Cryptocurrency: The Ultimate Guide

近年来,随着新资产类别在投资者投资组合中确立地位,加密货币已在全球范围内崭露头角。

Cryptocurrencies have emerged as popular investments in recent years, but their biggest boost came from COVID-19, with increasingly more investors favouring the digital assets as the unfolding pandemic hit global stock markets.

But the decentralised exchanges are also highly volatile, making them less reliable than safe haven investments such as gold.

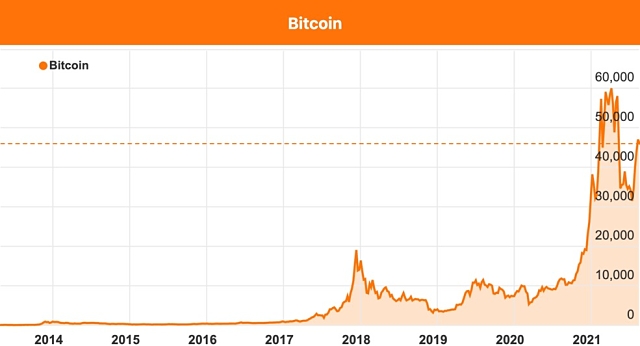

The latest price movements have demonstrated this – while Bitcoin has rallied almost 300% in the last 12 months to around US$46,000 (A$63,800), it crashed from April’s all-time high of US$65,000 (A$83,000) after China moved to crack down on cryptocurrencies and Tesla boss Elon Musk abruptly reversed plans to accept Bitcoin as payment for electric cars.

Bitcoin has experienced volatile price action as the technology gains adoption.

Though despite this volatility, Bitcoin has proven its resilience over the last decade and continues to garner support as a store of value.

What is cryptocurrency?

A cryptocurrency is a digital token that allows for the exchange of value over a peer-to-peer network.

Cryptocurrencies operate using a decentralised, digital ledger called blockchain, which holds an immutable record of all transactions as reconciled by the network’s nodes.

The lack of a central authority to approve monetary transactions is one of the hallmark features of a cryptocurrency, and also one of the most controversial features.

According to Coinmarketcap.com, there are more than 9,500 existing cryptocurrencies traded on over 300 exchanges. Regardless of any initial scepticism the financial world may have had, the global cryptocurrency market cap has grown to US$1.99 trillion.

his is well behind gold at $15.27 trillion but comparable to silver at $1.98 trillion, rendering it an asset class to be considered from an investment standpoint.

According to the Independent Reserve Cryptocurrency Index (IRCI), an annual report that provides an overview of everyday Australian attitudes towards cryptocurrency, the best-known cryptocurrency among Australians is Bitcoin.

It is also the most widely adopted cryptocurrency globally, now valued at US$46,000 with a market capitalisation exceeding US$869 trillion (as at 17 August 2021).

To put this in perspective, the market cap of Bitcoin on this day was equal to the combined market capitalisation of Australia’s 25 largest companies.

In a sign of increased confidence, more Australians viewed Bitcoin as a store of value, 19.1% up from 16.7% in 2019.

To truly understand the significance of Bitcoin as an emerging asset class, it is helpful to understand the history of currency and our relationship with money as a society.

A brief history of exchange: from barter to Bitcoin

Money is understood as a universally accepted means of payment for goods and services. It is defined by possessing a triad of functions: unit of account, medium of exchange, and store of value.

Though the earliest forms of exchange were through barter, society evolved to understand the importance of trade efficiency, and the need for a more convenient, standardised unit of exchange became apparent.

The predecessors of today’s modern currency were born during the Iron Age when the “bimetallism” monetary standard was introduced to set a fixed exchange rate between silver and gold.

Some centuries later, and on the other side of the world, the idea of money being backed by nothing but a shared belief in value was put into practice on the Yap islands of Micronesia.

Rai stones, circularly carved stones up to 3.6m in diameter and 4,000kg, have been used as currency among the islanders for centuries. For Rai stones too heavy to move, ownership of the stone was transferred by adding the new recipient to the oral history of the stone, as was the tradition.

Paper money’s initial function was as a temporary “promise of redemption” (in the words of the American economist Milton Friedman) for those precious metals that were too heavy to move easily.

This later evolved into representative money backed by a government that guarantees an exchange of paper money and an exact amount of silver and gold. This system is commonly referred to as ‘the gold standard’, and it dominated much of the 19th and 20th century global economy.

As early as the 17th century, federal governments have been outsourcing the task of managing the issuance and stability of their national currencies to central banks. These are privately-owned entities that implement a country’s monetary policy, often acting as a ‘lender of last resort’ to banks in dire need of capital or the government itself.

During the gold standard era of money, central banks would also manage the gold reserves used to back the currency’s value.

When the Great Depression of the 1930s hit, panic took over, and many people wanted to trade their money for the gold that backed it. As gold-backed currencies cannot increase their supply without increasing the size of their gold reserves by a proportional amount, governments could not simply print money to stimulate the economy the way they do now.

In 1931, the United Kingdom became the first world power to abandon the gold standard, no longer redeeming British pounds for physical gold. In 1933, United States President Franklin Roosevelt took the idea a step further and banned ownership of gold by the public.

