The past week is one in which the chickens really came home to roost and the fear of bad economic news became a reality.

First there was the NAB index of business conditions which showed that consumer confidence had tumbled out of optimism and into pessimism – even after the election result and a cut in official interest rates to just 1.25%.

Then there finally was confirmation that we are in a retail recession with the NAB business survey showing numbers which NAB group chief economist Alan Oster said showed the Australian retail sector was now “GFC-level terrible”.

Consumer confidence, retail and employment all in trouble

“Retail is really, really doing it tough, and it’s getting worse,” he said.

“While the retail industry has lagged the other sectors for some time, the recent deterioration has seen conditions in the industry fall to levels not seen since the GFC,” he said.

As if to confirm the retail recession were several real-life ominous revelations – a sizable $103 million expected write down in full year earnings for the Wesfarmers (ASX: WES) owned Kmart and Target followed by the loss of 450 executive roles at the Tooronga head office of former Wesfarmers stablemate Coles (ASX: COL).

Polishing off the gloom was the employment numbers which all but confirmed that the Reserve Bank will once again be looking to cut interest rates again in the next couple of months.

While the employment numbers themselves can be read a number of ways, they were significantly boosted by the number of part time jobs provided by the Federal Election – all of which can be expected to disappear for the next survey.

You wouldn’t have known any of this from the Australian share market, which ended the week at a fresh 11-year high as surging iron ore prices pushed up mining stocks.

Share market continues to rise

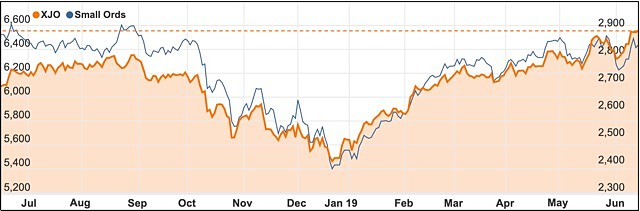

The ASX 200 Index rose an impressive 1.7% or 110.1 points for the week to 6554 this week.

US President Trump’s deal with Mexico to avoid tariffs on Mexican goods was well received by markets and investors were also happy to see central banks moving towards cutting interest rates, which should support asset prices.

There were some deals to be had as well with Vocus (ASX: VOC) shares up 14.1% to $4.36 after AGL Energy (ASX: AGL) made a $3 billion takeover bid for the telecommunications company.

The offer came a week after Swedish private equity firm EQT withdrew its takeover bid.

Under the deal AGL would pay $4.85 for each Vocus share, which is a significant premium even to the current higher share price.

AGL shares were down 6.2% for the week to $19.57.

Higher iron prices drive miners

Some of the week’s best performances came from the big miners as price of iron ore rose another 10% to an impressive $US110.20 a tonne.

Fortescue Metals Group (ASX: FMG) had the most leverage to the higher price, with a 12.2% rise for the week to $8.80 but BHP (ASX: BHP) was no slouch, rising 6.8% to end the week at $40.30 while Rio Tinto (ASX: RIO) added 7.6% to $105.34.

It wasn’t all good news with shares in annuity provider Challenger (ASX: CGF) falling hard (down 18.3% for the week to $6.50) after it said it now expected to achieve the bottom end of its guidance in the 2019 financial year.

The company cited lower interest rates and the disruption to the advice industry caused by the Hayne royal commission for the sales weakness.

Another profit warning came from gambling group Star Entertainment (ASX: SGR) with its shares falling 14.9% to $3.82 for the week.

Star said that softer economic conditions and a weaker performance by the international VIP business were to blame and it will cut as much as $50 million from its cost base.

Fund manager AMP Limited (ASX: AMP) also slumped 5.8% to $2.11 after the banking regulator issued new licence conditions on AMP Super due to ongoing concerns over its management in the wake of the Hayne Royal Commission.

The Energy sector rallied 1.7% on Friday alone, after concerns that attacks on two oil tankers could lead to conflict in the Gulf of Oman.

Iran has denied being involved despite the US blaming it for the attacks in one of the world’s key shipping routes.

Gold hits all-time high

Another commodity experiencing a resurgence in 2019 is gold.

