Despite the global push towards renewable energy, oil and gas remain the backbone for fuelling society, with oil still being the world’s most traded commodity. As a result, many ASX listed stocks have continued to search for the commodity.

When thinking about oil, one image that springs to mind is a lowly Texan hillbilly poking a hole in the ground and being sprayed with that tarry “black gold”, instantly striking him rich.

Funnily enough, there is a lot more to oil production these days, but for as long as we need petroleum and gas as energy resources, there are still fortunes to be made.

Discovery of oil is nothing new

According to ancient records, asphalt (a heavy, sulphur-rich oil) was used in the construction of the walls and towers of Babylon four thousand years ago, and oil wells were “drilled” using bamboo poles in China over 1600 years ago, with the oil burned to evaporate brine and produce salt.

In the 19th century, crude oil was refined to make kerosene as the standard fuel for lamps. However, it was the invention of the modern internal combustion engine later in the century that drove oil’s rise in popularity.

In 1886, German engineer Karl Benz began the first commercial production of gasoline-fuelled motor vehicles with an internal combustion engine.

In 1908, Henry Ford’s mass-produced and affordable Model T car was released to the American market and gasoline consumption soared over the twentieth century as car ownership became the standard and not just a luxury item for the wealthy.

Today, oil and gas have a multitude of uses, from the basic necessities of every day modern life such as cooking appliances, heating and fuel for cars, to running businesses, transportation, manufacturing and other industrial purposes.

Global demand for oil

In its World Energy Outlook released in November 2017, the International Energy Agency predicted four major shifts in the global energy system over the next 20 years.

It forecast renewable energy sources as largely displacing coal and making up about 40% of all energy generation in the world.

However, oil and gas would be the first and second most used fuels in the global mix, with natural gas consumption projected to rise 45% by 2040.

According to the Organization of Petroleum Exporting Countries (OPEC), the largest contribution to future energy demand is expected to come from natural gas, with demand projected to rise by nearly 34 million barrels of oil equivalent per day to reach a level of 93MMboed by 2040.

In addition, Forbes reported global oil-fuelled car sales were expected to reach 91 million in 2018, versus 73 million in 2010.

So, while there has been a recent social and environmental push away from fossil fuels and towards renewable energy sources, with the recent lithium battery boom being one example, oil and gas will continue to have a large grip on the energy demand of the future.

Black gold

There tends to be a lot of overlap with oil and gas, in terms of the different types and where the resources are found, so we’ll start off with a little science lesson explaining what is what.

Oil is made up of a range of liquid hydrocarbons, including conventional crude oil, condensate and liquefied petroleum gas (LPG), and unconventional shale oil.

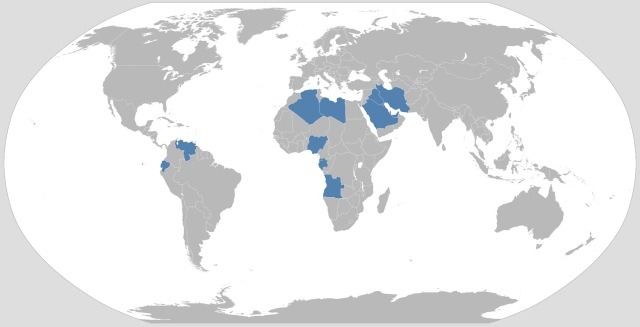

Nearly half of the world’s total oil reserves are in the Middle East, with Saudi Arabia being one of the globe’s top three oil producers, alongside Russia and the United States. Venezuela and Canada also hold a large share of oil reserves, with Canada’s mostly oil sands.

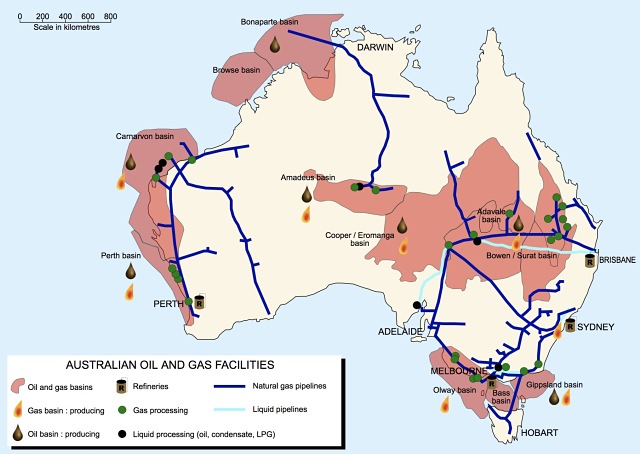

According to the Australian Energy Resources Assessment (AERA) report, a national assessment of the country’s energy resources, Australia holds only about 0.2% of the world’s oil reserves and imports the majority of its crude oil and refined petroleum products.

Most of the country’s known remaining oil resources are condensate and LPG associated with giant offshore gas fields in the Browse, Carnarvon and Bonaparte basins, although resources have also been found in the Perth, Canning, Amadeus, Cooper/Eromanga, Bowen/Surat, Otway, Bass and Gippsland basins.

Oil classifications or grades

Crude oil can be classified as light, medium or heavy according to its American Petroleum Institute (API) gravity, which measures a petroleum liquid’s density compared to water.

Light crude oil is measured as having an API gravity higher than 31.1 degrees, with oils between 40 and 45 degrees generally holding the highest value. This is the oil grade for LPG and gasoline.

Medium grade oil (with an API gravity between 22.3 and 31.1 degrees) is consumed in diesel fuel, jet fuel and kerosene, while heavy crude oil (with an API gravity below 22.3 degrees) can go in lower value products like residual fuel oil used to power large ships.

This type of oil often contains high concentrations of sulphur and other metals like nickel and vanadium. Bitumen is an example of an extra heavy and dense oil with an API gravity of less than 10 degrees.

Crude oil can also be classified as “sweet” or “sour” depending on its sulphur content, with sweet oil containing lower levels of sulphur and being a higher quality and more valuable product.

Main types of crude oil

The type of crude oil depends on the geographic location of the oil field and the characteristics of the oil itself.

While there are hundreds of types of crude oil traded on the global market, two primary types of crude oil serve as global benchmarks for oil prices: West Texas Intermediate and Brent Crude.

West Texas Intermediate (WTI)

WTI is sourced from US oil fields primarily in Texas, Louisiana and North Dakota.

Referred to as ‘light sweet crude oil’ due to its low density and low sulphur content.

These characteristics make it less expensive to produce and easier to refine than ‘heavy’ or ‘sour’ oils. WTI is the main benchmark for oil consumed in the US.

Brent crude

Brent crude oil arrives for 15 different oil fields located in the North Sea.

It is characterised as a “light and sweet” oil, although is not as ‘sweet’ and ‘light’ as WTI.

What the frack is gas?

Natural gas is a combustible mixture of hydrocarbon gases.

Conventional gas accumulates in a subsurface reservoir that can be readily produced, and fields can be “dry” (almost pure methane) or “wet” (associated with wet gas components such as ethane, butanes and condensate). Conventional gas can also be found with oil in oilfields.

Australia is more reliant on gas, with it being the country’s third largest energy resource after coal and uranium.

Most conventional gas resources can be found off the north-west margin in the Bonaparte, Browse and Carnarvon basins off Western Australia and the Northern Territory, although it has also been found in 11 other basins, both on and offshore.

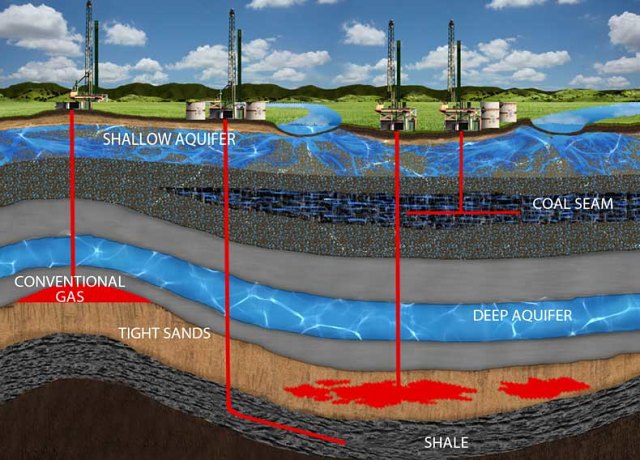

Unconventional gas occurs in more difficult to extract deposits, such as coal seams or in shales, low quality reservoirs (“tight gas”) or as gas hydrates. As a result, they tend to be more expensive expeditions requiring specialist technology.

