Weekly review: gently rising index disguises a rampant BHP

WEEKLY MARKET REPORT

Sometimes the muddling direction of the overall market can disguise a big move such as this week’s big rise in heavyweight miner BHP (ASX: BHP).

While a lot of the noise in the market has been around the continuing advance of the delta variant of COVID-19 and the associated infections and lockdowns in Sydney and Melbourne and the increasing competition in the buy now pay later (BNPL) space, BHP has been quietly pushing towards a new record, which it finally hit yesterday.

It seems investors are looking past the current lockdowns to the rising vaccination rates which hold promise that the days of long lockdowns could be numbered.

Lockdown fails to dampen the market

By the market close, the ASX 200 had risen 1% for the week and 0.2% for the day at 7348.1 points – not a bad achievement considering it was held back by the banks and technology firms and 11 million Australians remain in lockdown.

Amid all of this turmoil BHP quietly managed to better its previous record high of $51.82 set in March to reach $51.91 before easing off to close at $51.87.

The main reason behind BHP’s fantastic week, which saw the stock rise by 1.7%, was firming iron ore prices which have stubbornly stuck around the US$220 a tonne mark, despite predictions – and Chinese hopes – that they were set for a fall.

Rising oil prices have also helped BHP to outperform the other big miners, given its large petroleum arm.

Iron ore prices might have further to run

Many brokers are now predicting that the rise in iron ore prices is not over yet and that a once unthinkable price target of US$300 a tonne was not totally out of the question, with supply concerns out of Brazil and strong demand in China pointing towards a continuing outperformance by the big miners.

Also pushing up shares in the big miners is the prediction that shareholders will get to enjoy a cascade of cash as the companies report bumper earnings and dividends in the coming reporting season.

A key regulatory change from China’s central bank – the People’s Bank of China – reducing bank reserve requirements is thought to be a strong positive for iron ore prices due to the release of hundreds of billions of additional liquidity into the Chinese economy.

Fortescue Metals (ASX: FMG) also forged higher, up 0.5% to $25.84, not far off its record highs set back in January.

Rio Tinto (ASX: RIO) was the underperformer of the Pilbara trio, with its shares falling 0.4% to $130.56 after investors reacted to a disappointing production fall from its rich iron ore mines compared to the previous quarter.

Rio blamed heavy rain and replacement mine tie-ins for the production drop in the second quarter, which caused it to miss out on some of the fancy prices on offer.

The much-discussed move into the BNPL space by Apple and other tech titans such as PayPal continued to have a negative effect on the locally listed pioneers, with Afterpay (ASX: APT) falling a hefty 13.5% for the week to $103.21.

It was a similar situation for ZIP (ASX: Z1P) which was down 16.1% for the week to $7.10 despite a 2.75% recovery on Friday and Sezzle (ASX: SZL), which fell 7.2% for the week to $8.35.

Small cap stock action

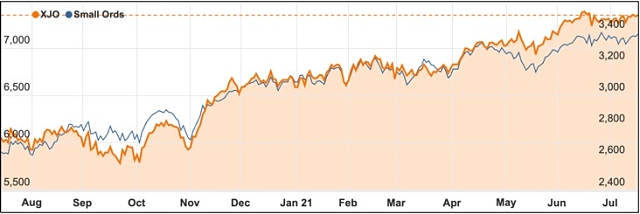

The Small Ords index soared 1.83% this week to close at 3391.6 points.

ASX 200 vs Small Ords

Small cap companies making headlines this week were:

Leaf Resources (ASX: LER)

Leaf Resource plans to double the output of natural rosin and terpene products from its Queensland-based pine chemical extraction plant from 8,000 tonnes per annum to 16,000tpa.

The company, which extracts the chemicals from pine stump waste, expects the doubled production could add about $38 million in revenue.

Leaf has received its maiden purchase order from Japan-based Yasuhara Chemical Co, which tested and analysed Leaf’s wood pellet samples and confirmed they meet specifications.

The company has also secured loan facilities to fund the proposed plant expansion.

Its technology aims to replace petroleum-based chemicals and plastics as the world moves towards a more sustainable future.

Wellnex Life (ASX: WNX)

Formerly Wattle Health, Wellnex Life relisted on the ASX this week with a fresh goal of shaking up Australia’s $5.6 billion health and wellness sector followed by expansion into the $5 trillion global market.

The company has 15 brands in its diverse portfolio with further brand launches planned.

