner of unprecedented proportions, both in terms of previous silver rallies and relative to all other commodities”.

He added that he believed the silver price would exceed even the great price run ups in 1980 and 2011 to beyond US$50/oz.

Late last year, one ex-JP Morgan trader pleaded guilty to fraudulently manipulating the precious metals markets from 2009 and 2015.

Four years previously, JP Morgan was sued by a lawyer on behalf of three traders who accused the bank of manipulating the silver futures market in 2010 and 2011, costing his clients’ $30 million in losses.

Mr Butler called out JP Morgan again this June, questioning why the bank seems to be “above the law”.

“Despite the guilty plea and announcement of an ongoing investigation, JP Morgan has continued to manipulate the price of silver and gold since the announcement, as well as continue to accumulate silver,” he said.

“I don’t think there could be a more significant market issue than JP Morgan’s manipulation of silver and gold and the only explanation for why so few see it is that they haven’t examined the public facts,” Mr Butler added.

Silver stocks on the ASX

With an optimistic outlook for silver let’s look at the ASX-listed companies with direct exposure to the commodity.

Adriatic Metals (ASX: ADT)

UK-based explorer Adriatic Metals 100% owns the Vares mining concession in Bosnia and Herzegovina, containing the Rupice and Veovaca polymetallic deposits.

Veovaca is a historic open cut zinc-lead-barite and silver mine and Rupice is an advanced nearby deposit that has exhibited high grades of base and precious metals.

In July, Adriatic announced a maiden resource estimate for Rupice and an updated resource for Veovaca, with both estimates including silver. The estimates followed the completion of more than 20,000m of drilling on the projects.

Rupice’s maiden indicated and inferred resource totals 9.4Mt at 5.1% zinc, 3.3% lead, 183g/t silver, 1.8g/t gold, 0.6% copper and 31% barite.

The updated Veovaca resource now totals 7.4Mt at 1.4% zinc, 0.9% lead, 41g/t silver, 0.1g/t gold and 13% barite.

In August, Adriatic released assay results from nine holes from a drilling program at Rupice, which demonstrated that high-grade mineralisation continued north into the Rupice North licence extension area and remains open.

Drilling highlights included a 38m intersection grading 174g/t silver, 1.9g/t gold, 6.2% zinc, 3.8% lead, 0.4% copper and 33% barite.

In late September, the company announced results from a preliminary metallurgical testing program on ore samples from both Rupice and Veovaca.

The test work confirmed excellent metallurgical recoveries and concentrate grades with silver content being particularly high in the lead (49.3%) and zinc (13.6%) concentrates from Rupice.

Adriatic’s newly appointed managing director Paul Cronin said the results are expected to have a significantly positive impact on the potential economics of the project, currently being evaluated in an upcoming scoping study.

“I am confident that results can be further optimised as we undertake more detailed test work to support the potential definitive feasibility study,” he said.

Aeon Metals (ASX: AML)

Polymetallic explorer Aeon Metals is advancing the Walford Creek project in Queensland – about 110km north-west of New Century Resources’ Century zinc mine near Lawn Hill.

Aeon has firmed up a copper lode resource for the project’s Marley and Vardy deposits of 17.6Mt at 1.14% copper, 0.87% lead, 0.74% zinc, 27.6g/t silver and 0.13% cobalt.

A scoping study was completed on the project in late October and indicated the project had an 11-year initial operating life.

It is estimated annual average copper equivalent production will total 42,500tpa, including 1Moz of silver as a by-product.

Over the mine’s life, it is forecast to generate 10.2Moz of silver. The majority of the mine’s revenue will come from cobalt and copper, with silver anticipated to contribute 7%.

Aeon is targeting project construction to begin at the start of 2022, with commissioning to kick-off 12 months later.

Argent Minerals (ASX: ARD)

Junior polymetallic explorer Argent Minerals owns controlling interests in the Kempfield, Sunny Corner and West Wyalong projects in the New South Wales Lachlan Orogen.

