Weekly review: Bulls win the battle as market edges over 6000 points

WEEKLY MARKET REPORT

After a tough tussle all week, the bulls just came out on top with the ASX 200 closing off on Friday at 6,066.1, up a skinny 6.7 points for the day.

Some weaker than expected profit results from heavy hitters like AMP (ASX: AMP) and Telstra (ASX: TLS) and some big stocks which went ex-dividend put some lead in the saddlebags and prevented the market from building up too much steam.

A weak US lead due to disappointing December retail sales numbers also kept the buyers scarce, although there was some optimism in US markets about a positive outcome from the US/China trade talks.

Oil price rise helps energy stocks

Pulling in the other direction, a rise in the oil price buoyed energy stocks with Woodside Petroleum (ASX: WPL) up 4.8% and Santos (ASX: STO) up 5.7% for the week.

There was also some stock specific profit news which boosted companies like Medibank Private (ASX: MPL), which rose 5.8%.

Medibank’s health insurance premium revenue grew 2.1% to $3.24 billion as 6,400 new policyholders joined over the half.

Medibank Private’s net profit fell 15% from a decline in investment income due to choppy investment markets.

Domain wins and loses

Similarly, Domain Holdings’ (ASX: DHG) shares added 17% despite the real estate advertising company recording a $156 million net loss for the first half.

Investors looked through that number which included a $177.5 million write-down and also through a decline in listings as the housing market continued to cool in Melbourne and Sydney.

The rise in Domain shares helped Nine Entertainment (ASX: NEC) put on a 10% spurt, due to its stake in Domain after the merger with Fairfax Media.

Whitehaven in the black

Whitehaven Coal (ASX: WHC) shares fell 10% after with total coal sales fell 9% to 8.4Mt and production also dropped off by about 8%.

It wasn’t all bad news though with Whitehaven managing to lift net profit by 19% and pay a special dividend.

Small cap stock action

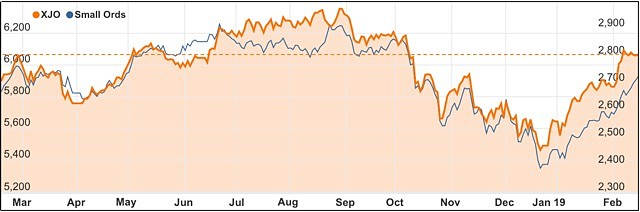

Outperforming this week was the Small Ords, finishing the week up a healthy 2.09%, meanwhile the ASX 200 managed to gain 0.09%.

Over the past month the the Small Ords index has rallied 8.11% compared to the ASX 200 at 4.33%, showing that the small cap sector is alive and well.

ASX 200 vs Small Ords index

Among the companies making news and driving the rally this week were:

Emerge Gaming (ASX: EM1)

Emerge Gaming has begun rolling out Cloudzen Pte Ltd’s GameCloud technology which has been dubbed the “Netflix of gaming”.

According to Emerge, GameCloud is a “revolutionary game streaming technology” that enables instant streaming of hundreds of 3D games for mobile devices.

The technology also allows multiplayer gaming, video streaming and social networking, with Emerge in discussions with telcos in various regions to bolster GameCloud’s roll-out world-wide.

Emerge’s timing couldn’t be better with the global eSports market predicted to tip US$3.2 billion (A$4.5 billion) by the end of this year.

City Chic Collective (ASX: CCX)

Following the divestment of its underperforming assets, City Chic Collective has reported a net profit after tax of $10.1 million for the half-year ending December 2018.

The company revealed sales revenue of $75.4 million and EBIDTA of $15.8 million.

Underpinning the company’s performance was the online platform, which was the most profitable division.

City Chic is focused on expanding throughout Australia and New Zealand and is also exploring disruptive retail models and partnership opportunities in the US and Europe.

Wellard (ASX: WLD)

Wellard achieved an important milestone this week after reporting its first half-year profit since listing on the ASX.

The company achieved a net after tax profit of $2.9 million – up from the $7.4 million loss it reported in the previous corresponding period.

Shoring up the profit was a 34% increase in revenue to $188.2 million, which excluded the divestment of two non-core assets.

The sale of La Bergerie Pre-Export Quarantine facility and abattoir Beaufort River Meats is expected to be completed in March and bring in $13 million in free cash flow.

IPH (ASX: IPH), Qantm Intellectual Property (ASX: QIP) and Xenith IP Group (ASX: XIP)

In a bid to disrupt Qantm Intellectual and Xenith IP’s merger plans, IPH threw a spanner in the works after scooping up a 19.9% stake in Xenith.

IPH also stated it planned to vote against Xenith and Qantm’s merger.

IPH payed $33 million for the interest in Xenith, with Xenith reporting it would proceed with the merger plans it had outlined with Qantm, which was due to be completed in April.

Qantm and Xenith announced the $285 million merger plans in November with Qantm shareholders to own 55% and Xenith shareholders to hold 45% of the consolidated entity.

Orthocell (ASX: OCC)

Orthocell’s recent study has revealed an 82% success rate for patients treated with its stem cell therapy Ortho-ATI.

The company treated 47 patients with chronic degenerative tendon injuries such as tendinopathy and tendonitis with Ortho-ATI during a study in 2018.

Patients were treated outside of formal clinical studies and 82% of those in the study said they were “satisfied” or “extremely satisfied” with Ortho-ATI.

Additionally, 83% of patients reported satisfaction in pain relief and improved performance in daily activities.