Citizens were required to trade in their gold at a flat ounce rate for US dollars. This had two effects that helped stimulate life into the economy: people had more dollars to spend, and the government could print more money thanks to its increased gold reserves.

Toward the end of World War II, the Bretton Woods agreement designated the US dollar as the currency to which all other currencies would be pegged, effectively replacing the UK pound sterling as the world reserve currency.

In turn, the dollar was pegged to the price of gold, and foreign governments could convert their dollars for gold at the US central bank, known as the Federal Reserve.

This system remained in place until 1971, when US President Richard Nixon unexpectedly took the dollar off the gold standard to combat inflation and unemployment. As a result, foreign governments could no longer convert their dollar holdings into gold, creating uncertainty for the future of their currencies.

Nixon’s move led the US government to adopt a ‘fiat money’ system, which is the monetary regime that modern economies run today. Printed on paper or plastic, fiat money lacks intrinsic value and is no longer tied to a physical commodity such as gold.

It is the mere backing authority of the government and our society’s acceptance of this system that allows fiat currency to retain its value.

Because the fiat system lacks a scarcity component, governments wield near-total control over a currency’s supply and value.

As a result, fiat has the fundamental weakness of being vulnerable to undue influence, which in some circumstances has led to dire consequences (such as hyperinflation and devaluation of currency).

This fragility has been one of the biggest motivations in developing the concept of digital currency.

The earliest implementations of the concept were introduced in the late 1980s with Digicash, but only picked up steam starting in 2008, after an unknown entity using the pseudonym Satoshi Nakamoto unveiled a technical whitepaper titled Bitcoin: A Peer-to-Peer Electronic Cash System.

One of the major breakthroughs of this paper was solving the double-spending problem that had plagued earlier digital currencies. In this situation, a digital currency could, through duplication or manipulation, be spent twice.

However, its most fascinating feature was removing the requirement for a central authority to approve the network’s transactions. It was a decentralised, disintermediated system of global value exchange.

The underlying technological capability of the blockchain on which Bitcoin was built presented the opportunity for use cases covering easier payment systems, programmable money, fiat-pegged ‘stablecoins’, and conveyance of digital ownership rights, among others.

This blockchain technology has seen the cryptocurrency landscape grow from Bitcoin to Ethereum and far beyond.

Bitcoin, along with ‘next-generation’ cryptocurrency platforms, are now disrupting the business model of traditional financial institutions because of their ability to change the rules of currency and the potential to displace intermediaries from their role in centralised systems.

Bitcoin vs Ethereum: the similarities and differences

For the first time early in 2021, the cryptocurrency market topped US$2 trillion (A$2.6 trillion), with Bitcoin accounting for roughly 50% of the entire global crypto market cap and Ethereum accounting for 15%.

In Australia, the IRCI 2020 report found 88.8% of respondents were aware of Bitcoin, compared to only 23.5% of respondents who were aware of Ethereum.

Bitcoin and Ethereum are the two largest and most established cryptocurrencies among the thousands that exist today. Bitcoin was launched in 2009, shortly after Satoshi’s whitepaper was released in 2008. The Ethereum network was proposed by Vitalik Buterin in 2013 and launched in 2015.

While both use blockchain technology and operate without a central authority, they can have very different purposes. Bitcoin (BTC) aims to be a digital currency first and foremost, while the token of the Ethereum network, Ether (ETH), can be used as a digital currency or to perform operations on the Ethereum platform, which uses smart contracts to power decentralised applications (DApps).

Correlation between Bitcoin and Ethereum

Ethereum has played second fiddle to Bitcoin since its earliest days. As a method of payment, Bitcoin is generally the more accepted of the two.

Early adopters and investors saw Bitcoin’s potential to become a new, digitally-based ‘one world currency’; one to compete with or even replace fiat systems.

As time went by, however, a new perception of cryptocurrency rose in popularity; one which saw its utility as a store of value. This quality has extended to other crypto assets that have proven themselves popular and of relatively sound technical design over the years.

Historically speaking, the price movement of ETH has followed the price movement of BTC, more often than not, though with a greater degree of volatility. However, this long-standing correlation is not expected to last indefinitely.

Thanks to its high degree of flexibility, Ethereum arguably has the potential for more ‘real-world utility’ than Bitcoin, although it is not regarded as a Bitcoin replacement.

Ethereum is a decentralised, open-source and distributed blockchain-based platform.

The launch of ETH 2.0 is expected to increase the network’s transaction capacity by several fold and give Ethereum an advantage over Bitcoin in terms of its ability to host universally accessible applications, such as those made possible via smart contracts.

We are currently noticing a gradual decoupling of ETH and BTC prices as the former continues to enjoy newfound popularity, largely thanks to the decentralised finance (DeFi) and non-fungible token (NFT) movements fuelling its demand.

Stablecoins, such as Tether (USDT), are currently experiencing heavy flow to exchanges. The rise of competitors like Cardano (ADA) and Polkadot (DOT) further staves off BTC’s market cap dominance.

