Australian shares were up slightly for a second week on Friday with investors hoping for an interest rate cut in the US, even as the chances of a local cut have evaporated.

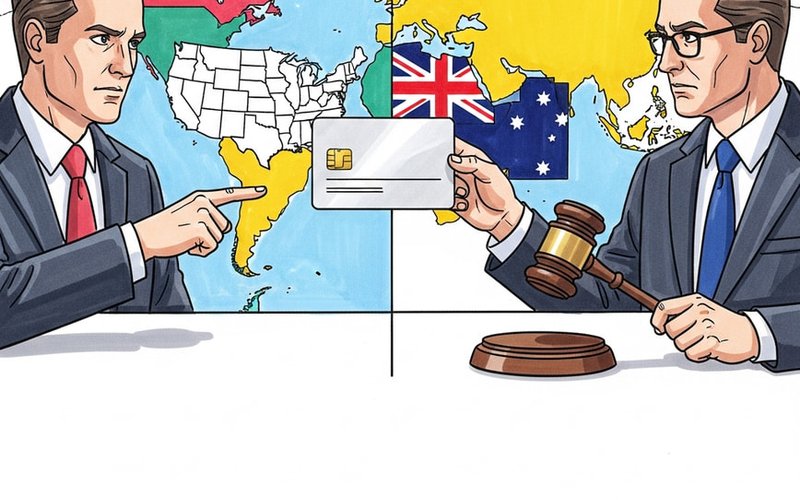

With the US Fed and the local Reserve Bank both meeting this week to decide on official interest rates, there are still strong hopes the US will cut rate even though still strong Australian inflation have greatly reduced the chances of any cut here.

Indeed, most observers have scaled back hopes of any interest rate cuts in Australia and have instead pencilled in potential hikes in 2026.

Despite this the market reaction to the possible different direction for Australian and US interest rates was still modestly bullish, with a US cut now needed to see markets rise further.

Locally the market saw modestly higher prices for financials and some selective strength among mining companies which contributed to the overall market rise.

Banks firmer

For the banks, Westpac (ASX: WBC) was up 1.1% to $38.09, Commonwealth Bank (ASX: CBA) rose 0.7% to $154.21, National Australia Bank (ASX: NAB) rose 0.9% to $40.86 and ANZ (ASX: ANZ) were flat at $35.33.

Perhaps surprisingly shares in Bendigo Bank (ASX: BEN) were up 2.5% to $10.38 despite Victoria Police arresting then releasing four people in relation to a money-laundering investigation linked to a bank branch.

Lithium stocks rally

Double digit broker upgrades for projected lithium demand delivered a strong boost to the lithium miners.

Shares in IGO (ASX: IGO) rose 7.1% to $6.93, Mineral Resources (ASX: MIN) jumped 4.6% to $50.15 and Liontown (ASX: LTR) were up 4.8 % to $1.32.

Gold stocks were also firmer as gold prices hit a six-week high, with Newmont (ASX: NEM) shares firming by 2.8% to $138.20.

The big miners were mixed with shares in Rio Tinto (ASX: RIO) down 1.5% to $138.47 after brokers pointed out that the miner’s 2026 production guidance came in 3% below consensus.

In contrast, BHP (ASX: BHP) rose 0.8% to $44.84.

Technology stocks were also a mixed bag, depending on individual announcements.

NextDC (ASX: NXT) rose 3.1% to $13.86 on news of its partnership with OpenAI.

Megaport (ASX: MP1) rose 3.4% to $13.24 after it appointed Lisa Hennessy to its board although WiseTech Global (ASX: WTC) fell 0.7% to $73.32.

Solomon Lew’s Premier Investments (ASX: PMV) saw its shares fall hard by 15.9% to $15.22 after it released first-half guidance that was around 18% below broker expectations.

That was bad but Saluda Medical (ASX: SLD) had a terrible first day on the share market, sinking 52.1% to $1.27, with the float price of the medtech group of $2.65 now a distant memory.

BetMakers (ASX: BET) fell 5.4% to 17.5¢ after it signed an agreement to acquire the Las Vegas Dissemination Company.

The Week Ahead

It is a big week for central banks with the Reserve Bank of Australia holding its last meeting for the year on Monday and Tuesday.

Any hopes of a rate cut were dashed by October’s hot inflation reading which lent more support for a rate rise rather than a cut.

What will Bullock say?

It will be interesting to see what Governor Michele Bullock has to say when she releases the decision after the RBA meeting.

On Wednesday the US Federal Reserve releases its decision which is thought likely to be a cut to the official rates.

It is by far a done deal though, with the long US Government shutdown resulting in the Fed flying a little blind due to economic figures being delayed and the shutdown itself having an economic impact.

Hints of a cut

The main hints of a rate cut have come from Fed members who have uniformly given hints of a rate cut, so markets will be on tenterhooks about the decision, particularly as US President Trump continues to consider who to appoint as the new Fed Chair when Jerome Powell’s term ends in May next year.

The Bank of Canada is meeting on Wednesday as well but is widely expected to leave cutting at its last meeting.

The main local release will be the Australian jobs figures which are expected to see 25,000 new jobs created in November.

The remaining question if there is a US rate cut is whether it will be enough to provoke a Santa rally on the share market?

Such rallies don’t happen every year but one is possible this year if the cards happen to fall the right way.