Tesla plans to have 1 million self-driving robo-taxis on the road by 2020

Any Tesla vehicle with autonomous driving capabilities will be able to operate as a robo-taxi, earning the owner of the vehicle passive income.

World-renowned electric vehicle (EV) manufacturer Tesla has announced yet another revolutionary milestone that is set to transform both the automotive industry and society.

In addition to being a leading EV producer, currently fuelled by the rampant lithium battery industry, Tesla has now set its sights on delivering autonomous self-driving cars to the masses.

Tesla’s enigmatic – and often eccentric – chief executive officer Elon Musk said that within a year, at least 1 million Tesla cars will be on the road that are fully capable of driving themselves.

The move puts Tesla in direct competition with Waymo, the current market leader made by Google’s parent company Alphabet Inc. With the world’s largest electronics manufacturer, Apple, another company in the running with its iCar project.

At the end of 2018, Tesla’s global sales totalled 532,000 units. In the US, Tesla vehicle sales increased by 280% from 48,000 to 182,400 last year. To underline its growing dominance, market research suggests Tesla’s sales represented about 20% of the all-electric cars on the world’s roads.

Not content with the driver-dependent EV market in isolation, Tesla is now pursuing the driverless market too.

In a presentation to investors, Musk declared that customers will be able to put their cars onto a shared network of 1 million “robo-taxis” that will enable full autonomy for car drivers.

Owners of Tesla’s vehicles will be able to generate income as their car drives people from destination A to B.

Robo-taxis usher in a new era of automotive

In effect, car drivers will now become passengers with vehicles capable of navigating autonomously.

Analyst reaction to the news was especially critical of the timeline with a million robo-taxis in less than a year considered to be “vintage Elon Musk” and “half-baked without considering pricing, insurance liability, regulatory or legal requirements,” according to Wall Street research firm Cowen.

Tesla said it plans to make its autonomous robo-taxis feasible by using advanced camera and sensor technology.

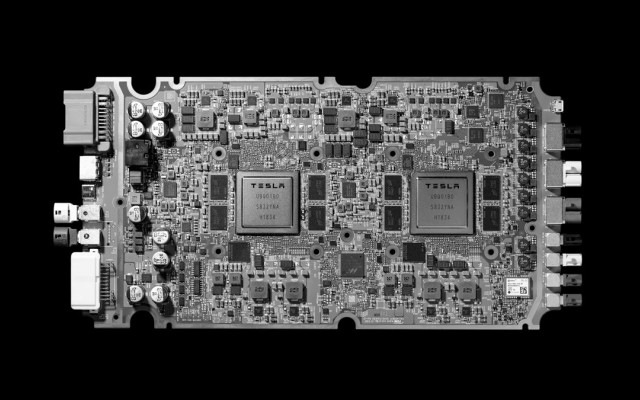

All cars manufactured by the EV maker will sport eight vision cameras, 12 ultrasonic sensors, radar and a “full self-driving computer” as standard, which Tesla has labelled as a “custom-designed beast” with over 6 billion transistors, allowing all its cars to take in multiple sources of information at 2,300 frames per second.

Tesla’s new Full Self-Driving Chip houses 6 billion transistors and is capable of processing up to 2,300 frames per second – a 21x improvement over previous generation hardware.

By soaking up bundles of data with its cameras and sensors, Tesla’s software does the rest and claims to be able to navigate its autonomous fleet in all weather conditions.

In addition to navigating around busy streets with dozens of other cars, Tesla says its cars are also being amped up in terms of longevity and durability.

Its newest models – the Model S and Model X – now come with an all-new drivetrain design that substantially increases each vehicle’s range, achieving a landmark 370 miles for Model S Long Range and 325 miles for Model X Long Range in recent tests.

Paying for the future

The futuristic plans being hatched by Tesla do raise questions – financial ones first and foremost.

The cost of making a big push into autonomous vehicles only adds to Tesla’s already pressurised balance sheet that has felt the brunt of aggressive R&D and marketing spend in recent years.

Tesla considers itself as a “vertically-integrated manufacturer” with proficiency in multiple domains, including batteries, electric motors, sensors, and artificial intelligence. Being adept in several trades is rather expensive and has induced Tesla to post increasingly negative cash flows over the past five years.

Despite the spiralling costs, Tesla is projecting growth, expansion and market dominance, but this is likely to result in more capital raises in the near term, coupled with having lost US$702 million in the past quarter due to a drop in Model 3 deliveries.

By ushering the automotive industry into the next generation of lithium-battery-powered electric vehicles, Tesla has successfully taken EVs mainstream and readied them for mass adoption.

Long gone are the worries of lengthy charging cycles, low-range travel and overpriced vehicles compared to the petrol-powered status-quo.

Tesla’s aggressive business model and cutting-edge technology appear to have succeeded in marketing electric cars to the mainstream public, with autonomous cars now set to become yet another selling point for consumers.

Not only is luxurious and fuel-efficient driving marketable, but clearly, so is being chauffeur-driven without the need to even have a driving licence.

Back in 2016, Tesla repeated the trick first done by Ford back in 1908. The launch of its Model 3 had striking similarities with Ford’s Model T, first launched in the early 20th century.

What Ford did for the 20th century, Tesla wants to do for the 21st – to usher in a new paradigm of travel for the masses.

In broader terms, Tesla is driving towards an entirely different energy future that is built on better energy storage.

The Tesla effect has the potential to shift how the world thinks about energy and, therefore, could affect the values of key raw materials required for an energy-efficient future.

Not only could Tesla do for the lithium industry what Ford did for the hydrocarbon industry, Musk also wants to harness entirely new tech innovations such as artificial intelligence, wide scale automation and the Internet of Things (IoT).

Trouble in paradise

Despite the positives being put forward by Tesla and giddy investors, there could be some trouble ahead for the autonomous automotive sector. There are still many challenges that remain unsolved, ranging from the technical to the ethical.

What happens if a car cannot process all the information it needs to? What if a sensor is obscured by mud or dirt? Who is responsible if a car runs over a pedestrian – the passenger or the manufacturer? What happens if a car is hacked, disrupted or deviated?

In addition to the technical and ethical questions, there are also far more rudimentary quality concerns. A video of a Tesla car spontaneously combusting in a Shanghai parking garage earlier this week sent its shares 4% lower.

Surveillance video of Tesla exploding in Shanghai parking lot goes viral https://t.co/F6CqDRtj5r pic.twitter.com/KLLfeAbZ45

— Jalopnik (@Jalopnik) April 22, 2019

The news led Evercore, a prominent US brokerage house, to cut its recommendation on shares of the Silicon Valley company to ‘sell’, thereby becoming the 12th firm in the past year to recommend abandoning Tesla’s futuristic EV vision and raising bearish sentiment to the highest level since the company’s inception in 2003.

The most recent segue into automation could potentially be a case of Tesla biting off more than it can chew, although Musk has delivered in the past and revolutionised a number of industries almost single-handedly.

“The fundamental message that consumers should be taking today is that it’s financially insane to buy anything other than a Tesla. It will be like owning a horse in three years,” Musk reportedly said.

Wise words or a marketing gimmick?

As with all technological breakthroughs – time will ultimately tell.