A dramatic pullback late in the day saw the Australian share market give up all of its Friday gains and plunge 0.7% as sudden fears over the future direction of US interest rates took hold.

Gold shares were particularly hard hit by rumours the US President was about to nominate Kevin Warsh as the next US Federal Reserve Chair took hold.

Warsch seen as more hawkish than other choices

A former Fed governor, Warsch was seen to visit the White House after President Trump said he would announce the new Fed chair on Saturday Australian time.

Warsch is seen as less likely to introduce a rapid series of interest rate cuts than some of the other candidates for the job, which caused a crunch in the price of gold and plenty of collateral damage to the price of Australian gold shares.

From gains to sharp losses as bullion drops 5%

During the afternoon crunch which was the biggest fall in nearly two weeks, the ASX 200 dropped 58.4 points, or 0.7%, to 8869.1 points after it had earlier risen to 8971.6 points.

Despite the fall, only 4 of the 11 sectors ended lower and the index remained up 1.8% for January and was also up 0.1% for the week.

Gold bullion fell as much as 5% on the Warsh speculation, settling at around US$5200 an ounce and the US dollar rose.

Silver ended near US$111 an ounce and the Australian dollar slid 0.7% to about US70.05¢.

Materials bear the brunt

Materials was the worst hit sector on the ASX, falling more than 3% as investors dumped gold shares.

Some of the worst hit included Ora Banda (ASX: OBM) shares which fell 11.7% to $1.28, while Newmont shares (ASX: NEM) lost 7.9% to $173.53 and Genesis Minerals (ASX: GMD) shares fell 9.9% to $7.59.

Even the big miners were hit by the fall, with Rio Tinto (ASX: RIO) shares down 3.5% to $151.55 and BHP (ASX: BHP) shares (ASX: BHP) down 1.8% to $50.57.

Defensive earnings sought

Defensive shares had a rare day in the sun with health care outperforming as investors looked for refuge before an expected Reserve Bank of Australia rate rise in the coming week.

CSL shares (ASX: CSL) rose 1.1% to $181.42, while the sleep device company ResMed shares (ASX: RMD) climbed 3.1% to $37.54 after beating second-quarter earnings forecasts.

Energy stocks headed in both directions.

Whitehaven Coal shares (ASX: WHC) fell 6.7% to $8.83 as investors took some profits off the table after a 13% rise for the month.

Oil and gas companies were still trading well with Woodside shares (ASX: WDS) up 0.8% to $25.37 and Santos shares (ASX: STO) up 2.5% to $7.01.

Nine Entertainment shares (ASX: NEC) climbed 5.1% to $1.14 as it paid $850 million for digital outdoor advertising group QMS Media and sold its radio arm to the Laundy family.

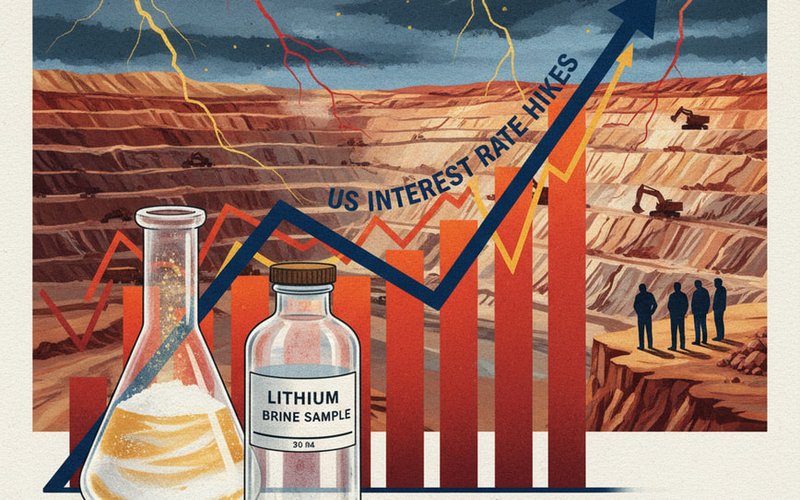

Shares in lithium miner PLS (ASX: PLS) fell 6.5% to $4.29 after reporting a solid December quarter, with higher realised lithium prices driving a 49% jump in revenue to $373 million despite lower production volumes.

Shares in Star Entertainment (ASX: SGR) fell sharply by 15.6% to 13.5¢ after it warned of ongoing uncertainties following a pre-tax and interest profit of just $6 million in the December quarter.

The week ahead

There are no prizes for guessing which announcement for the coming week will be the most talked about, with the Reserve Bank now highly likely to increase official cash rates at its first meeting for the year on Tuesday.

While the focus will still be on the actual decision – which is now odds on to be a rise due to firming inflation numbers – there will also be plenty of analysis about whether this will be a one-off rise or the first in a series of rises.

High chance of interest rate rise

Most economists are backing a rise on Tuesday due to underlying inflation pressures becoming more entrenched but the jury is still out about whether the board will opt for a single rise before waiting for later figures or embark on a series of rises to really quench inflationary pressures.

Either way the chances are that after Tuesday official interest rates will rise by 0.25% to 3.85%, causing a cascade effect through home loans, other loans, and deposit rates.

RBA Governor Michele Bullock will also testify before Parliament on Friday.

In the UK, the Bank of England (BOE) is expected to hold its benchmark interest rate at the current 3.75%, despite UK inflation remaining the highest in the G7.

The European Central Bank is also expected to hold its benchmark rate at 2% on Thursday amid divided opinions about the inflation outlook.

Other things to watch out for overseas include US job figures and China's manufacturing numbers.

Corporate profit season arrives

Locally, there are some other highlights, including home values, job advertisements, and building approvals, but the biggest news will be the arrival of the corporate reporting season.

Some of the companies reporting include Credit Corp, Amcor, Centuria Office REIT, Boss Energy, Pinnacle Investment Management, Beach Energy, Garda Property, News Corp, and REA Group.

The fourth quarter results in the US also continue with some of the reporting companies being Walt Disney, Palantir Technologies, AMD, Amgen, Merck, Mondelez, PayPal, PepsiCo, Pfizer, Take-Two Interactive Software, Alphabet, Eli Lilly, Novo Nordisk, Uber Technologies , ARM Holdings, Ford, Qualcomm, Snap, Amazon.com, Barrick Mining, Bristol-Myers Squibb and Estee Lauder.