Market wrap: risk assets sold as market loses ground for the week

WEEKLY MARKET REPORT

The Easter hangover continued for the Australian share market on Friday, with the ASX 200 shedding 0.6% or 40.7 points to 7773.3 points as markets digested the news that US interest rates may not fall at all this year.

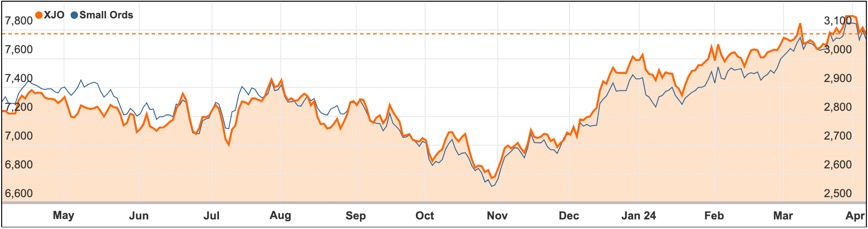

That meant the ASX 200 had fallen 1.6% for the week, recording falls on three of the four trading days after Easter.

Wall Street stocks had earlier tumbled overnight after a Fed official raised the possibility of delivering none of the interest rate cuts the market is expecting if inflation worsens.

US rates might stay steady all year

Minneapolis Fed President Neel Kashkari said that he is now questioning the need to cut rates if so many areas of the economy look to be solid.

He had earlier signalled the likelihood of two rate cuts this year, “but if we continue to see inflation moving sideways, then that would make me question whether we need to do those rate cuts at all.”

While Kashkari is not a voting member on the Fed’s policy-making committee, his comments may reflect the feelings of those who are as the US economic readings continue to point to a solid economy that doesn’t seem to need any further stimulus.

Here in Australia the interest rate-sensitive technology sector fell 1.4% and the materials sector 0.8% as iron ore continued its weak performance.

Energy higher on oil rise

Every single sector closed lower but energy was the best performer with a marginal fall of just 0.02%.

The reason was not hard to find because benchmark crude oil futures topped $US91 a barrel to reach their highest level in five months.

That sent shares in local oil stocks up with Santos (ASX: STO) shares up 0.6% to $7.93 and Woodside (ASX: WDS) up 0.2% to $30.60.

Oil prices seemed to be cheered on by the prospect of firmer crude demand with improved data coming out of China amid fairly solid economic data from the big markets of the US and Europe.

Miners mixed as iron slumps

It was a different story for iron ore, with prices off another 1.5% to $US98 a tonne helping BHP (ASX: BHP) shares fall 0.9% to $44.35 and Rio Tinto (ASX: RIO) shares to fall 1% to $120.55.

The mining picture is mixed though, with gold down slightly from a record but copper advancing to its highest level for 14 months.

Fund managers continued to rise and fall on their performance.

Asset manager GQG Partners (ASX: GQG) had a good day with its shares up 4.1% to $2.29 after funds under management climbed to $US143.4 billion to the end of March.

The picture was not so rosy for rival Magellan (ASX: MFG) which posted net outflows of $700 million for March.

That disappointment led to its shares shedding 3.7% to $9.49 a share.

The technology sector fell 1.2% on Friday alone, with shares in WiseTech (ASX: WTC) down 1.7% and Xero (ASX: XRO) shares down 1.6%.

One of the few rays of sunshine on the market was the real estate investment trusts (REITS) which held up fairly well although some of the other large miners were hit including Lynas Rare Earths (ASX: LYC) shares, down 2.9% and shares in Mineral Resources (ASX: MIN) down 1.4%.

Small cap stock action

The Small Ords index fell 1.72% for the week to close at 3069.9 points.

ASX 200 vs Small Ords

Small cap companies making headlines this week were:

Aurumin (ASX: AUN)

Aurumin has initiated a reverse circulation drilling campaign at the Sandstone gold project, aiming to explore nine new open pit targets through 40 holes across 4,000 metres.

