Weekly review: Share market overcomes weak offshore leads to end on a high

WEEKLY MARKET REPORT

Australian shares once again showed their resilience as they overcame weak offshore leads to end the week on a high.

Other than energy stocks, there were rises across the board on Friday as the ASX 200 added 28 points to close at a week high of 6,167.3 points.

Even in the energy space there were plenty of valid reasons for the weakness with sector giant Woodside Petroleum (ASX: WPL) shedding a little above 4.1% as it started to trade ex-dividend.

Aussie coal bans hurting

News that Australian coal was being refused entry at five ports near Dalian in northern China also sent a shiver through the sector with New Hope (ASX: NHC) paring 3.55% off the price, Yancoal (ASX: YAL) losing 2.8% while Whitehaven Coal (ASX: WHC) started badly but recovered over the day to add 0.66%.

The banking sector was mixed after a particularly strong week and resources were a bit of a drag so it was up to good profit results in some unfamiliar “hero’’ sectors such as consumer discretionary, utilities and communications to power the market higher.

Some great results power market

Since spinning out Coles (ASX: COL), Wesfarmers (ASX: WES) appears to have improved its performance. The company announcing a first-half profit of $4.5 billion and paying a special $1 per share dividend to shareholders.

Internet company, Netcomm (ASX: NTC) was one, with its shares leaping a nice, round 50% after releasing its first half results and announcing it had received a $161 million takeover offer from US based Casa Systems.

Shares in funeral home operator InvoCare (ASX: IVC) added a healthy 12%, despite a 57% slide in net profit, as warmer winter weather led to fewer deaths over the half.

Cosmetic company and Sukin brand owner BWX Ltd (ASX: BWX) also surprised with a 30% share price jump even after the company recorded a 52% slide in net profit after operating expenses also rose.

Investors seemed to look right through the results and the lack of an interim dividend to anticipate a better time coming with chief executive officer Myles Anceschi producing a bullish forecast after good growth by Sukin and a number of other brands and an end to production issues.

Even Dreamworld owner Ardent Leisure (ASX: ALG) enjoyed a rare positive day with shares piling on 4.2% despite the fact that the 2016 fatal accident on the river rapids ride was still costing the company more than $5 million in the half.

There were some negatives such as a 5.3% fall in Regis Healthcare (ASX: REG) shares after the aged care provider outlined some extra costs relating to the aged care Royal Commission.

Overall, though, there were plenty of positives to draw from the market as some solid profits across the board powered some price action.

Small cap stock action

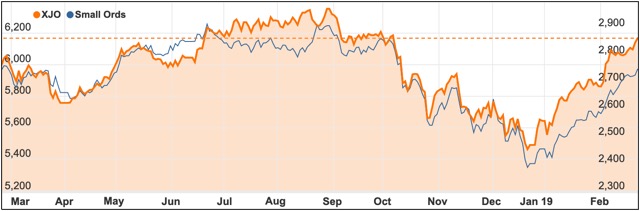

The Small Ords index had another strong week, climbing 0.74%, as the market continues to rally in 2019.

ASX 200 vs Small Ords index

Those making news this week were:

Leigh Creek Energy (ASX: LCK)

Leigh Creek Energy has begun the process of upgrading its large gas resource to reserve status, after heralding the pre-commercial demonstration success at its syngas plant in South Australia.

The company reported commercial synthesis gas (syngas) production at its namesake energy project had achieved a peak flow of 7.5 million cubic feet of gas per day.

“The success of this trial has effectively unlocked a large energy resource of huge value and captured key data that validates the fact that this proven ISG technology can be successful in a commercial application,” Leigh Creek managing director Phil Staveley said.

Situated at the Leigh Creek coal fields, Leigh Creek’s project has a 2C resource of 2,964 petajoules of gas and the company now has sufficient information to upgrade a good portion of its contingent resources to a bankable 2P (proven) reserve.

Bionomics (ASX: BNO)

Further data analysis of a phase two trial evaluating Bionomics’ BNC210 drug in treating post traumatic stress disorder has revealed positive results.

The additional analysis indicated the drug could have significant benefits to PTSD patients when the exposure is adequate.

Rather than focusing on the dose, the exposure-response was evaluated using the blood levels of the drug in each patient.

This analysis quantified the level of efficacy was related to the amount of drug in a patient’s blood and Bionomics is looking to design a further trial to help get BNC210 eligible for “fast track” designation.

