Authorised Investment Fund investee company outperforms business forecast

Asian Integrated Media’s forward bookings into 2019 are up 10% year-on-year.

Investment fund company Authorised Investment Fund (ASX: AIY) has delivered positive news to its shareholders by announcing that one of its flagship investments has outperformed its business forecast during Q3 2018.

AIY is a “pooled development fund” that takes significant stakes in various businesses as part of a commercial strategy based on identifying and partnering with promising commercial opportunities.

However, the fund maintains an industry-agnostic outlook and currently holds investments in a range of companies working within marketing, media, renewable energy and cosmetics.

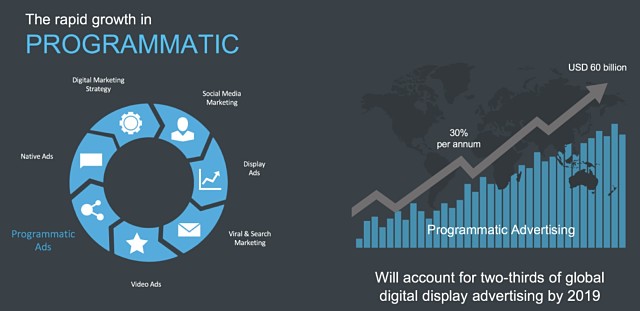

One of its major targets was Asian Integrated Media (AIM), a global media representation company with a programmatic advertising division occupying a market niche AIY was keen to gain exposure to, given the strong rate of growth and development of the sector in recent years.

AIM signed an exclusive investment agreement with AIY in April this year. At the time, AIY had agreed to acquire a 25% interest in AIM but retained an option of increasing its holding up to 30% “at any time” over the next 3 years.

Via its holding, the company has a significant influence on AIM’s activities and a sizable interest in how it is performing.

Aiming for consistent progress

According to AIM, the company has raised its forward bookings by 10% on a year-on-year basis and has confirmed it is “looking to add new business platforms in 2019.”

More specifically, revenues from its recently-launched Travel Elite product are expected to see healthy growth rates and AIM has confirmed that the new Travel Elite spinoff is already “in discussions with leading airlines and travel organisations in the Asia Pacific and the Middle East”.

In August this year, AIM created Travel Elite, a bespoke programmatic digital advertising company focused on tapping into exclusive travel data from leading airlines across the globe.

Travel Elite intends to bring together mostly luxury brands seeking to better target international travellers via highly targeted first party data to form programmatic advertising opportunities, and ultimately generate high-value sales of luxury goods.

AIM has forecast revenues for Travel Elite alone to be in excess of US$16 million over the next 3 years, meanwhile AIY’s market cap currently sits at $9.3 million.

To date, AIM has established partnerships with Cathay Pacific, Qantas, Singapore Airlines, Conde Nast, Grand Prix Management Group, Handelsblatt, Die Zeit and Daily Mail UK among several other major companies and brands.

On a broad market basis, the airline industry ancillary revenues – peripheral business activity outside of their main focus – last year was estimated to reach US$82 billion, or, around US$20 per passenger. To highlight the importance of ancillary earnings and the extent of the fierce competition amongst airlines, airlines generated around US$35 billion in total profit last year – less than half of what ancillary activities generate.

Market research suggests that digitally-powered and internet-dependent advertising can deliver more efficient deployment of marketing budgets and can significantly lower advertising costs for businesses.

Early indications suggest the market will continue to grow into a US$60 billion giant over the coming years as internet sales and e-commerce continue to grow their influence and further reduce the effectiveness of offline advertising.

From airline to online

Programmatic advertising refers to digital marketing techniques that generate computer-based automated buying, selling, placement, and optimisation of digital advertising.

One of the key focus areas has been airlines and international travel – given the high propensity for travellers to purchase additional ancillary goods and services, but also, the changing shift towards digital advertising amongst airlines.

According to the London School of Economics (LSE), airline advertising revenue is set to undergo a 115-fold increase over the coming decade with this year’s total of US$26 million expected to increase as high as US$3 billion by 2028 and then double again to US$6.8 billion by 2035.

“We’re thrilled our investment strategy into new media, in particular data, programmatic media and our new technology-led digital magazine experience, is starting to show results,” said Peter Jeffery, CEO and founder of Asian Integrated Media (AIM).

“The media landscape is going through serious transformation from traditional media to vastly new forms of consuming content on mobile devices. We always knew 2018 was going to be a tough year for the media industry and we’re thrilled our decision to diversify and invest in new media is building positive momentum,” added Mr Jeffery.

In additional news for AIY this week, the company increased has its stake in Aenea Cosmetics from 20% to now 30%.

The consideration for the 10% equity was $1 million and was funded in part from AIY’s recent rights issue and share placement.

Previously commenting on the partnership, Aenea Cosmetics’ founder Damien Zannetou said, “Aenea’s partnership with AIY will help fuel the Aenea brand’s rapid growth on a global scale. Our vision is to be the first luxury high tech skin care range based on the science of Epigenetics, available to discerning consumers through the world’s leading department stores.”