Weekly review: Market holds steady, interest rates key going forward, oil prices rally on global tensions

WEEKLY MARKET REPORT

This week has seen a number of macro themes making their mark on the Australian economy.

The benchmark ASX 200 closed out the week 0.36% lower to finish at 6,185.5 points as stock markets retained their composure overall, despite the volatility-inspiring news coming from home and abroad.

Interest rates in the limelight

The RBA left interest rates unchanged this week at 1.5%, as expected by most analysts.

However, there are foreign influences already on the horizon which could potentially change RBA policy going into next year.

Rising US interest rates fuelled by Donald Trump’s tax cuts, aimed at stimulating the US economy, could soon push the Australian dollar below US70 cents.

That’s the fear being expressed by importer businesses and Australian holidaymakers.

On the flip side, weakness in the Australia dollar could help lift local inflation and thereby induce the RBA to increase borrowing costs as a means of capping inflation and supporting the dollar which has been treading water against all major currencies in recent months.

The Australian dollar dropped to a 2-year low of US70.78 cents against the US dollar on Thursday which coincided with another potential problem for the Australian economy – the US 10-year Treasury yield endured its largest one-day gain since Donald Trump’s election win in November 2016.

The growing yield differential between the US and Australia could spell a sombre future for the Aussie dollar.

Oil prices rise

Crude prices hit 4-year highs this week of around US$76 per barrel with geopolitical angst also making multiyear highs as a mixture of Iran’s defiance, Venezuela’s internal crisis and Russia’s doggedness continues to spook oil market participants.

With the market currently divided as to whether will reach for above $100 a barrel or settle down as OPEC and the US flood the market by boosting production, the imminent future in oil is looking volatile, to say the least.

Small cap stock action

Despite the macroeconomic themes overhanging stock markets, the Australian small-cap index was resilient and closed out the week slightly down 0.67% at 2,844.1 points.

High Grade Metals (ASX: HGM)

High Grade Metals announced that it has commenced its maiden exploration drilling campaign at its flagship Leogang copper-cobalt project in Austria.

The metals junior is focusing on the historic high-grade Nockelberg mine – a source of cobalt ore for artisanal mining stretching back over 400 years.

The drill program is forecast to be completed in the following four to six weeks, with the company planning to drill at its nearby Schellgaden gold project soon after, meaning there will be plenty of news on the horizon for High Grade Metals.

Authorised Investment Fund (ASX: AIY)

The pooled development fund enjoyed good news from one of its investments this week.

Asian Integrated Media (AIM), a global media representation company increased its forward bookings by 10% on a year-on-year basis and has confirmed it is looking to add new business platforms in 2019.

The company said that revenues from its recently-launched Travel Elite product are expected to see healthy growth rates and AIM has confirmed that the new Travel Elite spinoff is already in discussions with leading airlines and travel organisations in the Asia Pacific and the Middle East.

Further out, AIM has forecast revenues for Travel Elite alone to exceed US$16 million over the next 3 years.

AIY this week also increased its stake in one of its other investee companies, Aenea Cosmetics, from 20% to now 30%.

Invigor Group (ASX: IVO)

Invigor has signed a deal to distribute and expand one of Asia’s most popular online payment platforms, Alipay, into Hong Kong.

The news comes a week after the company struck a similar deal with Winning Group to distribute and expand its WeChat Pay services across South East Asia.

With Alipay having a registered base of 520 million users and WeChat of around 1 billion users, Invigor is well placed to leverage its service offerings into Asia.

MyFiziq (ASX: MYQ)

The Australian software company announced a timely deal this week that will see the company’s technology integrated into a mobile application utilising the market appeal of UFC fighter Conor McGregor.

Conor McGregor’s fight in Las Vegas this weekend, against UFC Lightweight champion Khabib Nurmagomedov, is expected to be one of the biggest pay-per-view events in history with several companies looking to associate themselves with the former champ.

MyFiziq signed a deal with digital fitness solutions company FitLab that will see its 3D modelling technology implemented in various training programs promoted by the biggest draw in mixed martial arts fighting with the company forecasting around 250,000 paid users in the near-term, made possible by Conor McGregor’s millions of social media followers.

