Hot Topics

Trending stories and market-moving news from the ASX small-cap sector

The Weekly Finger: On bruised legs and bruised portfolios

Oil surges; crude ETF jumps 33% in a week—the biggest weekly gain on record—plus a new Finger on the Pulse episode and a revamped Investor Pulse site.

Top Stories

How Australia’s Most Financially Challenged State Found an Answer to the Housing Crisis

Victoria's land tax surge hits landlords, boosting Melbourne housing affordability and sparking more first-home loans, a policy quirk with budget implications.

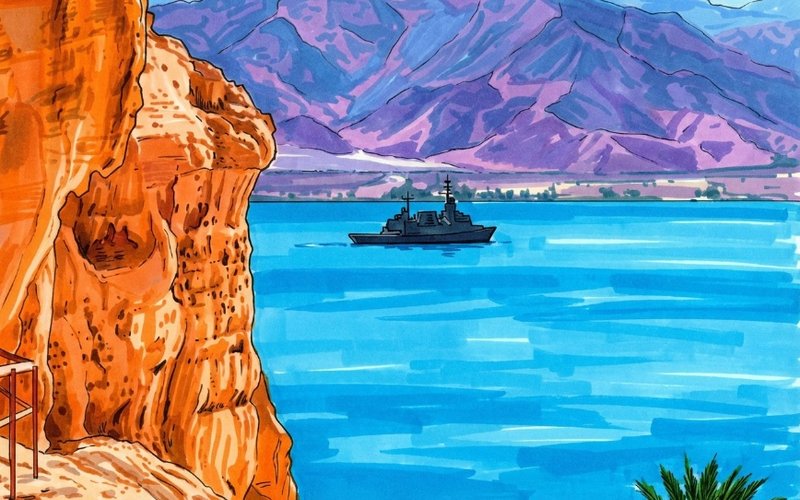

Weekly Wrap: ASX slides 3.8% as Middle East conflict spooks markets

ASX 200 plunges 3.8% for the week as Middle East conflict lifts oil and inflation fears, sparking rate hike bets while energy stocks rally.

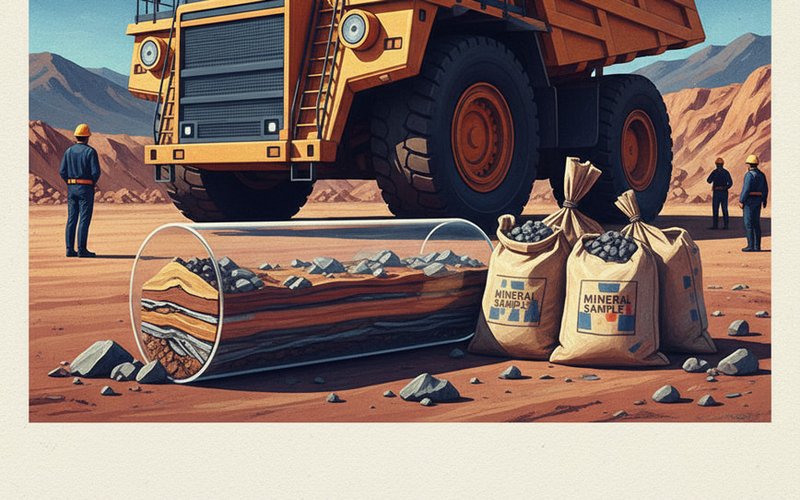

Has Tungsten Been an Oversight for Investors? How to Get ASX Exposure

Tungsten prices jump 500% in 12 months amid supply bottlenecks and China export controls. ASX exposure could offer a fresh, high-stakes macro theme.

Latest Hot Topics

Which Stocks Benefit from a Uranium Supply Deficit?

Uranium supply deficit could lift shares as Australia leverages domestic reserves and SMRs to secure base-load power.

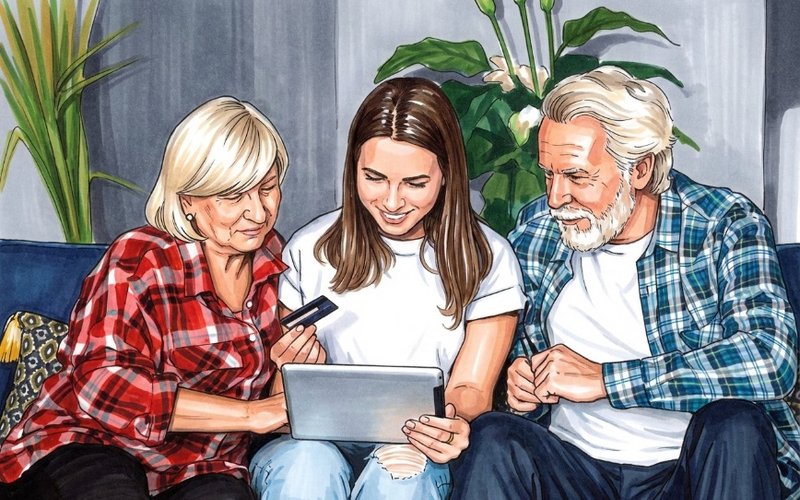

Australia’s Best (and Worst) Bank

Australia's Bank of Mum and Dad pumps $35b a year into housing, but rising non-performing loans and fairness issues threaten the unofficial lender's future.

The Weekly Finger: CBA PR team dancing in the streets, waving flags etc

CBA faces police probe over a $1bn mortgage-fraud hole, sparking talk of a banking lending overhaul and potential share moves.

US-Iran War: Energy, Gold, and Silver

Oil jumps as US-Iran tensions flare; Hormuz risk, insurers drop cover. Gold, silver and miners rally as a new mining bull market awakens.

Time for Pensioners to Get Aggressive

Pensioners urged to be aggressive with cash as March deeming rates rise to 1.25% and 3.25%; beating returns could protect income.

Earnings Season Growth Leaders: Gold, Copper, Industrials and More

Earnings season shifts to a stock-pickers market as the RBA lifts rates to 3.85%; focus on cash flow and balance sheets, with Macquarie leading earnings.

Where are the New Copper Discoveries? Deficit Remains, Small Caps to Benefit?

Copper faces a structural deficit through 2026 as demand from renewables and AI surges, boosting ASX-listed miners with new long-life supply.

Time to Get Active on Super Collapses

$1.2B First Guardian/Shield super collapse hits 11,000 investors as deadlines loom; AFCA and Netwealth payouts underway - check if you’re affected