Low exposure strategy helps Wisr grow new loan originations in uncertain COVID-19 market

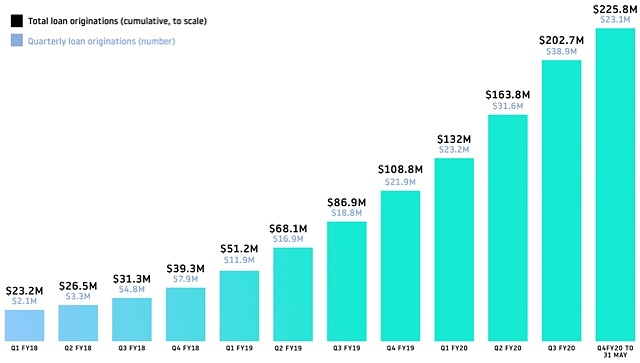

Wisr has returned to pre-COVID-19 loan origination levels, delivering $23.1 million in new loans in April and May.

An “exceptionally low exposure” to high-risk COVID-19 sectors has seen consumer lending company Wisr (ASX: WZR) grow its new loan originations by 48% in a four-week period.

The company delivered $23.1 million in new loans originated in the first two months of the fourth quarter of 2020, comprising $9.3 million in April and $13.8 million in May and representing 48% month-on-month growth.

Growth in May saw loan originations return to pre-COVID-19 levels, despite Wisr maintaining a significantly tighter credit policy introduced in March in response to the pandemic.

The month also saw total weekly settled loan volumes exceed $4 million for the first time, achieved with the company in lockdown “work from home” mode.

Wisr’s quarter-on-quarter loan origination growth.

Today’s announcement follows news that Wisr made it onto the All Ordinaries index after the ASX’s quarterly rebalance.

Rapid response

Wisr chief executive officer Anthony Nantes said the positive results were enabled by the company’s “rapid response” to COVID-19 conditions during the third quarter.

“That response, combined with a prudent approach to loan origination in the fourth quarter, have allowed us to continue to responsibly lend to our customers to help them consolidate, refinance, purchase and fulfil their needs through the Wisr ecosystem in these uncertain times,” he said.

“We have now surpassed pre-COVID-19 origination levels [which] is an exceptional validation of our fintech business model, proprietary technology, and high-performance culture,” Mr Nantes added.

Secured vehicle delay

A hiccup in the company’s progress has been the delayed launch of its secured vehicle finance product, which was “soft launched” in the second quarter and continued through the third quarter as a revenue-generating pilot program.

The product – which won a RateCity Gold Award 2020 for New Car Loan Lender – was due to be rolled out across Wisr’s full range of distribution channels in the fourth quarter; however, this was delayed when the onset of social distancing rules put the brakes on the car buying market.

“The entire auto sector experienced significant disruption in April and May due to social distancing, which meant buyers were unable to inspect vehicles,” Mr Nantes said.

“We are now planning to launch the product in the first quarter of 2021.”

Relief packages

From March to the end of May, Wisr provided 395 customers (or 5.8% of its customer base) with pandemic-related relief packages consisting of short-term payment deferrals, where interest on the outstanding principal during the full or partial deferral period will be capitalised, in line with industry standard.

At 31 May, $10.3 million (or 6.7% of total portfolio loan balances) were on a payment deferral, including $3.4 million from the NAB-funded Wisr Warehouse debt facility, representing 5% of the warehouse’s balance.

“We expected a period of heightened customer hardship stemming from COVID-19; however, the impact has been very manageable in light of our very small balance sheet loan exposure, prime customer base and exceptionally low exposure to high-risk sectors,” Mr Nantes said.

“We are now back to pre-COVID-19 levels for customer support requests,” he added.

At midday, shares in Wisr were up 22.58% to $0.19.