Top 10 IPOs on the ASX in 2019

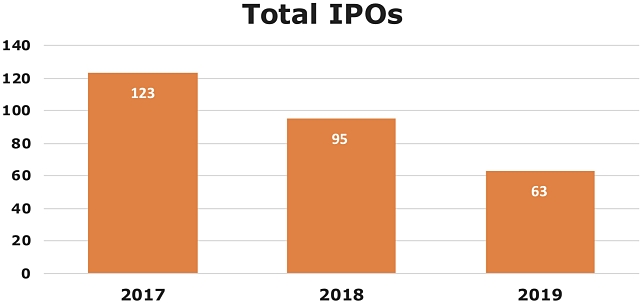

2019 was a slow year for IPOs on the ASX with only 63 listings in total.

Last year presented a mixed bag of results for initial public offerings (IPOs) on the Australian Securities Exchange (ASX), though tech companies emerged as the clear favourite for investors in 2019.

Despite new listings dropping by a third, more than 61% of the ASX newcomers finished the year above their issue price – a big improvement on 2018, where 73 of the 95 companies that listed finished in the red.

ASX Listings senior manager James Posnett told Small Caps that “ASX IPO activity in 2019 broadly reflected the downward global trend”, adding that growth in small and mid-cap IPOs appeared to be the key theme of the year.

“Technology companies, cross-border listings and listed investment companies/trusts (LIC/LITs) featured strongly,” he said.

IPO performance 2018 v 2019

According to the ASX’s figures, there were 92 new listings in 2019, down 30% from 2018’s total of 132.

If you exclude exchange traded funds, debt issues, spin-offs and reverse takeovers – as we did last year – this brings the total down to 63, which is 33.7% lower than the 95 market floats recorded in 2018 and 35% lower than the four-year average of 97.

Listings filtered in throughout the year at a slow and steady pace, but a December rush of 16 IPOs gave the numbers a boost.

Significantly less small cap companies listed last year – 30 companies had a market capitalisation of less than $100 million on listing in 2019, compared to 79 in 2018.

Despite the drop in new listings, ASX IPOs significantly outperformed the broader S&P/ASX 200 index in price, growing by 35% compared to 18.4%.

This made 2019 the fourth time in five years that IPOs have outperformed the ASX 200, measured on year-end averages.

Australian listings also beat the price performance of IPOs in the US markets, which increased by 19.6% overall in 2019.

Capital raised

According to the ASX’s data, the total capital raised through IPOs reflected the fewer listings, coming in at $6.9 billion.

While this figure is 19% lower than the $8.5 billion raised in 2018, it is slightly more than 2017’s total of $6.4 billion.

Although, the average IPO deal size increased 18% to $112 million in 2019 due to fewer micro-cap listings, Mr Posnett said.

The most IPO capital was raised by listed investment companies and trusts (LIC/LIT), with KKR Credit Income Fund (ASX: KKC) and Magellan High Conviction Trust (ASX: MHH) topping the list, respectively raising $925 million and $862 million.

The largest IPO of the year by market capitalisation was fintech business Tyro Payments (ASX: TYR), which was worth about $1.36 billion when it listed on the ASX in December.

The Sydney-based eftpos machine provider and business lender raised $287 million in its oversubscribed IPO.

A strong year for fintechs

Compared to 2018, a larger chunk (more than a third) of the market entrants came from the tech sector with Mr Posnett describing 2019 as “one of the ASX’s strongest years for fintech IPOs”.

“There are now over 50 fintech companies listed on the ASX,” he said.

Around 30% of the IPOs came from the financial sector while 17.5% came from information technology. Although together, the two sectors contributed more than 77% of the total IPO funds raised in 2019.

To further raise the profile of the tech sector, the ASX is planning to launch a new index next month named the S&P/ASX 200 All Technology Index.

“While still an emerging industry, there are more than 620 active fintech companies in Australia, spanning a variety of sub-categories. As the industry continues to develop, expect increasing merger and acquisition activity, as well as capital raising in both the private and public markets,” Mr Posnett said.

In addition to Tyro Payments, other December fintech floats included MoneyMe (ASX: MME) and OpenPay (ASX: OPY).

In 2018, 37% of the market entrants came from mining and resources. In contrast, only a handful listed in 2019 with industry-related companies falling more into the commercial services and equipment sub-categories, such as heavy equipment contractor Mader Group (ASX: MAD) and waste management company M8 Sustainable (M8S).