4DS Memory (ASX: 4DS)

Memory technology developer 4DS Memory has finished up testing with its partner imec where both parties carried out process modifications to a batch of 300mm wafers.

4DS is developing non-volatile memory storage known as ReRAM with testing carried out on functional 300mm wafers, which focused on endurance and retention.

In readiness for the testing, imec produced 23 300mm wafers, with analysis revealing 4DS’s Interface Switching ReRAM memory could be cycled.

Testing also revealed the best retention results 4DS had achieved outside of its own facilities to-date, with 4DS claiming it and imec had obtained “invaluable data” to boost refinements and manufacturing iterations.

Kalium Lakes (ASX: KLL)

Sulphate of potash (SoP) explorer Kalium Lakes has secured the necessary licences for its flagship Beyondie SoP project in WA.

WA’s Department of Mines, Industry, Regulation and Safety awarded Kalium with two mining licences, 15 miscellaneous licences and a gas pipeline permit, which are in addition to 15 previously-granted exploration licences.

The permits cover Kalium’s proposed activities at the project including brine extraction, evaporation ponds, SoP purification, water supply, pipelines, communications, power generation, accommodation facilities and supporting infrastructure.

Kalium’s strategy is to become Australia’s first SoP operation to produce premium fertiliser for domestic and international markets.

Lepidico (ASX: LPD)

Lepidico has generated a high purity lithium hydroxide material using the LOH-Max process it developed in collaboration with Strategic Metallurgy.

The process takes away the need to produce sodium sulphate as a by-product but uses conventional equipment – attracting lower capital and operating costs than current methods of converting lithium sulphate to lithium carbonate or lithium hydroxide.

As a result, Lepidico plans to integrate the LOH-Max technology into its WA-based pilot plant, which is due for commissioning in May.

Under an agreement with Strategic Metallurgy, Lepidico has the right to use LOH-Max and sole rights to market the technology across the world.

CCP Technologies (ASX: CT1)

Internet of Things solution provider CCP Technologies has reduced its operating costs by $1.5 million and, as a result, expects to break even in the second-half of 2019.

The company said the operating cost reduction had not negatively impacted revenue or sales.

CCP has a suite of commercial projects in the pipeline, with several highly material and progressing subscription opportunities available.

These projects have not been included in forward revenue estimates, but CCP noted that if it won the projects they would “add substantially” to projected revenue.

Real Energy (ASX: RLE)

Advanced gas explorer Real Energy has continued its positive run after reporting it is on track to book maiden reserves for its flagship Windorah gas project.

Windorah is estimated to hold 13.7 trillion cubic feet of gross prospective gas-in-place resources, with Real Energy planning to convert a portion of the resources to reserves in the “near term”.

Real Energy is carrying out pressure build-up surveys and collating data from its recently shut-in Tamarama-2 and Tamarama-3 wells.

As part of its strategy to produce gas from Windorah as soon as possible, Real Energy has already received strong interest from several commercial gas buyers.

Jervois Mining (ASX: JRV)

Jervois Mining is hoping to become the next owner of Tanzania’s Kabanga nickel-cobalt project and recently met with the country’s new Minister for Minerals the Honourable Doto Biteko.

Glencore and Barrick Gold previously spent more than US$250 million on exploration and predevelopment at the project but this was halted when the nickel price sunk.

The duo had kept the project via a retention licence, but that was cancelled in 2018 by the Tanzanian Government – leaving Kabanga up for grabs.

As a result, Jervois lodged an exploration permit application and Jervois chief executive officer Bryce Crocker told Small Caps although the recent discussions with the Tanzanian minister were confidential, the company was “pleased” with the ongoing engagement.

Lithium Australia (ASX: LIT)

Processing technology company and lithium explorer Lithium Australia reported its LieNA process offers a number of potential advantages over traditional spodumene refining methods.

The technology can convert spodumene at a lower temperature using caustic soda. The converted material is then leached and recovered as a tri-lithium phosphate.

Initial success with LieNA follows on from Lithium Australia’s achievements with its SiLeach process including making a lithium-ion battery from mine waste such as lepidolite.

To firm up a feedstock for its processing technologies, Lithium Australia is advancing the Youanmi project in WA, where field work has confirmed the presence of lepidolite-bearing pegmatites.

Emerge Gaming (ASX: EM1)

Emerge Gaming plans to launch its ArcadeX gaming platform in Australia next month after a successful pilot in South Africa.

