Is a nickel renaissance imminent for Poseidon Nickel?

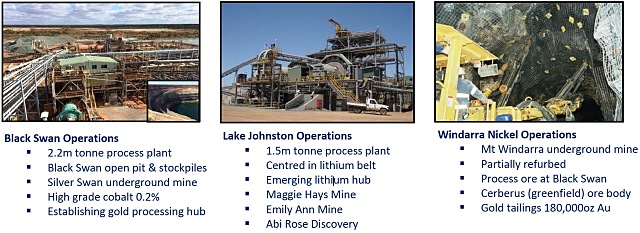

Aerial shot at Poseidon Nickel’s Lake Johnston operation.

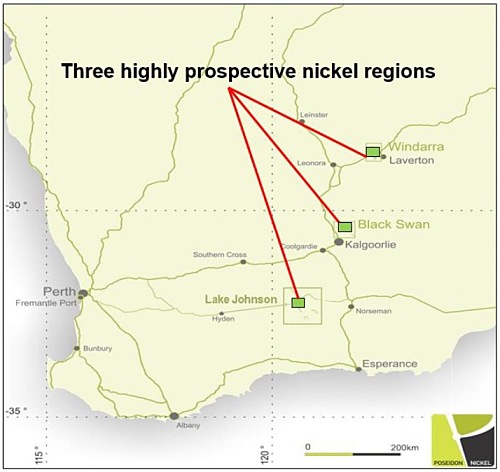

One of Andrew Forrest’s primary punts, Poseidon Nickel (ASX: POS), is heavily invested in one of the world’s highest grade nickel mines – Silver Swan, and its 400,000t nickel resource base across three pedigree nickel provinces in Western Australia.

In addition to its huge nickel resource, the company has two strategically located multi-mineral plants with massive processing capacity that it is looking to “toll treat” neighbouring gold producers as well as securing their own gold mine.

With a 9% nickel grade at Silver Swan, Poseidon Nickel is targeting the emerging electric vehicle, consumer electronics, and green energy markets for its nickel ore.

Poseidon Chief Operating Officer Michael Rodriguez told Small Caps, the company’s view is the nickel price will follow that of cobalt’s which has shot from around US$12 per pound to almost US$30 per pound in less than 12 months.

This is on the back of the burgeoning electric vehicle market and the specialised lithium-ion batteries used to power the vehicles. In addition to lithium, cobalt, manganese and other minerals, the high powered, durable, rechargeable batteries require high purity nickel to add fire resistance and stability.

Major shareholder in Poseidon Nickel, Andrew ‘Twiggy’ Forrest.

The amount of nickel consumed in the battery is predicted to grow, according to several analysts.

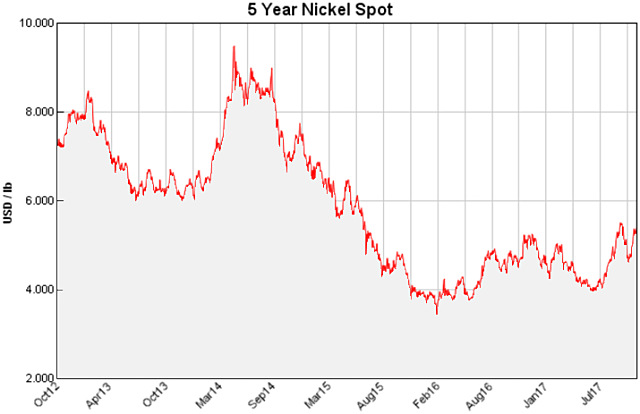

However, historically prolonged subdued nickel prices have caused the Western Australia operations to be placed on care and maintenance, while Poseidon rides out the slump.

Previous glory

During Western Australia’s mining boom, Poseidon Nickel was a resources play to be reckoned with. By early July 2007, its share price rocketed past the A$2.00 mark.

But, since the global financial crisis, Poseidon’s share price has followed the downward dip of its beloved commodity, with its stock currently trading at around $0.02.

Should the nickel price begin to recover and remain stable, sitting above the US$6 per pound mark, Mr Rodriguez said the Poseidon board is poised to pull the trigger to fast-track Silver Swan into production.

“What our board is looking for is a tightening in that volatility, so we don’t trigger a significant cash draw only to find the price retreats and have a false start.”

He added the board was also anticipating a reduction in the London Metals Exchange nickel stockpile which was at 387,940t on 20 October 2017.

Building value in the interim

Poseidon has remained opportunistic by securing two massive processing plants and begun exploring tenements prospective for lithium, gold and other minerals.

