Graphite is a paramount ingredient in numerous industry applications including the surging lithium-ion battery sector. The mineral has been classified as critical in the United States and European Union and this status, combined with rising consumption, has spurred a spate of graphite-focused stocks on the ASX.

What many lithium investors may not be aware of is the fact the booming lithium-ion battery comprises up to 40 times more graphite than lithium.

While graphite’s uptake in the lithium-ion battery is rocketing, its primary end-use is the global steel industry.

The steel sector has stagnated in recent years, but it has begun its upward climb with the World Steel Association estimating global steel production rose 5% during 2017.

As this sector picks up and the lithium-ion battery swallows more of the graphite market, the mineral is facing a near-future of tight supply and resultant price hikes.

China’s mighty influence

Because China contributes between 65% and 80% of global graphite supplies, the sector has largely been at the mercy of China’s supply and demand decisions for years, with the Asian powerhouse nation also setting the global standard for the commodity’s price.

Since 2015, China’s government has taken a harder line on pollution and made sweeping changes to clean up some the country’s environmental problems. This has led to rolling back production and intermittent shutdowns of mines and operations for multiple commodities including graphite.

As part of its environmental focus, graphite production in the region was curtailed mid-last year causing a sudden drop in the country’s exports.

China’s production cuts led to tighter global graphite supplies during the latter half of the year, triggering the mineral’s price to bounce off its bottom in October 2017, after languishing there since 2016.

Graphite prices between 2011 and 2017

Graphite is not traded on any commodity exchange and its pricing is based on direct seller and buyer negotiations. As such, published prices are rough guides with the graphite market relatively opaque, albeit, less so now.

The mineral’s final price also comes down to myriad factors including purity, crystallinity, size (mesh), downstream processing (ie spherical graphite), and desired end-use.

As a rough guideline, flake graphite with +80 mesh and graphitic carbon content over 95% generally commands the highest price, with the value typically increasing with purity and size.

According to analyst Roskill, the October rebound for flake graphite containing 94% to 97% total graphitic carbon (TGC) resulted in a 36% price jump to an average US$863 per tonne. Medium flake graphite pulled in around US$953/t, while large flake graphite rose to US$998/t.

Two months later, analyst Benchmark estimated the free-on-board price for large flake graphite out of China comprising 94-95% TGC and +80 mesh had risen to US$1,125 in December 2017.

During the 12 months between December 2016 and December 2017, Benchmark purports the price for all natural graphite products had leapt, on average, 25%.

Despite the recent price resurgence, graphite still has a way to go till it returns to its former glory.

The United States Geological Survey organisation (USGS) reported graphite prices for late 2011. The organisation stated the price for microcrystalline graphite comprising 80% to 85% TGC, which is the lowest of all graphite types, was between US$600 to US$800/t in 2011. Medium-to-large flake graphite with 90% TGC ranged from US$1,150/t to US$2,000/t. Meanwhile, the rarer and purer Sri Lankan lump and chip graphite containing 99% TGC was raking in between US$1,700/t to US$2,070/t during that same period.

For synthetic graphite, the USGS claimed the 99.9% pure synthetic graphite was bringing in between US$7,000/t and US$20,000/t.

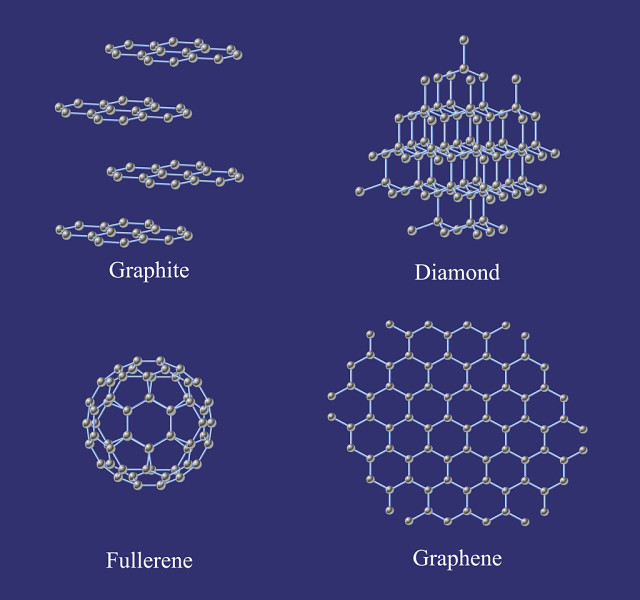

Graphite and its complexity

Perhaps more complex than some other commodities, the graphite market is less transparent and influenced by more factors including ore type, purity, downstream processing, and destined end-use.

As with mineral’s numerous pricing influences, there are also several forms of graphite, with each type better suited to particular applications.

The mineral expresses both metallic and non-metallic properties and can be sought for both or its individual qualities.

To better understand the mineral, its supply and demand dynamics and global performance, it helps to go back to basics.

What is graphite?

Graphite is a soft form of pure carbon that is generally black in colour and found as crystal flake or a mass in the natural environment.

The mineral requires pressure to develop into its three-dimensional structure and comprises parallel sheets of carbon atoms piled on top of each other.

Graphite is one of three naturally existing carbons, with the other two, coal and diamonds, comprising the same chemical formulas but different properties.

Graphite can be classified as micro-crystalline (amorphous), or crystalline.

Micro-crystalline graphite looks like anthracite coal to the untrained eye and has the lowest graphitic carbon content. Whereas, crystalline graphite can present as flake in varying sizes, or lumps and chips, which are higher grade but come from smaller and deeper operations, primarily, Sri Lanka.

Graphite is deemed eco-friendly and a chemically inert and safe material.

Graphite history

The first known use of graphite has been traced back to 750 BC to 43AD, where the material was used in paint for decorating ceramics.

Some 1,500 years later, an English shepherd apparently found the anthracite-type graphite and realised it could be used to mark sheep.

French inventor Nicholas Jacques Conté combined clay with graphite and created the world’s first “modern pencil”.

Around the same time, it was noticed graphite could be used in refractories to line the moulds. Weapon manufacturers found cannon balls and other artillery were smoother and more effective when crafted in the graphite-lined mould.

In 1779, Swedish chemist Carl Scheele discovered graphite was actually a form of carbon and not the “black lead” it was widely believed to be at the time.

A decade later, German geologist Abraham Gottlob Werner came up with the name graphite, which means “to write” for the mineral.

Graphite types and their origins

Micro-crystalline graphite is the most abundant form, accounting for about 60% of the graphite market. This graphite’s carbon ranges from 70% to 85% and it is mostly utilised for its lubricant properties.

The remaining 40% of natural graphite occurs as flake or the Sri Lankan lump and chip material. Flake has a natural graphitic carbon content ranging between 80% and 98% and is found in varying sizes and coarseness. The lump graphite is much rarer, but a higher grade and comes from smaller and deeper operations.