The crypto market is also making headway in Australia. The market cap value of Bitcoin reached a new milestone in March 2021 when it became greater than the total value of Australian dollars in circulation.

A couple of months later, Ethereum stole the spotlight when it surpassed Australia’s largest banks in market cap after rising 15-fold in price over the course of a year. Ethereum reached an all-time high of A$5,645 on 12 May 2021.

Cryptocurrency adoption and regulation

An overview of the current state of affairs with regards to cryptocurrency from a market and legal point of view.

The current state of adoption in Australia

The IRCI 2020 revealed that nearly 1 in 5 Australians own some form of cryptocurrency, with 18.4% of participants identifying as crypto holders. This reflects a significant increase from the 2019 survey results, especially among the 25-44-year-old investor demographic.

Bitcoin clearly remains the most popular cryptocurrency in Australia, with 74% of respondents who own cryptocurrency reporting ownership of BTC.

In terms of crypto holdings, Victoria took the title for the highest rate of crypto ownership at 20%, with New South Wales just behind at 19.5% and Queensland at 16.4%.

Overall, 42.7% of Australians who held crypto reported making money and increasing their wealth through cryptocurrency in 2020. The report also indicates that 54.5% of 45-54-year-olds made a profit in the prior 12 months.

This marks a substantial improvement from the previous year’s figure of 35% for the same age range, and a solid result considering the prolonged bear market that extended from mid-2018 through early 2020.

Emergence of blockchain and cryptocurrency in Australia

Independent-minded and adventurous in spirit, Australians gravitated toward cryptocurrency adoption early on and have had a strong blockchain community for several years.

The community was self-formed before the Australian Digital Commerce Association (ADCA) was founded by Ronald M Tucker in 2014.

ADCA’s role was to promote the industry, increase participation and interface, and educate the Australian government’s teams responsible for overseeing digital assets and related payment technology.

In 2019, at the annual APAC Blockchain Conference, the merger of ADCA (formerly ADCCA) and Blockchain Australia (BA) was unveiled to promote blockchain technology across the Asia Pacific region.

The newly merged Blockchain Australia is headed by chief executive officer Steve Vallas, with the board comprised of Adam Coulter (chair), Karen Cohen (board secretary), and other notable figures including Anya Nova of Power Ledger, Michael Bacina of Piper Alderman, Adriana Belotti of Prismatik, Jason Lee of Algorand Foundation, Caroline Bowler of BTC Markets and John Bassilios of Hall & Wilcox. The board is also joined by the Independent Reserve chief executive officer Adrian Przelozny, who has served since the inception of ADCA.

Cryptocurrency regulatory standing in Australia

In 2017, the Australian government declared cryptocurrencies were legal and should be treated as property subject to capital gains tax (CGT).

The Australian Tax Office (ATO) has made it clear they are prepared to go after crypto traders who misreport their earnings, but being a novel industry, the question is who exactly meets the definition of ‘crypto trader’?

While any income or loss event incurred on a crypto exchange is likely a taxable event, this event is a bit more qualified for crypto miners, as the ATO considers the intent of the miners.

In other words, if you mine crypto as a hobby, it’s not taxable; but if it is a business operation, then it is. The ATO has not yet provided definitions to separate these two classifications, so it’s hard to be certain of what actually needs to be reported.

As an investor, however, it would be helpful to know what your tax obligations are.

Besides tax regulation, Australian Transaction Reports and Analysis Centre (AUSTRAC) is a government-regulating body responsible for providing financial intelligence to help deter financial system abuses, such as money laundering and the financing of terrorism.

The Australian Securities and Investments Commission (ASIC), on the other hand, is independent of the Australian government and is part of the Council of Financial Regulators (CFR).

The CFR is a coordinating body that includes the Australian Prudential Regulation Authority (APRA), the Reserve Bank of Australia, and the Australian Treasury. Unlike AUSTRAC, CFR has no regulatory and policy-making decision powers as a group, as these powers reside in and are exercised by their four members.

They do, however, play a big role in the stability of Australia’s financial regulatory system by coordinating different regulating bodies.

The Australian government is largely considered to be ‘crypto-friendly’ but there have been recent calls for a greater degree of clarity for crypto regulations.

Speaking as ADCA board director in 2018, Adrian Przelozny lobbied AUSTRAC for increased regulation of the industry, recognising that such regulations created a greater degree of certainty for traders and investors.

It was the same year that AUSTRAC announced the implementation of more robust cryptocurrency exchange regulations and required exchanges to comply with government anti-money laundering and counter-terrorism financing (AML/CFT) reporting obligations.

In 2019, to commemorate 10 years of cryptocurrency, the Reserve Bank of Australia (RBA) published a paper titled Cryptocurrency: Ten Years On. Here, the RBA acknowledges that cryptocurrency’s resilience during the ‘Crypto Winter’ of 2018 and 2019 was, at the very least, proof of its status as an investment class.

The RBA even engaged in a blockchain proof of concept project to enhance their own operations in 2020 with global blockchain consultancy ConsenSys.

More recently, during the 2021 Australian Blockchain Week, NSW Senator Andrew Bragg mentioned that the absence of a legitimate regulatory framework and policy forces crypto entrepreneurs to pursue friendlier jurisdictions with regulatory clarity.