The company’s 100% owned flagship Kempfield project has a mineral resource estimate of 26Mt at 40g/t silver (for 33Moz of contained silver), 0.12g/t gold, 0.46% lead, 1% zinc, 2% zinc equivalent and 120g/t silver equivalent (for 100Moz contained silver equivalent).

An exploration target for potential mineralisation, additional to the existing resource, has been estimated at 20-50Mt including 20-40g/t silver.

Argent believes a high-grade gold exploration focus at Kempfield will provide potential for early revenue from small-scale gold production.

Although, in its annual report released in September, Argent chairman Peter Wall said a new large-scale development scenario could provide significant leverage to silver, which has recently “emerged from the shadows into the spotlight”.

Argent also holds a 70% stake in the Sunny Corner project in joint venture with Golden Cross Resources (ASX: GCR).

According to the company, the historic Sunny Corner mine produced more than 90t of silver in the late 19th century and was, at one time, the largest silver producer in NSW.

The project has been estimated to hold an inferred mineral resource of 1.5Mt at 3.7% zinc, 2.1% lead, 0.39% copper, 24g/t silver and 0.17g/t gold.

Argent’s 78% owned West Wyalong project is focused on copper and gold exploration.

Austral Gold (ASX: AGD)

South America-focused Austral Gold owns the Guanaco/Amancaya silver and gold mine complex in Chile and holds a 70% interest in the Casposo silver and gold mine in Argentina.

The company’s portfolio also includes the Pinguino, San Guillermo and Reprado exploration projects.

A total of 136,867oz silver was produced at the Guanaco/Amancaya mine during the recent September quarter.

Combined with a 16,273oz gold output, this represents a 16% increase compared to the same period in 2018, although the combined production was down 2% from the June quarter.

Austral also commenced a drilling campaign in the Amancaya North vein system with a focus on the Amancaya North, Julia and Veta Central Sur veins.

The Casposo mine has been on care and maintenance since April, with Austral citing “lower than budgeted silver prices and less than expected production in 2018 and 2019” as the reason.

However, the company said it planned to boost exploration activities at the project with a focus on certain advanced targets.

In its September quarterly report, Austral said it has completed the design of an exploration and drilling program at Casposo for the fourth quarter.

At Pinguino in Argentina, a trenching and drilling program is being designed with the aim of expanding the deposit’s oxidised silver-rich resource.

Azure Minerals (ASX: AZS)

Azure Minerals is focused on developing a portfolio of mineral projects in Mexico, with most including silver.

The company’s flagship Oposura zinc-lead-silver project in the north has a JORC resource of 3.1Mt at 5% zinc, 2.7% lead and 18g/t silver.

Studies have identified an initial six-year mine life at 500,000tpa for annual metal in concentrate production of 19,000t zinc, 10,000t lead and 145,000oz silver.

During the September quarter, Azure completed a phase one mining campaign at Oposura, which exceeded initial production targets.

It stockpiled 6,100t of high-grade ore and commenced trial processing of the first batch in late October.

Steady-state toll treatment of the ore is scheduled to start in December to produce separate zinc and lead-silver concentrates, which are intended to be sold on the spot market to locally-based metals traders or smelters.

Azure is also focused on its 100% owned Alcaran silver-gold exploration project, which contains a 32.2Moz silver resource.

In October, the company announced “spectacular” high-grade silver assays returned from historical mine samples in the southeast of the project area, including up to 3,675g/t silver.

Azure is planning a two-stage 7,000m drilling program for the December quarter, which will include resource expansion drilling at the Loma Bonita gold and silver deposit as well as additional greenfields exploration drilling elsewhere at Alcaran.

Alcaran also contains the Mesa de Plata silver deposit, which represents 27.4Moz of the 32.2Moz resource defined at the project.