Looking to lock-in long term value, the company has also recently established several non-binding agreements with gold producers to hire out up to 3 million tonnes per annum (mtpa) gold processing capacity at Black Swan.

“Our goal of a co-processing environment at Black Swan makes complete sense because it actually drags down the break-even cost of nickel, because now you have shared services,” Mr Rodriguez said.

In addition to diversifying, since 2007, Poseidon’s nickel resources have flourished from 40,000t to 400,000t.

Poseidon is also quietly completing all its pre-operation work to fast-track nickel production when the decision to restart production is finally made.

Black Swan and Lake Johnston capacity on the ground

A significant upside in possessing both Black Swan and Lake Johnston, is Poseidon’s ability to go from care-and-maintenance to full-scale producer across multiple commodities with minimal lead time.

Also, both plants are centrally positioned within the company’s tenements, and all power, water and road infrastructure are already in place.

Compared to emerging producers and, even, existing producers in the region, the plants afford Poseidon several opportunities.

Poseidon’s Black Swan operation.

“We’ve got a plant, Black Swan, which is a beast. It is a 2.2mtpa plant which will likely do 3mtpa of gold ore and it’s in a very strategic location,” Mr Rodriguez told Small Caps.

“It can unlock two things: the first one, it can unlock value for any sulphide or refractory gold deposit to produce a gold concentrate. It also has the ability to take 3mpta free milling gold to dore with the addition of equipment and a modest investment.”

As part of Poseidon’s plan to cut costs and build efficiencies, it has entered discussions with several nearby gold producers.

At present, Northern Star Resources (ASX: NST), Aphrodite Gold (ASX: AQQ) and Empire Resources (ASX: ERL) are investigating the viability of using Black Swan to process their gold ore.

Poseidon has a detailed engineering study underway at Black Swan to confirm the potential and expenditure required to process both gold and nickel at the plant at the same time.

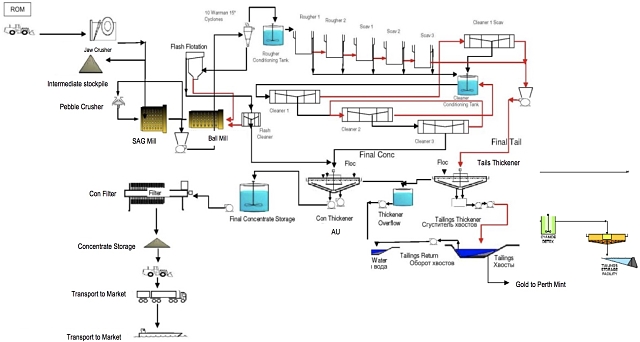

Simplified nickel and gold concentrator flow sheet + CIL for Black Swan.

Once complete, Poseidon plans to make the agreements with interested parties binding.

Meanwhile, Kidman Resources (ASX: KDR) undertook a feasibility study in to restarting Poseidon’s Lake Johnston facility, which has been estimated at A$12 million.

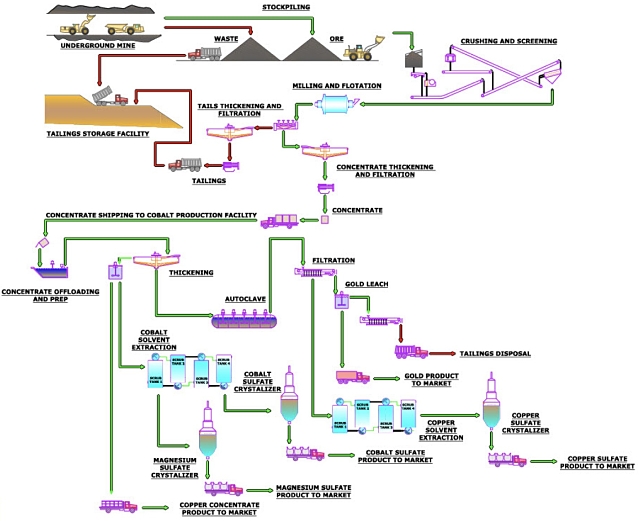

Nickel Concentrator flowsheet with POX for Ni & CoSO4 Crystal.

Also at Lake Johnston, Poseidon and Lithium Australia are investigating processing lithium ore concurrently with nickel.

Lithium Australia has developed its own patents for concentrating lithium from silicates using its SiLeach® process. The company has also publicly stated using Lake Johnston could “provide a low-capital entry” into lithium chemical production using this process.

Lithium potential

In addition to looking at lithium processing capabilities at Lake Johnston, Poseidon and Lithium Australia are exploring nearby tenure for lithium mineralisation.

The combined tenements equate to about 1,000 square kilometres and Poseidon owns approximately 25%.

