John Beveridge

John is a highly experienced business journalist and formerly chief business writer for the Herald Sun. He has covered Federal politics in Canberra, was Los Angeles Bureau chief for News Limited and was also chief of staff for the Herald Sun. He has covered a wide range of small and large cap ASX stocks and has a special interest in mining, technology and biotech.

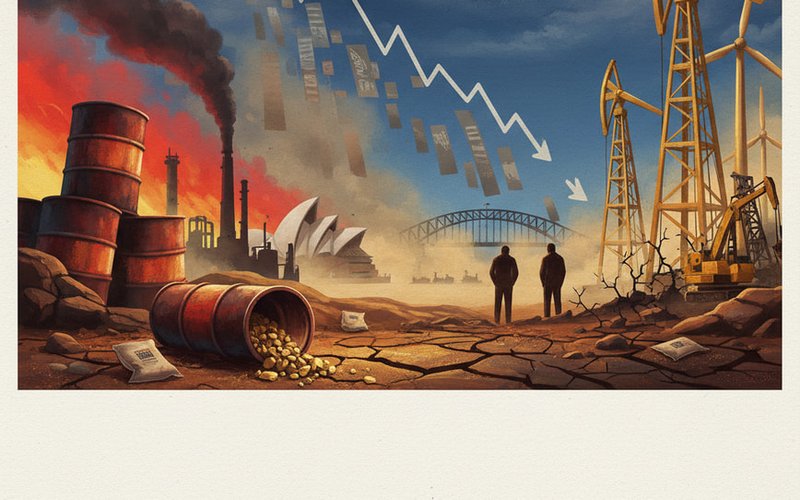

Weekly Wrap: ASX slides 3.8% as Middle East conflict spooks markets

ASX 200 plunges 3.8% for the week as Middle East conflict lifts oil and inflation fears, sparking rate hike bets while energy stocks rally.

Australia’s Best (and Worst) Bank

Australia's Bank of Mum and Dad pumps $35b a year into housing, but rising non-performing loans and fairness issues threaten the unofficial lender's future.

Time for Pensioners to Get Aggressive

Pensioners urged to be aggressive with cash as March deeming rates rise to 1.25% and 3.25%; beating returns could protect income.

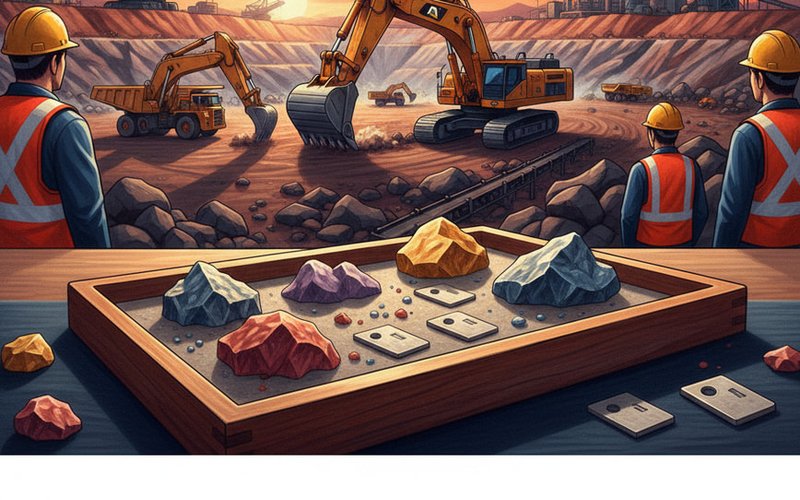

Weekly Wrap: A record close and 3.7% month a big thumbs up

ASX 200 finishes at record close, up 3.7% in Feb as BHP profits beat and banks top forecasts; Block rockets on staff cuts; rare-earths rally lifts Lynas/Iluka.

Time to Get Active on Super Collapses

$1.2B First Guardian/Shield super collapse hits 11,000 investors as deadlines loom; AFCA and Netwealth payouts underway - check if you’re affected

Health Insurance Costs Just Keep Rising

Australian private health insurance premiums rise 4.41% from April 1, the steepest since 2017, as cover downgrades rise and Medibank posts profits.