Alliance Resources (ASX: AGS)

Alliance says it could be on the verge of owning the nation’s largest graphite discovery by mineral content at its Yeltana graphite prospect in South Australia, after receiving results from explorational technical data this week.

The resource junior believes the size of its exploration target is “nationally significant” as the estimated tonnage and grade ranges indicate it could well be one of the largest of its kind in Australia by mineral content.

Graphite is quickly emerging as a key component of the ongoing lithium-ion battery revolution and several companies are now in the chase.

Tando Resources (ASX: TNO)

Tando has taken yet another step to accomplishing its goal of acquiring a 73.95% stake in a high-grade vanadium project in South Africa.

The resource junior completed its acquisition of the SPD vanadium discovery in the Limpopo province of South Africa but must complete a set of exploration milestones as part of the deal.

Tando plans to establish a JORC-compliant measured resource, and complete scoping, pre-feasibility and definitive feasibility studies at the project over the coming months and going into next year.

The company currently drilling at the project which is due to be completed by the end of this month.

Six Sigma Metals (ASX: SI6)

The metals junior announced exceptional grades of mineralisation as it continues its hunt for a strong lithium resource in northern Zimbabwe.

Following a rock sampling at its Shamva lithium project, Six Sigma said that the high-priority Bonnyvale prospect delivered grades as high as 4.38% lithium oxide, with further geological discoveries related to surface mineralisation considered likely.

Six Sigma’s Shamva project acreage comprises various pegmatite dykes including Bonnyvale, the northerly-striking Loch Ness suite, Ronspur (Mkana) and several other unnamed dykes which could potentially be the subject of future exploration programmes.

Winchester Energy (ASX: WEL)

Winchester Energy completed a perforation and acidisation programme at one of its existing wells within the Strawn Formation and says the well immediately flowed 88 barrels of oil after the well was reopened following a shut in.

Given the “exciting” result, Winchester has estimated that the well could achieve an initial production rate of approximately 200 barrels per day.

IPOs this week

For readers interested in the latest ASX debutants and upcoming IPOs, Small Caps has you covered.

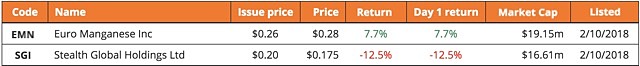

The latest stocks to make their way onto the ASX this week include:

Euro Manganese (ASX: EMN)

The aspiring manganese producer completed its dual listing this week after deciding to list on Canada’s TSX and Australia’s ASX simultaneously.

The resources junior is advancing the evaluation and development of the Chvaletice Manganese Project, located in the Czech Republic – a project which is thought to contain one of Europe’s largest manganese deposits.

Euro Manganese hopes to establish a productive operation in the heart of the EU where consumption of high-purity manganese products is expanding on the back of the emergent lithium battery industry, the growing use of manganese by car makers and by the high-performance steel and aluminium alloy industries.

After listing at $0.26 per share, Euro Manganese shares finished the week with a 7.7% premium at $0.28 per share.

Stealth Global (ASX: SGI)

Distribution company Stealth Global listed on the ASX this week, at $0.20 per share and raising $12.5 million.

Stealth Global supplies a range of safety, industrial, healthcare and workplace consumable products to business customers across Australia, Africa, the United Kingdom, Europe and Asia.

The company plans to expand its existing operations and further build on its integrated network of branches, sales representative and call centres which have positioned the company as a disruptive online platform.

One of its key differentiators is its implantation of a multi-channel business model that enables faster and smoother sales and distribution while offering one-stop service for supply and logistics.

Despite a high-profile listing and being chaired by former Seven West Media Western Australia chairman Chris Wharton, Stealth Global finished the week at $0.175 per share, down 12.5% from its listing price.

The week ahead

A number of economic data points are scheduled to come out from the banks next week, including NAB business confidence, Westpac consumer sentiment, plus home loan data.

The data will give an indication on where the market may head next, as the market has been trending sideways with the housing sector softening in the background in recent months.

The RBA is set to deliver a financial stability review on Friday which may give an indication if and when rates will change.

Out of the US, inflation and crude oil stock data are ones to look out for, after the unemployment rate came in at 3.7% this week, a 49-year low.

In Asia, China will release its import and export figures, with analysts expecting to see a proof of a slowdown in trade.