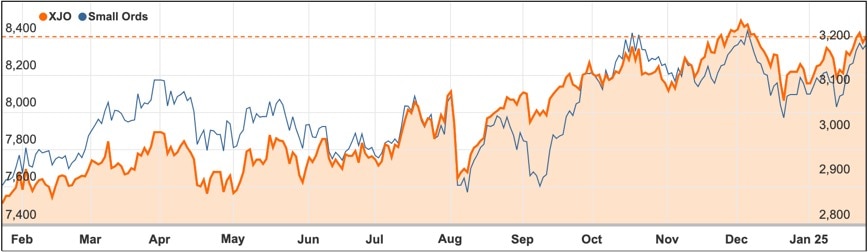

After a week of having President Trump in power, the Australian share market charged back to within just 1% of regaining its record high.

While nine of the eleven sectors were positive, it was retailers and miners that were largely responsible for the Friday rally as the ASX 200 index closed up 0.4%, or 30.2 points, to 8408.9 points.

The Australian dollar also firmed, rising to a five-week high of US63.17c.

Much of the rally was based on the widening belief that Trump’s much vaunted tariff wars would be much slower and more limited than had been feared, after Trump said he had engaged in a “good, friendly” conversation with Chinese President Xi Jinping and indicated he was reluctant to use heavy handed actions against the country.

Miners up but energy stocks hit

That remark bolstered Chinese and Hong Kong stocks – and didn’t hurt Australian mining stocks either – although Trump’s plea for OPEC to “bring down the cost of oil” to drive down inflation and interest rates caused some damage to energy company share prices.

Lower oil prices after that jawboning saw shares in Woodside Energy (ASX: WDS) drop 1.9% to $24.48 while Beach Energy (ASX: BPT) shares fell 1% to $1.50.

The opposite happened for the miners which rose on the back of potentially lower Chinese tariffs, with BHP (ASX: BHP) shares up 0.5% to $39.10, Rio Tinto (ASX: RIO) shares up 0.3% to $118.33 while Fortescue (ASX: FMG) shares jumped 1% to $18.81.

Wesfarmers leads retailers up

Retailers were also noticeably stronger with Wesfarmers (ASX: WES) shares up 3.3% to $74.66 on the back of positive broking reports after it jettisoned loss-making online retailer Catch in the face of tough competition in that space and continues to perform well with Bunnings.

Commonwealth Bank (ASX: CBA) shares jumped 0.5% to $158.65, leading the rest of the banks higher with the exception of ANZ (ASX: ANZ) shares which fell 0.07% or 2c to $30.18.

One of the best gains came from retailer Premier Investments (ASX: PMV) which added 6.7% or $1.77 to its share price to hit $28.62 after it successfully merged a portfolio of apparel brands with Myer (ASX: MYR), which also added 2.6% to its share price to hit 98c.

There was plenty of stock specific trading action – most of it positive on the back of good announcements.

Shares in resources engineering group Monadelphous (ASX: MND) jumped 5.8% to $14.88 after the group forecast interim net profit would exceed consensus estimates while 4DMedical (ASX: 4DX) shares also leapt 6.2% to 60¢ after the company struck a supply deal with Qscan Radiology Clinics.

Synlait Milk (ASX: SM1) shares jumped a healthy 23.9% to 44¢ after the dairy processor boosted its second half guidance and forecast a return to profitability this year.

Not so fortunate were shareholders in online retailer Kogan.com (ASX: KGN) who saw their shares fall 15.2% to $5.07 after it grew revenue by just 9.9% in the first half of the 2025 financial year.

Small cap stock action

The Small Ords index rallied 1.42% to 3201.9 points.

The week ahead

Quite apart from the expected flurry of actions from Donald Trump in the coming week, there is a welter of local and offshore news to keep market traders occupied.

For Australia the biggest news should be the inflation update for the December quarter which has most analysts tipping that the Reserve Bank’s key core inflation measure – the trimmed mean – should rise around 0.5%, bringing the annual rate down to 3.2%.

Such an outcome would bolster the chances of seeing an official interest rate cut from the Reserve Bank at its February board meeting but any signs that inflation is failing to fall could torpedo lower rates.

Rate cuts expected for Canada and Europe but not the US

The US Federal Reserve is likely to hold its official rate steady at a meeting on Wednesday but Canada is likely to shave 0.25% off its reference rate on the same day.

That leaves just the European Central Bank which is also expected to shave another 25 basis points off its reference rate on Thursday.

The other market moving possibilities in the coming week come from corporate announcements with plenty of US fourth quarter earnings released and the Australian profit season also starting at the end of the week.