This gas is generally extracted via hydraulic fracture stimulation or “fracking”, which has caused a bit of a stir around the world due to environmental concerns. The process involves drilling into the ground before a high-pressure water mixture is injected into the rock to fracture it apart, allowing the gas to be released.

One environmental concern is the huge quantity of water that is required, which must also be transported to the fracking site.

According to environmentalists, another is the potential for chemicals used in the water mixture to escape and contaminate nearby groundwater. However, the industry has disputed these claims, saying any pollution incidents were the results of bad practice.

In March last year, Victoria became the first state in Australia to permanently ban onshore unconventional gas exploration and development, including fracking and coal seam gas (CSG). WA is looking to follow suit, having imposed a 12-month moratorium on the extraction method in September.

South Australia adopted a 10-year fracking moratorium in late 2016, but only in the south-east of the state in a region with a large agricultural and cattle grazing sector.

Tasmania also has a moratorium in place on fracking until March 2020, although shale oil and gas exploration is still permitted. Fracking is so far permitted in other states, so long as it adheres to strict rules to minimise environmental impact.

In April, the Northern Territory’s fracking moratorium was lifted under the condition that all 135 recommendations of a recent scientific inquiry would be implemented in full.

These new rules include having environmental management plans signed off by the environmental minister, new requirements prior to exploration and production, and increased criminal penalties for environmental harm.

In Queensland, commercial production of CSG has grown rapidly in the last two decades, mainly driven by the state government’s decision for gas resources to make up at least 13% of all power supplied to the state electricity grid by 2005. The requirement was increased to 15% by 2010 and needs to be at 18% by 2020.

Queensland’s Bowen and Surat basins are the country’s main producers of CSG, but reserves have also been proven in NSW and exploration has been undertaken across WA and SA.

Then there’s liquified natural gas (LNG), which is created by cooling natural gas to -160 degrees Celsius to form a clear, colourless liquid that is 600 times smaller than natural gas and therefore easier to store and transport in specially designed tankers.

The North West Shelf Venture in northern WA first began shipping LNG cargoes in 1989. Since then, other LNG developments have started in WA (Pluto, Gorgon and now Wheatstone) and in Darwin, NT.

Queensland currently hosts three major projects involving the conversion of CSG into LNG for exporting: the Gladstone LNG, Australia Pacific LNG and Queensland Curtis LNG projects.

The US$40 billion Inpex-operated Ichthys project, which involves piping gas from offshore WA fields to a Darwin plant, is due to complete commissioning in the next few months.

In addition, oil and gas supermajor Shell is in the process of starting up its Prelude floating LNG project, located off the coast of Broome in WA.

Prelude is the world’s largest floating natural gas facility ever built and is expected to produce 3.6 million tonnes of LNG and 1.3Mt of condensate per year when in operation.

Oil price drivers

The oil price is predominantly driven by three factors: current supply, future supply and of course, demand.

Over the past decade, the oil price has soared and plummeted amid various economic crises, natural disasters and political movements around the globe.

The commodity reached an all-time high of US$145.31/bbl in July 2008, before plunging down to below US$35/bbl during the Global Financial Crisis later that year.

Between 2010 and 2014, it hovered between US$80/bbl and US$110/bbl, although the price dropped again due to low demand, the impact of the controversial fracking revolution, decisions made by OPEC and other world events.

In late November 2017, OPEC and non-OPEC countries led by Russia reached the decision to extend production cuts until the end of 2018 in order to nudge the price back up and rebalance the market.

This was the first time that Russia was willing to cooperate with OPEC as the country needs oil to sit at least above US$53/bbl for its federal budget to breakeven, according to Russian investment bank Renaissance Capital.

Brent crude, one of the global benchmarks for the oil price, is currently sitting at around US$70/bbl but is expected to average US$60/bbl in 2018, according to the median estimate of 27 analysts surveyed by Bloomberg in December.

This has at least satisfied Russia and despite OPEC’s restrictions, the country boosted its oil production to a 30-year-high of 10.97MMbpd in March, according to Russian Energy Ministry data.

However, some other OPEC countries have much higher breakeven prices for their budgets and hence strongly pushed for the output cuts to stay in place.

In Saudi Arabia, officials are wanting oil prices to be closer to US$80/bbl in order to float national oil company Saudi Aramco’s initial public offering on an international stock exchange as well as its domestic exchange, the Tadawul.

The government plans to sell about 5% of the company, hoping to raise US$100 billion in what is likely to be the world’s largest ever IPO – valuing the company at US$2 trillion. However, Saudi Arabia’s energy minister has now hinted in a Bloomberg interview that the IPO would be delayed until 2019.

Saudi Arabia and other OPEC member countries are next due to meet in Vienna this June to discuss a potentially longer extension of supply cuts.

Other factors working to balance the market out and drive the price in an upward trend include escalating tension in the Middle East threatening security supply, and the growth of middle class populations in undeveloped nations.

Australia as a world energy leader

According to a report by energy research group Wood Mackenzie, 2018 will see Australia take the top spot from Qatar as the world leader in LNG production.

This may come as a bit of a surprise since Australian government bodies have been warning of a critical gas supply shortage, particularly due to the declining reserves in Victoria’s Bass Strait after more than 40 years of operation.

The Australian Competition & Consumer Commission (ACCC) released a report in September last year that predicted a supply shortfall in the east coast domestic gas market of up to 55 petajoules (PJ) in 2018.

In addition, gas spot prices in some states have more than doubled since 2016, with the ACCC claiming that small businesses and low-income households are being particularly affected.

However, there appears to be no shortage of LNG – the issue is with keeping it on Australian shores.

So, in June last year, the federal government implemented the Australian Domestic Gas Security Mechanism to limit LNG exports.

In October, the major east coast producers reached agreement with the government, by way of the Australian East Coast Domestic Gas Supply Commitment, to guarantee sufficient natural gas supply to domestic customers to meet the forecasted supply shortfall in 2018 and 2019.

The companies also agreed to sell natural gas produced in excess of contract volumes to the domestic market before selling globally and committed to making gas available to electricity generators during peak periods.

Despite this, the commodity has been predicted to overtake coal as the country’s second largest exported resource from an earnings perspective.

This projection is backed by data from the Department of Industry, Innovation and Science forecasting LNG export earnings will reach A$35 billion between 2018 and 2019 as a result of increases in export levels, particularly due to rising demand from India.

In addition, Australia is expected to become the world’s largest CSG producer, accounting for almost half of international production from 2020 onward.

With Australia surging forward in world energy production, its timely to look at some of the oil and gas stocks poised to benefit on the ASX.

The big players on the ASX

Listed below are the major oil and gas stocks on the ASX.

Beach Energy (ASX: BPT)

Adelaide-based Beach Energy is Australia’s largest onshore oil producer with a core focus on exploring and developing its 69,000sq km-plus acreage in the Cooper Basin.

In total, the company holds interests in more than 450 exploration and production tenements in Australia and New Zealand, including the offshore Burnside gas discovery in the Browse Basin off WA.

Its recent acquisition of Lattice Energy from Origin Energy was a transformative transaction for Beach, with the company reporting a 150% boost in production to 6.6MMboe and an 89% rise in sales revenue to A$393 million for the March 2018 quarter.

In addition, Beach has an active exploration drilling program running across its Cooper Basin projects and is progressing a stage two development plan for its Waitsia gas project in WA with joint venture partner AWE Limited, which has recently been compulsorily acquired by Japanese conglomerate Mitsui.

BHP Group (ASX: BHP)

Australia-based BHP Group is considered the world’s biggest mining company, based on a market capitalisation of A$100.3 billion.

The mining giant also has an extensive petroleum portfolio, with operations including exploration, development and production activities both off and onshore Australia, the US and Gulf of Mexico, Trinidad and Tobago, Algeria and the UK.

Cooper Energy (ASX: COE)

Gas major Cooper Energy was originally focused on Central Australia’s Cooper Basin but has now expanded its portfolio of assets into the Otway (on and offshore) and offshore Gippsland basins of Victoria.

The company’s assets have been estimated to contain 54.1MMboe in total proved and probable reserves and it produces about 7PJ of gas per annum, mainly from its operated Casino Henry gas project in the Otway Basin. It also produces around 300,000bbls of oil per annum from low cost operations in the Cooper Basin.

In addition, Cooper currently has a major development underway at the offshore Sole gas field in the Gippsland Basin. The project comprises a A$355 million subsea development linking to the Orbost gas processing plant onshore Victoria, which will also undergo a A$250 million upgrade before being reopened. At the end of March, the project was 40% complete.