“It made sense to pool the resources and reduce our costs and improve efficiencies. It will improve the probability of finding a commercial lithium deposit,” Mr Rodriguez said.

Poseidon’s Lake Johnston operation.

In May 2016, Poseidon reported it had discovered high grade lithium pegmatites at the tenements, with assays ranging between 2.8% and 3.85% lithium oxide.

“Our geologists are bullish about finding a lithium deposit that has other minerals in it that we could potentially commercialise on the basis it has the size.”

Mr Rodriguez added Poseidon has demonstrated it can float several lithium minerals including spodumene, petalite and lepidolite at its nearby Lake Johnston plant.

The joint initiative between Lithium Australia and Poseidon keeps costs down and increases the potential of Lake Johnston becoming a central lithium processing hub in the region, while co-processing its nickel ore.

Poseidon has plans to start further exploration in the area towards the end of the year.

Nickel operations

Although reviewing other opportunities, Poseidon’s focus lies in nickel and the restart of its unparalleled Silver Swan mine.

With six mines within a 300km radius of Kalgoorlie, the company has been exploring and mining the region under varying guises for decades.

A definitive feasibility study back in May revealed Poseidon’s flagship nickel project Silver Swan had an initial two years’ mine life with the potential to grow this to seven years using ore from other nearby deposits and stockpiles.

Once in full swing, Poseidon anticipates 7,000t per month of high grade nickel ore mined at 9% from the flagship mine.

The company’s other nickel deposits include Lake Johnston, Mt Windarra, South Windarra, Cerberus and Black Swan, with Lake Johnston and Black Swan also hosting the high capacity processing plants.

Starting off with the Mt Windarra asset in 2007, the company’s total nickel resources have swelled to 400,000t placing them in the top 1% compared to their peers.

Nickel market diverges

According to Mr Rodriguez, the nickel market is showing signs of diverging with nickel laterite ore flowing into ferro-nickel and nickel pig iron for the lower grade stainless steels.

Meanwhile, the higher-grade nickel sulphide and concentrates will be channelled into the burgeoning battery industry.

In the rapidly growing electric vehicle, consumer electronics and green energy markets, nickel is the primary ingredient in a battery’s cathode. It is often used with manganese and cobalt. The incorporation of nickel provides prolonged life, stability and prevents fire.

“You get higher power density, longer life, more recharges per battery, and you get a much more robust battery,” Mr Rodriguez said.

The Australian Energy Market Commission and the CSIRO published a report which reveals lithium-ion batteries (including nickel manganese and cobalt) and sodium nickel chloride molten salt batteries would see increased market uptake in coming years.

Additionally, commodity analysist Roskill claims newer cathodes contain up to eight times more nickel than cobalt and manganese, where, previously, these materials were equal portions.

Mining at Poseidon’s Mt Windarra nickel project.

The analyst predicts nickel demand in lithium-ion batteries could surge as much as 400,000t by 2025, but cautions this could change if the nickel price becomes prohibitive or newer technologies displace the battery formulation.

“The market is quite bullish at the moment,” Mr Rodriguez said. “There are quite a few nickel bulls out there taking positions. And there are lots of gold bulls out there taking positions.”

Poseidon Nickel’s renaissance

Far from its former glory of more than US$22 per pound, nickel was trading at US$5.47 per pound on Friday 20 October 2017, which is one the highest prices the metal has commanded in more than two years.

So, it has a lot of room to go before hitting previous peaks should it do so.

The fundamentals arguably exist for a nickel revival as investors sniff around the scene and the commodity price begins to recover, although there is no guarantee which way prices will go in any market.

However a new market is opening up with the metal’s further incorporation in a budding lithium battery scene worth potentially US$77.4 billion by 2024, according to Transparency Market Research.

As this has been happening, Poseidon has been preparing – establishing itself with a world-class nickel resource in a low-risk province.

Adding to the upside potential is the company’s existing infrastructure and processing capacity to “hire out” to gold producers in the region to reduce its own operating costs.

The company has also shored itself up to weather any potential downturn by diversifying into lithium and gold potential across its tenements.

Meanwhile, the executive team watches the nickel price move upwards, ready to pull the trigger if it hits and stays above that golden US$6 per pound mark.

“In the next 12 months, there’s no question that nickel will be hitting the US$6 per pound range. And when that happens, Poseidon will aim to be the first nickel sulphide producer off the stumps,” Mr Rodriguez said.

“There’s no reason why we can’t because we have 9% nickel in resource.”

Comments quoted in this article are views and opinions of the company and individuals within the company, not investment advice. You should always seek professional financial advice before making any investment decision.