Top 10 IPOs on the ASX in 2018

77% of companies that listed on the ASX in 2018 finished the year below their issue price.

There’s no way of sugar coating it, 2018 was a disappointing year for initial public offerings (IPOs) on the Australian Stock Exchange (ASX).

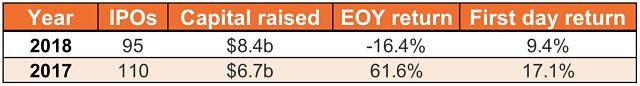

Of the 95 companies that listed, 73 finished the year below their issue price.

In total, the average return share price return from IPOs by year’s end was a dismal -16.4%, which is not the sort of returns early stage investors are looking to make.

However, it wasn’t just IPOs that were impacted. It was a rocky year for the market overall, with the ASX 200 index shedding 7% during 2018, following a sell-off in the market towards the end of the year.

The good news

Of the companies to make their way onto the ASX, 79 had a listing market cap of $100 million or less, showing that small caps still led the charge when it came to new opportunities.

Looking at initial share price performance for new ASX entrants, 53% of companies closed out the opening day’s trading session above their IPO price, with the average first day return being 9.4%.

Capital raised

During 2018, companies listing on the ASX both big and small raked in a combined $8.4 billion in IPO capital raised – up more than 25% on the 2017 figure of $6.7 billion.

What made 2018 different from other years is that it heralded three $1 billion-plus market cap IPOs, which listed after raising substantial revenues: Viva Energy Group (ASX: VEA), Coronado Global Resources (ASX: CRN), and L1 Long Short Fund (ASX: LSF).

Combined, the $1 billion-plus market cap IPOs generated 56% of the $8.4 billion raised, with the three companies pulling in a combined $4.75 billion in value.

Of the $8.4 billion raised, companies with a market cap below $100 million, contributed $710 million, or 8% of the total funds raised.

On average, a small cap stock raised $9.86 million for its IPO, down on the $13 million average secured in 2017, suggesting small cap companies failed to attract the same level of investor interest.

Additionally, during 2018, only 72% of the ASX debutants were able to meet their target raise amount, which was down on the prior two years.

In 2017, 79% of new listings achieved their goal, with 2016 seeing a stronger figure of 83% hit their target. This could be a potential trend signifying a drop in the quality of companies listing combined with a lack investor appetite.

Sector breakdown

Of the various sectors represented on the ASX, the bulk of the market entrants in 2018 came from the mining and resources (37%) and information technology fields (18%).

Mining, resources and energy accounted for the majority of funds raised – about 58%, with the finance sector locking-in around 30% of all IPO revenue.

On a listing basis, 35 IPOs were mining and resource-focussed stocks, while 17 were technology and 13 finance.

Drilling deeper into the data, out of the 35 mining and resource listings, 60% had gold-focused projects, while 23% were primarily looking for copper and 14% had cobalt projects.

It’s also worth noting that despite having the lion’s share of listings, only one resources company made it into the top 10 IPOs for percentage return in 2018.

Overall, most sectors generated negative three-month returns, with IT, healthcare and essential consumer goods the only three to give investors a return on their outlay.

Of the three sectors, essential consumer goods gave investors the biggest return of almost 40% on their money after three-months.

IPO performance 2017 vs 2018

Throughout 2018, 95 IPOs were accounted for. While this was a decent figure, it was below the 2017 listing number of 110.

Of the 2018 IPOs that made their way onto the ASX, 79 were small caps with a market cap of $100 million or less.

Although still a healthy amount, it was lower than the 88 small caps that muscled their way on to the ASX in 2017.

Despite the lower number of listings, investors threw a lot more cash behind what stocks actually made their way onto the ASX, with 2018 IPO revenue up on 2017 levels – indicating the cash was there, but investors were more selective as to which stocks they put their money into.