Cooper is developing this project with the aim of supplying 24PJ of gas per year to utility and industrial gas customers from 2019. According to the company, a further 63PJ remains available for further contracts.

Freedom Oil & Gas (ASX: FDM)

Formerly named Maverick Drilling & Exploration, Freedom Oil & Gas changed its name in late 2016 as well as its focus, establishing a large position in the liquids-rich region of the Eagle Ford shale in Texas, US.

Last year, the company carried out a horizontal drilling program on its acreage with two wells commencing production in November.

In February, Freedom kicked off a drilling program comprising a further four wells in the acreage. Following this, the company is planning a more continuous field development program.

Karoon Gas Australia (ASX: KAR)

Offshore oil and gas explorer Karoon Gas Australia has working interests in the Browse and Carnarvon basins off WA and in the Ceduna Basin in the Great Australian Bight. It also operates six blocks in Brazil’s Santos Basin and holds a stake in a block off the coast of Peru.

The company’s current focus is its wholly-owned Santos Basin project, where the Kangaroo and Bilby light oil discoveries were made in 2013, followed by the Echidna light oil discovery in 2015.

In April, Karoon submitted final discovery evaluation reports and declarations of commerciality relating to the Echidna and Kangaroo light oil accumulations to Brazil’s oil and gas regulator.

The documents submission marks the end of the company’s exploratory phase and upon approval, the development and production phase of the project can commence.

Liquefied Natural Gas (ASX: LNG)

Perth-based LNG developer Liquefied Natural Gas is involved in bringing mid-scale projects to the international energy market.

Last month, the company closed on the sale of its wholly-owned subsidiary Gladstone LNG Pty Ltd, which owns the site of the proposed Fishermans Landing LNG project at the Port of Gladstone in Queensland. The company was proposing to develop a 3.5Mtpa LNG plant at the site before scrapping the idea about a year ago.

LNG Limited’s portfolio now includes LNG export terminals in Nova Scotia, Canada and Louisiana, US with a combined aggregate production design capacity of 20Mtpa, with expansion options.

The company also owns a pipeline company that is proposing to construct and operate a 62.5km gas pipeline to link gas supply to its Bear Head terminal in Canada.

In addition, its wholly-owned subsidiary LNG Technology Pty Ltd has designed and patented the “optimised single mixed refrigerant” (OSMR) process, which combines several existing technologies into one integrated liquefaction system, resulting in a plant operating at a low cost with a more efficient design that generates lower emissions and improved project economics.

In March 2018, LNG Limited reported it had extended the financial close of a binding LNG offtake agreement relating to its Magnolia terminal in Louisiana. The original deal, inked in mid-2015 with Meridian LNG Holdings Corporation, included firm capacity rights at Magnolia for up to 2Mtpa for an initial 20-year term with an option to extend by a further five years.

Mineral Resources (ASX: MIN)

Australian mining major Mineral Resources is primarily focused on iron ore, manganese and lithium.

Although, in December last year it acquired the Red Gully gas processing facility and petroleum exploration tenure from Empire Oil & Gas (ASX: EGO) after the latter company went into voluntary administration in September.

The Red Gully facility only has one producing well, which was shut down last year for a reserve assessment and all attempts at bringing it back into production failed.

According to Mineral Resources, further efforts to recommence output from the well during the December quarter were unsuccessful and the company is now considering its options for this operation.

However, the company said it was considering an exploration program for the newly acquired Perth Basin exploration assets, which are highly prospective for oil and gas.

Santos (ASX: STO)

Australian gas major Santos has been operating for more than 60 years with producing assets in SA’s Cooper Basin, as well as being partnered up in WA’s Carnarvon Basin, the Darwin LNG project in the NT, and the Gladstone CSG-LNG project in Queensland. It is also a foundation partner in the PNG LNG project in Papua New Guinea.

In addition, the company holds exploration assets in Australia, Papua New Guinea, Bangladesh and Malaysia, as well as oil assets in NSW, WA and Asia, although these are run separately as a standalone business.

Santos is a pioneer company, having made many first discoveries including the first natural gas find in the Cooper Basin in 1963 and first oil in 1970. It also made the first discovery in the Carnarvon Basin in 1984.

The company is currently being targeted by US energy player Harbour Energy with the latter proposing a $13.5 billion takeover offer.

In April, Santos said Harbour had commenced due diligence as part of an engagement process but there was no certainty that the proposal would result in an offer that is accepted by Santos’ board to present to shareholders.

Also in April, Santos announced it had entered the front end engineering and design (FEED) phase for the development of the Barossa field offshore northern Australia to backfill the Darwin LNG project.

The Barossa development will extend the operating life of Darwin LNG for more than 20 years, as production from the Bayu-Undan fields are expected to cease in the 2020s.

Senex Energy (ASX: SXY)

Onshore oil and gas explorer and producer Senex Energy has oil and gas assets in SA’s Cooper Basin as well as gas assets in Queensland’s Surat Basin.

In Queensland, the company is focused on progressing its Western Surat gas project and Project Atlas.

The first pilot for Western Surat was delivered in late 2016 with unprocessed gas sold to Gladstone LNG. In 2017, Senex invested A$50 million to a drilling and construction program in the south-eastern portion of the permits which contributed to a 65% boost in proven Surat Basin gas reserves.

Material gas production from Western Surat is anticipated this year and Senex already has a 20-year gas sales deal in place with Gladstone LNG for up to 50PJ per day from the project.

Senex was awarded the Project Atlas acreage by the Queensland Government in September last year. This project involves the delivery of CSG to be sold to the domestic market, with first gas targeted for 2019.

In the Cooper Basin, Senex runs low cost oil producing assets in joint ventures, mainly with Santos and Beach Energy.

Sino Gas & Energy Holdings (ASX: SEH)

Unconventional gas developer Sino Gas & Energy Holdings holds a portfolio of assets in the Ordos Basin in north China’s Shanxi province.

Sino currently has two central gathering stations (CGS) in production, Sanjiaobei and Linxing West, and plans to commission and ramp-up production at a third CGS (Linxing North) by the third quarter of 2018.

Bringing the third CGS online will increase the total installed nameplate capacity to 42MMcfd.

Its 2018 work program also includes the drilling of up to 50 wells across its projects. In April, the company reported that the program was underway with seven rigs mobilised for drilling.

Oil Search (ASX: OSH)

Founded almost 90 years ago, Oil Search is one of Papua New Guinea’s largest companies and operates all of the nation’s producing oilfields.

The company also has a large exploration and appraisal portfolio and has a 29% stake in the ExxonMobil-operated PNG LNG project.

In February, the company also acquired a 25.5% stake in the Pikka Unit and adjacent exploration acreage plus a 37.5% stake in the Horseshoe Block in the North Slope region of Alaska, US. It assumed operatorship in March and recruitment is now underway to build a subsurface, drilling and operational team based in Anchorage, in preparation for a drilling program to start in early 2019.

Oil Search’s 2018 work program also includes the drilling of three appraisal wells in Papua New Guinea. The first, Kimu-2 in the Forelands region, is due to spud shortly.

Origin Energy (ASX: ORG)

One of Australia’s leading energy retailers, Origin Energy also holds interests in gas exploration and production projects in Queensland’s Bowen and Surat basins, WA’s Browse Basin and NT’s Beetaloo Basin.

The company is the upstream operator of the A$24.7 billion Australia Pacific LNG project, which started production in late 2015 and now supplies nearly 30% of domestic east coast gas demand, in addition to exporting LNG to Asia.

Origin is responsible for developing the project’s CSG fields in the Surat and Bowen basins as well as the main transmission pipeline that transports the gas to an LNG processing facility on Curtis Island near Gladstone, Queensland.

In an effort to move to a “simpler and leaner operating model”, Origin closed on the A$1.58 billion sale of its subsidiary Lattice Energy to onshore explorer Beach Energy at the end of January.

Lattice is a conventional upstream oil and gas business with operating interests in offshore projects in Victoria, Tasmania and New Zealand, as well as non-operating holdings in the onshore Cooper Basin in central Australia.

In late April, Origin announced it would be rebranding to ‘Good Energy’ with a new, refreshed logo. The company said the new brand campaign would “highlight its commitment to making energy smarter, easier, more sustainable and more affordable to customers”.

Woodside Petroleum (ASX: WPL)

Australia’s largest independent oil and gas company, Woodside Petroleum holds an extensive portfolio of assets in established, emerging and frontier plays in Australia, the Asia-Pacific region, the Atlantic margins and sub-Sahara Africa. It also operates a fleet of floating production storage and offloading (FPSO) facilities.