He noted the lack of such a framework has led to crypto-related business becoming ‘de-banked’ in Australia and that the government is not ready for the impending wave of change inspired by breakthroughs in blockchain-based fintech.

Cryptocurrency exchanges

Exchanges are essentially marketplaces for commodities, stocks, derivatives and other financial instruments. In this respect, crypto exchanges are no different, except that they specialise in the trade of cryptocurrency (fiat/crypto and crypto/crypto trading).

In Australia, crypto exchanges are regulated by AUSTRAC. Regulated cryptocurrency exchanges play two vital roles: they allow users to convert between fiat currency (AUD, NZD, USD) and cryptocurrency; and facilitate the buying and selling of cryptocurrencies between the two sides of the crypto market.

Cryptocurrency exchanges have their own order book where every order is recorded, validated, matched, and settled, allowing various methods for dictating the terms of those trades, such as specifying whether they are market or limit order trades.

Investing in cryptocurrencies is becoming easier as more on ramps are developed.

Australian exchanges have various operational processes required by law, such as built-in customer identification (KYC) policies which provide safety for local customers. Australian exchanges are backed by regulated, tax-paying entities which are held accountable for their operations, operating as on-ramps for customers who want to convert their fiat currency into crypto.

Decentralised exchanges have started to gain popularity in the market as they allow more exotic product offerings. The most significant difference is that while their mechanism for exchange is transparent and auditable, the management is typically anonymous and jurisdiction-less.

Because of this, decentralised exchanges don’t usually handle fiat-related deposits or transactions. You will first need to acquire cryptocurrency via a regulated exchange before you can access a decentralised exchange (DEX).

Centralised exchanges provide convenience and a greater degree of assurance for traders that DEXs can’t. While they may support fewer tokens or services than their decentralised counterparts, they play a vital role as the on/off ramps for fiat into cryptocurrency.

DEXs, on the other hand, retain the user’s absolute control over their assets, but can also suffer from a variety of security concerns as there is no oversight or consumer protection from regulators.

Crypto taxation: more signals of mainstream adoption

In 2019, the ATO started collecting records from Australian cryptocurrency exchanges on an ongoing basis to ensure tax compliance, which is similar to the procedures for mainstream banking providers.

In a very general sense, cryptocurrencies are subject to capital gains tax (CGT) and ordinary income tax in Australia. Any time they are bought, sold or exchanged, it triggers a CGT event.

There is more nuanced guidance provided by the ATO around the tax treatment of cryptocurrencies, which covers unique crypto events such as hard forks, airdrops or the loss of your private keys.

Given the potential complexity of reporting each CGT event, especially for high volume traders, leading accounting firm KPMG and cryptocurrency exchange Independent Reserve partnered in 2019 to develop a tool that would provide tax summaries for customers at the end of each financial year.

These summaries can then be provided to their accountants to help support their tax reporting obligations.

Self-managed superannuation funds

A self-managed superannuation fund (SMSF) is a type of retirement fund in which the member is also a fund’s trustee. This puts the responsibility of the fund in the hands of the member, allowing them to manage it as they see fit.

This may involve the addition of non-traditional asset classes like cryptocurrency to the fund. The member is also responsible for remaining in compliance with tax laws while acting as a trustee.

Despite indications from the IRCI 2020 that one in two Australians under the age of 35 are interested in moving their retirement funds into crypto, there is still no retail or industry superannuation fund in the country that offers this option.

It took crypto exchanges like Independent Reserve and BTC Markets to fill this gap by introducing crypto SMSF products.

According to the ATO, SMSFs account for over $764 billion, or about 25%, of the total value of superannuation investments in Australia as of December 2020.

Despite there being no retail superannuation fund support for cryptocurrencies, Independent Reserve has seen their SMSF accounts grow to more than 8,000 through organic growth alone. This represents just a tiny fraction of Australian superannuation accounts, suggesting there is huge growth potential remaining in this space.

Even as a higher-risk investment than most traditional asset classes, cryptocurrencies have proved a viable investment option available for SMSFs. In 2016, the first SMSF account was opened on Independent Reserve. The account had $41,000 invested into Bitcoin and is now valued at more than $3 million, an effective return of 90% year-on-year.

A wave of institutional adoption

Last February, the RBA announced the extension of its quantitative easing program by an additional $100 billion, with little to no expectation for increased interest rates until 2024.

This figure pales in comparison to the US’ quantitative easing program, which has exceeded US$7 trillion (A$9 trillion). Recently, US Federal Reserve chairman Jerome Powell confirmed that quantitative easing will continue into the foreseeable future.

These events, among other things, have those in high-up financial circles worried about future inflation risks. For some, cryptocurrencies such as Bitcoin are being viewed as an inflation hedge in the US, along with some other stock investments, such as Paypal, Square, and Tesla.

In August 2020, MicroStrategy cited declining returns from cash and the weakening US dollar when it invested A$336 million into Bitcoin as a treasury reserve asset.