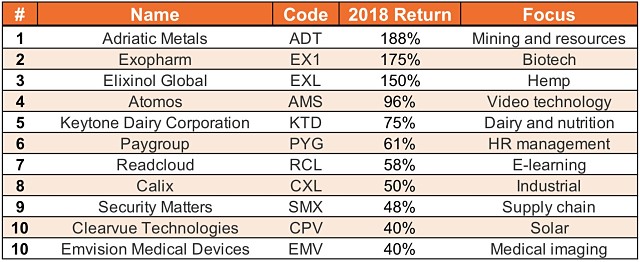

List of the top 10 IPOs in 2018

Although many IPOs underperformed in 2018, several stars shone bright.

Small Caps has compiled a list of the top 10 performing companies based on return at the end of the year.

Adriatic Metals (ASX: ADT)

Since listing in April, shares in the zinc and base metals explorer have exploded on the back of impressive high-grade drilling results from the Vares project in Bosnia.

Adriatic Metals successfully raised $10 million during its IPO, managing to secure financial endorsement from base metals giant Sandfire Resources in the process.

Sandfire subscribed for $2 million to secure a 7.7% stake in the company, with the parties also entering into a strategic partnership which sees Adriatic benefit from Sandfire’s technical and strategic expertise.

Adriatic aggressively pushed on with drill programs at the Vares zinc-polymetallic exploration permit in Bosnia following its IPO in a bid to fast-track the activities to a development-ready stage.

The UK-based company is anticipating a maiden mineral resource estimate for the Rupice deposit, located within the Vares project, in early 2019

Results to date have been encouraging, with drilling returning thick zones of high-grade mineralisation over 42m grading 14.1% zinc, 8.4% lead, 245 grams per tonne silver, 5.7g/t gold, 1.4% copper and 34% barium sulphate from 222m.

Exopharm (ASX: EX1)

Anti-ageing products promising to help people remain forever young is a booming business. Combining anti-ageing techniques with improved health and wellness, however, is in its infancy. This is something Exopharm is looking to change.

The Australian biotech firm successfully raised $7 million ahead of its December listing with plans to develop and commercialise its products for regenerative medicine treatment.

Its vision is to harness the potential potency of exosomes to initially treat conditions such as wounds, osteoarthritis and dry age-related macular degeneration.

Exosomes remains an emerging field, with research pointing to exosomes as being a crucial output of adult stem cells to drive healing and regeneration in humans.

With its Ligand-based Exosome Affinity Purification technology, the company is seeking to manufacture exosomes to enable studies in humans for age-related conditions.

Elixinol Global (ASX: EXL)

Cannabis stock Elixinol Global has had a stellar rise on the bourse following its ASX emergence in January.

The company, which operates in the industrial hemp, dietary supplements and emerging medicinal cannabis sectors, raised $20 million via its IPO with funds directed towards the development of its Australia-based facilities for cannabis cultivation and manufacturing.

The company reported bumper revenue for the first half of 2018, with Elixinol chief executive officer Paul Benhaim claiming it was the only ASX-listed company in the cannabis sector to record a profit so far.

Elixinol’s growth has been driven by strong sales in its consumer products division, which includes hemp-derived foods and dietary supplements.

The company’s performance to date has been well received by investors, and with interest in cannabis stocks showing no signs of abating, Elixinol will be looking to continue its strong 2018 performance this year.

Atomos (ASX: AMS)

It hasn’t been listed long, but Atomos is already proving a hit with investors.

The global video technology company is seeking to further tap into the burgeoning camera equipment market following its December IPO where it raised $6 million.

The company’s listing on the ASX comes after the firm achieved $35.6 million in revenue for the 2018 financial year.

Atomos, which has offices in the US, Japan, China, UK and Germany, delivers video production devices for the content creation markets.

The company claims its technology unlocks the potential of digital cameras, enabling higher quality video and greater creative flexibility at a lower cost.

Atomos is focused on expanding into the growing social and entertainment video content markets and plans to use the IPO funds to support its global growth strategy, which include adding to its pro video segment.

Keytone Dairy Corporation (ASX: KTD)

New Zealand-based Keytone Dairy Corporation is another company that has had a strong run since its ASX listing in July, which saw it raise $15 million.

The manufacturer and exporter of dairy and nutrition blended products is experiencing strong product demand out of global markets such as China and South East Asia after beginning production of powdered milk in 2013.

Since the company’s ASX debut, Keystone Dairy has reported healthy growth figures, with revenue for the first-half of the year to the end of September totalling $1.38 million.