The company is a leading LNG operator, producing about 7% of the total global LNG supply.

Its big developments in Australia are currently the Wheatstone, Scarborough and Browse LNG projects offshore WA.

The second LNG train at the Wheatstone project is expecting to start producing LNG during the current June quarter. Once both trains and the domestic gas facility are fully operational, Wheatstone will contribute more than 13MMboe of annual production.

At the end of April, Woodside announced it had locked in a deal with Perdaman Group to supply gas from its Scarborough field to the latter’s proposed US $3.3 billion Burrup Peninsula coal-to-urea plant in the Pilbara region of WA. Under an inked memorandum of understanding (MoU), Woodside has agreed to supply 125 terajoules (TJ) per day of gas from the early 2020s for up to 25 years.

The company also operates the Pluto LNG project, where a recently approved truck loading facility is expected to start up in the second half of 2018. This facility will extend existing infrastructure from the onshore WA processing facility to provide LNG for local distribution.

Woodside has also commenced studies on a pipeline to link Pluto to the North West Shelf project’s Karratha gas plant in northern WA.

Small cap oil and gas stocks on the ASX

Listed below are the small cap oil and gas players on the ASX.

88 Energy (ASX: 88E)

Focused on the North Slope of Alaska, oil explorer 88 Energy operates the large, onshore Icewine project in joint venture with Houston-based Burgundy Xploration.

The partners are aiming to prove up around 3.6 billion barrels of oil from the liquids-rich HRZ unconventional resource play within the project.

In early April, 88 Energy announced it was gearing up for a “pivotal” year, despite the tragic news that Burgundy chief executive officer Paul Basinski had passed away.

Upcoming activities include the reopening of the Icewine 2 well and subsequent flow testing, expected in April or May, and the return of results from two three-dimensional seismic surveys, recently completed at Icewine and the company’s Yukon Gold oil project (also located onshore Alaska).

88 Energy is also preparing for the launch of a planned farm-out of its conventional interests at the Icewine project, with the formal process expected to commence in mid-2018 and the aim to complete the process before planned drilling operations begin in 2019.

ADX Energy (ASX: ADX)

In addition to gold and base metal interests in Australia, ADX Energy wholly-owns and operates three oil and gas blocks located offshore between Tunisia and Italy. It also has a 50% stake in the Parta oil and gas exploration block, onshore Romania.

The offshore blocks include the Dougga and Lambouka gas discoveries, which contain mean recoverable contingent gas resources of 194 billion cubic feet (Bcf) and 42MMbbls of associated condensate and LPGs, and mean recoverable gas resources of 309 Bcf, respectively.

ADX plans to drill and test a well on the Dougga Sud prospect in the second half of 2018 and has already engaged Noble Drilling Services’ drillship GlobeTrotter II to provide the drilling services.

In March, the company finalised a deal with AIM-listed oil and gas investment company Reabold Resources to invest US$2 million in the Parta appraisal program scheduled for later this year.

This program will comprise two re-drill wells planned in the second half of 2018 to test 33Bcf of prospective and contingent resources spread over a total of five gas reservoirs.

AJ Lucas Group (ASX: AJL)

Drilling, engineering and investment company AJ Lucas Group holds interests in shale gas exploration licences in the UK through its 47% shareholding in Cuadrilla Resources.

At the start of April, Cuadrilla announced it had completed drilling of UK’s first ever horizontal shale gas well at its Bowland project in Lancashire.

The company next planned to drill a second horizontal well at the Preston New Road exploration site, then complete hydraulic fracturing of the two wells in the third quarter of 2018, before running flow tests and potentially connecting to the local gas grid in 2019.

According to Cuadrilla, at least 200 trillion cubic feet (Tcf) of natural gas is trapped in the shale rock of its Lancashire Bowland exploration licence area, which also includes a second proposed shale gas exploration site, Roseacre Wood.

American Patriot Oil & Gas (ASX: AOW)

Conventional oil explorer and developer American Patriot Oil & Gas is gearing up for a busy 2018, with plans to acquire distressed cash flow producing assets and give them new life.

In the last six months, the company has already scored a chunk of acreage in the Texas and US Gulf Coast region, taking advantage of cheap deals in a high oil producing and low operating cost area.

Fully funded by a recently approved US$40 million debt facility, American Patriot has been eyeing off further acquisitions and is aiming for a production target of more than 2000 barrels of oil per day (bopd) by the end of the year.

Armour Energy (ASX: AJQ)

Armour Energy’s core focus is its Kincora gas project, located on the Roma Shelf of Queensland’s Bowen-Surat Basin. The 3000sq km acreage was acquired from Origin Energy in September 2016 and comprises petroleum tenements and production and transportation infrastructure, including the Kincora gas and LPG plant.

First commercial gas sales commenced at Kincora in October last year. Further work being undertaken at the plant is expected to ramp up production to 20TJ per day within the next 12 months.

In March, the company was awarded additional acreage near the project under the Queensland Government’s recent petroleum acreage release tender.

Armour chief executive Roger Cressey said the company was confident the new acreage would provide further resources for long-term gas production.

“The close proximity of this new tenement to Armour’s Kincora gas plant means gas resources can be easily connected, processed and delivered to market,” he said.

Armour also recently announced it expects to receive a A$6 million funding grant under the Federal Government’s Gas Acceleration Program, which has been designed to fast track projects with the best prospects of bringing significant new gas volumes to target markets by mid-2020.

The company also holds a vast chunk of acreage in the Northern Territory. However, in the same month as the Kincora acquisition, the Northern Territory Government imposed a fracking moratorium on onshore unconventional reservoirs, thus placing a halt on any territory-wide activity for Armour.

In April 2018, this ban was lifted, subject to strict new laws and industry regulations. This is expected to be positive news for Armour, which to date has made five discoveries from six wildcat wells and has identified 193 leads and prospects targeting 4.9Tcf of best estimate prospective gas resources at its McArthur Basin project.

The company has also been granted an exploration licence in Uganda, in a region where to date, discoveries have totalled about 6.5MMbbls of oil initially in place.

Baraka Energy & Resources (ASX: BKP)

Baraka Energy & Resources holds around 4 million acres (over 16,000sq km) in the southern part of NT’s Georgina Basin, considered to be one of Australia’s most prospective onshore basins.

The company’s McIntryre-2 well, spudded in October 2011, was the first horizontal well to be drilled in Australia. Operations included 1000m of fracking, and the results showed gas potential, as well as some evidence of oil in the samples.

Baraka has been in limbo for the past few years, with activities suspended at its project while the NT has had a moratorium on fracking. However, upon the ban’s conditional lift in April, Baraka announced it would now “pursue a farm-in partner to pursue the positive attributes of its permit”.

Bass Oil (ASX: BAS)

Focused on South East Asia, Bass Oil operates the Tangai-Sukananti joint operation contract in the South Sumatra Basin onshore Indonesia.

The project contains the Tangai and Bunian oilfields and the company’s gross (55% share) 2P reserves have been estimated at 1.35MMbbls of oil.

At the start of April, Bass Oil announced a 20% boost in daily field production to 650bopd, with further gains of between 150 and 250bopd expected over the coming weeks. According to the company, the uplift was the result of optimisation work completed in the last six months, particularly de-bottlenecking the flow line from the Bunian-3 well.

Blue Energy (ASX: BUL)

Blue Energy has its foot in a lot of oil and gas projects across Queensland and NT, with its main focus being its 100% owned Bowen Basin gas project in north eastern Queensland. This project has been independently certified to contain gas reserves of 298PJ and gas resources of 3000PJ.

The company is pushing for a 400km pipeline to link the Bowen Basin with the east coast gas market. In June last year, it entered into an MoU with major energy infrastructure company APA Group to explore the development of new pipeline infrastructure and other related midstream infrastructure required to bring Blue’s gas resources online.

Brookside Energy (ASX: BRK)

At the start of March, US-focused Brookside Energy announced it had increased its oil and gas lease holding in Oklahoma’s Anadarko Basin by 17% and had planned to capture additional acreage throughout the rest of this year, backed by an increased leasing facility of US$4 million.

The company also recently said it expected to earn around US$2 million over the next 12 months – thanks to the steady ramp up of production at its Stack oil and gas acreage in Oklahoma.

Buru Energy (ASX: BRU)

Buru Energy is focused on exploring and developing oil and gas resources in the Canning Basin, in the southwest Kimberley region of WA.

In July last year, the company delivered its first barrels of oil since the restart of production at its 100%-owned Ungani conventional oilfield.

