There were two numbers released in the national accounts this week that tell you all you need to know about the desperation and the hope of Australia’s recession.

The first – and the one to get all of the attention – was the unnerving 7% collapse in GDP during the June quarter.

That is the deepest economic contraction since the 1930’s depression and effectively heralded the arrival of the recession, with the economy shrinking by 6.3% over the past year.

The other figure – which received a lot less attention – was the astounding rise in the household savings ratio which reached 19.8%, the highest level since 1974.

Private spending has stalled

What the figure show is that the COVID-19 pandemic has stopped private spending on goods and services in its tracks, with discretionary spending falling 25%, spending on services collapsing by 17.6% and spending on hotels, cafes and restaurants down 56.1%.

Spending on transport was down a staggering 85.9%.

All of these spending cuts and consequent fall in GDP show the dramatic effect of the pandemic lockdowns on economic activity but in some sense they are “false” numbers because they show what people were able to spend rather than what they wanted to spend.

Savings going through the roof

The other side of that coin – which should give the economic optimists plenty to get excited about – is that the savings are being stashed away safely to be spent or invested in the future.

When households are suddenly saving 20c in every dollar, that is a major change in saving behaviour that suggests worry about what the future will bring but also potential spending that is being saved for when goods and services are open and available.

In some states that is already underway as their lockdown rules are relaxed and bars, restaurants and shops reopen and spending begins to ramp back up.

In Victoria, with a strict lockdown still ongoing, there is little chance of a more positive outcome for the next quarter, which is significant given that Victoria makes up about a quarter of national GDP.

The other recovery factor to consider is jobs, with the recovery of the jobs market over the coming months and years the biggest factor over where Australia’s economic growth goes from here on.

If employment picks up a bit faster than expected, then those saved dollars will start to be wheeled out and spent – some before Christmas.

If the jobs recovery is very slow, then you would expect those saved dollars to stay in bank accounts for a long time – despite attracting terrible interest rates – as people pull their heads in until some confidence reappears.

Aussie market has a big fall

If you were looking for the share market to breath some joy into the recession numbers it was the wrong place to go, with Friday delivering the worst session for four months.

The 3.1% dive stripped $56 billion off the value of Australian companies as the local market meekly followed on from a Wall Street bloodbath that saw the Dow Jones index lose 807.77 points and the NASDAQ tumble almost 5%.

The benchmark ASX 200 finished down 187.1 points at 5925.5 points – a far cry from its levels above 6100 points and down 2.4 per cent for the week.

Friday alone eroded two buoyant days with its worst one-day performance since May 1.

Obediently it was the Australian tech names that copped the brunt of the falls with the tech index shedding 5.6%.

Afterpay (ASX: APT) was down 6.7% to $78.20, bringing its weekly losses to 11.9%.

That followed on from the big tech names in the US suffering large falls, including Tesla, Apple and Microsoft.

All Australian sectors were down with the memories of two solid days quickly fading as a broad-based fall saw only six companies manage a share price rise.

There was open speculation about the US falls, with some calling it an overdue and healthy correction while others saw the pullback as a sign that markets were getting nervous before the US election in November and may continue to wallow.

It wasn’t just tech that fell, with blood products giant CSL (ASX: CSL) down 4.1%, big miner BHP (ASX: BHP) down 3.8% and all of the big banks down by between 2.1% and 3.1%.

Small cap stock action

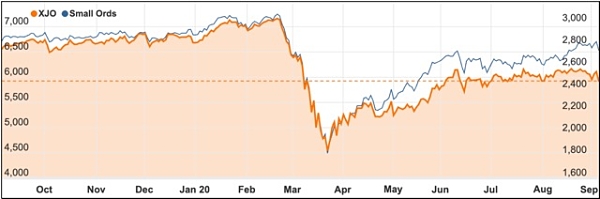

The Small Ords index fell 1.5% this week to close on 2759.3 points.

Small cap companies making headlines this week were:

Respiri (ASX: RSH)

Respiri’s wheezo asthma management device has been shown to be an accurate tool for detecting the presence of wheeze in patients with chronic respiratory ailments.

A total off 11 physicians used the electronic hand-held device to assess wheeze severity in 56 patients who had been admitted with airway disease and a clinically-detectable wheeze.

Preliminary results of the clinical study showed the technology could demonstrate a high degree of accuracy when compared to a physician’s assessment of the chest and trachea using a stethoscope.

The company said patient self-assessment using wheezo would confer a “high degree of confidence” in wheeze measurement and monitoring outside of a clinic environment.

Southern Gold (ASX: SAU)

South Korea-focused explorer Southern Gold has secured $10.2 million in an oversubscribed capital raising to help fund its next major discovery.

North American company Crescat Capital LLC took a cornerstone position in the raising, investing $2.5 million for a 9.8% equity interest in the company.

Metal Tiger also subscribed for $1.7 million and Flannery Family Office committed $1 million. Both entities maintain their 17.1% and 10.4% respective shareholdings.

Renowned economic geologist Dr Quinton Hennigh is a technical advisor to Crescat. Dr Hennigh’s experience includes senior positions with Newcrest Mining, Newmont Mining and Homestake Mining.