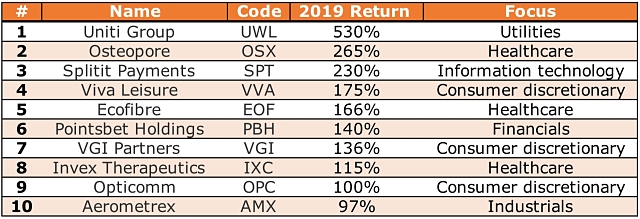

Healthcare companies also featured in the mix, with three of them making it to our top 10 list.

2020 outlook

Looking ahead, Mr Posnett said the macroeconomic environment “should improve in 2020 as some of the geopolitical uncertainties of 2019 subside, such as the easing of global trade tensions and greater clarity around Brexit”.

He said while global levels of private capital are at an all-time high, long-established reasons for companies to choose an IPO still apply.

“Access to capital, liquidity and visibility are all enhanced in the public market. For small and mid-cap companies, an ASX listing is often a more favourable option to later-stage private funding rounds and other stock exchanges,” Mr Posnett said.

“With a strong pipeline, the key themes of technology, cross-border and LIC/LIT IPOs are most likely to continue in 2020,” he added.

List of the top 10 IPOs in 2019

Small Caps has compiled a list of the top 10 performing companies based on return at the end of the year.

Here’s a more in-depth look at those companies:

Uniti Group (ASX: UWL)

Telecommunications provider Uniti Group topped the list of 2019 ASX debutants, making a superb 530% gain since listing in February.

The company’s growth strategy involves the acquisition of businesses that align with its stated “three pillars” of wireless, fibre and specialty telco services.

Uniti raised $13 million during its IPO then went on a spending spree, closing several acquisitions throughout the year including a FuzeNet, Pivit, Fone Dynamics, Call Dynamics, LBNCo and Open Networks.

Its most recent purchase of 1300 AUSTRALIA for $78 million was finalised in mid-December. To fund this, the company successfully completed a placement raising $84.9 million.

Worth less than $38 million on listing, Uniti now has a market capitalisation of more than $460 million.

Osteopore (ASX: OSX)

By the end of 2019, medical tech company Osteopore had made a 265% return since its September listing.

The Australian and Singapore-based business raised $5.25 million through its IPO with ambitions of becoming a world-leading producer of 3D-printed medical implants.

Specifically, its patented implants have been engineered to stimulate and facilitate “regenerative bone healing”.

In October, the company reported third quarter sales of $298,000 and year-to-date sales of $730,000.

In November, Osteopore announced a deal with Boao Yiling Life Care Centre in China and secured first orders of its products to be used in rhinoplasty surgery.

The company also welcomed medical device company Cochlear’s former chief executive officer Jack O’Mahony as a board advisor.

In addition, Osteopore is working with a subsidiary of Japanese medical researcher Terumo Corporation to jointly progress application development in an area of dental surgery with a patient-specific, second generation implant.

Splitit Payments (ASX: SPT)

One of the first market floats of 2019, Splitit continued to enjoy success throughout the year, finishing with a 230% return by year-end.

The Israeli-based lender was touted to rival Buy Now Pay Later giants such as Afterpay (ASX: APT) and Zip (ASX: Z1P) and generated significant investor buzz, raising $12 million in its heavily oversubscribed IPO.

The company planned to use its IPO funds to strengthen its sales and marketing efforts to boost merchant acquisitions and help build distribution channels.

Although falling short of the calibre of the multi-billion-dollar instalment payment majors, with a market capitalisation of about $137 million, Splitit posted strong results throughout the year.

During the third quarter, the company recorded a total of US$466,000 in merchant fees, up 25% from the June quarter and almost doubling the corresponding period in 2018.

It also revealed 624 merchants and 235,000 customers were using its instalment payment solutions.

In addition, Splitit locked in significant partnerships with companies such as major Australian online retailer Kogan.com and Hong Kong’s digital payments business EFT Payments Asia.

Viva Leisure (ASX: VVA)

Australian fitness club owner Viva Leisure has had a strong run since joining the ranks mid-year, gaining 175% since its listing price by the end of 2019.

Over the last six months, the company completed the acquisition of Fitness 24/7 businesses in New South Wales and Victoria, as well as 10 Healthworks fitness centres in Queensland.

In December, it announced the planned $13.5 million acquisition of 13 FitnFast Health Clubs in NSW, Victoria and the Australian Capital Territory. This deal is expected to complete before the end of March 2020.

The tech-focused company also recently unveiled its ‘Club Lime Member ID’ app, which enables keyless entry into its 24/7 gyms via the member’s mobile phone or Apple watch, as well as launched a dedicated DAB+ (digital) radio station called ‘Club Lime Radio’.

In an investor presentation released in early December, Viva provided a revenue guidance for the 2020 financial year of $58.7 million, which takes into account the new contributions from Healthworks and FitnFast.

