Weekly review: Reserve Bank hints next move, Australian housing remains uncertain, biotech sector boom

WEEKLY MARKET REPORT

The ASX 200 recovered somewhat this week closing up 0.74% at 5,939.5 points, just shy of the psychological 6,000 support level.

A sign of relief for the markets having taken a plunge the week prior.

However mixed economic news has many scratching their heads as to where the market is headed next.

Employment numbers improving

On the positive note, Australia’s unemployment rate unexpectedly fell this week to 5%, the lowest since April 2012, as the economy added 5,600 jobs. Meanwhile the number of people unemployed declined by 37,200 in September to 665,800.

A boost for the economy as analysts were expecting the jobless rate remain steady at 5.3%.

Continued growth of full-time jobs in the country has accounted for over 70% of the total employment increase experienced in 2018.

The government will be hoping that improved employment conditions will translate into wage growth which has remained stagnant in recent times.

Reserve Bank hints next move

Meanwhile the Reserve Bank of Australia (RBA) having left rates on hold for a record 26 consecutive months at a mere 1.5% has helped drive the economy, as has the weakened Australian dollar, according to meeting minutes released this week from the central bank.

The longstanding ‘do nothing’ policy by the RBA may be set to change in near future, stating that the next move in rates is likely to be up.

However noted it will be keeping an eye on credit growth and availability following tighter lending standards that are expected to be even further increased once the Royal Commission into the banking sector has been finalised.

The RBA announcing in their meeting minutes that “housing prices had declined noticeably in Sydney and Melbourne”, although this may just be the beginning according to AMP chief economist Shane Oliver.

Australian housing still uncertain

A 20% fall in the Melbourne and Sydney property market can be expected according to Mr Oliver.

Previously Mr Oliver stated that a 15% drop from the peak was likely to play out to 2020, however has updated his forecast based on data in recent weeks.

Data coming in from CoreLogic shows that sales in capital cities are at 20 year lows despite the fact Australia’s population has boomed over that period.

Should the trend of declining property prices and sales continue it may be difficult for the RBA to justify any rate increase.

The weakening property market has seen the property listings businesses take a hit with Domain (ASX: DHG), owner of domain.com.au, down 14.52% in the past month. While rival REA Group (ASX: REA), owner of realestate.com.au, has shed 19.46% over the same timeframe. Reduced property listings being blamed.

Directors of Domain bought shares this week, signalling that they believe this to be a buying opportunity. The five directors acquired a combined total of $307,468 worth of DHG shares on the market.

Meanwhile property valuation business Landmark White (ASX: LMW) has remained steady and has continued to pay out dividends, with the company utilising a business model that thrives when the property market either rises or falls.

Falling house prices are also welcomed news for Australia’s younger generation, with many feeling that the ‘Aussie dream’ of owning a home was slipping out of reach. Coupled with recent news that an oversupply of avocados are set to hit the market, the ‘smashed avocado generation’ may have reason to rejoice in the near future.

Biotech sector receives boost thanks to Biotron

Australia’s biotech sector has received a positive injection of interest thanks to Biotron (ASX: BIT) achieving phase 2 success with its HIV drug, BIT225.

Shares in Biotron have risen over 1280% in the past month, such is the high-risk, high-reward nature that many biotech companies are renowned for. Investors seeing the gains have begun increasing their exposure to the sector.

The rising tide has brought numerous biotech companies along for the ride, most on no news at all.

Antisense Therapeutics (ASX: ANP), who is targeting a treatment for Muscular dystrophy closed the week up 194.1%. Memphasys (ASX: MEM) which focuses in the IVF space was up 128.6%, Living Cell Technologies (ASX: LCT) was up 96.7%, also on no news, the company expects to release 18 month efficacy data for its NTCELL in the treatment of Parkinson’s disease next month.

A handful of others in the biotech space that saw a lift this week include: eSense-Lab (ASX: ESE) up 89.2%, Suda Pharmaceuticals (ASX: SUD) up 75%, Stemcell United (ASX: SCU) rose 54.55%, while Alchemia (ASX: ACL) climbed 50%.

Timely that with the spotlight now on the biotech sector, the annual Australian Biotech Invest conference is being held later this month in Melbourne.

Small Caps is a proud sponsor of the event, which is free for investors to attend and showcases a wide selection of ASX listed biotech companies. Investors can register here.

Small cap stock action

Although down more than 4% from a month ago, the Small Cap index managed to finish Friday in the green. The index gained 0.50% to end the week at 2,705 points.