During the December quarter, two oil development wells on the field were completed, with testing and hookup to the central production facility planned for the first quarter of 2018.

Unfortunately, harsh weather conditions pushed back progress with the unexpected shut-in of the field , but Buru reported at the start of April that flowline installation work was expected to commence shortly.

Six trucks are expected to be available on re-start, which will allow production capacity of up to 2400bopd.

Buru said arrangements are well advanced for additional trucks from another contractor to take output capacity up to the company’s target of 3000bopd.

It is also planning a 2018 drilling program of up to four exploration wells.

Byron Energy (ASX: BYE)

Byron Energy is the operator of several oil and gas blocks in the shallow waters of the US Gulf of Mexico.

Its flagship development is South Marshall Island Block 71, which commenced first oil production from two out of three wells in late March, with the third well brought online in April.

The three online wells are currently producing oil at a controlled combined rate of 4650bpd, as well as 3200 cubic feet per day of gas. According to Byron’s 50:50 joint venture partner Otto Energy (ASX: OEL), this was more than 90% of the platform’s throughput capacity.

Calima Energy (ASX: CE1)

Calima Energy operates the 72,014 acre (291.4sq km) Calima Lands project, located in Canada’s British Columbia and considered to be highly prospective for the Montney formation.

It also has a 50% stake in four offshore production sharing contracts (PSC) in Western Sahara in North Africa, as well as a 10% stake in Bahari Resources which owns 40% of a PSC in the Republic of Comoros, off the coast of Tanzania and Mozambique.

At the end of March, Calima said Bahari was in the process of farming out its Comoros interest, with several parties being short-listed to enter the second phase of due diligence.

Carnarvon Petroleum (ASX: CVN)

Carnarvon Petroleum is an oil and gas explorer with a focus on offshore prospects in WA’s North West Shelf.

The company’s wholly-owned Buffalo project has a contingent resource estimated of 31 million barrels, with potential revenue of US$2 billion at current oil prices.

In November, Carnarvon was granted a new oil exploration permit covering 1512sq km of shallow water in the Bonaparte Basin. The block is adjacent to the Montana and Skua producing oilfields and the company said it had already identified several large targets with multiple reservoir levels.

Carnarvon also holds 20% and 30% interests in permits making up the Phoenix project in the offshore Canning Basin, where operating partner Apache (now Quadrant Energy) made the first major offshore oil find in Australia in over 15 years, with the Phoenix South-1 exploration well in 2015.

Further drilling campaigns are planned for the Phoenix project this quarter. In mid-April, Carnarvon announced the GSF Development Driller-1 semi-submersible drilling rig had spudded the Phoenix South-3 well.

The objective of this well is to assess the gas and condensate discovered at the top of the Caley interval in the Phoenix South structure, which is estimated to contain a gross mean recoverable prospective resource of 489Bcf of gas and 57MMbbls of associated condensate.

Central Petroleum (ASX: CTP)

Natural gas exploration junior Central Petroleum holds exploration permits over a vast area of the Northern Territory and Queensland.

In early March, the company announced it had been given the go-ahead to develop its Mereenie gas project in the NT with its much larger joint venture partner, financial major Macquarie Group.

The development includes a A$12 million upgrade of the processing plant to increase capacity to 63TJ per day, to coincide with the Northern Gas Pipeline (an A$800 million project that will connect the NT with the eastern gas pipeline grid) becoming operational at the end of the year.

Central also recently announced a 50:50 joint venture partnership with Incitec Pivot, Australia’s largest supplier of fertilisers and other industrial products. The deal involves the partners developing a natural gas project in Queensland to support the long-term viability of Incitec’s Gibson Island fertiliser facility.

According to Incitec, first gas production is anticipated around 2022 (depending on the confirmation of proven reserves and further development of the acreage).

Challenger Energy (ASX: CEL)

Challenger Energy is focused on the Karoo Basin shale gas play in South Africa.

Through its 95%-owned subsidiary Bundu Gas & Oil Exploration, it has lodged an application for the Cranemere project, which covers 3500sq km of land centred on the historical Cranemere shale gas discovery well.

Due to the current political climate in South Africa, delays and uncertainties surrounding the timing of exploration rights awards remain.

In its December 2017 quarterly report, Challenger stated it would continue to focus on internal cost control and was “also evaluating other projects that could add a further dimension to the company’s portfolio”.

Comet Ridge (ASX: COI)

Comet Ridge is a CSG explorer with projects in Queensland’s Bowen and Galilee basins, as well as in the Gunnedah Basin of northern NSW.

The company holds a 40% majority stake in the Mahalo CSG project, in joint venture with larger gas players Santos and Origin Energy, which each hold 30% interests.

In March, Comet Ridge announced a massive 473% boost in 2P (proved and probable) reserves at the Mahalo CSG project in Queensland, to 172PJ of gas. This makes it one of the largest undeveloped gas resources on the Australian east coast.

The company has also recently praised a well from its Mira pilot scheme, one of two pilot schemes on the project, for reaching 1 million cubic feet per day (MMcfpd) of gas production, with the flow rate continuing to rise.

Cue Energy Resources (ASX: CUE)

In Australia, Cue Energy Resources has 100% rights to two permits in WA’s offshore Carnarvon Basin, and a 20% stake in a third after farming out 80% equity to UK supermajor BP in 2016.

BP also has an option to acquire a 42.5% equity in another of Cue’s Carnarvon Basin permits, containing the Ironbark gas prospect which has a best estimate prospective recoverable gas resource of 15Tcf.

Last November, Australian major Beach Energy also struck a deal with Cue to take a 21% stake in the block. In total, the deals have conditionally secured 75% of funding for the planned Ironbark-1 exploration well.

The Ironbark prospect is less than 50km from the North Rankin offshore platform and in close proximity to Pluto and Wheatstone LNG infrastructure, providing cost-effective commercialisation options.

Cue also wholly-owns the Mahakam Hilir PSC in Indonesia and holds minority stakes in two other Indonesian projects, as well as a minority interest in the OMV-operated Maari and Manaia oilfields in New Zealand.

Doriemus (ASX: DOR)

British oil and gas company Doriemus holds minority interests ranging between 10% and 20% in three onshore UK conventional oilfields.

At the beginning of April, the company announced oil production had resumed from three temporarily suspended wells at the Angus Energy-operated Lidsey and Brockham oilfields.

The wells are now currently producing oil at a gross aggregate estimated flow rate of 212bpd, and offtake of all production from the two oilfields was expected to commence “imminently”.

“These initial flow rates from these three wells in the UK are promising and future production will now contribute meaningful cash flow to our operations,” Doriemus executive chairman David Lenigas said.

The third oilfield the company holds interest in is Horse Hill, where upcoming extended well testing is planned for the Horse Hill-1 oil discovery well.

Elk Petroleum (ASX: ELK)

Focused on the northern Rocky Mountains in North America, Elk Petroleum is involved in enhanced oil recovery (EOR), a process utilising various methods and technologies to extend the life of an otherwise depleted oil reservoir.

In April, the company announced the start of oil production from its 49%-owned Grieve EOR project in Wyoming. First output is in the range of 1100 to 1200bopd but is expected to ramp up to about 2100bopd by the end of the 2018 calendar year.

In November last year, the company also acquired operatorship and a 63% stake in the Greater Aneth Oilfield in Utah for US$160 million.

According to Elk, the Aneth Oilfield is one of the most significant EOR projects in the US, with a 30-year operating history and total production of about 450MMbbls of oil to date. The field has also been estimated to contain more than 300MMbbls of additional recoverable oil.

Emperor Energy (ASX: EMP)

Emperor Energy’s core project is a wholly-owned exploration permit in the offshore Gippsland Basin in Victoria’s Bass Strait.

The permit lies in shallow waters and contains two gas discovery wells: Judith-1 drilled by Shell in 1989 and Moby-1 drilled by Bass Strait Oil in 2004.

Emperor’s main focus is the Judith prospect, which has been estimated to contain 1.8Tcf of gas in place and is located 2km north of the now producing Esso (ExxonMobil) and BHP Petroleum operated Kipper gas field.

In March, the company announced it had completed a well log evaluation of the Judith gas discovery. It also recently renewed its exploration permit over the area and pans to drill an exploration well in the Judith north structure by early 2021.

Emperor also has 100% rights to the Backreef exploration area in the onshore Canning Basin, and a retention lease in the offshore Carnarvon Basin in WA.