Later that month, the company said club membership spanning about 60 locations exceeded 70,000 members, up 30% since July.

Ecofibre (ASX: EOF)

Hemp-focused Ecofibre is another company that has had a strong run since its March listing, which saw it raise $20 million.

The IPO funds were intended to fast-track the commercialisation of Hemp Black – a range of innovative hemp-based textiles developed in partnership with Thomas Jefferson University in the US.

Ecofibre claims the sustainable hemp-derived textiles offer ‘high performance’ capabilities such as moisture management, temperature regulation, no friction or static and conductivity, as well as having anti-bacterial and bio-repellent properties.

In its December report, the company said the grand opening of its new US headquarters and the Hemp Black processing facility is scheduled for April 2020. The processing facility is expected to be commissioned and operational by the end of June.

It also posted second quarter revenue of $14.7 million, up 2% on the September quarter and 106% from December 2018.

The company’s US product line also includes nutraceutical products for people and pets, as well as topical creams and salves, produced under subsidiary Ananda Health.

In Australia, Ecofibre produces locally grown and manufactured hemp food products including protein powders, dehulled hemp seed and hemp oil under a Tasmania-based subsidiary called Ananda Food.

Pointsbet Holdings (ASX: PBH)

Corporate bookie Pointsbet Holdings made its ASX debut in June after raising $75 million through its IPO.

With operations in Australia and the US, the company offers sports and racing wagering products through its scalable cloud-based platform.

The company’s stock has been on a steady rise since listing, supported by strong September quarter results including a 138% increase in turnover year-on-year to $235.8 million and a 223% rise in registered clients, reaching close to 150,000.

In October, Pointsbet said it had accepted more than 10 million bets over the last 12 months.

The company entered the US market in July 2018 and has continued to expand its presence in the country.

In November 2019, it said the recent legalisation of sports betting in Colorado now enabled it to look to launch retail and mobile operations in the state in 2020.

In January, Pointsbet struck an exclusive deal to provide online and mobile sports wagering and gaming in the US state of Michigan, and said it is in continued talks regarding retail sportsbook operations at the Northern Waters Casino Resort.

By year-end, Pointsbet gained almost 140% since listing and had a market capitalisation of about $624 million.

VGI Partners (ASX: VGI)

Sydney-based investment management firm VGI Partners listed on the ASX in June after raising $75 million in its IPO.

The hedge fund owns VGI Partners Global Investments (ASX: VG1), which has been listed since 2017, and VGI Partners Asian Investments (ASX: VG8), which floated on the market this November.

In addition to ending 2019 with a 136% return and being seventh on this list, VGI ranked ninth in the top 10 listings in order of market capitalisation. It was valued at about $557 million on listing and is now worth about $906 million.

Invex Therapeutics (ASX: IXC)

Biopharmaceutical company Invex Therapeutics raised at least $10 million through its IPO and hit the ASX in July.

The Perth-based company planned to use the funds to advance its ambitions of repurposing the diabetic drug Exenatide for neurological conditions.

According to Invex, the drug can lower intracranial pressure by reducing cerebral spinal fluid secretion in the choroid plexus of the brain.

Shortly after listing, Invex’s stock shot up to $1.40 before tapering off dramatically, but by the end of 2019 it was still up more than double the issue price, at $0.86.

In October, the company announced the granting of a patent in Japan and completed recruitment for a phase two clinical trial targeting the treatment of idiopathic intracranial hypertension with Exenatide.

Invex completed the dosing regimen of the trial in January and said it expected top-line results in late Q1/early Q2 2020.

Opticomm (ASX: OPC)

Australian broadband network builder OptiComm listed in August after raising $42.3 million through its IPO and promising to deliver faster internet services to new residential estates.

The company builds fibre networks into new residential developments and then wholesales the infrastructure to retail service providers.

OptiComm’s stock quickly climbed to double the price not long after listing and stayed that way through to the end of 2019.

Aerometrex (ASX: AMX)

One of the most recent floats on the ASX is Aerometrex, which listed in December following its $25 million IPO.

The Adelaide-based company specialises in aerial photography and mapping and has developed an online aerial imagery subscription service called MetroMap, which provides current and historical imagery over Australian capital and regional cities.

Aerometrex planned to put about a third of its IPO funds toward further development of its MetroMap application, while another 20% was budgeted for its 3D modelling business.

In January, the company announced the launch of new 3D models and measurement tools within its MetroMap service and said sales momentum for the subscription service has continued.

While still a new listing, the company ended 2019 with its stock nearly doubling in price, representing a 97% return.