The company is pushing ahead with its phase of rapid expansion and investment, with construction of the second purpose-built manufacturing facility and associated plant and equipment continuing in order to more than triple the production capacity.

PayGroup (ASX: PYG)

While Melbourne-headquartered PayGroup is in the business of human resource management software, its payroll services business props up its revenue figures.

The company has a global reach, handling payroll and human resource services for companies located in 18 countries across the Asia-Pacific region.

After abandoning a float in 2017, the company raised $8.5 million via its IPO in May to help fund its expansion plans and bankroll technology upgrades.

The company expressed a positive business outlook in its half yearly reports, with its channel partner program expected to be an important growth driver for the company. International referral partnerships are expected to support expanding PayGroup’s reach into North America, UK and Europe.

ReadCloud (ASX: RCL)

It hasn’t been a smooth ride for E-learning solutions provider ReadCloud since its February ASX debut, after having raised $6 million for its IPO.

With shares steadily climbing for the first six months of the year, the company posted a maiden loss of $1.2 million in August which wasn’t well received by investors. This was despite it recording a 155% increase in revenue to $2.1 million.

While the company’s share price hasn’t clawed back from the earlier losses, ReadCloud has affirmed its strong sales pipeline and investors are keen to reap the benefits of the company’s growth ambitions.

Management estimate that ReadCloud’s software and products will be in more than schools in the 2019 school year, representing a 106% compound annual growth rate on the 2016 financial year.

Calix (ASX: CXL)

Shares in Calix appreciated quickly upon its ASX listing, after having raised $8 million, as the Australian technology company managed to attract investor interest from the get-go.

While the stock has tapered off slightly since its share price high of $0.95 in July, it has managed to clinch eighth spot in the top performing IPO’s for 2018.

The company’s core technology is a patented kiln built in Bacchus Marsh, Victoria that produces mineral honeycomb. The minerals are then used to help protect sewer assets from corrosion.

As well as attracting a few high-quality institutional investors, its FY18 results produced some pleasing outcomes, including a boost in revenue and gross margins.

The company is continuing to make inroads across growing market segments such as the US, with its Southern California project set to go live this month. Under the project, Calix’s Charleston units will dose ACTI-Mag into the city’s sewers to mitigate odours.

Security Matters (ASX: SMX)

The Israel-based supply chain integrity and blockchain company joined a somewhat crowded market when it listed after a $6 million raise in October, becoming one of 18 Israeli companies to trade on the ASX.

Security Matters was founded on its “Intelligence on things” marking technology, which claims to offer a safe and effective way of tracking items and providing a tamperproof record of movements through the supply chain from raw materials to manufacturing and sale.

The technology is reported to provide a viable solution across multiple sectors including the global anti-counterfeit market, which was estimated in 2015 to be worth US$1.77 trillion.

The company has kicked off an initial proof of concept project with agriculture firm Hazera Seed to explore the feasibility of embedding its technology into seeds.

ClearVue Technologies (ASX: CPV)

Renewables were the flavour of the year and Perth-based innovative building material developer ClearVue Technologies has certainly managed to tap into the renewable energy boom.

The company operates in the Building Integrated Photovoltaic (BIPV) sector which involves incorporating solar technology into glass and building surfaces to produce renewable energy.

2018 was a big year for ClearVue after raising $5 million for its listing, with the company, receiving accreditation to commercialise its solar window technology into both the Australian and European markets.

The company’s progress in moving towards monetising its technology has helped it tie for tenth spot on the top performing IPO list for 2018.

EMvision Medical Devices (ASX: EMV)

Listing in December was Brisbane-based EMvision Medical Devices which successfully listed following a $6 million oversubscribed IPO.

The funds raised will be used to develop the company’s medical imaging technology – a portable, cost effective, non-invasive brain scanner that could speed up the diagnosis of brain injuries and stroke.

The company is currently undertaking healthy human trials to evaluate how the clinical prototype performs in a real-world environment.

EMvision will then run a pilot clinical trial at the Princess Alexandra Hospital to collect data from patients with diagnosed ischaemic and haemorrhagic stroke, with confirmatory CT or MRI images.