During the South Africa pilot, Emerge achieved a high returning user count and long engagement times.

The company has now optimised the platform to generate even stronger results ahead of its roll-out throughout Australia, the US and Europe.

In the Australian launch, ArcadeX, which is an eSports and casual gaming tournament platform, will be available on iOS and Android.

Australian Vanadium (ASX: AVL)

Australian Vanadium is progressing ahead of schedule with a drilling program aimed at collecting diamond core samples for pilot scale studies.

To-date, Australian Vanadium has delivered 9t of diamond core samples comprising various materials from within Gabanintha’s proposed open pit.

The company will evaluate the samples with its proposed processing flow diagram to generate refined vanadium pentoxide samples, with data from the test work to be used to refine pre-feasibility study results.

Once the current drilling program has been completed, Australian Vanadium will have collected 30t of diamond core samples to analyse in the pilot program.

Freehill Mining (ASX: FHS)

Chile-focused Freehill Mining has unlocked copper and gold potential at its Yerbas Buenas iron ore project.

The company carried out an induced polarisation survey across the project and identified “moderately strong chargeability anomalies in the project’s north.

“The completion of the IP survey is a significant step forward in verifying the presence of what we believe is a large sulphide structure that may host the copper and gold mineralisation typically found at surface in the area,” Freehill chief executive officer Peter Hinner said.

Freehill is currently planning a drilling program to begin in the June quarter which will target the anomaly.

Bryah Resources (ASX: BYH)

Another explorer to firm up an anomaly this week was Bryah Resources, which has uncovered a large-scale target potentially associated with base metals and gold at its Bryah Basin project in WA.

Soil sampling and on-ground mapping led to the identification of a large alteration cell, which is immediately to the east of where Bryah’s recent drilling intersected gold.

Bryah managing director Neil Marston told Small Caps discovering the anomaly via wide-spaced sampling vindicated the company’s methodical exploration approach to the project.

To gather a better understanding of the anomaly, Bryah plans to carry out a mobile metal ion survey, which will be followed up with drilling.

IPOs this week

Companies listing on the ASX in 2019 will be looking to improve the performance from last year where 77% of the companies that listed finished the year below their issue price.

However there were still some shining stars, here are the top 10 IPOs of 2018, along with some market insights.

Small Caps readers who want to view upcoming IPOs or see the performance of stocks that have listed in 2019 can now do so.

The latest companies to make their way onto the ASX this week were:

Candy Club (ASX: CLB)

Candy Club made its was on to the ASX on Tuesday after raising $5 million via the issue of 25 million shares at $0.20 each.

The company operates a confectionary subscription service that delivers a box containing six varieties of sweets directly to customers, with the US confectionary market worth US$35 billion in 2017, alone.

Candy Club will use its IPO funds to grow its business-to-consumer and business-to-business divisions through increased sales and marketing.

The company also plans to purchase automated packaging equipment with the IPO proceeds.

Candy Club finished its first week on the ASX even at $0.20.

Mediland Pharm (ASX: MPH)

The second company to debut on the ASX this week was Mediland Pharm, which raised $12.5 million via the issue of 62.7 million shares at $0.20 each.

Upon listing, the company had an enterprise value of around $51 million and plans to use its IPO funds to capture inbound Chinese visitor interest in health and wellbeing.

Mediland plans to develop a range of own-brand health care and cosmetic products to promote within its stores.

The company was established in 2002 and has become a retailer servicing Chinese inbound tourism, with visitors hosted at Mediland’s strategically located retail outlets in Sydney, Melbourne and Surfers Paradise in Queensland.

Investors reacted positively to the company’s debut, with its share price ending its first day of trade at $0.21, having listed on Friday.

The week ahead

The final week of the profit reporting season is upon us and it is usually one which traders’ approach with caution.

Lots of small companies with bad results to reveal often wait until the end of the profit season to air their dirty laundry in the hope of being lost in the rush – an approach which rarely seems to work.

No doubt the same will happen this year, although results so far have been fairly strong.

International factors will again be important to keep an eye on this week with US economic growth data and testimony by the US Federal Reserve chair two to watch out for.

Chinese numbers covering manufacturing and the services sector should give an indication on how quickly the heavily populated country’s economy is growing.

Locally, the main indicators to watch for are construction data on Wednesday and business investment figures on Thursday, which should feed into the continuing debate over whether Australia’s growth rate is slowing or not.