Weekly review: RBA unleashes pincer movement to get Australia growing again

WEEKLY MARKET REPORT

This week has heralded an unprecedented pincer movement of fiscal and monetary policy designed to get the Australian economy growing again after the economic shock of COVID-19.

A week after Treasurer Josh Frydenberg unleashed what is undoubtedly one of the most stimulatory national Budgets in the world in terms of percentage of GDP, the Reserve Bank followed up that with a vow to really crunch down interest rates.

In signalling official rates will fall to just 0.1% from November, RBA Governor Dr Philip Lowe was also effectively announcing the arrival of Quantitative Easing or QE in Australia.

In short, the RBA will be buying bonds across the range of maturities up to ten years to really crush interest rates and ensure that State and Federal Governments will be able to borrow big, knowing they have a ready market for their bonds and very low loan servicing costs.

Get ready for falling loan and deposit rates

Businesses and consumers will similarly face lower borrowing costs, with short term rates of up to three years effectively being forced down to the same 0.1% as the cash rate through QE.

It is a pincer movement that should have the desired effect of boosting employment and force-feeding investment, given that leaving money on deposit will effectively become pointless.

Already record low term deposit rates are set to be run over again by the steam roller so the next couple of weeks offer perhaps the last opportunity for some time to lock away some still relatively puny cash returns that will nevertheless look heroic soon.

Instead, savings will be redirected towards investment, with the RBA’s $200 billion term funding facility for the banks sure to keep the loans flowing.

Aussie market running well while dollar is falling

This unprecedented pincer movement of fiscal and monetary policy was the primary reason why the Australian share market has been on a tear in October and looks like remaining strong for a while.

The Australian dollar will be kept low as 10-year bond rates fall, boosting exports while businesses are spoiled for choice with cheap finance, subsidised employment programs and higher unemployment throwing up the opportunity to pick up some talented and motivated staff.

Of course, there are many negatives around, both local and international with COVID-19 still ravaging Europe and the US, the US election sure to throw up plenty of changes whoever wins, international travel constraining immigration and many Australian households facing very difficult times financially.

Worries remain despite serious stimulus

Still, the fiscal and monetary settings could not be more accommodative so everything including the kitchen sink has been thrown at this COVID-19 recession so at least nobody will die wondering about what might have been.

As you might expect it was a strong week on the share market, even if some of the gloss came off on Friday as some profits were taken off the table.

The ASX 200 was down 33.5 points or 0.5% to close at 6176.8 points but still managed to add an impressive 1.2% for the week.

Heavyweights drag market back a little

The big miners, banks and blood products group CSL all fell on Friday, following on from a weaker session on Wall Street as US stimulus talks continued to disappoint.

Westpac (ASX: WBC) was the worst of the banks, down 0.6% to $18.66 and market leader CSL (ASX: CSL) ended down 0.7% at $299.

Mining titan BHP (ASX: BHP) fell 1.4% to $36.25 while Rio Tinto (ASX: RIO) fell 0.9% to $95.45 – not a bad result considering it reported a drop in quarterly ore shipments and iron ore prices fell.

Transurban (ASX: TCL) also lost 2.7% to $13.70 after a solid October so far, although the lockdown in Melbourne continues to slash traffic numbers on its central Citylink toll road.

The property sector also hit a bit of trouble with Mirvac (ASX: MGR) and Scentre Group (ASX: SCG) both falling 3.5%.

Double share price rise on new deal

In a rare example of a win-win deal, shares in Tyro Payments (ASX: TYR) were up 5.9% after it announced an alliance with Bendigo Bank (ASX: BEN) for the use of its payment solutions across Bendigo’s merchant network.

Bendigo shares were also up 2.5%.

As expected, the Australian dollar has been weakening against most global currencies, down 2.3% for the week at US70.75c.

