Glencore’s Mutanda mine shutdown could prompt earlier than expected cobalt price revival

Glencore’s open pit Mutanda copper mine in the Democratic Republic of the Congo.

With analysts and miners alike forecasting an improvement in the cobalt sector over the medium and longer-term, Glencore’s closure of its Mutanda mine in the Democratic Republic of Congo may have prompted a faster than expected revival, according to UBS.

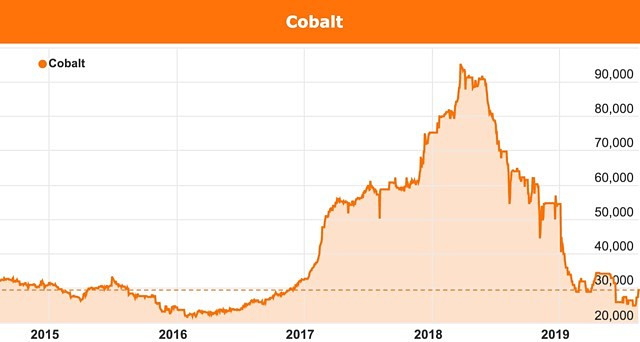

The critical battery metal began soaring in 2017 before reach a dizzying high of US$43 per pound (US$94,750 per tonne) in March 2018.

Driving the surge were tight supplies and increasing uptake of the metal in lithium-ion batteries, which are essential to the accelerating electric vehicle sector.

However, cobalt’s high prices and supply concerns out of the DRC led battery manufacturers to rejig their lithium-ion battery formulas including the common nickel, cobalt and manganese composition, which was equally one-thirds of each metal.

New formulas now possess less cobalt, but manufacturers have been unable to eradicate the mineral altogether, meaning it remains critical to the lithium-ion battery and, subsequently, electric vehicles.

With more than half the world’s cobalt arising out of the DRC and human rights violations clouding the region, manufacturers have also been pushed to find more ethical sources of the mineral.

Cobalt prices per tonne in US dollars.

Adding to the situation was a worldwide increase in cobalt production and sales. Higher production combined with less than expected uptake in lithium-ion batteries and end-users’ avoidance of the metal tipped the market into oversupply, with the cobalt price plummeting to a low of US$11.79/lb (US$25,000/t) late last month.

Mutanda shutdown

With the metal trading at US$13.83/lb on Monday, and not anticipated to surge again in the near-term, LSE-listed global miner Glencore’s chief executive officer Ivan Glasenberg revealed the company was transitioning its Mutanda cobalt operation to temporary care and maintenance by the end of 2019.

Mr Glasenberg said the move was in response to low cobalt prices, which have reduced the project’s economic viability.

The project’s economic viability hasn’t been helped by the DRC Government’s new Mining Code which was made law last year and increased cobalt royalties from 2% to 10%.

Despite closing Mutanda, Mr Glasenberg pointed out that Glencore will resume operations once “economic conditions sufficiently improve”.

During the first half of 2019, Glencore’s cobalt production across its three copper-cobalt African assets was 19,500t, with Mutanda contributing 13,400t during the period – and accounting for more than 45% of Glencore’s African cobalt output.

Although Mutanda will be on temporary care and maintenance, Mr Glasenberg said the company would continue with its studies at Mutanda to ensure a “long-term” mine life.

“Ultimately, cobalt medium and long-term fundamentals remain well underpinned by the expected strong structural demand growth arising from electric vehicles.”

Analyst UBS has publicly stated that shutting down output at Mutanda would curb the cobalt market surplus between now and 2030.

The analyst said it anticipated the situation would spark the cobalt price to rise over the next 18-months to reach US$20/lb – up 45% on Monday’s price of US$13.83/lb.

Late last year, Glencore temporarily suspended sales from its Kamoto mine in the DRC after uranium was discovered and prevented 1,472t of cobalt from being exported.

The temporary production suspension triggered the cobalt price to surge from US$45,000-US$52,000/t within days.

UBS has also noted the cobalt market is likely to move into a deficit again by 2025 with cobalt demand forecast to grow from 130,000tpa to 270,000tpa during the period.

Electric vehicles drive cobalt’s comeback

Driving cobalt’s comeback will be the electric vehicle market, where lithium-ion batteries are essential.

Other critical lithium-ion battery minerals include lithium, manganese and nickel and producers and explorers alike are also predicting a rise in consumption of their respective commodities as a result of the increased adoption of electric vehicles.

Electric vehicle demand is expected to significantly ramp up between now and 2025, with Lithium Australia (ASX: LIT) managing director Adrian Griffin noting about 50 million of the vehicles will be on roads around the world by 2030.

50 million electric vehicles are predicted to be on roads around the world by 2030.

He pointed out this prediction is backed by legislative requirements in many regions of the world.

The world’s third largest cobalt play by market cap, Jervois Mining (ASX: JRV) is also betting on the market’s comeback.

Jervois is fast-tracking the Idaho Cobalt Operation (ICO) in the US, where US$100 million has been spent on advancing the asset to-date.

Chief executive officer of Jervois, Bryce Crocker, said the project was “strategically positioned” to take advantage of forecast improvements in the cobalt sector.

Mr Crocker told Small Caps the company was “excited to be moving forward” with ICO, with the asset believed to be the only source of domestic cobalt mine production in the US.

Back in Australia, Northern Cobalt (ASX: N27) managing director Michael Schwarz pointed out that although some lithium-ion battery formulas use less cobalt, demand for the commodity remains strong and will be underpinned by the electric vehicle market.

Mr Schwarz added that consumption for the metal in other markets including alloys and ceramics continues to remain robust.

He also noted that supply concerns arising out of the DRC will continue to prompt end-users to source cobalt from ethical miners is stable jurisdictions such as those in the US and Australia.