Empire Energy Group (ASX: EEG)

Primarily focused on oil and gas production, Empire Energy Group has operations in the Appalachia (New York and Pennsylvania) and Mid-Continent (Kansas and Oklahoma) region of the US.

It is also undertaking an exploration and development program of its shale assets in the Appalachia area, and in Australia’s Northern Territory.

In February, the company received commitments to raise more than A$1.87 million via a private placement of 150 million fully paid ordinary shares at an average issue price of A$0.0125 per share.

Empire said the proceeds would be used for funding obligations to keep its NT tenements in good standing, facilitate discussions and negotiations with potential NT farm-out partners and to strengthen the management team and working capital requirements.

Eon NRG (ASX: E2E)

Eon NRG has several assets prospective for oil, gas and battery minerals throughout the US.

The company’s current exploration activities are underpinned by cash flow from its oil and gas operations.

Eon’s oil and gas assets include Borie Field and Silvertip Field in Wyoming, as well as two producing oilfields in California.

Late last year, Eon took over as operator at the Borie oilfield in Wyoming, which produced about 70bopd in the March quarter after the company completed three workovers on wells in the field.

Across its oil and gas assets, for the March period, Eon achieved gross production of 50,654boe and sold 33,787boe at an average price of US$62.89/bbl giving the company positive net cash flow.

FAR Limited (ASX: FAR)

Africa-focused explorer FAR Limited’s biggest claim to fame is its 15% stake in the world class SNE deep-water oilfield, discovered offshore Senegal in late 2014 and operated by UK independent Cairn Energy.

The discovery has since been appraised with seven successful wells over two drilling campaigns and development planning is underway, with a final investment decision expected in early 2019.

FAR also recently announced it had joined forces with Malaysian petroleum giant Petronas to drill an exploration well offshore The Gambia.

The Samo-1 well is expected to spud in late 2018 and will be the first exploration well to be drilled offshore The Gambia since 1979.

Under the farm-out deal, Petronas has agreed to fund 80% of the total well costs up to a cap of US$45 million, for a 40% stake in FAR’s two offshore blocks.

Fremont Petroleum Corporation (ASX: FPL)

Aptly named Fremont Petroleum Corporation, this production and development company is focused on the second oldest oilfield in the US – in Fremont County of Colorado.

The company’s flagship asset is its 100% owned Pathfinder oil and gas project, where independent estimates have calculated a 90% probability that it contains 220Bcf of gas and 35MMbbls of oil.

In February, Fremont reported that it expects to become cash flow positive by the end of the 2018 fiscal year from oil sales of 100bopd. In addition, gas sales negotiations for the Pathfinder project were progressing to plan.

In addition to its Colorado operations, the company has a non-core oil and gas producing property in Kentucky and interests in two wells in Texas.

Galilee Energy (ASX: GLL)

Originally focused on coal, Galilee Energy now runs the Glenaras gas project in western Queensland, targeting CSG in the Galilee Basin Betts Creek and Aramac coal beds.

The project has been independently certified to contain a 3C contingent resource of 5314PJ of gas.

Galilee is currently undertaking a multi-lateral pilot program on the project, which involves the drilling of three lateral wells and conducting a production testing pilot with the aim to ultimately convert a large portion of the resources to reserves.

In late April, the company reported it had spudded the third well in the program.

Galilee also has interests in Texas and Kansas in the US, as well as the Magallanes Basin CSG project in Chile.

Horizon Oil (ASX: HZN)

Horizon Oil operates two of four licences (in which it holds varying interests) that make up the proposed 1.5 million-tonnes-per-annum Western LNG project in Papua New Guinea.

This project involves the development of the appraised Western Province gas resources via pipeline to a gas liquefaction facility located near Daru Island, and export of LNG and condensate from Daru.

Earlier this year, Horizon reported that independent, third-party pre-FEED studies commissioned on the three components of the project – upstream, pipelines and the liquefaction facility – were substantially completed.

According to the company, the preliminary results of the studies provided “good confirmation of the technical viability and economic attractiveness of the project”.

In addition, Horizon holds a 26.95% working interest in four producing fields in China’s Beibu Gulf, operated by Chinese national oil company CNOOC, and a 26% stake in the OMV-operated producing Maari and Manaia fields in New Zealand.

Icon Energy (ASX: ICN)

Queensland-based CSG explorer Icon Energy holds natural gas, shale gas and oil exploration permits in Australia’s Gippsland and Cooper basins.

Its shale gas-prospective permit ATP855, located in the Nappameri Trough of the Copper Basin, has a 2C contingent resource of 1.57Tcf of gas and was declared a potential commercial area by the Department of Natural Resources and Mines in August last year.

The company is preparing for a stage two exploration program on the permit, designed specifically to address outstanding technical questions and determine the commercial viability of the gas resource.

Icon said it was also seeking domestic and international funding for the appraisal and development program on the permit.

Last year, the company carried out a 293sq km 3D seismic survey over its Cooper-Eromanga Basin permit ATP594 which identified natural gas and oil prospects. In its December quarterly, Icon said it was in talks with potential farm-in partners to develop this tenement.

In mid-March, Icon completed the sale of its corporate office on the Queensland’s Gold Coast for A$7.1 million and plans to lease the building back for a three-year period. Proceeds from the sale will be used for capital expenditure associated with company’s exploration program as well as general working capital.

Interpose Holdings (ASX: IHS)

In April, Interpose Holdings announced it had gained an 80% stake in the Cabora Bassa gas and condensate project in Zimbabwe via a planned buyout of Invictus Energy Resources.

Under the binding deal, Interpose has agreed to pay US$500,000 for the acquisition and plans to conduct a A$4.5 million capital raising to develop the project.

The Cabora Bassa project includes the Mzarabani prospect, which Interpose said was potentially the largest, seismically defined, undrilled hydrocarbon structure onshore Africa.

The company’s planned exploration program will include reprocessing of gravity and aeromagnetic data completed by Mobil from when the major oil company explored the project area in the 1990s.

It also intended to carry out an environmental impact study, fund a third party independent resource certification and begin drilling preparations for the first exploration well.

Jupiter Energy (ASX: JPR)

Oil explorer Jupiter Energy holds 100% rights to an exploration permit, Block 31, in the Mangistau Basin of West Kazakhstan.

The company currently has trial production licences approved for five of its wells, located on the Akkar East and West Zhetybai oilfields.

In its March 2018 quarterly, Jupiter reported steady production from three of its wells in Akkar East and said workover operations for a well in West Zhetybai was scheduled for May, with the restart of production expected in the third quarter.

During the March quarter, the company made oil sales of about US$910,000 with all oil sold into the domestic market as is required under Kazakh laws when wells are producing under trial licences.

Jupiter said its plan going forward was continue discussing longer term funding options with interested parties.

Key Petroleum (ASX: KEY)

Key Petroleum’s core business is the pursuit of conventional and unconventional “wildcat” (new, unproven or unexplored) exploration opportunities.

The company holds interests in oil and gas exploration permits in WA’s North Perth and Canning basins, with its most recent acquisition being Production Licence L7, located in the onshore Perth Basin and containing the Mount Horner Oilfield.

According to Key managing director Kane Marshall, the acreage contains a proven producible oil pool and has material exploration upside which is consistent with the company’s portfolio approach.

“This acquisition provides Key with not only flexibility to commercialise possible future discoveries in the EP437 [Key’s adjoining permit] and L7 areas but potentially revisit an area in L7 with no work program commitments where oil has been recovered from several wells but with little exploration activity for a number of years,” Marshall said.

In November last year, the company’s wholly-owned subsidiary Key Cooper Basin Pty Ltd also acquired three permits from Beach Energy in Queensland’s Cooper Eromanga Basin.

According to Key, preliminary seismic mapping has identified conventional gas potential in the Permian gas fairway, which extends from the central part of the basin west into Key’s acreage.

This is very encouraging for the company, given that any future gas resource has a direct route to commercialisation via the defined east coast gas market and established infrastructure.

Kina Petroleum (ASX: KPL)

Kina Petroleum is focused on oil and gas exploration and production in Papua New Guinea, holding equity in seven petroleum prospecting licences in the country.

The company’s business strategy involves limiting its exposure to pre-drilling field work costs and since 2010, it has farmed out working interests to major players including Oil Search and most recently, Santos in December last year, to explore its permits.

Kina’s primary focus is its PRL 21 LNG development project, where it is evaluating options including the early production and export of liquids.

In December 2017, Kina announced a share placement raising about A$5.4 million, with funds to go towards pre-development work, as well as potential near-term activities on two other prospecting licences.