Previous studies on Mesa de Plata have demonstrated good potential for a simple, relatively low-cost, open pit mining operation with silver extraction by a combination of gravity separation and flotation, or heap leach/CIL processing. Azure said in its September quarterly report it planned to restart metallurgical studies on this area.

BHP Group (ASX: BHP)

BHP Group’s Olympic Dam operation in South Australia is primarily exploited for copper, with gold, uranium and silver present as by-products.

During the September quarter 2019, BHP’s refined silver output from the mine was 245,000oz.

The company also generated 1.1Moz of silver from its Antamina operation in Peru and 1.62Moz from Escondida in Chile.

This amounted to 2.97Moz of payable silver concentrate to BHP.

The major miner has also unearthed silver mineralisation while drilling its Oak Dam copper discovery – also located in South Australia.

Equus Mining (ASX: EQE)

Equus Mining is focused on silver and gold exploration on the Cerro Bayo mining district in southern Chile.

In late June, the company announced its intention to acquire all of the mining properties, resources and mine infrastructure at Mandalay Resources’ (TSX: MND) Cerro Bayo project in Region XI, located near Equus’ existing Los Domos epithermal gold-silver-base metal project.

In early October, Equus confirmed it had executed binding documentation giving it three years to exercise its option to acquire the assets, which include a tailings facility and 1,500t processing plant currently on care and maintenance.

Consideration for completion of the acquisition, should Equus exercise its option, is the issue of 19% of the company’s share capital to Mandalay, as well as a 2.25% net smelter royalty on project from the Cerro Bayo mining claims.

Prior to being placed on care and maintenance in June 2017, the Cerro Bayo mine, mill and flotation plant had produced about 40Moz silver and 600,000oz gold.

Equus believes the district holds good potential for hosting significant additional gold and silver resources. During the September quarter, the company defined a series of large-scale high priority drill targets situated close to the Cerro Bayo mine infrastructure in preparation for maiden drill testing.

At the Los Domos project, Equus deferred the submittal of environmental studies to the relevant government authorities to the December quarter. These studies are required prior to the next phase of drilling.

Horizon Minerals (ASX: HRZ)

Horizon Minerals is the result of a merger between Intermin Resources (ASX: IRC) and MacPhersons Resources (ASX: MRP), which subsequently delisted in June 2019.

The emerging gold producer has exposure to silver by way of its 100% owned Nimbus silver-zinc-lead-gold project near Kalgoorlie-Boulder in Western Australia.

Nimbus is a shallow-water and low-temperature volcanic hosted massive sulphide deposit with epithermal characteristics.

It has a current mineral resource estimate of 12.08Mt at 52g/t silver, 0.2g/t gold and 0.9% zinc containing 20.2Moz silver, 77,000oz gold and 101,000t zinc.

Within this global resource, Nimbus has a high-grade silver-zinc resource of 255,898t at 773g/t silver and 13% zinc containing 6.4Moz silver and 33,000t zinc.

No recent activity has been reported for this project, with Horizon focused on the potential acquisition of Focus Minerals’ Coolgardie gold project and the development of open pit gold mining at its Boorara project.

Investigator Resources (ASX: IVR)

At a rate of 86%, Investigator Resources is the ASX-listed company that offers the highest silver exposure.

This exposure rate is defined as the ratio of the silver in-ground value compared to the total in-ground value of the mineral resource.

The company’s 100% owned Paris silver project in South Australia’s southern Gawler Craton is regarded as the country’s highest grade, undeveloped, non-by-product silver project.

It has a JORC 2012 resource estimate of 9.3Mt at 139g/t silver and 0.6% lead for 42Moz contained silver and 55,000t contained lead.

According to Investigator, the Paris resource is a shallow deposit of high-grade silver amenable to simple open pit mining should a decision be made to progress development.

The company has recently engaged a consultant to undertake a review of the structural geology interpretation of the deposit to identify potential to define additional mineralisation or improve the grade. This study is due to be completed in November.