Alt Resources (ASX: ARS)

Gold explorer Alt Resources has identified gold at the Shepherds Bush prospect within its Mt Ida project in WA.

The company carried out a review of historical data and uncovered previous drill intersections of 12m at 1.65g/t gold, 20m at 1.37g/t gold and 32m at 0.91g/t gold.

Alt plans to complete follow up drilling once it receives approvals.

Shepherds Bush is 2km for the Spotted Dog South and Tim’s Find gold deposits, with the Mt Ida project hosting a global resource of 3.9Mt at 2.07g/t gold for 257,000oz gold.

Galan Lithium (ASX: GLN)

Over in Argentina, Galan Lithium has confirmed the brines it had intersected within a maiden drill hole at its Candelas project contain high-grade lithium.

Initial assays from the intersection revealed 65m at 862 milligrams per litre of lithium from 235m.

Galan said the test work had revealed the lithium brine had low contaminants and was comparable to the nearby “high-quality” brines currently mined at Salar del Hombre Muerto.

The company is now working “full steam ahead” to fast-track the exploration program at the Candelas.

Zip Co (ASX: Z1P)

Buy now, pay later company Zip Co had added Chemist Warehouse to its digital finance platform.

Australia’s largest pharmacy retailer will allow its customers to use their Zip account to pay for purchases online and in-store.

This latest deal follows earlier partnerships Zip has made with Bunnings, Officeworks, Target, EB Games, Virgin Australia and Tigerair.

Part of the delayed payment trend, the deal with Chemist Warehouse is expected to be live within the next few months.

Navarre Minerals (ASX: NML)

Another gold explorer to report gold hits this week was Navarre Minerals, which unearthed the precious metal from two shallow aircore holes at the Langi Logan project in western Victoria.

The company intersected 2m at 19.4g/t gold at the Target A zone, as well as 4m at 1.7g/t gold and 1m at 4.5g/t gold.

Navarre managing director Geoff McDermott said the results were “highly impressive” and indicate the potential for a gold discovery at the project.

“Drilling is ongoing, and we look forward to expanding the mineralised zone as we strive to deliver our second gold find along the proven Stawell gold corridor,” Mr McDermott said.

Freehill Mining (ASX: FHS)

Freehill Mining has discovered a large magnetic anomaly within the northern portion of its flagship Yerbas Buenas project in Chile.

After carrying out a recent ground high resolution magnetic geophysical survey, Freehill confirmed historical data and identified numerous moderate-to-strong anomalies extending from the project’s south to its north.

Freehill’s technical team has used the high-resolution survey results to plan a more targeted drilling campaign which is due to begin in the June quarter.

Data from an induced polarisation survey is due to be released shortly as well as assays from drilling that was carried out in the December quarter.

Impression Healthcare (ASX: IHL)

In the medical cannabis space, Impression Healthcare has signed an exclusive memorandum of understanding with cannabinoid research company RespireRx Pharmaceuticals.

The MoU with RespireRx is a natural extension to Impression’s existing dronabinol project and paves the way for both parties to negotiate terms where Impression would licence, partner or complete a joint venture with RespireRx to use dronabinol to treat obstructive sleep apnoea.

RespireRx has completed phase two clinical trials in treating obstructive sleep apnoea with dronabinol and has achieved “statistically significant improvement” in symptoms.

The parties intend to introduce dronabinol to the Australian market through the government’s Special Access Scheme, with the medicine already given US Food and Drug Administration approval.

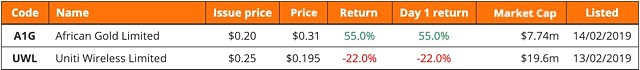

IPOs this week

Small Caps readers who want to view upcoming IPOs or see the performance of stocks that have listed in 2019 can now do so.

The latest companies to make their way onto the ASX this week were:

African Gold (ASX: A1G)

As its name suggest, African Gold was incorporated to explore for gold in the African country Cote d’Ivoire.

The company was incorporated in February last year and acquired two granted mining exploration licences in Cote d’Ivoire that are prospective for gold and other minerals.

African Gold made its ASX debut on Valentine’s Day after issuing 22.5 million shares at $0.20 each to raise $4.5 million.

The company’s share price rocketed to $0.40 during its first day before slipping to end the week at $0.295 – a 47.5% premium on its offer price.

Uniti Wireless (ASX: UWL)

Internet service provider Uniti Wireless’ stock began trading on Wednesday after the company raised more than $13 million in its IPO.

As part of Uniti’s IPO it acquired FuzeNet Pty Ltd which is also an internet service provider and offers broadband and internet data connectivity services.

The merged entity plans to supply wireless and fibre broadband access to super-fast networks and services – providing an alternative to NBN and a replacement to copper networks.

The company announced a trading halt on Friday – freezing its share price at $0.21, which was a fall on its $0.25 offer price.

The week ahead

Here in Australia, we will get some details on whether the wages pick up the Reserve Bank has been forecasting has arrived.

It will also be another busy week for company profit reports.

The December quarter Wage Price Index which is released on Wednesday is expected to show a 0.6% rise but the RBA would prefer a more robust number.

Other things to look out for this week include the RBA board minutes out on Tuesday and the employment figures for January which are out on Thursday.

Overseas, the US figures are still a little up in the air because of the government shutdown and financial markets will be closed on Monday for the George Washington’s Birthday/President’s Day public holiday.

The Chinese house price index for January is also out on Friday.