The primary countries where crystalline flake graphite deposits are found include: Brazil, Canada, China, India and Madagascar with several other African nations emerging with advanced huge high-grade graphite deposit discoveries including Mozambique and Tanzania.

On the other hand, the more valuable Sri Lankan lump graphite can reveal grades higher than 90% from hand sorting alone and before beneficiation.

In addition to naturally occurring graphite, there are several processed graphite products including expanded graphite. Expanded graphite is made by treating the flake with chromic and sulfuric acids.

The acid treatments augment the surface area up to 1,000 times. Expanded graphite is used to create graphite sheets and foils for a variety of industrial, consumer electronics and battery markets.

Expanded graphite also has a huge emerging market with its incorporation in flame retardant building materials. According to Graphex Mining (ASX: GPX), China needs around 2mt of expandable graphite a year.

Graphex managing director Phil Hoskins said expandable graphite demand is rapidly growing with the material sought at levels ten times higher than the booming lithium-ion battery sector.

Another graphite product is spherical graphite, which is made from processing flake graphite.

The flake form is then altered into spherical shapes and purified to at least 99.95% graphitic carbon. The resultant spherical graphite is between 10 and 40 microns, with a larger surface area, and conductivity.

This beneficiated graphite is the primary graphite product used in the lithium-ion battery’s anode.

Although it hasn’t been derived from natural graphite, synthetic graphite is used in many of the same applications as its natural alternatives.

Synthetic graphite is purer, but costlier and is consumed in nuclear moderator rods, as well as some batteries and other natural graphite applications where purity is the primary driver and expense less of an issue. However, it is unsuited to foundry because of its higher porosity.

Differences between graphene and graphite

A rapidly emerging product derived from graphite is graphene.

Simply, graphene is a two-dimensional atomic layer of graphite and is the strongest material discovered to date.

The material is usually created from graphite by mechanical exfoliation. However, this method of liberating graphene is time-consuming and costly.

Graphene has numerous properties that make it an appealing alternative in multiple applications. Because of this, many companies are working on commercially viable ways of mass-producing the material.

Graphene is more robust than a diamond, with 40 times the gemstone’s strength. Graphene is also flexible, thin, light, transparent and a fantastic conductor of electricity and heat.

The material is actually a better conductor of electricity than graphite.

Graphene’s use in many applications is under investigation including energy, electronics, coatings, sensors and membranes for purifying water – just to name a few.

Despite its great qualities, commercial production to-date has been limited. Although, one Australian company First Graphene (ASX: FGR) has claimed it is on the path after opening a scalable graphene producing operation in Western Australia.

Graphite uses

Natural graphite is used in hundreds of applications within steel and manufacturing sectors – mostly due to its ability to retain strength and rigidity under temperatures exceeding 3,600 degrees Celsius.

The steel and manufacturing sectors also seek out graphite for its resistance to oxidation.

Additionally, the mineral is self-lubricating and resistant to chemicals.

With both metallic and non-metallic properties, graphite’s primary metallic features include its thermal and electrical conductivity. These features have resulted in the mineral’s burgeoning use as the anode material in the lithium-ion battery.

The mineral’s non-metallic assets comprise its elevated thermal stability, as well as its capacity to remain inactive against chemical reactions and reduce friction. When sought for these properties, the mineral is incorporated in lubricants, coatings, consumer electronics, crucibles, pencils and refractories.

Graphite’s self-lubrication, and resistance to oxidation and temperature stress afford it another important feature for its use in the lithium-ion battery anode.

Lithium-ion battery, electric vehicles and renewable energies

Currently, the lithium-ion battery market consumes about 25% of global graphite supplies, however this figure is expected to escalate.

Analysts have bandied about several evaluations for the lithium-ion battery market, with Transparency Market Research tipping it to be worth about US$77.4 billion (∼A$99 billion) by 2024, powered by burgeoning electric vehicle and renewable energy markets.

Meanwhile, lithium-ion battery technology researcher Cadenza Innovation is more bullish and has estimated the market for lithium-ion batteries in electric vehicles, alone, will grow to US$175 billion (∼A$223 billion) by 2025, and its consumption in renewable energies will soar to US$400 billion (∼ A$509 billion) by 2030.

Then there’s European battery manufacturer TerraE’s forecast with the head of the European Union Battery Alliance predicting the EU battery market, alone, will be worth about €250 billion (∼A$391 billion) per annum by 2025

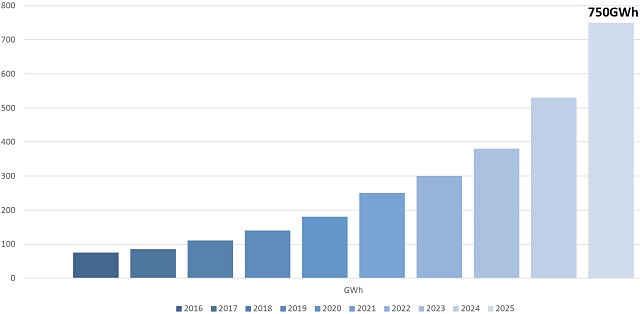

To keep up with these insatiable budding markets, Benchmark estimates the pace of global lithium-ion battery production will increase from 39 gigawatt-hours (GWh) a year in 2014 to more than 750GWh a year by 2025.

Accordingly, world graphite demand is expected to intensify.

With such massive anticipated growth in the pipeline, battery manufacturers worldwide have invested billions in building new factories.

One of the world’s largest lithium-ion battery manufacturers and electric vehicle producers is Tesla, which has allocated more than US$5 billion to developing a 35GWh lithium-ion battery mega factory just for meeting the demand of its planned 500,000 cars per annum electric vehicle stock. Construction of the factory started in 2014 and is due to finish this year.

Tesla isn’t the only battery manufacturer with a massive plant in development, LG Chemical has multiple plants planned across the US, China, Poland and Korea – all ranging in size from around 5GWh to just under 20GWh.

Several Chinese companies purportedly have plans to build lithium-ion factories with a combined capacity to produce 120GWh of batteries per annum.

CATL has the largest development in the pipeline with a whopping 100GWh manufacturing plant to be constructed in China.

Over in Europe, TerraE plans to produce 34GWh of lithium-ion batteries by 2028 from a plant in Germany.

In addition to the lithium-ion mega-factories, Benchmark claims several new anode mega-factories are also under development.

BTR New Energy Materials will produce 60,000tpa of anode material from this year with three other 100,000tpa plants due to come online by 2020.

The feedstock needed for just these anode factories is estimated at 486,000tpa of mined flake graphite and a further 139,000tpa of synthetic graphite.