In September, Investigator raised $2.2 million through the completion of a placement to institutional and sophisticated investors. Part of the proceeds from the capital raising went towards this geological review. Among other purposes, the company said funds will also be used to assess future options for the Paris project.

Kingsgate Consolidated (ASX: KCN)

Sydney-based Kingsgate Consolidated owns the suspended Chatree gold mine, which also produced silver when in operation, in Thailand and the Nueva Esperanza silver and gold project in Chile.

For the 15 years that it was in operation, Chatree had produced more than 1.8Moz of gold and more than 10Moz of silver.

However, the Thai Government ordered all gold mining to cease in Thailand by the end of 2016, resulting in Chatree being placed on care and maintenance.

Since that time, Kingsgate has been working on ways to remedy the situation and in March 2019, the company finally received a settlement of its political risk insurance policy of more than $82 million.

In its September quarterly report, Kingsgate said it was still working towards having about US$7.5 million of gold and silver inventory (in the form of high-grade sludge) that remained at the Chatree site at the time of the mine’s closure released for sale.

The company is also continuing to fight to recover the lost value of Chatree closure via arbitral proceedings that have commenced under the Australia-Thailand Free Trade Agreement.

Meanwhile, Kingsgate had appointed a corporate advisor in late 2018 to assist in the sale of its Nueva Esperanza project in order to clear debt and fund its fight over Chatree.

Although now that the insurance settlement has been paid, the company said it now has the “luxury of being able to carefully and methodically consider its strategy around the Nueva Esperanza project, which may include further development, joint venture opportunities or sale”.

At September 2019, Chatree’s total mineral resources were estimated at 163.6Mt at 5.59g/t silver and 0.65g/t gold for 29.4Moz contained silver and 3.42Moz contained gold.

Nueva Esperanza’s mineral resources totalled 39.4Mt at 66g/t silver and 0.39g/t gold for 83.4Moz contained silver and 490,000oz contained gold. The project’s ore reserves were estimated at 17.1Mt at 87g/t silver and 0.5g/t gold.

Kingston Resources (ASX: KSN)

Gold explorer Kingston Resources is advancing the former Misima gold project in Papua New Guinea.

The company is focused on gold, but the asset has silver credits. A resource for the project totals 82.3Mt at 1.1g/t gold and 5.3g/t silver.

Contained silver within the resource amounts to 13.9Moz.

Kingston owns 70% of Misima.

Moreton Resources (ASX: MRV)

Moreton Resources revealed silver processing operations at its Texas mine (part of the Granite Belt Metals project) were now up and running.

As a result, the Queensland-based mine is now generating “strong cashflow” from the silver concentrate sales.

During the September 2019 quarter, Moreton boosted silver concentrate production at Texas by 34% compared to the June period.

This led to a 48% rise in silver concentrate sales for the September quarter, and a 75% fall in production costs.

Despite the improved scenario, Moreton ended the quarter with a $1 million loss – primarily due to higher production, staffing and administration costs than actual cash inflows.

For the remainder of 2019, Moreton plans to continue ramping up silver production at Granite Belt Metals.

Total ore under irrigation is about 550,000t, with a further 1Mt of existing ore to be prepared for further leaching and silver concentrate production.

Myanmar Metals (ASX: MYL)

Myanmar Metals has a 51% majority participating interest in the world-class Bawdwin deposit in Shan State, Myanmar.

In the past two years, the company and its two local joint venture partners have upgraded the project’s maiden mineral resource seven times. The most recent upgrade, announced in August, estimates indicated and inferred resources totalling 100.6Mt at 4% lead, 97g/t silver, 1.9% zinc and 0.2% copper.

According to the Myanmar Metals, Bawdwin is poised to become a global top 10 producing silver mine and is expected to produce more than 10Mozpa of silver in steady-state production.

The Bawdwin Starter Pit focuses on the central China lode and will be mined down to 220m below the current valley floor for an initial 13-year mine life.

