Weekly review: late rally saves markets as Aussie dollar continues its fall

WEEKLY MARKET REPORT

The Aussie dollar tumbled to decade lows this week – dropping to US67.24c on Monday, before slipping further late on Friday to US67.1c.

Triggering the fall was an escalation in the ongoing US-China trade war with US President Donald Trump threatening to increase current tariffs on US$250 billion of Chinese imports from 25% to 30% from 1 October.

He also said he will bump planned tariffs on a further US$300 billion worth of Chinese goods from 10% to 15%.

President Trump has now gone so far as to tell US companies to find alternative sources of business than China.

Currency experts anticipate the trade war will continue to cause the Chinese yuan to fall, which is also at decade lows – hitting 7.147 per US dollar on Monday.

The declining yuan is pressuring the Aussie dollar and analysts have been predicting a continuing decrease for the Australian currency, with Capital Economics’ touting the dollar will drop to US60c.

Declining dollar sparks share market tumble

The declining dollar has had a cascade effect – sparking the Australian share market to shed $30 billion on Monday’s open.

However, the market regained some of its falls as the week unfolded, with the ASX 200 clawing back some ground to finish Friday at 6595.2 points, up 1.77%.

Petrol prices soar

The falling Australian dollar drove petrol prices to a four-year high this week. The ACCC revealed the average price for petrol in FY2019 was 141.2c per litre across the country’s five largest cities.

This was up 7c a litre on FY2018.

“The AUD-USD exchange rate is a significant determinant of Australia’s retail petrol prices because international refined petrol is bought and sold in US dollars in global markets,” ACCC chair Rod Sims explained of the price hike.

Nickel strengthens amid ongoing trade wars

Despite falls in other commodities, the ongoing trade war hasn’t been able to keep nickel down with the commodity posting more gains this week – hovering at U$7.412 per pound on Friday, which is a rise of 15% for the month and 54.3% increase for the year-to-date.

Driving this rise are increasing demand and a dry pipeline of advanced nickel project. Stockpiles have been eroding in recent months – spending several weeks below 150,000t, before bouncing back slightly to 150,708t.

Western Areas (ASX: WSA) noted it has experienced increasing interest for its nickel sulphide product, while BHP (ASX: BHP) anticipates demand for the mineral will continue expanding.

Construction continues to drag

According to the Australian Bureau of Statistics, nation-wide, in seasonally adjusted terms, total dwelling approvals dropped 9.7% in July – propelled by falls in Victoria (24.3%) and New South Wales (17.5%).

Private dwellings (excluding houses) fell 18.4%, with private housing approvals decreasing 3.3%.

WA recorded the biggest drop of 3.8% in the private housing sector, followed by South Australia (1.6%), Queensland (0.8%), and Victoria (0.6%).

The value of all buildings approved declined for the fourth consecutive month – dipping 1% for July. Accounting for the decreased value, were residential buildings which shrunk 1.9%.

Reporting season reveals some bright spots

As the current reporting season comes to an end, several high performers were revealed.

Unsurprisingly, Afterpay (ASX: APT) was a star performer in FY2019, unveiling a 130% rise in its customer-base over FY2018 – which helped the company post a 86% increase in income to $26.41 million, driven by 140% growth of underlying sales to $5.2 billion.

Afterpay closed Friday at $30.98 – a gain of 32.96% for the week.

Wesfarmers (ASX: WES) was another high performer with revenue of $27.9 billion for the full year, generating a 13.5% rise in its earnings per share.

Shares in the company finished marginally higher for the week at $39.10 per share.

Shipbuilder Austal (ASX: ASB) also achieved a positive FY2019 with the company unveiling $61.4 million in record profits – up 64% on the previous corresponding period.

Underpinning the profit was $1.852 billion in revenue.

The positive FY2019 results spurred the company’s share price up more than 17.22% for the week to end at $4.22.

Poor performers

On the flip side of reporting season was Caltex Australia (ASX: CTX) which experienced a 55% drop in its first half 2019 net after tax group profits to $135 million.

To curb its fall, Caltex said it would sell 50 petrol stations to reduce its costs, with EBIT from fuels and infrastructure (including Lytton) plummeting 99% on 1H2018 levels to a mere $1 million.

By Friday, Caltex’s share price had slid more than 9% to trade at $23.96.

Boral (ASX: BLD) also had a woeful week, with investors selling off stock after it revealed a small 4% revenue increase to $5.8 billion, but a 7% fall in earnings per share to 37.5c.

