Gold stocks set to shine in 2019 as investors flock to safe-haven metal

The scene is being set for Australian gold stocks to potentially rally in 2019.

With continued global uncertainty showing no signs of abating, 2019 is shaping up for what could be a bumper year for ASX-listed gold stocks.

Increased market volatility and political instability stemming out of Europe has seen investors turn to the safe-haven metal in an attempt to hedge against risk.

Gold has been on the incline since its low of US$1,160.73 per ounce in mid-August and is set to end 2018 significantly higher.

Gold ETF vs ASX 200

According to resources analyst Gavin Wendt, market jitters could bode particularly well for gold prices and gold equities next year.

“From a political and economic point of view, there’s just enormous uncertainty out there which is concerning for the US and on an international level,” he said.

“Gold is really in the box seat for 2019.”

“If we start to see inflation emerge in the US economy, then that’s great for gold and if we start to see unease in the US stock market then investors will look for alternatives and they already are.”

Weaker US dollar forecast

The Department of Industry, Innovation and Science’s latest Resources and Energy Quarterly noted that the US and China trade tensions, and a softer US dollar were likely to support gold prices in 2019 and 2020.

“With US monetary conditions tightening modestly over the next 15 months, a correction in US equity markets remains a significant risk over the forecast period. Such a correction would likely result in fund flows into gold,” the report noted.

The department forecast prices of the safe-haven metal to increase by 0.4% and 2.7% in 2019 and 2020, to average US$1,275 per ounce and US$1,310/oz, respectively.

Although, other commentators are far more bullish on the precious metal.

Bulls on parade

Speaking to Small Caps earlier this year, Peter Schiff, head of Euro Pacific Capital, said the market could soon see US$5,000/oz.

Mr Schiff, however, has maintained this bullish outlook for almost a decade. He believes the reason his forecasts haven’t played out is directly related to the Federal Reserve.

“The market is running hot on money printing from the Fed,” he said.

“Record low interest rates and quantitative easing has seen speculative money drive up asset prices creating bubbles; this can’t go on forever.”

“We are going to see a stampede into gold when the time comes.”

Mr Schiff is known for his accurate predictions of the housing market collapse and global financial crisis that eventuated in 2007 and 2008.

Gold boost bodes well for silver

While silver generally trails behind its precious metal peer, Mr Wendt said silver could benefit from renewed interest in gold.

“Silver tends to lag behind gold in terms of price performance,” he said.

“You do get investors taking profits out of gold when gold has had its run and then putting it into silver.”

“I think silver will have its go [in 2019].”

Silver has been trading sideways since September; however, it appears to be on the verge of breaking out of its range.

The price of silver is often known to overshoot movements in gold, in that a 3% move in gold can see silver stir by 5%, as an example of its increased volatility.

Gold stocks to come on the radar

With sentiment for gold erring on bullish, Mr Wendt said it would bode well for the cashed-up, tier-2 miners such as Northern Star Resources (ASX: NST) and Saracen Mineral Holdings (ASX: SAR) who already have strong operating margins.

As for the smaller gold companies, Mr Wendt said higher gold prices could result in much-needed funds for the juniors and spur the big guns to engage in possible corporate activity.

“Some of these cashed-up companies are also going to be looking for acquisitions so the juniors are in a good position to benefit from any corporate activity,” he told Small Caps.

Gold major Newcrest Mining (ASX: NCM) is also one to keep an eye on if the price of the precious metal continues to improve.

Newcrest produced 548,000oz of gold in its September quarter, up 5% on the previous year and projects gold production to increase over the remainder of the financial year.

Exploration spend tracking upwards

With gold prices projected to track higher over the near-to-medium term, gold-focused companies will be armed with an incentive to ramp up exploration efforts.

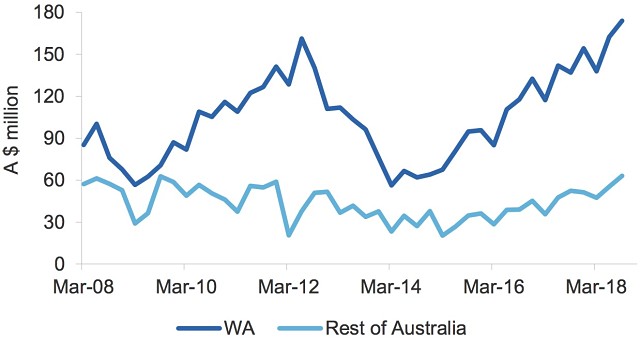

According to the Resources and Energy Quarterly report, Australia’s gold exploration expenditure rose by 24% year-on-year (in the 2018 September quarter) to $240 million, likely driven by an expected rise in gold prices in 2019 and beyond.

Money has been returning into gold exploration in recent years.

With all indicators pointing to a buoyant gold market come 2019, Australia’s producers will waste no time ramping up production to capitalise on improved market conditions for the precious metal.

Gold miners produced nearly 80 tonnes of gold in the September period, representing a 9.8% year-on-year increase.

With more growth on the horizon driven by mine expansion and greenfield operations coming online, Australia’s gold mine production is forecast to expand 3.6% in 2018–19.

Higher export volumes and a weaker outlook for the Australian dollar and US dollar exchange rate will prove favourable for Australia’s gold export earnings which are forecast to increase by 0.4 and 3.9% in 2018–19 and 2019–20 to $19 billion and $20 billion, respectively.