Dividends may be coming to the rescue of the Australian share market, which finally eked out a 4 point rise to close out the week.

That still represented a 0.2% fall for the week after Monday’s catch up crunch from Friday falls but the result could have been worse.

It has been a monster week for juicy dividends, with the likes of Telstra (ASX: TLS), Commonwealth Bank (ASX: CBA) and BHP (ASX: BHP) depositing money into shareholder bank accounts, some of which is likely to be filtering back into the market.

All told around $9 billion of dividends was paid out this week alone, which may have been enough to account for the marginal daily rise, which was contributed to by an improved performance by the financial, healthcare, retail and mining sectors.

Good March quarter more than erases terrible December one

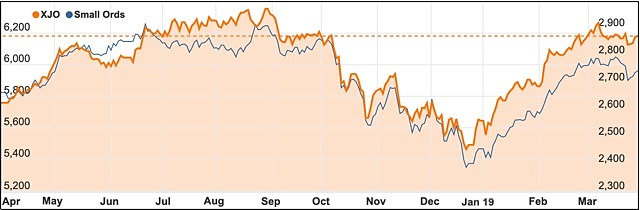

The last trading day of the March quarter pretty much completed a 9.8% reversal of the terrible December quarter’s 9.04% fall.

That means we have had a great start to the calendar year on the share market but we’re still only just ahead of where we were way back in October last year.

The geopolitical concerns that forced the market down and then up again still remain dominant with the US-China trade dispute and continuing tortuous Brexit negotiations keeping a lid on expectations, along with sluggish economic growth in many parts of the world.

Iron ore supply continues to tighten

There is a bit of individual company news around with Rio Tinto (ASX: RIO) declaring force majeure on some iron ore contracts as it assesses damage to its Cape Lambert port facility following Cyclone Veronica.

That comes on top of Brazilian iron ore giant Vale confirming that up to 75 tonnes, or 4.7% of its normal production, was lost due to mine closures after the tragic tailings dam collapse.

Despite the potential damage at Cape Lambert, Rio Tinto’s share price was up 1.6% to $97.91.

Goat and organic baby food supplier Bubs Australia (ASX: BUB) remained on a trading halt ahead of an announcement regarding a proposed acquisition and capital raising.

BUB shares have jumped by an amazing 43% in March after the company entered a distribution partnership with a Chinese company.

The share slide in fleet management group Eclipx Group (ASX: ECX) continued after its proposed merger with McMillan Shakespeare fell over, more than halving its share price.

During the week, its shares fell a further 14.1% to $0.64.

Rare earths company Lynas Corp (ASX: LYC) added 28.6% to $2.09 after Wesfarmers (ASX: WES) made a $1.5 billion takeover offer.

While Wesfarmers said it had the management and money to solve the company’s Malaysian processing problems, Lynas has not been impressed by the offer and is standing firm about remaining independent.

Small cap stock action

The Small Ords index recovered 1.3% for the week to close at 2,744.7 points.

Among the companies making headlines this week were:

Leigh Creek Energy (ASX: LCK)

Leigh Creek Energy announced it had upgraded its resources to reserve status this week for its namesake syngas project in South Australia.

The new estimate has been reclassified from a 2C contingent resource to a 2P reserve of 1,153PJ, which is equivalent to 1.1 trillion cubic feet.

According to the company, this upgrade confirms the Leigh Creek project as holding one of Australia’s biggest undeveloped and uncontracted gas reserves.

Leigh Creek is looking to sell its syngas into urea-based fertiliser products as well as the east coast gas market.

Gooroo Ventures (ASX: GOO)

Career solutions technology company Gooroo Ventures has teamed up with Microsoft to roll-out its technology across universities, schools and colleges worldwide.

The agreement has two phases, with Microsoft to pay Gooroo to test and refine its career planner application under the first phase.

This is scheduled to be completed by the end of June, with the duo to agree to commercial release terms and the model for large-scale delivery of Gooroo’s application before the end of July.

“This deal signifies how Gooroo’s unique technology and human thinking science is being applied to address a globally recognised problem that effects millions of students each year,” the company stated.

White Rock Minerals (ASX: WRM), Sandfire Resources (ASX: SFR)

Junior mineral explorer White Rock Minerals has secured the backing of mid-tier explorer Sandfire Resources to advance its Red Mountain project in central Alaska.

The high-grade zinc and precious metals project will be explored via a joint venture agreement, where Sandfire can earn into the interest by spending a minimum of $20 million over four years, giving it a 51% interest.

Sandfire can elect to increase its interest in the project to 70% by sole funding $10 million on exploration and delivering a pre-feasibility study.

