Two really pivotal events really drove markets this week – the Reserve Bank’s decision to wind back stimulus and countenance higher interest rates and the gangbusters reception for Australia’s first cryptocurrency ETF.

While both events were at least partly predictable, the arrival of more certainty helped to drive the market higher than sheer speculation could.

The Reserve decision to wind back bond purchases and the rhetoric behind the 2024 target for official interest rates climbing off the 0.1% floor was a realisation that financial gravity does work.

It allowed bond yields to float upwards where the bond market was more comfortable, factored in the arrival of inflation – albeit with a hopeful transitory vibe – and stopped everyone fretting about a battle between the RBA and recalcitrant bond traders.

For the RBA it allows some precious breathing time in which it can keep a close eye on the data, without losing its shirt buying too many bonds that fatten up the balance sheet like a Christmas goose for little practical benefit.

Built up demand for crypto

It was a similar story for crypto – or, more specifically, BetaShares Crypto Innovators ETF (ASX: CRYP) – which had an absolutely gangbusters debut on Thursday.

In just 15 minutes of trading it had blitzed the previous record for first day ETF volume of $8 million, on its way to a stellar $39.7 million of net buys and massive volume for its first day.

That shouldn’t have been a surprise – there has been incredibly strong interest in crypto investments in Australia for a couple of years – so when an easy to trade opportunity arrives that pent up demand was a given.

However, with Crypto containing a range of exposures to crypto mining and blockchain-related companies including Silvergate Capital Corp, Marathon Digital Holdings Inc, Galaxy Digital Holdings Ltd and Coinbase Global Inc, this is hardly a pure exposure to Bitcoin and Ethereum.

More crypto based ETF’s on the way

It does give an indication of what is in store once investors can trade the spot price of the two larger crypto coins – something that is not too far away now that the Australian Securities and Investment Commission (ASIC) has given the thumbs up providing a long list of guidelines is followed.

With even larger investors such as institutions and family offices keen to get some easily traded exposure to crypto, this should be both a fertile and volatile investment theme as the crypto arena really goes mainstream.

Central banks and crypto – who has the discipline?

Arguably, the two events are even linked loosely, with the furious money printing and quantitative easing driven bond buying of the world’s central banks a stark contrast to the much more disciplined supply rules surrounding Bitcoin and many other crypto assets.

In an era in which cash literally has been debased by chronic oversupply and emerging inflation, who is to say that those trading crypto assets are really the speculative players here?

The end result of this increased certainty was that the Australian share market charged through its best week since May, with some good corporate news helping things along.

Broad gains in gold and positive corporate news

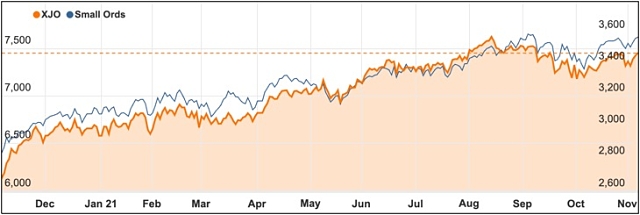

The ASX 200 closed up 0.4% or 28.9 points to 7456.9, with all sectors posting gains for the week aside from energy which fell again on Friday on a weaker oil price.

Interestingly, Australian gold stocks were among the better gainers after the RBA, the US Federal Reserve and the Bank of England all said they were not in a rush to raise interest rates.

News Corp shares (ASX: NWS) jumped 7% to close at $33.90 after a really strong result, including a billion dollar buyback and indications that a potential float of Foxtel is looking more likely.

REA Group shares (ASX: REA) jumped 8% to a record intraday high of $180.67 in response to its first quarter results.

Link Administration (ASX: LNK) was the other big performer after Private equity firm Carlyle returned to the table with a $2.8 billion offer which sent its share price zooming before it closed up 8.5% higher at $4.70.

It wasn’t all great news with Afterpay (ASX: APT) shares hit by Square’s results Friday morning, closing down 5.5% at $117.50, after its suitor reported soft revenue from bitcoin trading for the September quarter.

Small cap stock action

The Small Ords index rose a stellar 2.02% for the week to close on 3573.7 points.