Other consumer electronics and green energy companies have manufacturing facilities in the pipeline, with many wheeling and dealing with miners to ensure a consistent graphite source as supply tightens.

Many miners themselves are integrating throughout the supply chain to cut out the middle man and retain profits along the route.

Adding to escalating graphite demand, Tesla’s renowned chief executive officer and international billionaire Elon Musk noted the lithium-ion battery should be renamed the nickel-graphite battery, because the primary cathode material is nickel, with the anode comprising graphite and silicon oxide.

Mr Musk said there was a “little bit” of lithium in the battery but that it was more like the “salt on the salad”.

Benchmark estimates the battery anode makes up about 30% of the lithium-ion battery’s entire manufacturing expenses. Graphite then accounts for 50% of the anode cost. As a result, the mineral constitutes a 15% slice of the entire battery’s manufacturing outlay.

Beware of the disruptive technologies in the pipeline

However, at the very core of technology is the fact it is constantly evolving. There are already several technologies that have been created or are under development as potential replacements of graphite in the lithium-ion battery anode.

Some of the main innovations in the pipeline include coated silicon, synthetic graphite, titanium dioxide-based nanotube fibres and graphene-based products.

Small cap Anteo Diagnostics (ASX: ADO) aims to disrupt the lithium-ion battery with its nano-coating technology on silicon for incorporation in the battery anode.

According to Anteo, silicon can store up to 10 times more energy than graphite, but it is currently unusable because it expands and contracts while charging. This can rapidly degrade the battery and shorten its life.

Anteo has carried out proof of concept test work using its nano-coating technology on silicon. With Anteo’s coating, the silicon is stabilised during charging and discharging, preventing battery degradation.

The company has filed a patent for its coating technology in 18 countries and is currently researching its coating in various concentrations on silicon via a six-month project with US-based Polaris Battery Labs.

Study results are anticipated mid-year.

Hazer Group (ASX: HZR) produces synthetic graphite made of iron, copper, aluminium and magnesium for use in lithium-ion battery anodes and other applications.

In August last year, Hazer reported the University of Sydney tests had independently verified Hazer’s 86% synthetic graphite could be optimised to 99.95% purity.

The university compared its synthetic graphite product’s purity with other uncoated artificial graphite products’, which revealed an average purity of 99.92%.

The company has started testing its 99.95% synthetic graphite’s performance in lithium-ion batteries in collaboration with the University of Sydney.

Samples of its material have also been sent to third parties for review.

Hazer estimates the synthetic graphite market is worth US$15 billion. The company is evaluating commercialisation options for its product, including building and operating its own plant and selling its synthetic material directly to customers, or developing partnerships and/or generating royalty revenue by licensing its intellectual property to cashed-up third parties.

Over in Israel, UltraCharge (ASX: UTR) has created nanotube fibres made from titanium dioxide as a replacement for graphite in the battery anode. The company claims its technology is a “game changer” due to the global abundance of titanium dioxide minerals and its ability to be processed more simply. UltraCharge claims titanium dioxide is a less costly raw material than graphite.

Additionally, UltraCharge has inked a MoU with Chemours to develop a more cost-effective process for developing the anode material. The agreement also includes a commercial mass production option.

However, at this stage, the technology is yet to be commercialised.

Skeleton Technologies is a private company based in Germany and has developed ultracapacitor (also known as supercapacitors) technology. Skeleton’s ultracapacitor is encased in an aluminium can with the positive pole comprising a carbon electrode, aluminium collector and separator. The negative pole is the same.

According to Skeleton, its ultracapacitors store in energy in an electric field, unlike batteries, which generate energy with a chemical reaction.

The company claims its performance advantage comes from its curved graphene material.

Another company on the cusp of bringing a disruptive technology online is Lithium Australia’s (ASX: LIT) lithium-ion battery recycling process, which the company’s managing director Adrian Griffin says will give the company the “ability to rebirth used lithium-ion batteries”.

The company also purports its technology will be more cost-effective than traditional manufacturing methods.

Despite the advent of these technologies, Battery Minerals (ASX: BAT) co-founder and former managing director Cherie Leeden told Small Caps she did not believe the technologies would dent the demand for naturally sourced graphite.

She said there was enough demand for graphite in the current market to ensure graphite miners were assured their product will remain vital to the lithium-ion battery sector for at least the next decade.

Ms Leeden pointed out lithium-ion battery manufacturers such as Tesla had spent billions on building factories based on the current technology and were not about to make huge changes to their manufacturing processes and facilities any time soon.

Additionally, at this stage, natural graphite has a cost advantage over the more expensive synthetic material.

What does the future of graphite look like?

The analyst consensus is that graphite prices will continue their upward trajectory – powered by the lithium-ion battery industry and improving steel sector. There’s also the possibility China will curb production once again as it attempts to get on top of its carbon emissions.

World graphite mine production was around 1.2 million tonnes in 2016. Anode material, including synthetic, swallowed 110,000t of all synthetic and natural graphite produced that year.

According to Benchmark, total natural graphite production was around 2.4mt in 2017. This production is anticipated to tip 4mtpa to meet rising steel sector and battery demand.

Numerous analysts have bandied about forecasts regarding graphite consumption in the lithium-ion battery, with Benchmark estimating the battery anode could devour as much as 691,875tpa by 2025 – about a 600% surge on 2016 consumption levels.

The analyst expects global industries will absorb more than 1.2mtpa of flake graphite by 2025, with China leading the way.

With the numerous multi-billion lithium-ion battery market valuations bandied about, combined with expanding international government policies promoting electric vehicle and renewable energy uptake, a firming steel sector, and budding flame retardant building materials sector, it is evident that demand for graphite will boom in the coming years – so long as a new technology doesn’t put a spanner in the works.

Graphite stocks on the ASX

As the graphite mining sector positions to surge with the lithium-ion battery energy revolution, we’ve taken a look at the graphite stocks listed on the ASX that are poised to benefit.

Archer Exploration (ASX: AXE)

Archer Exploration is exposed to graphene and graphite markets and is currently exploring for several commodities in South Australia, including graphite at its wholly-owned Eyre Peninsula graphite project near Cleve.

The project includes Campoona Shaft, Campoona Central and Wilclo South deposits.

A scoping study at Eyre Peninsula was published in September 2016 and indicated the project could produce 98.5% pure battery-grade graphite, which is suitable for graphene manufacture.

Initially, the 140,000tpa graphite mine would bring in around A$858 million over 17 years, with a A$36 million pre-production capital cost.

In early December last year, Archer reported it had been granted a mining lease over its Campoona Shaft graphite deposit, along with two multipurpose leases for necessary operational infrastructure including a graphite and graphene processing plant.

Archer’s next stage in advancing Eyre Peninsula is gaining all outstanding regulatory approvals, as well as completing an environment protection and rehabilitation program.