Lakes Oil (ASX: LKO)

Australia’s oldest oil company, Lakes Oil has been exploring tight gas and shale oil and gas across Victoria for more than 70 years.

The company holds onshore exploration permits in Victoria’s Gippsland and Otway basins and has also expanded to exploring oil, gas and condensate fields in western Queensland and South Australia.

In addition, Lakes holds a minority stake in the Strata-X Energy operated Eagle oil project in California, US.

Following the Victorian government’s blanket ban on exploring for onshore unconventional gas resources a year ago, the company wrote to the resources minister in October proposing to “cooperatively carry out conventional drilling” to bring competitively priced natural gas to market as quickly as possible.

However, the proposal was met with a big fat “no” and Lakes faced off with the state in court in March.

The company argued that the Victorian Petroleum Act, as it was amended in March 2017, specifically provided that exploration commitments under existing tenements were excluded from the exploration moratorium and alleged that further variations made by the government in December last year were “illegal”.

In their latest ASX announcement, released in mid-March, Lakes said the legal proceedings were completed but the company was still waiting for the justice’s final decision.

Leigh Creek Energy (ASX: LCK)

Leigh Creek Energy is focused on developing the Leigh Creek coal field in northern South Australia for in situ gasification (ISG).

Also known as underground coal gasification, ISG is the process of converting coal from its solid state into a gaseous form, resulting in the generation of synthetic gas (syngas) containing methane, hydrogen and other valuable components.

The syngas can be used to produce electricity directly or further refined into other products such as synthetic methane and ammonia.

The company believes the Leigh Creek coal resource is technically suitable for ISG, in addition to being close to infrastructure. The location also avoids sensitive features such as acquifers, residents, towns, sensitive land uses or sites of high environmental value.

In April, Leigh Creek Energy announced it had received environmental approval for the pre-commercial demonstration (PCD) stage of its Leigh Creek ISG project.

Following completion of drilling and the above ground plant construction, the company plans to operate the PCD for up to 90 days with the aim of producing first gas via ISG.

At the start of May, Leigh Creek Energy announced the workshop fabrication of the above ground plant was complete and ready for mobilisation and final site fabrication.

Lion Energy (ASX: LIO)

Lion Energy holds a minority interest in the Seram PSC joint venture, located on Indonesia’s Seram Island and containing the 2 Tcf Lofin gas discovery which was appraised in 2015.

The company also currently holds a 40.7% stake in the South Block A PSC in the North Sumatra Basin and has 100% rights in a large conventional area in eastern Indonesia.

In the last month, Lion announced it had undertaken an internal review of its asset portfolio and decided to direct its resources to acquiring oil and gas producing, or near term producing assets in South East Asia, while looking to dispose of its current “non-core” assets.

This means it will retain the Seram PSC but dispose of any unconventional interests, as well as conventional exploration assets it deems to be “higher risk”. Lion also said it intends to build its portfolio via acquisitions or possible farm-ins.

Melbana Energy (ASX: MAY)

Melbana Energy is an explorer focused on prospects in Cuba, Australia and New Zealand.

It currently has a deal with the Cuban government to evaluate the potential to boost output at its shallow-water Santa Cruz oilfield on the country’s north coast. If the study confirms this potential, Melbana aims to exclusively negotiate a long-term incremental oil recovery production sharing agreement.

The company also holds an exploration permit in joint venture with Canadian explorer TAG Oil in New Zealand’s Taranaki Basin.

In March, the partners declared its Pukatea-1 well an oil discovery after it achieved natural flows at an initial rate of 600bopd.

According to Melbana chief executive Robert Zammit, the discovery provided the joint venture with “a basis to commence planning for the next stage of the development of the resource and the potential restart from the currently suspended Puka field”.

Metgasco (ASX: MEL)

Metgasco had previously explored for CSG in the Northern Rivers region of NSW before it accepted a A$25 million offer from the state government to withdraw from its exploration licences in 2015, following pressure from local green groups and farmers to shut down fracking activities in the region.

The company currently has a 5.77% shareholding in Byron Energy (ASX: BYE) under a staged financial investment announced in 2016. Byron operates several offshore blocks in the US Gulf of Mexico and the Bivouac Peak project in Louisiana with joint venture partner Otto Energy (ASX: OEL).

In addition, Metgasco reported in February it had reached agreement with traditional landowners regarding access and use of land making up two prospecting licences in south west Queensland’s Cooper Basin.

The two permits are soon expected to be awarded to Metgasco by the state’s mines and energy department.

New Standard Energy (ASX: NSE)

With a focus on frontier basins offering “high risk but high reward”, New Standard Energy currently holds 100% rights to two exploration permits in WA’s onshore Carnarvon Basin.

In January, the company said it was planning to continue exploration activities on its permits and was in talks with the state’s mines and petroleum department to settle on a new work program.

Norwest Energy (ASX: NWE)

WA-focused explorer Norwest Energy holds a 25% operating interest in the Xanadu project in the offshore Perth Basin.

Its joint venture partners are Whitebark Energy (ASX: WBE) with a 15% stake, Triangle Energy (ASX: TEG) with 30%, and private company 3C Group holding the remaining 30% interest.

In September last year, Norwest announced the Xanadu-1 deviated well (from an onshore surface location to an offshore target) as an oil discovery, as demonstrated by elevated gas readings, oil shows, fluorescence and cut-fluorescence while drilling.

A 3D seismic acquisition program over the oil discovery is was planned for the March 2018 quarter.

Norwest also holds equity in other onshore and offshore tenements in the Perth Basin. At the Lockyer Deep prospect, where the company has a 20% working interest, an exploration well is due to be completed in June 2018.

NuEnergy Gas (ASX: NGY)

NuEnergy Gas is a CSG explorer and developer with PSCs across South Sumatra, Central Sumatra and East Kalimantan in Indonesia.

The company’s main focus is its Tanjung Enim PSC, where an initial plan of development is currently being prepared. This process includes resources verification and reserves certification, pre-FEED studies including production facilities design selection, environmental studies and non-subsurface related surveying.

In September last year, NuEnergy executed an MoU with Indonesia’s state-owned energy company PT Pertamina to jointly evaluate the economic viability of CSG supply from the Tanjung Enim PSC area with the aim to use the resource to fulfil Pertamina’s gas consumer needs in Sumatra.

NuEnergy also recently drilled two exploration wells on the Rengat PSC for the purpose of fulfilling its work commitment, however this area will be relinquished as no attractive commercial discoveries have been found based on the drilling programs to date.

Oilex Limited (ASX: OEX)

Focused on the exploration and development of petroleum resources around the Indian Ocean Rim, Oilex Limited has a near-term production project in India and an early stage exploration project in WA’s Canning Basin.

The company’s 45% owned and operated Cambay field project in India has been estimated to contain a 2C contingent resources of 926Bcf of gas and 61MMbbls of oil.

Oilex has conceptualised a phased field development program building up to a target recovery of about 150Bcf of gas and about 6-8MMbbls of condensate production.

The company’s 2018 work program includes the drilling of two vertical wells on the Cambay field later in the year.

Otto Energy (ASX: OEL)

In addition to its 50% stake in the SM71 shallow-water oil development, Otto Energy has partnered up with Byron Energy in the Bivouac Peak project with a staged farm-in deal to earn a 45% interest.

This project is located in the transitional zone (coastal marshlands) and is technically considered onshore Louisiana.

Survey and permit work on the Bivouac Peak prospect has been ongoing with drilling operations expected to begin in the second half of the 2018 calendar year.

Pancontinental Oil & Gas (ASX: PCL)

Conventional oil and gas explorer Pancontinental Oil & Gas has key assets in Namibia and California, US, as well as other interests in Kenya’s Lamu Basin and Australia’s Perth Basin.

In 2013, the company farmed out a 35% stake and operatorship of its Walvis Basin project offshore Namibia to UK major Tullow Oil. Pancontinental will now be fully carried through the cost of drilling the upcoming Cormorant-1 well, which is due to spud in September.

The Cormorant prospect has the potential to contain prospective resources of 124MMbbls of recoverable oil based on an unrisked best estimate.

In California, Pancontinental’s interest in the Tulainyo gas discovery in the Sacramento Basin is held by Gas Fields LLC, which is 40% owned by Pancontinental and 60% owned by Raven Energy (ASX: REL).

Pancontinental also holds equity in Sacgasco-operated Sacramento Basin projects containing the Dempsey and Alvares gas discoveries.

Petrel Energy (ASX: PRL)

Petrel Energy is a petroleum exploration, development and production company with projects in Uruguay, Spain and Canada.