Wellnex’s portfolio includes a 10-year agreement with Australia’s largest pharmacy chain Chemist Warehouse, and distribution deals with Coles, Woolworths, Priceline, Sigma Pharmaceuticals and Australian Pharmaceutical Industries.

A recent $2.88 million entitlement offer will ensure the company has enough cash to pursue its growth plans of capturing a wider market and boosting its distribution channels.

Plenti Group (ASX: PLT)

Fintech lender Plenti Group’s goal of becoming cash flow positive by June 2022 is getting closer with the company unveiling a record June 2021 quarter.

The company is also on its way to achieving a $1 billion loan book after the month of June alone brought in an all-time high of $83.4 million in loan originations.

Plenti says the June monthly figure represented the $1 billion annual run-rate.

For the entire June quarter, Plenti posted $216.4 million of loan originations which was 260% higher than the previous corresponding period and a 26% increase on the March 2021 quarter.

Galan Lithium (ASX: GLN)

Aspiring lithium producer, Galan Lithium has achieved a 99.88% pure lithium carbonate product during proof of concept testing on brine samples from its flagship Hombre Muerto West project in Argentina.

Galan managing director Juan Pablo Vargas de la Vega noted the minimum purity requirement was 99.5% lithium carbonate equipment for the battery sector.

“Importantly, from our studies, Galan’s high grade and low impurities brine has demonstrated that we can produce high purity lithium carbonate at a low cost,” he added.

With the success of its test work, Galan has expanded its project footprint in the region with the acquisition of the Casa Del Inca III tenement, which adds 3sq km to the company’s Hombre Muerto West project.

QMines (ASX: QML)

Recent ASX debutant QMines has returned more positive results from a maiden drilling program at the Mt Chalmers copper project, which is 17km northeast of Rockhampton in Queensland.

The company has received the final assays from the last four holes of the 11-hole program.

A highlight intersection was 7.5m at 0.75g/t gold, 23g/t silver, 0.24% copper, 3.5% lead and 7.4% zinc from 70.5m, including 2.2m at 16.8% zinc, 8.3% lead and 41g/t silver, along with 0.85g/t gold and 0.54% copper.

Intervals with better gold and copper grades were 0.6m at 3.31g/t gold, 87g/t silver, 5.21% copper and 1% zinc from 115m; 15.2m at 2.36g/t gold and 0.67% copper from 139m, including 2m at 9.31g/t gold and 1.34% copper from 154m; and 14.6m at 1.01% copper from 185m.

The results will be included in a resource update which expected in the “near future” with another drilling program underway.

AssetOwl (ASX: AO1)

Developer of the inspector360 platform for the real estate sector AssetOwl has teamed up with Attree Real Estate director and licensee Nathan Want to accelerate the platform’s roll-out.

The deal paves the way for Mr Want to use his existing and extensive industry connections to boost the uptake of inspector360 across WA and Australia’s east coast.

“Having worked with AssetOwl’s product for the last few months, it is clear to me that their inspector360 tool is the real estate inspection platform of the future,” Mr Want said.

“I am of the view that inspector360 has the potential to make a positive impact on the industry,” he added.

In consideration for the collaboration, Mr Want will receive 8.5 million AssetOwl options across five tranches.

Kin Mining (ASX: KIN)

Advanced gold explorer Kin Mining has generated more encouraging gold assays from the Cardinia Hill prospect within its flagship Cardinia project in WA’s north eastern goldfields.

Highlight assays in the latest results batch were 11m at 2.52g/t gold, 7.8m at 2.9g/t gold and 4.5m at 2.67g/t gold.

The positive drill results followed St Barbara (ASX: SBM) scooping up an almost 20% stake for $25.3 million in Kin earlier in the week.

Kin had a productive June quarter at Cardinia with drilling and exploration, which will underpin a resource upgrade later in the current period.

The week ahead

One of the most significant but unnoticed occurrences last week was the New Zealand central bank’s move to halt bond purchases – something that could herald the beginning of a rising official interest rates on the other side of the Tasman.

There is unlikely to be any hint of a similar total winding back of stimulus when the minutes of the Reserve Bank of Australia are released this week, although the RBA have been cutting back its bond buying a little.

It is well worth keeping an eye out for signs of a turn in rates, given that it will herald a totally different approach to pricing shares.

Other than the RBA minutes, the other big release to watch out for is the provisional retail trade data, which is likely to show spending weakness due to lockdowns.

Offshore we are in for a fairly quiet week of economic releases with US housing and manufacturing data the biggest one to watch.

The continuing US profit reporting season is likely to set the tone for the overall share market and specific stocks, with a raft of household names set to report.