Small cap stock action

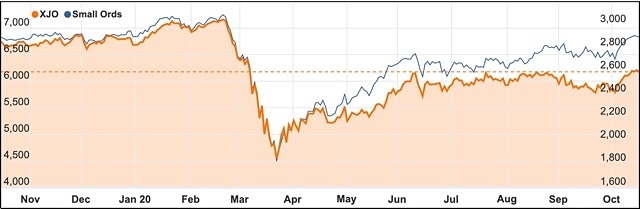

The Small Ords index gained a marginal 0.62% for the week to close on 2895.3 points.

ASX 200 vs Small Ords

Small cap companies making headlines this week were:

Azure Minerals (ASX: AZS)

Drilling at Azure Minerals’ 60% owned Andover project in WA’s west Pilbara has unearthed more nickel and copper sulphide mineralisation.

Following this mineralisation being observed in the first hole of the drill program earlier this week, the second hole has now intercepted 14.5m of semi-massive, matrix and disseminated nickel and copper sulphide mineralisation from 104.5m.

Azure managing director Tony Rovira said the holes validate previous geophysical modelling and interpreted locations identified from EM surveys.

Drill core has been sent for analysis with the assays from the first hole expected soon.

Angel Seafood Holdings (ASX: AS1)

Oyster producer Angel Seafood Holdings has experienced a record September 2020 quarter ahead of the upcoming peak demand season.

For the September period, Angel sold 2.7 million oysters, which was 78% higher than the same period in 2019.

The record sales have been attributed to increased retail penetration following the company’s fast-tracked retail strategy after COVID caused restaurant closures.

“We continue to receive positive feedback from our customers and are progressing initiatives to further increase retail penetration,” Angel founder and chief executive officer Zac Halman said.

Digital Wine Ventures (ASX: DW8)

Online beverage supplier Digital Wine Ventures had a busy week, revealing it wine distribution business WineDepot had experience a new record in processed orders.

As part of this, WineDepot has welcomed 17 new customers representing 34 new brands and bringing the total number of brands using the platform to 126.

Digital Wine Ventures followed up this news with an announcement it would acquire South Australia-based Wine Delivery Australia for $2.4 million.

The acquisition is expected to add more efficiencies to its beverage supply chain for both consumer and trade orders.

Wide Open Agriculture (ASX: WOA)

Wide Open Agriculture’s world first regenerative oat milk made from WA oats will be officially launched later this month, with the milk to be rolled-out across the state in November, then nationally and internationally throughout 2021.

Branded as OatUp, the first production run has now been airfreighted from the European manufacturer to WA.

“Launching our first packaged product, into the $2.8 billion plant-based milk category is an immense step forward for Wide Open Agriculture,” managing director Ben Cole said.

“OatUp will offer a new pathway for WA’s regenerative oat growers to reach conscious food consumers in Australia and Asia,” he added.

Meteoric Resources (ASX: MEI)

Gold explorer Meteoric Resources’ has hit more bonanza gold at its Juruena project in Brazil.

Several intervals exceeded 90g/t gold. Highlight assays were 11m at 2.34g/t gold and 0.28% copper from 42m, including 1.1m at 93g/t gold from 235.9m; 14.3m at 10.2g/t gold from 293m, including 0.6m at 109g/t gold from 297.4m.

Meteoric managing director Dr Andrew Tunks said the drilling program had produced enough positive results for the company to commit to updating the resource which will be included in an upgraded scoping study.

Drilling has also indicated there is a deeper copper-gold system at the project, with an IP program planned to fine a “potential tier one” copper-gold target.

Blackstone Minerals (ASX: BSX)

Nickel hopeful Blackstone Minerals unveiled a positive scoping study for its proposed Ta Khoa nickel mine and downstream processing plant in Vietnam.

The company plans to produce a precursor nickel for Asia’s lithium-ion battery sector, with the study estimating capital outlay of US$314 million to build an 8.5 year mine to generate 12,700t of nickel annually.

Annual pre-tax cash flow of US$179 million has been forecast from the operation. Blackstone noted there remains considerable upside to produce by-products and firm up more resources to underpin an even larger and longer operation.

Raiden Resources (ASX: RDN)

The latest junior to jump into WA’s booming gold space is Raiden Resources after it told investors this week it was acquiring a portfolio of assets in the Pilbara.

