Weekly review: Santa rally tapers off after a bumper year on the share market

WEEKLY MARKET REPORT

Santa Claus really is coming to town, although the much-vaunted Santa rally ran out of a little steam on Friday.

Never mind, there are still a couple of trading days to go before the rotund guy comes down some chimneys and barring any last minute snafus, 2019 has been a surprisingly fantastic year for Australian share market investors, delivering average returns above 20% and even higher for those investors who rode some of the hot sectors during the year.

On Friday, the benchmark ASX 200 index finished down 16.8 points, or 0.3%, to close at 6816.3 points.

Second weekly rise for the ASX 200

That is still a weekly rise of 1.1% which is not bad in a week when the serious action is really starting to trail off for the holidays.

The ASX 200 has now risen for two straight weeks and is only a fraction above 1% below the record highs it hit in late November.

Looking more closely at who was naughty and nice on the market, energy stocks were weaker with a 0.9% slide led by a 1.8% drop in Origin Energy (ASX: ORG) shares which fell to $8.62.

Consumer staples were also 0.8% lower with Woolworths (ASX: WOW) down 1.6% to $37.24 while smaller retail cousin Metcash (ASX: MTS) was also dipped 1.5% to $2.60.

Macquarie bucks the banking trend to break a record

Bucking a downward trend for financials of 0.4%, investment bank Macquarie (ASX: MQG) added 0.2% to notch up a new closing high of $140.25.

The big four banks were heading in the opposite direction, all recording modest falls.

Giving the share market a little bit of backbone were the industrial, REITs, utilities and materials sectors which all firmed with miner Rio Tinto (ASX: RIO) jumping and impressive 1.4% to $103.66.

Online lottery retailer Jumbo Interactive (ASX: JIN) saw its shares crunch 14.5% to $15.74 after the hot stock delivered a trading update that fell short of what the market was expecting.

Investors who have stuck with Jumbo all year won’t be disappointed, given it has more than doubled during the year even with this fall.

Lendlease (ASX: LLC) shares were also under the pump, falling 4.6% to $18.02 after announcing it has conditionally agreed to sell its engineering unit for $180 million.

Positive global leads were a big help during the week with news that the United States and China were finally on the same page on trade and had agreed to a phase one trade agreement welcome news, along with a solid victory for Boris Johnson’s Conservative Party in the UK general election.

Wealth on the rise

One of the more interesting publications during the week was the finance and wealth data from the Australian Bureau of Statistics which is the most complete look at household balance sheets.

Not surprisingly, despite lots of economic concerns during the year the actual numbers were impressive as the recovery in property prices and a sterling performance by the share market was reflected in much stronger wealth levels at the household level.

Total household wealth or net worth rose by 3.0% to a record high of $10,912.4 billion in the September quarter after rising by 2.6% to $10,594.4 billion in the June quarter.

Over the year to September, net worth rose by 4.3%.

In per capita terms, wealth rose by $10,698.6 which is the biggest increase since December 2016 and took the September quarter figure to a record-high of $428,573.5 per person.

The wealth data is a very good leading indicator of future spending so it was a cheery note in what has otherwise been a fairly gloomy picture of late with employment, retail spending and wages growth all very disappointing.

Small cap stock action

The Small Ords index closed up 1.01% on 2911.1 points.

ASX 200 vs Small Ords

Small cap companies making headlines this week were:

AusCann Group Holdings (ASX: AC8)

AusCann revealed this week it was planning to bring its cannabinoid-based hard-shell capsules to Australian patients in the first half of next year.

The company has completed manufacturing and testing of the capsules with a commercial-sized batch now released for clinical evaluation, which will provide key information regarding dose selection.

“These results will build the clinical evidence supporting the unique benefits of AusCann’s capsules necessary to open a large market for the company,” AusCann chief executive officer Ido Kanyon said.

AusCann claims its solid-fill capsules are a unique form for medicinal cannabis.

XCD Energy (ASX: XCD)

In Alaska’s most successful oil and gas lease sale in 13 years, XCD Energy has managed to lock-in four leases encompassing 185 square kilometres on the Nanushuk oil fairway within the country’s National Petroleum Reserve.

The new leases are adjacent to XCD’s existing Project Peregrine permits and host analogous leads to ConocoPhillips Harpoon prospect, which will be drilled next year.

To secure the leases, XCD paid a US$51,992 (A$75,548) non-refundable deposit with the outstanding balance of US$259,960 (A$377,800) to be paid in February next year.

XCD will fund this from its recent $2 million capital raising that was also backed by the company’s management.

Norwest Energy (ASX: NEW)

It’s been a successful week for Norwest Energy which revealed it had raised $795,100 in an oversubscribed share purchase plan that had a $500,000 target.

Proceeds from the plan and recent placement will enable Norwest to drill the Lockyer Deep-1 well in the first half of next year.

The company has also appointed Bruce Clements to its board as a non-executive director.

Mr Clements has held senior appointments with ExxonMobil, Ampolex, Roc Oil, AWE and Santos and has 20 years’ experience in the Perth Basin.

MRG Metals (ASX: MRQ)

Mineral sand explorer MRG unveiled assays from aircore drilling at the Koko Massava target within the Corridor Central tenement in Mozambique.

