Weekly review: Markets plunge, China and Japan ditch US dollar, AMP hits record low

WEEKLY MARKET REPORT

Global capital markets are now down five weeks in a row, shedding some US$8.2 trillion in the process.

Over the past month the ASX 200 is down 8.51%, finishing this week flat at 5,665.2 points.

Over in the US the NASDAQ is down 13% from its all time high, with the Dow down 9%, erasing all gains made in 2018.

Tech stocks led the slip with markets breaking key technical levels, investors will be looking for support from here.

Potentially offering relief, the US reported 3.5% annual GDP growth overnight, beating expectations of 3.4%. Increased consumer spending playing its part coming in at its highest level since the end of 2014.

China and Japan sign currency deal, ditch US dollar

The two Asian powerhouses sealed a multi-billion dollar currency swap arrangement, aimed at improving financial stability and spurring business activity in both countries.

According to the Bank of Japan, the deal will allow the exchange of local currencies between the two central banks for up to 200 billion yuan or 3.4 trillion yen (US$30 billion). The deal will last until 25 October, 2021.

With China and Japan being the two two main holders of the US Treasury securities and seeing their holdings sold down of notes and bonds in August the US may need to rethink its aggressive stance that has been the status quo over the past few decades.

The global shift away from the US dollar in global trade has become a trend amongst many nations including Russia, China, Japan, Iran, Turkey, Venezuela, and the rest of the BRICS block.

Essentially countries that will later be sanctioned by the US for doing so, propagandised by the mainstream media or invaded militarily.

Others that found ditching the US dollar is not as easy as it seems includes Iraq, Iran, Libya and Syria. All facing the common trend of timely US military intervention.

However with Russia stating that it’s a matter of national security to move away from US dollar dependence and now the rest of Asia moving away as well, we are well and truly witnessing the gradual dethroning of the US dollar as the world’s reserve currency.

Russia having recently sold off nearly all of its US debt, now sitting at US$14 billion from its 2011 level of US$180 billion, and acquired gold instead. India joining suit and dumping over $15 billion in US government bonds recently.

AMP shares hit record low

It has been a year to forget for AMP (ASX: AMP), as we reported back in August the insurance and fund manger giant faces an uncertain future.

The company’s stock is down over 25% in the past month alone, with profit falls and the Royal Commission taking its toll.

AMP has previously admitted that it charged customers for advice they never received and also mislead corporate watchdog ASIC.

This week AMP announced the selling off of its Australian and New Zealand insurance businesses to Resolution Life for $3.3 billion and also revealing the planned float of its remaining New Zealand business in 2019.

Along with the news, AMP revealed a massive outflow of $1.48 billion in funds as customers took their money out of the troubled wealth manager.

Small cap stock action

The Small Cap index plunged more than 5% this week to close Friday at 2,545.2 points, down 10.31% over the past month.

Despite the deeper fall into the red, several shining stars broke through the clouds, with notable news:

Impression Healthcare (ASX: IHL)

Impression Healthcare began the application process this week to obtain various medical cannabis licences from Victoria’s health department and the Australian Government’s Office of Drug Control.

Once it secures the licences, Impression will be able to import, store, distribute and export medical cannabis products from its Melbourne facility.

To boost its foothold in Australia’s medical cannabis sector, Impression inked a deal with US-based cannabis supplier AXIM Biotechnologies.

As part of the deal, Impression will distribute AXIM’s cannabinoid-based products.

Paradigm Biopharmaceuticals (ASX: PAR)

Paradigm Biopharmaceuticals snapped up a heads of agreement with US-based Pro Players’ Elite Network, which has a membership of more than 11,000 retired NFL players and elite athletes.

Under the agreement, the companies will use the network to identify US athletes with knee and joint complaints.

Paradigm will treat the sufferers with its injectable Pentosan Polysulfate Sodium, which is also under trial in Australian Football League players.

The injectable drug has been used in more than 125 Australian athletes as part of a clinical trial with 85.6% of those treated reporting a reduction in joint pain and a further 91.2% indicating improved knee function.

Esports Mogul (ASX: ESH)

Over in the eSports arena, Esports Mogul unveiled two updates this week, which include a VIP subscription feature to its online eSports tournament platform and news its Mogul Android app has moved to the quality assurance testing phase.