To progress its foray into graphene, Archer purchased 100% of Carbon Alltropes in late October 2017. Carbon Alltropes is an online graphite and graphene market place, which Archer hopes will afford distribution capacity once Eyre Peninsula is producing.

Additionally, the company secured world renowned graphene expert Dr Mohammad Choucair as chief executive officer.

In late March, Archer advanced its relationship with the University of Adelaide to include developing advanced graphene and carbon-based materials for biosensing applications used in human health.

Archer claimed the graphene and carbon-based biosensors could enhance medical processes, food toxicity tests as well as agricultural and environmental testing methods.

These milestones assist Archer in its strategy to become Australia’s first vertically integrated graphite and graphene operation.

Ardiden (ASX: ADV)

Ardiden wholly-owns the Manitouwadge flake graphite project which encompasses 5,300 hectares and 20km of strike in Canada.

Preliminary test work at the project indicated up to 80% of the Manitouwadge graphite was either large or jumbo flake. The test work also produced up to 96.8% graphite concentrate from using gravity and flotation processing of the large and jumbo flakes.

Manitouwadge graphite can also be processed into expandable graphite, graphene and graphene oxide.

Manitouwadge is about 50km from Canada’s Trans-Canada Highway and 20km from rail.

In late April last year, drilling returned intercepts up to 10.8% TGC.

At the time of writing no further news on Manitouwadge was available as Ardiden focused on advancing its Seymour Lake lithium project.

Argosy Minerals (ASX: AGY)

Although focussed on advancing its flagship Rincon lithium brine project in Argentina’s Salta Province, Argosy Minerals retains a 100% stake in the Erongo graphite project in Namibia.

The company is actually in the process of relinquishing Erongo to focus on advancing Rincon, with first lithium carbonate equivalent due in April this year.

At the end of the December 2017 quarter, Argosy had not offloaded Erongo and no further news was available.

Bass Metals (ASX: BSM)

Graphite miner Bass Metals has cemented its position at its 100%-owned flagship Graphmada large flake graphite project in Madagascar after executing agreements giving it 20-year full landholder rights over the area.

The agreement is back-dated to 2016, when Bass Metals first took control of the operation, and will provide the company with ownership security through to 2035. The agreement encompasses 461,000 square meters and includes all infrastructure and most graphite resources and identified mineralisation.

In conjunction with the 20-year landholder agreements, the project has 40-year mining permits in place.

During the last three months of 2017, Bass secured an offtake agreement for half of its forecast 6,000tpa flake concentrate production under stage one.

Limited production occurred in the final months of 2017 due to optimisation and refurbishment works at the project.

By the end of January, stage one recommissioning was advanced with the mine planned to be operational by the end of March.

A stage two expansion is due to come online in 2019 boosting production to 20,000tpa.

Graphmada comprises four large flake deposits with an estimated 382,000t of contained graphite.

Once the mine is back online, Bass claims it will be one of a “few publicly listed large graphite producers in the world”.

In addition to Graphmada, Bass owns the Andapa graphite project where recent assays returned 10m grading 5.54% fixed carbon. The company plans to follow up these maiden results in the second half of 2018.

Battery Minerals (ASX: BAT)

One of the hotter small cap graphite stocks at the moment is Battery Minerals which just inked its fourth offtake contract securing 80% of its planned graphite production at its flagship Montepuez project in Mozambique.

Battery is hoping to commission Montepuez by the end of the year, with first graphite concentrate shipments planned for the March 2019 quarter.

During its first production stage, Battery aims to produce up to 50,000tpa of graphite concentrate with an average concentrate of 96.7% total graphite carbon.

Staged expansions have been planned to grow the mine’s output to more than 100,000tpa by 2022.

A value engineering study was undertaken on Montepuez which estimates of operating cash flow of US$20 million per annum for the first 10 years, with payback within two years.

In addition to Montepuez, Battery owns the Balama graphite project – also in Mozambique. Balama has returned higher grades and a bigger proportion of large and jumbo flake than Montepuez.

A scoping study on Balama was reported in early March and projected a mine life higher than 10 years and initial annual production of 55,000tpa of graphite concentrate. The study estimates a pre-production costs of US$50 million, with payback within one-and-a-half years.

Speaking with Small Caps, Battery co-founder and former managing director Cherie Leeden said Mozambique was home to some of the world’s richest graphite deposits and Balama and Montepuez would remain profitable during a low pricing environment due the high-grade ore and low processing costs.

Ms Leeden said the projects had been selected in Mozambique, because of the country’s rich graphite deposits and the region being a known mining friendly jurisdiction with political stability, competitive royalties, and existing infrastructure.

BlackEarth Minerals (ASX: BEM)

Recent ASX debutant BlackEarth Minerals listed on the ASX on 19 January, after raising A$5.45 million in its IPO.

The company will use its IPO cash to fund a 200-hole drilling diamond and reverse circulation drilling campaign at its Maniry graphite project in Madagascar which began in early March.

BlackEarth is targeting a maiden resource by mid-2018 and claims preliminary minerology indicates very large flake graphite deposits may exist. In addition to Maniry, BlackEarth owns the Lanapera graphite project about 50km from Maniry.

Earlier exploration at Maniry revealed near surface intersections of 12m grading 11.6% total graphite carbon, and 14m at 11.3% total graphite carbon.

BlackEarth managing director Tom Revy said the company would carry out more mineralogical work on Maniry ore, with previous studies revealing the potential for coarse flake graphite.

Lithium Australia remains a substantial holder in the company with an 18.10% interest.

Black Rock Mining (ASX: BKT)

Another African focussed graphite explorer, this time Tanzania, Black Rock Mining is advancing its 100%-owned Mahenge graphite project.

A definitive feasibility study into the project’s potential was started in mid-December 2017, with the aim of defining plant performance and product variability from the Ulanzi deposit. The study is due for completion in the latter half of this year.

Black Rock chief executive officer John de Vies said Mahenge was the “best undeveloped graphite project in the world”.

Mahenge has a JORC-complaint resource of 211.9mt at 7.8% TGC for 16.6mt of contained graphite. Project reserves are 69.6mt grading 8.5% TGC for 5.9mt of graphite, with the reserve, alone, supporting a 32-year production time line.

An optimised pre-feasibility study was published in August 2017 and allows for the Tanzanian Government’s proposed 16% free-carried interest and royalty hike to 4.3% shows the project retains an after tax net present value of US$905 million.

Capital expenditure is estimated at US$90 million to process 250,000tpa, with EBITDA of more than US$220 million anticipated annually.

During 2017, Black Rock and other miners across Tanzania were thrown into disarray after the Tanzanian Government passed legislation putting up mineral export taxes and enforcing a larger government stake in some assets.

