Hot Topics

Trending stories and market-moving news from the ASX small-cap sector

Which Stocks Benefit from a Uranium Supply Deficit?

Uranium supply deficit could lift shares as Australia leverages domestic reserves and SMRs to secure base-load power.

Top Stories

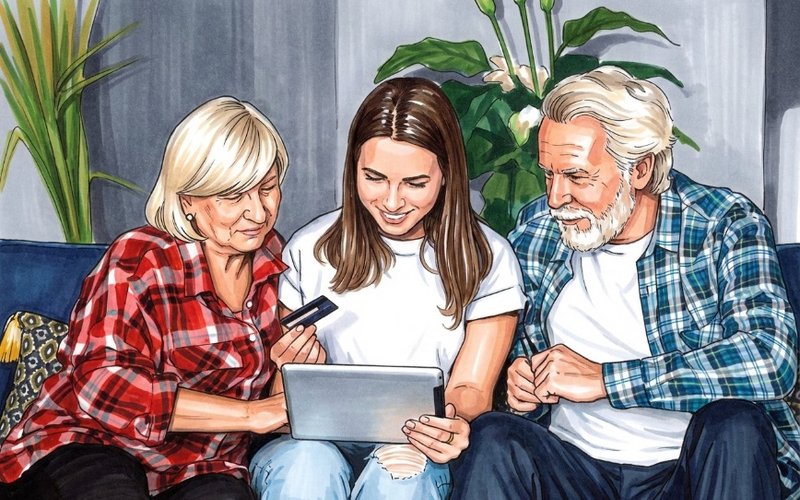

Australia’s Best (and Worst) Bank

Australia's Bank of Mum and Dad pumps $35b a year into housing, but rising non-performing loans and fairness issues threaten the unofficial lender's future.

The Weekly Finger: CBA PR team dancing in the streets, waving flags etc

CBA faces police probe over a $1bn mortgage-fraud hole, sparking talk of a banking lending overhaul and potential share moves.

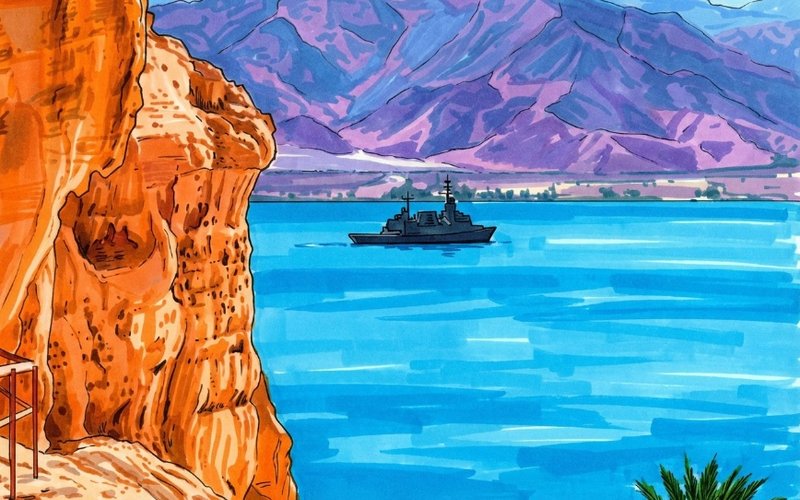

US-Iran War: Energy, Gold, and Silver

Oil jumps as US-Iran tensions flare; Hormuz risk, insurers drop cover. Gold, silver and miners rally as a new mining bull market awakens.

Latest Hot Topics

Time for Pensioners to Get Aggressive

Pensioners urged to be aggressive with cash as March deeming rates rise to 1.25% and 3.25%; beating returns could protect income.

Earnings Season Growth Leaders: Gold, Copper, Industrials and More

Earnings season shifts to a stock-pickers market as the RBA lifts rates to 3.85%; focus on cash flow and balance sheets, with Macquarie leading earnings.

Where are the New Copper Discoveries? Deficit Remains, Small Caps to Benefit?

Copper faces a structural deficit through 2026 as demand from renewables and AI surges, boosting ASX-listed miners with new long-life supply.

Time to Get Active on Super Collapses

$1.2B First Guardian/Shield super collapse hits 11,000 investors as deadlines loom; AFCA and Netwealth payouts underway - check if you’re affected

The Weekly Finger: Older, fitter, faster, more fragile

Markets shift as AI fuels software sector; old leadership fades while new contenders tighten their grip.

Health Insurance Costs Just Keep Rising

Australian private health insurance premiums rise 4.41% from April 1, the steepest since 2017, as cover downgrades rise and Medibank posts profits.

Silver’s Historic Rally and the Structural Deficit: Are ASX Small Caps Underappreciated?

Silver surges on structural deficit and tariff fears; ASX miners poised to benefit as supply tightens—are Australian small caps undervalued?

ASX Earnings Season Growth Leaders: From ABB to MAH, VNT and more

RBA lifts rates to 3.85% as easy money ends; ASX growth names ABB, MAH, VNT lead with pricing power and stronger cash flow.