XCD Energy pegs more Alaskan ground ahead of maiden oil resource

XCD Energy has been named the apparent high bidder on all four leases it bid on in the Alaskan North Slope’s oil and gas land grab.

XCD Energy (ASX: XCD) has snapped up the four leases it bid on in the highly prospective Nanushuk oil fairway in what is being hailed as Alaska’s most successful oil and gas lease sale in 13 years.

Emerging from a trading halt this morning, the Alaska-focused oil company confirmed its wholly-owned subsidiary Emerald House LLC has been named by the US state’s Bureau of Land Management (BLM) as the apparent high bidder for the leases, which span 45,783 acres (185sq km).

This year’s National Petroleum Reserve – Alaska (NPR-A) oil and gas lease sale is being regarded as the most successful lease sale since 2006, with US$11 million (A$16 million) in bids received for more than 1 million acres. This compares to the US$1.5 million in bids placed in Alaska’s 2018 lease sales.

Other successful bidders included explorer Bill Armstrong’s company North Slope Exploration LLC and US oil major ConocoPhillips (NYSE: COP).

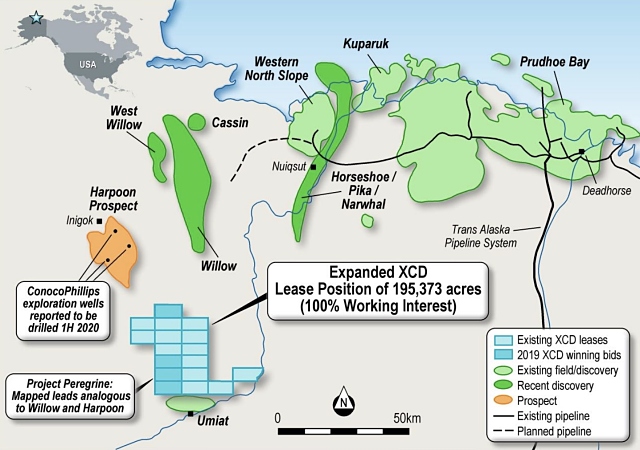

The additional leases will add to XCD’s existing 149,950 acres (607sq km) on the North Slope, known as Project Peregrine, and are being integrated into the company’s independent prospective resource report.

XCD said this report is now expected to be completed in January 2020.

The new leases

The four leases are adjacent to XCD’s existing acreage making up Project Peregrine and effectively grow the company’s lease position on Alaska’s North Slope to 195,373 acres (790sq km).

According to XCD, the new leases contain analogous leads to the Harpoon prospect being drilled by ConocoPhillips in its 2020 exploration campaign.

Two of the three wells planned to be drilled on this large prospect are within 25km of XCD’s northern lease boundary.

XCD Energy’s leases relative to ConocoPhillips’ Harpoon Prospect and Willow oil field.

XCD revealed it has paid a 20% non-refundable deposit of US$51,992 (A$75,548) for the four leases with the remaining balance of the US$259,960 (A$377,800) winning bid due in February.

The company is fully funded to complete the acquisition following its recent successful $2 million capital raising.

Management also backed the company in this recent placement, with XCD managing director Dougal Ferguson plus non-executive directors Peter Strickland and Tony Walsh snapping up between $15,000-$50,000 each in shares.

Nanushuk pioneer leads bids

Armstrong-led North Slope Exploration scooped up the majority of the acreage in the sale, reportedly winning bids on 85 of the 92 tracts.

Mr Ferguson said Armstrong’s large acquisition was a significant endorsement of XCD’s own exploration strategy, since Armstrong was the one that unlocked the Nanushuk oil play at the Pika and Horseshoe discoveries.

“Having an explorer of this pedigree now stepping across into the NPR-A in such a big way can only be a positive for XCD,” he said.

Maiden resource

XCD recently completed its Integrated Nanushuk Technical Regional Overview or ‘INTRO’ study at Project Peregrine and planned to release an independent prospective resource report.

In today’s update, the company said it has requested independent reservoir evaluation firm ERC Equipoise integrate the new leases into the volumetric calculations for the report.

This maiden resource estimate is now expected to be completed in January.

“These new leases capture the balance of the leads that XCD has re-mapped using the reprocessed seismic data and now completes the land acquisition for our Project Peregrine,” Mr Ferguson said.

XCD previously unveiled the first lead within the project – Merlin – which has been internally estimated to contain a best-estimate unrisked recoverable prospective resource of 255 million barrels of oil.