“We find the global acceptance, brand recognition, ecosystem vitality, network dominance, architectural resilience, technical utility and community ethos of Bitcoin to be persuasive evidence of its superiority as an asset class for those seeking a long-term store of value,” MicroStrategy chief executive officer Michael Saylor said.

Since MicroStrategies’ first purchase, the value of its BTC holdings has increased 10.3%, as announced in its 2021 first quarter report. The company purchased US$15 million (A$19 million) more Bitcoin in April, bringing its total holdings to 91,579 BTC, which is valued at over US$5 billion (A$6.5 billion).

Not to be outdone, Tesla followed suit and purchased US$1.5 billion (A$1.94 billion) worth of BTC in February.

A few months later, Tesla sold 10% of its Bitcoin holdings in an effort to prove it was a liquid asset (should its liquidation be required), generating a US$101 million profit (A$130 million) from the US$273 million (A$354 million) sale – a 59% gain in less than three months.

If its $1.5 billion investment bought it around 43,000 BTC, post-sale it would have approximately 38,000 Bitcoin remaining, with a book value of US$2 billion (A$2.6 billion).

In its short lifespan, the cryptocurrency market has paved the way for recognition of digital currencies as an emerging asset class, as well as a derivatives market.

Stablecoins

A common criticism of cryptocurrencies is their high volatility, which makes them less reliable as a medium of exchange in daily life.

In response to this problem, a category of cryptocurrencies known as ‘stablecoins’ were developed to offer stability and low volatility. This is achieved by tying the value of the cryptocurrency to an external asset, such as a fiat currency.

There are two classes of stablecoins. As the name suggests, asset-backed stablecoins have assets such as fiat money or gold backing the token in a stable, one-to-one relationship.

The best known example of this class is Tether (USDT), which is pegged to the US dollar.

The second class, synthetic stablecoins, maintain their stability programmatically without holding reserves of an underlying asset.

One of the best known projects in this space is Synthetix, a derivatives liquidity protocol founded by Australian entrepreneur, Kain Warwick.

While Bitcoin and Ethereum remain two of the most widely used cryptocurrencies, USDT has established itself as a very strong contender on exchanges. This is especially true throughout Asia Pacific as USDT allows traders to exit volatile trading positions without having to actually cash out to fiat currency.

In fact, Tether usage was so high in June 2020 that it comprised 33% of all value transacted on a blockchain, and actually beat Bitcoin as the most received crypto that month, according to a report by blockchain analytics firm Chainalysis.

Tether has repeatedly faced controversy over the state of its reserves as it has been alleged that its tokens are not backed 100% by cash; a matter that was investigated and settled by the New York Attorney General in 2021.

Central Bank Digital Currencies

The role of physical cash is diminishing thanks to new developments in digital money and payments. In response to this, central banks are now creating their own virtual currencies.

Inspired by the global adoption of cryptocurrencies and stablecoins, Central Bank Digital Currencies (CBDCs) are envisioning a new form of central bank money that serves as both a medium of exchange and store of value.

There is a stance growing in favourability among central banks, such as the Monetary Authority of Singapore and the Hong Kong Monetary Authority, that sees adoption of CBDCs as a utility to correct economic inefficiencies.

For emerging economies such as those served by the Cambodia-based Project Bakong, the most compelling rationale for CBDC adoption is the social and economic inclusion it can bring, thanks to its reduction of traditional barriers to entry.

Overall, CBDCs offer an opportunity for central banks to operate with efficiency, faster payment and settlement systems, and lower risks.

There are two ongoing proposals for the CBDC, namely:

Wholesale CBDC

As the more popular proposal, wholesale CBDC offers lower credit and liquidity risks as the token is deemed a bearer asset.

This means there is an actual value transfer, whereas in the current system, banks just transfer debits and credits without actual value.

The focus of a wholesale CBDC is to create more efficient interbank relationships by removing some of the overhead incurred when dealing with physical cash.

Retail CBDC

Retail CBDCs are a popular concept with emerging economies because the design tends to be more favourable for those seeking financial inclusion.

On the downside, they tend to be more disruptive to the predominant finance system. One of the distinguishing features of a retail CBDC is that it is considered a liability of central banks and therefore falls under their balance sheet.

Similar to asset-backed stablecoins, CBDC-to-fiat conversion rates are pegged at a 1:1 ratio with the underlying fiat currency.

Retail CBDCs can also be issued to the general public with anonymity but are still traceable using distributed ledger technology. They are referred to as ‘retail CBDCs’ because they create a direct relationship between the central bank and retail customers.

Before a CBDC can be launched, however, it needs to go through the entire legislative process so it can be accepted as legal tender.

CBDC global adoption

A survey from the Bank for International Settlements (BIS) indicates developed and emerging countries are looking at CBDCs with varying levels of interest. The broad appeal of CBDCs among all countries is that they bring together the benefits of both the fiat and digital currency system.

China, for instance, was a first-mover when it announced the adoption of its own CBDC, the digital yuan. It will allow offline transactions, will not require a bank account, and has interoperability features with WeChat and AliPay. However, its plans for the use of digital yuan extend beyond its border and therefore pose a threat against the US dollar dominance.