The laws also require development of processing plants within the country to ensure Tanzania benefitted from mining activities as much as possible.

Buxton Resources (ASX: BUX)

Buxton Resources wholly-owns the Yalbra graphite project about 250km from Meekatharra in WA.

Exploration during 2013 returned high grade and thick graphite intersections including 32m grading 23.4% TGC, which includes a 7m interval containing 32.6% TGC.

Another intersection was 31m grading 22.5% TGC with a 6m interval containing 33% TGC.

By early 2014, Buxton reported an inferred resource estimate for the project of 2.27mt grading 20.1% TGC.

The company claims the drill results are some of the highest-grade intersections to be reported in Australia.

Metallurgical testing using a diamond drill sample grading 20% TGC achieved a 91% pure concentrate. Leach testing purified the concentrate to 99.5% and up to 99.7% purity.

However, no recent exploration or activity has been reported on the project since mid-2016.

Castle Minerals (ASX: CDT)

Castle Minerals has been exploring for multiple commodities including graphite and gold at its 10,000sq km Wa project in north west Ghana.

In 2012, Castle published a maiden graphite resource for the Kambale deposit within the project, with the resource sitting at 14.4mt grading 7.2% TGC for 1.03mt of the contained metal.

At the time of writing, no graphite exploration had been undertaken since late 2014.

Comet Resources (ASX: CRL)

Exploring for graphite in Australia, Comet Resources has uncovered high grade graphite at its wholly-owned Springdale project about 30km from Hopetoun in Western Australia.

Springdale includes 220sq km of tenements and is 150km from the Port of Esperance.

The company recently reported mineralisation remained open at depth and along strike within the Eastern Zone of its project, which has an identified strike of 800m.

Better results from drilling at the Eastern Zone were 12m grading 12.2% TGC, with a 5m interval comprising 23.1% TGC.

Another notable intersection within this zone was 6m grading 18.3% TGC, including 5m grading 21.7%.

Drilling at the Northern Zone and the Eastern Zone returned similar results with a 3m interval grading 35.1% TGC pulled out of the Northern Zone.

Comet is evaluating producing graphene from its Springdale graphite after it discovered in April last year that it could make graphene from the graphite by electrical exfoliation.

The company claims it is rare for graphene to be produced this way directly from a graphite deposit.

Cougar Metals (ASX: CGM)

Although exploring for multiple commodities across Australia, Brazil, Canada and Madagascar, Cougar Metals’ remains dedicated to advancing its Toamasina graphite project in Madagascar, which the company believes will produce a near-term cash flow.

Drilling in mid-2017 returned thick intersection including one that was 30m at 6.03 TGC, with a 6m interval containing 10.34% TGC.

A trench also returned a 51m intersection at 6.37% TGC.

However, field activities at Toamasina were immediately stopped in October last year after DNI Metals’ instigated what Cougar Metals purports to be “baseless criminal” charges.

According to Cougar, the charges and “false complaints” were a “deliberately dishonest act on the part of DNI to further frustrate Cougar’s earn-in on the project.”

The duo will be heading to arbitration with the London Court of International Arbitrators to settle the matter.

First Graphene (ASX: FGR)

Over in the graphene space, First Graphene opened its commercial graphene facility in late November last year and shipped its first graphene products a few days later.

The maiden shipment was taken to a US-based construction materials company for testing in cement products.

Graphene product samples were also sent to customers in the UK and Italy for testing.

Final construction of the facility including a laboratory for quality control was finished in early February and the company pronounced it had officially commissioned the plant, which is scalable to meet any surges in demand.

First Graphene has 160,000t of high-grade Sri Lankan graphite stored at its WA-based facilities. According to the company, the stockpile is enough for two years’ full-time production at the graphene facility.

The company plans to continue ramping up its plant and working on its graphene-based products including FireStop.

First Graphene is also collaborating with Flinders University to develop a non-toxic way of producing graphene oxide which can be used in coatings, filters, membranes and batteries.

Graphex Mining (ASX: GPX)

Tanzania-focussed Graphex Mining is advancing its coarse flake Chilalo graphite project in the country’s south-east. The company claims its Chilalo graphite is the coarsest flake in the world.

Adding to its brag bag, is Graphex Mining’s claim it has the highest estimated operating margin of US$1,424/t compared to its peers Walkabout, Sovereign, Magnis, Triton, Black Rock Mining, Syrah, Battery and Volt.

An updated feasibility study on the project’s economics is underway, but Graphex Mining’s previous feasibility study predicted a 10-year mine life, with average production of 69,123tpa for annual EBITDA of US$47 million.

The project has indicated and inferred resources of 53.5mt at 5.6% TGC, with a higher-grade resource of 16.9mt grading 10.2 TGC.

The reserve estimate is 4.7mt grading 11% TGC for 517,000t of graphite.

To bring the project online, Graphex Mining is in advanced offtake, financing and joint venture discussions with CN Docking Joint Investment and Development Co and China Gold Group Investment to secure all or part of its A$100 million capital expenditure funding requirements.

CN Docking met with Tanzanian Government officials in early February as one of the company’s requirements prior to making a final decision.

Hexagon Resources (ASX: HXG)

Hexagon Resources recently achieved a 99.999% pure graphite concentrate via a trial using its proprietary thermal purification process on ore samples from its flagship McIntosh graphite project in WA.

The McIntosh project hosts flake graphite and covers 330sq km in the east Kimberley. Resources for the project sit at 21.3mt grading 4.5% total graphite carbon for 964,000 contained tonnes.

Additionally, more than 85% of the graphite flake is greater than 180 microns.

The recent metallurgical study revealed the ore “purified easily” because impurities were outside of the flake rather than being trapped inside, with purity levels ranging between 99.9991% and 99.9998%.

Hexagon managing director Mike Rosenstreich claims the extra “nine” in the purity level, made the company’s graphite concentrate pure enough for the nuclear sector.

He added this would attract a premium price.

A definitive feasibility study is underway to boost outcomes calculated in the earlier pre-feasibility study, which revealed a post-tax net present value of A$183 million for the project for a 2.4mtpa operation to produce 88,000tpa of 98% TGC flake concentrate for an initial eight years.

However, the company plans to expand this through ongoing exploration, with Hexagon targeting up to 220mt for up to 11mt of contained graphite. The company cautions this target is purely conceptual at this time.

The definitive feasibly study, which is investigating adding value via downstream processing and other enhancements, is due for completion mid-year.

Kibaran Resources (ASX: KNL)

Kibaran Resources is another Africa-focused graphite explorer, which is advancing its Epanko graphite project in Tanzania.

Epanko has a current mineral resource of 30.7mt grading 9.9% TGC.