MRG chairman Andrew Van Der Zwan said the first eight holes of out of the 82-hole program have “typically exceeded” visual field estimates.

“The implications of this are both unequivocal and significant, since the enormous, near surface high-grade mineralised footprint at Koko Massava is based on field visual grade estimation of the 82 aircore holes, together with earlier visual and laboratory heavy mineral sand assay results from auger drilling,” he added.

Better results were 18m at 7.44% total heavy mineral from 3m, 15m at 8.15% THM from 30m, 24m at 7.19% THM from 3m and 6m at 11.89% THM from 21m.

MRG expects to deliver a maiden resource for Corridor Central at the end of the next quarter.

Galan Lithium (ASX: GLN)

Geophysics surveys across Galan Lithium’s Pata Pila and Rana del Sal licences, part of the company’s Western Basin projects in Argentina, have identified “highly conductive horizons”, which Galan believes confirm “extensive brine potential”.

The anomalies were identified on leases adjacent to Livent Corporation’s Fenix lithium brine operation.

Galan will use the survey results to assist in developing the maiden resource for its Western Basin projects.

On Friday, Galan revealed it had contracted Chilean-based Ad-Infinitum SPA to begin preliminary studies into processing options for the nearby flagship Candelas project.

The studies are expected to focus on conventional processing technologies including traditional evaporation pond systems and an associated lithium carbonate plant.

Ad-Infinitum has previously provided services to Livent, Galaxy Resources, Yara Australia and Salt Lake Potash.

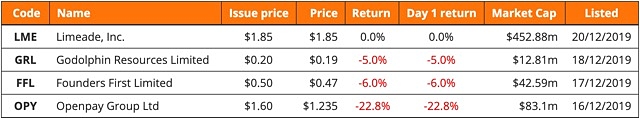

ASX floats this week

Small Caps readers who want to view upcoming IPOs or see the performance of stocks that have listed in 2019 can now do so.

The latest companies to make their way onto the ASX this week were:

Godolphin Resources (ASX: GRL)

Ardea Resources spin-out Godolphin Resources managed to successfully list on the ASX before Christmas after raising $7.5 million in its IPO.

The company issued 37.4 million shares at $0.20 and after taking into account IPO and listing costs, the Godolphin now has $6.5 million to kick off drilling at its New South Wales Lachlan Fold Belt tenements.

Godolphin owns 3,200sq km in the region, with tenements believed prospective for copper and gold.

Drilling is scheduled to begin at the Mt Aubrey deposit next month, which has an existing resource of 679,000t at 2.3g/t gold for 50,300oz.

All up, the Lachlan Fold Belt tenements have global resources of 431,000oz contained gold across Mt Aubrey, Lewis Ponds and Yeoval.

Godolphin slipped 5% to close out its first week on the ASX at $0.19.

Founders First (ASX: FFL)

Craft beverage producer Founders First debuted on the ASX on Tuesday after raising more than $15.7 million via the issue of 31.56 million shares at $0.50 each.

The company will use its funds toward growing the Jetty Road and Foghorn business while expanding brand distribution.

Additionally, funds will be used to complete acquisition of craft breweries and distilleries that Founders First deems of high quality.

Founders First finished its first week on the ASX at $0.47 – down 6% on its offer price.

Openpay (ASX: OPY)

Buy now pay later newcomer Openpay achieved its goal of an ASX listing before Christmas.

The company’s shares began official quotation on Monday after raising $50 million via the issue of 31.25 million shares at $1.60 each.

IPO proceeds will be used towards enhancing its technology platform and decisioning tool, while boosting receivables growth via increased funding.

Prior to listing, Openpay had 1,754 active merchants in Australia, but supports merchants in New Zealand and launched in the UK earlier this year.

By Friday close of trade, Openpay’s share price had fallen almost 23% to $1.235.

Limeade (ASX: LME)

The final stock to make its way onto the ASX this week was employee experience software company Limeade.

The company raised $100 million in its IPO giving it a market capitalisation on its ASX debut of $490.8 million.

According to Limeade, its platform helps organisations better-care for their employees by unifying delivering well-being, engagement and inclusion solutions.

The company currently serves 175 companies across 100 countries and has more than 2.4 million users.

Limeade claims its customers have up to three times lower employee turnover with about 85% of employees feeling engaged at work.

Under the offer, 54.1 million CDIs were up for grabs at $1.85 each, with a one-for-one CDI per share ratio.

Limeade closed out its first day at $1.85 after reaching an intraday high of $1.95.

The week ahead

As you would expect, the flow of data will slow to a trickle over the festive season and only really get going well into the New Year.

In Australia in the coming week the Corelogic home value index for December is likely to show a continuation of the property recovery while the news will likely be more muted for private sector credit and the Markit/CBA manufacturing purchasing manager’s index for December.

Looking overseas there is a rash of US housing figures of various types as well as consumer confidence numbers while China is releasing some figures on industrial profits and purchasing manager indices.

The US Federal Reserve (FOMC) meeting minutes will also be released in what is otherwise a week to get ready for Santa to arrive rather than worrying about sniffing the wind for fresh economic insights.