As early as 2017, a group of fintech start-ups proposed to the RBA the concept of a digital currency pegged to the Australian dollar. The most recent development in this proposition has been the Senate Committee on Technology and Finance submission of recommendations regarding the ‘regulatory implications’ of CBDCs.

Prominent industry leaders, such as Michael Bacina of law firm Piper Alderman, are urging the government to go beyond a wholesale CBDC.

The increasing global push for the research and development of CBDCs stems from diverse motivations. There is no global consensus yet and design choices bring about their own set of complications and challenges, although the potential benefits are clear.

Research on CBDCs is continuing to gain momentum and use cases are beginning to flourish, lending merit to the real-world applicability of the underlying technology.

Cryptocurrency investment options

Almost one in five respondents said they intended to purchase cryptocurrency in 2021, according to the IRCI 2020.

Spot trading vs futures trading

Spot trading on cryptocurrency exchanges is the basic type of trade where users purchase an actual crypto asset and hold it until they decide to sell or exchange it.

With futures trading, investors do not purchase the asset itself but rather contracts that represent the asset, for the purpose of speculating on its future price.

Dollar cost averaging

An increasing number of exchanges provide an automated way of buying cryptocurrencies at regular intervals as a way of reducing the impact of price fluctuations. This form of investing is known as dollar cost averaging (DCA).

DeFi staking – liquidity

DeFi staking and lending are two popular techniques for investors to increase their holdings in cryptocurrency. We recently witnessed the total value locked in DeFi climb nearly 100-fold, from less than US$1 billion (A$1.3 billion) in early 2020 to US$72 billion (A$96 billion) so far in 2021.

Staking allows cryptocurrency holders to lock up their tokens to produce an annualised percentage yield (APY, or just ‘yield’). It is redefining finance as it allows investors to borrow and lend funds immediately with little authentication. Staking provides liquidity for decentralised exchange while providing a way of earning through APY.

Yield farming (also known as liquidity mining), on the other hand, enables an investor to deposit coins in liquidity pools with different protocols. Here, cryptocurrencies are ‘locked’ for certain periods, and in exchange, investors earn rewards.

DeFi staking – lending markets

The most popular yield farming protocols currently are MakerDAO, Compound, Aave, and Uniswap. Yield farmers tend to use these different DeFi platforms as a way to optimise their staked funds and get returns.

Uniswap is known for popularising DEXs thanks to its automated market maker (AMM), which allows for one-click swaps of ERC20 tokens. In return, Uniswap rewards UNI holders with a share of the platform’s transaction fees.

MakerDAO is a pioneer in the space and rewards its participants for keeping the value of its stablecoin, DAI, on par with the value of the US dollar.

Aave lets users borrow assets and earn compound interest through its token, as it gives holders discounted fees and governance tokens as well.

Non-fungible tokens

Non-fungible tokens (NFTs) are digital assets often used to represent real-world objects such as art, music, videos, and other collectibles, although there are certainly more use cases that demonstrate the power of this technology.

For instance, Australia was in the news lately when Tokens For Humanity issued NFT token artworks as a source of fundraising revenue for animal welfare groups.

NFTs are considered by many to be the latest phenomenon in the crypto investment space. The catalyst for the explosion of interest in the industry was when an NFT collage by the artist Beeple named Everyday: The First 5,000 Days, sold at a Christie’s auction for US$69 million (A$92 million).

NFTs are capable of providing ownership tracking, authentication, and as such, provenance using blockchain. They are bought and sold online with cryptocurrency.

The NFT market saw an increase of more than 800% since the beginning of 2021 and is now worth around US$490 million (A$654 million); although the number is still changing very rapidly. For many reasons, NFTs are considered to be a high-risk investment.

Exchange-traded funds

An exchange-traded fund (ETF) is an investment fund that tracks the price of an underlying asset such as an index, a commodity or sector, and is traded on a traditional stock exchange.

As it stands now, Bitcoin ETFs are still non-existent in Australia and the US, but this may change in 2021. The reluctance for regulators to approve a Bitcoin ETF was partly because of the largely unregulated nature of cryptocurrency markets, even though the asset class continues to gain traction within the investment community.

In Germany and Canada however, Bitcoin and Ethereum ETFs are now available, where they are structured similar to gold ETFs.

In Australia, ASX executive general manager Max Cunningham recently stated that developments in Europe – along with a huge local demand for crypto – compelled the bourse to take a serious look at crypto ETFs this year.

There is an indirect way to invest in Bitcoin, which is through a blockchain ETF. First, let’s differentiate the two. A Bitcoin ETF is an exchange-traded fund that tracks the value of Bitcoin and allows you to trade it without having to buy Bitcoin itself.

With a blockchain ETF, you’re essentially buying shares of a fund of companies that develop or use blockchain, the underlying technology of cryptocurrency.

ETFs have been a popular investment tool as they can help minimise volatility by spreading the risks across an industry or an asset class.

While crypto ETFs in the ASX remain unlikely to launch in 2021, ASIC commissioner Cathie Armour stated in the Senate Committee on FinTech that a Bitcoin ETF is possible so long as rules are in place.

There is certainly a shift towards a friendlier attitude among regulators in this area, which could be read as a major signal indicating more formal crypto adoption in Australia.