A bankable feasibility study into the project has indicated 60,000tpa production with annual earnings before interest tax depreciation and amortization (EBITDA) of US$44.5 million over 18 years.

Kibaran is also exploring adding value with downstream processing to produce spherical graphite, fine, unpurified and purified products using its own “green” method.

The downstream processing study revealed a 20,000tpa operation of spherical graphite with EBITDA of US$31.5 million.

To bring the project online, Kibaran is in debt discussions with multiple lenders.

Funding documents have been finished and the company is awaiting the new Tanzanian regulatory framework which is imminent to finalise arrangements. Kibaran claims it has reviewed the proposed regulations and that they do not impede development of the project.

Kibaran is also negotiating potential offtake agreements and liaising with potential investors.

Lincoln Minerals (ASX: LML)

Back in Australia, Lincoln Minerals is advancing its 100%-owned Kookaburra Gully graphite project in South Australia and published its feasibility study and maiden reserve estimate in late November last year.

A pre-tax net present value of A$81 million was given to the project, which has a probable ore reserve of 1.34mt grading 14.6% TGC.

Adding to the reserve is a mineral resource estimate of 2.03mt grading 15.2% TGC, with mineralisation remaining open at depth and along strike to the north-east.

In the study, about 7,000tpa of graphite concentrate is expected to be produced in the first year of mining, with that ramping up to 35,000tpa of flake graphite concentrate at 90% purity by its fourth year in operation.

The feasibility study proposed a 10-year mine life with a A$44 million start-up cost. Additionally, metallurgical test work confirmed up to 98% purity concentrate was possible with no further cleaning stages.

Lincoln is exploring adding value by processing the concentrate into spherical graphite. The company is also looking at opportunities to expand the operation.

Development has been targeted to begin by the end of 2019 and, in the interim, Lincoln will carry out more metallurgical testing and drilling at Kookaburra Gully.

Lithium Australia (ASX: LIT)

Lithium Australia has its fingers in multiple pies and recently spun out BlackEarth Minerals (ASX: BEM) which owns the Maniry and Lanapera graphite projects in Madagascar.

The company retains an 18.10% stake in BlackEarth Minerals. For more information on these graphite projects, please refer to BlackEarth Minerals earlier in the guide.

Magnis Resources (ASX: MNS)

Magnis Resources owns the Nachu graphite project in Tanzania, which has produced a 99.99% purity coated spherical graphite anode product.

Nachu has an initial 15-year life producing 240,000tpa of graphite concentrate and a special mining licence and special economic zone status in Tanzania.

As a result of the Tanzanian Government’s changes, mining at Nachu was postponed indefinitely.

During this time, Magnis has become integrated along the supply chain during the past 12 months, with the company becoming increasingly involved in establishing lithium-ion battery gigafactories across the US, Germany and Australia.

Magnis has gone from becoming an emerging graphite producer to a graphite buyer and becoming an active participant in lithium-ion battery manufacturing.

Ongoing discussions with the Tanzanian Government regarding the special economic zone licence resulted in an agreement in early March.

Under the agreement, Magnis’ subsidiary Magnis Technologies Tanzania will own and operate the processing plant at Nachu to initially produce refined jumbo and super jumbo flake graphite and spheroidal graphite for the battery market.

The company’s other subsidiary Uranex Tanzania will be subject to the government’s new regulations and responsible for all mining operations and will sell all mined graphite directly to Magnis Technologies Tanzania for processing.

The company is also evaluating other sources of natural and synthetic graphite.

Metals Australia (ASX: MLS)

Metals Australia is advancing the Lac Rainy 4,450 hectare graphite project in Quebec. The project is about 20km from an historic iron ore mining town and situated in a known graphite province.

Lac Rainy is adjacent to Focus Graphite’s Lac Knife deposit which has a measured and indicated resource of 13.6mt at 14.95% TGC.

A drilling program is planned for 2018 to assess the mineralisation and provide more representative samples for metallurgical testing and flowsheet refinement.

In mid-January, Metals reported it had achieved a commercial grade graphite concentrate up to 96.7% purity from metallurgical testing of Lac Rainy ore.

However, SGS Canada, which carried out the testing, stated the samples analysed were not deemed representative of the overall graphite deposit due to the small size, distribution and surface oxygenation.

SGS advised the company to gather more samples with an accurate representation for further testing, which will be obtained during the upcoming drill campaign.

Mineral Commodities (ASX: MRC)

Mineral sands explorer and producer, Mineral Commodities executed a joint venture in November last year to own an initial 51% interest in Munglinup graphite project near Esperance in WA.

The company plans to fast-track development of Munglinup, which has existing measured and indicated resources of 3.625mt grading 15.3% graphite. The project has a mining lease valid till August 2031.

The joint venture with Gold Terrace also allows for Mineral Commodities to increase its ownership to 90% by fulfilling various conditions throughout 2018.

Mineral Commodities executive chairman Mark Caruso said the joint venture gives the company an opportunity to enter the battery materials market.

In late November, a scoping study revealed Munglinup would cost about A$47 million to develop with 56,000tpa of anticipated graphite concentrate over nine years. Total cashflow from the project of A$270 million has been calculated.

The nine-year mine life is preliminary with mineralisation remaining open in all directions.

Mineral Commodities inked a memorandum of understanding in late December with Kwinana-based Doral Fused Alumina Plant to investigate downstream processing of the Munglinup’s flake graphite to produce anode material.

Initial metallurgical test work on the flake graphite has offered up better results than historical studies, with concentrate purity ranging between 95% TGC and 97.4% TGC.

Mustang Resources (ASX: MUS)

Notorious in investor circles for its failed maiden ruby auction late last year, Mustang Resources refreshed its management team in mid-January with the appointment of Dr Bernard Olivier as managing director and Cobus van Wyk as chief operating officer.

As well as mining rubies from its Montepuez project in Mozambique, Mustang is exploring for graphite at its 80%-owned Caula project, which is close to Syrah Resources’ Balama graphite mine.

Assays from exploration at the project returned up to 26% TGC. In early November last year, Mustang published a maiden resource for Caula of 5.4mt grading 13% TGC for 702,600t of contained graphite.

Metallurgical test work on the ore categorised 44% of the ore between large and super jumbo flake size.

The test work also produced a 96% total graphite carbon concentrate using a simple conventional flowsheet.

A concept study is underway and due to finish in the next quarter and comprises 1,400m of diamond drilling data.

In mid-March, Mustang reported plans to bring Caula online by mid-2019, with preliminary indications of a 15,000tpa 97% graphite concentrate operation under a stage one development.

A stage two development could grow to 75,000tpa of graphite concentrate with 2,000tpa of 99.9% pure vanadium.

Mustang also holds an interest in six other graphite tenements in Mozambique, known as the Balama graphite project.

