Weekly review: market has a bad week but is it the pause that refreshes?

WEEKLY MARKET REPORT

After a mainly very strong January, we have just finished a soggy week of trading on the Australian market, which closed down 2.8%.

Despite that poor weekly performance, January still managed to be a positive month, with the steep falls near the end of the month perhaps being the pause that refreshes rather than the beginnings of a bearish phase.

Time will tell but when US futures turned down after lunch on Friday, many investors thought it was time to take their chips off the table and head home early for the weekend.

The big banks and miners deflated during Friday afternoon, taking the ASX 200 index down with them following the big $40 billion plunge on Thursday.

By the Friday close the ASX 200 was down 0.6% at 6607.4 points and 2.8% for the week, with even the tech sector and some retailers feeling the heat.

That may be disappointing but it is worth remembering that the market is just coming off an 11-month high so it is hardly a disaster, with January still up 0.3%.

Some rises as lower iron ore price hits miners

There were also some heavyweights on the rise including blood products biotech CSL (ASX: CSL), toll giant Transurban (ASX: TCL) and telco Telstra (ASX: TLS).

There is also little doubt that the ongoing short squeeze activity on Gamestop (NYSE: GME) and other US shares has unsettled markets, with some hedge funds forced to liquidate their positions more broadly as they cash up to make up for big short selling losses.

There are concerns that more chaos could be coming as the Reddit retail trading raids could move on to other targets.

Even the local “mini-me” – nickel cobalt company GME Resources (ASX: GME) – which had flown upwards because it had the same ticker code as the US company Gamestop suffered a 20% fall, back to 6.8c a share which is not far from where it was before all of the misplaced enthusiasm arrived.

Falling iron ore prices weighed on the big miners, with BHP (ASX: BHP), Rio Tinto (ASX: RIO) and Fortescue Metals (ASX: FMG) all sharply lower, with Fortescue losing 4.1%.

In the end, the ASX 200 finished 0.3 per cent ahead for January, which was still the fourth straight monthly gain.

Small cap stock action

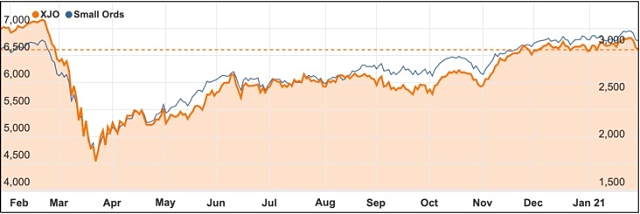

The Small Ords index fell 2.86% to 3080.9 points for the week.

ASX 200 vs Small Ords

Small cap companies making headlines this week were:

Crowd Media (ASX: CM8)

Australia-based Crowd Media has teamed up with AI company Aflorithmic Labs to drive Crowd’s “talking head” platform.

Aflorithmic will create a voice cloning and core AI engine for Crowd’s platform, which will be used across multiple sectors including influencer marketing and ecommerce.

In return, Crowd will put $1.77 million into Aflorithmic’s current fundraising round. The investment will give Crowd a 10% stake in Aflorithmic.

Strategic Elements (ASX: SOR)

Pooled development fund Strategic Elements’ investee Australian Advanced Materials has reached a “significant milestone” in its self-charging battery technology.

The CSIRO, University of New South Wales and AAM are collaborating on the technology which generates electricity from humidity in the air of skin surface.

Latest results have achieved a 4.4 volt battery output from moisture in the air over a five hour testing period. Due to the encouraging results, Strategic managing director Charles Murphy said the company would add PhD material science expertise and create a panel of industry specialists.

During the December quarter, Strategic had net expenditure of $441,000 which included costs incurred from managing investees AAM and Stealth Technologies.

Altech Chemicals (ASX: ATC)

Altech Chemicals has kicked-off performance testing of graphite particles coated with high purity alumina using its proprietary coating technology.

Testing will be undertaken in lithium-ion batteries with Altech revealing its first batch of coated graphite has been generated.

Altech anticipates the results will show extensions to battery life using its HPA coating technology.

Venus Metals (ASX: VMC)

Gold explorer Venus Metals has identified rare earth elements during a reconnaissance surface sampling program at its Nardoo Hill West project in WA.

Venus collected 48 stream sediment samples and 26 rock chips which returned REE and a peak grade of 0.149% total rare earth oxide plus yttrium. Three REE target areas have now been identified.

Over at its Vidure South prospect, Venus confirmed its potential for “highly prospective” magmatic PGE mineralisation.

Strandline Resources (ASX: STA)

Aspiring heavy mineral sands producer Strandline Resources is advancing discussions regarding a debt facility to finance the remainder of capital funds required to develop its Coburn mineral sands project.

The company has shortlisted lenders regarding a $100 million debt tranche, which will add to the $150 million government-backed Northern Australia Infrastructure Facility.

The capital requirements to develop Coburn have been estimated to amount to $260 million.

The week ahead

Here in Australia, the Reserve Bank will be in the crosshairs for the biggest news of the week with the monthly interest rate decision on Tuesday and RBA Governor Dr Philip Lowe delivering a speech at the National Press Club in Canberra on Wednesday.

While there is unlikely to be any change to the current ultra-low interest rate settings, this will be the first time we have seen and heard from the RBA this year so any snippets or hints about how Dr Lowe sees events unfolding will be important news.

Backing up that RBA outlook will be a raft of strongly related figures including home prices, home lending, job advertisements, building approvals, new car sales, retail trade and on Friday the RBA’s statement on monetary policy, including the latest economic forecasts.

Overseas, President Biden and his freshly minted economics team will be closely monitoring US jobs data for signs that the jobs recovery is continuing and also statistics on construction, job cuts, factory orders, payrolls and the trade deficit.

Chinese numbers on manufacturing and services marks a return in earnest for statistical releases as February begins.