Blackstone Minerals (ASX: BSX)

Blackstone Minerals has unearthed broad zones of high-grade massive sulphide nickel during a maiden drilling program at the Ban Chang prospect within the Ta Khoa nickel-platinum group elements (PGE) project in northern Vietnam.

Four holes intersected the 15m-wide zones grading up to 3.32% nickel, 3.89% copper and 1.65 grams per tonne PGE.

These assays add to the high-grade nickel-copper-PGE results from the initial four holes at Ban Chang that were reported in August.

The results follow Blackstone’s recent blind discovery of massive sulphide nickel targets at the Viper zone east of Ban Chang.

Lithium Australia (ASX: LIT)

Integrated lithium technology developer Lithium Australia had a big week of announcements, starting with subsidiary Envirostream reporting it had completed plant sampling of a field trial using zinc and manganese from spent alkaline batteries as a micro-nutrient source in Australian-made fertilisers.

Managing director Adrian Griffin said using material from recycled batteries to enhance fertilisers can “certainly divert toxic materials from landfill” and has potential to provide more sustainable inputs to improve crop yields.

The company also confirmed it had received approval for a three-phase battery system developed by part-owned subsidiary Soluna Australia to be added to Clean Energy Council’s Battery Assurance Program.

The premium-quality Soluna 15K Pack HV battery system is believed to be the most advanced residential energy storage system available in the country, with first orders installed around homes in Perth’s northern and southern suburbs in July.

On Thursday, Lithium Australia announced the signing of a farm-in agreement with Okapi Resources which would allow Okapi to earn a 75% interest in mineral rights (other than lithium) over the Maggie Hays tenements in WA’s Lake Johnston area.

Mr Griffin said the joint venture would add value to its exploration assets, with upside for gold and base metal discoveries while retaining all of the lithium potential.

AD1 Holdings (ASX: AD1)

Recruitment technology firm AD1 Holdings posted strong results for the 2020 financial year, citing a 2019 cost rationalisation program and business realignment strategy as the key to improved revenues.

AD1 managing director Prashant Chandra told shareholders the company was expecting to achieve breakeven before year end after delivering its first ever cash flow positive quarter in June.

To shore up its revenue, AD1 sought to build a strong foundation during the year by renewing existing contracts including those with NSW and Victorian governments.

“These are the two largest employers in the country and the NSW government, in particular, is our oldest customer,” Mr Chandra said.

Digital Wine Ventures (ASX: DW8)

Online beverage supplier Digital Wine Ventures posted its 2020 financial results this week, showing it had more than doubled its earnings on the previous year thanks to a maiden WineDepot revenue of $84,250 in January, on the back of 19 wineries joining the platform.

All up for FY 2020, Digital Wine Ventures achieved $566,141 in revenue – up 139% on 2019 levels.

Securing an exclusive partnership with Australia Post to facilitate the establishment of Digital Wine Ventures’ depot network was considered an operational milestone, as was the receipt of a liquor licence in January, allowing the company to launch its B2B marketplace.

Digital Wine Ventures chief executive officer Dean Taylor said the support from shareholders in recent months had been “absolutely overwhelming”.

“It shows the confidence that they have in our business and their desire to be part of this exciting journey as we set out to disrupt the global wine and beverage supply chain,” he added.

Credit Intelligence (ASX: CI1)

Financial services provider Credit Intelligence posted its 2020 results this week, with highlights including a 384% jump in full-year net profits and a 125% increase in revenues over the previous year.

FY 2020 revenue rose 125% to $13.6 million, while net profit grew 384% to $2.54 million.

The company confirmed COVID-19 disruptions had little negative impact on its results and suggested the economic downturn caused by the pandemic may just work to its benefit in years to come.

Its Hong Kong base specialising in bankruptcy administration and individual voluntary arrangement “continues to trade well” in light of current social and political unrest.

Tesoro Resources (ASX: TSO)

Chile focused gold explorer Tesoro Resources revealed this week it had unearthed the widest intercept to date at its El Zorro project.

The intercept was 231m wide and graded 0.83g/t gold.

Within that were several higher-grade intervals including 54m at 1.68g/t, 25m at 3.36g/t, 6.7m at 11.57g/t, 24.3m at 2.43g/t, 13.26 at 3.25g/t, 3.66m at 10.76g/t, and 15.9m at 1.04g/t.

Tesoro managing director Zeff Reeves described the intercept as “exceptional” claiming it was a reflection on El Zorro’s potential and the “outstanding” working being undertaken by the company’s team.

Drilling is ongoing at the project.

The week ahead

All eyes will once again be on the US market in the coming week and also on the COVID-19 numbers out of Victoria as the laggard state comes closer to winding back its lockdown a little.

Some of the statistical releases to watch for include payroll jobs & wages data, business and consumer confidence surveys and lending figures.

All will give some indication of how the pandemic is playing out in the real economy.

It seems that job advertisements have been rising above pandemic lows as the resources-focussed states of Queensland and Western Australia have opened up and Chinese demand has been on the rise.

Internationally, US markets are closed on Monday for Labour Day but there are data releases for consumer credit, jobs, mortgage applications, inventories and jobless claims.

Chinese data on imports and exports and inflation round out a week that will once again see the giant US market take the lead.