Weekly Wrap: ASX slips on war fears as earnings beat expectations buoy week

War fears nudge ASX 200 lower despite QBE's 21% profit surge; energy gains lift oil names, tech slumps; Guzman sinks below float.

Why Paying Off Your Mortgage Is Not Always a Good Idea

Paying off your mortgage isn’t always best. Consider offset accounts for flexibility, and diversify into super or investments for long-term gains in Australia.

The Big Boomer Sell-Down

Boomer wealth transfer accelerates as retirees cash up, downsize and boost super. A$3.5 trillion wave of inheritances headed to younger Australians.

Weekly Wrap: AI Margin Squeeze Hits Software Peers as ASX Slips, Yet Week Ends Higher

ASX slips 1.4% as AI fears squeeze software margins; yet the week climbs 2.4% on bank strength and gold rebound.

Teaching Your Children to Use the Financial Playground

Early super choices for kids can add a million to retirement; teach risk vs reward and delayed gratification in the financial playground.

How to Escape a Mountain of Junk Debt

Australian households drowning in over $1m junk debt as rates rise; 100 suburbs now exceed $1m in debt, signaling looming financial pain.

Weekly Wrap: ASX 200 slides 2% as froth indicators deepen global pullback

ASX 200 skids 2% as Bitcoin froth indicators fade and AI concerns weigh on tech and miners; weekly loss 1.8%.

When Billions in Tax Concessions Really Start to Add Up

Tax concessions cost Australia a record $184.1b this year, up $50b in a year, led by CGT relief; Senate inquiry into CGT concessions due March.

How to Use KPMG Figures to Avoid Misery and Build Resilience

KPMG reveals 25–34s amassed 63% wealth via pandemic leverage; with rates up and prices high, learn practical steps to build financial resilience.

Weekly Wrap: Late pullback slams gold shares

ASX slips 0.7% as late pullback drags gold shares lower on Fed chair speculation; bullion drops ~5% amid rate-hike fears.

Productivity Takes a Holiday

Productivity Commission delivers 47 reform recommendations for Australia: tax tweaks, upskilling, and data reforms that could boost GDP billions if acted on.

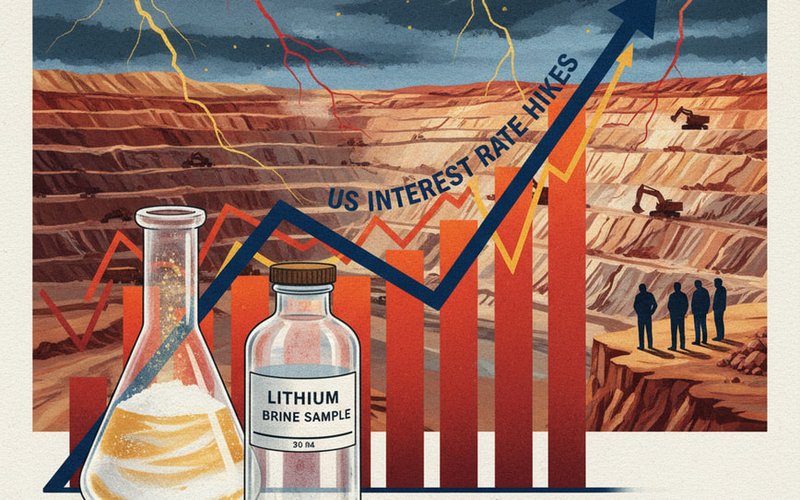

Rate Rise Looking More Likely

Dollar climbs as unemployment hits 4.2% and rate-hike bets surge ahead of CPI release; trimmed-mean at 3.2% could force Feb/Mar rise.

Weekly Wrap: Rising rates lift AUD and gold as miners lead ASX gains

Gold hits fresh highs and miners rally as rates rise; Life360 soars on upbeat guidance, AUD hits 16-month peak, ASX 200 slips 0.5% for the week.

Retirees Flock to Generous Downsizer Contributions

One of the hidden secrets of quickly increasing superannuation accounts is really starting to get some traction, with figures released by industry fund HESTA showing that the use of downsizer contributions to beef up superannuation balances increased a lot in 2025.