In early January, Mustang topped up its coffers with a A$19.94 million funding facility, which will go towards advancing Caula and development of Montepuez.

Novonix (ASX: NVX)

Formerly known as GraphiteCorp, the company changed its name to Novonix in July last year after taking over the NOVONIX Battery Testing Services business a month earlier.

Novonix is working towards becoming an integrated developer and supplier of materials, equipment and services to the lithium-ion battery sector.

Novonix established the PUREgraphite joint venture in April last year with Coulometrics. The parties are based in the US and recently installed a pilot plant in preparation for larger trials of manufacturing anode materials with high electrochemical efficiency.

To provide some graphite feedstock, Novonix owns the Mount Dromedary graphite project in Queensland, where its first drilling program was completed in September 2015 prior to the company listing on the ASX.

At the time of writing, Novonix was awaiting environmental authority approvals and a mining licence for the project, which it anticipates receiving this year.

Oakdale Resources (ASX: OAR)

Oakdale Resources is advancing its namesake graphite project in South Australia’s Eyre Peninsula.

The company’s exploration tenements in the region encompass 1,812sq km and include Oakdale and Oakdale East projects.

Combined, the project has a mineral resource of 6.22mt at 4.8% TGC within a larger saprolitic graphite resource of 13.45mt at 3.3% TGC.

A scoping study on the project revealed a capital expenditure of $48.7 million to construct a mill to process ore from an open pit operation to produce 94,500tpa of graphite.

Initially, Oakdale’s process includes generating a graphite float concentrate that exceeds 90% TGC. The company plans to treat the concentrate with acid washing to produce a 99% TGC material.

Total revenue over the initial three-year operation is forecast to reach exceed $345.8 million. After costs, revenue of $170.2 million has been estimated.

Oakdale is currently seeking prospective off-take partners to advance the project.

Peninsula Mines (ASX: PSM)

Peninsula Mines owns several graphite projects in South Korea with the company priding itself on being on the “doorstep of the world’s largest market for high-growth expandable graphite and lithium-ion battery production”.

The graphite projects comprise Yongwon, Daewon, Chugwang, Eunha, Wolmyeong and Gapyeong, which are prospective for flake graphite as well as higher grade and more jumbo flake graphite.

Metallurgical testing on Yongwon jumbo flakes returned 97% TGC, while testing on Daewon large flake revealed up to 96.6% TGC.

In addition to the battery sector, Peninsula is targeting the growing building cladding market which uses graphite.

In late October, Peninsula inked a non-binding offtake agreement with Graphene Korea. As part of proposed agreement, Graphene Korea will purchase 20,000t of graphite flakes with 180 microns or higher, and a minimum purity of 95% TGC.

Also, during the December period, Peninsula secured a large-flake supply agreement with DNI Metals, which owns large flake projects in Madagascar.

Quantum Graphite (ASX: QGL)

Quantum Graphite went into voluntary administration in late 2015 and suspended operations at its Uley graphite mine in South Australia to conserve its cash.

The company is seeking to address efficiency issues with a revised mine plan and carrying out further exploration and metallurgical test work.

However, Strategic Energy Resources (ASX: SER) owns an 11% stake in Quantum and a royalty on graphite sold from the mine. Strategic Energy has made a play to strip the Uley mining leases from Quantum Graphite and have them transferred to itself.

Strategic Energy has cited Quantum’s September share issue to Chimaera Capital as “artificially affecting control” and could result in Chimaera gaining more than 20% control of Quantum.

In early February, the Australian Government’s Takeovers Panel declined to make a declaration of unacceptable circumstances.

Renascor Resources (ASX: RNU)

Renascor Resources’ focus remains on developing its Siviour graphite project in South Australia, which encompasses about 1,370 square kilometres and comprises four granted exploration licences.

The project is near to local towns and ports, with access to power, roads and rail.

According to Renascor, Siviour hosts one of the world’s largest known graphite resources with a JORC-compliant indicated and inferred resource totalling 80.6 million tonnes for 7.9% TGC for 2.2 million tonnes of the contained metal. The reserve is 45.2mt grading 7.9% TGC for 3.6mt of graphite.

A pre-feasibility study was published in mid-March and indicated a 30-year operation producing 142,000tpa for the first 10 years and 117,000tpa thereafter.

The study investigated large-scale production as well as a lower capital smaller scale production, which would enable operations to begin in 2019.

Under a smaller scale operation scenario, the capital expenditure would be US$29 million to produce 22,800tpa for the first three years before growing to a larger operation in the fourth year.

Capital expenditure in the larger scenario would be US$99 million but have a shorter payback period of 1.8 years.

Renascor is in ongoing discussions with potential offtake partners from China, Europe and the US.

A spherical graphite scoping study was completed in early February and revealed the potential for a downstream spherical graphite processing operation to boost the project’s value.

A mineral lease application for the project is scheduled to be lodged by July 2018, with the company’s continuing with assessing its best path forward.

Sayona Mining (ASX: SYA)

Queensland-based Sayona Mining is focused on advancing its Authier lithium project in Canada. However, the company owns the East Kimberley graphite project, which includes 278sq km and is about 240km from Wyndham export port.

Sayona owns 100% of the graphite within the project’s four tenements, with initial drilling returning up to 12.2% TGC.

Exploration during the 2015-2016 financial year returned massive intersections including one at 109m grading 1.84% TGC from 22m.

According to Sayona, the mineralisation remains open at depth and along strike with 25km of strike identified to date.

Despite the results, Sayona has not undertaken any further exploration at the project while it focusses on its lithium assets.

Sovereign Metals (ASX: SVM)

Another African explorer Sovereign Metals is investigating its 100%-owned Malingunde graphite project near Malawi’s capital city Lilongwe.

The project comprises two prospecting licences and Sovereign recently reported assays from aircore drilling of 23m grading 21.2% TGC, and 36m grading 11.1% total graphite carbon, with an 8m interval comprising 20.1% TGC.

Sovereign claims the grade, flake size and soft nature of the host mineralisation enhances the project’s potential of becoming a “low cost”, “high margin” graphite mine.

A scoping study demonstrated Malingunde could produce up to 44,000tpa of graphite concentrate over 17 years.

Sovereign is carrying out a pre-feasibility study which is scheduled to be completed mid-year, along with an updated resource estimate. A placement was completed in late December giving Sovereign A$6.5 million to fund technical study work in the definitive feasibility study.

Malingunde is only 15km from Lilongwe and also close to rail and power.

Strategic Energy Resources (ASX: SER)

Although focussed on its bag of other commodities, Strategic Energy Resources has an 11% interest in Quantum Graphite (formerly Valence) and receives a 1.5% royalty on production from the Uley graphite project in South Australia.