The precious metal reached an all-time high in Aussie dollar terms of $1,966 per ounce.

Gold this week also reached a 26 month high against the Euro and in US dollars, the gold chart is on the verge of breaking out, proving that 2019 is the year for gold.

Small cap stock action

The Small Ords index climbed 1% this week to close on 2,842 points.

Among the companies making headlines this week were:

Bligh Resources (ASX: BGH) and Saracen Mineral Holdings (ASX: SAR)

Gold miner Saracen Mineral Holdings made a takeover play for Bligh Resources on Friday, with the takeover valuing Bligh at $38.2 million.

The all scrip takeover will comprise Bligh holders being issued 0.369 Saracen shares for every Bligh share held – equating to an offer of $0.128 per Bligh share and representing a 97% premium to the company’s closing price of $0.065 on Thursday.

Saracen hopes to unlock the value of Bligh’s Bundarra project, which has 660,000oz in gold resources and is only 30km from its Thunderbox gold operation.

Bligh’s board and largest shareholder Zeta Resources have unanimously endorsed the takeover.

Tasman Resources (ASX: TAS) and Strategic Resources (ASX: SER)

Twiggy’s iron ore vehicle Fortescue Metals Group is securing more copper ground in South Australia via farm-in agreements with Strategic Energy Resources and Tasman Resources.

Fortescue will earn 80% of Strategic’s Myall Creek copper-gold project by spending $1.5 million on exploration over five years. The project is close to BHP’s renowned Oak Dam West discovery.

Meanwhile, Tasman’s Vulcan exploration licence is in proximity to BHP’s Olympic Dam operation and Fortescue will secure an initial 51% interest in the licence by spending $4 million on exploration over three years.

Fortescue can then elect to expand its ownership of Vulcan to 80% by investing a further $7 million on exploration over five years.

Australian Potash (ASX: APC)

Australian Potash released an update on exploration and development at its Lake Wells sulphate of potash project, with a JORC reserve estimate for the project due soon.

As part of the company’s ongoing exploration, it confirmed this week it had hit a wide, high-yielding basal sand intersection, with indicative flow rates above project requirements.

Australian Potash has now installed five production wells at the project with 30% of the stage one bore field to be production-ready when the definitive feasibility study is released later this year.

The company is also assessing the optimal commercial-scale construction and design for the proposed evaporation ponds at Lake Wells.

CountPlus (ASX: CUP)

Financial services firm CountPlus will acquire Commonwealth Bank of Australia’s subsidiary Count Financial for $2.5 million.

Under the acquisition, CountPlus will own 85% of Count Financial, with a discretionary Count member firm trust to retain the other 15%.

According to CountPlus, the deal will amalgamate the entire Count company network to enable a focus on delivering accountant-led financial advice.

Earlier this year in April, CountPlus acquired 40% of Rundles Prime Pty Ltd and a 20% interest in Rundles Financial Planning Pty Ltd for $2.48 million.

TV2U (ASX: TV2)

This week TV2U completed its acquisition of the Talico Technologies’ intellectual property portfolio, which is now expected to bring in revenue in the short-term.

TV2U will acquire Talico’s digital analytics, video, IoT and OTT IP along with Talico’s IoT-focussed commercial projects.

Acquiring Talico’s IP will help TV2U to maximise revenue growth opportunities via its existing and future OTT/internet protocol television deployments.

With Talico’s IP, TV2U’s business model will be split between IoT consultancy, IoT/OTT platform delivery and resell opportunities.

Marquee Resources (ASX: MQR)

Cobalt explorer Marquee Resources has moved into South America’s Lithium Triangle after agreeing to acquire Centenario Lithium, which owns a 30% stake in lithium brine explorer Lithium Power International Holdings (Argentina).

The leases, which cover an area of 68sq km, are located in an area that has intense solar radiation for nine months of the year – making it favourable to a solar evaporation processing style.

Lithium Power International (ASX: LPI) holds the other 70% in the Argentinian lithium brine explorer.