In October last year, Petrel’s 62.7%-owned Cerro Padilla-1 well in Uruguay discovered 2m of oil saturated sand, making it the first-ever confirmed onshore hydrocarbon find in the country.

A second exploration well, Cerro de Chaga-1, was spudded in mid-November.

The following month, Petrel entered into a share purchase agreement to sell up to 49.9% of its wholly-owned subsidiary Schuepbach Energy Espania, which owns the Tesorillo project in southern Spain.

The deal, snapped up by AIM-listed Prospex Oil and Gas, will generate sale proceeds of more than €2 million, which will be used to fund a work program targeting the historic Almarchal-1 discovery well on the project.

Petsec Energy (ASX: PSA)

Oil and gas explorer and producer Petsec Energy has operations in the shallow waters of the Gulf of Mexico and onshore Louisiana, US, as well as onshore Yemen.

At the start of the year, the company’s 2P oil and gas reserves in the US stood at 15.9Bcf of gas and 1.137MMbbls of oil.

Its Mystic Bayou oil and gas field in Louisiana has produced more than 34MMbbls of oil and 39Bcf of gas in its target horizons.

The offshore Hummer field was brought online last November and is currently producing at 18 MMcfpd and 370bopd gross.

In March, Petsec announced it had gained 100% ownership and operatorship of its Al Barqa licence (Block 7) in Yemen via the acquisition of an Oil Search subsidiary, which held a 40% stake in the block.

The licence contains the Al Meashar oil discovery made by Oil Search in 2010 as well as nine prospects and leads identified through seismic mapping with target sizes ranging from 2MMbbls to 900MMbbls oil gross.

Block 7 provides material upside to Petsec’s existing Damus production licence in Yemen, which holds the developed An Nagyah Oilfield and four undeveloped oil and gas fields, containing substantial oil and gas resources in excess of 34MMbbls of oil and 550Bcf of gas.

Due to the current political climate of Yemen, the An Nagyah Oilfield has been shut in since early 2014.

Petsec chairman Terry Fern said in March he hoped the recent welcome and encouragement the company received from senior members of the Yemen Government would allow the early restart of production in the oilfield.

Pilot Energy (ASX: PGY)

Pilot Energy holds working interests in a handful of onshore and offshore exploration permits in WA.

Its business strategy entails minimising project entry costs and work commitments, while adding value to its assets through desktop studies prior to seeking farm-in partners to fund seismic and/or drilling programs.

In February, the company announced it had sold its beneficial interest in one offshore WA exploration permit to Perth-based independent Black Swan Resources, while retaining a 7.5% share of any net profit interest derived from the permit in each calendar quarter.

Pilot chairman Wilson Xue said the deal with Black Swan was consistent with the company’s minimisation strategy.

“It enables the company to reduce its risk exposure and expenditure on the project to essentially zero while retaining a portion of the profits which may result from Black Swan’s exploration efforts should they be successful,” Xue said.

Pura Vida Energy (ASX: PVD)

Africa-focused oil explorer Pura Vida Energy has a portfolio of assets in offshore Morocco, Gabon and Madagascar.

The company’s stock is currently under voluntary suspension until its receives a response from Gabon’s Director General of Hydrocarbons following a submission made in March relating to its Nkembe PSC.

Pura Vida is seeking to change the terms of the licence contract to attract funding and facilitate its proposed work program, which includes an appraisal/development well and an exploration well, in addition to arguing the licence’s expiration date.

The company was also in the process of farming out an interest in the Nkembe Block to Havoc Partners, however both parties have agreed to extend the option to acquire until May, in order to finalise work and hopefully receive a response from the Director General.

Range Resources (ASX: RRS)

Range Resources is an operator and majority interest holder in five blocks in Trinidad (onshore and offshore) containing 16MMbbl in proven and probable reserves.

In March, the company’s oilfield services business Range Resources Drilling Services Limited announced it had landed a contract to provide a workover rig for oil supermajor Shell’s onshore operations in Trinidad.

Range also holds interest in the Perlak oilfield, located in the Northeast Sumatran Basin of Indonesia. The day after its Shell contract news, the company said it was accelerating a work program to reopen the field, with first oil production anticipated in mid-2018.

Raven Energy (ASX: REL)

At the start of this year, Raven Energy refreshed its image, changing its name from Magnum Gas & Power and refocusing on its US assets.

The company’s 60%-owned subsidiary Gas Fields LLC is earning a 33.33% stake in the Tulainyo gas project in California’s Sacramento Basin, where data from a recently drilled appraisal well has indicated multiple potential pay zones including up to 56m of estimated net pay in sandstones.

In its rejuvenation efforts, Raven has also sold its 25% stake in the Serowe CSG project in Botswana to its farm-in partner Strata-X Energy Limited (ASX: SXA). The process was finalised in March, giving Strata-X 100% ownership and control of the project.

Since completion of the sale, Raven’s stock has been under a voluntary suspension pending an announcement related to the Botswana divestment and “active negotiations with respect to a strategic acquisition”. Watch this space.

Real Energy Corporation (ASX: RLE)

Real Energy Corporation is an oil and gas explorer focused on the Cooper Basin in south-west Queensland.

Its flagship Windorah gas project has been estimated to contain a prospective resource of 13.7 trillion cubic feet of gas initially in place.

Following the success of its Tamarama-1 well, which has been flowing gas at variable rates ranging between 0.5MMcfpd to 2MMcfpd since November 2017, the company planned to drill two appraisal wells.

“The drilling and fracking of Tamarama-1, and the subsequent gas flows from the well, have taught us a great deal and we are applying some of the methodology that we have developed to the drilling of Tamarama-2 and Tamarama-3,” Real Energy managing director Scott Brown said.

The company inked a deal with Ensign International to contract its drilling rig 964, which spudded the Tamarama-2 well in mid-April.

Real Energy said if the wells are successful, the company would look to establish pilot production and eventually connect flow lines so that sales gas could be supplied to Australia’s east coast gas market.

“This is potentially a huge gas resource … we have a lot of scope to progressively develop Windorah which sits within a proven hydrocarbon province,” Brown said.

Rey Resources (ASX: REY)

Rey Resources is a diversified explorer and developer with oil and gas interests in WA’s onshore Perth and Canning basins, as well as coal tenements in the state.

The company holds a 25% stake in the Buru Energy-operated Fitzroy Blocks in the Canning Basin. In 2017, the joint venture commenced initial planning and preparations for a magneto-telluric survey to be acquired in the permit.

However, Buru is lodging an application to extend its minimum work requirements on the permit after the WA Government introduced a moratorium on fracking in the Kimberley region of the state last September.

At its wholly-owned Derby Block in the Canning Basin, Rey has completed the initial drilling cost analysis for a commitment well and was planning to complete further work, including a drilling environmental plan and engagement of a drilling contractor, in the first half of 2018.

The company also holds a 43.47% stake in a Perth Basin exploration permit in a joint venture with Key Petroleum (operator) and Pilot Energy. At this block, a work program commitment has currently been suspended while options for land access are being investigated after failing to reach suitable terms for access with the landholder.

At the start of March, Rey announced it had extended the maturity dates of two facility loans until the end of 2019, as well as increased the facility amount of its A$1.5 million loan with ASF Group to A$2 million.

Sacgasco (ASX: SGC)

Sacgasco is focused on developing onshore natural gas prospects in California’s Sacramento Basin, targeting gas supply to the local Californian market as well as export LNG markets.

In December, the company confirmed its Dempsey gas project as a significant discovery and placed its Dempsey well into production in January.

An enhanced reservoir stimulation program, intended to significantly improve the productivity of the well, began in March. In mid-April, Sacgasco reported that testing of the third zone in the Dempsey well had resulted in a further flow of clean natural gas with the quality of the gas samples being consistent with other zones.

“Ongoing testing demonstrates that we are sitting on a very large and undeveloped active petroleum system located in the under-explored strata of the North Sacramento Basin,” Sacgasco managing director Gary Jeffery said.

“The resources identified in the Dempsey well so far are very meaningful as our existing owned and operated infrastructure immediately connects us to California’s premium gas market,” he added.

State Gas (ASX: GAS)

State Gas has a 60% operating stake in a conventional gas project in central east Queensland, where exploration and appraisal well drilling has produced gas from the targeted Cattle Creek formation and Reids Dome beds.

The company recently lodged a pipeline survey licence application with Queensland’s mines department to investigate suitable routes for a feeder pipeline to connect its project with the Queensland gas pipeline and the broader east coast gas market.

Strata-X Energy (ASX: SXA)