Some of the more notable news this week included:

Talga Resources (ASX: TLG)

Talga Resources has continued outperforming after new battery testing with its graphite anode product achieved “ultra-fast” rates and beat a competitive commercial product.

The test was undertaken on Talga’s Talnode-X product and showed it had 20% more capacity and power, as well as 94% first cycle efficiency and zero capacity fade after 300 cycles.

Additionally, the graphite anode product achieved a high charge capacity of 300 ampere hours per gram at a charge rate of three minutes.

In comparison, the commercial product’s high charge capacity was 300Ah/g in 60 minutes or more.

American Patriot Oil & Gas (ASX: AOW)

American Patriot Oil & Gas emerged from a trading suspension this week with news it has executed some “transformative transactions”.

The company anticipates the deals, which include a new funding arrangement will help set it up as a leading US-based producer of conventional oil and gas.

As well as the new funding arrangement, American Patriot has completed its Peak Energy and Magnolia & Burnett acquisitions, which are expected to boost production 10-fold from 30 barrels of oil equivalent per day to 300boepd.

The new assets also add 1.9 million barrels of 1P oil and gas reserves to American Patriot’s portfolio.

Prescient Therapeutics (ASX: PTX)

Prescient Therapeutics announced that is has teamed up with an unnamed “leading private US-based drug development company” to generate new “PH domain and Akt inhibitors”.

The novel drugs will be based on Prescient’s experience in developing its targeted cancer therapy drug PTX-200.

“A core plank of this strategy is the generation of new intellectual property for Prescient,” the company stated.

PTX-200 works by inhibiting an important tumour survival pathway known as AKT, which is key in several cancers including breast, ovarian and leukaemia. A phase 2 trail using PTX-200 in women with advanced breast cancer has demonstrated “encouraging efficacy signals”.

Eden Innovations (ASX: EDE)

A US public transport operator has endorsed Eden Innovations’ concrete additive EdenCreek after a successful two-year infield trial tested the product’s durability, strength and lifecycle costs.

The trial involved using EdenCrete enriched concrete in a section of the Metropolitan Atlanta Rapid Transit Authority’s (MARTA) fleet carpark.

According to Eden Innovations, during the trial EdenCrete offered long-term resistance to daily aggressive conditions and extreme rolling frictional forces from buses and other vehicles.

Eden Innovations said the positive trial may result in the inclusion of EdenCrete in future MARTA projects.

Bryah Resources (ASX: BYH)

Bryah Resources unlocked further gold potential at its Bryah Basin project in WA after drill results this week revealed thick mineralised intersections at the project’s Windalah prospect.

Previously referred to as the Mars 1 anomaly, Windalah revealed intersections of 27m at 1.43g/t gold, with two 3m higher grade intervals comprising 4.16g/t gold and 6.29g/t gold.

Other notable intersections were 21m at 1.21g/t gold, including 6m at 3.52g/t gold and 12m at 0.71g/t gold.

Mineralisation remains open along strike and down dip, with remaining assays from the drilling campaign anticipated in the coming weeks.

Pure Minerals (ASX: PM1)

Pure Minerals shouldered its way into the battery metals sector after agreeing to snap up 100% of Queensland Pacific Metals Pty Ltd.

Queensland Pacific Metals has locked in ore supply agreements with New Caledonia-based Societe des Mines de la Tontouta and Societe Miniere Georges Montagnat SARL. The company also plans to begin feasibility studies into developing a 600,000 wet metric tonne per annum nickel and cobalt processing plant in Townsville.

Once operational, Queensland Pacific Metals anticipates it would produce about 25,000tpa of nickel sulphate and 3,000tpa of cobalt sulphate from the 600,000t of nickel and cobalt ore it sources from the New Caledonian producers.

Pure Minerals has paid a $75,000 deposit for Queensland Pacific Metals and has 45 days to carry out due diligence on the company.

Orbital Corporation (ASX: OEC)

Orbital Corporations has expanded its existing agreement with Boeing subsidiary Insitu, with the extended agreement expected to generate up to $350 million over the next five years.

Drone technology provider Orbital’s designs will facilitate a modular range of propulsion systems that can be integrated across numerous unmanned aerial vehicle platforms.

Orbital will deliver multiple propulsion systems and services across Insitu’s unmanned aircraft systems including assembly, supply and overhaul of three propulsions systems, which Orbital refers to as its modular propulsion solution.