Cryptocurrency security options

The control and security of cryptocurrency is always a hot topic. Cryptocurrencies are typically a ‘bearer instrument’: whoever possesses the token, owns the token.

Purists will tell you if you don’t control the private key that corresponds to your public balance, then you don’t really own your crypto. Hence the saying, “not your keys, not your crypto.”

The reality is a little more nuanced, and there are times when it is appropriate to trust a custodial solution to hold your coins. For instance, if you’re not really technically savvy, or at least not yet, it might be a good option to trust your funds with a worthy custodian, such as a trusted exchange or wallet provider.

Regardless of your choice, success generally comes down to keeping best security practices in mind and possessing a full awareness of the risks associated with crypto.

Understanding the various options for storing and managing your cryptocurrency is an important part of the journey, so try not to leave them uncovered.

Hosted wallets on exchanges

As the easiest to set up and most popular crypto wallet for new entrants, a wallet hosted and managed by a crypto exchange on your behalf is typically the starting point for new users.

Well established and regulated exchanges invest heavily in security infrastructure to provide this service for their clients, and as a result, they have been trusted as stewards of billions of dollars in crypto capital.

Storing crypto on an exchange is useful for fast access to trading but comes with the limitation of not having full custody of your account. As such, it is imperative that investors work with trusted exchanges only.

In Australia, Independent Reserve is the only exchange to offer insurance on crypto assets. Their insurance, however, only covers the loss or theft of crypto from their cold storage (hardware wallets) that is stored in high-security facilities.

Software and browser wallets

PC applications like Electrum and browser extensions like MetaMask let users manage their own crypto directly from their computer.

These are incredibly popular services that give investors the ability to interact with crypto on various online services, currency exchange markets, and e-commerce processors, while remaining lightweight and user-friendly.

Given their popularity, illicit actors and scammers try to get users to install fake versions of these services all the time.

It pays to remain vigilant when installing any crypto software, and make sure you are downloading only from a trusted publisher.

Mobile wallets

Widely known as an “e-wallet”, a mobile wallet refers to an app that allows users to receive, store and send crypto funds from their mobile device.

Highly modernised mobile wallet solutions like Trust Wallet provide support for scores of different coins and tokens.

Mobile wallets are mostly used for smaller balances and payments. They are convenient but often considered less safe as their security is tied to the security of the physical device.

Hardware wallets

Hardware wallets, also known as “cold storage”, are used for the secure storage of cryptocurrency on physical devices. They often look like USB sticks and must be physically connected to a computer in order for stored funds to be sent.

Basically, hardware wallets allow users to store private keys in a secure, physical device kept separate from the software used to initiate a transaction. The two leading providers of hardware wallets are Ledger and Trezor.

They both offer great security, but since there is no third party accessing or controlling the wallet, control of stored funds is solely the responsibility of the customer. This means there is no one to help the user reset their password if he/she forgets their 12-word seed phrase.

Third-party custody

Trusted entities acting like banks such as Onchain Custodian and BitGo provide services to corporates, family offices, and high net worth individuals (HNWI) for secure, insured crypto custody.

They provide a high level of security as these custodians need to be technical experts, up-to-speed with proper finance regulatory processes and compliance safeguards.

The future of crypto

In the book, The People’s Money, the late Adam Tepper wrote that to understand the future of cryptocurrencies such as Bitcoin, it’s important to look at the fundamental principles underlying them.

Analysing the advantages of Bitcoin over any other currency requires that a person must recognise what the alternatives are.

The emergence of digital currencies has the potential to change how society thinks about money. While still far off from replacing fiat, Bitcoin’s image as a store of value continues to grow, especially in countries experiencing economic hardships, such as Argentina and Venezuela, which regularly use cryptocurrencies as alternatives to their own.

According to the World Economic Forum, around 86% of the world’s central banks are now exploring the benefits and drawbacks of a central bank digital currency, showing a shift in perspective. Even institutional money is now expected to flow in through the upcoming years.

Morgan Stanley announced it will offer its clients access to Bitcoin funds while MasterCard will begin facilitating payments in cryptocurrency in 2021. Goldman Sachs also followed suit in offering cryptocurrencies to its investors. These events are representative of how banks will, per usual, follow the money.

While we may be far from seeing homogenous legislation regarding cryptocurrency, nations around the world are increasingly preparing and adopting cryptocurrency regulations.

This signals an impending transformation of how money is moved around the world; one which ideally shifts control of financial power away from the hands of a few and back to the average person.

Popular tokens

Here are some of the more well known cryptocurrencies:

Bitcoin (BTC)

Bitcoin is still the heavyweight in the cryptocurrency world. As programmed from the beginning, there will only ever be 21 million BTC in existence, which ensures its scarcity for the market.

Its proof-of-work powered blockchain and protocol for achieving consensus laid the foundation for cryptocurrency development. As such, it has been imitated countlessly and remains the gold standard in cryptocurrency.

Bitcoin’s all-time high was A$84,561 at the close of trade on 14 April 2021. As of today, BTC is trading around AUD$63,000, about 57% higher than the start of the year.