VIP subscribers will have access to exclusive tournaments, private Esports Elite leaderboards, extra rewards for daily tournaments, profile personalisation and “customised prizing rewards”.

Meanwhile, the Mogul app is designed as a companion to the desktop Mogul Arena platform and will allow users to manage upcoming matches and communicate with other gamers.

A second version of the app is due for release in the March quarter of next year and will allow users to play leading mobile eSports titles from their smartphones. The updated version will also provide expanded access to Esports’ Esports Elite feature.

BARD1 Life Sciences (ASX: BD1)

Biotech stock BARD1 Life Sciences has achieved high diagnostic accuracy in its early breast cancer detection blood test.

The BARD1 BC test uses the same diagnostic platform as the company’s ovarian screening test, and was able to distinguish between malignant and benign breast cancer lesions, with studies revealing “high diagnostic accuracy” across all subtypes and stages.

Screening was undertaken in women with familial accumulation of breast cancers and identified mutations in the breast cancer genes BRCA 1 and BRCA 2.

“This development addresses an unmet need for an accurate, reliable and affordable blood test to detect breast cancer early,” BARD1 Life Sciences chief executive officer Dr Leearne Hinch said.

Engage:BDR (ASX: EN1)

Engage:BDR has integrated IPONWEB’s BidSwitch into its platform, which it says will give agencies, supply-side platforms (SSPs), demand-side platforms (DSPs) and publishers supply, demand and services to attract and engage audiences in real-time.

BidSwitch is connected with more than 400 of the world’s largest DSPs and SSPs to link and trade media across the display, mobile, native, video, TV, DOOH and VR ecosystems.

Engage:BDR anticipates integrating BidSwitch will have a “significant impact” on its revenue, due to the “sheer incrementality (partner overlap), volume of bids and access to hundreds of programmatic players, which would be new for [the company]”.

The news follows Engage:BDR’s announcement it was working with renowned social media expert and “influencer marketing pioneer” Dan Fleyshman.

Mr Fleyshman and Engage:BDR chief executive officer Ted Dhanik spoke this week about the importance of social media-focused advertising and the growing significance of influencer marketing on brand recognition.

Security Matters (ASX: SMX)

Supply chain integrity and blockchain technology company Security Matters filed a patent application with the US this week for its technology that can detect and extract plastic particles found in packages, stacks, bales and crops within the farming industry.

The marking technology can be applied to plastic products like films, nets, and packages, which makes it easily identified within crops for removal.

According to various research, about 700,000t of microplastic is added to farms throughout the US and Europe, with the material affecting water supplies, crops, produce and the environment.

Security Matters joined the ASX last week with its marking technology providing companies a safe and effective way of tracking items and offering a tamperproof record throughout the supply chain.

Invigor Group (ASX: IVO)

Invigor Group has moved an existing memorandum of understanding with China’s Winning Group Holdings to “unconditional” status.

The three-month trial period was waved and under the now binding agreement the duo will deploy Tencent Holding’s WeChat Pay throughout South East Asia.

WeChat is one of China’s most popular payment and social platforms with more than 1 billion users and 900 million actively using WeChat Pay.

“In the short time since we announced the memorandum of understanding with Winning Group, we have quickly promoted the merits of our WeChat relationship to leading brands, retailers and mall owners in Singapore and Hong Kong,” Invigor chief executive officer Gary Cohen said.

High Grade Metals (ASX: HGM)

Austria-focused mineral explorer High Grade Metals started drilling its wholly-owned Schellgaden gold project, with the first phase drilling campaign estimated to take a maximum of six weeks to complete.

One rig will be initially operating at the 126sq km project, with two more rigs to be transported from the company’s Leogang copper-cobalt project when the drilling campaign has been finished there.

Drilling at Schellgaden will focus on the historic Stublbau workings where gold has been mined for centuries.

The campaign will also test the geological connections between Stublbau and the Katschberg transport tunnel. However, High Grade managing director and chief executive officer Torey Marshall said the targets may change based on geology, logistics, time and ongoing drill results.

Dubber Corporation (ASX: DUB)

Dubber has snapped up an agreement with IBM to create a recording solution to capture and analyse voice data.

The embedded solution agreement will combine IBM’s Watson artificial intelligence technology with Dubber’s cloud-based call recording capabilities to offer clients a comprehensive analysis of their recorded calls and meetings.