However, Quantum has been in administration since mid-2016 and Strategic Energy launched a bid to strip the Uley graphite mine leases from Quantum and transferred back to the company.

In early February, the Australian Government’s Takeovers Panel declined to make a declaration of unacceptable circumstances. Further information can be seen under Quantum graphite’s entry in the guide.

Strategic Energy has a 16% interest in Ionic Industries which is working with CleanTeQ (ASX: CLQ) on its membrane and adsorbent water treatment methods using graphene oxide technology.https://smallcapsau.mystagingwebsite.com/walkabout-resources/

Commercial outcomes from this work is anticipated within 18 months.

Syrah Resources (ASX: SYR)

One of Tolga Kumova’s success stories Syrah Resources is the owner of what the company claims is the world’s largest graphite resource – its Balama project in northern Mozambique.

Mr Kumova took Balama from an exploration project through to beginning of development before handing over the reins in late 2016.

Balama has a 50-year mine life with graphite grading 17%. Syrah aims to supply about 40% of the global graphite market’s feedstock.

Overall reserves for the Balama project rest at 114.5mt grading 16.6% TGC for 18.6mt of contained graphite.

During the December quarter, Syrah achieved maiden production of bagged saleable flake and fine graphite products and is ramping up to around 180,000tpa by the end of the year and up to 300,000tpa by the end of 2019.

The construction and commissioning team was demobilised, and responsibility handed over to the operations team on 1 January this year and by the end of that month, Syrah had produced around 3,000t of saleable graphite.

Final capital costs to get the project up and running hit US$215 million.

Syrah is anticipating Balama will become cashflow positive by the second half of the year.

The company is also evaluating downstream processing operations to add further value to the project.

Talga Resources (ASX: TLG)

Based in Perth, Talga Resources has a different approach to mining graphite. The company wholly-owns its graphite deposits in Sweden and a proprietary processing technology to produce graphene and nanographite for lithium-ion batteries, coatings, construction and carbon composite sectors.

Talga’s strategy is to develop a vertically integrated graphite and graphene business that produces innovative materials for these markets. The company’s processing technology can create quality graphene and nanographite for commercial operation using its own graphite material.

During the December quarter, the company noted a 20% improved battery capacity when testing its anode substance compared to a conventional spherical graphite anode material.

Additionally, Talga has secured a lithium-ion battery commercial development partnership with Japan’s Recruit R&D.

Further research partnerships and investment negotiations remain ongoing with an expanded phase three graphene test facility in Germany due for commissioning this quarter.

Thundelarra (ASX: THX)

Thundelarra owns 100% of the Allamber project in the Northern Territory’s Pine Creek region. Earlier drilling at the project had returned TGC assaying between 7.1% and 10.1%.

Due to an existing landowner passing away that had previously granted land access, Thundelarra has sought to secure an updated land access agreement with the new owner.

The company claimed it had attempted to contact the new owner multiple times with no success. Until a new agreement is established, Thundelarra can’t continue with exploration at the project.

At the end of January, Thundelarra stated its efforts to contact the new owner were continuing.

Triton Minerals (ASX: TON)

Another graphite explorer in Mozambique, Triton Minerals is fast-tracking its Ancuabe project in the region.

Ancuabe has a JORC-compliant reserve of 24.9mt grading 6.2% total graphite carbon for 1.5mt of contained graphite, with a definitive feasibility study published in December revealing a 60,000tpa graphite concentrate operation over 27 years.

To get into production, Triton is looking at a capital expenditure of US$99.4 million, with project free cash flow after tax of US$753 million.

Triton is aiming for producing its first graphite concentrate by the end of September 2019, with early site works to begin in May this year and construction to officially begin in August. However, this remains contingent on gaining all requisite approvals and finance.

Ancuabe was historically mined between 1994 and 1999 with about 7,500t of flake graphite pulled out of the ground.

Volt Resources (ASX: VRC)

Volt Resources is rapidly advancing its Bunyu graphite project in Tanzania, with stage one development due for completion within the next 12 months.

Bunyu has a resource estimate of 461mt grading 4.9% TGC and is situated 140km by sealed road from Tanzania’s Port of Mtwara. Meanwhile, the reserve estimate is 127mt grading 4.4% TGC and both the resource and reserve estimates only comprise 6% of the actual project area.

The company lodged its mining licence applications in early February to cover stage one and stage two development at the project.

Under stage one, Volt is anticipating producing 20,000tpa of graphite products, with stage two targeting 170,000tpa after 2020.

Stage one capital costs are estimated at US$30 million.

Volt is progressing offtake agreements with US-based Nano Graphene, which has tested and confirmed the quality of Bunyu’s graphite and is investigating using its propriety technology to refine the graphite into graphene.

The company has also received positive feedback on its ore from its China-based partner China National Building Materials General Machinery.

Volt is aiming for a final decision on project development by the end of June.

Walkabout Resources (ASX: WKT)

Another Tanzanian graphite explorer is Walkabout Resources, with its flagship Lindi jumbo graphite project. Walkabout has a 70% interest in four licences and an option to purchase the remaining 30% stake.

In late February, Walkabout reported the China Export Credit and Insurance Agency had approved 80% of its required funding for sourcing its project equipment from China.

As part of the agreement, Walkabout can pay a US$1.9 million deposit plus a fee and receive US$9.75 million to finance equipment purchases.

Under the company’s initial definitive feasibility study in February 2017, an open pit mine and graphite processing plant were proposed for Lindi.

However, due to the legislative changes underway in Tanzania a revised feasibility study was published in August which reduced the project capital start up to US$29.6 million.

If the proposed Tanzanian government’s 16% free-carried stake in Lindi and 1% clearing fee if eventuates, then Walkabout claimed the gross financial effect would be US$101 million over the life of mine or 8.4% of its total revenue.

Lindi has reserves of 5mt grading 16.1% TGC for 809,081t of contained graphite and total resources of 29.6mt grading 11% TGC for 3.25mt of contained graphite.

The study indicates a 40,000tpa of graphite concentrate can be produced with payback period within two years.

As with the other Tanzanian graphite plays, Walkabout anticipates an official decision from the Tanzanian government in the near-term.

**SEE ALSO:

**– Gold stocks on the ASX

– Silver stocks on the ASX

– Cobalt stocks on the ASX

– Lithium stocks on the ASX

**– Zinc stocks on the ASX

– Nickel stocks on the ASX

– Rare earth stocks on the ASX

****– Vanadium stocks on the ASX

– Uranium stocks on the ASX

– High Purity Alumina stocks on the ASX

– Mineral sands stocks on the ASX

– Tin stocks on the ASX

– Tungsten stocks on the ASX

– Hydrogen stocks on the ASX

**– Oil and gas stocks on the ASX

– Cannabis stocks on the ASX