Australian Government launches plan to capture opportunities in critical minerals

The new policy aims to create the investment opportunity, innovation and infrastructure required for Australia to reach its potential in the critical minerals sector.

The Australian Government has mapped out an ambitious plan to position Australia as a “world powerhouse” in the minerals that drive the energy, renewable and aerospace industries.

Dubbed the Critical Minerals Strategy, the recently released plan sets a vision for Australia to lead the way in the exploration, extraction, production and processing of critical minerals.

Essentially, the strategy outlines a policy framework for the nation’s critical minerals with the goal of creating the conditions needed to develop the emerging sector by supporting innovation and attracting new investment.

Trade, Tourism and Investment Minister Simon Birmingham said Australia was well-placed to capture the value on offer through rising global demand for the minerals.

“We have some of the world’s richest stocks of critical minerals and while the market for some of our minerals such as lithium is relatively mature, other minerals markets such as cobalt remain largely underdeveloped in Australia,” he said.

“We’ve got the stocks, we have the potential and now we need to develop the downstream and high-value activities right here in Australia such as processing and manufacturing.”

What are critical minerals?

Critical minerals are considered essential for the economic and industrial development of major and emerging economies.

They are minerals used in high-tech and high-value products, including electric vehicles, rechargeable batteries, electronics, mobile devices and defence technologies.

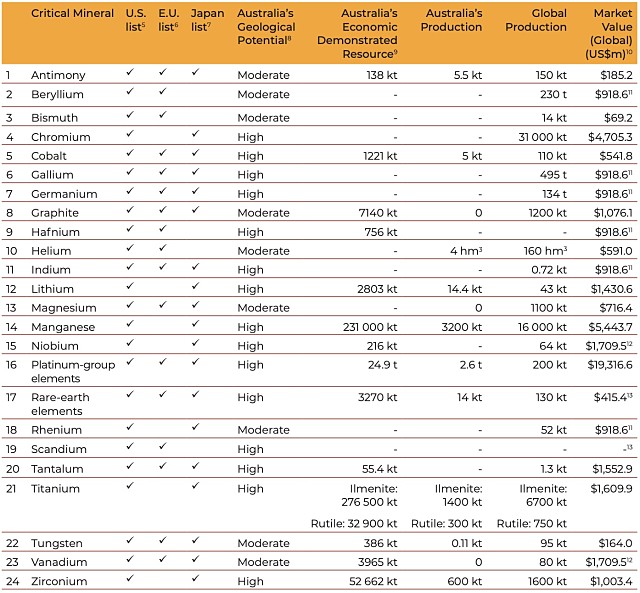

The government’s strategy lists a total of 24 critical minerals present in Australia, which include graphite, manganese, scandium, cobalt and lithium.

Table of the 24 critical minerals in Australia.

Technological change and advancements have been a major demand driver for critical minerals, particularly lithium, cobalt and rare earth elements.

The government report highlighted Australia’s abundant critical mineral endowment, with the nation holding the world’s third largest reserves of lithium.

Australia is also ranked sixth in the world for rare earth elements and second for production, with the report noting that many of the deposits remain untapped.

While Australia is moving up the lithium value chain, other critical minerals, such as cobalt, have been slower to advance.

“With the right supporting framework, the government expects cobalt and other critical mineral markets could develop in response to increasing global demand,” the report added.

Mineral riches

Minister Birmingham said the country’s critical minerals sector presented “huge economic opportunities”.

Lithium is already leading the charge, with Australia capturing about US$550 million of the lithium markets US$1.4 billion value in 2017.

The country’s lithium sector is relatively mature given Australia hosts most of the resources needed to make the lithium-ion battery. However, the government has recently expressed a desire to better seize the lucrative lithium-ion value chain.

In the Critical Minerals Strategy report, it highlighted that lithium hydroxide was worth almost 20 times more than unprocessed concentrate.

“This is a sign that our economy is moving to capture more of the full value chain of lithium, which is worth around A$213 billion annually.”

On the other hand, cobalt remains far more underdeveloped in Australia.

Cobalt, which is used in batteries, catalysts and pigments, is primarily produced as a by-product of copper and nickel ore processing and production.

While Australia has vast cobalt resources, the country’s cobalt operators only produced 4,971 tonnes of the metal in 2017.

Spurring investment

The government’s strategy has set out a raft of specific actions with the overarching aim of promoting investment in Australia’s critical minerals sector, providing incentives for innovation to lower costs and connect current and pipeline critical minerals projects with infrastructure development.

On the investment pillar, the report noted that the ability to attract new sources of capital remained crucial to the development of the country’s critical minerals sector.

Major critical mineral operations located in Australia.

As part of the plan, the investment component will focus on improving the data and knowledge base of Australia’s resource potential as well as identifying potential investors and off-take opportunities for Australian projects.

The government’s trade and investment agency, Austrade, will be the key vehicle to promote more international investment in the country’s critical minerals sector, specifically in downstream projects and greenfield opportunities.

Propelling innovation and infrastructure

A range of measures have been listed in the report with the goal of developing an “innovative critical minerals sector that is globally competitive.”

The report stated that development of new technologies and the improvement of extraction processes by Australian operators were essential in helping to reduce the cost of critical mineral extraction and improve the environmental impact of the separation of critical minerals.

In line with the innovation push, the government has earmarked A$20 million of funding in round seven of the Cooperative Research Centre Projects program for projects with a specific focus on critical minerals.

In addition, the Cooperative Research Centre for Optimising Resource Extraction will receive A$34.45 million from 2016-2021 to develop energy-saving and resource-expanding technology that will allow lower-grade ores to be economically and eco-efficiently mined.

On infrastructure, the strategy aims to connect “critical minerals opportunities with infrastructure developments.”

The report noted that road upgrades could reduce commercial costs for operators of critical minerals by improving roads’ flood immunity to reduce road closures during wet seasons, supporting more productive heavy vehicle access and usage, and improving access to key infrastructure, such as ports.

For example, lithium mines and production around Port Hedland in the northwest of Western Australia are set to benefit from upgrades to the Marble Bar Road – Coongan Gorge, which is being financially aided through the Northern Australia Roads Program (NARP).

“Australia has a track record of building the infrastructure required to mine and transport its natural resources to global markets,” the report stated.

“This can be expected to continue in the case of critical minerals.”

Over in the United States, under president Donald Trump, the nation has similarly laid out a strategy to secure 35 minerals deemed critical for nation security and economic prosperity.