During the September quarter, Myanmar Metals reported recent drilling had extended the strike length of the Yegon lode to more than 300m. This lode runs parallel to the China lode and a majority of it is hosted within the planned Starter Pit.

The company is working towards the delivery of a definitive feasibility study in early 2020, with a study team appointed to expand on its previously published scoping study and prefeasibility study results. It has also commenced project finance and offtake discussions.

New Century Resources (ASX: NCZ)

In August 2018, zinc producer New Century Resources reopened the Century mine in Queensland to produce zinc, lead and silver from mineralised tailings.

The Century project’s South Block, East Fault Block and Silver King deposits have a JORC 2012 mineral resource estimate totalling 9.4Mt at 6.1% zinc, 4.6% lead and 65g/t silver for 186,000t contained zinc, 337,500t contained lead and 10.5Moz contained silver.

The Century tailings have proven ore reserves of 71.6Mt grading at 12g/t silver for 28.3Moz silver.

The mining operation includes a mineral flotation processing plant with the capacity to produce 7Mtpa hard rock or 12.5Mtpa tailings and a 304km underground slurry pipeline that connects the mine to a large-scale port and ship-loading facility at Karumba.

For the September quarter, the company reported producing 53,500t of concentrate grading 49% and 150g/t silver.

Newcrest Mining (ASX: NCM)

One of the world’s largest gold miners, Newcrest Mining produces silver as a by-product of its gold operations across Australia, Papua New Guinea, Indonesia and Canada.

During the September quarter, the group produced 198,723oz of silver, with more than half (111,491oz) of its silver output deriving from the Cadia gold operation in New South Wales.

The company’s next top silver-producing mines are Gosowong in Indonesia which produced 38,023oz silver during the quarter and its Telfer mine in Western Australia with a quarterly output of 29,019oz silver.

Newcrest’s total silver mineral resources across all operational and non-operational provinces add up to 93Moz.

Cadia Valley’s silver resource is estimated at 3.1 billion tonnes at 0.68g/t silver for 67Moz contained silver.

For the 12 months ended June 2019, Newcrest reported making $15 million in silver revenue, down 12% from the previous financial year. Compared to the company’s $3.2 billion in gold revenue, silver barely makes a dent on its books.

OZ Minerals (ASX: OZL)

At the start of 2019, copper major OZ Minerals signed a joint venture deal with Red Metal (ASX: RDM) to earn a 51% stake in the exploration junior’s Mount Skipper lead-zinc-silver and copper-gold project in Queensland.

The ‘greenfields discovery alliance’ also includes exploration projects focused on copper combined with gold, cobalt and nickel.

Under the deal, OZ was provided with a two-year option to fund a series of mutually agreed proof-of-concept work programs on the projects.

The company completed a single drill hole for 951m at Mount Skipper during the September quarter, although no significant mineralisation was intercepted.

Follow-up geophysical work including downhole and ground electro-magnetic surveying is being planned for the fourth quarter, Oz reported.

The company also has exposure to silver at its 100% owned Prominent Hill mine in South Australia, where the metal is produced as a by-product of its copper-gold mining operation.

During the September quarter, OZ recorded the operation milling 2.36Mt of ore, grading 1.18% copper, 0.5g/t gold and 3.15g/t silver.

Pacifico Minerals (ASX: PMY)

In late 2018, Western Australian explorer Pacifico Minerals acquired a 75% stake in the Sorby Hills project in the Kimberley region, where it plans to develop a large, near-surface lead-silver-zinc deposit.

In March 2019, following an infill drilling campaign, the company lifted the project’s total mineral resource estimate by 82% to 29.97Mt grading 3.7% lead, 43g/t silver and 0.6% zinc.

Indicated resources also increased by 123% to 10.85Mt at 3.9% lead, 46g/t silver and 0.4% zinc.

An updated pre-feasibility study released by Pacifico later that month confirmed the proposed $94.5 million development could economically produce a high quality, high-grade lead-silver concentrate.