Ethereum (ETH)

Ether (ETH) is typically used to pay the transaction fee called ‘gas’ for any token built on the Ethereum network. It is the backbone for more than 9,000 tokens created using the network’s ERC-20 standard.

The long-awaited Ethereum 2.0 update promises to bring an improved level of transaction throughput, helping to address scaling issues currently plaguing the network.

On 3 May 2021, Ethereum surpassed the market cap of Australia’s largest banks with its value having increased 15-fold from just a year ago. Ethereum’s all-time high was A$5,650 on 12 May 2021.

Ripple (XRP)

Ripple was designed to optimise remittance procedures for banks, payment providers, and digital asset exchanges, enabling real-time settlement and negligible transaction fees. Ripple has numerous partners around the world, including American Express and remittance powerhouse MoneyGram, which use XRP to ensure efficient transfer of funds between borders.

Polkadot (DOT)

Polkadot is a protocol designed to enhance interoperability between blockchains by relaying information between them. Its platform allows a diversity of blockchains to transfer messages and value in a trust-free fashion, sharing their unique features while pooling their security to leverage the Polkadot network.

Chainlink (LINK)

LINK is the native token of the Chainlink protocol and used to serve up real-world data to other protocols. LINK is used to pay Chainlink network operators for their services and data. As such, it bridges the gap between blockchain and real-world data which is especially important for many decentralised finance applications.

Tether (USDT)

Tether is best known as the most widely used US dollar stablecoin. It is employed extensively for cross border settlement and as a holding currency on exchanges so that traders can avoid switching out to fiat between trades.

USD Coin (USDC)

USDC is another stablecoin backed fully by reserved assets and redeemable on a 1:1 basis for US dollars. It is governed by a membership-based consortium that sets the technical, financial and policy standards for stablecoins.

Bitcoin Cash (BCH)

Bitcoin Cash (BCH) is a fork of the Bitcoin client code, launched in 2017 when a small contingency of Bitcoin developers disagreed with the direction the project’s development was headed. The BCH community is focused on keeping their transactions affordable and thus an efficient system for the transfer of digital cash.

Litecoin (LTC)

Also a fork of Bitcoin, Litecoin utilises a similar protocol with a few important parameter tweaks. Like Bitcoin, it relies on proof-of-work for consensus and operates on a permissionless, peer-to-peer network. Unlike Bitcoin, average block lengths are only two minutes (as opposed to BTC’s 10 minutes), and the total amount of LTC to ever be created is 84 million (as opposed to BTC’s 21 million).

Stellar Lumens (XLM)

Lumens are the native crypto for Stellar, an open-source blockchain payment system that processes payments instantly. It was created in 2014 by Jed McCaleb, who previously served as the chief technology officer of Ripple. McCaleb wanted to redesign Ripple with features specifically designed for use by individuals rather than institutions, and thus Stellar was born.

Synthetix Network Token (SNX)

Synthetix is an Ethereum-based liquidity protocol for derivatives that mints new synthetic assets. It has a staking feature with a relatively high annualised percentage yield (APY). It also brings in traditional assets such as gold, silver, and fiat currencies like the US dollar to the crypto ecosystem. Recently, Synthetix announced it will now allow users to trade top tech stocks.

Compound (COMP)

The Compound protocol allows users to borrow and lend crypto. Users who provide crypto to be lent out by the protocol earn rewards in the form of COMP tokens. Recently, COMP reached a new high, more than doubling from A$524 at the start of April to A$1,089 on 12 May, thanks to a series of governance tokens and a second batch of development grant receipts. Current COMP is trading back around A$552.

Yearn Finance (YFI)

YFI is the governance token built on Ethereum for the Yearn Finance protocol. It is essentially a decentralised aggregator of different lending protocols used for automated yield farming strategies. Its most recent initiative was a buyback program that helped its price surge in mid-April.

Aave (AAVE)

Aave is another Ethereum-based governance token but for the Aave protocol, where users can borrow and lend different digital assets (including stablecoins and altcoins), use them as collateral, and earn passive income through interest.

Dogecoin (DOGE)

Dogecoin is a cryptocurrency that started as a joke and a fun alternative to Bitcoin. It features the internet famous Shiba Inu dog meme and was used as a tipping mechanism on social media platforms like Reddit. There is no hard cap on the number of Dogecoin tokens that can be created. DOGE has been experiencing a phenomenal increase as of late thanks to a huge boost from Elon Musk and various online groups. The total market value of Dogecoin is currently around $42 billion.

SEE ALSO:

– Gold stocks on the ASX

– Silver stocks on the ASX

– Lithium stocks on the ASX

– Cobalt stocks on the ASX

– Graphite stocks on the ASX

– Zinc stocks on the ASX

– Nickel stocks on the ASX

– Rare earth stocks on the ASX

– Vanadium stocks on the ASX

– Mineral sands stocks on the ASX

– Uranium stocks on the ASX

– High Purity Alumina stocks on the ASX

– Tin stocks on the ASX

– Tungsten stocks on the ASX

– Hydrogen stocks on the ASX

– Oil and gas stocks on the ASX

– Cannabis stocks on the ASX