Nickel price surge to be driven by electric vehicle demand

As the global commodity spotlight navigates to nickel, many punters have stopped questioning whether a nickel renaissance could be on the cards and are, instead, taking bets on how imminent the revival will be.

The fundamentals arguably exist for a nickel revival as investors sniff around the scene and mainstream interest gathers momentum as the nickel price continues its upward trajectory after a prolonged period languishing at the bottom of the cycle.

Driving the mounting frenzy is the electric vehicle, consumer electronics and sustainable energy markets which all require the lithium-ion battery as a power source.

What has been relatively quiet until now, is the part nickel plays in the battery make-up.

Although various formulations are on the market, the lithium-ion battery comprises multiple commodities including lithium, cobalt, manganese, high-purity alumina and, you guessed it – nickel.

In its high-purity concentrate nickel sulphate form, the mineral comprises a part of the battery’s cathode component, traditionally along with cobalt and, sometimes, manganese.

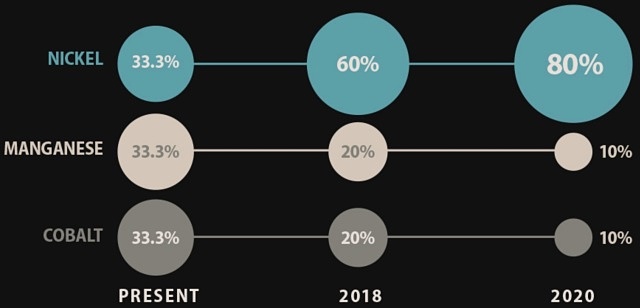

Nickel is set to make up 80% of the mass in NCA and NMC cathodes, used by companies like Tesla and Chevy.

However, due to cobalt’s surging price and potential supply bottle necks, battery manufacturers have been substituting much of the cobalt with nickel.

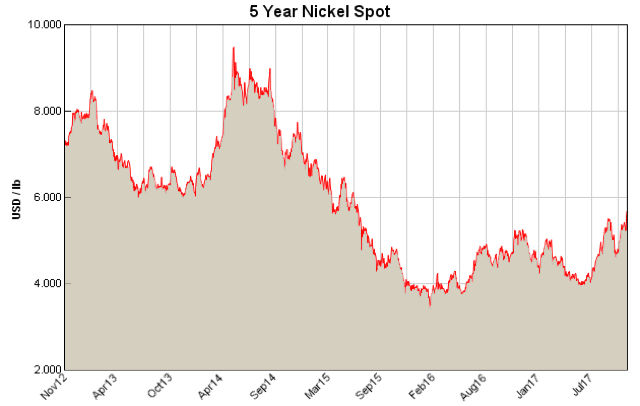

With a much cheaper price and easier to come by in the current market, nickel consumption has picked up – triggering the commodity to hit its highest price in more than two years on Wednesday 1 November 2017.

On Wednesday, the cash buyer price for nickel on the London Metals Exchange broke through the US$12,500 per tonne ceiling to hit US$12,690 per tonne for the first time since June 2015.

Nickel major Panoramic Resources cited RBC Capital Market’s report, which predicts the nickel price would sit at about US$8.00 per pound from about 2022 and beyond.

When RBC released the report in June the nickel price per pound was hovering at US$4 and this was forecast to remain at this price or slightly higher for 2017 through to the end of 2018.

However, the commodity’s price per pound has already shot past that mark to hit US$5.76 per pound (US$12,690 per tonne) on Wednesday.

What’s happening in the nickel market?

Two primary market streams for nickel have begun to emerge as the lithium-ion battery revolution takes off.

Until now, nickel has traditionally been consumed in nickel pig iron to manufacture lower grade stainless steels.

However, the purer nickel concentrates such as nickel sulphate are directed into the burgeoning battery market.

When included in these batteries, nickel provides fire resistance, higher stability, more power, longer life and more recharges per battery.

Back in April this year, Roskill published a report revealing the newer batteries are consuming up to eight times more nickel than cobalt and manganese, where, previously these materials were in equal portions.

Roskill was bullish on the nickel market, predicting demand for the “unsung” metal could surge as much as 400,000 tonnes by 2025.

The primary driver is nickel’s price and availability compared to cobalt, which shot from around US$12 per pound to almost US$30 per pound in less than 12 months.

Adding to these forecasts is the Australian Energy Market Commission and the CSIRO’s report which reveals lithium-ion batteries (including nickel manganese and cobalt) and sodium nickel chloride molten salt batteries would see increased market uptake in coming years.

Electric vehicle market and its battery requirements

According to Transparency Market Research, the budding lithium-ion battery scene will be potentially worth US$77.4 billion by 2024 – powered by electric vehicles.

However, Roskill cautions this market explosion depends on multiple factors including consumer, producer and government policies and development of necessary infrastructure.

When looking at consumer options, Nickel major Panoramic Resources claims electric vehicles can offer favourable elements compared to traditional petroleum and gas-powered cars.