The company also unveiled a weaker forecast for FY2020 – downgrading its anticipated profits from 15% to 5%.

Boral’s share price fell 5.35% for the week to finish Friday at $4.25.

Sector movements

Information technology and materials were the best performing sectors this week – up 4% and 1% respectively.

Utilities edged into the green, while Healthcare dipped its toe in the red.

The worst performing sectors were Energy and Communication Services with both dropping more than 2%.

Small cap stock action

The Small Ords index rose again this week to close at 2837.3 points, up 1.09%.

ASX 200 vs Small Ords

Small cap companies making headlines this week were:

Bryah Resource (ASX: BYH)

Bryah Resources finally got the news it was waiting for this week after OM Holdings committed to the manganese joint venture over the Bryah Basin project in WA.

After paying a $250,000 exercise fee, OM will now spend $2 million on manganese exploration at the project to grow its interest from 10% to 51%

OM can then spend a further $4.3 million on exploration over two more stages to eventually own up to 70% of the project’s manganese rights.

While manganese exploration is underway, Bryah revealed it was completing a $2 million placement to advance gold and copper exploration at both Bryah Basin and Gabanintha assets.

Total Brain (ASX: TTB)

Teaming up with IBM and the US Department of Veteran Affairs, Total Brain’s mental health and fitness technology will be embedded into IBM’s Thrive360° of Mental Fitness platform.

Total Brain’s technology will drive IBM’s mobile-based solution Get Results in Transition (GRIT), which has been developed for veterans, active duty service members and reservists to assist them with understanding and strengthening their mental fitness, social connections and overall well-being.

“This partnership has the capacity to revolutionise mental health and fitness management across large populations that are exposed to significant stress or material change and uncertainties,” Total Brain chief executive officer Louis Gagnon said.

According to Total Brain, its technology is the first branded digital solution dedicated to helping people who live with considerable stress or are going through life transitions.

Meteoric Resources (ASX: MEI)

A drilling program is scheduled for September at Meteoric Resources’ Novo Astro project in Brazil after rock chip sampling revealed up to 290.13g/t gold.

Five other samples assayed above 1g/t gold and included 8.75g/t gold and 4.72g/t gold.

Although previous rock chip sampling programs have yielded similar results and the project hosts multiple artisanal mines, the project has never been drilled.

The upcoming drilling program will comprise 21-holes for 2,500m. Concurrent to the drilling, Meteoric will also undertake geophysical programs across the project.

Azure Minerals (ASX: AZS)

As silver and gold continue their upward run, Azure Minerals revealed it has regained 100% of the Alacran project from Teck resources.

Azure previously owned the Mexico based silver and gold project after earning the stake from Teck. However, Teck exercised a clawback right to secure 51% of the asset by spending US$10 million on advancing the asset between 2017 and 2020.

However, Teck’s focus had been copper and it was unable to discover a viable copper deposit, resulting in Teck offering Azure first rights to regain 100% of the asset.

Azure’s previous exploration at Alacran firmed up global resources of 32.2Moz of silver and 150,000oz gold. Now the project is back in Azure’s hands, the company will undertake further exploration with the hope of more silver and gold discoveries.

VRX Silica (ASX: VRX)

A definitive feasibility study for VRX Silica’s Arrowsmith North silica sand project in WA estimates sales for the mine’s initial 25-year life would bring in $2.773 billion.

The study is based on the project’s ore reserves of 204Mt at 99.7% silica within the mining lease application area, with overall reserves totalling 223Mt at 99.7% silica.

Capital expenditure in the BFS is estimated at $28.26 million which would build a 2Mtpa operation that would attract after tax and finance cashflow of $835 million over 25 years.

VRX is advancing offtake discussions with managing director Bruce Maluish noting the company had received “significant interest” from potential customers across the Asia Pacific.

Impression Healthcare (ASX: IHL)

Two leading medical experts have been appointed to Impression Healthcare’s medical advisory board and will assist the company with all facets of its traumatic brain injury and periodontal disease clinical trials.

Dr Ronjith Jithoo and Dr Simon Hinckfuss will take up their positions next week and will also be responsible for securing funding grants, assisting with product development, presenting research findings and assisting with documentation.

Impression’s positive partnership news has also continued with the company securing a five-year supply agreement with Air Liquide SA subsidiary Air Liquide Healthcare Australia.