According to the duo, the combined technology will be offered as a software-as-a-service product to businesses and governments globally, with the duo to kick-off the offering in the Asia Pacific.

The analysed recordings will enable companies to understand and caption customer sentiment, identify business process improvements, and help companies meet industry compliance requirements.

Longtable Group (ASX: LON)

Food and beverage company Longtable Group reported it had a positive September quarter, with initial numbers indicating its St David Dairy business sales grew 33% on the same period in 2017.

Additionally, the company’s Maggie Beer Products division outperformed the board’s expectations and delivered a profitable quarter.

The company’s Paris Creek Farms brand was relaunched in South Australia and will be rolled out across the nation in the coming weeks.

Meanwhile, Longtable directors Tom Kiing and Tony Robinson both scooped up shares in the company, with Mr Kiing buying $447,000-worth on-market, and Mr Robinson purchasing $40,382.

IPOs this week

Readers of Small Caps that want to view upcoming IPOs or see the stocks that have listed in 2018 and how they are performing can now do so.

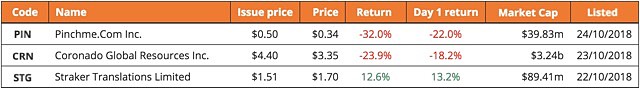

The latest stocks to make their way onto the ASX this week include:

Straker Translations (ASX: STG)

New Zealand-based Straker Translations has developed a hybrid translation platform that uses a combination of machine translation and a pool of freelance translators.

The cloud-based platform manages the end-to-end translation process to create a first draft translation before going to a freelance translator for refinement.

Straker joined ASX ranks on Monday after raising $21.2 million through the issue of 12.185 million shares at $1.51 each. The company also sold 1.87 million shares at $1.51 each to Straker SaleCo.

After reaching a $1.91 high after listing, Straker finished the week at $1.70 – up more than 12% on its offer price.

Coronado Global Resources (ASX: CRN)

US-headquartered Coronado Global Resources joined the ASX club on Tuesday to advance its metallurgical coal operations in Australia and the US and capture the growing steel market.

The company issued 290 million CHESS Depositary Interests (CDI) at between $4.00 and $4.80 per CDI to raise up to $1.39 billion.

The offer was to provide Coronado liquidity and enable others to invest in the company, while funds will be used to pay down existing debt and provide financial flexibility to pursue growth opportunities.

Coronado’s price slipped to end the week at $3.35 per CDI after bouncing between a $3.84 high and $3.05 low.

PINCHme.com Inc (ASX: PIN)

New York-based PINCHme.com started trading on Wednesday after raising $8 million through the issue of 15.9 million CDIs, which equated to 45,070 shares.

The issue price was $0.50 per CDI, which was equivalent to $177.50 per share.

PINCHme operates a product sampling and digital promotions platform which matches large fast moving consumer goods brands with PINCHme’s members.

PINCHme has collated comprehensive personal data on its members including their personal spending habits. In return, members receive free product samples.

Meanwhile, PINCHme’s fast moving consumer goods clients receive product reviews, insights, social media engagement and consumer feedback.

The company ended the week at $0.34 – down 32% on its offer price.

The week ahead

In Australia, inflation numbers are out on Wednesday, with 0.4% growth forecast for the quarter, 1.9% year-on-year.

September figures are due for new home sales and building approvals, showing if the housing sector has managed to stem declines, having fallen consistently in recent months.

Also trending to the downside, retail figures out on Friday will give an indication if the sector has managed to halt recent declines.

Employment, non farm payroll data and manufacturing numbers out of the US will be ones to watch, with the US experiencing record unemployment under Trump.

However it should be noted that if measured using the same yardstick in 1980, the real unemployment rate is around 20%, as people not looking for work after a certain timeframe are no longer included along with a host of other changes to make the data look better than it is, George Orwell style.

With the US midterm elections coming up on 6 November, expect the battle between Trump and the mainstream media to intensify in the coming days as the establishment propaganda machines go into overdrive, also we can expect to see the career politicians pull out their dirty tricks to try sway influence and public opinion.

With the country divided on so many issues, particularly politically, these elections could have major impacts on the markets and abroad depending on how it plays out.

Over in China, manufacturing and industrial profit numbers are ones to look out for.

However after watching ‘The China Hustle‘ documentary, you really have to start wondering how reliable the data coming out of China is, both from the government and public companies. Recommended weekend viewing.