Small cap companies making headlines this week were:

AML3D (ASX: AL3)

It was a big news week for additive manufacturing company AML3D which sold its second Arcemy 3D printer to an Australian university and secured a contract with an aerospace company.

The Royal Melbourne Institute of Technology (RMIT) has purchased the Arcemy printer for $400,000. RMIT will use the unit for post doctorate research, education and industry-related initiatives.

AML3D has also been engaged by an undisclosed US aerospace entity to produce a specialised 3D printed high-strength alloy part using its wire additive manufacturing technology.

With this contract, AML3D plans to build understanding of its technology and establish strategic relationships within the global aerospace industry.

Invex Therapeutics (ASX: IXC)

As part of its strategy to secure global registration for its lead drug Presendin, Invex Therapeutics will proceed with a phase III clinical trial focused on meeting regulatory requirements in the EU, UK, US and Australia.

The trial will evaluate Presendin in treatment of idiopathic intracranial hypertension (IIH) and use the design and advice received from the European Medicines Agency.

About 240 patients will be recruited for the study which will be undertaken across Europe, the UK, Australia and US.

The trial’s endpoints will involve assessing the difference in intracranial pressure from baseline to 24 weeks, as well as evaluating vision and monthly headache days.

Angel Seafood (ASX: AS1)

October heralded a new record for Angel Seafood which reported an all-time monthly high in oyster sales and revenue.

In October, Angel sold 1.4 million oysters, which was a 20% increase on September’s levels and 100% higher than October 2020.

The record sales propelled Angel to hit a new monthly revenue high of $1.2 million.

Angel chief executive officer and founder Zac Halman said the increased sales were a result of mounting demand within its retail channels and the restaurant and food service industries re-opening as Victoria and NSW emerge from lockdowns.

Argenica Therapeutics (ASX: AGN)

Pre-clinical studies of Argenica Therapeutics’ drug ARG-007 have yielded positive results when it is used in animal models with hypoxic-ischaemic encephalopathy (HIE), which occurs when the brain is damaged from not receiving oxygen or blood flow.

HIE can occur in adults, but it is a more common problem in infants that are impacted by an oxygen depriving event during birth.

In infants, the condition is known as perinatal asphyxia or perinatal hypoxia-ischaemia.

Argenica’s ARG-007 was originally designed to treat stroke victims, but when administered immediately following hypoxia-ischemia in an animal model it was found to “very significantly” lower the volume of brain tissue death.

TZ Limited (ASX: TZL)

Cloud-based smart technology developer TZ Limited has collared more than $1 million in new contracts, including a purchase order from Chevron.

Chevron has contracted TZ to install 2,800 smart lockers at its new Perth headquarters.

This follows TZ securing a contract to supply hardware and software to CSL’s headquarters. This contract comprised 2,000 smart storage lockers.

TZ is also in the process of expanding its smart technology offering and shifting its business model to recurring software as a service revenue rather than one off installations and perpetual licences.

Vintage Energy (ASX: VEN)

Gas explorer Vintage Energy completed flow testing of its Odin-1 well this week, which is located in Queensland’s Cooper Basin.

Prior to shut-in, the well achieved a stable raw gas flow rate of 6.5MMscfd on a 28/64-inch choke and well head pressure of 1,823psi.

The positive news on Odin-1 follows Vintage tripling gas reserves at its nearby Vali field.

An independent evaluation has estimated the field to have gross 2P reserves of 92Bcf – up from the previous 30.3Bcf.

Vintage noted the updated estimate included reserves from the Toolachee formation and an increase to those in the Patchawarra formation.

The week ahead

There are a few data points to watch out for this week, with the major one being the October jobs data.

Other highlights include business and consumer confidence, with some of that focus sure to be on indications of inflation pressures.

The jobs report could see the unemployment rate rise a whisker due to continued lockdowns in Sydney and Melbourne but the number of jobs is expected to rise.

Overseas the big focus will be on inflation readings in both China and the US with both countries also releasing consumer and producer prices data.

Front of everybody’s minds will be indications of the direction of inflationary pressures, although falling volatility indicators show that markets seem to be entering a more settled period at the moment.