The study is based on an open pit operation with a 1Mtpa plant using conventional flotation processing technology.

Since the release of the pre-feasibility study, Pacifico has undertaken further drilling and metallurgical testing, returning positive results including high-grade shallow intersections and flotation recoveries that were higher than the assumptions made in the study.

According to the company, the phase two drilling results are expected to materially increase indicated resources in the next mineral resource estimate update.

This update, anticipated in October, will underpin the upcoming optimised pre-feasibility study.

A phase three drilling program is also due to commence in October and will consist of 3,000m of reverse circulation drilling aimed at adding to shallow indicated and inferred resources.

Pacifico’s 25% joint venture partner in the Sorby Hills project is Henan Yuguang, China’s largest lead smelting and silver producer.

PNX Metals (ASX: PNX)

Gold and base metals explorer PNX Metals’ Hayes Creek zinc-gold-silver project in the Northern Territory includes a 16.2Moz silver resource.

The project comprises 14 wholly-owned mineral leases including the Iron Blow and Mt Bonnie VMS deposits acquired in 2014 from a subsidiary of Canada’s Kirkland Lake Gold (ASX: KLA).

A definitive feasibility study is ongoing at Hayes Creek following the successful completion of a pre-feasibility study in July 2017, which confirmed the project as a high value, relatively low-risk and technically strong development opportunity.

The proposed development is based on a steady-state 450,000tpa processing rate with ore sourced from initial open pit mining operations at Mt Bonnie and subsequent underground mining at Iron Blow. A total of about 3Mt of ore is forecast to be processed over a 6.5-year mine life.

The pre-feasibility study predicts annual production in concentrates to be 1.4Moz silver, 14,700oz gold and 18,200t zinc.

In its September quarterly, PNX said work is ongoing in relation to an environmental impact statement with submission expected during the second quarter of 2020.

Red Metal (ASX: RDM)

Junior explorer Red Metal 100% owns the Maronan silver-lead and copper-gold project in the Carpentaria province of Queensland, which has been estimated to contain inferred resources of 30.8Mt at 6.5% lead with 106g/t silver.

According to preliminary metallurgical testing undertaken in 2015 and 2016, the lead and silver mineralisation is soft, coarse grained and returned recoveries of between 91-94% for the silver.

Based on drilling analysis, Red Metal also believes there is the potential for a large, higher grade Cannington-style silver-lead-zinc deposit and enriched copper-gold system existing at depth below the presently outlined resource.

No recent exploration at the project has been reported, although the company said in its September quarterly report it hopes a “positive return in sentiment towards base metals or a potential re-rating of the silver price in keeping with the current high gold price should renew interest” from potential joint venture funding sources.

South of Maronan, Red Metal also holds the Mount Skipper lead-zinc-silver and copper-gold project in a joint venture with OZ Minerals (ASX: OZL).

OZ is earning a 51% stake in Mount Skipper, along with other greenfield projects focused on copper combined with gold, cobalt and nickel.

During the September quarter, a single drill hole was completed at the project, but no significant mineralisation was intercepted.

Follow-up geophysical work including downhole and ground electro-magnetic surveying is being planned for the fourth quarter, Oz reported.

Rimfire Pacific Mining (ASX: RIM)

The major focus for gold and copper explorer Rimfire Pacific Mining is its Fifield project in New South Wales, where it made the Sorpresa greenfields gold and silver discovery in 2010.

In 2014, the company announced a JORC inferred and indicated maiden resource of 6.4Mt at 0.61g/t gold and 38g/t silver for 125,000oz gold and 7.9Moz silver.

However, subsequent exploration has led the company to focus on the project area’s significant gold mineralisation potential.

Sandfire Resources (ASX: SFR)

Although focused on copper, Sandfire Resources has exposure to silver via its recent acquisition of MOD Resources, which owned the T3 copper-silver project.

