Global eSports market revenues to surpass $1 billion in 2019

The eSports market could be worth as much as US$3 billion (A$4.5 billion) by the end of 2019.

The eSports industry is set to blitz past the $1 billion mark for the first time in its relatively short history and could reach somewhere between US$1.1-3.2 billion (A$1.5-4.5 billion) by the end of this year, depending on a range of factors that underpin the industry’s growth.

That’s the estimate provided by Newzoo, a leading global provider of games and eSports analytics, which forecasts a new age of eSports that’s free from the restrictions of traditional media.

In its 2019 Global Esports Market Report, the analytics company says the eSports market is set to experience 27% year-on-year growth and will break the US$1 billion mark backed by sponsorship and brand investments.

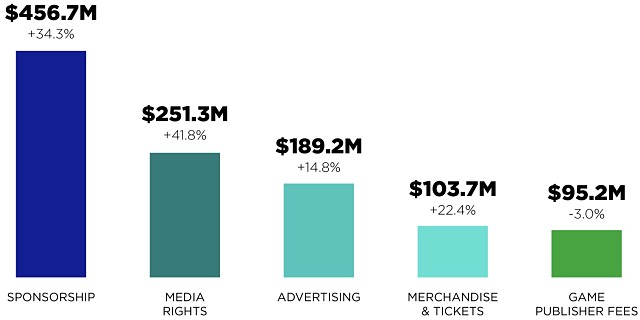

Newzoo says that around 82% of the total market will come from endemic and non-endemic brand investments such as media rights, advertising and sponsorship, with sponsorship currently the highest-grossing individual eSports revenue stream worldwide, set to generate US$456.7 million (A$644 million) in 2019.

Esports revenue streams are set go grow at least 26.7% in 2019.

“eSports’ impressive audience and viewership growth is a direct result of an engaging viewership experience untethered to traditional media,” says Peter Warman, chief executive officer of Newzoo.

“Plenty of leagues and tournaments now have huge audiences, so companies are positioning themselves to directly monetise these eSports enthusiasts.

While this began happening last year, the market is constantly expanding on its early learnings,” said Mr Warman.

Growing audiences

Not only is revenue set to grow by more than a quarter, but eSports viewership is also expected to make parallel advances.

Global eSports audiences will increase to almost 454 million people worldwide in 2019, a year-on-year growth rate of 15%.

Newzoo’s report explains that this audience is likely to consist of 201.2 million so-called “eSports enthusiasts”, people who watch eSports more than once per month, and 252.6 million “occasional viewers”, those that watch less than once per month.

As the eSports market matures and the number of local events, leagues, and media rights deals increases, the report’s authors anticipate the average revenue per fan to grow to $6.02 by 2022.

Key factors anticipated to boost both revenues and viewership are innovation and further investment, specifically from “no-endemic brands”.

Over the course of two days around 20,000 gamers flocked to the Melbourne & Olympic Park precinct for the 2018 Melbourne Esports Open.

While many brands have already entered or are currently planning their entrance, other brands have yet to make their first venture.

“Both digital broadcasters and TV media companies have already started to compete for eSports content and the extent to which these deals will generate a direct return on investment will impact the pace of media rights growth,” Newzoo says.

Other factors driving popularity and that could potentially increase revenues further are increased eSports franchising, new content formats and premium passes – measures that are being promoted by various companies operating in the eSports space in an attempt to establish market share.

In addition, there is the prospect of mobile gaming also joining the fray. Companies such as Esports Mogul (ASX: ESH) have taken steps to integrate cross-platform compatibility and to allow mobile gamers to participate in the growing eSports industry.

With the industry still in its infancy companies like Esports Mogul have plenty of spare capacity to grow into over the next few years.

Racing into position

One eSports segment, in particular, that could be making headlines in the near future is Formula 1 racing. According to Formula 1’s head of marketing Ellie Norman, an eSports competitor could race in Formula 1 within the next 10 years.

This follows what could be described as an underdog performance earlier this year when eSports pro Enzo Bonito won a head-to-head race with ex-Formula E champion Lucas di Grassi during a Race of Champions event. Bonito’s victory came as a shock to many analysts within the world of motor racing, not to mention eSports.

Racing simulators have always held a prominent place in the hearts of gamers, keen to emulate their favourite drivers and take to the world’s greatest race tracks in the comfort of their own gaming chairs.

The concept of racing simulation is now being “professionalised” by many leading championships including NASCAR and the Le Mans 24 Hours organisers.

Formula 1 now has its own official eSports championship comprising entrants from every team except Ferrari.

McLaren has its own simulation project which was won by was Brazilian Formula 4 racer, Igor Fraga, last year.

China’s hat in the eSports ring

Much like other global sectors, China is seeking to dominate the eSports industry with its substantial market likely to become a powerhouse factor for the future of the entire industry.

eSports is becoming extremely important for China, where major cities such as Chongqing, Xi’an, and Hangzhou are competing to become the country’s new eSports hub.

Newzoo says China is set to generate revenues of around US$210 million in 2019, overtaking Western Europe as the second-largest region in terms of revenues.

China currently has a surging growth in mobile eSports, including casual titles. However, there may yet be trouble ahead.

Newzoo’s report forewarns that the recent slowdown of game licences in China will affect Chinese gamers’ exposure to new eSports titles.

Fewer new games are appearing in the market, especially when it comes to Battle Royale and mobile titles in general.

Meanwhile, in North America – currently the world’s richest games market – the eSports industry is again set to top the pile, forecast to achieve revenues of $409.1 million in 2019 and could reach as high as $691.1 million by 2022.

Newzoo forecasts that the largest share of North America’s 2019 eSports revenues – around US$196.2 million – will come from sponsorship, while media rights will contribute most to this growth and will remain the fastest-growing and second-largest eSports revenue stream in the region.

The 23.9 million eSports enthusiasts in North America will generate $17.13 per fan this year, higher than any other area.

With eSports industry growth going from strength to strength (and on track to become a multi-billion industry in the coming years), gaming is set to extend its dominance of the broader entertainment industry – while delivering yet more interactive content for consumers in the process.

As they say in gaming circles, “game on”.