The company will acquire the 823sq km portfolio by purchasing Pilbara Gold Corp, which has the right to a majority interest in the assets.

Projects are believed prospective for gold, nickel, copper and PGE, with the Arrow gold project being adjacent to De Grey Mining’s Hemi gold discovery.

Raiden managing director Dusko Ljubojevic said the portfolio could “rapidly transform” the company with multiple tier one exploration opportunities available.

Tigers Realm Coal (ASX: TIG)

Russia-focused coal miner Tigers Realm will move to the next stage of its Amaam coking coal project development after securing a $10 million contract with UK-based Derek Parnaby Cyclones International.

The UK company will construct and supply the components for a 150tph modular coal handling and preparation plant, which will be installed at Amaam.

Tigers expects the new plant will enable it to sell a higher value product of consistent quality into global semi-hard coking coal markets.

To undertake civil works on site to support the plant’s installation, Tigers has engaged a local Russian engineering firm.

Navarre Minerals (ASX: NML)

Diamond drilling at Navarre Minerals’ 49% owned Tandarra project in Victoria has confirmed multiple gold structures, including returned a 1m interval grading 82.3g/t gold.

The mineralisation is 50km from Kirkland Lake Gold’s high-grade Fosterville mine and within the state’s 22Moz historic Bendigo goldfield.

Assays from four diamond drill holes have confirmed extensions to the Tomorrow prospect, with assays ranging from 2.4-3.5g/t gold.

Mineralisation has also been extended at the Macnaughtan and Lawry targets within the project.

Interviews

AVZ Minerals (ASX: AVZ) managing director Nigel Ferguson discusses the company’s latest updates on advancing its flagship Manono lithium and tin project in the DRC.

Manono is renowned worldwide for hosting the largest known hard rock lithium resource, which is a staggering 400Mt at 1.65% lithium.

The company is convinced the resource size can be trebled with further exploration, and a DFS on the current reserve has revealed a very robust project, which has attracted significant interest from potential offtake partners and financiers.

Nova Minerals (ASX: NVA) chief executive officer Christopher Gerteisen gives investors an update on the latest news from its Estelle gold project in Alaska.

The interim resource at the company’s flagship Estelle project has boosted contained gold from 2.5 million ounces to 3.3Moz and is underpinned by 7,200m of drilling.

Angel Seafood (ASX: AS1) founder and CEO Zac Halman discusses the company’s successful retail penetration strategy, which has led to an all-time high in oyster sales.

For the September quarter, Angel Seafood achieved oyster sales of 2.7 million, which was an almost 80% increase on the previous 2019 September period.

Angel Seafood is poised to meet even greater demand through the upcoming peak season along with restaurants reopening following COVID and growing retail sales.

Recently appointed Navarre Minerals (ASX: NML) managing director Ian Holland speaks with Small Caps regarding the company’s Victoria-focused gold strategy.

Navarre has its sights sets on a major gold operation at its Stawell Corridor project which lies within Victoria’s 80Moz gold province.

The project is 40km along strike of producing mines, with drilling already unearthing two primary gold prospects and the Langi Logan discovery.

Navarre is also advancing St Arnaud, Jubilee, Stavely Arc and the Tandarra joint venture.

The week ahead

While the US election and the continuing and worrying COVID-19 numbers out of Europe will continue to be monitored closely, there are also some Australian specific things to watch.

Of particular concern is the apparent targeting of Australian exports by China, with cotton the latest commodity to feel the lash from the middle kingdom after coal and wine copped it earlier.

At this stage it seems to be a scaling back of orders rather than a total ban but this space is really worth keeping an eye on.

Also, really important this week will be the speech by Deputy Reserve Bank Governor Guy Debelle and other RBA news including the minutes of the October meeting, which might add to the discussions around the much-mooted move to 0.1% on the cash rate in November.

Also worth watching for are consumer confidence numbers, household spending intentions, weekly payroll and jobs numbers and detailed labour force numbers for September.

Internationally, Chinese GDP numbers for the September quarter are out on Monday, along with retail, production and investment numbers and home price numbers while a range of US numbers on the housing market will be released.