Australia’s gold production ‘almost certain’ to fall after record highs in 2019

Australia’s gold production is forecast to drop significantly following record output levels in 2019.

Gold production in Australia hit an all-time high in 2018, but new research sees the country’s output falling dramatically by 2024 as some of its biggest gold mines peter out.

Australia broke a 21-year production record last year after producing 317 tonnes (about 10.2 million ounces) of gold according to data released by analyst Surbiton Associates in March.

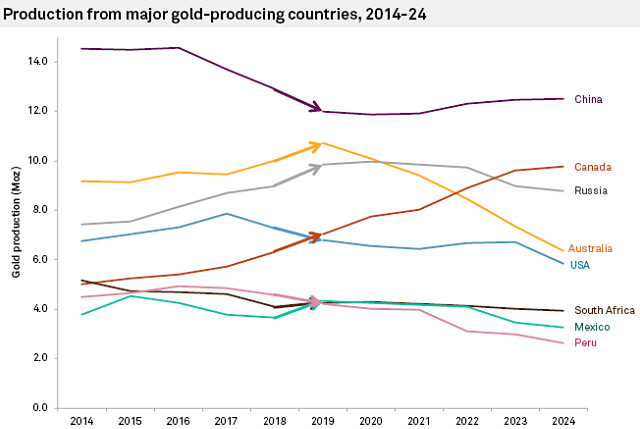

A recent report by market analysis firm S&P Global Market Intelligence predicts this record gold production will grow further to around 10.7Moz in 2019 – equivalent to about $19.2 billion – placing the country second behind China in a list of the world’s biggest gold-producing nations.

However, the report forecasts Australia will slide to fourth place behind Canada and Russia by 2024.

Australia set to fall behind other countries in gold output.

According to the report’s author, S&P analyst Christopher Galbraith, Australia’s gold production is expected to “fall the most” – by more than 40% to 6.3Moz over the next five years – due to the depletion of several ageing mines.

“Even if it doesn’t fall by 40% by 2024 – essentially, what we consider the worst-case plausible scenario, production will almost certainly fall,” Mr Galbraith told Small Caps.

With the Australian dollar gold price recently trading near record highs of more than $1,815 per ounce, this could potentially equate to about $8 million in lost output.

Depleting resources from ageing mines

Mr Galbraith said the underlying reason for Australia’s fall in production is “the depletion of several long-lived assets such as St Ives, Paddington, Telfer, Edna May, Southern Cross, Agnew/Lawlers and more”.

“Those have been great mines, they’ve had excellent lives, but, nevertheless, all good things must eventually come to a close and they are running out of gold,” he said.

However, he noted that the expected commissioning of Vista Gold’s Mt Todd project and the reactivation of the Union Reefs Operations Centre in the Northern Territory would “partly mitigate the loss from those aforementioned closures”.

Gold Fields’ $621 million Gruyere project in Western Australia is also expected to pour its first gold bar in June and this project was mentioned in the S&P report as being a large contributor to the global output boost predicted for this year.

Mr Galbraith pointed out there was also potential to replace Australia’s depleting mines through exploration.

“There’s a lot of exploration going into Australia and it is bearing fruit,” he said.

“Unfortunately, it’s simply smaller fruit, so those large deposits that have been identified in the past, they’re simply not materialising.”

In contrast, Perth Mint chief executive officer Richard Hayes has dismissed S&P’s research, telling reporters a significant fall in Australian gold production was highly unlikely.

“Australia is the second largest producer of gold and has the world’s largest known gold reserves, so I would be very, very surprised if there’s this production cliff we’re all going to fall off in five years’ time,” he said.

Merger and acquisition activity

Mr Galbraith told Small Caps other factors also needed to be considered when looking at global trends in the gold sector, including the high degree of merger and acquisition activity underway.

“Merger and acquisitions are being carried out to grow or at least maintain production, while holding or lowering costs as much as possible,” Mr Galbraith explained.

He added this activity was changing how large production bases were looking and pointed to the Barrick and Newmont Mining Corporation’s operational consolidation in Nevada as an example.

According to Barrick, the merger would allow both parties to capture about US$500 million in pre-tax synergies over the first five years of the joint venture – equating to about a $5 billion pre-tax net present value over 20 years.

“If a similar degree of consolidation was to play out in Kalgoorlie, for example, although it wouldn’t add gold back into production, it could feasibly change the cost profile of the region, making sure the region’s gold mines remain profitable as long as possible.”

Global output to reach record high

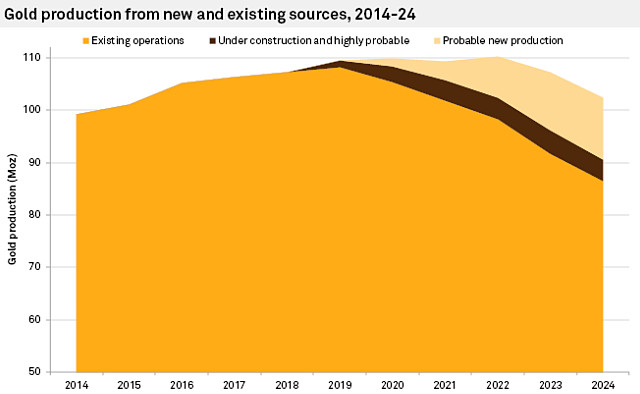

Despite Australia’s predicted descent, the S&P report has forecast global gold output to increase for an 11th consecutive year to reach a new record high of 109.6Moz in 2019 – up from 107.3Moz in 2018.

“We believe the forecast growth of 2.3Moz in 2019 will be the strongest growth in the past three years, debunking commentary calling for peak gold,” Mr Galbraith said.

In the report, he attributed more than half of this predicted increase to recently commissioned mines or new mines scheduled to come on stream during the year.

Forecast global gold production.

These include the above-mentioned Gruyere project along with other new production streams including Agnico Eagle Mines’ Meliadine project and Eldorado Gold’s commissioned Sigma-Lamaque mine, both in Canada, as well as restarted operations at AngloGold Ashanti’s Obuasi mine in Ghana and Equinox Gold’s Aurizona project in Brazil.

China is expected to contribute just less than 12Moz to global gold output this year and will stay the clear front-runner through to 2024.

Canada is projected to pass the US in gold production in 2019 to be the fourth-largest producing country for the year, before bounding to second place by 2024.

According to Mr Galbraith, the ongoing ramp-up of gold projects in Russia would contribute too – equalling Australia’s production levels in 2020 before surpassing it at third place by 2024.

In his report, Mr Galbraith also predicts global output will remain steady for the next few years before beginning to decline after 2022, “as indicated by the declining global reserve base”.