These targets, located within close proximity to the processing plant, will be explored for various types of mineralisation, including porphyry/intrusive-hosted vein, banded iron-hosted, and structural shear style in mafic and ultramafic units.

The Sandstone project, which Aurumin acquired in early 2022, is a historic gold operation central to the company’s strategy, boasting a mineral resource of 881,300 ounces and infrastructure aimed at supporting future gold mining activities.

Recently, the company secured $2.5 million through a share placement to improve its financial position for the project’s development and added a high-grade tenement to the Sandstone portfolio, enhancing its exploration prospects.

This strategic expansion includes historic mines with notable past gold production, underlining Aurumin’s commitment to developing Sandstone and expanding its exploration efforts.

Boss Energy (ASX: BOE)

Boss Energy is set to restart uranium production at the Honeymoon mine in South Australia, achieving a major milestone in their strategy with the imminent filling of the first drum of uranium in the next fortnight.

The company has successfully prepared the processing plant ion exchange (IX) column with uranium-rich lixiviant from the wellfields, indicating enhanced efficiency in uranium recovery and an improved economic outlook for the project.

Managing director Duncan Craib highlighted the achievement of key goals to increase the uranium concentration in the feed solution and expand the processing facility, aiming to increase production rates and reduce costs.

The uranium extraction process involves injecting lixiviant into the orebody to dissolve uranium in situ, with the uranium-rich fluid then pumped to the surface and processed to produce high-quality uranium oxide.

The Honeymoon mine, which Boss acquired in 2015 and was previously shut down in 2013 due to low uranium prices, is now poised for production amidst a favourable market with uranium prices near US$88 per pound.

Regeneus (ASX: RGS)

Regeneus and US-based Cambium Medical Technologies (CMT) have merged to advance the development of Elate Ocular, for the treatment for dry eye disease.

The merger, finalised through regulatory filings in Georgia, USA, resulted in the issuance of new shares in Regeneus to CMT shareholders, who will also receive a 5.5% revenue royalty from Elate Ocular.

Following the merger, Regeneus will change its name to Cambium Bio and is seeking to alter its ticker code to ‘CMB’ on the Australian Securities Exchange.

Key leadership changes include the appointment of Terence Walts as chief executive officer of CMT to oversee US operations, and Dr Edmund Waller as chief scientific officer, while Leo Yao Lee has resigned.

The newly combined entity is actively seeking additional financing to proceed with FDA-recommended phase 3 trials for Elate Ocular, aiming for a mid-2025 start.

In addition, Cambium raised $3.48 million via a two-tranche placement at $0.006 per share.

Cycliq (ASX: CYQ)

Cycliq introduced its most advanced bike camera and light system, Fly6 Pro, showcasing 12 years of research and technological advancements.

The Fly6 Pro features include 4K video recording, 100-lumen light output, 7-hour battery life, wi-fi connectivity, an OLED display, and a USB-C connector, emphasising safety and user convenience.

The product’s launch aligns with Cycliq’s commitment to enhancing global cycling safety through innovative, user-centered design.

In a recent Black Friday campaign, Cycliq reported $1.2 million in sales, with significant contributions from the US and UK markets, indicating strong consumer interest in cycling safety and technology products.

Cycliq operates internationally, with a robust online presence and a wide retail distribution network, having shipped over 200,000 units globally since its inception in 2012.

The week ahead

There are a host of new economic announcements this week in Australia, which taken together will help to illuminate how the economy is travelling.

They include data on housing loans, dwelling starts, consumer and business confidence, payroll data, business turnover and household spending.

The offshore data is arguably more important with the US inflation figures front and centre, along with producer and trade prices and the minutes of the last Federal Reserve meeting.

Chinese inflation and trade data should show how the slow Covid recovery is progressing there while central banks in Canada, New Zealand and Europe hand down interest rate decisions.

The other local feature is plenty more large dividend payments with around $3.1 billion to be paid to investors from ASX 200 companies, with some of that total sure to be reinvested in the share market.