Sandfire now wholly-owns the T3 and exploration tenements in the Kalahari copper belt spanning more than 11,000sq km.

A feasibility study was published on T3 in late March and indicated an initial 11.5-year operation that would process 3.2Mt of ore per annum with an average copper grade of 1% and silver grade of 13.2g/t.

Annual silver production is estimated at 1.1Moz.

Inclusive of the primary copper product, the study forecasts life of mine revenue of US$2.3 billion.

Sandfire is also earning a 70% interest in White Rock Mountain’s Red Mountain project in central Alaska.

The project is prospective for VMS mineralisation which includes an inferred resource of 9.1Mt at 5.8% zinc, 2.6% lead, 157g/t silver and 09g/t gold.

Sandfire’s exploration budget for Red Mountain exceeds $8 million for 2019.

Silver Mines (ASX: SVL)

Leading Australian silver explorer Silver Mines owns the Bowdens and Barabolar silver projects in central New South Wales.

According to the company, Bowdens is the largest undeveloped silver deposit in the country with a substantial mineral resource estimate of 275Moz silver equivalent and 97Moz of silver equivalent ore reserves.

A feasibility study has been completed for a 2Mtpa development comprising an open cut mine feeding a new processing plant with a conventional milling circuit and differential flotation to produce two concentrates to be sold for smelting off-site.

The plant is designed for a project life of 17 years with life of mine production planned to be about 53Moz silver, 116,000t zinc and 83,000t lead.

At the end of the September quarter, Silver mines said it was in the final stages of completing an environmental impact statement, which it expects to lodge in the “coming months” in conjunction with mining lease and development applications.

During the quarter, the company reviewed exploration results from the first round of drilling at the Cringle and Kia Ora West prospects at its Barabolar project, located about 10km northwest of Bowdens.

The nine-hole drilling program targeted multiple gold-silver high-grade rock chip samples and associated strong arsenic anomalism in soils, as well as a strong IP chargeability anomaly coincident with a copper anomaly in soils.

Regional soil sampling and gravity surveys were also undertaken at Barabolar during the quarter. An expanded 4,000m drilling program is now being planned.

South32 (ASX: S32)

Diversified mining giant South32 wholly owns the Cannington mine in North West Queensland – one of the world’s largest producers of silver and lead.

The mine has been in production for more than two decades and now produces about 6% of the world’s silver.

The 3Mtpa mining operation comprises an underground hard rock mine, a surface processing facility, a road-to-rail transfer facility and a concentrate handling and ship-loading facility at the Port of Townsville.

Silver, as well as zinc and lead, is extracted from the ore using grinding, sequential flotation and leaching techniques to produce high-grade lead and zinc concentrates with a high silver content.

Cannington’s is estimated to contain a total mineral resource of 55Mt at 184g/t silver from the underground sulphide and 30Mt at 98g/t silver from the open cut sulphide.

As at June 2019, its ore reserves totalled 21Mt at 173g/t silver with an estimated 12 years of mine life remaining.

During the September quarter, South32 reported 694,000t of ore mined including 2.97Moz of payable silver production. This silver output was higher than the last two reporting periods but less than the September 2018 quarter’s 3.18Moz silver production.

The company’s silver production guidance for the full 2020 financial year is 11.2Moz.

In 2018, South32 also completed the acquisition of Arizona Mining, adding the high-grade zinc, lead and silver Hermosa development option in Tucson, US to its portfolio.

In June 2019, the company declared a mineral resource for the Taylor deposit at Hermosa of 155Mt at 69g/t silver with a contained 344Moz of silver.

More than 70% of this resource is in the measured and indicated categories, which South32 said provided a “compelling base from which to advance the Hermosa project’s pre-feasibility study and target additional mineralisation”.

The company has been undertaking a drilling, resampling and relogging program and expects to conclude its pre-feasibility study before the end of the 2020 financial year.

Troy Resources (ASX: TRY)

Troy Resources has a 30% interest in the Austral Gold-managed Casposo silver and gold mine in Argentina.