Panoramic Resources said electric vehicles are 10 times cheaper to “fuel” than traditional cars, with this figure expected to improve as the technology becomes more advanced.

Additionally, electric vehicles have much less moving parts with about 18 compared to a fuel-powered car that has more than 2,000. Fewer parts means the vehicles are cheaper to maintain and car manufacturer Tesla has demonstrated this with its infinite mile warranty.

Meanwhile, China is again at the helm driving growth, this time in electric vehicle purchases. The International Energy Agency published a report stating electric car registrations hit a record in 2016 with more than 750,000 sales across the globe – steered by China which registered 336,000 new electric cars.

By April 2017, multiple car manufacturers had announced ambitions to build electric vehicle sales including: BMW, Chevrolet, Chinese-based manufacturers, Daimler, Ford, Honda, Renault-Nissan, Tesla, Volkswagen and Volvo.

The International Energy Agency predicts the electric car market will transition to mass market adoption within the next 10 to 20 years, anticipating stock may range up to 70 million by 2025.

As the most ambitious electric vehicle manufacturer, Tesla, alone, is targeting 500,000 electric vehicle sales by 2018 and double that by 2020.

“Our cells should be called Nickel-Graphite, because primarily the cathode is nickel and the anode side is graphite with silicon oxide.”

– Elon Musk

To support is growing market, Tesla has invested US$4 billion in a giga factory to manufacture batteries for its growing electric vehicle stock.

Meanwhile, consumer electronics and green energy companies also have battery manufacturing facilities in the pipeline.

More bullish than the International Energy Agency, Panoramic Resources believes as more batteries are manufactured, and capacity and technology is enhanced, the electric vehicle price will drop to a point where it is affordable to consumers by 2022 and conventional cars will be obsolete by 2030.

Whether traditional cars become obsolete in the next five years or the next 30, one thing is certain, if the electric market continues booming, the lithium-ion battery industry is likely to follow, and, subsequently, nickel.

Nickel inventory

As of 2 November 2017, nickel stockpiles on the London Metals Exchange were at 381,444 tonnes, which 6,496 tonnes less than the 387,940 tonnes held in inventory on 20 October 2017.

Despite a small drop off in inventory, nickel levels are still high as they come off this year’s peak of almost 390,000 tonnes at the end of August/early September.

Nickel inventory has been steadily building during the past five years from a little under 100,000 tonnes in January 2012 to its current amount, which is still more than 280% higher than five years ago.

If you look at the nickel inventory just before the global financial crisis buffeted international markets, the London Metals Exchange had less than 20,000 tonnes in stockpiles. This is when the nickel price was hovering at US$50,000 per tonne.

Taking this into account, it appears the current inventory has more to shed before the nickel price is pressured.

Supply and demand

At its October meeting, the International Nickel Study Group pointed out global stainless steel production had grown 5% on 2016 levels, with further growth expected in 2016, which could lead to increased nickel pig iron production.

For 2017, the group anticipates nickel consumption will rise to 2.150 million tonnes, up 5% on 2016 usage.

Meanwhile, production is projected to rise to 2.052 million tonnes, almost 100,000 tonnes less than demand, which should help ease some of the nickel inventory on the London Metals Exchange.

Looking further ahead, due to the damp commodity climate, fewer nickel discoveries have been made or developed in the last decade, which could cause issues as demand picks up and current resources are depleted.

Poseidon Nickel poised to be first off the rank

Last week, Small Caps published an article on one of Australia’s primary nickel plays Poseidon Nickel (ASX: POS), which is looking to be first off the rank to re-start nickel production in time for the next bull run.

Poseidon Nickel chief operating officer Michael Rodriguez told Small Caps the company had closely followed the nickel market’s movements stating, at the time, there were currently “quite a few nickel bulls out there taking position”.

Billionaire mining entrepreneur Andrew “Twiggy” Forrest.

Backed by renowned mining entrepreneur Andrew “Twiggy” Forrest, Poseidon Nickel has been strategically positioning itself during the downturn, ensuring it was ready to take maximum advantage of the recovery.

Poseidon Nickel owns one of the world’s highest-grade nickel mines, Silver Swan, and is heavily invested its 400,000 tonne resource base across Western Australia’s three pedigree nickel provinces.

Adding to that is the company’s two strategically located multi-mineral plants with massive processing capacity and capability to “toll treat” ore from neighbouring mines in conjunction with its own nickel and shave substantial excess cash costs.

Mr Rodriguez said he believed the nickel price was on its way up and would hit the US$6 per pound level and stay there making production profitable again.

He added he anticipated this would occur in the next 12 months.

Many other nickel producers have projects on care and maintenance and if the nickel price punches their respective price points, the market will witness a swathe of nickel projects dusted off, developed and restarted.

However, Roskill cautions if the nickel price becomes too cost prohibitive this could impact its use in coming years. The industry analyst also advises there’s the risk of new technology disrupting the market and displacing the current lithium-ion battery.