Gas demand to grow as the world moves away from coal

By 2030, gas will overtake coal as the world’s second-largest source of energy.

As the world strives for a cleaner and greener future, a significant transition away from coal is becoming more evident.

However, oil still appears to top the charts in the power generation mix, and recent research has forecast a rise in gas to reach second in the ranks.

Australia appears to be well placed to take advantage of this outcome given its proximity to emerging economies and potentially enormous gas resources.

But with the east coast gas shortage on the horizon and gas prices already peaking, are we ready?

The global outlook

Towards the end of last year, the International Energy Agency (IEA) released its latest World Energy Outlook, which predicted global energy demand to grow by more than a quarter by 2040, while the demand for natural gas is predicted to rise by 45% in that time.

In fact, in the agency’s ‘New Policies Scenario’, natural gas is considered to be the fastest growing fossil fuel and will overtake coal by 2030 as the second-largest source of energy after oil.

According to the IEA we can expect to see a 45% increase in the demand for natural gas by 2040.

The IEA has attributed air pollution reduction strategies and a rise in liquefied natural gas as the main drivers of this global shift in energy sources.

Coal, which currently accounts for around 40% of global energy sources, is anticipated to drop to about a quarter by 2040.

Meanwhile, renewable energy is predicted to do the opposite, growing from a quarter to more than 40% within the same time-frame.

However, the IEA said this growth in renewables still won’t sufficiently tackle climate change, with energy-related carbon dioxide emissions anticipated to grow by 10% to 36 gigatonnes in 2040, mainly due to the forecast growth in oil and gas.

Asian economies driving demand

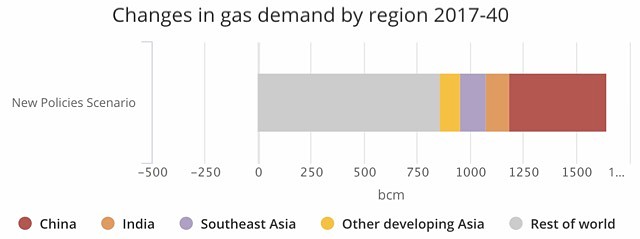

The IEA believes China will become the largest importer of gas, with net imports reaching the level of the European Union by 2040.

The country is already the third largest user of natural gas (behind the United States and Russia) and currently imports about 40% of the gas it consumes.

In addition, emerging economies in Asia would make up about half of total global gas demand growth and account for 60% of LNG imports by 2040, the IEA reported.

Speaking with Small Caps, Real Energy (ASX: RLE) managing director Scott Brown said the growing demand for gas can be linked to a rising standard of living in these emerging economies.

“If you actually look at the energy consumption per person and you look at GDP [gross domestic product] growth, they track each other very nicely,” he said.

“As people get richer, they need more machines, more things, and undoubtedly, you’ve got to supply those machines with more energy.”

Mr Brown added that while the world is aiming to work towards a cleaner future, renewable energy can be unreliable and requires support from other sources.

“If you’re going to have fairly unreliable energy sources that are rather intermittent, like solar and wind, you need back up, and gas is a really good one to back up those other power sources,” he said.

Mr Brown said the advantage of gas was that is can be switched on and off very quickly, compared to using coal and nuclear for power generation, which needs to be run constantly.

“A lot of those countries have had a pretty harsh winter – I know certainly in China it’s been snowing pretty hard – and, naturally, you want to heat your home. Gas is much better to heat than, say, burning timber or coal like they used to do,” he said.

In addition to domestic heating, gas has a multitude of industrial purposes such as in the production of fertiliser and plastics.

Is Australia ready?

The Australian Petroleum Production and Exploration Association (APPEA), which represents the nation’s oil and gas industry, has welcomed the IEA’s report, saying Australia could benefit from this predicted outcome.

“This outlook is very positive news for Australia. Australians will see a steady stream of high paying jobs, export dollars and revenue for governments for decades to come,” APPEA chief executive officer Dr Malcom Roberts said.

He referenced the IEA’s projection that LNG exports would overtake pipeline gas as the main form of long-distance trading and said most of the growing demand for natural gas would come from China, India and other Asian countries which are increasingly turning to the energy source to help improve urban air quality.

Almost 50% of the growth in demand for gas predicted by 2040 is expected to come from Asia.

“Australia’s proximity and reputation for reliable supply means we are well‑placed to capitalise on this growing opportunity. It is vital that we maintain this reputation,” Dr Roberts said.

Then again, it is questionable whether Australia is really set up to benefit from this forecast outcome, given the nation’s divided views on unconventional oil and gas exploration and particularly, its extraction method of hydraulic fracturing, or ‘fracking’.

According to the IEA’s report, the US is predicted to account for 40% of total gas production growth to 2025.

However, then a host of new suppliers are set to emerge and take over as US shale gas output flattens and these other countries start turning to unconventional methods of gas production.

In Australia, fracking is restricted in many states and territories. Victoria is especially against it, with onshore exploration permanently banned altogether.

Although, the technique is more widely permitted in Queensland and in the last year, Western Australia and the Northern Territory have relaxed their blanket bans to permit fracking operations in certain areas.

Dr Roberts said Australia cannot afford to be complacent in an extremely competitive global market.

“If Australia is to capture further investment in LNG production, it is vital the policy settings are right – maintaining a stable and competitive tax regime, resisting calls for interventions in the gas market and reducing regulatory costs,” he said.

Natural gas spiked towards the end of 2018 signalling pricing pressures.

In addition, Australia has been facing looming gas shortages in the east coast and is suffering (or benefitting, depending if you are a consumer or a producer) from rising gas prices.

It seems clear that a growth in natural gas demand will worsen these issues, although Mr Brown said both can be linked to current “anti-development” policies.

“Most of the problems on the east coast of Australia are due to state government restrictions … The best source of gas is always a domestic source, so close to where the actual consumption is, because you don’t have to transport it,” he said.

“The fundamentals are there’s lots of people in Asia that want gas and are prepared to pay the price and Australia just has to pay whatever the international price is going to be.”

“I think there will be enough gas to go around, but we’re paying an international benchmark rather than a domestic one,” Mr Brown added.

The declining coal industry

The IEA’s ‘New Policies Scenario’, which foresees coal falling behind gas as a leading energy source, takes into account emission reduction policies and legislation and assumes more energy efficiencies in fuel use, buildings and other factors.

In Australia, National Electricity Market data for the December 2018 quarter showed brown coal generation falling to its lowest level in the history of the power grid, while solar and wind surged.

In addition, energy experts have predicted wind and solar supply will flood the market as these are the cheapest forms of new supply, and cheaper than existing coal and gas supply in some cases.

In addition, market research firm IBISWorld has predicted a 14.2% decline in 2018-2019 revenues from the black coal mining industry due to a fall in both coking and thermal coal prices.

“Thermal coal prices are expected to decline as global economies continue to transition away from coal as part of increasing efforts to reduce greenhouse gas emissions,” IBISWorld senior industry analyst Kim Do told reporters.

Despite this, coking and thermal coal production in Australia is anticipated to rise in the current financial year, according to the firm.