BrainChip (ASX: BRN)

US-based BrainChip has released the beta version of its powerful neural network converter, which enables users to convert existing convolutional neural networks (CNN) to an Akida compatible event-based spiking neural network (SNN).

Inspired by human neuron biology, BrainChip develops AI-based computing solutions with the technology capable of learning autonomously, evolving and associating information.

The Akida chip, which will incorporate the neural network converter, is scalable and allows users to connect Akida devices together, enabling complete network training and inference for multiple applications.

“The low power inherent in the Akida device will set a new standard in neural network design, implementation and performance,” BrainChip chief operating officer Roger Levinson explained.

“They can leverage existing CNN solutions as well as incorporate next generation SNN solutions all in a single development environment and on a single device and achieve a low power solution without sacrificing performance,” Mr Levinson added.

Emerge Gaming (ASX: EM1)

Viacom’s African division VIMN Africa has signed an agreement with eSports platform operator Emerge Gaming to build and roll-out a new eSports product NickX for children.

The NickX interactive eSports tournament will be based on Emerge’s ArcadeX platform, with Emerge responsible for developing, operating and maintaining the platform.

In return, VIMN Africa will allow the platform to showcase content from its Nickelodeon brand.

Emerge was unable to disclose the full financial impact of the agreement, but expects the arrangement will result in a “material return”, which is expected to occur through brand take-up, premium and in-app subscriptions as well as advertising.

ASX floats this week

Small Caps readers who want to view upcoming IPOs or see the performance of stocks that have listed in 2019 can now do so.

The latest companies to make their way onto the ASX this week were:

Prospa Group (ASX: PGL)

Fintech firm Prospa Group debuted on the ASX on Tuesday after issuing 29 million shares at $3.78 in its IPO to riase $109.6 million.

The online small business lender will use the IPO proceeds to fund the equity portion of its growing loan book, working capital, repaying corporate debt and investing in new products and regions.

Prospa’s current net loan book exceeds $300 million, with revenue expected to grow by 26% during 2019.

During its first week of trade, Prospa reached a high of $4.55 before closing Friday at $3.58 – down 5.3% on the offer price.

PointsBet Holdings (ASX: PBH)

PointsBet’s securities started trade on Wednesday after the company raised $75 million via the issue of 37.5 million shares at $2 each.

The corporate bookmaker offers sports and racing betting products via its scalable cloud-based platform.

PointsBet entered the US market in July last year and has continued to expand its presence in the country.

Offer proceeds will fund marketing and customer acquisition, as well as software and platform development.

PointsBet finished on Friday at $2.30 – a 15% premium to its offer price.

Victory Offices (ASX: VOL)

ASX newcomer Victory Offices is a provider of flexible workspaces including serviced, shared and virtual offices.

The company debuted on Friday after raising $30 million by issuing 15 million shares at $2 each.

IPO proceeds will fund the company’s next phase of growth with eight new locations across Melbourne, Sydney and Brisbane noted for its development program, which will comprise fitting out offices to suit a variety of clients from sole traders and start-ups through to small-to-medium enterprises.

Victory reached a peak of $2.30 on its first day of trade and closed 7.5% higher at $2.15.

Tubi Ltd (ASX: 2BE)

Tubi’s securities began trading on Friday with company raising $5.76 million in its IPO.

The company issued 28.8 million shares at $0.20 each to secure the $5.76 million, which will fund the growth of its high-density polyethylene pipe mobile manufacturing plants.

Tubi operates a plant under construction the US and has four other new plants under development.

After listing, Tubi reached a high of $0.315 before slipping slightly to close its first day on the ASX at $0.295, which was a 47.5% premium to the offer price.

The week ahead

Other than global changes which could impact on oil and iron ore prices, the Reserve Bank will once again dominate the news this week.

Governor Dr Philip Lowe is giving a speech in Adelaide on Thursday which follows the release of the June 4 board meeting on Tuesday.

There has been a lot of speculation that the RBA will look to cut rates again in the next few months so any indications will create headlines.

It is a similar situation in the US, with the Federal Reserve announcing its interest rate decision.

Although there is no expectation of a rate cut this time around, the language will be carefully watched for any dovish undertones.