Red Mountain hosts two high-grade deposits with an inferred resource of 9.1Mt at 12.9% zinc equivalent for 1.1Mt of contained zinc equivalent.

Winchester Energy (ASX: WEL)

Winchester Energy has had a positive week at its White Hat 20#3 well after reporting it had observed oil and gas shows throughout the Caddo Formation and in three out of three of its targets.

Oil and gas shows were observed from 6,565ft to 6,650ft within the formation, which was not a target, but a known oil producer in the surrounding Permian Basin.

The positive results follow from the primary upper Strawn Sand target exhibited good to excellent oil and gas shows, as well as shows in the Strawn Lime and Three Fingers shale.

Once wireline logging has been completed, the well will be cased and then deepened to test the Ellenburger Formation.

Chesser Resources (ASX: CHZ)

Initial drilling at Chesser Resources’ Diamba Sud project has intersected high-grade gold.

Assays from the first phase of a 5,000m reverse circulaiton program at the eastern Senegal project have returned 18m at 5.61g/t gold from 6m, including 8m at 11.84g/t gold from 14m; 10m at 2.72g/t gold from 19m, including 1m at 16.30g/t gold from 23m, and 8m at 3.48g/t gold from 34m.

Chesser expects to complete the current program shortly and will report assays as they come to hand.

Diamba Sud encompasses 53.2sq km over the gold-bearing Kedougou-Kenieba Inlier and only 2km from the Senegal Mali shear zone which hosts several multi-million-ounce gold deposits including Barrick’s 18Moz Loulo-Gounkoto complex.

Lithium Consolidated (ASX: LI3)

Lithium Consolidated has managed to bag two lithium exploration licences in Mozambique’s Alto Ligonha pegmatite province, making it the first ASX-listed company to enter Mozambique for hard rock lithium.

The licences cover 10.98sq km and were previously exploited for beryl, tantalite and rare-element minerals.

Meanwhile, the company received an extension to due diligence, which is carrying out at the Bepe and Kondo historical hard rock lithium assets in Zimbabwe.

Under the extension, Lithium Consolidated can carry out due diligence until 15 April 2019.

Authorised Investment Fund (ASX: AIY)

Authorised Investment Fund’s equity in Asian Integrated Media is looking to be more fruitful after the investee company reported it had hooked an exclusive media sales deal with the publisher of in-house guest magazines for the world’s largest luxury hotel chains including Conrad, Four Seasons, Ritz Carlton and Waldorf Astoria.

US-based publisher Pace Communications has granted Asian Integrated Media the responsibility for its hotel in-house guest magazines’ advertising sales throughout Asia and Australia.

“We are delighted to be working with such prestigious, luxury hotel brands, and, in particular, for Asian Integrated Media’s advertiser client base to promote their brands specifically within the China market,” Asian Integrated Media founder and chief executive officer Peter Jeffery said.

“This deal compliments so much of what our company is already doing working with many of the world’s leading airlines and our Travel Elite digital advertising and programmatic advertising platform,” Mr Jeffery added.

IPOs this week

Small Caps readers who want to view upcoming IPOs or see the performance of stocks that have listed in 2019 can now do so.

The latest company to make its way onto the ASX this week was:

Ecofibre (ASX: EOF)

Ecofibre was added to the official list on Friday after raising $20 million in its IPO by issuing 20 million shares at $1.00 each.

Ecofibre provides hemp products to US and Australian markets and the company is experienced in breeding and growing the material.

The company’s products include nutraceuticals for humans and pets, as well as protein powders, hemp seed and oil.

Ecofibre is also working on its Hemp Black product which is hemp-based products in textiles and composites, with IPO funds to accelerate the commercialisation of Hemp Black and its Ananda Food brand.

During its first day of trade, Ecofibre rocketed as high as $1.75 before closing at $1.70, a 70% premium to its IPO issue price.

The week ahead

We are heading for a very busy week of announcements in Australia with the handing down of the Federal Budget on Tuesday the main event, although the Reserve Bank’s interest rate decision on the same day will also be closely watched for any signs of a move towards cutting rates.

Most of the rumours have next year’s budget already in surplus, with an announcement of some further income tax cuts above those already planned highly likely.

There could also be some other surprises as well, although any joy over budget plans will necessarily be muted due to the fact that we will face an election straight afterwards which could well see Bill Shorten installed as Prime Minister.

That would involve ripping up this budget and starting again, something that will be hinted at in the budget reply address and during the election campaign.

Other than these big-ticket items, the main interest will be in home price figures, trade numbers and new car sales with some offshore highlights including US retail trade and construction spending.

There is also expected to be another Brexit vote in the UK House of Commons and the US-China trade talks are continuing.