Using Orbital’s technology, Insitu’s customers are expected to have enhanced production lead times, greater volume flexibility, tailored performance application and “guaranteed quality”.

Real Energy (ASX: RLE)

Real Energy continued advancing its flagship Windorah gas project in Queensland after securing deals with two major Australian oil and gas companies Santos (ASX: STO) and Beach Energy (ASX: BPT).

This week, Real Energy locked-in binding agreements with the majors to tie-in its gas wells to the Santos-operated gas gathering network in the Cooper Basin.

Real Energy’s gas will then be processed at Santos and Beach Energy’s Moomba facilities in South Australia for sale into the east coast gas market.

“The signing of the gas processing agreement allows us to commercialise our gas without the need to build an expensive gas plant and other associated infrastructure,” Real Energy managing director Scott Brown said.

Tando Resources (ASX: TNO)

South African vanadium explorer Tando Resources firmed up its vanadium prospectivity at its flagship SPD project in the area after uncovering visible host mineralisation in every hole of the initial drilling campaign.

Magnetite is known to host vanadium at the project and was visible in all 16 holes in the diamond core and the reverse circulation rock chips.

Initial assays from the drilling program returned 7m at 0.84% vanadium from 3m, and 35m at 0.66% vanadium from 47m, including two higher grade intervals of 9m at 1.12% vanadium and 2m at 1.61% vanadium.

Once Tando has received all assays from the campaign, it will publish its maiden resource before the end of the year.

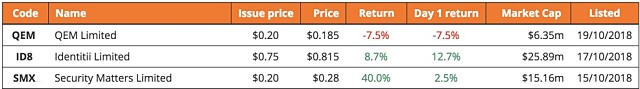

IPO tracker

Readers of Small Caps that want to view upcoming IPOs or see the stocks that have listed in 2018 and how they are performing can now do so.

The latest stocks to make their way onto the ASX this week include:

Security Matters (ASX: SMX)

Israel-based Security Matters was the first to enter the exclusive ASX club this week, with the company making its debut on Monday after raising $6 million in its IPO.

The supply chain integrity and blockchain company issued 30 million shares at $0.20 each with funds to go towards commercialising its patented item tracking technology.

Security Matters’ concept is known as The Intelligence On Things and includes “resilient physical marking and tagging”. According to the company, it translates to creating a digital twin connected to original and innovative blockchain technology. This assists with brand protection, supply chain integrity, track and trace, and product liability.

Additionally, the Israeli Government initially developed and proved the technology, with Security Matters now owning all the IP for non-defence-based applications.

Security Matters closed Monday at $0.205 and has climbed steadily throughout the week to end the at a $0.28 high.

Identitii (ASX: ID8)

Blockchain start-up Identitii joined ASX ranks on Wednesday after raising $11 million in its IPO.

Identitii issued 14.6 million shares at $0.75 each and entered the ASX with a $40 million market cap.

The company started ASX life at $0.95, which was a 20% premium to its IPO price.

IPO funds will be allocated toward advancing and commercialising Identitii’s blockchain platform for banks and corporates which allows them to securely overlay documents and information on messages moving through existing payment networks.

Global giant HSBC is already using Identitii’s blockchain technology.

After a positive first week, Identitii closed Friday at $0.815 – an 8.6% gain.

QEM Ltd (ASX: QEM)

Vanadium explorer QEM floated on Friday after raising $5 million in its IPO.

The company issued 25 million shares at $0.20. Upon listing, QEM had 100 million shares on issue giving it a market cap of $20 million.

QEM will use its IPO funds to advance its wholly-owned Julia Creek vanadium project in Queensland, with a 3,000m drilling program planned to begin immediately.

The project has a JORC inferred resource of 1.7 billion tonnes at 0.34% vanadium. Additionally, the project hosts a 3C oil shale resource of 589MMbbls.

QEM opened trade at a small 5% premium, before dipping to close its first day at $0.185.

The week ahead

Things look quiet on the Australian front, at least for now, with quarterlies and annual reports out next week from numerous companies.

Out of the US we can expect to see GDP numbers, with 3.1% growth forecast for the quarter. In addition new home sales numbers for September will give a better guide as to how the US market is tracking overall after existing home sales data out this week came in lower than expected, as did retail numbers coming in at a dismal 0.1% growth.

Industrial profit numbers from China will give further insight into how the Asian powerhouse nation is tracking after this week announcing that economic growth had slowed down to 6.5% in the third quarter, a nine-year low, as trade frictions with the US continue to take its toll.