Austral placed the mine on care and maintenance in April 2019 due to “lower than budgeted silver prices and less than expected production in 2018 and 2019”.

However, the company said it planned to boost exploration activities at the project with a focus on certain advanced targets.

In its September quarterly, Austral said it has completed the design of an exploration and drilling program at Casposo for the fourth quarter.

Valor Resources (ASX: VAL)

Valor Resources is focused on developing the Berenguela copper-silver deposit in southern Peru with the goal of becoming a producer of copper cathode and silver bullion, as well as manganese products.

The project has a JORC 2012 mineral resource estimate totalling 45.9Mt at 85.99g/t silver, 0.76% copper, 5.09% manganese and 0.28% zinc, or 1.28% copper equivalent based on a 0.5% copper equivalent cut-off grade.

In August 2018, Valor completed a positive scoping study for the project based on a shallow open pit mining operation and conventional reductive acid-leach processing.

At the start of 2019, Rio Tinto (ASX: RIO) subsidiary Kennecott Exploration Company signed a joint venture option agreement in respect to the project, paying US$700,000 up-front and agreeing to spend US$2 million on exploration expenditure over 12 months.

Following this, Kennecott can exercise its option for form a 50:50 joint venture on Berenguela by paying an additional US$3 million to Valor.

Kennecott can earn another 25% (taking its stake up to 75%) by funding an additional US$5 million on the project within three years.

In its September quarterly report, Valor said a soil sampling program and a 1,427m four-hole diamond drilling program has been undertaken, with the drilling results analysed together with the relogging of 3,400m of existing core from 15 diamond drill holes.

Assay results from the drilling and sampling programs are being processed and will be integrated into a deposit model for continued exploration work programs.

White Rock Minerals (ASX: WRM)

Victorian exploration company White Rock Minerals 100% owns the advanced Mt Carrington gold-silver epithermal project in northern New South Wales and holds the Red Mountain high-grade zinc-silver-lead-gold project in Alaska in a joint venture with Sandfire Resources (ASX: SFR).

Mt Carrington is estimated to contain a mineral resource of 23Moz silver and 340,000oz gold.

White Rock completed a pre-feasibility study in 2017, confirming Mt Carrington as a viable ‘gold first’ project with significant potential upside in subsequent silver production and future gold and silver exploration.

At the end of September 2019, White Rock announced an equity raising of up to $5.4 million through a 2-for-3 pro-rata non-renounceable entitlement offer, with funds to be used to complete an environmental impact statement, progress the permitting and approvals process and complete a definitive feasibility study on the project.

White Rock’s Red Mountain project in central Alaska has an inferred mineral resource of 9.1Mt at 5.8% zinc, 2.6% lead, 157g/t silver, 0.1% copper and 0.9g/t gold. The estimate includes 46.1Moz of contained silver.

In March 2019, Sandfire entered a joint venture deal to earn up to 51% of White Rock’s interest in Red Mountain by spending $20 million on exploration over four years.

Sandfire can then elect to up its stake to 70% by sole-funding a further $10 million and delivering a pre-feasibility study with an ore reserve within a further two years.

White Rock can then elect to contribute its percentage share of expenditure to retain its 30% interest.

While the project has a silver resource, the companies are focused on developing its zinc potential.

**SEE ALSO:

**– Gold stocks on the ASX

– Lithium stocks on the ASX

– Cobalt stocks on the ASX

– Graphite stocks on the ASX

– Zinc stocks on the ASX

– Nickel stocks on the ASX

– Rare earth stocks on the ASX

– Vanadium stocks on the ASX

– Uranium stocks on the ASX

– High Purity Alumina stocks on the ASX

– Mineral sands stocks on the ASX

– Tin stocks on the ASX

– Tungsten stocks on the ASX

– Hydrogen stocks on the ASX

– Oil and gas stocks on the ASX

– Cannabis stocks on the ASX