Victorian gold miners to be hit with royalty as Australia achieves 21-year production record

The Victorian government is set to raise gold royalties from zero to 2.75%.

The Victorian Labor government’s state budget, handed down by Treasurer Tim Pallas on Monday, includes plans to introduce a 2.75% royalty on gold production.

Over the weekend, Mr Pallas revealed several new and increased charges expected for the budget, including adding gold to the list of minerals subjected to a royalty with only small miners exempt from the tax.

The royalty update is meant to be in line with other Australian states and follows a strong wave of investment in Victoria’s gold sector in recent years, propelled by Kirkland Gold’s (ASX: KLA) discovery of the Eagle zone at its Fosterville gold mine in 2015.

However, local mining companies have appeared blindsided by the move with even the Minerals Council of Australia (MCA) saying the Victorian government failed to appropriately consult with the industry prior to announcing the plan.

“The Andrews Government has not consulted or listened to regional communities that rely on highly paid, high skilled jobs that mining delivers in Victoria,” MCA Victoria director James Sorahan said.

“A new 2.75% gold tax would add to uncertain project approval and regulatory regimes and regulatory duplication and inconsistencies.”

“It would also drive away investment at the very time when Victoria needs the ongoing long-term prosperity created by mining in gold operations in Fosterville, Ballarat and Stawell,” he added.

While all other states currently have varying gold royalty systems in place, Mr Sorahan said this was not a good enough reason to impose one in Victoria since it “ignores the unique characteristics of gold mining” in the state.

“Royalty regimes are designed differently in each state to encourage development of a state’s mineral resource for the benefit of the community, including different royalty rates, depreciation arrangements, exemptions and other features,” he said.

Australian gold production for the first three months of 2019 totalled 78 tonnes, the highest March quarter output since 1998.

In Western Australia, the royalty rate for gold is still only 2.5% despite the state having a significantly larger gold industry than Victoria.

But, in South Australia the rate is 3.5% and in Queensland, it ranges between 2.5-5% depending on average prices.

Meanwhile in New South Wales, the rate is calculated as 4% of the ex-mine value of production (the value less allowable deductions).

Victorian miners to be affected

Kirkland is the company that would be most affected by the royalty update, with its Fosterville mine being Victoria’s top gold producer.

During the March quarter, the mine produced more than 128,000 ounces of gold and is expected to reach a total output of 600,000oz this year.

In late January, AuStar Gold (ASX: AUL) recommenced mining activities at its Morning Star mine and is currently ramping up production, reporting a record 6.074kg of dore bullion poured from seven production days in April.

Earlier this month, the company announced it was in talks with the administrators of Centennial Mining to potentially takeover the embattled company and its assets including the A1 gold mine, located in the same goldfield (Wood Point-Walhalla) as AuStar’s Morning Star and Rose of Denmark assets.

Toronto-listed Mandalay Resources (TSE: MND) operates the Costerfield gold-antimony mine in central Victoria, which produced 4,105oz of gold during the March 2019 quarter.

In addition, Melbourne-based private company Arete Capital Partners poured its first gold from the rejuvenated Stawell mine in January.

Arete chief executive Campbell Olsen on Monday said he was “shocked and a bit stunned” about the planned royalty rate increase since “there has been no discussion whatsoever”.

“This forces our investors to review everything, we are getting questions from abroad about what is going on and where this has come from. Our international investors thought this was a reasonably consistent jurisdiction but now it looks like WA all over again – it looks like a smash and grab,” he told reporters.

Some other companies that may need to consider Victoria’s royalty in the future include Chalice Gold Mines (ASX: CHN), GBM Gold (ASX: GBM), Dart Mining (ASX: DTM), Catalyst Metals (ASX: CYL), Nagambie Resources (ASX: NAG), Kalamazoo Resources (ASX: KZR) and Navarre Minerals (ASX: NML), which have gold exploration and/or development assets in the state.

Record March quarter gold output

The news follows reports that Australian gold production has hit its highest level for any March quarter since 1988.

At 78 tonnes, output is the highest it’s been in 21 years for the March quarter despite being 4% lower than the October to December 2018 period, according to gold mining consultancy Surbiton Associates.

The firm said several factors result in the March quarter “almost invariably” achieving the lowest gold output each year, including the fact that the period is only 90 days long compared to 91 days in the June quarter and 92 days in the September and December quarters.

“Every day makes a difference, since Australia’s current production of around 320t of gold a year is nearly nine-tenths of a tonne of gold a day,” Surbiton director Dr Sandra Close said.

Another reason is that production is often lost in the March quarter due to bad weather in the tropical cyclone season.

“While some production was lost in north Queensland this year, the northern part of Western Australia was far less affected than usual,” Dr Close said.

During the March 2019 quarter, Australia’s largest gold producers were Newcrest Mining (ASX: NCM) with 218,819oz produced at Cadia East in New South Wales, followed by Newmont Goldcorp’s (NYSE: NEM) Boddington (in Western Australia) and Tanami (in the Northern Territory) mines at 155,000oz and 131,000oz, respectively.

Number four was Kirkland Gold’s Fosterville mine in Victoria, producing 128,445oz during the quarter.

No ‘production cliff’ in sight?

Dr Close has rejected recent claims made by market analysts S&P Global Market Intelligence that Australian gold is on a “production cliff” with local mines on the verge of “running out of gold”.

“There are many factors that affect ore reserves and therefore the life of each mine,” she said.

“I cannot predict the future but at the moment, there do not appear to be major causes for concern on the horizon.”

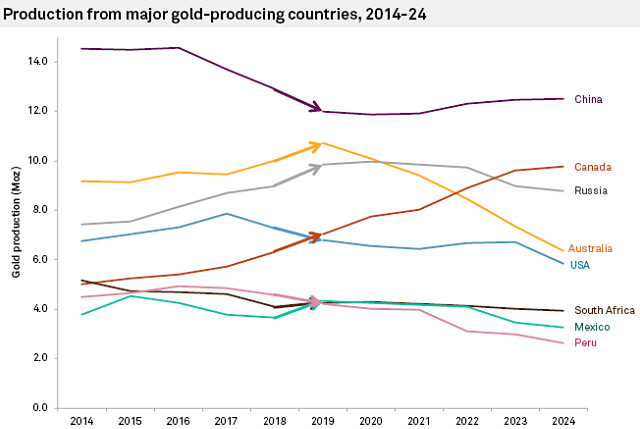

Gold production forecast by nation according to S&P Global Market Intelligence.

Dr Close said changes in gold prices and exchange rates plus changes in exploration, mining and processing costs were all factors affecting the economics of mining any individual deposit.

“It should be remembered that Australia is a land of generally small and medium-sized gold mines and large multi-million-ounce discoveries are quite rare,” she said.

“Just because such large deposits are seldom discovered locally, it does not mean that total Australian gold production is about to fall in a heap,” Dr Close added.

According to the United States Geological Survey, Australia holds the largest gold reserves of any country at 9,800t, which is equivalent to 31 years of production at current rates.

This far exceeds the estimated gold reserves of China (currently the world’s largest producer) at 2,000t or just five years of production.