XCD Energy unveils 1.6 billion-barrel maiden oil resource for Project Peregrine

XCD Energy has announced an independent prospective resource of 1.6 billion barrels of oil for Project Peregrine on Alaska’s North Slope.

Junior explorer XCD Energy (ASX: XCD) has unveiled a maiden prospective oil resource of 1.6 billion barrels (net of government and other royalties) for its wholly-owned Project Peregrine on Alaska’s North Slope.

The company emerged from a trading halt today to announce the independent report’s findings, in which assessor ERC Equipoise tallied the mean unrisked recoverable oil resources of the Merlin and Harrier prospects.

The estimate is significantly higher than the internal estimate of 255 million barrels of oil that XCD announced for one of its primary leads last September, three months prior to the company adding four new oil leases to its project.

The earlier internal estimate only comprised one horizon from the Merlin lead, which has now been matured to a mean resource estimate of 622 million barrels of oil as a result of multiple horizons being able to be now intersected from the one Merlin location.

Speaking with Small Caps, XCD managing director Dougal Ferguson said he is confident that the Project Peregrine’s large resource will attract “a variety of mid to large scale” companies in an upcoming farm-out campaign.

“The resource is substantial and it’s on trend with plenty of new drilling activity and existing big discoveries,” he said.

Drilling options

Mr Ferguson said XCD is continuing to assess the potential of using a smaller drilling rig to drill the shallow Nanushuk play in the Merlin and Harrier prospects, both of which only require drilling to around 5,000ft to fully test the shallow objectives. These objectives make up about two-thirds of the total prospective resource.

However, the report identified a third objective, named Harrier Deep, which is a deeper target that could be accessed from the same wellbore.

This prospect would require a larger, traditional North Slope drilling rig to reach the Torok target at about 10,000ft.

Mr Ferguson said the timing of the drilling program will become clearer following the commencement of a farm-out campaign, with the opportunity to pursue the low-cost shallow initiative being a way to “provide optionality” for incoming companies.

“If a major wants to shoot 3D [seismic] and drill with a traditional drilling rig, that’s fine by us; but the low cost early drilling option also opens doors for mid to large independents that might feel they have missed the Nanushuk boat.”

“They can have a crack at the shallow [targets] for a fraction of the cost and still find near a billion barrels, if successful,” he said.

How Project Peregrine compares to other North Slope projects

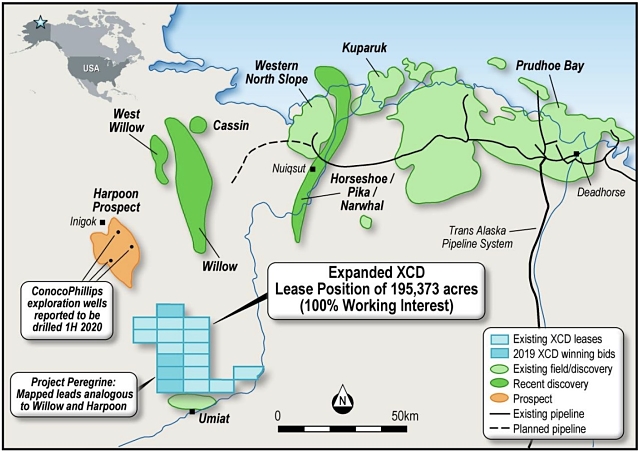

Project Peregrine covers an area of more than 195,000 acres within the National Petroleum Reserve – Alaska.

The leases are about 35km south of ConocoPhillips’ owned and operated Willow discoveries, which are estimated to contain up to 800MMbbls of oil equivalent.

The US oil and gas major is drilling four appraisal wells at Willow and up to three exploration wells at its Harpoon prospect, located about 15km northwest of XCD’s Harrier prospect.

XCD Energy’s lease position relative to ConocoPhillips Harpoon Prospect and Willow Oil Field.

The Willow oilfield is considered a direct analogy to XCD’s Merlin prospect while Harpoon is interpreted to lie on the same sequence boundaries as the Harrier prospect.

XCD believes success at Harpoon would likely “materially upgrade” XCD’s Harrier prospect.

“Three exploration wells at Harpoon is a pretty big deal… they must be pretty confident,” Mr Ferguson said of ConocoPhillips’ drilling plans.

To the east of Project Peregrine, junior explorer 88 Energy (ASX: 88E) is aiming for the February spud of its Charlie-1 appraisal well at Project Icewine.

In late 2019, 88 Energy finalised a farm-out to UK company Premier Oil, which will fund up to US$23 million in well costs for a 60% stake.

According to 88 Energy, Charlie-1 has a total gross mean prospective resource across seven stacked targets of 1.6 billion barrels – equivalent to Project Peregrine’s new resource estimate.

“Any success from the activity going on around us should really change people’s view on this highly prospective area and attract more interest in the company and the area as results are announced,” Mr Ferguson said.

Farm-out campaign

Mr Ferguson said XCD can now embark on its farm-out campaign “with confidence that the size of the prize is significant enough in our lease area to attract a range of companies”.

The campaign will officially launch at the upcoming international NAPE Summit in Houston, Texas, on 5 February.

XCD is aiming to lock in a farm-in partner this year to target exploration drilling at the start of 2021, which is the northern hemisphere’s winter drilling season.