Under the agreement, Impression will supply Air Liquide with the Sleep Guardian ‘Silensor’ and ‘Dorsal’ mandibular advancement devices, with Air Liquide to then distribute the devices throughout 180 sleep clinics in Australia.

Paradigm Biopharma (ASX: PAR)

A phase 2 clinical trial using Paradigm Biopharma’s injectable pentosan polysulfate (iPPS) drug Zilosul has revealed the treatment can slow cartilage degradation in patients with osteoarthritis of the knee.

The trial resulted in a reduction in two key biomarker levels: cartilage oligomeric matrix protein (COMP) and ADAMTS-5.

These biomarkers are associated with cartilage degradation and are elevated in people with progressive osteoarthritis.

The trial revealed COMP levels in those treated with iPPS declined 11.9% over 53 days compared to a placebo group of 2.1%. ADAMTS-5 levels reduced 5.1% with iPPS compared to an average 10% rise in these levels in the placebo group.

Key Petroleum (ASX: KEY)

Following Strike Energy and Warrego’s “staggering” gas discovery at their West Erregulla-2 well in Perth Basin, Key Petroleum has begun firming up targets within its nearby acreage.

The discovery is within the Kingia Sandstone and comprised a 97m gross gas column, including a 67m section with several high-quality large units of clean sand with thick blocky porosity and high gas saturation.

Key has reviewed offshore and onshore wells in the northern portion of the Perth Basin, which has revealed the gas reservoir is “regionally extensive”.

The company will search for leads within its own portfolio including permits EP 437 and L7.

Echo Resources (ASX: EAR) and Northern Star Resources (ASX: NST)

Another gold takeover was reported this week after Northern Star Resources said it would acquire Echo Resources in an all cash off-market acquisition that values Echo at $242.6 million.

The offer proposed Echo holders would receive $0.33 for every share held – which was a 40% premium to Echo’s last trading price of $0.237 on 19 August.

Echo’s board recommended the offer, which is also a 80.3% premium, to Echo’s 60-day volume weighted average price of $0.183.

Northern Star’s strategy behind the acquisition is to secure Echo’s Yandal gold project and associated critical infrastructure in the region.

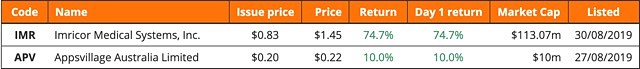

ASX floats this week

Small Caps readers who want to view upcoming IPOs or see the performance of stocks that have listed in 2019 can now do so.

The latest companies to make their way onto the ASX this week were:

AppsVillage Australia (ASX: APV)

AppsVillage Australia began ASX life this week after raising $5 million in its IPO.

The company issued 25 million shares at $0.20 and plans to use proceeds raised to build on existing sales, marketing and other initiatives to expedite growth.

AppsVillage provides small-to-medium businesses with a software-as-a-service solution, which gives companies an “inexpensive” and “simple” to build and manage their own branded mobile app.

The company has integrated its solution with both Facebook and Instagram.

By Friday, AppsVillage had closed its first week at $0.22.

Imricor Medical Systems (ASX: IMR)

MRI-compatible device manufacturer Imricor Medical Systems began trading on Friday after raising $13 million via the issue of more than 14.5 million CDIs in the IPO and 1.08 million shares – all at $0.83 each.

Imricor claims it is the first company in the world to bring commercially viable and safe MRI-compatible products to the cardiac catheter ablation market.

The company is in the process of getting CE Mark and Australian regulatory approvals, with raised funds to help Imricor build on its growth strategy.

Imricor closed out its first day and week at $1.45, which was an almost 75% premium to its offer price.

The week ahead

A number of things to keep an eye out for next week include the Reserve Bank’s decision with interest rates on Tuesday.

The RBA is tipped to keep rates on hold at a low 1%.

However, language in the RBA’s statement will be closely watched to see if there’s any signals of further rate cuts coming in the near term.

Retail sales numbers for July are out the same day to that will provide a bell weather, despite it being a lagging indicator.

On Wednesday we have gross domestic product numbers for the second quarter out. Annual growth of 1.5% is forecast from the previous 1.8%, despite the RBA envisioning 2.75%.

Over in the US we have non farm payroll numbers for August out and manufacturing numbers, after GDP being revised down this week to 2% from the forecast 2.1%.

China’s manufacturing PMI numbers for August are out tomorrow and are expected to come in lower as signs of a global slowdown continue, despite central banks around the world lowering interest rates.